February 2026

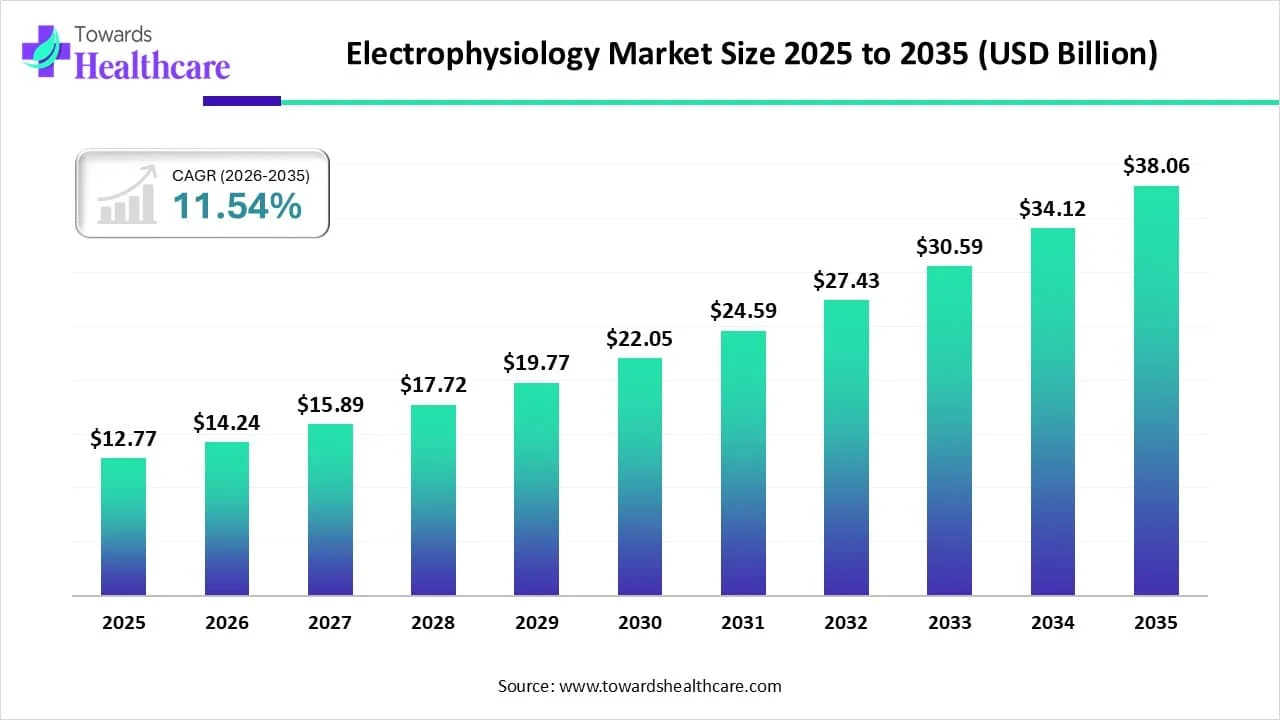

The global electrophysiology market size was reported at US$ 12.77 billion in 2025 and is expected to rise to US$ 14.24 billion in 2026. According to forecasts, it will grow at a CAGR of 11.54% to reach US$ 38.06 billion by 2035.

The electrophysiology market is witnessing strong growth as hospitals and clinics increasingly integrate advanced cardiac monitoring and treatment systems into routine care. Expanding awareness of early arrhythmia detection, along with a shift toward personalized heart rhythm management, is encouraging adoption. Strategic collaborations between medical device companies and research institutions are accelerating product innovation. Furthermore, the rise in cardiovascular health programs and better access to specialized care in developing regions are creating new opportunities for market expansion.

