January 2026

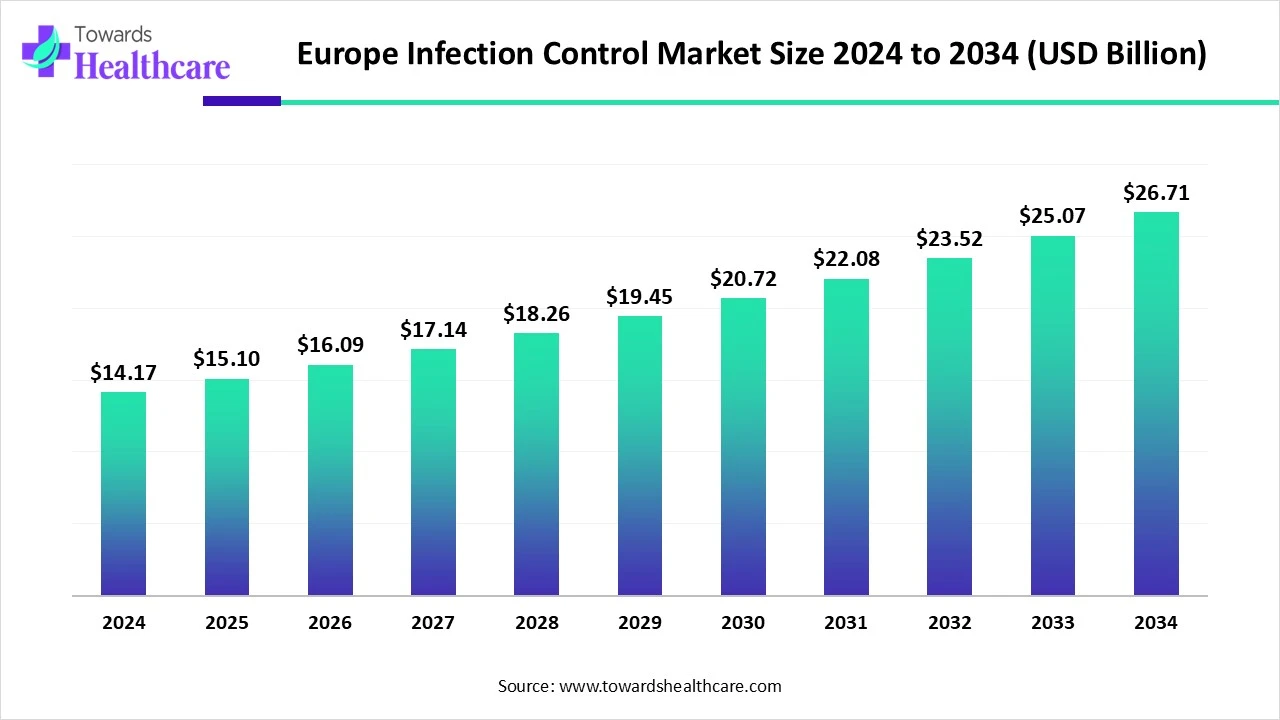

The Europe infection control market size is estimated at US$ 14.17 billion in 2024, is projected to grow to US$ 15.1 billion in 2025, and is expected to reach around US$ 26.71 billion by 2034. The market is projected to expand at a CAGR of 6.54% between 2025 and 2034.

The Europe infection control market is expanding rapidly due to growing infectious disease awareness after COVID-19, increasing government support, and increasing healthcare spending. Increasing government support, such as the European Committee on Infection Control, which goal to support infection control and preventive measures in Europe, and the European Centre for Disease Prevention and Control (ECDC), supports EU governments in preparing for and stopping the spread of diseases.

| Table | Scope |

| Market Size in 2025 | USD 15.1 Billion |

| Projected Market Size in 2034 | USD 26.71 billion |

| CAGR (2025 - 2034) | 6.54% |

| Leading Region | Western Europe |

| Market Segmentation | By Product/Solution Type, By Technology/Modality, By End-User/Setting (Tier-1), By Distribution / Channel, By Region |

| Top Key Players | Ecolab Inc., Diversey (Solenis / Diversey brand), STERIS plc, Getinge AB, 3M Company, Becton, Dickinson and Company (BD), Mölnlycke Health Care AB, Reckitt Benckiser Group plc (RB), Sotera Health / Sterigenics (Sotera group), Belimed AG, Matachana Group, MELAG Medizintechnik GmbH & Co. KG, MMM Group (Müeller Medizinische Maschinen), PDI (Professional Disposables International), Metrex Research (Metrex), Clorox Healthcare (The Clorox Company), B. Braun Melsungen AG, Cardinal Health, Kimberly-Clark Professional, Pal International Ltd. |

