December 2025

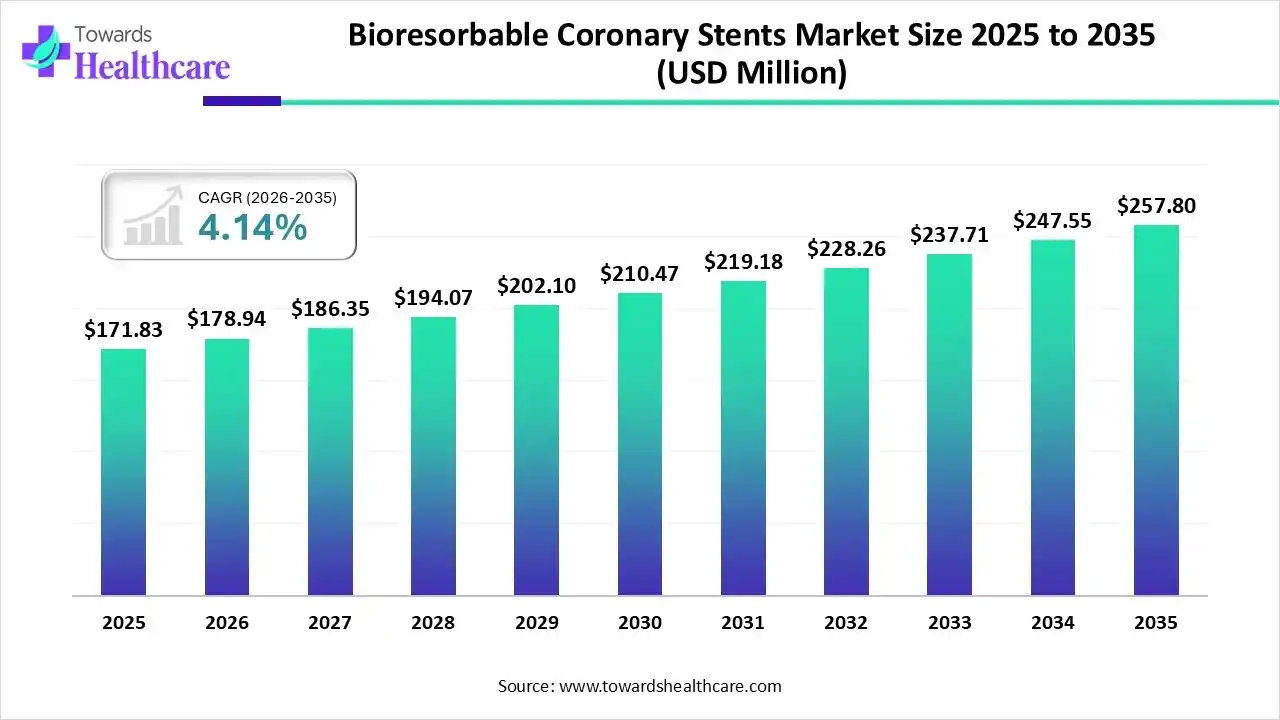

The bioresorbable coronary stents market size was estimated at USD 171.83 million in 2025 and is predicted to increase from USD 178.94 million in 2026 to approximately USD 257.8 million by 2035, expanding at a CAGR of 4.14% from 2026 to 2035.

