February 2026

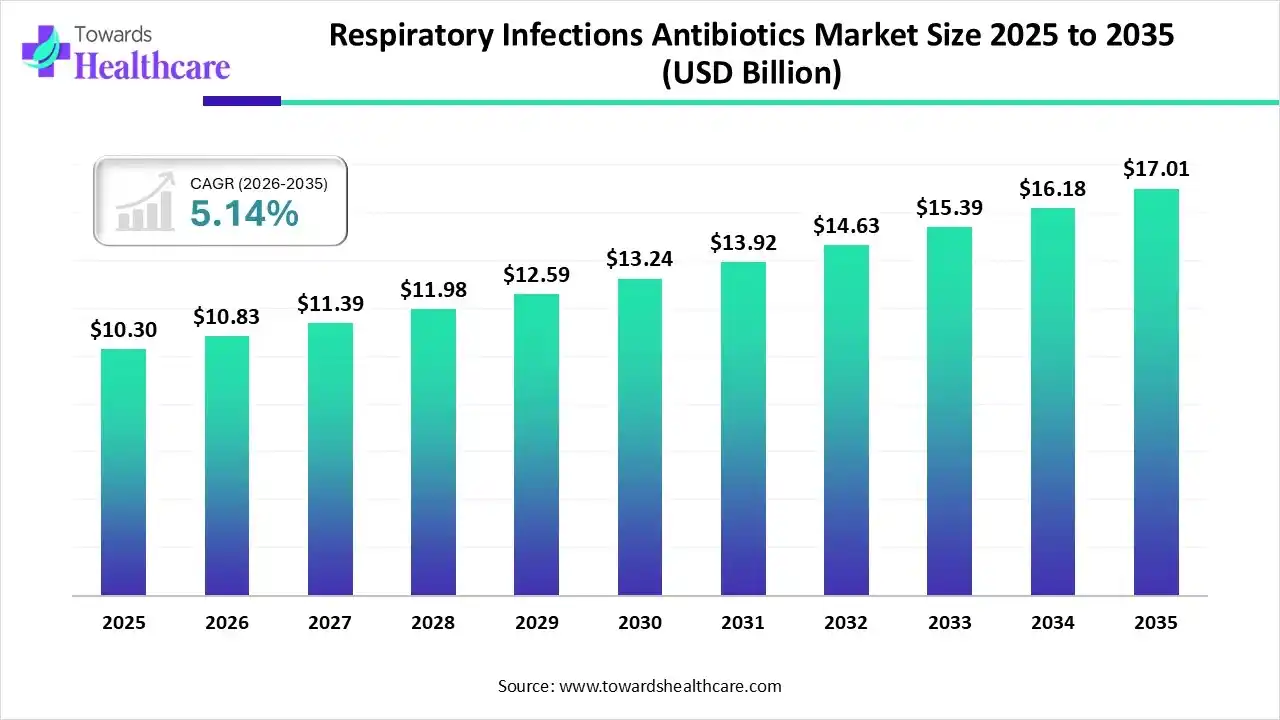

The global respiratory infections antibiotics market size was estimated at USD 10.3 billion in 2025 and is predicted to increase from USD 10.83 billion in 2026 to approximately USD 17.01 billion by 2035, expanding at a CAGR of 5.14% from 2026 to 2035.

The increasing respiratory infection burden globally is increasing the demand for their antibiotics, where their growing innovations are being accelerated with the use of AI. These innovations are also being supported by the government, promoting their new launches. The growing antibiotic consumption, health awareness, and robust healthcare are also increasing their use, while companies are also introducing their new products, promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 10.83 Billion |

