January 2026

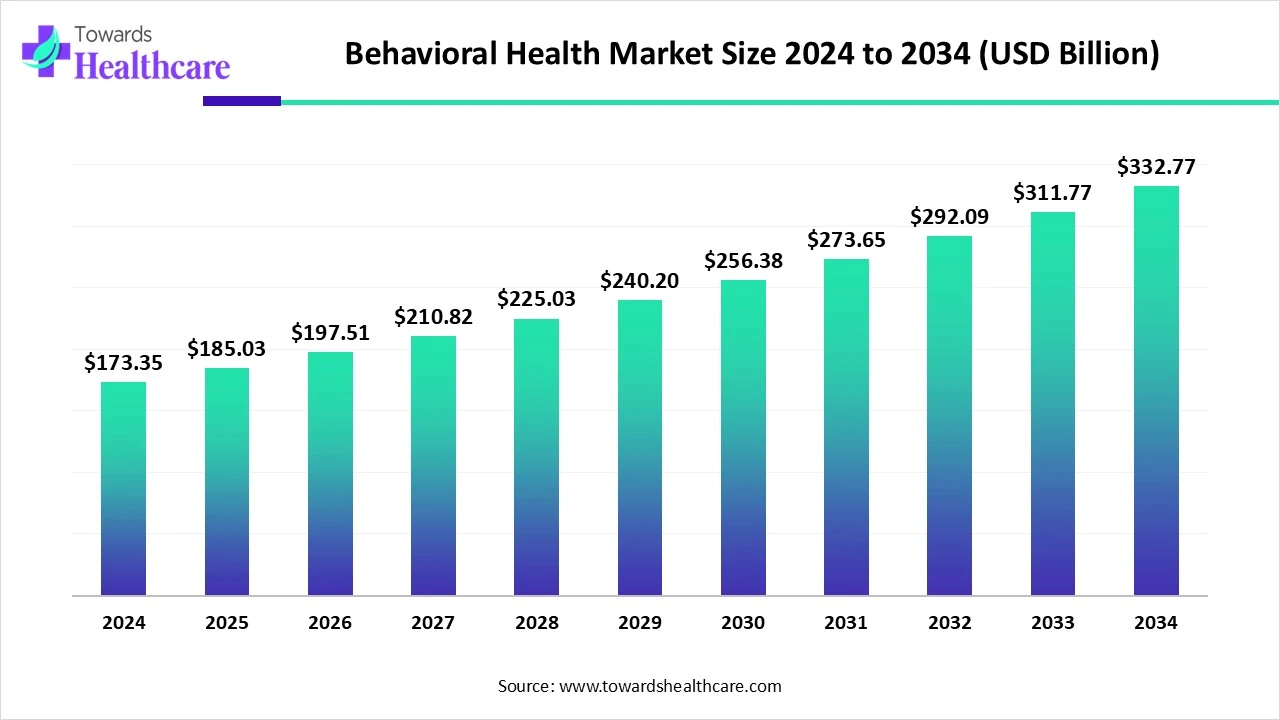

The global behavioral health market size is calculated at US$ 173.35 billion in 2024, grew to US$ 185.03 billion in 2025, and is projected to reach around US$ 332.77 billion by 2034. The market is expanding at a CAGR of 6.74% between 2025 and 2034.

Over the course of the projected period, the behavioral health market is anticipated to expand significantly. Growth in the market is anticipated to be fueled by the rising incidence of behavioural health problems, better access to care, increased public awareness of mental health concerns, and industry participants collaborations and acquisitions. Furthermore, a change in the trend of telehealth-based therapy usage and the introduction of advantageous federal and state legislation are anticipated to propel market expansion. Furthermore, market expansion is anticipated as a result of the government emphasis on promoting virtual care services by launching awareness campaigns regarding these therapies.