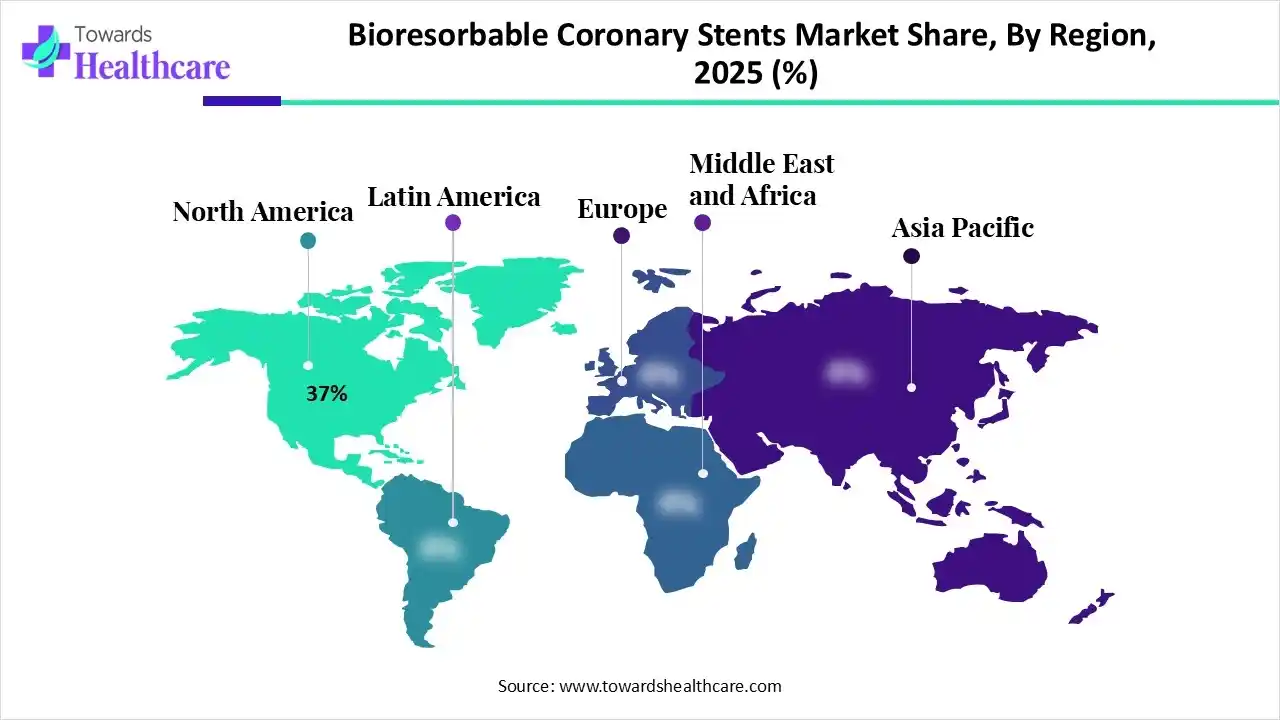

The bioresorbable coronary stents market is shaped by the increasing prevalence of cardiovascular diseases and growing preference for minimally invasive cardiovascular interventions. Key trends include technological advancements in bioresorbable scaffold materials and expanding use in hospitals and cardiac centers worldwide. North America has been a leading regional market due to well-established healthcare infrastructure, high adoption of innovative stenting technologies, and significant clinical procedure volumes, reinforcing its dominant position.

| Key Elements | Scope |

| Market Size in 2026 | USD 178.94 Million |

| Projected Market Size in 2035 | USD 257.8 Million |

| CAGR (2026 - 2035) | 4.14% |

| Leading Region | North America by 37% |

| Market Segmentation | By Stent Type, By Material, By Application / Indication, By Procedure Type, By Region |

| Top Key Players | Abbott Laboratories, Boston Scientific Corporation, Biotronik SE & Co. KG, Terumo Corporation, Elixir Medical Corporation, REVA Medical, LLC, MicroPort Scientific Corporation, Meril Life Sciences Pvt. Ltd., Amaranth Medical Inc., Arterial Remodeling Technologies S.A. |

A bioresorbable coronary stent is a temporary vascular scaffold placed in a narrowed coronary artery to restore blood flow and then gradually dissolves or is absorbed by the body once the vessel heals, unlike traditional permanent metallic stents that remain indefinitely. These stents reduce long-term complications and support normal vessel function after resorption, addressing clinical concerns such as late thrombosis and chronic inflammation.

The global bioresorbable coronary stents market is being driven by the rising prevalence of cardiovascular diseases, the growing preference for minimally invasive procedures, and continuous technological innovations that improve material biocompatibility and performance. Adoption is increasing as interventional cardiologists favour devices that support healing and reduce lifelong foreign body presence, contributing to market expansion.

