January 2026

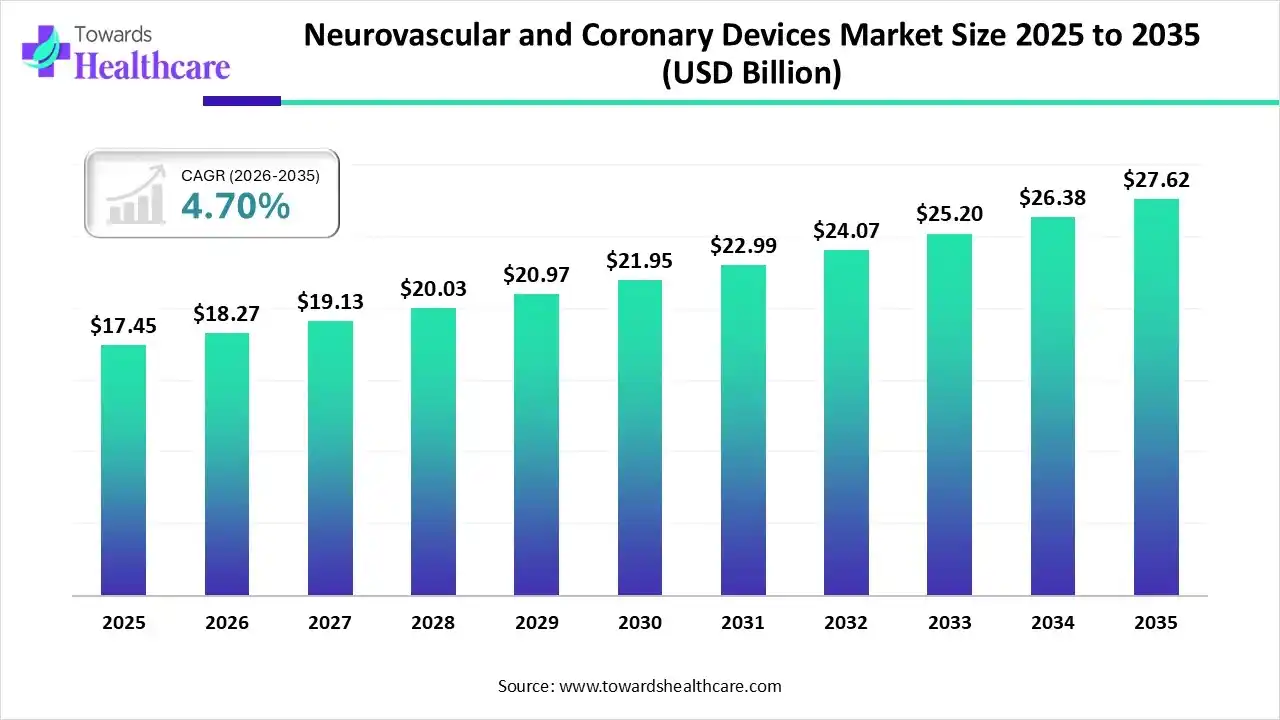

The global neurovascular and coronary devices market size was estimated at USD 17.45 billion in 2025 and is predicted to increase from USD 18.27 billion in 2026 to approximately USD 27.62 billion by 2035, expanding at a CAGR of 4.7% from 2026 to 2035.

The growth in the neurovascular and coronary artery diseases globally is driving the demand for their devices for early detection and effective treatment. The companies are utilizing AI technologies to enhance their features and are investing in and launching new devices. The advanced healthcare sector, growing innovations, and stringent regulations are driving the use of these products, which is promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 18.27 Billion |