| Projected Market Size in 2035 | USD 17.01 Billion |

| CAGR (2026 - 2035) | 5.14% |

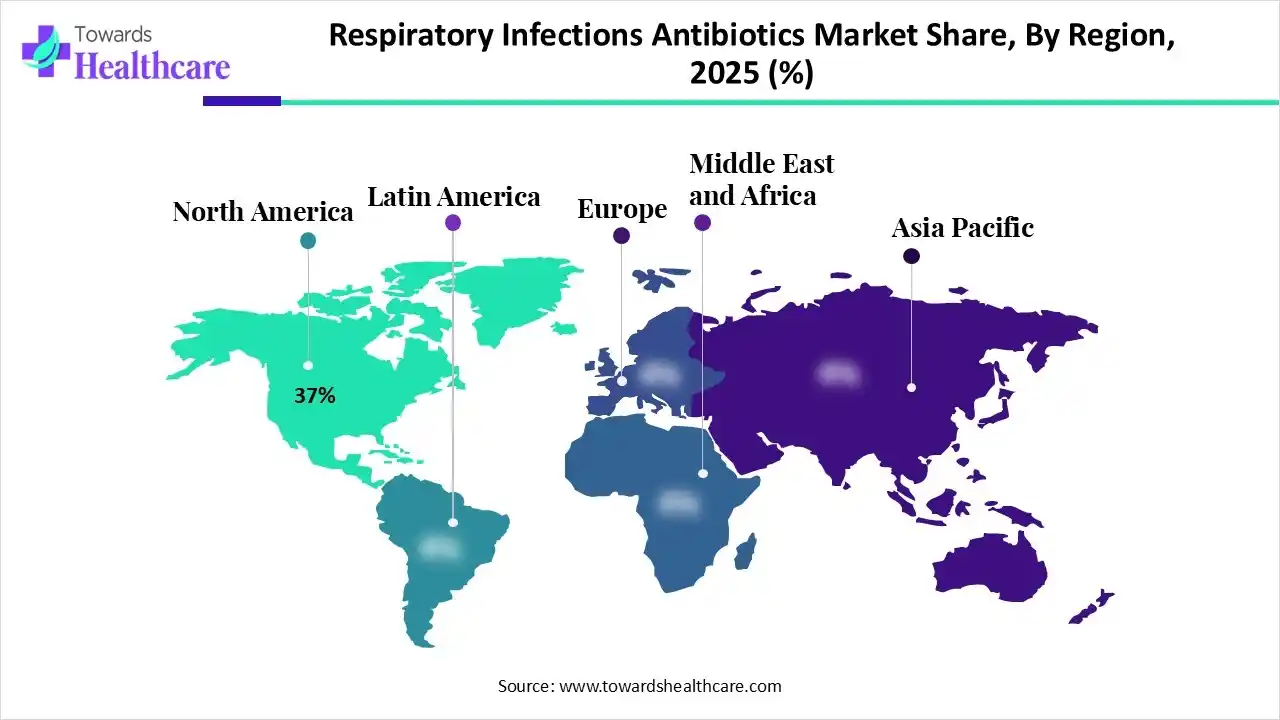

| Leading Region | North America by 37% |

| Market Segmentation | By Antibiotic Class, By Route of Administration, By Indication/Infection Type, By Healthcare Setting, By Region |

| Top Key Players | GSK plc., Pfizer Inc., Bayer AG, Merck & Co., Novartis AG, Sanofi S.A., Cipla Limited, Johnson & Johnson, AbbVie Inc., AstraZeneca plc |

The respiratory infections antibiotics market is driven by growing challenges with antimicrobial resistance (AMR) and respiratory diseases. The respiratory infections antibiotics include antibiotic drugs used to prevent, treat, and manage bacterial respiratory tract infections, such as community-acquired pneumonia (CAP), hospital-acquired pneumonia (HAP), bronchitis, sinusitis, tonsillitis, otitis media, and other bacterial respiratory conditions. This market encompasses systemic antibacterial agents administered via oral, parenteral, or inhalation routes across inpatient, outpatient, and community healthcare settings.

The healthcare systems are increasingly adopting AI-powered diagnostic tools for accurate diagnosis of respiratory infections, which helps in avoiding unnecessary antibiotic treatment. It is also being used to accelerate drug development and predict infection patterns. Similarly, AI helps in providing suitable and effective antibiotics depending on the patient and pathogen profiles, where they are also being used to monitor the use of antibiotics, reducing the chances of overuse or misuse.

Numerous R&D studies are being conducted where the researchers are focusing on targeting the resistant bacterial strains, driving the development of next-generation antibiotics.

The companies are developing various inhaled and nebulized antibiotics along with their personalized therapies to enhance potency and limit side effects.

Different types of drug delivery technologies are being developed to provide target-specific action and a sustainable release mechanism in order to enhance patient adherence to the treatment.