AI integration can significantly improve the bioresorbable coronary stents industry by enhancing stent design, clinical decision-making, and manufacturing efficiency. Machine learning models help optimize material composition, strut thickness, and degradation rates to improve safety and performance. AI-powered imaging and predictive analytics support precise patient selection, reducing complications and improving outcomes. In manufacturing, AI enables quality control, defect detection, and process optimization, while data-driven insights accelerate research, regulatory compliance, and post-market surveillance across global healthcare systems and long-term clinical innovation worldwide.

Next‑generation polymers and magnesium-based bioresorbable materials are being developed to improve mechanical strength, ensure controlled degradation, and reduce inflammation, enhancing safety, long-term patency, and clinical outcomes compared with earlier stent designs.

Advances in delivery systems and catheter technology allow for easier, safer, and more precise stent implantation, reducing procedural complications and promoting faster patient recovery in complex coronary interventions.

Integration of high-resolution imaging techniques like OCT and IVUS improves lesion assessment, stent positioning, and post-implant monitoring, lowering restenosis risk and enhancing the long-term efficacy of bioresorbable stents.

Growing clinical evidence, real-world data, and streamlined regulatory pathways are increasing acceptance among cardiologists worldwide, supporting broader adoption of bioresorbable stents for complex and high-risk coronary lesion management.

