January 2026

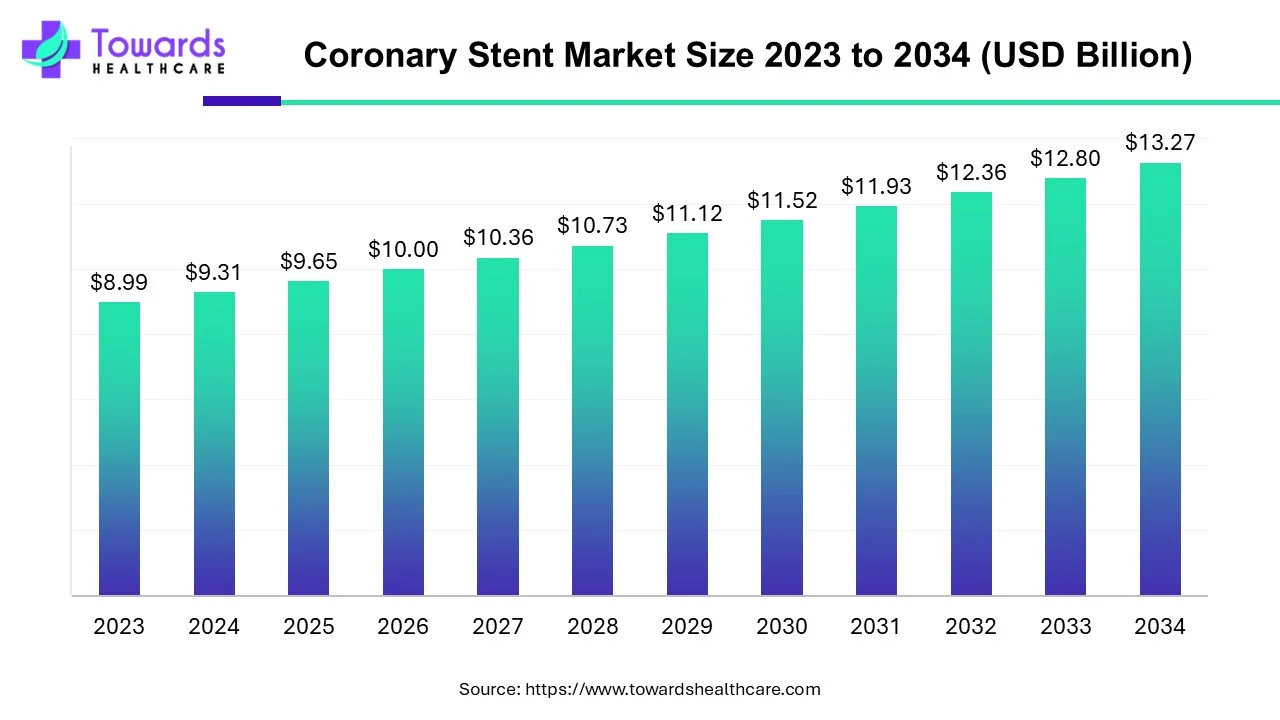

The coronary stent market size stood at US$ 9.65 billion in 2025, grew to US$ 10.00 billion in 2026, and is forecast to reach US$ 13.74 billion by 2035, expanding at a CAGR of 3.6% from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2025 | USD 41.65 Billion |

| Projected Market Size in 2035 | USD 177.5 Billion |

| CAGR (2026 - 2035) | 15.6% |

| Leading Region | North America by 41% |

| Market Segmentation | By Type, By End Use, By Geography |

| Top Key Players | Biotronik SE & Co. KG, Cook, Terumo Corporation, Abbott, BD, MicroPort Scientific Corporation, B. Braun Melsungen AG, Boston Scientific Corporation, Medtronic |

Coronary stents are mostly preferred in coronary artery diseases which is the most significantly driving the coronary stent market. Coronary stents are medical devices majorly used in most angioplasty (a procedure used to open clogged coronary arteries due to coronary artery disease) procedures. Coronary arteries when clogged because of underlying atherosclerosis disease, these coronary stents are used. This procedure of introduction of coronary stents is called percutaneous coronary intervention (PCI).

