Europe Biomedical Refrigerators and Freezers Market Size, Key Players with Insights and Growth

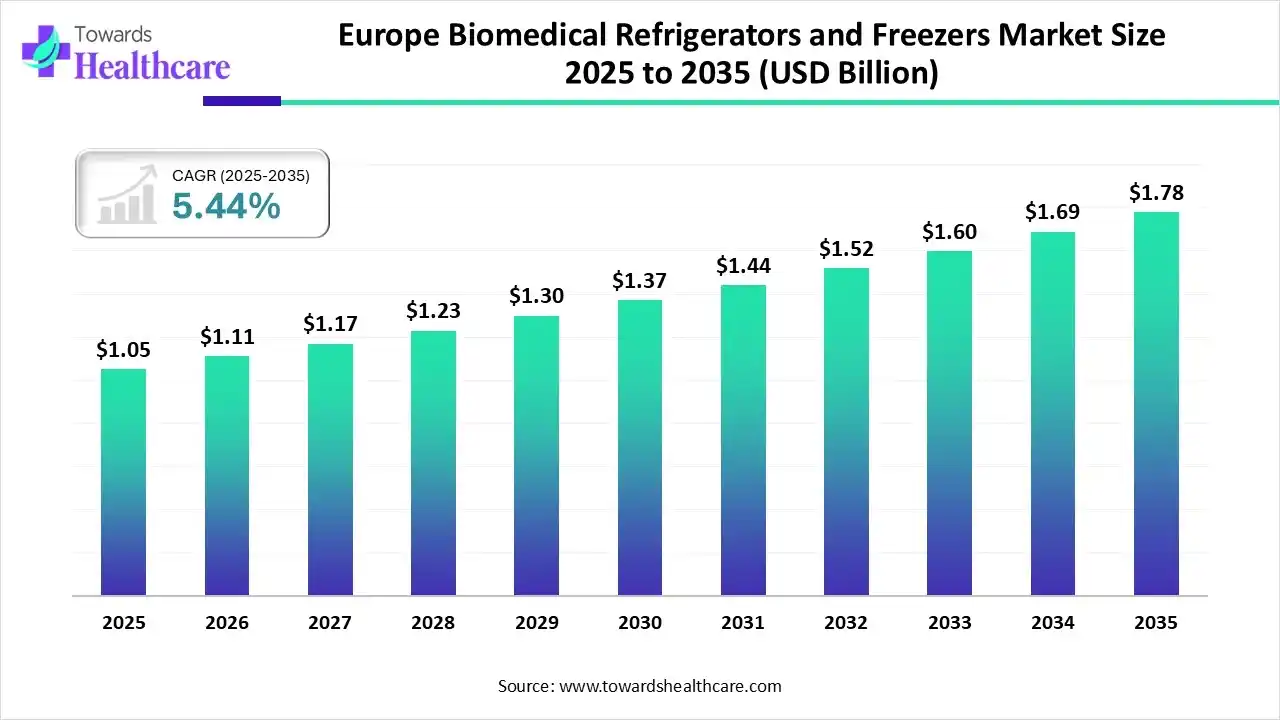

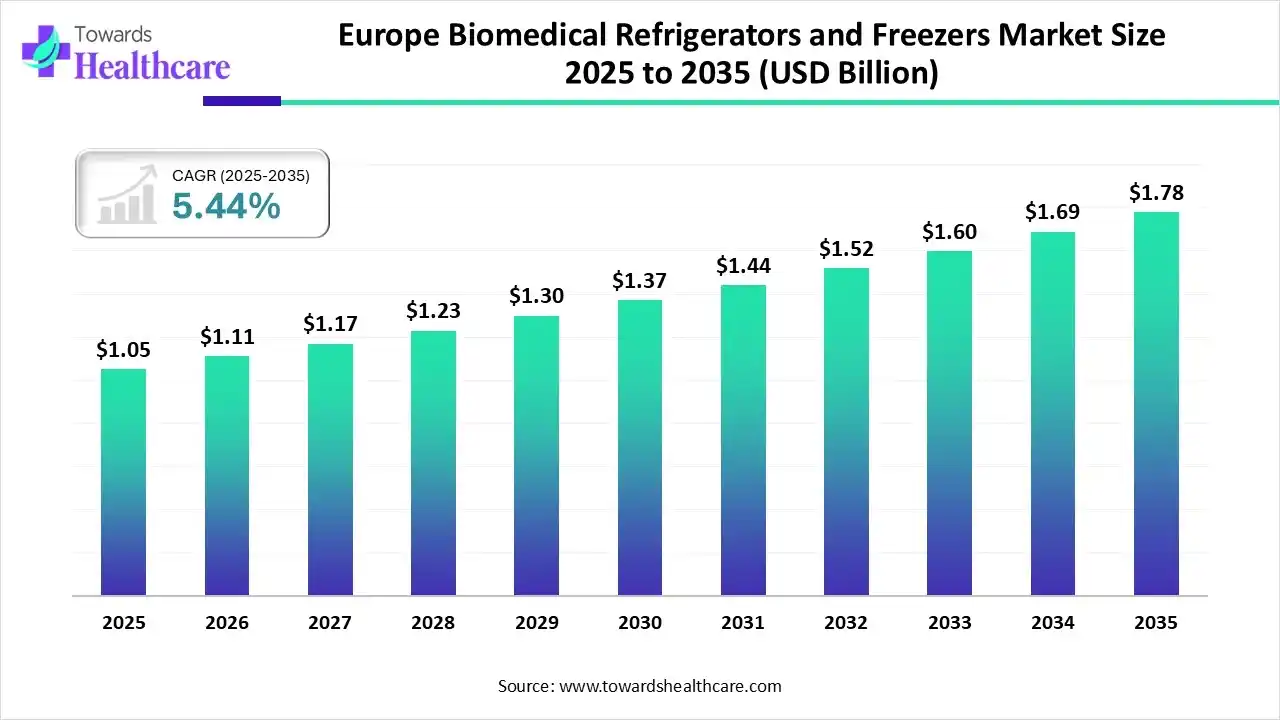

The Europe biomedical refrigerators and freezers market size is calculated at USD 1.05 billion in 2025, grew to USD 1.11 billion in 2026, and is projected to reach around USD 1.78 billion by 2035. The market is expanding at a CAGR of 5.44% between 2026 and 2035.

The Europe biomedical refrigerators and freezers market is primarily driven by the growing demand for biologics and the increasing awareness of blood donations. Government bodies are continually working to strengthen the region's cold chain infrastructure. Favorable trade policies across Europe and internationally potentiate the need for biomedical freezers. Integrating artificial intelligence (AI) in refrigerators and freezers helps analyze sample conditions and temperature.

Key Takeaways

- Europe Biomedical Refrigerators and Freezers industry poised to reach USD 1.05 billion by 2025.

- Forecasted to grow to USD 1.78 billion by 2035.

- Expected to maintain a CAGR of 5.44% from 2026 to 2035.

- Western Europe held a major revenue share of 75% in the market in 2024.

- Eastern Europe is expected to host the fastest-growing market in the coming years.

- By product type, the upright refrigerators & freezers segment contributed the biggest revenue share of approximately 55% in the Europe biomedical refrigerators and freezers market in 2024.

- By product type, the undercounter/benchtop units segment is expected to expand rapidly in the market in the coming years.

- By end-user, the hospitals & clinics segment led the market with a share of approximately 40% in 2024.

- By end-user, the academic & research institutes segment is expected to witness the fastest growth in the market over the forecast period.

- By application, the vaccine & drug storage segment held a dominant revenue share of approximately 50% in the market in 2024.

- By application, the biological sample storage segment is expected to show the fastest growth over the forecast period.