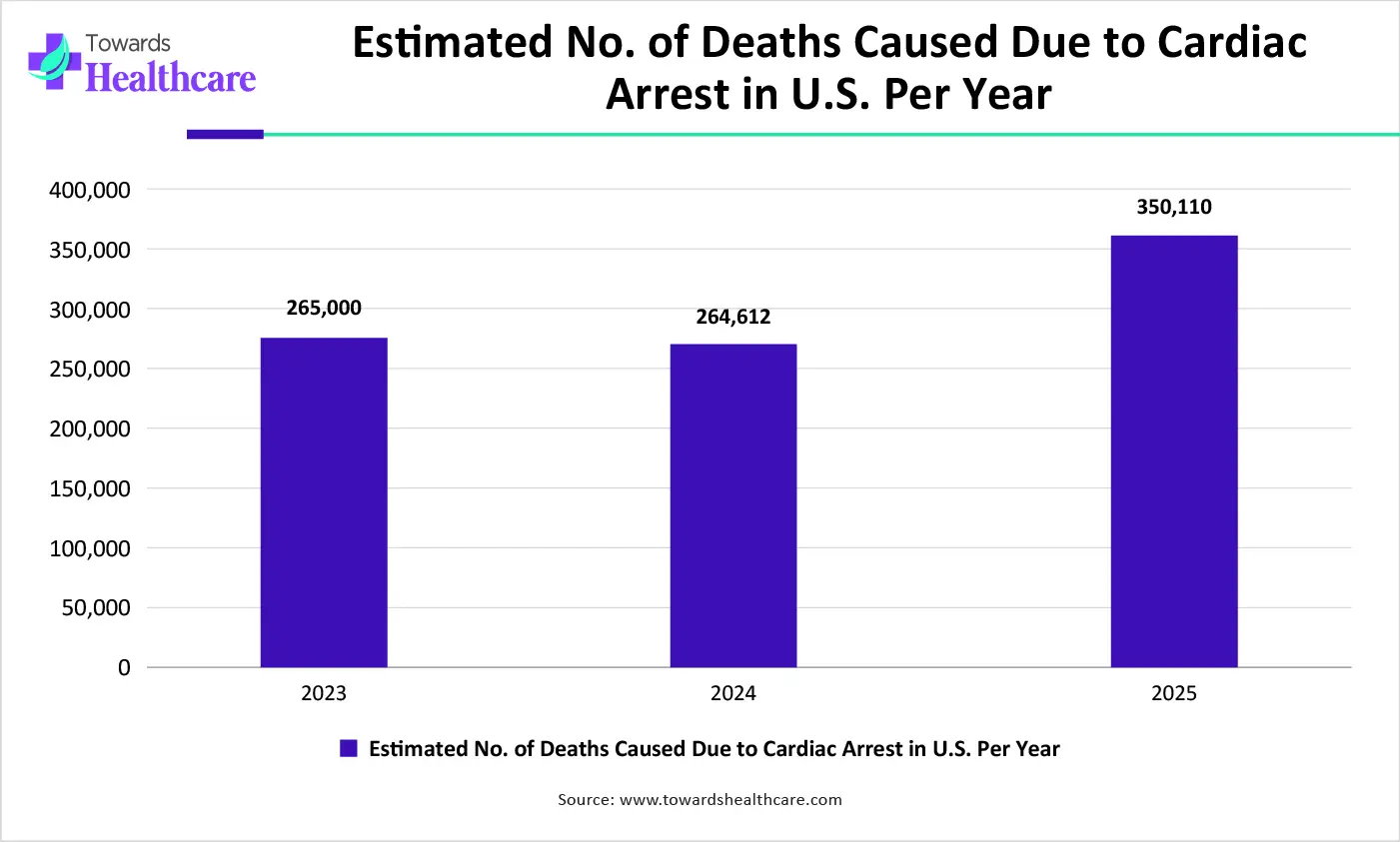

Increasing rate of number of deaths due to cardiac arrest has driven the growth of the bioresorbable coronary stents market through several clinical and healthcare-system mechanisms.

| Year | No. Deaths Due to Cardiac Arrests in the U.S. per Year |

| 2023 | ~265,000 |

| 2024 | ~264,612 |

| 2025 | ~350,110 |

Which Stent Type Segment Dominated the Bioresorbable Coronary Stents Market?

The polymer-based bioresorbable stents segment dominates the market with a share of approximately 60% due to its biocompatibility, controlled degradation, and flexibility, allowing easier implantation in complex lesions. They reduce long-term complications, support vessel healing, and enable favourable clinical outcomes, while widespread adoption, technological advancements, and physician familiarity further strengthen their preference over other stent types.

Metallic Bioresorbable Stents

The metallic bioresorbable stents segment is anticipated to be the fastest-growing, with a CAGR of approximately 18% in the market, due to its enhanced radial strength, superior mechanical support, and predictable degradation, which allow treatment of complex coronary lesions. Advancements in magnesium and alloy technologies improve safety and efficacy, while growing clinical acceptance, improved patient outcomes, and ongoing R&D efforts drive rapid adoption and market expansion globally.

Why Did the PLLA-Based Stents Segment Dominate the Bioresorbable Coronary Stents Market?

The PLLA-based stents segment dominates the market with a share of approximately 50% due to its excellent biocompatibility, controlled resorption, and proven clinical performance. Its polymer structure ensures vessel support during healing while minimizing inflammation, thrombosis, and restenosis risks. Widespread adoption, regulatory approvals, and strong physician confidence further reinforce PLLA’s leading position in bioresorbable coronary stent applications.

Magnesium Alloy Based

The magnesium alloy-based segment is estimated to be the fastest-growing in the market, with a CAGR of approximately 20%, due to its rapid, predictable bioresorption, excellent mechanical strength, and reduced risk of late thrombosis. Advancements in alloy formulations enhance safety and support complex lesions, while increasing clinical adoption, ongoing R&D, and favorable patient outcomes drive accelerated growth in the global bioresorbable coronary stent market.

Which Application/ Indication Segment Led the Bioresorbable Coronary Stents Market?

The stable angina segment dominates the global bioresorbable coronary stent market with a share of approximately 55% due to the high prevalence of chronic coronary artery disease and predictable lesion patterns. Patients benefit from improved vessel healing, reduced long-term complications, and minimally invasive procedures. Widespread clinical adoption, physician familiarity, and favourable treatment outcomes further reinforce this segment’s leading position.

Acute Myocardial Infarction (AMI)

The acute myocardial infarction (AMI) segment is anticipated to be the fastest-growing in the market, with a CAGR of approximately 17% due to the rising incidence of heart attacks and demand for rapid, effective coronary intervention. Bioresorbable stents provide temporary vessel support, reduce long-term complications, and enable faster recovery. Increased clinical adoption, advancements in stent technology, and improved patient outcomes drive rapid growth in this segment.

Which Factors Make Elective PCI Procedures the Dominant Segment in the Market?