| Table | Scope |

| Market Size in 2025 | USD 185.03 Billion |

| Projected Market Size in 2034 | USD 332.77 Billion |

| CAGR (2025 - 2034) | 6.74% |

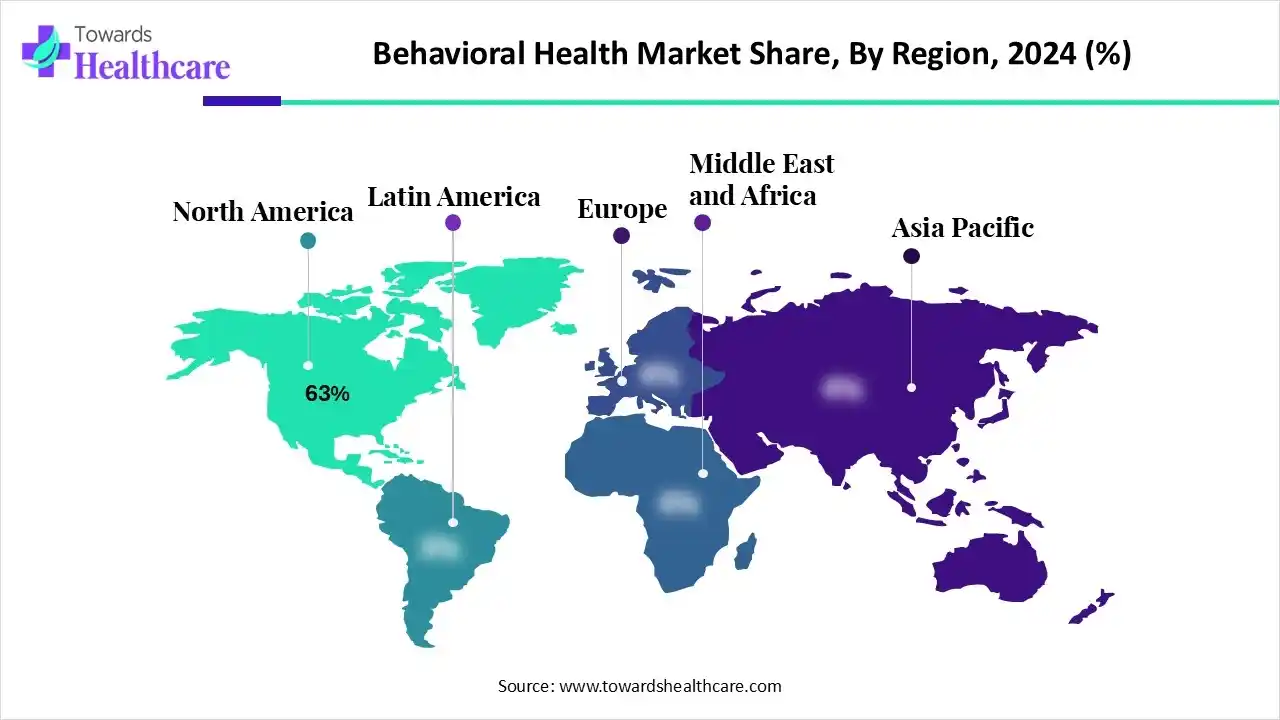

| Leading Region | North America 63% |

| Market Segmentation | By Condition Category, By Service Modality, By Patient Age Group, By Payer/Funding, By Region |

| Top Key Players | Universal Health Services (UHS), Acadia Healthcare, HCA Healthcare, Lifepoint Behavioral Health, Priory Group (UK), Ramsay Health Care, Sheppard Pratt Health System, Optum Behavioral Health (UnitedHealth Group), Carelon Behavioral Health, Magellan Health, Teladoc Health/BetterHelp, Talkspace, Headspace Health (Ginger + Headspace), Lyra Health, Modern Health, Spring Health, Quartet Health, Array Behavioral Care, Brightline, SonderMind |

The behavioral health market encompasses clinical services, programs, and enabling platforms addressing mental health and substance use conditions across inpatient, outpatient, community, residential, and virtual settings. It includes psychotherapy, psychiatry/medication management, crisis stabilization, intensive outpatient/partial hospitalization (IOP/PHP), residential treatment, community-based services (ACT/CM), and tech-enabled care (telepsychiatry, digital therapeutics, employer EAP-style benefits). Growth is propelled by rising prevalence and awareness, employer and payer focus on access, integration with primary care, virtual-delivery scale, and parity/regulatory reforms.

Government Programs: Mental health and behavioural health awareness is growing among people, especially in developing countries. With growing awareness, the demand for mental health services is also growing, leading to a growing interest taken by governments. Many governments have launched various mental and behavioral health programs, and many are planning to launch new or improve existing programs in the future.

