November 2025

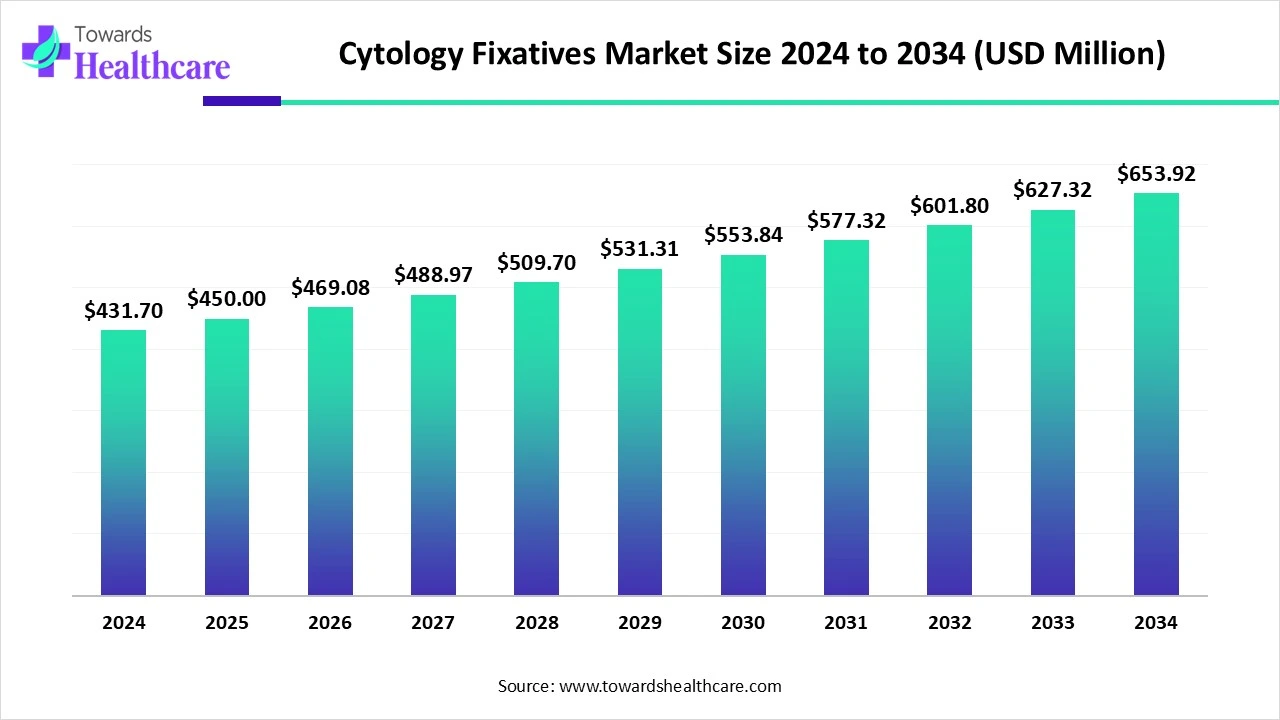

The global cytology fixatives market size is calculated at USD 431.7 million in 2024, grew to USD 450 million in 2025, and is projected to reach around USD 653.92 million by 2034. The market is expanding at a CAGR of 4.24% between 2025 and 2034.

The cytology fixatives market is primarily driven by the increasing demand for screening and early diagnosis of chronic diseases. This leads to a greater number of diagnostic laboratory tests. The rising prevalence of chronic disorders and growing research and development activities also promote the market. The future of the market looks promising, with the integration of AI/ML in cytology fixatives.

| Metric | Details |

| Market Size in 2025 | USD 450 Million |

| Projected Market Size in 2034 | USD 653.92 Million |

| CAGR (2025 - 2034) | 4.24% |

| Leading Region | North America |

| Market Segmentation | By Product, By Application, By End-User, By Region |

| Top Key Players | Atom Scientific Ltd., Azer Scientific, Inc., Becton, Dickinson, and Company, Cancer Diagnostics, Inc., Histo-Line Laboratories, Leica Biosystems, Merck, Morphisto GmbH, Nev’s Ink, Inc., Solmedia Ltd. |

Fixation is the primary step in any histological and cytological laboratory technique. It refers to fixing cells in a tissue in a chemical and physical state, resisting any morphological change, distortion, or decomposition after subsequent treatment with various reagents. The primary objectives of fixation are to preserve tissue, prevent any change in shape or size of the tissue, prevent any autolysis, prevent bacterial growth, and have better optical clarity of the cells. The most common examples of cytology fixatives are ethyl alcohol, methanol, formaldehyde, glutaraldehyde, and picric acid.