| Projected Market Size in 2035 | USD 27.62 Billion |

| CAGR (2026 - 2035) | 4.7% |

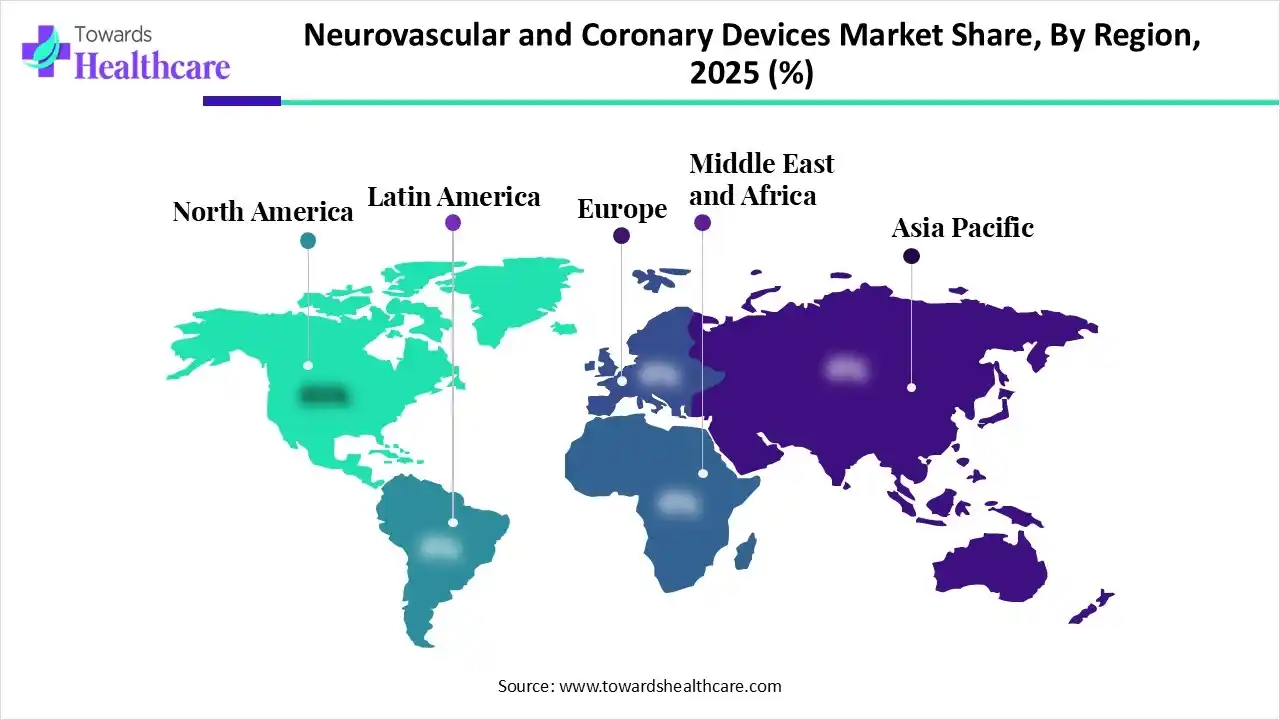

| Leading Region | North America |

| Market Segmentation | By Product Type, By Disease/Condition Treated, By Procedure Type, By End-User, By Region |

| Top Key Players | Medtronic plc, Stryker Corporation, Terumo Corporation, Johnson & Johnson, MicroPort Scientific Corp, Penumbra Inc., Abbott Laboratories, Edwards Lifesciences, W. L. Gore & Associates |

The neurovascular and coronary devices market is driven by increasing incidences of stroke, heart disease, aneurysms, the geriatric population, and advancements in minimally invasive procedures. The neurovascular and coronary devices encompass medical devices used for the diagnosis or treatment of various neurovascular and coronary arterial diseases. These devices are used to restore blood flow, open narrow arteries, stabilize weak blood vessels, treat brain aneurysms, repair heart valves, and maintain normal heart rhythm.

The use of AI in the neurovascular and coronary devices market is increasing, as they are being used for image analysis and early detection of diseases. It also provides optimized device placement and predicts the risk of complications. They are also being used to develop wearable sensors and implants, which can monitor the blood flow and pressure chance, where their use in personalized treatment planning and real-time monitoring is increasing.

Due to a growth in cardiovascular and neurovascular diseases, as well as their awareness, the demand for neurovascular and coronary devices is increasing, driving their innovations.

The companies are developing various minimally invasive devices such as catheter-based thrombectomy, drug-eluting stents, and transcatheter. Etc, to meet the growing patient demands.

The companies are focusing on developing various next-generation neurovascular and coronary devices as well as integrating digital health solutions to enhance their safety, efficiency, and remote monitoring.