For instance,

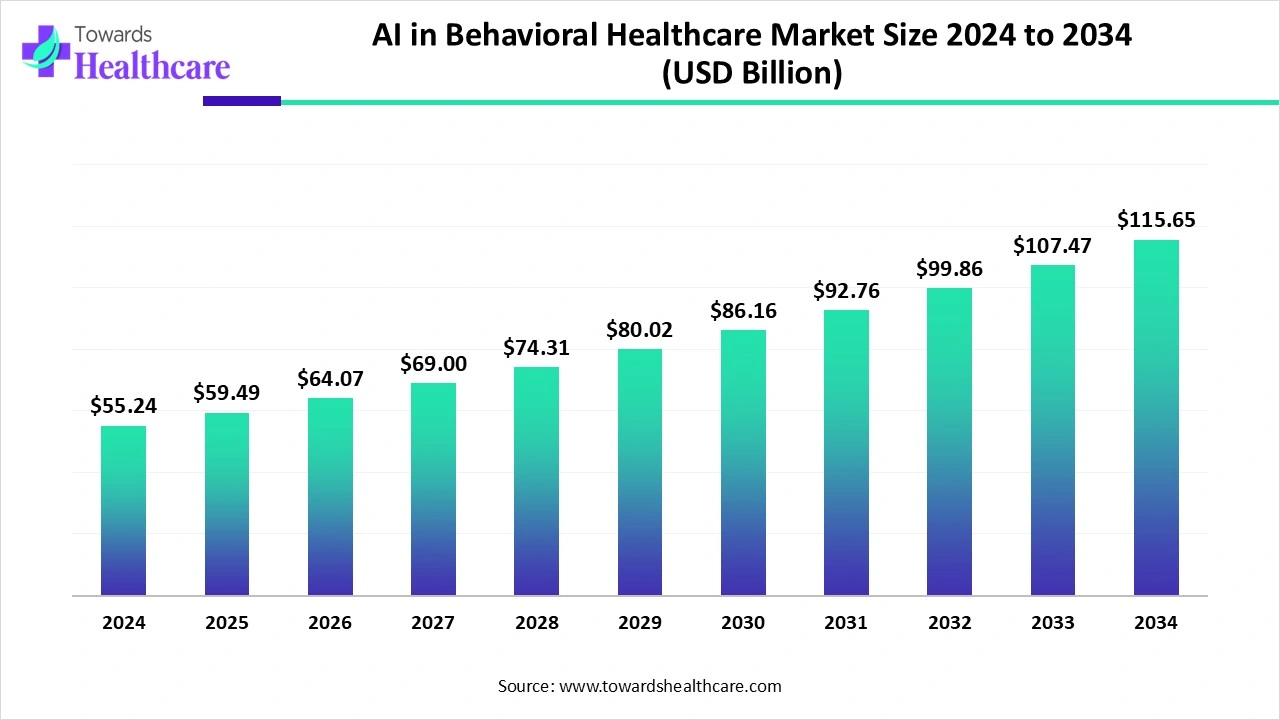

AI has amazing powers, including the ability to process large datasets quickly and to make it easier to analyse intricate patterns and correlations. AI has the ability to completely transform mental healthcare by offering insights and solutions that were previously unattainable through traditional approaches, particularly in the field of mental healthcare, where comprehending complicated human behaviours and emotions is crucial.

In 2024, the global AI in behavioral healthcare market stood at about US$ 55.24 billion. By 2025, it’s expected to rise to US$ 59.49 billion - and if trends continue, it could reach nearly US$ 115.65 billion by 2034, growing steadily at a 7.69% annual rate.

Rising Cases of Depression Drive the Behavioral Health Market

It is estimated that 3.8% of the world population suffers from depression, including 5.7% of adults over 60 and 5% of adults (with rates of 4% for men and 6% for women). This indicates that 280 million individuals globally suffer from depression. According to World Health Organisation (WHO) forecasts, serious depression is expected to become the main cause of disability by 2030.

Shortage of Skilled Professionals

One major issue impeding market expansion is the lack of qualified workers in the medical field. This scarcity is caused by a number of factors, such as a dearth of educational institutions that offer specialised coursework in behavioural disorder therapy, a lack of knowledge about the different types of addiction, low pay and benefits for behavioural health professionals, a demanding workload, and an uncertain career path.

What is the Future of the Behavioral Health Market?

Employers, insurers, care providers, and government legislators all have unique chances to expand on the disruptive elements and improve behavioural health in the future. The vast amount of data available to insurers may be used to build new connections with policyholders and enable preventative measures to meet behavioural health requirements. In order to give their patients individualised treatment, healthcare professionals can integrate a variety of innovative technology into their practice. Employers may enhance performance and retention by providing their staff with unique behavioural health assistance. By assisting in the development of common ethical and regulatory frameworks centred on cutting-edge behavioural health technologies, government officials may promote closer collaboration amongst industry participants.

By condition category, the mood & anxiety disorders segment held the largest share of the behavioral health market in 2024. The most prevalent mental illness in the world is anxiety. Currently, an estimated 4% of people worldwide suffer from an anxiety illness. Only around 1 in 4 individuals in need of therapy (27.6%) receive any treatment at all, despite the fact that there are very effective therapies for anxiety disorders. The actions necessary to offer suitable therapies for individuals with mental health issues, particularly anxiety disorders, are highlighted in WHO Comprehensive Mental Health Action Plan 2013–2030.

By condition category, the substance use disorders (SUD) segment is anticipated to grow at the highest rate during the upcoming period. Substance abuse negatively impacts a person health, raising the likelihood of mental health issues, chronic illnesses, and, unfortunately, millions of avoidable deaths annually. In 2019–2020, the WHO Global Survey on Progress with SDG goal 3.5 was carried out. 154 (79.4%) of the 194 WHO Member States answered the survey. A comprehensive plan to further direct the execution of the 2010 WHO Global strategy to decrease the harmful use of alcohol with the goal of decreasing alcohol-related harms globally is the WHO Global Action Plan for Alcohol 2022-2030.

By service modality, the outpatient counselling & psychiatry segment was dominant in the behavioral health market in 2024. Clients visit outpatient mental health institutions at predetermined times for lessons or therapies, which function more like a medical clinic. For the majority of clients, this works effectively because it allows them to continue living their daily lives while still getting the mental health care they need to enhance their mental health. Generally speaking, outpatient therapy can greatly lower a client chance of needing inpatient facility services or a stay in a mental health hospital.

By service modality, the tele-behavioral/virtual care segment is estimated to witness the highest growth during 2025-2034. The use of telehealth for behavioural health is still widespread. While lowering care obstacles like stigma worries, telemedicine may improve access, continuity of care, patient privacy, and convenience for behavioural health patients. In order to provide complete, patient-centered treatment, telehealth can help integrate primary care and behavioural health.