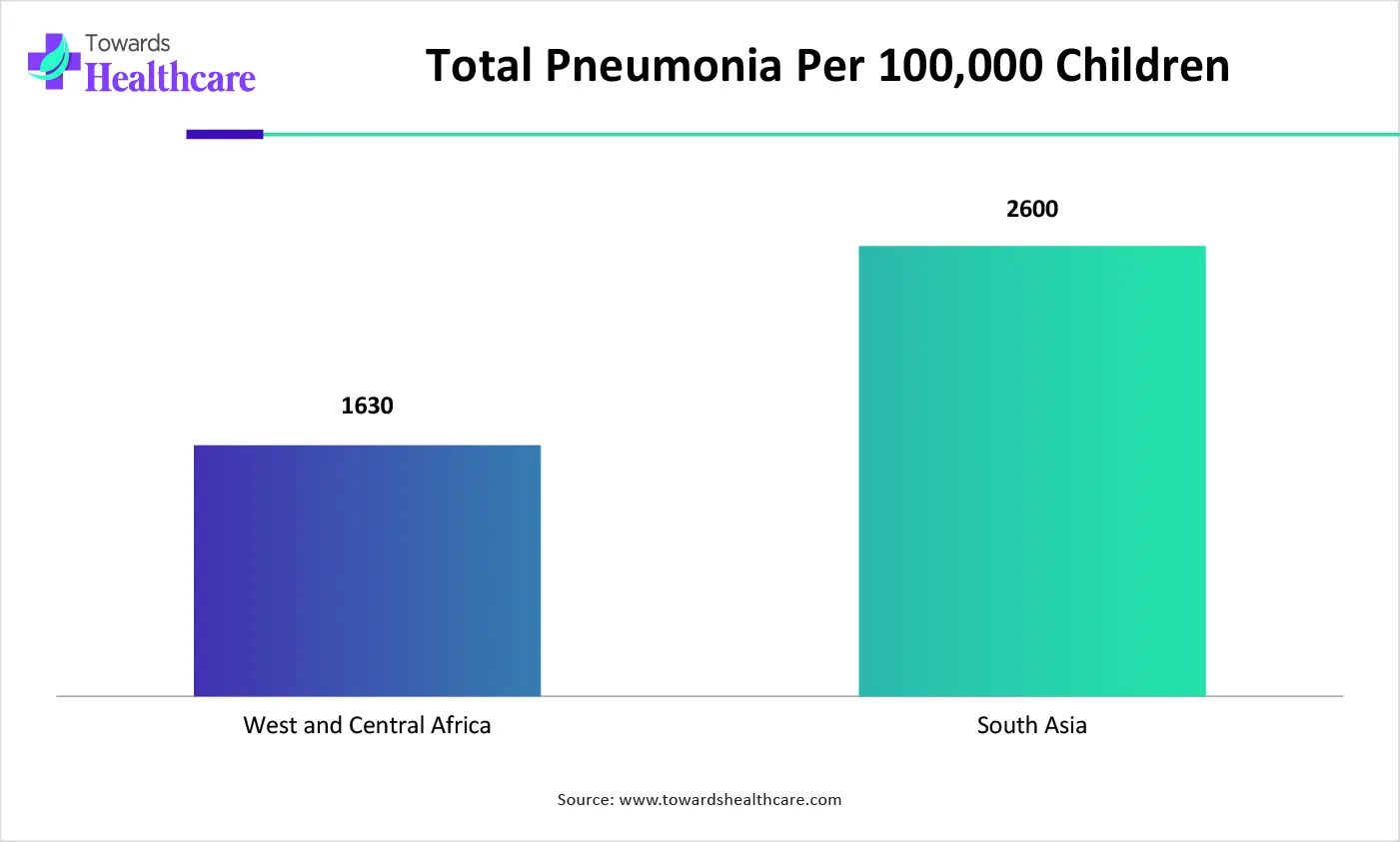

| Regions | Pneumonia Patients Per 100,000 Children |

| West and Central Africa | 1630 |

| South Asia | 2600 |

Why Did the Beta-Lactams Segment Dominate in the Respiratory Infections Antibiotics Market in 2025?

The beta-lactams segment held the largest share of approximately 43% in the market in 2025, due to their broad-spectrum activity. This increased their use as the first-line treatment option. At the same time, their proven safety and success rates, along with their widespread availability, also increased their acceptance rates.

Oxazolidinones

The oxazolidinones segment is expected to show the highest growth with a CAGR of approximately 10% during the upcoming years, due to growing resistant infections. Moreover, the limited alternatives are increasing their use, where their enhanced effectiveness is also increasing their adoption rates.