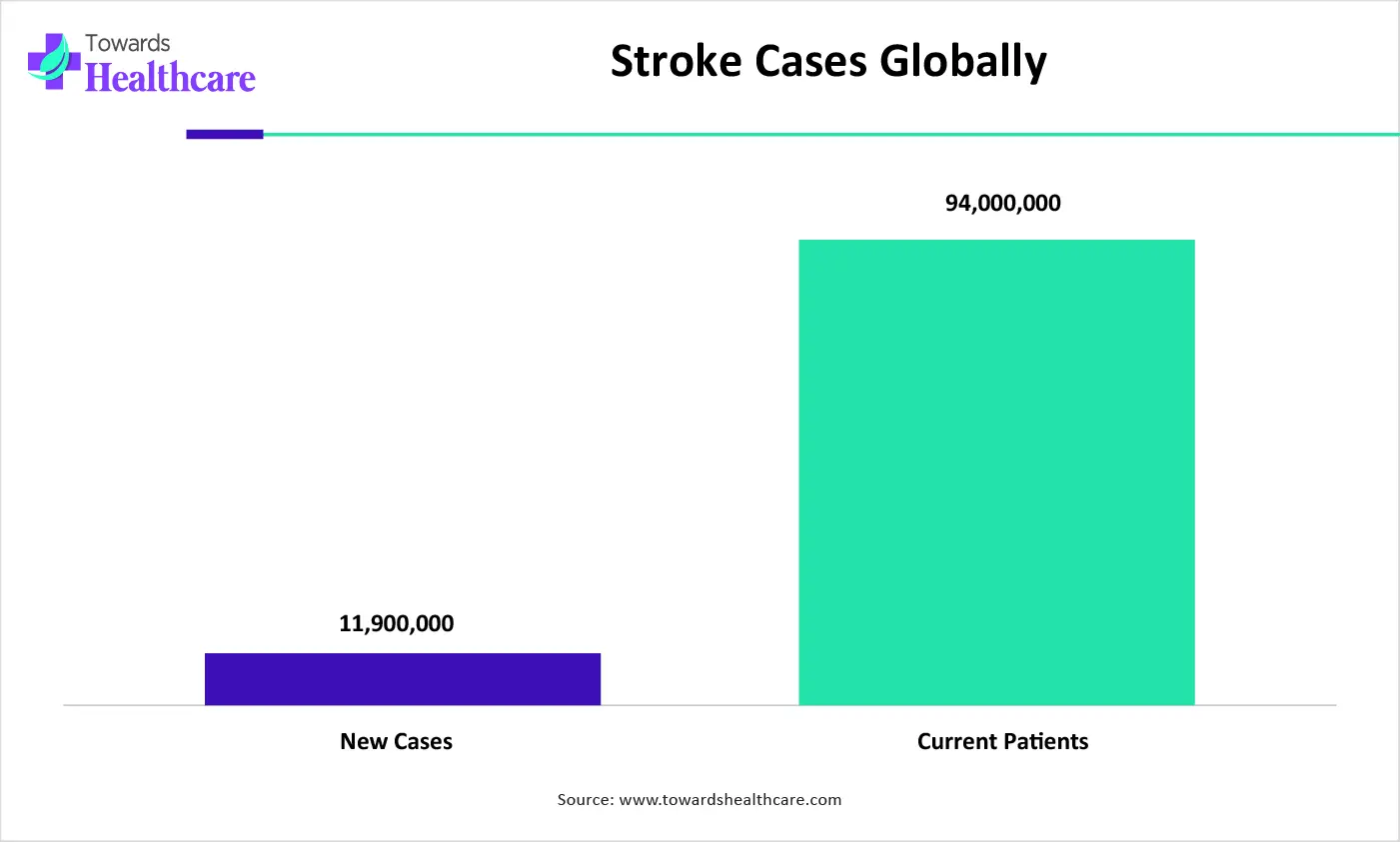

| Global stroke population | Incidence rates |

| New Cases | 11,900,000 |

| Current Patients | 94,000,000 |

Why Did the Stent Retrievers Segment Dominate in the Market in 2025?

The stent retrievers segment held the largest share in the neurovascular and coronary devices market in 2025, due to their minimally invasive approach. This, in turn, increased their use widely, where the reimbursement policies also promoted their acceptance rates. Additionally, the growth in stroke cases and R&D has also increased their use and innovations.

Flow Diverters

The flow diverters segment is expected to show the fastest growth rate during the predicted time, due to their increasing use in complex aneurysms. Additionally, their increasing success rates and minimally invasive approach are also increasing their adoption, where the growing early diagnosis is also promoting their use.

How Coronary Artery Disease Segment Dominated the Market in 2025?

