February 2026

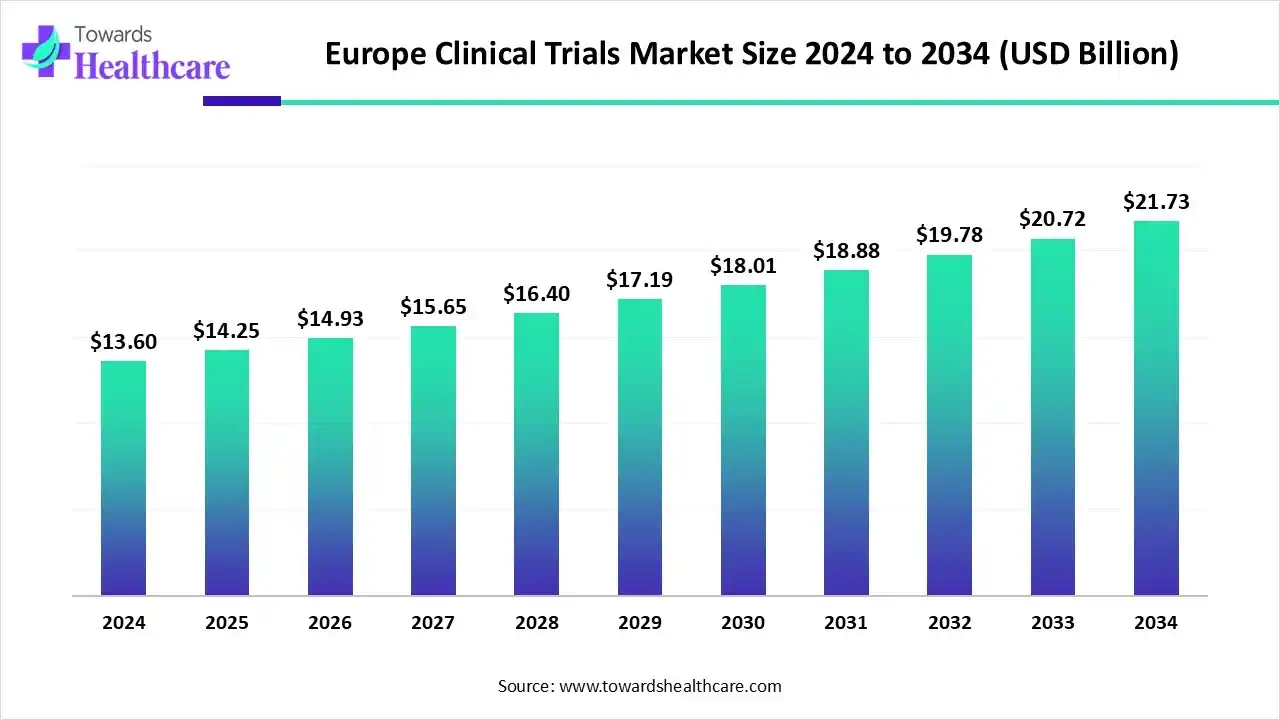

The Europe clinical trials market size is calculated at US$ 11.04 billion in 2025, grew to US$ 11.65 billion in 2026, and is projected to reach around US$ 18.81 billion by 2035. The market is expanding at a CAGR of 4.80% between 2026 and 2035.

Due to a growing geriatric population and increasing incidences of various diseases, the clinical trials in Europe are increasing. Additionally, the growth in awareness is driving the demand for accurate and fast diagnostic devices as well as for targeted and personalized treatment options. Additionally, the presence of strong regulatory standards ensures the product quality, safety, and effectiveness, where AI is also being used in these trials due to its various applications. Moreover, the companies are participating in clinical trials supported by the investments, where their results are also being presented in various European events, promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 11.04 billion |

| Projected Market Size in 2035 | USD 18.81 billion |

| CAGR (2026 - 2035) | 4.80% |

| Market Segmentation | By Phase, By Study Design, By Indication |

| Top Key Players | Novo Nordisk, Syneos Health, AstraZeneca, Novartis, F. Hoffmann-La Roche, Bayer, Sanofi, Charles River Laboratories, Johnson & Johnson, PSI, Medpace Holdings, TFS HealthScience, Ergomed, Almac Group, WuXi AppTec |

The Europe clinical trials market is driven by growing adoption of new technologies and streamlined regulations to maintain its position as a global leader in clinical research. The Europe clinical trials refer to the clinical trials of the products conducted within the European regions under the regulatory framework of the European Medicines Agency (EMA) and other government and national authorities, to ensure the safety, efficacy, and quality of the products developed. The area of interest for these clinical trials includes the development of lung cancer vaccines, personalized vaccines, HIV prevention solutions, and other treatment options.