European infection control comprises products, equipment, services, and software used to prevent, monitor, and manage healthcare- and facility-associated infections across hospitals, clinics, long-term care, laboratories, and other institutional settings. Key product categories include chemical disinfectants & antiseptics, sterilization equipment and consumables, single-use disposables and PPE, environmental cleaning systems (including automated UV/HPV systems), hand-hygiene solutions, and surveillance/ environmental-monitoring & reporting systems.

The Europe infection control market also covers related services (facility cleaning contracts, sterilization services, training, validation, and waste management) and digital solutions (infection surveillance, antimicrobial stewardship support, and analytics). European demand is driven by stringent regulation, hospital accreditation pressures, AMR awareness, and public-health preparedness policies.

Increasing partnership and collaboration between government organizations and healthcare companies drives the growth of the market.

For instance,

Increasing healthcare funding for the adoption of advanced technology for controlling infectious diseases, which contributes to the growth of the market.

For Instance,

Integration of AI in European infection control drives the growth of the market, as AI-driven technology arises as a fascinating option that has huge potential to entirely transform infection control. AI-driven technology revolutionizes infection prevention by analysing vast quantities of data, noticing patterns, and predicting outcomes. Healthcare consultants track hygiene procedures, detect the early indicators of infection spreading, and enhance the application of antibiotics by the use of AI‐based solutions. AI-driven incorporation in infection control ushers in a novel era of proactive and modified patient care while allowing healthcare teams to make up-to-date decisions. AI provides novel opportunities to improve infection control, from preventing outbreaks to improving antimicrobial use, eventually enhancing patient safety and care.

Increasing Burden of Infectious Diseases

Antimicrobial resistance (AMR) is a public health and development threat. It's estimated that bacterial AMR led to 1.27 million global deaths. Misuse and overuse of antimicrobials in humans, animals, and plants drive the development of drug-resistant pathogens. AMR affects countries in all regions and income levels. Poverty and inequality exacerbate its drivers and consequences, with low- and middle-income countries most affected. To address AMR in human health, we need to prevent all infections, which may lead to inappropriate use of antimicrobials, ensure universal access to quality diagnosis and treatment of infections, and foster strategic information and innovation, all of which contribute to the growth of the Europe infection control market.

High Cost Challenges

Advanced infection control technologies come with high initial investment costs. This can make it tough for small healthcare facilities to afford AI-powered monitoring systems, even though they'd save money in the long term by reducing infections. A major challenge for the Europe infection control market is investing in staff training and education, which limits its growth.

Recent Advancements in Smart Sensors and Wearables

Many hospitals are using smart sensors and wearables to track patient and staff compliance with hygiene practices. Monitoring hygiene is crucial for maintaining high standards of patient safety. These smart sensors can detect when staff sanitize their hands before and after interacting with patients, which promotes accountability. Wearable technology plays a key role in ensuring compliance by providing real-time data on hand hygiene and overall cleanliness. By making hygiene tracking and compliance monitoring more efficient, wearable technology helps hospitals maintain strict infection control measures and create a healthier environment for patients and staff. This, in turn, supports the growth of the Europe infection control market.

By product type, the consumables segment led the market in 2024, as these consumables are the products that are applied in the sterilisation process in the medical care facilities, with indicators and disinfectants. They are significant for maintaining the sterility of healthcare devices, so preventing infections and confirming patient safety. It supports building long-term relationships with medical institutions and improves the brand’s standing. It is significant to ensure they provide comprehensive support and training for the products.

On the other hand, the automated disinfection systems segment is projected to experience the fastest CAGR from 2025 to 2034, as automated disinfection systems help to remove or lower reliance on operators and so they have the latent to enhance the effectiveness of terminal disinfection. The most general used systems are hydrogen peroxide vapor, aerosolized hydrogen peroxide (aHP), and ultraviolet (UV) light. Automated decontamination needs very low to zero consumption of water.

