December 2025

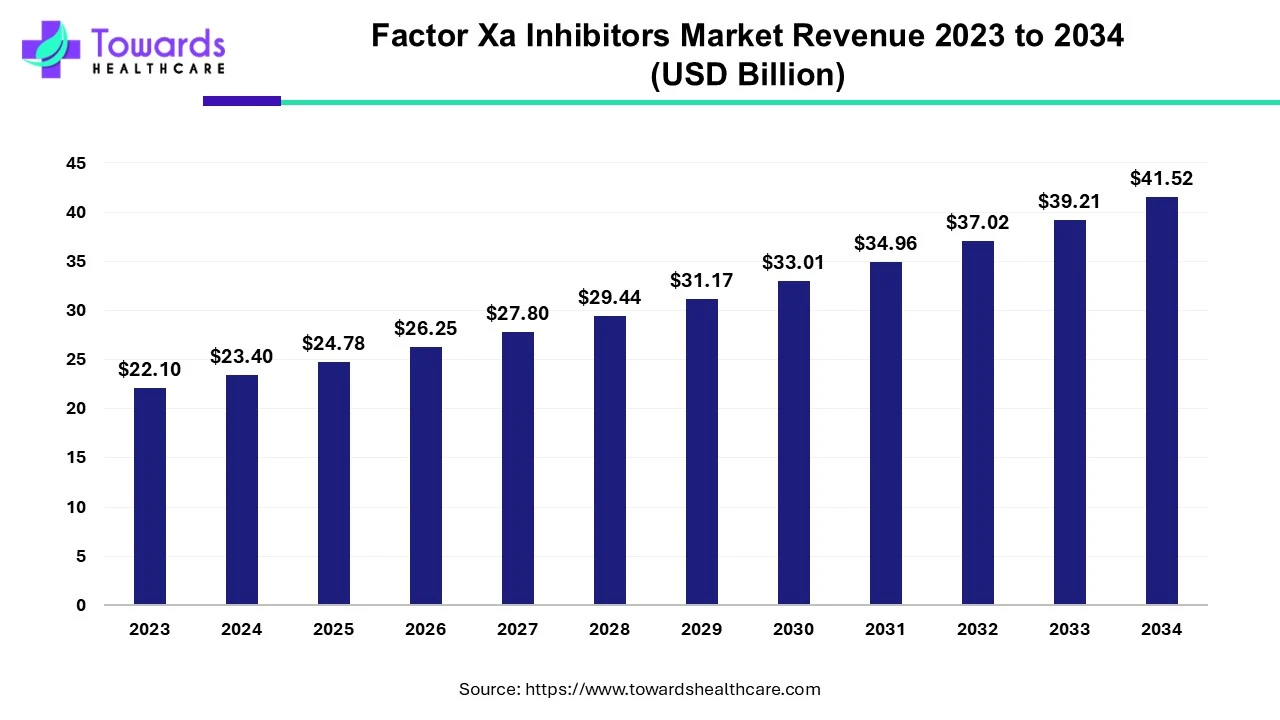

The global factor Xa inhibitors market was estimated at US$ 22.1 billion in 2023 and is projected to grow to US$ 41.52 billion by 2034, rising at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2034. The growing prevalence of various heart-related health issues is driving the market.

Inhibitors of factor Xa (FXa) are the most recent class of anticoagulants. They attach to FXa and prevent prothrombin from cleaving into thrombin, which stops the coagulation cascade. Because of their quick onset and brief half-lives, they offer the benefit of requiring less "bridging" close to surgery. Currently, several oral and injectable direct factor Xa inhibitors are in clinical development.

DOACs are the future of the factor Xa inhibitors market. Pharmacological research over the last ten years has produced novel direct oral anticoagulants (DOACs) that target molecules that can inhibit certain and individual coagulative cascade pathways. The goal of developing new DOACs is to provide an effectiveness that is at least as high as that of VKAs. There is a lot of optimism for the future since clinical research is being done to broaden the list of indications for DOACs, and experience is still expanding outside of the trial environment.