The use of AI in Europe is transforming the drug development process, which in turn is driving its use in clinical trials and to develop smarter, faster, and patient-centric trials. They are also being used to develop decentralized trials and help in the detection of critical operational risks. Moreover, the growing awareness and investment are encouraging the use of AI to improve site readiness and boost trial efficiency.

For instance,

Growing initiatives: To simplify and harmonize the complex regulatory submission process of clinical trials, new initiatives are being introduced by the government and other regulatory bodies. These initiatives are encouraging innovations across Europe. Additionally, they are also attracting investments, accelerating the clinical trials.

For instance,

| Companies | Clinical Trials Data | Event | Source |

| INNODIA | First trial results of the minimum effective dose of an off-label diabetes treatment for children and young people using an adaptive trial | European Association for the Study of Diabetes (EASD) | Faster, innovative clinical trials for type 1 diabetes treatments proven possible by INNODIA | IHI Innovative Health Initiative |

| Savara Inc. | Data from Phase 3 IMPALA-2 Clinical Trial of Molgramostim Inhalation Solution (Molgramostim) for Autoimmune Pulmonary Alveolar Proteinosis (aPAP) | European Respiratory Society (ERS) Congress 2025 | Savara Inc. - Savara Presents New Data From the Phase 3 IMPALA-2 Clinical Trial of Molgramostim Inhalation Solution (Molgramostim) in Patients With Autoimmune Pulmonary Alveolar Proteinosis (aPAP) at the European Respiratory Society (ERS) Congress 2025 |

| Novartis | Data from 34 abstracts across its oncology portfolio | European Society for Medical Oncology (ESMO) Congress 2025 | Novartis to present new data from 34 abstracts in advanced prostate and early breast cancer at ESMO 2025 |

| Immutep Limited | Three abstracts from first-in-class MHC Class II agonist, eftilagimod alfa (efti) clinical trials | European Society for Medical Oncology (ESMO) Congress 2025 | Immutep | LAG-3 Immunotherapy for Cancer & Autoimmune Disease |

| Immutep Limited | Data from the TACTI-004 Phase III trial | European Lung Cancer Congress (ELCC) 2025 | Immutep | LAG-3 Immunotherapy for Cancer & Autoimmune Disease |

By phase type, the phase 3 segment held the dominating share of the market in 2024, due to a growth in drug development. At the same time, the presence of a wide range of patients enhanced the phase 3 trials. Additionally, the growth in the collaboration with other countries also encouraged these trials.

By phase type, the phase 2 segment is expected to show the highest growth during the predicted time. The increasing number of startups is focusing on the development of novel treatment options for various diseases, which is promoting the phase 2 trials. Similarly, the growing demand for targeted therapies to tackle the growing genetic diseases is also contributing to the same.

By study design type, the interventional study segment led the market in 2024 and is expected to show the fastest growth rate during the upcoming years, driven by stringent regulations that require evidence-based data. Moreover, the growth in drug development, along with new diagnostic devices, has enhanced the use of these study designs. Additionally, as they provide reliable and reproducible results, their use in phase 2 and 3 trials has increased.

By indication type, the pain management segment led the market in 2024 and is expected to sustain its position during the predicted time, due to growth in the geriatric population. Similarly, the growing cases of arthritis, back pain, or neuropathy are also driving the clinical trial of pain management treatment. Moreover, the growing demand for opioid alternatives is also contributing to the same.

In the pain management segment, the oncology subsegment held the largest share of the market and is expected to show the highest growth during the upcoming years, as there is a rise in cancer cases. This, in turn, is increasing the demand for targeted and personalized treatment options. Additionally, the growing R&D investment is driving oncology innovation, promoting their clinical trials.

A 2025 publication from the Annals of Oncology estimated a decrease in the European Union from 2020 to 2025, with favorable trends for most cancers except pancreatic, lung, and bladder cancers. In 2022, the World Health Organization (WHO) reported over 3.7 million new cases and 1.9 million deaths from cancer annually in Europe, making it the second leading cause of death.

The Europe clinical trials market is expected to show significant growth during the forecast period, as it consists of a unified regulatory framework, such as the EU Clinical Trials Regulation, which streamlines the approval process, attracting sponsors from different countries. The growth in research and development supported by the government funding is also driving the clinical trials. Additionally, the growing diseases, awareness, and demand for targeted treatment options are also increasing innovation, promoting their clinical trials. All these factors, along with the growing utilization of advanced technologies, are enhancing the market growth.

In April 2025, to develop a new Health Data Research Service, which will provide a single, secure access point to national datasets, a total of £600m ($764m) funding was announced by the UK Government. Moreover, to enhance the development of novel therapies and the fast-tracking of clinical trials will be supported by these funds.