By technology/modality, the chemical disinfection segment is dominant in the Europe infection control market in 2024, as it is an indispensable means of averting infection. This grasp true for medical care settings, but also for all other settings where transmission of pathogens poses a potential health challenge to humans and animals. Chemical disinfection of polluted environmental surfaces has been shown to interrupt the transfer of rhinovirus from these surfaces to hands.

The UV/light-based decontamination segment is projected to grow at the fastest CAGR from 2025 to 2034, as it is tremendously efficient in destroying microbes since no known bacteria or viruses are buoyant to UV light. Additionally, the technology is enhanced to a point where UV systems are generally the ideal OPEX and CAPEX-wise because of energy use, footprint, and a high level of computerisation. UV light is generally applied for drinking-water disinfection, with the benefits compared to chemical processes of not having an impact on the toxicity, smell, or taste of the water.

By end user, the hospitals & tertiary care centres segment led the Europe infection control market in 2024, as hospitals and tertiary care infection control technologies to strengthen prevention efforts and patient safety. Infection control technology development helps medical care conveniences enhance patient safety and prevent infectious disease outbreaks.

The long-term care & nursing homes segment is projected to experience the fastest CAGR from 2025 to 2034, as infection control technology advancements support the long-term care & nursing homes facilities in enhancing patient safety and avoiding infectious diseases. Improving the prevention and management of infections, eventually growing resident safety and quality of life.

By distribution channel, the direct OEM sales segment led the Europe infection control market in 2024, as healthcare OEMs are a significant part of the infection control consumables manufacturing industry. As this consumable comes in a broad range of instruments, apparatuses, implements, objects, implants, machines, even software or types of material, the medical device manufacturing industry is a vigorous sector of the economy. OEM manufacturer engineers, designs, and manufactures entire products and related systems.

On the other hand, the contracted service providers segment is projected to experience the fastest CAGR from 2025 to 2034, as the main advantages of contract service providers are cost-effective services. These providers are increasing spending on infection control services. It offers a variety of dedicated services which greatly benefit large-sized healthcare businesses. The range of services includes automotive sequencing, packaging, labeling, and returns management.

Western Europe is dominant in the market in 2024, as an increasing number of infectious health challenges are related to climate change, which are irregularly distributed within and between European countries. Major Western European countries are starting to shift from acute hospital-driven treatments to more localised, integrated, affordable health care settings, which contributes to the growth of the market.

For Instance,

Eastern Europe is the fastest-growing region in the Europe infection control market in the forecast period, as increasing ageing populations and growing prevalence of communicable diseases contribute to the increasing expense burden facing European medical care systems, which drives the growth of the European infectious diseases market. Growing adoption of digital technologies that improve the ability to both detect and respond to evolving infectious diseases by offering robotic and real-time mapping, creating novel sources of information, and enabling the discovery of pathogens, contributes to the growth of the market.

For Instance,

Research and development of European infection control includes different processes, such as detection and diagnosis of the pathogen, as well as the collection of existing tools to treat and manage the infection and curtail AMR. Consistently develop knowledge and have products ready for scale-up and distribution.

Key players: STERIS plc., Getinge AB, Ecolab, Inc., and 3M Company

Clinical trials for infection control include different strategies for pre-employment screening of infection control consumables, including a questionnaire, targeted serological testing, and mass vaccination without testing or personalized vaccination.

Key players: Infection Control Teams (ICTs), Infection Preventionists (IPs), and Clinical Research Organizations (CROs)

Infection control services are a useful, evidence-based approach that prevents patients and health care workers from being infected by avoidable infections. That includes maintaining the hygiene of hands, personal protective tools, suitable patient placement, and cleaning and disinfecting patient care devices.

In April 2025, David Shepherd, President & Chief Operating Officer, Advanced Wound Care at Convatec, stated, “ConvaNiox has significant potential for patients and healthcare professionals. Regulatory approval marks the beginning of what this novel technology can bring to the treatment of chronic conditions. ConvaNiox provides patients and medical care professionals renewed confidence by unlocking the potential of nitric oxide to treat a range of hard-to-heal wounds.”

By Product/Solution Type

By Technology/Modality

By End-User/Setting (Tier-1)

By Distribution / Channel

By Region

January 2026

November 2025

March 2026

November 2025