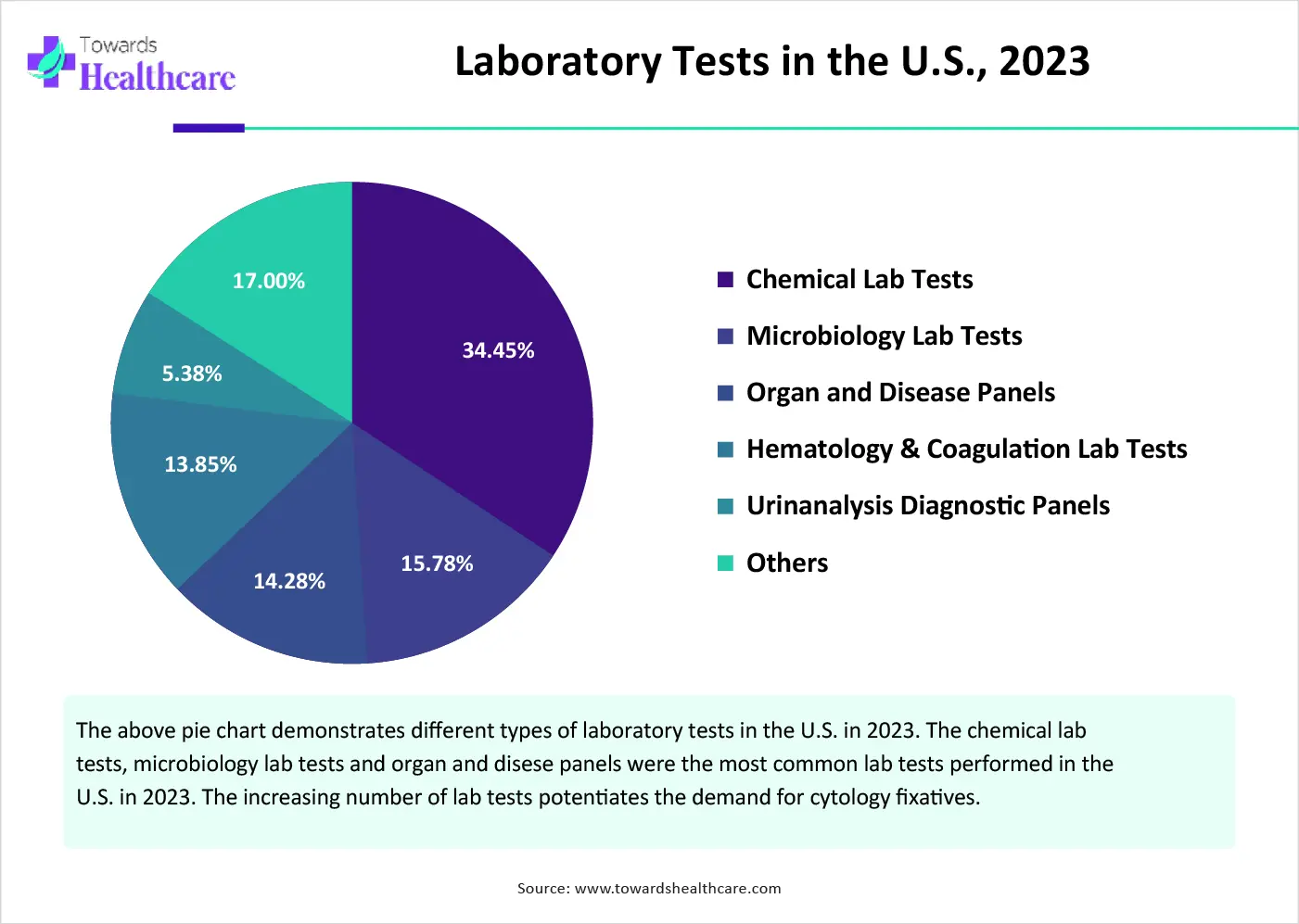

Numerous factors govern the market, including the growing demand for screening and early diagnosis of chronic disorders leads to an increasing number of diagnostic laboratory tests. The burgeoning microbiology sector, driven by technological advancements, potentiates market growth. The growing research and development activities in the microbiology sector boost the market. Government organizations create awareness for early diagnosis of chronic disorders through initiatives.

Artificial intelligence (AI) can revolutionize the market by automating sample preparation and fixation steps, thereby enhancing efficiency and diagnostic accuracy. Integrating AI in cytology can significantly reduce errors and improve patient outcomes. AI can help manage the storage of cytology fixatives based on their distinctive properties. It can suggest to laboratory personnel the type of fixatives to be used based on the diagnostic tests. It can also predict the adverse effects of fixatives on the cells.

Increasing Lab Tests

The major growth factor of the cytology fixatives market is the increasing number of laboratory diagnostic tests. The rising prevalence of chronic disorders, especially among the geriatric population, encourages people to undergo regular laboratory tests. Pathology and laboratory tests play a vital role in healthcare by aiding in disease diagnosis, monitoring treatment effectiveness, and guiding patient management. Effective diagnosis enables healthcare professionals to provide personalized treatment to patients and also aid in decision-making. The World Health Organization (WHO) stated that every medical decision relies on a proper diagnosis. Diagnostics influence 70% of healthcare decisions.

