February 2026

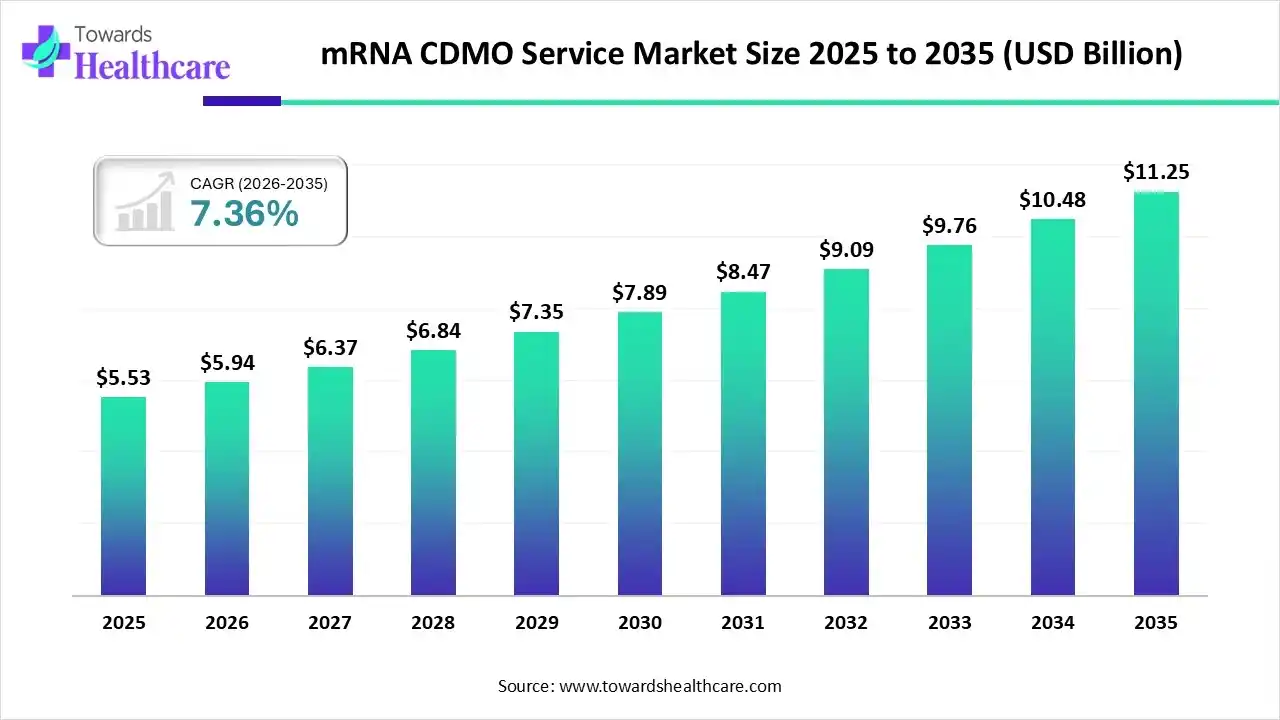

The global mRNA CDMO service market size was estimated at USD 5.53 billion in 2025 and is predicted to increase from USD 5.94 billion in 2026 to approximately USD 11.25 billion by 2035, expanding at a CAGR of 7.36% from 2026 to 2035.

The global market is rapidly growing, driven by rising mRNA therapeutics and vaccines demand, extensive outsourcing by biopharma, and expanding specialized manufacturing capacity.

mRNA CDMO service refers to outsourcing contract services that support the development, scale-up, and manufacturing of mRNA-based therapeutics and vaccines, including process development, GMP production, and regulatory support. The mRNA CDMO service market is growing because biopharma companies are increasingly adopting mRNA technology for diverse therapeutic applications. Outsourcing to specialized CDMOs provides expertise in complex mRNA process development, scalable manufacturing, quality assurance, and regulatory support. Growing R&D investments, technological advancements, and focus on faster commercialization timelines are driving demand for expert mRNA contract development and manufacturing services.