By patient age group, the adults segment held the major revenue of the market in 2024. Mental illness is widespread. In any given year, one in five individuals suffers from a mental disorder. According to the National Institutes of Health (NIH), 57.8 million individuals suffer from a mental disease. According to the NIH, different anxiety disorders are the most common mental diseases among people in the US. In 2023, 19.1% of adults reported having an anxiety problem.

By patient age group, the children & adolescents segment is estimated to achieve the fastest growth during the predicted time frame. Adolescence and childhood are crucial life phases for mental health. The brain is growing and developing quickly at this period. Children and teenagers develop cognitive and social-emotional abilities that are critical for taking on adult responsibilities in society and that influence their mental health in the future. Childhood epilepsy, developmental impairments, depression, anxiety, and behavioural problems are among the mental health issues that are responsible for a significant portion of youth sickness and disability. Although 15% of teenagers and 8% of youngsters worldwide suffer from a mental illness, most of them do not get treatment or seek assistance.

By payer/funding, the public & social insurance segment captured the major share of the behavioral health market in 2024. Since behavioural health has a significant influence on both population health and financial stability, public and social insurance programmes throughout the world are working more to incorporate it. In order to attain universal health coverage (UHC), several nations are increasing public insurance for vulnerable individuals, notwithstanding the wide variations in coverage for mental health.

By payer/funding, the commercial/employer-sponsored segment is anticipated to be the fastest-growing during the studied period. Globally, the expenses of poor mental health and its aftereffects are expected to increase from $2.5 trillion in 2010 to $6 trillion by 2030. For this reason, in addition to medical, pharmaceutical , and disability coverage, employer-sponsored benefits are increasingly including mental health benefits for staff members. Offering coverage alternatives to working families through workplace health insurance is an effective strategy, and the tax advantages of employer-based coverage only serve to increase its allure.

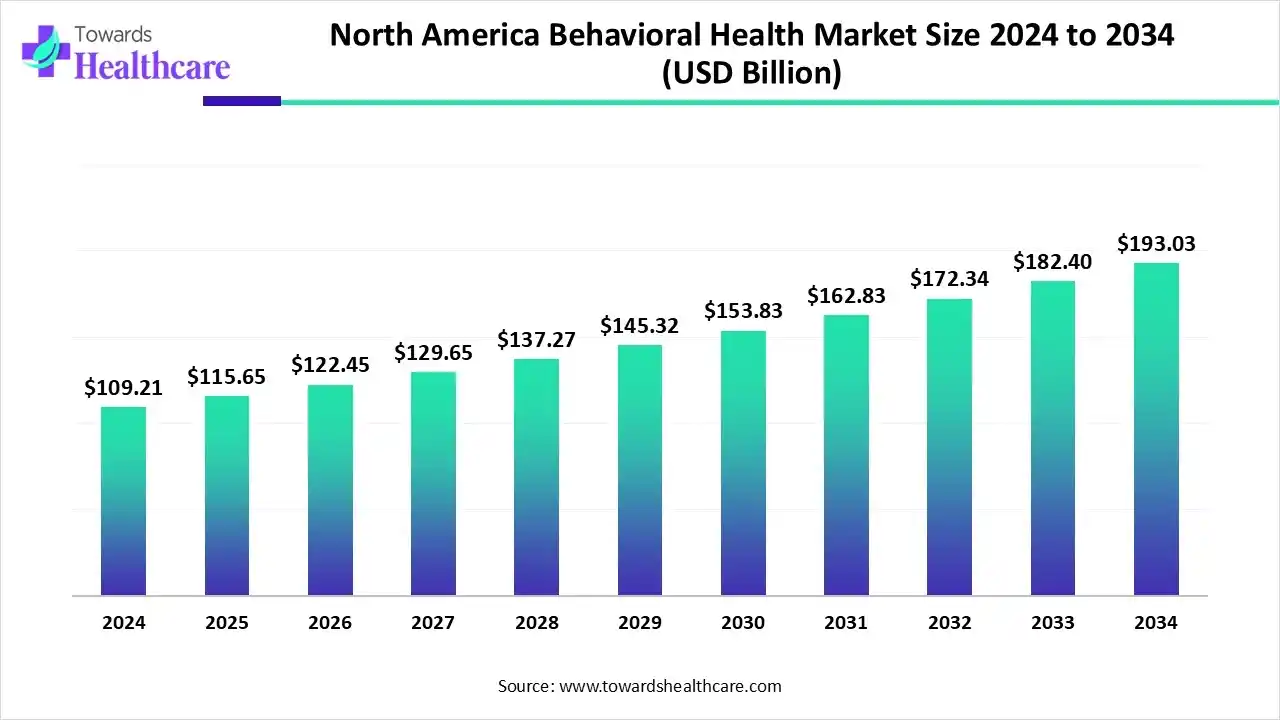

The North American behavioral health market is estimated at US$ 109.21 billion in 2024, increasing to US$ 115.65 billion in 2025, and is projected to reach approximately US$ 193.03 billion by 2034. The market is expected to grow at a CAGR of 5.86% from 2025 to 2034.