| Table | Scope |

| Market Size in 2026 | USD 14.24 Billion |

| Projected Market Size in 2035 | USD 38.06 Billion |

| CAGR (2025 - 2034) | 11.54% |

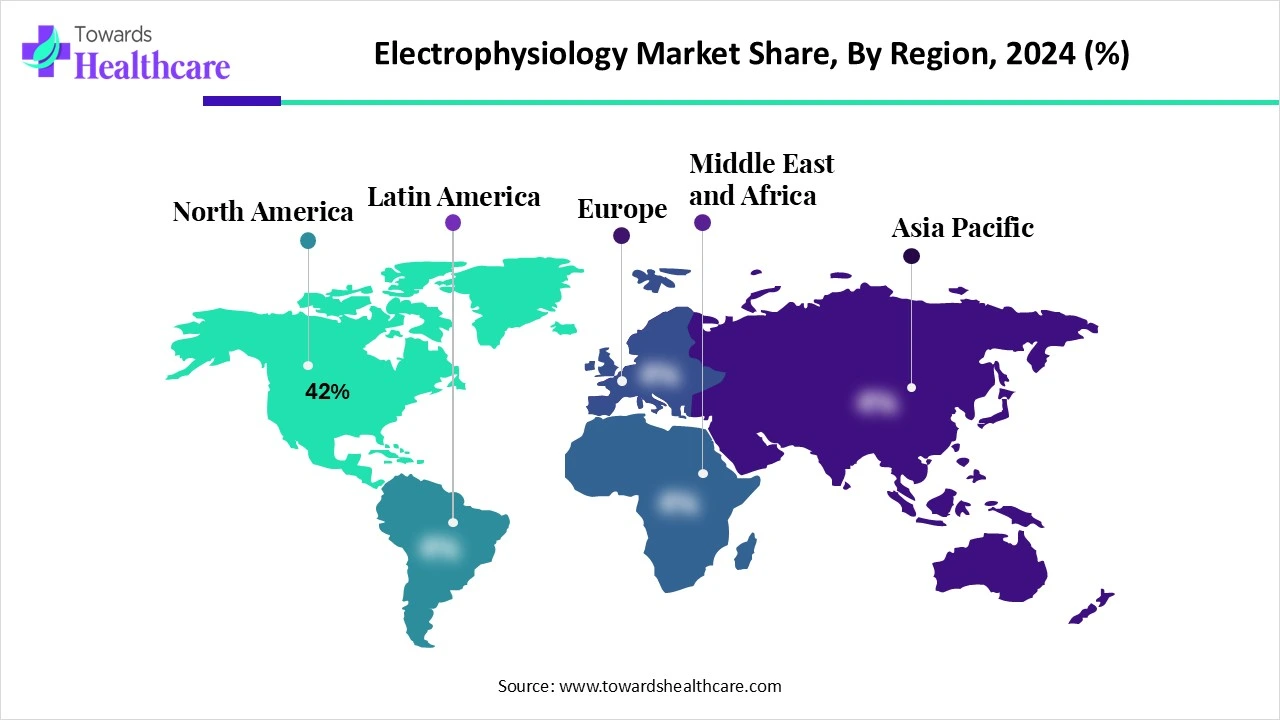

| Leading Region | North America Share 42% |

| Market Segmentation | By Product Type, By Procedure Type / Indication, By End User, By Region |

| Top Key Players | Biosense Webster (Johnson & Johnson / J&J), Abbott, Boston Scientific, Medtronic plc, Philips Healthcare, Siemens Healthineers, Biotronik, Acutus Medical, Stereotaxis, AtriCure, Baylis Medical, CardioFocus, Hemoteq / companies in single-use introducers & sheaths, Corindus, Cryoablation specialists / focal players, Electrophysiology consumables & OEMs, CardioInsight, Biosig Technologies, Farapulse / companies developing PFA / Pulsed Field Ablation, Smaller niche & OEM suppliers |

The electrophysiology market covers devices, systems, and consumables used to diagnose and treat cardiac arrhythmias, including tools for intracardiac mapping, cardiac ablation, pace-mapping, implantable device testing, and EP recording/monitoring. EP procedures (atrial fibrillation, SVT, VT ablations, device-related pacing/defibrillation testing) rely on diagnostic catheters, ablation catheters, and generators (RF, cryo, laser, ultrasound), 3D electroanatomic mapping/navigation systems, intracardiac echo, procedural imaging, and a broad range of disposables/accessories.

Market growth is driven by rising arrhythmia prevalence (aging populations), greater adoption of catheter ablation for AF, advances in mapping/robotics/energy modalities, and expansion of EP-capable centers. The electrophysiology market is evolving due to the rising prevalence of cardiac arrhythmias, advancements in diagnostic and therapeutic technologies, and increasing adoption of minimally invasive procedures. Growing awareness about early minimally invasive procedures. Growing awareness about expanding healthcare infrastructure further drives demand. Additionally, integration of artificial intelligence and 3D mapping systems is enhancing procedural accuracy and efficiency, fostering market growth and innovation in cardiac care solutions.

Technological Advancements: Innovations like 3D mapping, pulsed field ablation, and AI integration enhance accuracy and efficiency.

Supportive Government Initiatives: Funding and awareness programs encourage early diagnosis and treatment.