The elective PCI procedures segment dominated the bioresorbable coronary stents market with a share of approximately 60% due to planned, non-emergency interventions allowing precise stent selection and placement. These procedures ensure optimal patient outcomes, reduce complication risks, and provide controlled recovery. Growing physician confidence, technological advancements, and widespread adoption of minimally invasive techniques further reinforce this segment’s leading position.

Emergency PCI/Acute Interventions

The emergency PCI/acute interventions segment is estimated to be the fastest-growing, with a CAGR of approximately 18% in the market due to the increasing prevalence of acute coronary events and demand for immediate revascularization. Bioresorbable stents provide temporary vessel support, reduce long-term complications, and enable rapid patient recovery. Advancements in stent design, growing clinical adoption, and improved procedural outcomes are driving rapid growth in this segment.

North America dominated the bioresorbable coronary stents market with a share of approximately 37% in 2025. North America dominates the global market due to advanced healthcare infrastructure, high adoption of innovative medical technologies, and the strong presence of key stent manufacturers. Well-established cardiology networks, favourable reimbursement policies, and significant investments in research and development further support widespread clinical adoption and leadership in the region.

The U.S. dominates the North American market due to advanced healthcare infrastructure, high physician awareness, and early adoption of innovative cardiac devices. Strong research and development, supportive regulatory frameworks, widespread clinical trials, and significant investment by leading stent manufacturers further reinforce the country’s leading position in the market.