The coronary artery disease segment led the neurovascular and coronary devices market in 2025, due to growth in its incidence rates. Additionally, the growth in lifestyle changes and health awareness has also increased the early diagnosis. This, in turn, has increased the demand for various neurovascular and coronary devices.

Ischemic Stroke

The ischemic stroke segment is expected to show the highest growth during the predicted time, due to its increasing mortality rates driven by growing incidences. This is growing the demand for minimally invasive and advanced treatment devices, which is fueling the use and development of new neurovascular and coronary devices.

Which Procedure Type Segment Held the Dominating Share of the Market in 2025?

The mechanical thrombectomy segment held the dominating share in the neurovascular and coronary devices market in 2025, as it was the preferred option in acute ischemic stroke. It also offered improved compatibility with other devices. Moreover, their catheter-based approach increased their use across the healthcare sector.

Flow Diversion Procedures

The flow diversion procedures segment is expected to show the fastest growth rate during the upcoming years, driven by its minimally invasive approach, which is increasing its use in the treatment of intracranial aneurysms. This, in turn, is increasing their innovations to develop more safe and more effective devices.

What Made Hospitals the Dominant Segment in the Market in 2025?

The hospitals segment led the neurovascular and coronary devices market in 2025, due to high patient volume. The hospitals also offered a wide range of neurovascular and cardiovascular devices along with skilled personnel, which increased the patient outcomes. Additionally, the reimbursement policies also attracted the patients.

Specialized Cardiac Centers

The specialized cardiac centers segment is expected to show the highest growth during the upcoming years, as they offer advanced procedures and devices. At the same time, they also offer the latest products for the treatment of complex cases, where their chronic disease management services are also attracting patients.

North America dominated the neurovascular and coronary devices market in 2025, due to the presence of the advanced healthcare sector, which offered specialized neurovascular and coronary devices. They also provided reimbursement policies, which increased their use, as the industries also developed new devices. Additionally, growth in the disease also contributed to the market growth.

The U.S. consists of well-developed hospitals and specialized clinics, which are increasing the use of neurovascular and coronary devices. The increasing incidence of cardiovascular diseases is also increasing their demand, which is encouraging their innovations. Additionally, stringent regulations are enhancing their safety and efficacy, which is increasing their adoption rates.

Asia Pacific is expected to host the fastest-growing neurovascular and coronary devices market during the forecast period, due to growing cardiovascular diseases. The rapid urbanization and expanding healthcare are also encouraging their adoption rates. Similarly, growing health awareness, disposable income, and government support are increasing their advancements, enhancing the market growth.

Due to the presence of a large population, the disease burden in China is increasing. This, in turn, is increasing the demand for neurovascular and coronary devices, where the industries are developing next-generation devices. Moreover, the growing health awareness and disposable income are promoting their use for early diagnosis of diseases.

Europe is expected to grow significantly in the neurovascular and coronary devices market during the forecast period, due to growing demand for preventive care, which is driving the use of these devices for early disease diagnosis and treatment. The growing diseases and presence of advanced healthcare are increasing their utilization. Additionally, stricter regulations and reimbursement policies are driving their innovations and acceptance rates, promoting market growth.

The UK is experiencing a growth in cardiovascular and neurovascular disease, which is increasing the demand for their devices. At the same time, the presence of reimbursement policies is increasing their acceptance rates. Furthermore, the companies are developing new devices in compliance with regulatory standards, promoting new collaborations.