The factor Xa inhibitors market faces challenges in growth due to various side effects associated with the drugs. Bleeding, usually from the nose, gastrointestinal tract (GI), or genitourinary system, is one of the possible side effects. Direct factor Xa inhibitors have a decreased risk of brain bleeding but a higher risk of gastrointestinal bleeding when compared to the risk of bleeding with warfarin usage. Additional adverse effects might include nausea, lightheadedness, anemia, or elevated liver enzyme levels in the blood.

Many reasons contribute to North America's supremacy, including the region's sophisticated healthcare system, government assistance, rising pharmaceutical investments, and the innovation and financial commitments of major industry participants. Canada and the United States are the two main nations that support the market's expansion.

Atrial fibrillation is a common cause of stroke, and the prevalence of stroke is increasing in the U.S., which is promoting the growth of the factor Xa inhibitors market. For instance, In 2022, stroke was the cause of one in six fatalities (17.5%) from cardiovascular disease in the U.S. Between 2021 and 2022, the stroke death rate dropped from 41.1 per 100,000 to 39.5 per 100,000. In the U.S., a stroke occurs every 40 seconds or so. A stroke claims a life in this nation every 3 minutes and 11 seconds. In America, almost 795,000 people have a stroke each year. There are around 610,000 new or first strokes.

Asia Pacific is the biggest and most populated region, and it has advantages, including a broad consumer base and a large labor pool. Due to technological advancements, healthcare spending, and the participation of international market players, the factor Xa inhibitors market is growing quickly in the region. Another important factor contributing to the growth is the increasing prevalence of CVDs in the region. Among the countries that largely encourage the market's growth are China and India.

India records one stroke death every four minutes, making stroke the second leading cause of mortality in the nation, according to neurologist M V Padma Srivastava. Speaking at an event, Srivastava claimed that India has the highest rate of stroke, with a 68.6% incidence, a 70.9% stroke mortality rate, and a 77.7% loss of disability-adjusted life years (DALYs).

For instance

Europe is expected to grow at a notable CAGR in the factor Xa inhibitors market in the foreseeable future. The growing research and development activities and the rising adoption of advanced technologies drive the market. Key players, such as AstraZeneca Pharma and Roche Diagnostics, are the major contributors to the market in Europe. Government organizations launch initiatives to promote effective treatment and provide funding to develop novel anticoagulants.

The increasing number of clinical trials also contributes to market growth. As of July 2025, about 186 clinical studies have been registered on the clinicaltrials.gov website within 500 miles of Europe related to Factor Xa inhibitors as an intervention. (Source: Clinical Trials) The National Health Service England reported that a total of 1,200 strokes were avoided between 2023 and 2024, and about 9,000 strokes were avoided over the past five years. The effect was visible due to the use of anticoagulant medication and a focus on better detection of people with undiagnosed atrial fibrillation. (Source: NHS England)

By type, the oral drugs segment held the largest share of the market. Along with ease and compliance, the medication's pharmacokinetic and pharmacodynamic properties also affect how the drug is administered. Therefore, it is crucial to understand the characteristics of the various routes and associated tactics. Oral administration is one of the most widely used, practical, and cost-effective ways to deliver medication. The small intestine is usually where most drug absorption takes place, and the amount of drug absorbed via the intestinal epithelium influences the bioavailability of the treatment.

By application, the atrial fibrillation segment held a significant share of the market. It is atrial fibrillation that causes strokes most frequently. Patients with atrial fibrillation who get anticoagulant treatment have a lower risk of stroke and other embolic consequences. Projected studies indicate that by 2050, there will be 15.9 million Americans with AF, and by 2060, there will be 17.9 million in Europe.

Dr. Sanjeev Panchal, Country President and Managing Director at AstraZeneca India, commented that the company remains steadfast in its commitment to addressing unmet medical needs, and the approval of Andexanet Alfa underscores its dedication to bringing life-changing medicines to India at the earliest. He also said that the company is working to make this important medicine available for patients on FXa inhibitors who have life-threatening or uncontrolled bleeding. (Source: AstraZeneca)

By Type

By Application

By Region

December 2025

November 2025

November 2025

November 2025