North America dominated the behavioral health market share 63% in 2024. In North America, there is a rising awareness of mental health issues, along with initiatives to lessen stigma and promote transparency around obtaining mental health treatment. Media coverage, advocacy initiatives, and public education campaigns all help to lessen the stigma associated with mental illness and encourage people to seek assistance and treatment without worrying about prejudice or condemnation. Additionally, regional healthcare expenditure trends and economic situations have an impact on the industry.

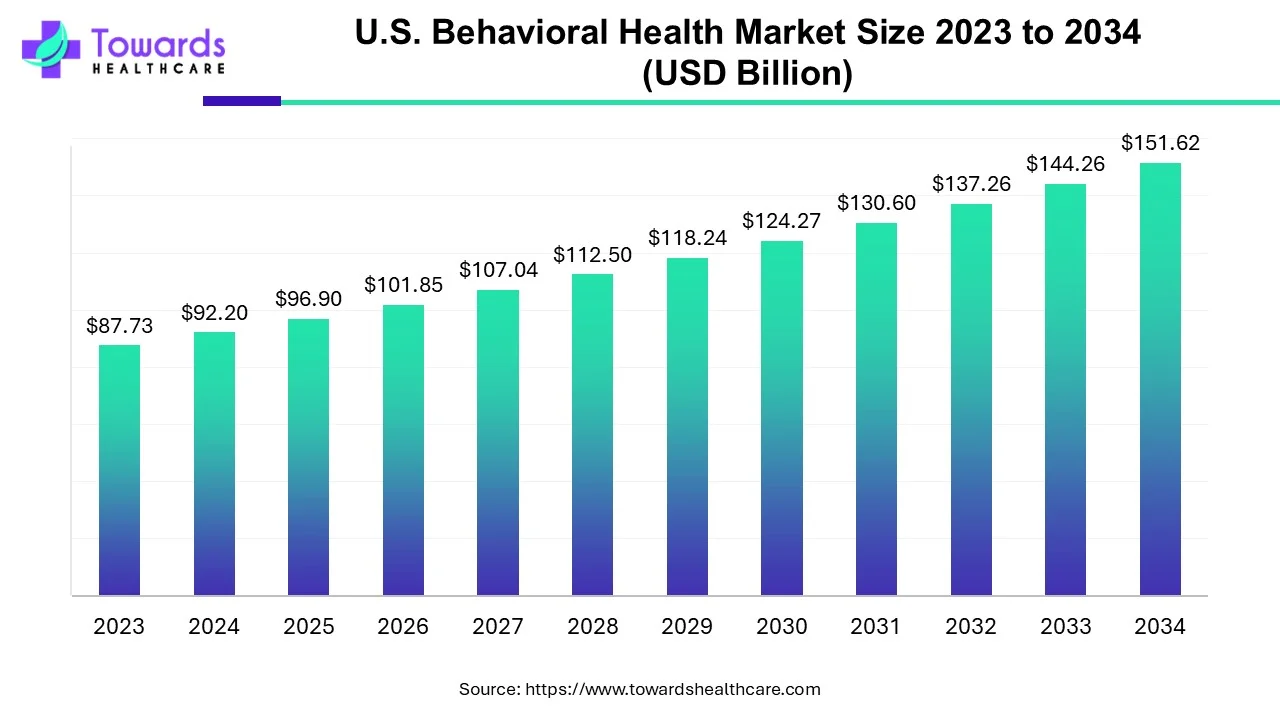

The U.S. behavioral health market was valued at USD 92.2 billion in 2024 and is projected to grow to USD 96.9 billion in 2025. By 2034, it is expected to reach USD 151.62 billion, expanding at a CAGR of 5.1% between 2024 and 2034.

With an estimated 5% of the population, or 15 million Americans, suffering from some type of depression, the U.S. ranks 29th in the world for the prevalence of depressive illnesses. On the list of the 30 nations with the highest rates of depression, it is the biggest. The prevalence of depression in the previous two weeks among adolescents and adults aged 12 and older was 13.1% during August 2021–August 2023; it declined as age increased overall and among both men and females.

In November 2024, with an emphasis on equity-deserving groups, the kids Mental Health Fund (YMHF), which was established by the federal government in Budget 2024, intends to promote the mental health of kids and their families as well as the accessibility and navigation of mental health services. Projects up to $500,000 in funding every fiscal year, with a maximum duration of 48 months, are sought after by the Youth Mental Health Fund.