AI is transforming the mRNA CDMO service market by optimizing mRNA sequence design, improving process development, and enhancing yield and quality control. Machine learning enables faster scale-up, predictive maintenance, and real-time manufacturing monitoring. AI-driven analytics also support regulatory compliance, reduce development timelines, lower costs, and help CDMOs deliver more consistent, customized mRNA manufacturing solutions to biopharma clients.

mRNA CDMOs are increasingly adopting automation and AI to optimize sequence design, process development, and quality control. These technologies improve manufacturing efficiency, ensure batch consistency, reduce human error, and accelerate scale-up and commercialization timelines.

CDMOs are investing in dedicated mRNA facilities with modular and scalable infrastructure. This expansion supports higher production capacity, regional supply security, regulatory compliance, and the growing demand for GMP-grade mRNA across multiple therapeutic programs.

The market is shifting beyond vaccines toward oncology, rare diseases, and personalized therapies. This diversification is driving demand for flexible CDMO services capable of customized production, smaller batch sizes, and rapid development cycles.

| Key Elements | Scope |

| Market Size in 2026 | USD 5.94 Billion |

| Projected Market Size in 2035 | USD 11.25 Billion |

| CAGR (2026 - 2035) | 7.36% |

| Leading Region | North America |

| Market Segmentation | By Application, By Indication, By End-use, By Region |

| Top Key Players | ApexBio Technology, BioNTech SE, Biocina, Lonza Group AG, Recipharm AB, Novo Holdings (Catalent, Inc.), Samsung Biologics |

Why Did the Viral Vaccines Segment Dominate in the mRNA CDMO Service Market in 2025?

The viral vaccines segment dominated the market in 2025 due to strong clinical pipelines targeting influenza, RSV, and emerging viral threats. mRNA platforms enable rapid antigen design, scalable manufacturing, and faster regulatory pathways, driving higher outsourcing to CDMOs. Established safety data, repeat production demand, and government-supported immunization programs further strengthened this market position.

Cancer Immunotherapies

The cancer immunotherapies segment is expected to grow at a significant CAGR because mRNA-based personalized cancer vaccines and neoantigen therapies are gaining momentum in clinical development. These treatments require specialized, flexible manufacturing capabilities that drive biopharma companies to partner with CDMOs. Increased oncology R&D investments, precision medicine focus, and strong collaboration trends further boost demand for mRNA CDMO services in cancer immunotherapy.

How the Infectious Diseases Segment Dominated the mRNA CDMO Service Market in 2025?

The infectious diseases segment dominated the market in 2025 due to a strong pipeline targeting influenza, RSV, CMV, and other viral pathogens. mRNA platforms enable rapid sequence development and scalable manufacturing, driving outsourcing to specialized CDMOs. Ongoing clinical programs, government-backed preparedness initiatives, and repeat production requirements further supported sustained demand for mRNA CDMO services.

| Diseases | % of Increased Infectious Diseases | In Year |

| Mpox | 41% | 2022-2025 |

| Tuberculosis | 9.3% | 2022-2025 |

| Malaria | 5.6% | 2022-2025 |

Metabolic & Genetic Diseases

The metabolic & genetic diseases segment is expected to grow at the fastest CAGR due to increasing focus on rare and inherited disorders with limited treatment options. mRNA and gene-editing therapies offer targeted, personalized solutions, driving strong clinical pipelines. These programs require specialized, small-batch GMP manufacturing, increasing reliance on CDMOs. Rising orphan drug incentives, research funding, and precision medicine adoption further support rapid growth.

Why Biotech Companies Segment Dominated the mRNA CDMO Service Market?

The biotech companies segment dominated the market due to limited in-house manufacturing capabilities and heavy reliance on outsourcing. Biotechs actively developing mRNA vaccines and therapeutics require specialized expertise, GMP infrastructure, and flexible small-batch production. High R&D intensity, faster developing timelines, and strategic partnerships with CDMO further drove strong demand from biotech companies.

