January 2026

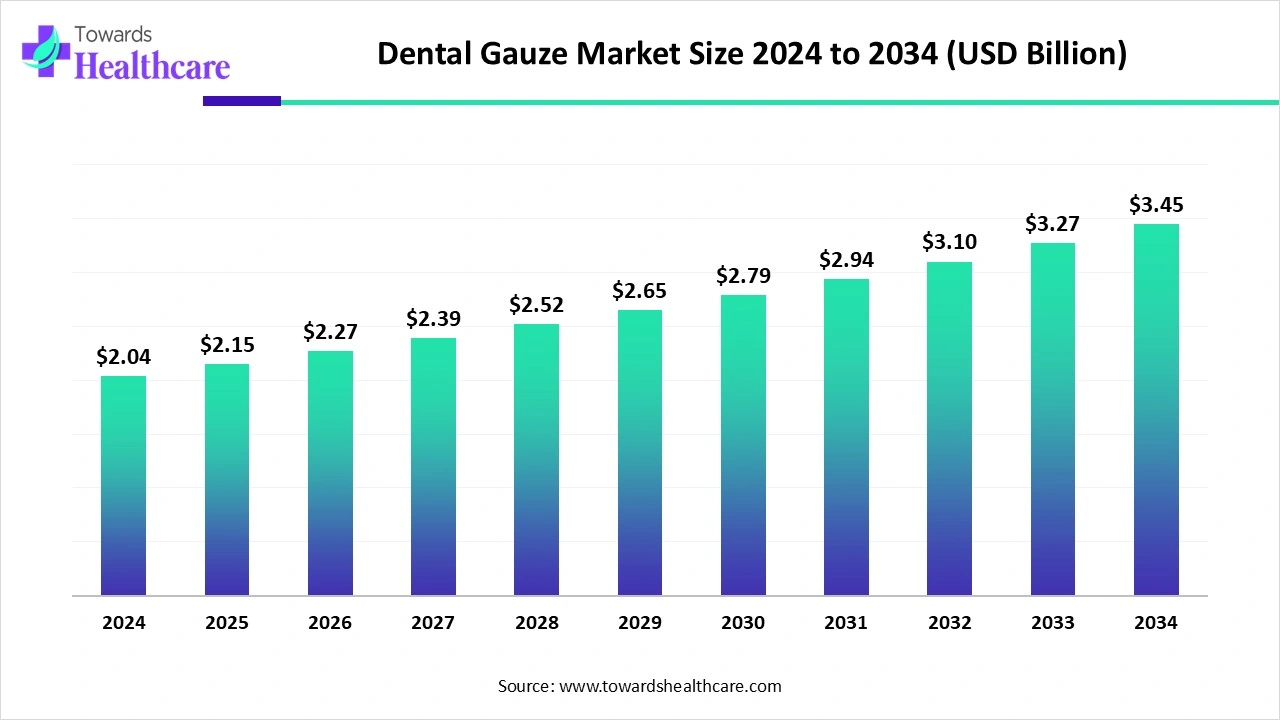

The global dental gauze market size recorded US$ 2.15 billion in 2025, set to grow to US$ 2.27 billion in 2026 and projected to hit nearly US$ 3.65 billion by 2035, with a CAGR of 5.44% throughout the forecast timeline.

The dental gauze market is witnessing steady growth driven by increasing dental procedures, rising awareness of oral hygiene, and the demand for infection control products. Key factors include innovations in absorbent and antimicrobial gauze, along with the shift toward disposable and eco-friendly products. However, the availability of alternative materials and products may restrain growth. Future opportunities lie in integrating gauze with digital dentistry solutions and developing advanced, multifunctional gauze to enhance procedural efficiency and patient care.

| Table | Scope |

| Market Size in 2025 | USD 2.15 Billion |

| Projected Market Size in 2035 | USD 3.65 Billion |

| CAGR (2026 - 2035) | 5.44% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Material, By Application, By Distribution Channel, By Region |

| Top Key Players | 3M, Johnson & Johnson (Ethicon), Medtronic, Smith & Nephew, B. Braun Melsungen AG, Cardinal Health, Mölnlycke Health Care, Dynarex Corporation, Deroyal Industries, Integra LifeSciences, Hartmann Group, Medline Industries, Patterson Dental Supply, Henry Schein, Inc., Dentsply Sirona, Septodont, Crosstex International, Richmond Dental & Medical, GASA Group, Lohmann & Rauscher |

The market covers absorbent medical-grade fabrics and dressings used in dentistry for bleeding control, wound protection, moisture absorption, and post-surgical oral care. These include sterile and non-sterile gauze in different formats, designed for applications in dental surgeries, extractions, and routine procedures. The dental gauze market is expanding as innovations in biodegradable and eco-friendly materials gain traction, aligning with sustainable healthcare practices.