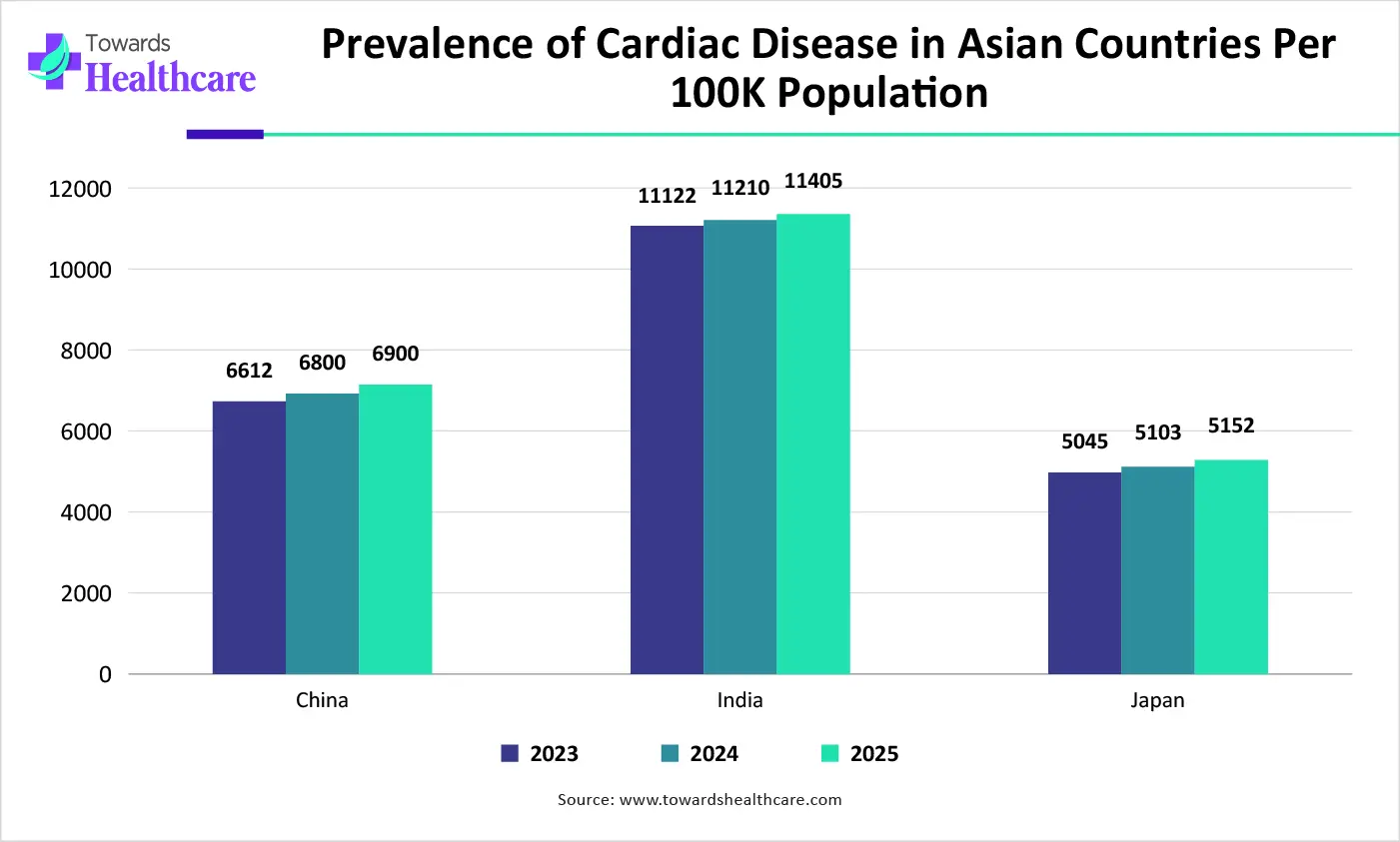

Asia Pacific is estimated to host the fastest-growing bioresorbable coronary stents market with a CAGR of approximately 18% during the forecast period. The Asia-Pacific region is the fastest-growing in the market due to rising cardiovascular disease prevalence, improving healthcare infrastructure, and increasing awareness of minimally invasive cardiac treatments. Growing adoption of advanced stent technologies, expanding medical facilities, and government initiatives supporting cardiac care further drive rapid market growth in the region.

China dominates the Asia-Pacific bioresorbable coronary stents market due to a large patient population, rising incidence of cardiovascular diseases, and expanding healthcare infrastructure. Government support for advanced cardiac treatments, increasing clinical adoption of innovative stent technologies, and significant investments by local and global manufacturers further strengthen China’s leading position in the regional market.

| Country | 2023 | 2024 | 2025 |

| China | 6612 | 6800 | 6900 |

| India | 11122 | 11210 | 11405 |

| Japan | 5045 | 5103 | 5152 |

Europe is expected to grow at a significant CAGR in the bioresorbable coronary stents market during the forecast period. Europe is a notably growing region in the market due to advanced healthcare systems, high adoption of innovative cardiac devices, and increasing prevalence of cardiovascular diseases. Strong clinical research, favourable regulatory frameworks, and rising physician awareness further support the uptake of bioresorbable stents across key European countries.

The UK is the fastest-growing country in the European bioresorbable coronary stents market due to advanced healthcare infrastructure, growing prevalence of cardiovascular diseases, and early adoption of minimally invasive cardiac technologies. Increased clinical trials, government support for cardiac care, and rising physician awareness further drive the rapid adoption of bioresorbable stents in the country.

| Company | Offerings | Headquarters |

| Abbott Laboratories | Absorb GT1 and other bioresorbable vascular scaffold systems | Abbott Park, Illinois, USA |

| Boston Scientific Corporation | Next-generation bioresorbable stent platforms and interventional cardiology devices | Marlborough, Massachusetts, USA |

| Biotronik SE & Co. KG | Magmaris resorbable magnesium scaffold | Berlin, Germany |

| Terumo Corporation | Bioresorbable stent technologies and vascular intervention systems | Tokyo, Japan |

| Elixir Medical Corporation | DynamX Bioadaptor system, DESolve bioresorbable scaffolds | Sunnyvale, California, USA |

| REVA Medical, LLC | Fantom polymer-based bioresorbable scaffolds | San Diego, California, USA |

| MicroPort Scientific Corporation | Firesorb bioresorbable coronary scaffolds | Shanghai, China |

| Meril Life Sciences Pvt. Ltd. | MeRes100 bioresorbable scaffold | Vapi, Gujarat, India |

| Amaranth Medical Inc. | Ultra-thin polymer scaffold platforms under development | Tampa, Florida, USA |

| Arterial Remodeling Technologies S.A. | PLA-based bioresorbable scaffold platforms | Paris, France |

By Stent Type

By Material

By Application / Indication

By Procedure Type

By Region

December 2025

November 2025