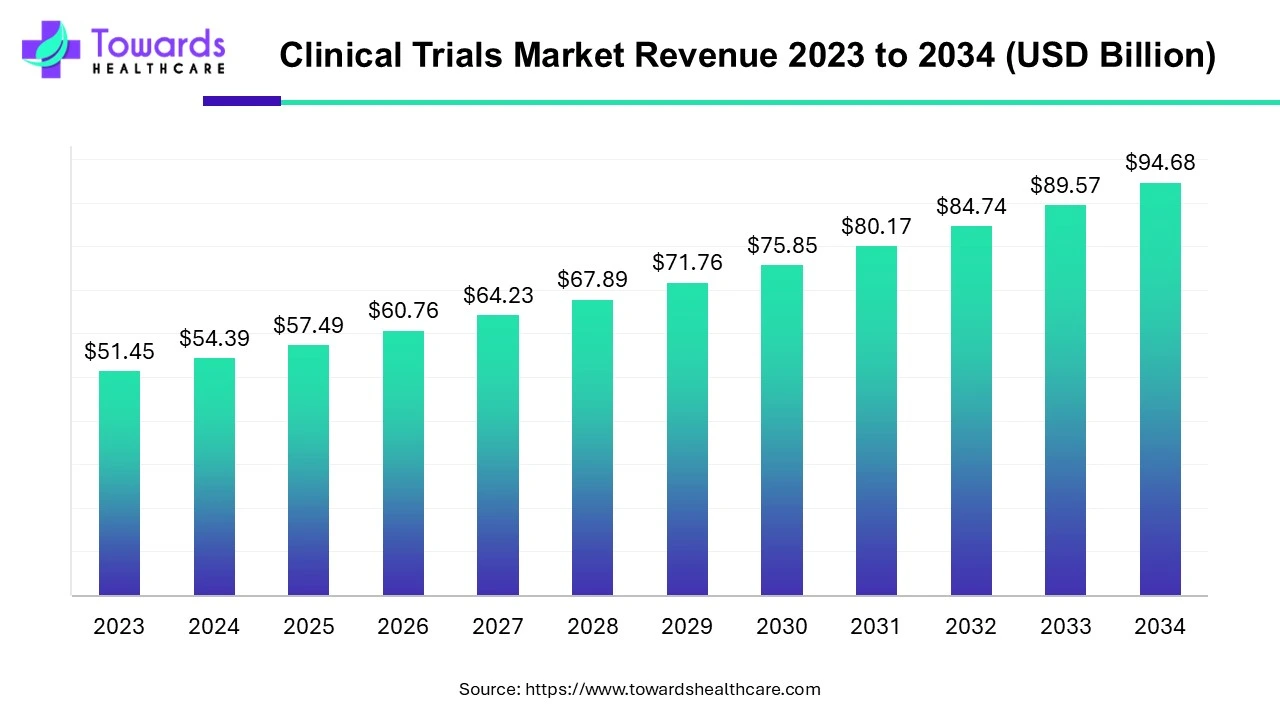

The global clinical trials market is valued at USD 98.91 billion in 2026 and is projected to reach USD 174.18 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.7% over the forecast period from 2026 to 2035.

With the use of technological advancements and regulatory harmonization, the R&D of Europe clinical trials are focusing on increasing the research efficiency and patient centricity.

Key Players: Novartis, AstraZeneca, F. Hoffmann-La Roche, Novo Nordisk, Bayer, Sanofi.

The implementation and optimization of the clinical trials regulation (CTR) to increase transparency, harmonize, and streamline the entire process through a single online platform is the primary focus in Europe clinical trials and regulatory approvals.

Key Players: Novartis, AstraZeneca, F. Hoffmann-La Roche, Novo Nordisk, Bayer, Sanofi, GlaxoSmithKline (GSK), Pfizer.

The formulation and final dosage preparation in the Europe clinical trials are expected to comply with the GMP standards outlined in Annex 13 of the EU GMP Guide, where the product must ensure its safety, quality, and consistency.

Key Players: Thermo Fisher Scientific, Catalent, Lonza, Almac Group, and Recipharm.

The packaging and serialization in the Europe clinical trials are expected to comply with Annex 13 of the EU GMP Guide and Falsified Medicines Directive (FMD), and must ensure patient safety and convenience during the complexity of decentralized trials.

Key Players: Thermo Fisher Scientific, Catalent, Lonza, Almac Group, Recipharm, Aenova Group.

The distribution of investigational medicinal products to hospitals and pharmacies is expected to adhere to EU Good Distribution Practices (GDP) and Annex 13 of the EU GMP Guide, where they must ensure products' integrity, traceability, and security, along with a temperature-controlled and transparent transportation process.

Key Players: Movianto, DHL Supply Chain, World Courier.

To enhance the patient experience and adherence, Europe clinical trials focus on enhancing their education, providing financial assistance, and decentralized trial elements such as home healthcare.

Key Players: ICON plc, IQVIA, Syneos Health, Parexel, Thermo Fisher Scientific

By Phase

By Study Design

By Indication

February 2026

February 2026

February 2026

February 2026