Quick Facts Table

| Key Elements |

Scope |

| Market Size in 2025 |

USD 1.05 Billion |

| Projected Market Size in 2035 |

USD 1.78 Billion |

| CAGR (2026 - 2035) |

5.44% |

| Leading Country |

Western Europe by 75% |

| Market Segmentation |

By Product Type, By End-User, By Application, By Region |

| Top Key Players |

Kirsch Medical, Liebherr, Ethicheck Ltd., Kalstein, Thermo Fisher Scientific, Eppendorf AG, Binder GmbH, Labcold Ltd., PHC Holdings Corporation |

Advancing Biomedical Preservation: Innovations Driving the Market

The Europe biomedical refrigerators and freezers market is fueled by biotechnology and vaccine production, public-health immunization programs, research activity, and cold-chain compliance requirements. It refers to the manufacturing, distribution, and aftermarket services for temperature-controlled storage equipment used in clinical, research, and biopharma environments, including laboratory refrigerators, ultra-low temperature (ULT) freezers, vaccine cold storage, blood bank refrigerators, pharmaceutical-grade cold rooms, blood and specimen transport coolers, and associated monitoring/controls.

Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the Europe biomedical refrigerators and freezers market is experiencing rapid growth, driven by innovations in refrigerators and freezers and the burgeoning biotech sector. Europe is emerging as a favorable location for biologics manufacturing. The increasing trade of biologics and vaccines also contributes to market growth.

- Sustainability Trends: Key players develop sustainable freezers that reduce the environmental impact by consuming less electricity. Sustainable freezers are being developed that operate for a longer time, eliminating the need to replace equipment more frequently.

- Major Investors: Private equity firms and venture capitalists invest heavily in companies and startups that manufacture biomedical refrigerators and freezers. They also provide funding to companies to adopt innovative equipment for the manufacturing and storage of temperature-sensitive biologics.

Smarter Cold Storage: AI-Driven Efficiency

The integration of AI and the Internet of Things (IoT) in refrigerators and freezers improves efficiency and device management, fostering Europe biomedical refrigerators and freezers market. AI enables suppliers to monitor temperature continuously, preventing product damage. It can also track products using RFID, providing real-time updates to manufacturers. Smart refrigerators and freezers can predict maintenance needs, optimize energy consumption, and alert users to potential issues before they become critical. They have high reliability and product security, offering unprecedented features. Thus, such innovations lead to efficient and compact cryogenic storage solutions.

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Market?

The upright refrigerators & freezers segment held a dominant presence in the Europe biomedical refrigerators and freezers market with a revenue of approximately 55% in 2024, due to more stable product storage and the ability to maintain optimal temperature. Upright refrigerators and freezers allow easy access to all the products. Researchers or manufacturers can easily view products through transparent doors, maintaining the inner temperature. Upright fridges provide more space and better organization for storing pharmaceuticals and biologics. Other benefits include easy cleaning and high energy-efficient.

Undercounter/Benchtop Units

The undercounter/benchtop units segment is expected to grow at the fastest CAGR in the market during the forecast period, due to easier installation and reliability. Undercounter refrigerators or freezers are widely preferred by laboratories and pharmacies as they have limited infrastructure space. Innovative undercounter freezers offer an ultra-low noise system, a safety lock, and a complete alarm system for sample safety and protection.

Chest Refrigerators & Freezers

The chest refrigerators & freezers segment is expected to grow significantly in the Europe biomedical refrigerators and freezers market. Chest refrigerators & freezers provide a spacious, open layout for storing large quantities of products compared to upright refrigerators. They contain a thermostat to regulate the temperature and a sealed lid to maintain energy efficiency, thereby contributing to environmental sustainability.

End-User Insights

Why Did the Hospitals & Clinics Segment Dominate the Market?

The hospitals & clinics segment held the largest revenue share of approximately 40% of the Europe biomedical refrigerators and freezers market in 2024, due to favorable infrastructure and suitable capital investments. Investments enable hospitals & clinics to adopt advanced refrigerators for various purposes. The increasing number of patient admissions necessitates hospitals to store a wide range of products, such as vaccines and blood products.