Increasing adoption of disposable products to minimize infection risks is also boosting demand. Furthermore, growth in pediatric and geriatric dental care, where wound management and comfort are critical, is driving usage. Strategic investment by manufacturers in specialized gauze products for faster recovery and patient convenience is creating new opportunities, further propelling market growth during the forecast period.

Strategic Partnerships: Collaborations between dental product manufacturers and healthcare providers are expanding the reach of innovative gauze solutions, ensuring wider availability in clinics and hospitals, and boosting market penetration.

Product Launches: Introduction of advanced gauze products, such as medicated, biodegradable, or highly absorbent variants, is driving adoption by improving wound healing, patient comfort, and aligning with sustainable healthcare practices.

AI can impact the market by optimizing supply chain management, ensuring the timely availability of gauze in clinics and hospitals. It can also support demand forecasting based on patient trends and dental procedure volumes. Moreover, AI-driven R&D can help develop innovative gauze materials with better absorbency, antimicrobial properties, and patient comfort. Integration of AI in digital dentistry further increases precision in treatment planning, indirectly boosting demand for advanced dental consumables like gauze.

Growing Prevalence of Oral Diseases

The increasing prevalence of oral diseases boosts the dental gauze market by creating higher demand for preventive and restorative procedures that require safe and effective wound management. As awareness of oral hygiene grows, more patients undergo routine treatments, extraction, and periodontal therapies, all of which utilize gauze for bleeding control and protection. This expanding patient base and the need for reliable post-procedure care are driving consistent market growth.

For Instance,

Availability of Alternative Products

The availability of alternative products acts as a restraint in the dental gauze market due to the increasing preference for advanced wound care materials. These alternatives, such as hydrocolloid and foam dressings, offer enhanced features like better absorption, faster healing, and reduced dressing changes, which are particularly beneficial in dental procedures requiring prolonged wound care. Consequently, healthcare providers may opt for these alternatives over traditional gauze, limiting the growth of the dental gauze market.

Integration with Digital Dentistry

The integration of digital dentistry presents a significant future opportunity for the dental gauze market. As digital technologies like CAD/CAM systems, intraoral scanners, and 3D printing become more prevalent, they enable more precise and minimally invasive dental procedures. These advancements often result in smaller incisions and reduce bleeding, thereby increasing the demand for specialized dental gauze products designed to manage these specific needs effectively. Consequently, the adoption of digital dentistry is expected to drive the demand for innovative dental gauze solutions.

The sterile dental gauze segment leads the market because it offers reliability and consistent performance in managing bleeding and maintaining a clean operative area. Its widespread use in routine dental procedures, such as extractions and periodontal treatments, ensures high demand. The preference for sterile products is also driven by patient safety concerns and professional standards in dental practice. Moreover, improvements in material softness, absorbency, and compatibility with other dental products have further strengthened its market dominance.

The impregnated/coated gauze segment is projected to grow rapidly as dentists increasingly seek products that simplify procedures and improve efficiency. These gauzes offer added benefits like pain relief, faster clot formation, and reduced post-operative care, making them attractive for busy practices. Rising adoption in cosmetic dentistry, oral surgeries, and pediatric dentistry, along with innovations in bioactive coating and plant-based additives, is driving market expansion. Enhanced patient comfort and procedural convenience are key factors behind its fast growth.

The cotton gauze segment dominated the dental gauze market in 2024 as it offers durability and ease of handling during complex dental procedures. Its natural fibers reduce the risk of tissue irritation and provide reliable support for medicated or coated applications. Growing demand in both routine and surgical dental treatments, combined with preferences for eco-friendly and biodegradable materials, has reinforced its market leadership. Furthermore, ongoing innovations in weave patterns and thickness variations enhance performance, driving higher adoption and revenue generation.

The non-woven gauze segment is projected to grow rapidly as it offers a lightweight, flexible, and highly absorbent alternative to traditional materials. Its ability to integrate with medicated coating and hemostatic agents makes it suitable for advanced dental treatments. Increasing preference for single-use, hygienic products in dental clinics and hospitals, along with innovations in eco-friendly and biodegradable non-woven fabrics, is driving adoption. Enhanced handling, faster production, and adaptability for specialized procedures contribute to its faster-growing market share.

The surgical procedures segment dominated in 2024 as dental gauze is essential for managing post-operative care and ensuring patient comfort during intensive treatments. Its use in advanced procedures, such as maxillofacial surgeries and reconstructive dentistry, drives consistent demand. Growing dental tourism and rising investments in specialized surgical centers have further boosted adoption. Additionally, innovations in gauze design, such as enhanced absorbency and antimicrobial coating tailored for surgical use, have strengthened its market leadership in this application segment.