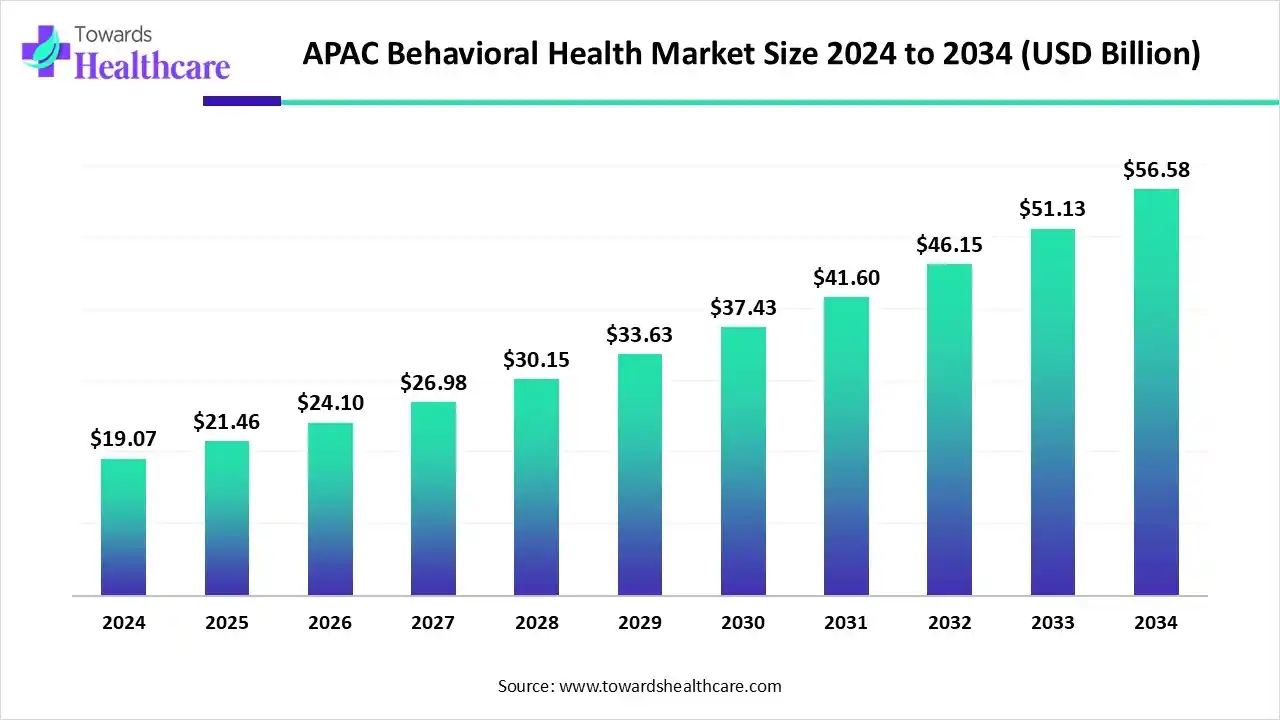

The APAC behavioral health market was valued at USD 19.07 billion in 2024 and grew to USD 21.46 billion in 2025. It is projected to reach approximately USD 56.58 billion by 2034, expanding at a CAGR of 11.49% between 2025 and 2034.

Asia Pacific is estimated to host the fastest-growing behavioral health market during the forecast period. Due to an increase in physical diseases and disabilities, as well as an increase in the use of illegal substances, Asia Pacific is seeing an increase in mental health issues. the large number of young people living there, as well as the rise in alcohol and drug usage. The incidence of suicide cases is increasing as a result of the increased frequency of depression. Additionally, the Asia Pacific behavioural health market is anticipated to rise as a result of increased expenditures in the region healthcare infrastructure and growing awareness of mental health issues.