Academic & Research Institutes

The academic & research institutes segment is expected to grow with the highest CAGR in the market during the studied years. The growing research and development activities and increasing R&D investments boost the segment’s growth. Academic & research institutes purchase refrigerators and freezers to store their research products, such as DNA, RNA, vaccines, and reagents. Refrigerators help maintain product integrity for experiments and clinical trials.

Pharmaceutical & Biotechnology Companies

The pharmaceutical & biotechnology companies segment is expected to show lucrative growth in the Europe biomedical refrigerators and freezers market due to the increasing development of novel products and the availability of innovative freezers. Innovative freezers simplify the operations of researchers, enabling them to focus on research analysis and outcomes. The increasing competition among key players necessitates them to expand their product pipeline.

Application Insights

How the Vaccine & Drug Storage Segment Dominated the Market?

The vaccine & drug storage segment accounted for the highest revenue share of approximately 50% of the Europe biomedical refrigerators and freezers market in 2024, driven by the rising prevalence of infectious diseases and increasing vaccine manufacturing in Europe. Government organizations of various European nations launch immunization campaigns to encourage people to get vaccinated. This contributes to a significant stride for the development of new vaccine candidates. As of 12th November 2025, a total of 494 clinical trials were registered on the clinicaltrials.gov website related to vaccines.

Biological Sample Storage

The biological sample storage segment is expected to witness the fastest growth in the market over the forecast period. The growing demand for personalized medicines leads to the development of novel biologics. According to the 2023 EBMT report on hematopoietic cell transplantation (HCT) and cellular therapies, approximately 43,902 patients received 47,731 HCT in 696 European centers. This data suggests the need for biomedical refrigerators for biologics supply and storage.

Research & Laboratory Applications

The research & laboratory applications segment is expected to grow at a notable CAGR in the Europe biomedical refrigerators and freezers market, due to growing research activities and the need to store temperature-sensitive pharmaceuticals and biologics. Laboratory refrigerators are designed to meet the stringent requirements of scientific research and healthcare environments, offering precise temperature control, uniform cooling, and specialized compartments for organizing samples.

Regional Analysis

Which Factors Influence Market Growth in Europe?

Numerous factors influence the Europe biomedical refrigerators and freezers market growth, including the increasing development of temperature-sensitive biologics and vaccines, as well as growth in clinical laboratories, research institutes, and blood bank capacity across Europe. Government bodies encourage people to get vaccinated through immunization programs. The rising adoption of energy-efficient and IoT/connected monitoring equipment augments the market. The growing public- and private-sector investment in healthcare infrastructure and cold storage for clinical trials propels market growth.

Industry Leaders Strengthen Western Europe’s Growth

The Western Europe region dominated the market in 2024, with a revenue of 75%. The market is driven by the presence of major pharma and biotech companies and advanced healthcare infrastructure. Countries like Germany, France, the UK, Switzerland, and Belgium are at the forefront of research and manufacturing of biologics. In 2024, Germany and Belgium were the major exporters of medicinal and pharmaceutical products in the EU, accounting for €67.9 billion and €41.4 billion, respectively.

Expanding Vaccine Research Drives Eastern Europe

The Eastern Europe region is expected to grow at the fastest CAGR in the Europe biomedical refrigerators and freezers market during the forecast period. The region is making constant efforts to develop a suitable manufacturing infrastructure for vaccines and biologics. Novel stem cells are increasingly developed to improve the quality of life of individuals in Eastern Europe. As of 12th November 2025, 77 studies were registered related to stem cell therapy in Poland.

Company Landscape

Thermo Fisher Scientific Inc.

Company Overview: Thermo Fisher Scientific is the world leader in serving science, with a mission to enable its customers to make the world healthier, cleaner, and safer. It is a global life science and clinical research company.