How the Oral Antibiotics Segment Dominated the Respiratory Infections Antibiotics Market in 2025?

The oral antibiotics segment led the market with approximately 55% share in 2025, due to growth in outpatient treatment. At the same time, it also provided easy administration, which enhanced patient compliance. Moreover, their affordability and availability also increased their use and adoption rates.

Inhalation/Nebulized Antibiotics

The inhalation/nebulized antibiotics segment is expected to show rapid growth with a CAGR of approximately 12% during the upcoming years, driven by their targeted drug delivery. This reduces their systemic side effects, which promotes their use for the management of chronic and resistant respiratory diseases.

Which Indication/Infection Type Segment Held the Dominating Share of the Respiratory Infections Antibiotics Market in 2025?

The community-acquired pneumonia (CAP) segment held the dominating share of approximately 37% in the market in 2025, due to the growth in its incidence. This, in turn, increased the demand for various antibiotics in a wide range of patient age groups as the first-line treatment options.

Hospital-Acquired Pneumonia (HAP) & Ventilator-Associated Pneumonia (VAP)

The hospital-acquired pneumonia (HAP) & ventilator-associated pneumonia (VAP) segment is expected to show the highest growth with a CAGR of approximately 11% during the predicted time, due to growing hospitalization rates. Moreover, increasing critical care is driving the use of ventilators, which is increasing the pneumonia cases and increasing the demand for effective antibiotics.

What Made Hospitals (Inpatient Care) the Dominant Segment in the Respiratory Infections Antibiotics Market in 2025?

The hospitals (inpatient care) segment led the market with approximately 45% share in 2025, due to growth in the patient volume. They also provided severe infection management, which increased the use of antibiotics. Moreover, they also offered injectable antibiotics and medical supervision, which enhanced the patient outcomes.

Outpatient Clinics

The outpatient clinics segment is expected to show rapid growth with a CAGR of approximately 10% during the predicted time, due to growing health awareness. This, in turn, is driving the early diagnosis of respiratory infections, increasing the demand for affordable oral antibiotics.

North America dominated the respiratory infections antibiotics market with approximately 37% in 2025, due to the high rates of antibiotic consumption, which is driven by the presence of advanced health infrastructure and growing diseases. Moreover, the rapid innovation supported by investments and reimbursement policies also increased their adoption and acceptance rates, which contributed to the market growth.

U.S. Market Trends

Due to the presence of high healthcare expenditure, the availability of antibiotics is increasing across the U.S. At the same time, while the growing cases of bronchitis and other respiratory infections are increasing, their use is also increasing. Moreover, growing early diagnosis and innovations are also increasing their adoption rates.