AI is driving growth in the electrophysiology market by enhancing diagnostic accuracy, optimizing treatment planning, and improving real-time decision-making during procedures. Advanced algorithms enable precise arrhythmia detection, integration with 3D mapping systems, and predictive analytics for patient outcomes. This leads to more efficient workflows, reduced procedural risks, and better success rates, encouraging wider adoption of electrophysiology technologies in clinical practice.

Rising Prevalence of Cardiac Arrhythmias

Increasing cases of irregular heart rhythms, including atrial fibrillation, are fueling the growth of the electrophysiology market. As these conditions pose serious health risks like stroke and heart failure, there is a greater demand for precise diagnostic tools and minimally invasive treatments. This surge in patients needing specialized care encourages the development and adoption of advanced electrophysiology technologies, ultimately expanding the market and improving patient outcomes worldwide.

For Instance,

High Procedure Costs

The expensive nature of electrophysiology procedures restricts market expansion by making treatments less accessible to many patients, particularly in cost-sensitive regions. The need for sophisticated devices and highly trained specialized drives up costs, which can deter hospitals from adopting these technologies widely. Moreover, high out-of-pocket expenses and limited insurance coverage further reduce patient willingness to undergo such procedures, thereby slowing overall market growth despite increasing cases of cardiac disorders.

Advancements in Minimally Invasive Technologies

Innovation in minimally invasive techniques offers great potential for the electrophysiology market by making procedures safer and more comfortable for patients. These technologies help decrease hospital stays and lower the likelihood of side effects, encouraging more patients to seek treatment. Furthermore, simpler and faster procedures can improve healthcare efficiency and broader availability, especially in resource-limited settings, ultimately supporting market expansion and better patient care.

For Instance,

The dominance of the electrophysiology catheters segment in the electrophysiology market in 2024 is driven by their essential function in enabling accurate mapping and targeted treatment of heart rhythm abnormalities. Rising investments in research and development have led to advanced catheter technologies with better manoeuvrability and real-time feedback. Moreover, the expanding use of catheter-based procedures in hospitals and clinics worldwide supports their strong market position, resulting in significant revenue generation within the electrophysiology sector.

The rapid growth of the access devices & consumables segment is fueled by the growing need for precision and reliability during electrophysiology procedures. As more complex interventions are performed, clinicians rely on advanced sheaths, introducers, and guide wires to navigate challenging anatomies. Furthermore, increasing hospital investment in upgrading procedural tools and rising awareness about reducing complications contribute to the market's accelerated growth over the forecast period.

The atrial fibrillation (AF) ablation segment dominated the electrophysiology market because of increasing awareness about AF’s serious health and the growing preference for minimally invasive treatments. Enhanced precision in ablation techniques and better post-procedure recovery rates encourage wider adoption. Additionally, the rising elderly population, who are more prone to AF, fuels demand. These elements combined make AF ablation a key revenue driver within the electrophysiology market.

The ventricular tachycardia (VT) ablation segment is poised for rapid growth as more patients with complex arrhythmias have tools that enable better identification of VT sources, increasing procedure success. Additionally, the rising availability of specialized VT ablation centers and growing investments in advanced electrophysiology technologies support this expansion. These factors, combined with increasing clinical evidence of ablation benefits, are driving the market's fastest CAGR in the electrophysiology market.

In 2024, the radiofrequency (RF) ablation segment led the market because it provides reliable and controlled energy delivery, making it a preferred choice among clinicians. Its long history of successful clinical use and strong safety profile encourages widespread adoption. Furthermore, ongoing innovations in RF technology have improved procedural precision and reduced recovery times. These advantages, along with broad availability in healthcare facilities, contribute to RF ablation maintaining the largest market share.

The cryoablation segment is projected to experience the fastest growth as it offers advantages like reduced inflammation and lower risk of blood clots compared to other energy modalities. Its effectiveness in treating complex arrhythmias and suitability for repeat procedures make it increasingly popular. Moreover, advancements in cryoablation technology and expanding clinical evidence supporting its benefits are encouraging more healthcare providers to adopt this method, driving strong market growth throughout the forecast period.

In 2024, the hospitals & cardiac centers segment dominated the electrophysiology market 2024 because they provide integrated care with access to multidisciplinary teams and advanced equipment. Their capability to handle high procedure volumes and offer post-operative care attracts more patients. Additionally, expanding healthcare infrastructure and government support for cardiac services in many regions boost their market presence. These factors combined make hospitals and cardiac centers the primary choice for electrophysiology treatment, leading to their revenue share.