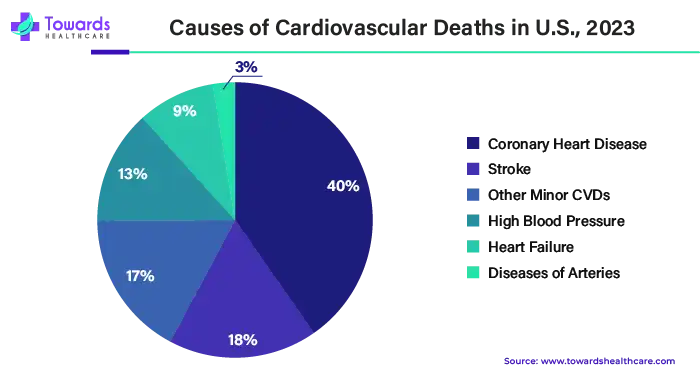

The coronary stent market began in the late 1980s, with the development of the first balloon-expandable stents. These devices transformed the treatment of coronary artery disease (CAD), which is the leading cause of death worldwide. CAD is caused by the accumulation of plaque in the coronary arteries, which restricts blood flow to the heart. This can cause chest pain (angina), heart attacks and heart failure.

Traditional treatment included bypass surgery, which was a very invasive procedure. Coronary stents are tiny expandable mesh tubes inserted into narrowed coronary arteries to prop them open and improve blood flow. Percutaneous coronary intervention (PCI), also known as angioplasty with stenting, is a minimally invasive procedure using catheters to deliver and implant the stent.

Coronary artery disease (CAD) is a huge danger to world health, killing millions each year. It is characterized by plaque formation in the coronary arteries, which are crucial for providing oxygen-rich blood to the heart muscle. This plaque constricts the arteries, limiting blood flow and potentially causing chest pain (angina), heart attacks, and cardiac failure. The increasing demand for coronary stents is mostly driven by the growing burden of CAD.

As the world's population ages, the risk of CAD inevitably rises. Older people are more likely to acquire plaque formation as a result of wear and strain on the body's systems. This growing generation creates a greater pool of potential patients who may require coronary stenting treatments. Modern lifestyles greatly contribute to the rise of CAD. Unhealthy diets heavy in saturated fat, cholesterol, and processed sugars are well-known risk factors. Furthermore, a lack of physical activity, smoking, and high-stress levels exacerbate the condition. As these lifestyle patterns continue, the prevalence of CAD is expected to increase.

Diabetes is a significant risk factor for CAD. The global diabetes epidemic has considerably increased the population's susceptibility to coronary artery problems. Diabetics have metabolic changes that increase plaque formation in the arteries, making them more likely to require coronary stents to restore blood flow.

The coronary stent market has expanded dramatically in recent years, owing mostly to the growing desire for minimally invasive and rapid recovery treatment options for coronary artery disease (CAD).

Traditional therapy for clogged coronary arteries included bypass surgery, which required a huge incision in the chest cavity. While efficient, this procedure has substantial downsides, including extensive surgical trauma, lengthy hospital stays, and extended recovery durations. Coronary stenting, on the other hand, provides a significantly less intrusive alternative. The technique entails introducing a catheter through a small incision in the groin or arm and guiding it to the occluded artery. Once positioned, a deflated stent is inserted and expands, keeping the artery open and improving blood flow.

This minimally invasive method has various benefits for patients:

The less invasive nature of stenting treatments results in speedier recovery times for patients. This is an important consideration for people who cannot tolerate the rigours of major surgery or who want to return to work and daily activities as soon as possible. Faster healing also lowers the overall healthcare expenses associated with prolonged hospital stays.

The coronary stent market has profited greatly from ongoing improvements in stent design and materials. Early stents were prone to restenosis, which occurs when the artery re-narrows after the surgery. Drug-eluting stents (DES) were a significant advancement, using slow-releasing medication to avoid restenosis and enhance long-term patency rates. Newer developments, such as bioresorbable stents that disintegrate over time, are being studied to provide further benefits.

The increased need for minimally invasive operations and faster recovery periods, together with developments in stent technology, are projected to drive the coronary stent market. As the global burden of CAD grows due to an aging population, poor lifestyles, and rising diabetes rates, the need for effective treatment alternatives such as coronary stenting is expected to stay high.

Furthermore, continuous research and development in stent technology point to even more successful and patient-friendly treatments in the future. This ongoing innovation, combined with the growing demand for minimally invasive procedures, is likely to drive the coronary stent market to new heights.

Coronary stents have seen tremendous changes since their introduction in the late 1980s. Early bare-metal stents (BMS) were a substantial improvement over traditional bypass surgery, providing a less intrusive option for treating clogged coronary arteries. However, restrictions such as restenosis (re-narrowing of the artery) fueled innovation in stent design, resulting in a wave of technological breakthroughs.

Drug-Eluting Stents (DES)

Biocompatible Coatings

Stent Design and Flexibility

When it comes to cardiac stents, cost-effectiveness is achieved by a delicate balance of optimizing patient care and managing healthcare spending. Encouraging the adoption of generic stents, which provide comparable efficacy to branded stents at a cheaper cost, is a significant cost-cutting strategy. Regulatory agencies can streamline the approval procedure for high-quality generic stents. Moving away from price-based models and towards value-based pricing can encourage manufacturers to create stents with better long-term results and fewer problems, potentially lowering overall healthcare costs.

