February 2026

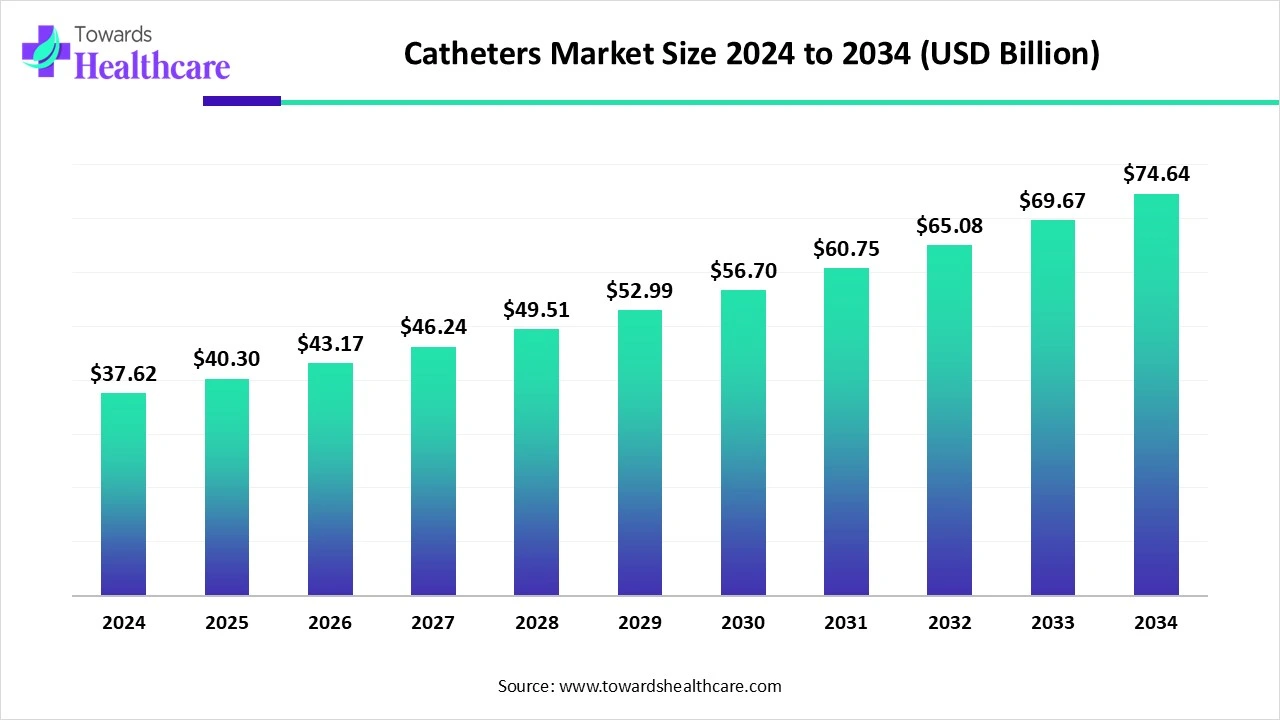

The catheters market size was reported at US$ 40.30 billion in 2025 and is expected to rise to US$ 43.17 billion in 2026. According to forecasts, it will grow at a CAGR of 7.12% to reach US$ 80.17 billion by 2035.

It is anticipated that the market would expand due to the expanding advances in catheter production and the rising number of related product releases. The development of catheters that produce superior results is the focus of several industrial businesses. Catheters will be in higher demand throughout the next projection period as a result of people's growing awareness of the need to prevent catheter-related bloodstream infections (CRBSI). Additionally, in order to keep up with the increasing demand for catheters, businesses are growing their manufacturing facilities and capabilities.

Catheters are flexible tubes inserted into the body to deliver or drain fluids, access vessels or body cavities, deliver devices (stents/balloons), monitor physiology, or administer drugs. The catheters market covers a very broad product set, cardiovascular (diagnostic & interventional) catheters, neurovascular, urological/urinary, intravenous/central venous, dialysis/hemodialysis access, drainage/care catheters, infusion and specialty catheters, plus related consumables, procedure kits, coatings (antimicrobial, hydrophilic), and services (sterile contract manufacturing, sterilisation, capital devices for interventional suites). The market is driven by minimally invasive procedures, ageing populations, rising cardiovascular & urological disease burden, and technological advances (coatings, drug-eluting catheters, integrated sensors).

Demand for Minimally Invasive Surgeries: By providing patients with less intrusive options than standard operations, minimally invasive procedures have completely changed the medical field. These operations use cutting-edge technology to operate through tiny incisions, which leads to a speedier recovery and fewer problems. Patients looking for cutting-edge medical care are increasingly using these procedures.