The hemostasis & bleeding control segment is projected to grow rapidly as dental practices emphasize faster procedure times and improved post-operative outcomes. Rising adoption of specialized gauze for managing excessive bleeding in complex treatments, such as implantology and oral surgeries, is fueling demand. Additionally, increasing focus on patient-centric care, coupled with innovations in bioactive and plant-based hemostasis materials, is driving market expansion. Enhanced reliability, ease of use, and reduced need for follow-up interventions contribute to its fastest-growing CAGR.

The hospital supply stores segment led the dental gauze market in 2024 as it offers streamlined access to diverse dental gauze products for both routine and specialized procedures. Their ability to provide timely restocking, bulk discounts, and certified quality products makes them preferred by hospitals and large dental clinics. Rising investments in hospital infrastructure and increasing surgical procedures have further boosted demand through this channel. Additionally, strong relationships with manufacturers and efficient logistics networks reinforce their position as the top revenue-generating distribution channel.

The online platforms segment is projected to grow rapidly as dental professionals increasingly prefer digital purchasing for time efficiency and flexibility. Platforms provide access to niche and advanced gauze products, often unavailable through conventional channels. The convenience of bulk ordering, subscription services, and direct-to-clinic delivery drives adoption. Additionally, the expansion of B2B e-commerce in healthcare, combined with promotional offers and user-friendly interfaces, is encouraging more dental practices to source gauze online, fueling the fastest CAGR of the segment in the market.

North America led the market in 2024 due to rising investments in dental research and development and the increasing prevalence of dental surgeries. The focus of the region on patient-centric care and adoption of technologically advanced dental products, including specialized and coated gauze, has strengthened demand. Additionally, favorable reimbursement policies, high disposable income, and strong collaborations between manufacturers and dental institutions have supported widespread product availability, securing the position of North America as the top revenue-generating region in the market.

The U.S. market is expanding due to the growing number of dental procedures, rising awareness of oral health, and emphasis on infection control in clinics and hospitals. Increasing demand for advanced gauze products, such as hemostatic and coated variants, along with innovations in material quality and absorbency, is driving growth. Additionally, supportive healthcare infrastructure and high adoption of disposable and sterile products contribute to the steady expansion of expansion.

The market in Canada is growing as dental clinics increasingly focus on efficiency and patient comfort during treatments. Rising investments in modern dental facilities, coupled with the demand for innovative gauze products like hemostatic and bioactive variants, are fueling market expansion. Additionally, government initiatives promoting oral health, an aging population requiring more dental care, and the preference for disposable, easy-to-use products are further driving the growth of the Canadian market.

Asia-Pacific is projected to grow rapidly as urbanization and healthcare investments expand access to dental services. The increasing prevalence of oral diseases, rising geriatric population, and growing popularity of cosmetic and surgical dental procedures drive demand for dental gauze. Additionally, the region benefits from the entry of global manufacturers, local production of cost-effective gauze products, and rising adoption of disposable and specialized gauze in both public and private dental clinics, contributing to its fastest CAGR in the market.

Research and development in dental gauze is aimed at creating advanced products with improved blood-clotting and antimicrobial capabilities. Modern gauze incorporates materials like oxidized regenerated cellulose (ORC) and gelatin sponges, often coated with active agents such as Feracrylum, silver nanoparticles, or chlorhexidine. These innovations enhance wound healing, reduce infection risks, and help prevent post-operative complications like dry socket, offering more effective and safer solutions compared to traditional gauze.

Dental gauze packaging is designed to preserve sterility through sealed pouches while ensuring ease of use and product protection. It typically includes branding and handling instructions for user guidance. Serialization adds unique identification codes to each package, enabling tracking throughout production and supply chains, ensuring regulatory compliance, and preventing counterfeiting. This approach enhances safety, traceability, and quality assurance in the distribution of dental gauze products.

Patient support for dental gauze focuses on guiding proper post-operative use, especially after tooth extractions. Instructions cover correct placement, pressure application, and duration, along with alternative measures, such as using tea bags for continued bleeding control. Patients are advised on when to discontinue gauze, the need to avoid suction to prevent dry sockets, and to seek professional help if heavy or persistent bleeding occurs, ensuring safe recovery and effective wound management.

In April 2024, oral care brand RADIUS launched its new Immune Support Toothpaste Collection, featuring both adult and pediatric options. According to the company, the toothpaste combines elderberry, vitamin C, vitamin E, and hydroxyapatite in what they call a Triple Action Immune Boost, designed to support the immune system while providing cavity protection and enamel remineralization. The collection includes Immuni-Minty Elderberry Mint for adults and Super Duper Bubble Berry Mint for children. Additional ingredients like coconut oil, baking soda, and elderberry also help with teeth whitening, as highlighted in the announcement made by the company.

By Product Type

By Material

By Application

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026