Corporate Information:

- Headquarters: Waltham, Massachusetts, United States

- Year Founded: 2006 (Formed by the merger of Thermo Electron, founded in 1956, and Fisher Scientific, founded in 1902)

- Ownership Type: Publicly Traded (NYSE: TMO)

History and Background: Formed from the merger of Thermo Electron and Fisher Scientific. It has grown into a multinational leader through sustained R&D, strategic acquisitions, and a vast portfolio of products and services for research, analysis, discovery, and diagnostics.

Key Milestones/Timeline:

- 1956: Thermo Electron co-founded.

- 1902: Fisher Scientific was founded.

- 2006: Thermo Electron and Fisher Scientific merge to form Thermo Fisher Scientific Inc.

- 2024 (April): Launched the TSX Universal Series ULT Freezers.

- 2024 (Q1): Revenue reported as $10.99 billion.

Business Overview: Provides analytical instruments, equipment, reagents and consumables, software, and services for various sectors, including life sciences research, diagnostics, and pharmaceutical manufacturing.

Business Segments/Divisions:

- Life Sciences Solutions: Reagents, instruments, and consumables for biological research.

- Analytical Instruments: Instruments, consumables, software, and services for laboratory and process control.

- Specialty Diagnostics: Diagnostic test kits, reagents, culture media, and instruments.

- Laboratory Products and Biopharma Services: (Includes cold storage equipment like biomedical freezers and refrigerators, lab consumables, and outsourced drug development and manufacturing services).

- Geographic Presence: Operates globally, serving customers in over 50 countries, with a substantial commercial and manufacturing footprint across North America, Europe (a major market), Asia Pacific, and others.

Key Offerings:

- Ultra-Low Temperature (ULT) Freezers (e.g., TSX Series)

- Laboratory Refrigerators and Freezers

- Blood Bank Refrigerators and Plasma Freezers

- Cryogenic Storage Systems

- A broad range of other laboratory equipment, consumables, and services.

End-Use Industries Served:

- Hospitals and Clinical Diagnostic Labs

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Blood Banks and Biobanks

- Government Agencies

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Continual strategic acquisitions to expand capabilities, such as the 2022 acquisition of PeproTech to bolster the biosciences business.

- Partnerships & Collaborations: Partnership with organizations like the National Cancer Institute on trials such as myeloMATCH to accelerate precision medicine research (e.g., for AML/MDS).

- Product Launches/Innovations: Launched the TSX Universal Series ULT Freezers in April 2024, designed for improved lab efficiency, sustainability, and flexibility by seamlessly adapting to workflows.

- Capacity Expansions/Investments: Announced a $2 billion investment over four years in the U.S. (including $1.5 billion for manufacturing capacity and $500 million for R&D) to strengthen the healthcare supply chain.

- Regulatory Approvals: Products are designed to comply with stringent global regulatory standards (e.g., U.S. EPA SNAP compliance for certain freezer lines).

- Distribution Channel Strategy: Utilizes a direct sales force, catalogs, and e-commerce platforms (Fisher Scientific brand) to provide purchasing convenience and global reach.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Focus on advanced temperature control, compressor technology, energy efficiency (e.g., utilizing natural refrigerants), and smart/IoT connectivity for remote monitoring.

- Research & Development Infrastructure: Operates R&D centers globally, with a focus on digital technologies and software engineering.

- Innovation Focus Areas: High-impact innovation in life sciences, drug development acceleration (e.g., Accelerator™ Drug Development solution), diagnostics, and next-generation sequencing.

Competitive Positioning:

- Strengths & Differentiators: Global market leadership, unparalleled product portfolio (Thermo Scientific, Fisher Scientific, etc.), strong brand recognition and trust, vast distribution network, and a focus on sustainability and energy-efficient products (e.g., TSX Series).

- Market presence & ecosystem role: Dominant role as a one-stop-shop provider for lab equipment and services, deeply embedded in the entire life sciences and healthcare ecosystem.

SWOT Analysis:

- Strengths: Market leadership (19% market share in Europe's cold storage), broad product portfolio, global supply chain, and strong financial position.