For instance,

Automation and artificial intelligence (AI) are transforming the dual access catheter market by improving catheter placement techniques, enabling real-time monitoring, and improving diagnostic accuracy. Particularly in high-risk patients who need simultaneous venous and artery access, AI-powered image guided systems are increasing the accuracy of dual-lumen catheter insertions. Additionally, automation in manufacturing is lowering production mistakes and ensuring constant product quality, which allows for a faster reaction to changing demand patterns in hemodialysis and critical care applications. By lowering hospital readmission rates, minimising infection risks, and providing predictive analytics in catheter-related issues, AI integration is having an even greater impact on post-operative patient treatment.

Rising Cases of UITs are Driving the Catheters Market

A prevalent infectious condition, UTIs need to be treated medically in both inpatient and outpatient settings. In the United States, it costs the economy more than USD 2 billion a year, and globally, it costs several billions. With an estimated 150 million cases each year, urinary tract infections (UTIs) are a major global public health problem. The main pathogens that cause UTIs are Klebsiella species, Escherichia coli (E. coli), and other Gram-negative bacteria. The problem is becoming worse on a global scale. Drug-resistant infection-related deaths are expected to increase from 700,000 to 10 million per year by 2050, with a potential global cost of USD 100 trillion

Complications Due to Catheter Usage

In-depth interviews and record examinations of over 2,000 patients revealed that over half of those admitted to catheterized hospitals had a problem. The most frequent complication that patients with indwelling urinary catheters encounter is most likely CAUTIs. They happen when germs get into the urinary system, generally through a catheter, and infect the kidneys, bladder, or urethra.

Technological Innovation and Patient-Focused Advancements

The catheters market will be driven by patient-centered innovations and technology innovation in the future, with the goal of improving comfort, safety, and accuracy. Smart sensor integration for real-time feedback, the use of sophisticated and biocompatible materials for increased flexibility and decreased infection risks, and device miniaturisation to facilitate minimally invasive operations are some of the major themes. While the integration of imaging systems guarantees accurate placement for targeted treatments, emerging technologies such as 3D printing and nanotechnology are opening the door for specially made, antimicrobial catheters.

| Table | Scope |

| Market Size in 2026 | USD 43.17 Billion |

| Projected Market Size in 2035 | USD 80.17 Billion |

| CAGR (2026 - 2035) | 7.12% |

| Leading Region | North America |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Product/Catheter Type, By Design/Feature, By Material, By End-User/Customer, By Region |

| Top Key Players | Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Becton, Dickinson and Company (BD), Teleflex Incorporated, Cook Medical, Cardinal Health, B. Braun Melsungen AG, Terumo Corporation, Edwards Lifesciences, Merit Medical Systems, Inc., AngioDynamics, Inc., CONVATEC/Hollister, Coloplast A/S, Nipro Corporation, Stryker Corporation, Olympus Corporation, Smiths Medical, Teleflex, C.R. Bard (now part of BD) |

What made the Cardiovascular Catheters Segment Dominant in the Market in 2025?