The ambulatory surgical centers & dedicated EP labs segment is set to grow rapidly as patients and providers favor convenient, lower-cost settings outside traditional hospitals. These centers offer streamlined workflows and faster scheduling, improving the patient experience. Advances in portable and compact electrophysiology equipment also enable complex procedures in these facilities. Additionally, increasing healthcare policies supporting outpatient care and growing demand for specialized EP services contribute to the accelerated growth of the market during the forecast period.

North America dominated the market share by 42% in 2024, due to a well-established healthcare infrastructure and high adoption of advanced cardiac technologies. The region benefits from significant investments in research and development, leading to innovative electrophysiology devices and procedures. Additionally, increasing prevalence of cardiac arrhythmias, rising patient awareness, and favorable reimbursement policies support market growth. The presence of key industry players and widespread availability of specialized cardiac centers further strengthen North America’s leading position in the market.

The U.S. market is growing due to the rising incidence of cardiac arrhythmias and increasing demand for minimally invasive treatment options. Advances in technology and better diagnostic tools improve procedure success rates, encouraging adoption. Additionally, growing awareness among patients and healthcare providers, coupled with supportive reimbursement policies, drives market expansion. The presence of advanced healthcare infrastructure and ongoing clinical research further contributes to the steady growth of the U.S. market.

The Canadian market is expanding due to increasing cases of cardiac arrhythmias and growing preference for advanced treatment options. Improved healthcare infrastructure and government initiatives to enhance cardiac care access support this growth. Technological advancements and rising awareness among healthcare professionals and patients also contribute. Additionally, increasing investments in research and development and favorable reimbursement policies further drive the market’s expansion in Canada.

The Asia Pacific region is expected to grow at the fastest CAGR due to the rising prevalence of cardiovascular diseases and increasing awareness about arrhythmia treatments. Expanding healthcare infrastructure, improving access to advanced electrophysiology technologies, and growing government initiatives to enhance cardiac care fuel market growth. Additionally, a large patient population, rising disposable incomes, and increasing investments by key players to penetrate emerging markets contribute to the rapid expansion of the market in this region during the forecast period.

China’s market is growing due to rapid urbanization and increasing healthcare spending, which improves access to advanced cardiac treatments. The expansion of specialized cardiac centers and the rising demand for minimally invasive procedures drive market growth. Additionally, growing collaborations between local and international companies accelerate technology adoption. Increased focus on early diagnosis and preventive care for heart conditions also contributes to the expanding market in China.

The Indian market is growing rapidly as more healthcare providers adopt cutting-edge cardiac technologies and specialized treatment centers emerge. Rising urbanization and lifestyle changes are leading to increased cases of heart rhythm disorders. Additionally, expanding health insurance coverage and government efforts to improve rural healthcare accessibility boost patient reach. The market also benefits from affordable procedure costs compared to developed countries, encouraging more patients to seek electrophysiology interventions.

Europe’s approach to the market emphasizes stringent regulatory standards and strong investments in research and innovation. The region focuses on integrating cutting-edge technologies like AI and robotics to improve procedural accuracy and patient outcomes. Collaboration between healthcare providers, academic institutions, and industry drives the development of advanced treatments. Additionally, Europe prioritizes patient safety and cost-effectiveness, supporting widespread adoption of minimally invasive procedures, which collectively propel growth in its market.

The UK market is growing due to increased government funding for cardiac care and the expansion of specialized arrhythmia treatment centers. Growing public awareness about heart health and early diagnosis drives patient demand. Additionally, the adoption of advanced minimally invasive technologies and favorable healthcare policies supporting innovative procedures contribute to market growth. Rising collaboration between the NHS and the private sector further accelerates access to electrophysiology services across the country.

Germany’s market is expanding due to a well-established healthcare system that supports advanced cardiac care and widespread availability of skilled specialists. The increasing prevalence of arrhythmias among the aging population boosts demand for effective treatments. Additionally, Germany’s focus on medical technology innovation and strong reimbursement frameworks encourages the adoption of new electrophysiology devices and procedures. Growing patient preference for outpatient and minimally invasive interventions also drives market growth in the country.

In January 2024, GE HealthCare launched the Prucka 3 with CardioLab EP Recording system, a digital platform that enhances the diagnosis and treatment of arrhythmias like atrial fibrillation (AFib), which is expected to rise significantly in the U.S. and Europe. The system improves signal clarity by reducing noise, ensuring precise data for effective procedures. Dr. Usman Siddiqui praised its consistent signal quality across technologies, while Devon Bream called it a “game changer” that offers flexibility and better patient outcomes, advancing the future of electrophysiology labs.

By Product Type

By Procedure Type / Indication

By End User

By Region

February 2026

February 2026

February 2026

February 2026