- Weaknesses: High cost of some advanced equipment, complexity of managing a vast, integrated organization.

- Opportunities: Growing demand for biopharmaceuticals and gene/cell therapies (requires specialized ULT storage), expansion of biobanking.

- Threats: Intense competition, stringent environmental regulations on refrigerants, and global economic volatility.

Recent News and Updates:

- Press Releases: In April 2024, highlighted the launch of the TSX Universal Series ULT Freezers, emphasizing their role in enhancing lab efficiency and sustainability.

- Industry Recognitions/Awards: Consistently recognized as a top supplier in the life sciences sector globally.

PHC Holdings Corporation (PHCbi)

Company Overview: PHC Holdings Corporation is a global company dedicated to improving health through digital and precision technology. The PHCbi brand focuses on developing and manufacturing innovative equipment for life sciences research, including biomedical refrigerators and freezers.

Corporate Information:

- Headquarters: Minato-Ku, Tokyo, Japan

- Year Founded: 1969 (as Matsushita Kotobuki Electronics Industry)

- Ownership Type: Publicly Traded

History and Background: Originated as a subsidiary of Panasonic (formerly Panasonic Healthcare, which became PHC Holdings). The company's products, sold under the PHCbi brand, are known for space-saving, energy-efficient designs and reliability, especially in sample preservation.

Key Milestones/Timeline:

- 1969: Company founded in Japan.

- 2018: PHC Holdings Corporation adopted its current name.

- 2024 (March 31): Reported 9,041 employees globally.

- 2024 (February): Launched a new dual-voltage model in the VIP ECO SMART ultra-low temperature freezer series in North America.

Business Overview: Focuses on healthcare devices and services across Diabetes Management, Healthcare Solutions, Diagnostics, and Life Sciences (where PHCbi cold storage belongs).

Business Segments/Divisions:

- Diabetes Management: Ascensia Diabetes Care.

- Healthcare Solutions: Electronic medical record systems, etc. (mostly Japan).

- Diagnostics & Life Sciences: (Includes PHCbi brand products for Biologic & Cell Preservation, Cancer Pathology, and Diagnostic Testing).

- Geographic Presence: Global presence, with products sold in over 125 countries, and strong brand presence in key markets like Europe, North America, and Asia.

Key Offerings:

- Ultra-Low Temperature (ULT) Freezers (e.g., VIP ECO SMART Series, TwinGuard Series)

- Laboratory Refrigerators and Freezers

- Blood Bank Refrigerators and Plasma Freezers

- CO2 Incubators and other cell culture equipment (under PHCbi brand)

End-Use Industries Served:

- Medical Institutions and Hospitals

- Universities and Academic Research Labs

- Pharmaceutical and Biotechnology Companies

- Biobanks and Gene Banks

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Historical corporate restructuring and acquisition activities to build the current four-segment structure (e.g., the formation of Ascensia Diabetes Care and Epredia).

- Partnerships & Collaborations: Engages in collaborations, such as hosting online roundtables on new therapies like CAR-T, showcasing industry thought leadership.

- Product Launches/Innovations: In February 2024, PHC Corporation of North America launched the dual-voltage MDF-DU703VHA-PA model in their VIP ECO SMART ULT freezer series, the first PHCbi ULT freezer with this capability, enhancing versatility for global customers.

- Capacity Expansions/Investments: Continues to invest in R&D to maintain a competitive edge in advanced, energy-efficient refrigeration.

- Regulatory Approvals: Units are designed to be compliant with major standards (e.g., WHO and CDC guidelines for cold chain).

- Distribution Channel Strategy: Utilizes a network of global distributors and regional sales offices, with a strong focus on serving the North American and European markets.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Focus on proprietary cooling technologies to ensure optimal temperature uniformity and energy efficiency (e.g., VIP ECO SMART technology). Emphasis on natural refrigerants for sustainability.