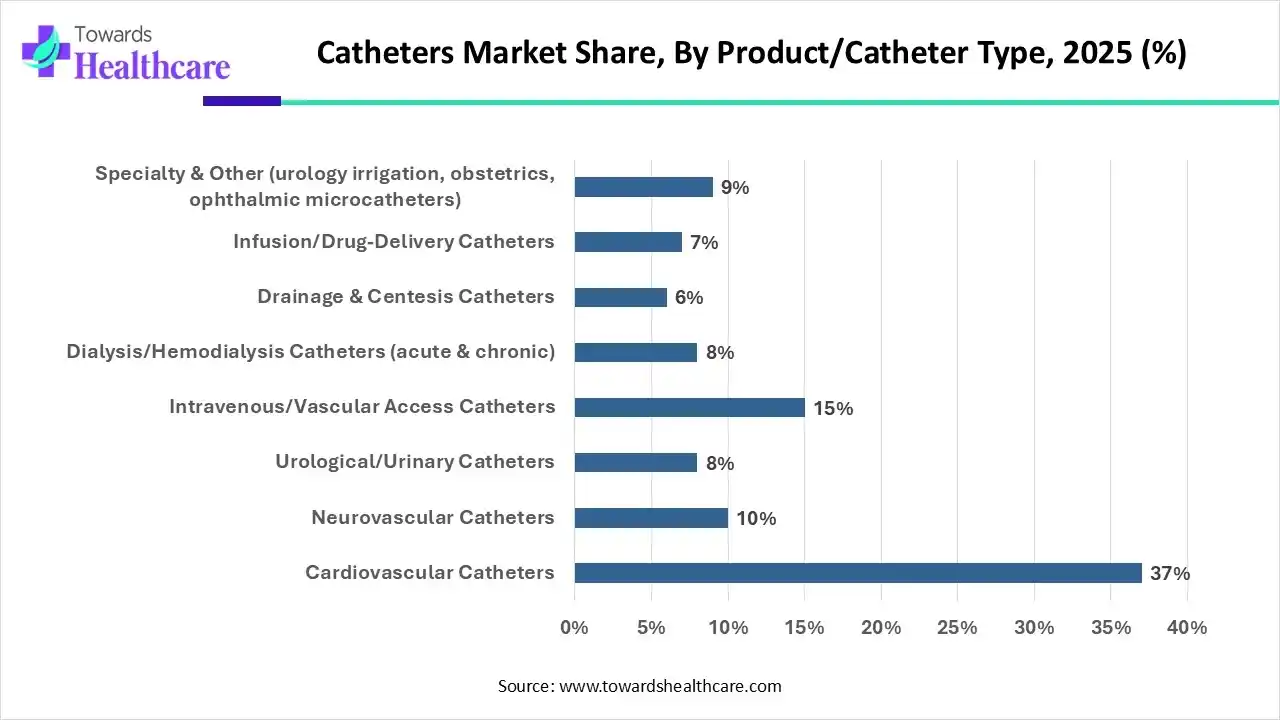

By product/catheter type, the cardiovascular catheters segment held the major share of the catheters market by 37% in 2025. Recent years have seen a significant evolution in the area of congenital cardiac catheterization in both adults and children. New imaging methods include 3D printing, holographic imaging, multi-modal image fusion, and three-dimensional (3D) rotational angiography might improve our comprehension of intricate congenital cardiac abnormalities for diagnostic or therapeutic objectives. More patients can now get percutaneous treatments because to advancements in device design and insertion methods, particularly those whose surgical risk is too high.

By product/catheter type, the neurovascular catheters segment is estimated to achieve the highest CAGR during the forecast period. Global patient care has been revolutionised by neurovascular microcatheters. They have greatly improved medical care in this area by making it possible to do minimally invasive procedures in a difficult area of the body. Brain aneurysms, ischemic stroke, and other neurovascular disorders are among the illnesses that microcatheters are used to treat.

Which Design/Feature Segment Dominated the Market in 2025?

By design/feature, the coated vs uncoated segment was dominant in the catheters market by 45% in 2025. These days, patients can choose between hydrophilic, pre-lubricated, or uncoated catheters. The most common and conventional intermittent catheter is uncoated. Within the unopened container, hydrophilic catheters self-lubricate thanks to a unique coating that responds to water. A sterile lubricant that resembles gel is applied to pre-lubricated catheters. They are ready to use immediately out of the box and are single-use.

By design/feature, the steerable/directional tip/sensor-integrated catheters segment is anticipated to be the fastest-growing during the upcoming period. With the use of steerable or directional catheters, which are flexible tubes used in minimally invasive operations, doctors may accurately navigate intricate anatomies like blood arteries. These catheters have a manoeuvrable tip that is frequently controlled by pull wires and a steering handle. By adding integrated sensors, including fibre optic sensors, real-time input on force, position, or other physiological characteristics may be obtained. This improves navigation accuracy, speeds up procedures, and increases patient safety by lowering radiation exposure.

Why was the Polyurethane (PU) segment Dominant in the Market in 2025?

By material, the polyurethane (PU) segment led the catheters market by 50% in 2025. Polymeric polymers like polyurethane (PU) are frequently used to make medical tubing, including intravascular catheters (IVCs). When utilised in blood-contacting applications, polyurethanes exhibit outstanding mechanical qualities, high elongation capacity, superior abrasion resistance, high flexibility and hardness, and good biocompatibility. Polyurethanes' bulk and surface properties are constantly being altered to enhance their physicochemical, blood-contacting, and infection-resistant qualities.

By material, the composite/hybrid materials segment is estimated to witness the highest growth during 2026-2035. Compared to conventional single-material catheters, which frequently have to choose between flexibility and durability, hybrid catheter designs mark a substantial advancement. Researchers and manufacturers have started investigating the synergistic qualities of composite materials, intelligent production processes, and novel geometries as a result of advances in materials science and engineering.

| Segment | Share 2025 (%) |

| Single-use/Disposable Catheters | 80% |

| Reusable/Resterilisable Catheters (niche) | 5% |

| Short-term vs Long-term Implantable | 15% |

What made the Single-Use/Disposable Catheters Segment Dominant in 2025?