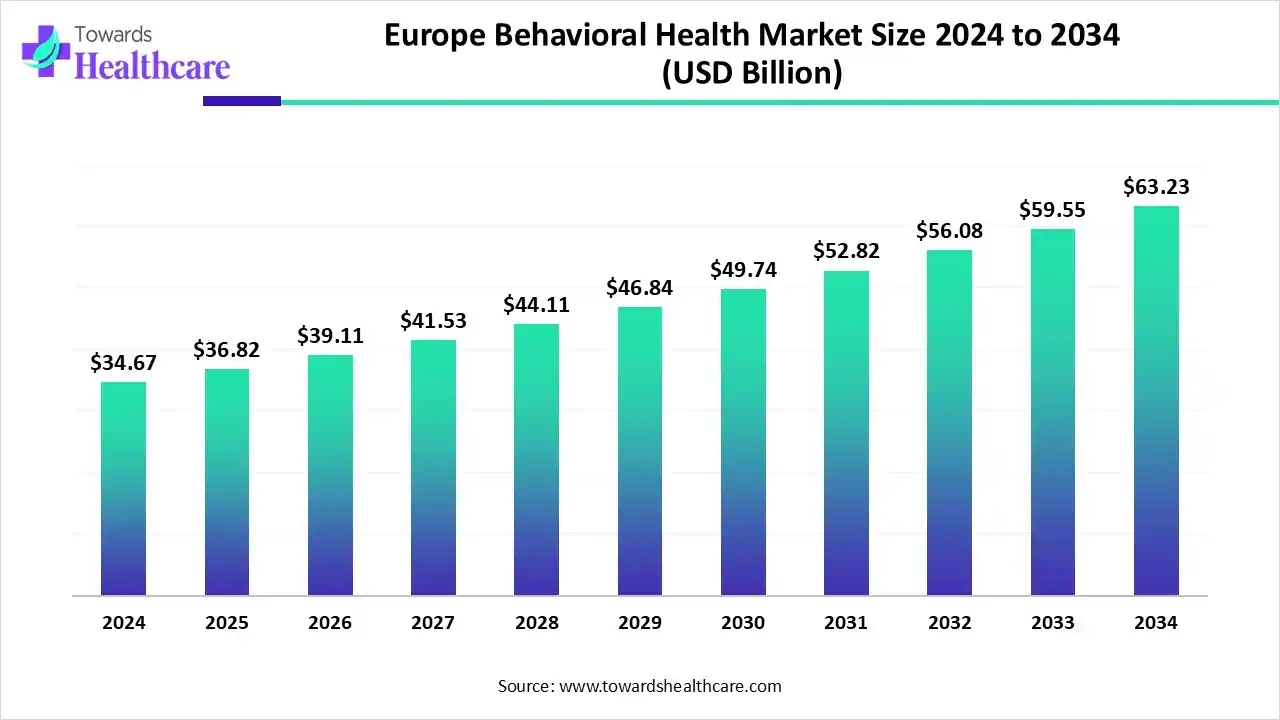

The Europe behavioral health market is valued at US$ 34.67 billion in 2024, rising to US$ 36.82 billion in 2025. It is expected to reach around US$ 63.23 billion by 2034, growing at a CAGR of 6.19% from 2025 to 2034.

Rising mental health disorders across Europe are driving increased demand for behavioral health solutions, including therapies, treatments, and digital platforms for detection, prevention, and care. The adoption of AI is enhancing accurate diagnosis and enabling personalized treatment plans. Continuous investments by both companies and governments in these services and emerging innovations, along with the development of new treatment options and digital tools, are collectively supporting the growth of the European behavioral health market.

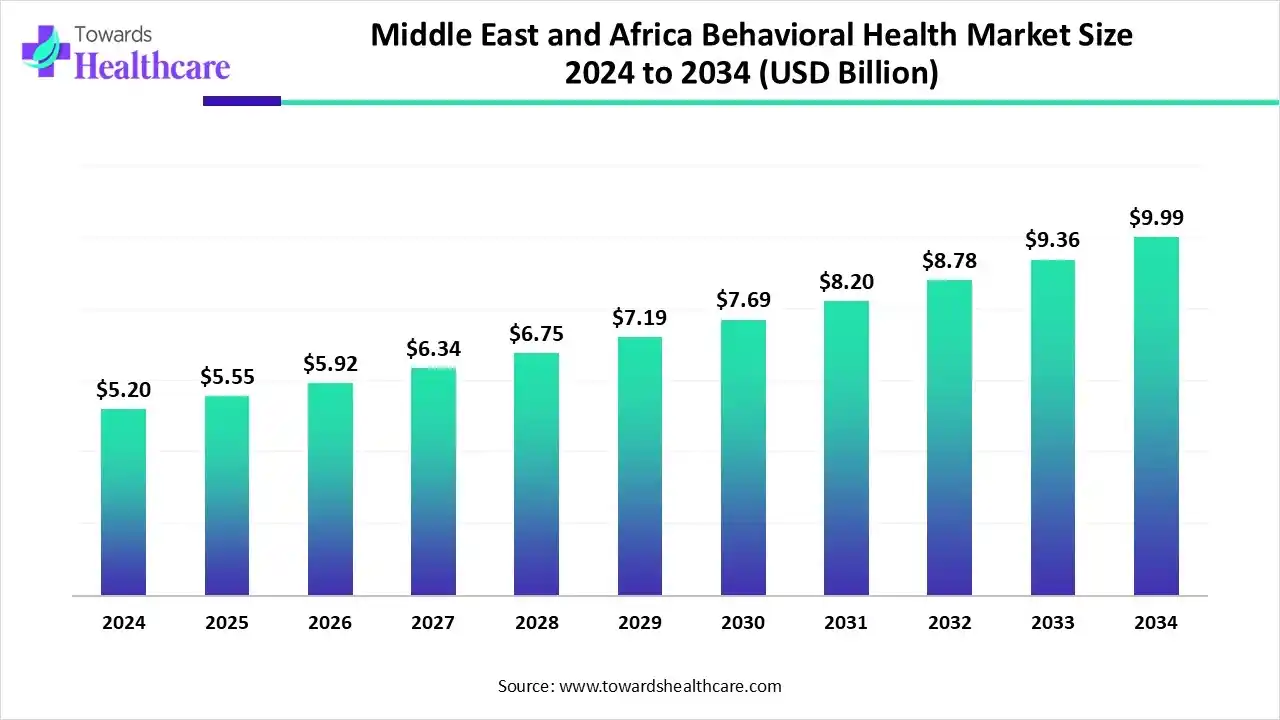

The Middle East & Africa behavioral health market is valued at USD 5.2 billion in 2024 and is expected to grow to USD 5.55 billion in 2025. It is projected to reach approximately USD 9.99 billion by 2034, expanding at a CAGR of 6.75% from 2025 to 2034.

The Middle East & Africa behavioral health market is experiencing rapid growth, driven by supportive government initiatives and the adoption of innovative strategies for managing mental health disorders. Factors such as a rising geriatric population, heightened awareness of mental health issues, and the growth of medical tourism further contribute to market expansion. Additionally, artificial intelligence (AI) is transforming tele-psychiatry by enabling efficient remote patient monitoring.