- Research & Development Infrastructure: Driven by an integrated digital and precision technology focus, leveraging decades of experience in high-precision Japanese manufacturing.

- Innovation Focus Areas: Sustainability (net-zero commitment), ultra-low temperature precision, dual-voltage capability, and space-saving ergonomic designs for laboratory environments.

Competitive Positioning:

- Strengths & Differentiators: Strong reputation for reliability and longevity, focus on energy-efficient and space-saving designs, and specialization in ULT freezers (PHCbi brand is highly recognized for ULTs).

- Market presence & ecosystem role: A highly specialized key player in the cold storage segment, particularly strong in research and biobanking due to its ULT offerings.

SWOT Analysis:

- Strengths: Strong focus on energy efficiency and green technology, high product reliability, recognized brand (PHCbi) in life sciences.

- Weaknesses: Smaller overall corporate size/portfolio breadth compared to the market leader, may have less name recognition in general laboratory products outside of its niche.

- Opportunities: Increased adoption of sustainable and green refrigerants (where they have a strong focus), growth in cell and gene therapy requiring -80°C and -150°C storage.

- Threats: Aggressive pricing by competitors, complexity of global supply chains.

Recent News and Updates:

- Press Releases: News in October 2025 regarding the PHC Group's commitment to achieving Net Zero Emissions, highlighting their sustainability focus.

- Industry Recognitions/Awards: Recognized for innovation in their ULT freezer lines.

Top Companies & Their Offerings

| Companies |

Headquarters |

Offerings |

| Arctiko |

Wiltshire, England |

Offers refrigerators, freezers, and ultra-low temperature freezers designed with superior features and reliability for commercial, pharmaceutical, and biomedical applications. |

| Vestfrost Solutions |

Esbjerg, Denmark |

It is a Danish manufacturer and a global supplier of high-quality, customer-driven refrigerators & freezers for professional use. |

| Evermed |

Italy |

The MPR and LR series of medical refrigerators are ideal for storing sensitive materials, such as vaccines, drugs, and samples. |

| Fiocchetti |

Italy |

Provides high-quality refrigerators and freezers for cold chain manufacturers for medical applications. |

| B Medical Systems |

Luxembourg |

Global manufacturer and distributor of medical-grade ultra-low freezers and vaccine refrigerators to safely store and transport medical products. |

Other Companies

- Kirsch Medical

- Liebherr

- Ethicheck Ltd.

- Kalstein

- Thermo Fisher Scientific

- Eppendorf AG

- Binder GmbH

- Labcold Ltd.

- PHC Holdings Corporation

Recent Developments in the Market

- In August 2025, Medguard announced an exclusive partnership with Snaige AB to distribute premium medical refrigerators to the Irish market. The partnership ensures Irish healthcare providers have direct access to world-class cold storage solutions designed specifically for hospitals, laboratories, pharmacies, and research facilities.

- In October 2024, the National Institute for Health and Care Research (NIHR) provided funding of £1 million to Oxford Hospitals to fund new research facilities and equipment. The funding will enable hospitals to purchase a two-glove isolator, which is used for preparing individual doses of trial medicines, and dedicated freezers and refrigerators to store the drugs.

Segments Covered in the Report

By Product Type

- Upright Refrigerators & Freezers

- Upright Refrigerators

- Upright Freezers

- Undercounter/Benchtop Units

- Undercounter Refrigerators

- Undercounter Freezers

- Chest Refrigerators & Freezers

- Chest Refrigerators

- Chest Freezers

By End-User

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutes

- Universities

- Private Research Labs

- Diagnostic Laboratories

- General Labs

- Specialized Diagnostic Labs

By Application

- Vaccine & Drug Storage

- Vaccines

- Temperature-Sensitive Drugs

- Biological Sample Storage

- Blood & Plasma

- Tissue & Cell Lines

- Research & Laboratory Applications

- Enzymes & Reagents

- Microbial Cultures

By Region

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Turkiye

- Albania

- Rest of Eastern Europe