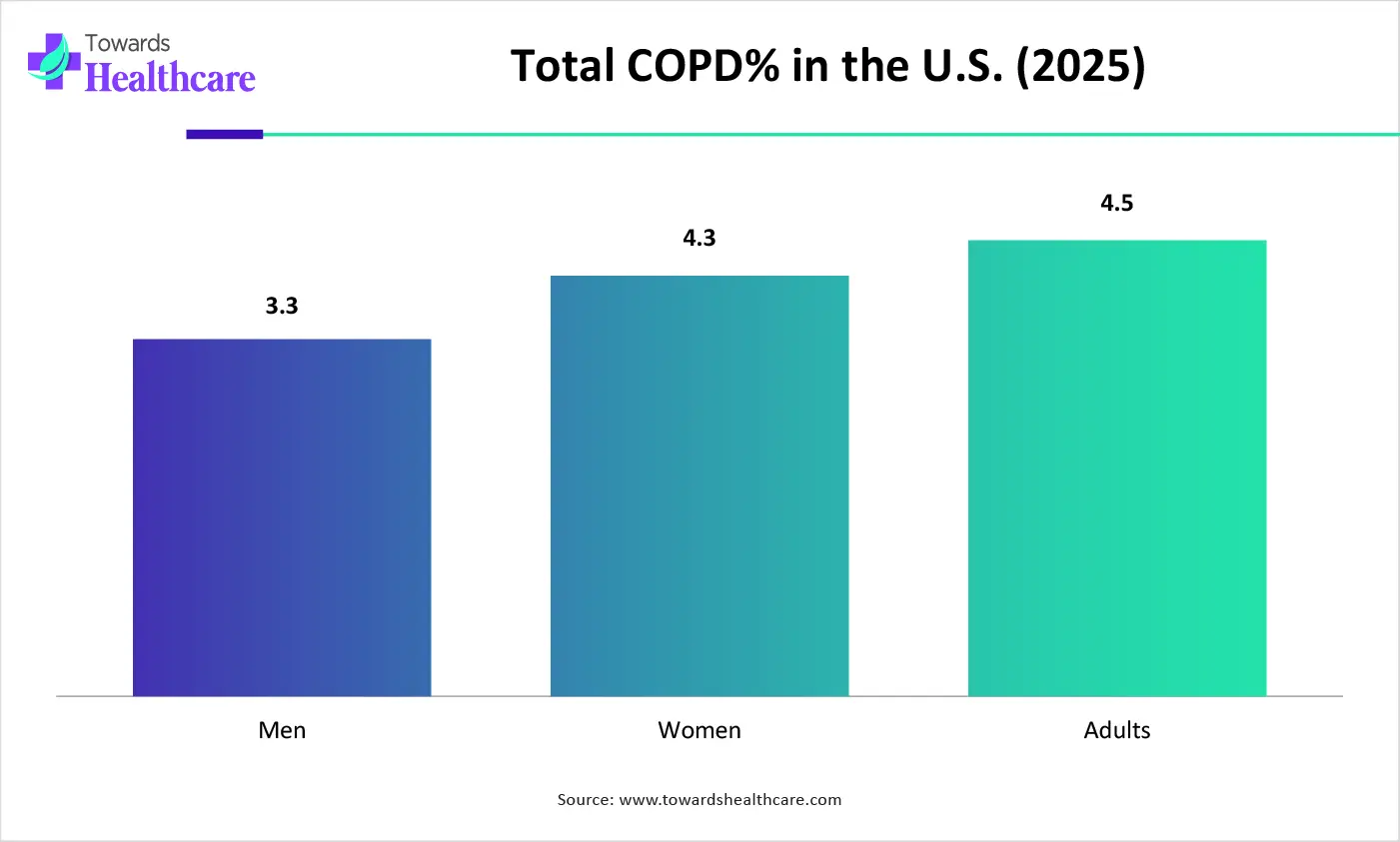

| Patients | COPD% |

| Men | 3.3 |

| Women | 4.3 |

| Adults | 4.5 |

Asia Pacific is expected to host the fastest-growing respiratory infections antibiotics market with a CAGR of approximately 10% during the forecast period, due to growing respiratory infections. At the same time, the rapid urbanization is increasing pollution, raising the risk of respiratory infections, and expanding healthcare is increasing the adoption of various antibiotics. The companies are also developing new antibiotics, enhancing the market growth.

China Market Trends

The growing volume of geriatric pollution in China is increasing the incidence of respiratory infections, driving the demand for antibiotics. The growing air pollution and awareness are also increasing the early diagnosis, where the presence of government policies is also increasing the consumption of antibiotics.

Europe is expected to grow significantly in the respiratory infections antibiotics market during the forecast period, due to robust healthcare. Additionally, growing health concerns and respiratory infections are also increasing the use of antibiotics, where the focus on antimicrobial stewardship is also driving their innovations. Moreover, growing R&D activities are also promoting the market growth.

UK Market Trends

The UK is experiencing a rise in respiratory infections, which is increasing the demand for effective antibiotics. The presence of advanced healthcare is driving the widespread availability. At the same time, the industries are also developing novel antibiotic products for targeted action.

| Companies | Headquarters | Solutions |

| GSK plc. | London, UK | Augmentin and Zinnat |

| Pfizer Inc. | New York, U.S | Zithromax and Tygacil |

| Bayer AG | North Rhine-Westphalia, Germany | Avelox and Cipro |

| Merck & Co. | NJ, U.S. | Zerbaxa and Recarbrio |

| Novartis AG | Basel, Switzerland | Amoxicillin and Levofloxacin |

| Sanofi S.A. | Paris, France | Tavanic and Rifadin |

| Cipla Limited | Mumbai, India | Azicip and Cipro |

| Johnson & Johnson | NJ, U.S. | Sirturo |

| AbbVie Inc. | North Chicago, IL, U.S. | Dalvance and Biaxin |

| AstraZeneca plc | Cambridge, UK | Zinforo |

By Antibiotic Class

By Route of Administration

By Indication/Infection Type

By Healthcare Setting

By Region

February 2026

January 2026

January 2026

January 2026