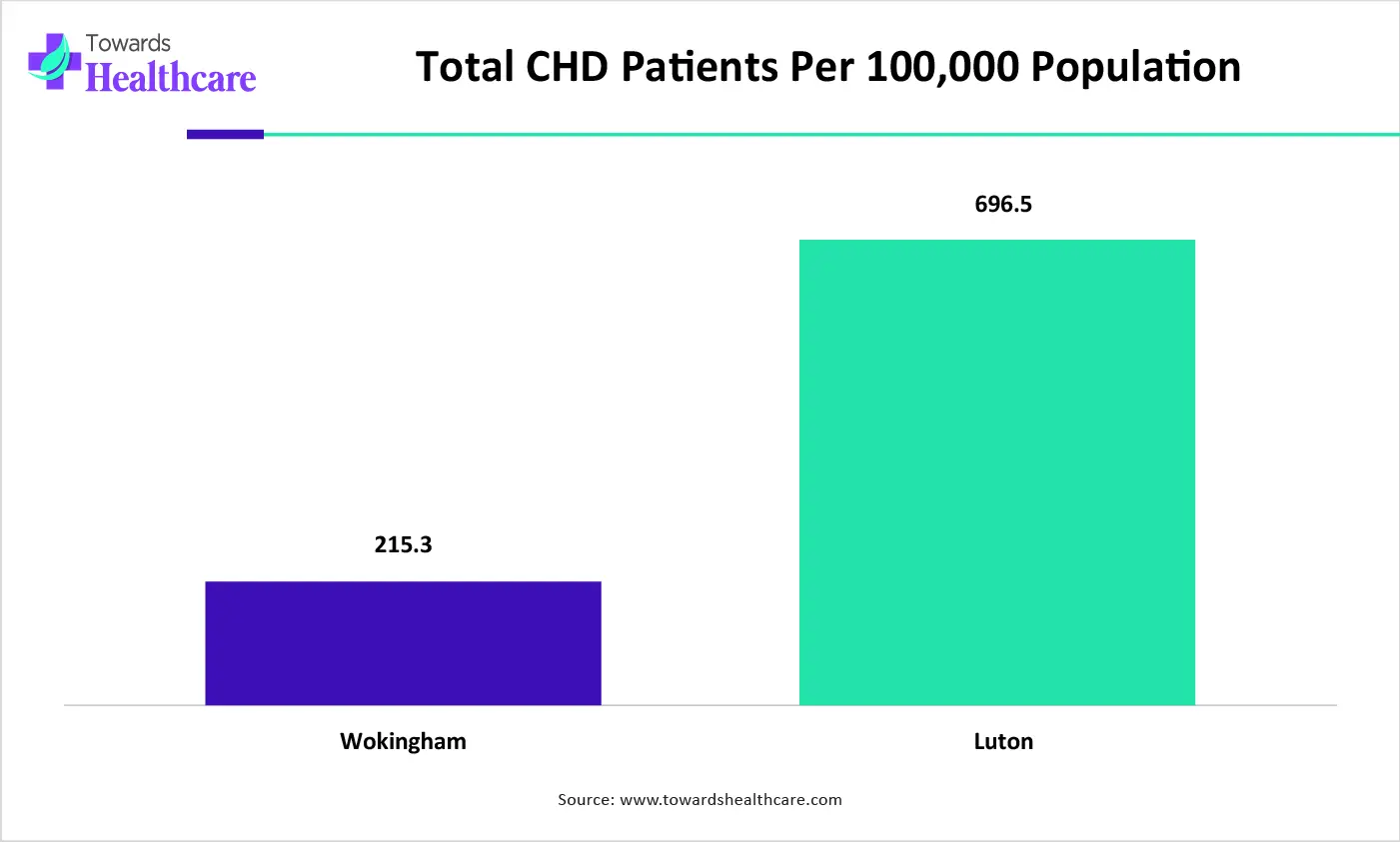

| Town | Coronary Heart Disease (CHD) Patients Per 100,000 Population |

| Wokingham | 215.3 |

| Luton | 696.5 |

| Companies | Headquarters | Neurovascular and Coronary Devices |

| Medtronic plc | Dublin, Ireland | Aneurysm coils, aspiration catheters, etc |

| Stryker Corporation | Michigan, U.S. | Mechanical thrombectomy devices, balloon angioplasty catheters, etc |

| Terumo Corporation | Tokyo Japan | Microcatheters, guidewires, and complex cerebral navigation technologies. |

| Johnson & Johnson | New Jersey, U.S. | Stent retrievers, Aneurysm coils, etc |

| MicroPort Scientific Corp | Shanghai, China | Stent retriever, coronary stents, neuro access systems, etc. |

| Penumbra Inc. | California, U.S. | Aspiration catheters and mechanical thrombectomy devices |

| Abbott Laboratories | Illinois, U.S. | Carotid artery stents and neurovascular access products |

| Boston Scientific Corp | Massachusetts, U.S. | Neurovascular access products and neurology devices. |

| Edwards Lifesciences | California, U.S. | Catheters, heart valves, and critical care monitoring products |

| W. L. Gore & Associates | Delaware, U.S. | Vascular grafts and synthetic patches |

By Product Type

By Disease/Condition Treated

By Procedure Type

By End-User

By Region

January 2026

January 2026

January 2026

January 2026