Government & Academic Research Institutes

The government & academic research institutes segment is expected to grow at the fastest CAGR due to increasing investment in mRNA research for vaccines, infectious diseases, and emerging therapeutics. These organizations rely on CDMOs for specialized manufacturing, regulatory compliance, and scalable production. Expanding public-private collaborations, funding initiatives, and focus on rapid outsourced mRNA development and manufacturing services.

North America dominated the market in 2025 due to advanced biotech infrastructure, high R&D investments, and strong government support for mRNA therapeutics. The presence of leading biopharma companies, specialized CDMOs, and extensive clinical pipelines for vaccines and personalized therapies fueled outsourcing demand, solidifying the region's position as the global hub for mRNA development and manufacturing.

U.S. Market Trends

The U.S. led the mRNA CDMO service market in 2025 by generating the highest revenue, driven by a strong biotech ecosystem, advanced manufacturing infrastructure, and substantial R&D investments. Extensive clinical pipelines, government funding, and the presence of leading CDMOs supporting mRNA therapeutics and vaccines further strengthened the country’s dominance in outsourced mRNA development and manufacturing.

The Asia Pacific region is expected to grow at the fastest CAGR in the market due to rising biopharma investments, expanding mRNA R&D, and increasing outsourcing to specialized CDMOs. Supportive government initiatives, growing healthcare infrastructure, and the entry of global and local players into the region are accelerating the adoption of mRNA manufacturing services, driving rapid market growth.

India Market Trends

India is anticipated to grow at a rapid CAGR due to increasing biopharmaceutical investments, expanding mRNA research capabilities, and rising demand for cost-efficient manufacturing. Strong government support for biotech innovation, improving GMP infrastructure, and growing collaborations between global firms and domestic CDMOs are accelerating India’s role in mRNA development and large-scale production during the forecast period.

Europe is expected to grow at a notable CAGR due to rising investments in mRNA research, expanding clinical pipelines, and increasing demand for outsourced manufacturing. Strong regulatory frameworks, government funding initiatives, and the presence of advanced CDMOs across key countries are supporting scalable production and attracting global biopharma partnerships during the forecast period.

UK Market Trends

The UK is anticipated to grow at a rapid CAGR due to strong government funding for its life sciences, expanding mRNA research programs, and rising demand for outsourced manufacturing. Advanced academic-industry collaborations, increasing clinical trials activity, and investments in GMO mRNA facilities are strengthening the UK’s role as a key hub for mRNA development and contract manufacturing.

| Companies | Headquarters | Offerings |

| ApexBio Technology | Texas, USA | Provides custom mRNA synthesis, reagents, and early-stage support, including RNA design and IVT services, to accelerate discovery and research programs. |

| BioNTech SE | Mainz, Germany | A biotech leader in mRNA therapeutics and vaccines with in-house and partnered CDMO capabilities for development and manufacturing of mRNA products. |

| Biocina | South Australia, Australia | Offers end-to-end mRNA CDMO services, including process development, analytical support, and GMP manufacturing from preclinical through commercial scale. |

| Lonza Group AG | Basel, Switzerland | Major global CDMO with comprehensive mRNA services covering process optimization, analytical testing, large-scale GMP production, and regulatory support |

| Recipharm AB | Stockholm, Sweden | Provides CDMO services, including mRNA process development, formulation support, and GMP manufacturing from clinical stages to commercialization |

| Novo Holdings (Catalent, Inc.) | Florida, USA | Delivers end-to-end mRNA CDMO solutions, including formulation, fill-finish, and large-scale GMP manufacturing for vaccines and therapies. |

| Samsung Biologics | South Korea | Offers global CDMO services that include mRNA process development, GMP manufacturing, and analytical capabilities to support clinical and commercial mRNA programs. |

By Application

By Indication

By End-use

By Region

February 2026

February 2026

February 2026

February 2026