By durability/use model, the single-use/disposable catheters segment held the major share of the catheters market by 80% in 2025 and is anticipated to grow at the highest rate during the predicted time frame. Many patients find single-use hydrophilic catheters to be a practical and preferred option for intermittent catheterization since they reduce the risk of both short-term and long-term problems. There is strong evidence that single-use IMC is linked to superior health outcomes, including as a lower incidence of urethral injuries and urinary tract infections, as well as an enhanced quality of life.

Which End-User/Customer Segment Dominated the Market in 2025?

By end-user/customer, the hospitals & surgical centers segment held the major revenue of the catheters market by 65% in 2025. Catheters are used for a variety of purposes in hospitals and surgical centres, mostly related to urine drainage and management, however they are also occasionally used for surgical operations. A frequent medical device for patients who have trouble peeing on their own or require assistance during and after surgery, catheters are used in both inpatient and outpatient settings.

By end-user/customer, the ambulatory surgery centers (ASCs) & outpatient clinics segment is expected to be the fastest-growing during 2025-2034. The goal of ambulatory surgery centres, or ASCs, is to provide surgical treatment without requiring patients to spend the night in the hospital. When it comes to surgery, outpatient procedures have several benefits over inpatient procedures. ASCs are usually manned by highly skilled and knowledgeable medical personnel and furnished with cutting-edge surgical equipment. Patients can get comfort, convenience, and individualised treatment from ambulatory surgical centres. For individuals seeking more individualised medical treatment, financial savings, or the avoidance of the inconvenience of a hospital stay, an ASC is a great option. Patients should do their homework and locate a trustworthy ASC that can meet their unique demands.

North America dominated the market in 2025. The causes of this growth include an ageing population, a rise in the prevalence of chronic diseases, technological developments, and rising healthcare expenses. The US leads the North American market because to its large patient population, advanced healthcare system, and extensive capacity for manufacturing medical equipment. Big catheter manufacturers are based in the US, and the favourable reimbursement climate there helps fuel the market's growth. North America is setting the standard for catheter technology. There is a great demand for many different types of catheters.

Females are at least four times more likely than guys to get a UTI. The following are important UTI statistics: About 40% of American women will get a UTI at some point in their lives. A UTI affects around 10% of women each year. Nearly 50% of patients get a second infection within a year, indicating the prevalence of recurrences. Among women aged 16 to 35, UTIs are most prevalent.

The use of cardiovascular catheters is anticipated to increase significantly over the next several years as a result of the rise in cardiovascular illnesses in Canada. About 17.7% of all fatalities in 2023 will be attributable to cardiovascular illnesses, making them the second most common cause of death in Canada. According to estimates, major cardiovascular illnesses claimed the lives of about 76,962 Canadians in that year.

Asia Pacific is estimated to host the fastest-growing catheters market during the forecast period. The government's investment in universal care, increased surgical volume, and health system modernisation all contribute to the strengthening of underlying demand. By 2030, the area is expected to spend USD 225 billion on medical technologies. Technology-transfer agreements, local manufacturing incentives, and the growing private hospital market in South-east Asia and India all reduce entrance hurdles. However, for businesses looking to expand in the APAC catheters market, diverse regulatory frameworks and price-cap laws necessitate sophisticated go-to-market tactics.

Concept creation, material selection, design, and prototyping are all part of catheter research and development. To guarantee safety and effectiveness, these steps are followed by thorough testing and validation. Before the final product is prepared for use, it must undergo sterile packing and sterilisation to satisfy stringent medical and regulatory requirements.

Key Companies: Medtronic, Boston Scientific, Teleflex, and Johnson & Johnson

A complicated procedure is used to distribute catheters to pharmacies and hospitals, guaranteeing that these medical supplies are easily accessible for patient care. This covers purchasing, storing, and dispensing; these tasks are frequently overseen by the hospital pharmacy or an authorised distributor of medical supplies.

Key Companies: Medtronic, Boston Scientific Corporation, Teleflex Incorporated, and B. Braun SE, along with distributors like McKesson Corporation.

Education, good cleanliness, and handling any problems are the main goals of patient support and services for catheter care. The goal of these services is to enable patients to properly care for their catheters and avoid infections. This covers how to properly insert and remove a catheter (if necessary), maintain a drainage bag, maintain good perineal cleanliness, and spot infection or other problems.

Key Companies: Medtronic, Teleflex, Coloplast, Convatec, and Cardinal Health

In September 2024, we are pleased to announce that EMBOGUARD has joined our family of CERENOVUS Stroke Solutions in Europe, stated CERENOVUS Worldwide President Mark Dickinson. This addition to our technology portfolio strengthens our resolve to alter the course of stroke by giving doctors a cutting-edge and all-inclusive toolkit to treat their patients.

By Product/Catheter Type

By Design/Feature

By Material

By End-User/Customer

By Region

February 2026

February 2026

February 2026

February 2026