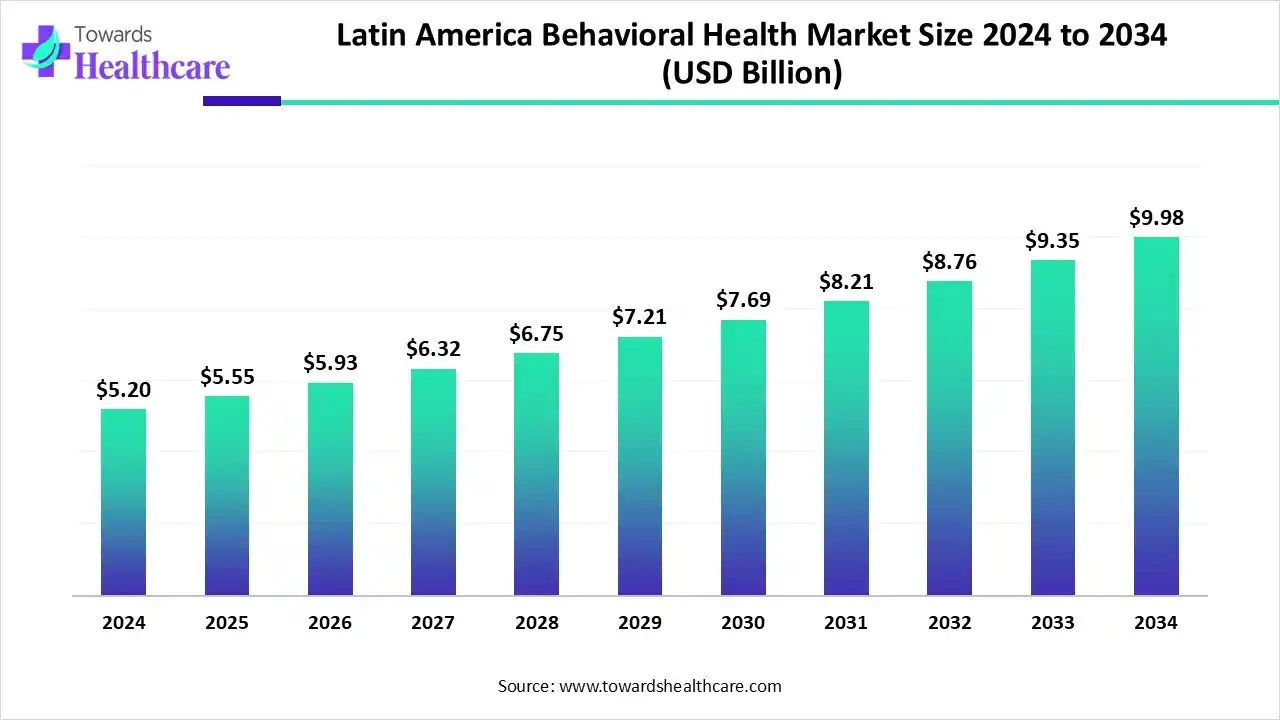

The Latin America behavioral health market in was valued at US$ 5.2 billion in 2024 and is expected to rise to US$ 5.55 billion in 2025. Looking ahead, the market is projected to reach approximately US$ 9.98 billion by 2034, growing at a CAGR of 6.74%.

The Latin America behavioral health market is witnessing steady growth as both private and public healthcare providers invest in specialized mental health services. Factors such as rising urbanization, workplace stress, and lifestyle-related mental health challenges are fueling demand for counseling, therapy, and psychiatric care. Technological innovations, including telepsychiatry and mobile health apps, are expanding patient access, while regional collaborations and training programs are enhancing professional capacity.

Similar to the phases of medication development, behavioural health research and development begins with fundamental science and intervention creation and progresses through refining, pilot testing, and efficacy/effectiveness testing in many contexts.

Key Companies Include: Modern Health, Kintsugi, Lyra Health, HealthJoy, Alto Neuroscience, HelloSelf, etc.

Phases 0-IV of the trial process, which lead the process from early human studies to post-marketing monitoring, comprise protocol design, randomisation, endpoint evaluation, protocol protection, and data collecting in accordance with Good Clinical Practice (GCP) recommendations.

Key Companies Include: Pfizer, Eli Lilly, and Novartis; specialized Contract Research Organizations (CROs) such as IQVIA and Lindus Health, etc.

In behavioural health, patient support and services entail matching people with the right care, which starts with a comprehensive evaluation to determine their requirements and then moves on to the creation of a customised treatment plan that could comprise counselling, medication, or other treatments. For long-term rehabilitation and well-being, it is also critical to educate patients about their disease, help them develop self-care skills, offer continuous emotional support, and connect them with peer services and support networks.

Key Companies Include: Lyra Health, Modern Health, Spring Health, Talkspace, BetterHelp, Eleanor Health, and Kintsugi etc.

In August 2025, according to a statement from Kristin Siragusa, CHE Behavioural Health Services vice president of revenue cycle, providing compassionate, whole-person care at CHE entails streamlining all aspect of the patient process, including invoicing. By selecting Inbox Health, we have been able to provide our patients a straightforward, efficient, and user-friendly platform.

By Condition Category

By Service Modality

By Patient Age Group

By Payer/Funding

By Region

January 2026

January 2026

January 2026

January 2026