Hospitals and healthcare institutions can arrange bulk purchasing agreements with stent producers to get better prices. Carefully selecting patients who will gain the most from stenting treatments, taking into account criteria like as disease severity and overall health, can help to avoid unnecessary procedures and expenditures. Streamlining procedures and reducing procedural durations can help to reduce operating room costs and resource utilization. Implementing programs to manage post-procedural care and lower hospital readmission rates can have a major influence on overall healthcare expenses.

While these stents may have a greater initial cost, their ability to minimize the need for subsequent operations due to permanent implant difficulties can result in long-term cost benefits. Creating stents with longer lifespans and reduced re-intervention rates can lessen the need for recurrent treatments and their associated expenses. Investing in research and development of stents with higher efficacy and lower complication rates can result in cost savings by minimizing the need for subsequent treatments.

Manufacturers, clinicians, hospitals, insurers, and regulatory agencies can collaborate to design and implement methods that encourage the cost-effective use of coronary stents while maintaining good patient care standards. Exploring risk-sharing arrangements in which manufacturers share some of the financial burden associated with problems or re-interventions may encourage them to create stents with better long-term outcomes.

Cost-effectiveness in the coronary stent market necessitates a multifaceted approach. Implementing these techniques allows stakeholders to ensure patients receive the best possible treatment while responsibly controlling healthcare expenses. It's crucial to remember that cost-effectiveness should never come at the expense of patient safety or good treatment outcomes. The goal is to achieve a sustainable balance that benefits both patients and healthcare systems.

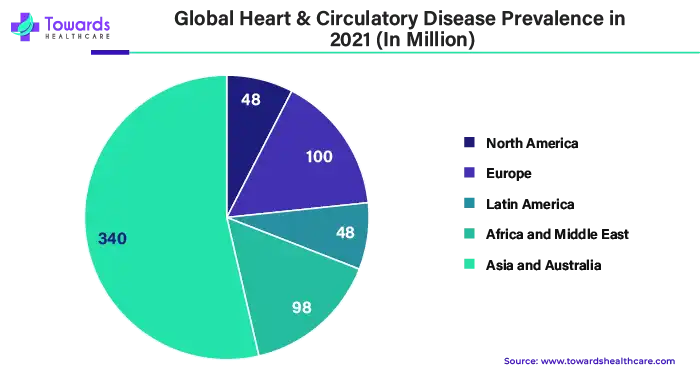

The coronary stent market landscape varies by geography, with some regions dominating and others showing great development potential. North America now dominates the global market for coronary stents.

Several causes contribute to their dominance, including:

Recent Instance,

U.S. Market Trends

Heart disease is the leading cause of morbidity and mortality in the U.S. The Centers for Disease Control and Prevention (CDC) reported that approximately 805,000 Americans have a heart attack annually. This corresponds to the increasing number of heart surgeries. Over 900,000 cardiac surgeries, including coronary bypass surgeries, are performed in the U.S. each year.

Europe is a well-developed market for coronary stents with intense competition. Stringent regulatory frameworks and an emphasis on cost-effectiveness may have an impact on pricing and market trends. European firms are actively engaged in the research and development of innovative stent technologies, including bioresorbable stents.

UK Market Trends

The UK government launches initiatives to ensure equal accessibility and affordability of cardiac surgeries. It aims to reduce premature deaths from heart disease and strokes by 25% within a decade. Cardiac surgery is a high-volume surgery, with about 28,000 adults undergoing a cardiac surgical procedure in the UK annually.

The geographical landscape of the coronary stent market is dynamic and changing. While North America now enjoys the leading position, the Asia Pacific area offers promising growth opportunities. Technological developments and a focus on cost-effectiveness are major trends influencing the future of this industry in all geographic regions.The market is driven by the growing geriatric population, the rising prevalence of chronic disorders, and the burgeoning healthcare infrastructure. Sedentary lifestyles and eating junk foods are the most common causes of heart attacks in Asia-Pacific countries.

China Market Trends

The UNFPA projected that the proportion of China’s elderly population will rise to approximately 30% from 2020 to 2050. The incidence rate of stroke and acute myocardial infarction among Chinese adults was 491 per 100,000 people and 87.6 per 100,000 people, respectively. These data potentiates the need for coronary stent.

(**We also provide cross-sectional analysis in market segments)

By Type

By End Use

By Geography

January 2026

December 2025

December 2025

November 2025