Potential Toxicity

Several cytology fixatives are toxic in nature and may harm laboratory personnel. Some common health issues of cytology fixatives are respiratory irritation, skin & eye irritation, and carcinogenic effects.

What is the Future of the Cytology Fixatives Market?

The increasing adoption of digital pathology and growing research and development activities present future growth opportunities for the market. The acquisition, management, sharing, and interpretation of pathology data is digitized through digital scanners and software applications. Digital pathology simplifies numerous complex tasks for researchers and saves a lot of time. Recent advances in whole slide imaging techniques and LIS/LIMS interfacing led to the adoption of digital pathology. Several researchers are currently developing novel fixatives with enhanced properties. Researchers also focus on alternatives that minimize toxicity and preserve biomolecules.

By product, the liquid-based fixatives segment held a dominant presence in the market in 2024. The demand for liquid-based fixatives is increasing due to their advantages, such as the ability to prepare uniform specimens, avoidance of drying, and minimal sample loss. Liquid-based fixatives can be used for the diagnosis of both gynecologic and non-gynecologic cytology. They can maintain and preserve cells for a long period. They also enable easier identification of abnormal cells and lead to more accurate diagnosis.

By product, the formaldehyde-based fixatives segment is expected to grow at the fastest CAGR in the market during the forecast period. Formalin-based fixatives contain 4% formaldehyde, are commonly used to preserve tissues for histological and anatomical purposes. They optimize penetration and reaction rates, providing reliable results at a defined pH. They are available in both liquid and dry forms. They are also used for electron microscopy. They are preferred due to low cost, ease of use, and good tissue penetration.

By application, the cancer screening segment led the global market in 2024. This segment dominated due to the rising prevalence of cancer and the need for screening and early diagnosis. The American Cancer Society estimated that there will be more than 2 million new cancer cases in the U.S. in 2025. (Source - Acsjournals) Cancer cytology tests analyze cells from body fluids or tissue samples under a microscope. They offer a non-invasive approach compared to biopsy tests.

By application, the diagnostic cytopathology segment is expected to grow with the highest CAGR in the market during the studied years. The growing demand for minimally invasive and cost-effective diagnostic procedures boosts the segment’s growth. Diagnostic cytopathology refers to analyzing cells obtained from body fluids to diagnose chronic disorders. It detects the presence of several abnormal cells in the body, leading to certain diseases. The increasing number of laboratory diagnostic tests is a result of advancements in diagnostic cytopathology.

By end-user, the hospitals segment held the largest revenue share of the market in 2024. The segmental growth is attributed to favorable infrastructure and the increasing adoption of advanced technologies. Patients usually prefer hospitals due to the presence of multidisciplinary experts and favorable reimbursement policies. They also prefer hospitals as they do not need to visit a separate lab for diagnostic purposes. Hence, the increasing number of patients potentiates the need for cytology tests, thereby promoting the use of fixatives.

By end-user, the cancer research institutes segment is expected to expand rapidly in the market in the coming years. The availability of suitable research infrastructure and the presence of skilled professionals augment the segment’s growth. Several government and private organizations provide funding for cancer research. Cancer research institutes require cytology fixatives for their research purpose to study tumor cells in detail.

North America dominated the global market in 2024. The presence of a robust healthcare infrastructure and the increasing number of laboratory tests are the major growth factors of the market in North America. The rising adoption of advanced technologies enables healthcare organizations to perform accurate diagnostic tests. Government organizations emphasize screening and early diagnosis of chronic disorders.

Key players, such as Becton, Dickinson and Co., Cancer Diagnostics, and Merck, are the major contributors to the market in the U.S. There are around 31,277 diagnostic and medical laboratories in the U.S. as of 2024. The increasing risk of cancer encourages people to conduct screening tests. The U.S. spends at least $43 billion on tests that check for five major cancers annually.

There are 2,391 businesses in the laboratory testing services in Canada. The National Initiative for the Care of the Elderly estimated that over 127,000 males and 120,000 females will be diagnosed with cancer in 2025. (Source - Nicenet)The Canadian Task Force on Preventive Healthcare, formed by the federal government, provides cancer screening guidelines for both patients and providers to aid in decision-making.

Asia-Pacific is expected to grow at the fastest CAGR in the cytology fixatives market during the forecast period. The rising prevalence of chronic disorders and the increasing geriatric population favor market growth. The growing research and development activities and favorable government initiatives increase the demand for microbiology lab tests, thereby cytology fixatives. The rapidly expanding microbiology sectors also promote the market.

The Chinese government has established targets of 50% cervical cancer screening coverage by 2025 and 70% by 2030 for women of appropriate age. According to a recent study, screening rates reached 51.5% women aged 35-64 years, 57.9% of women aged 35-44 years, and 36.8% women aged 20 years and above in 2023-2024. (Source - China cdc)

There are over 3 lakh diagnostic labs in India, and diagnostics account for around 9% of the industry. The federal government’s National Programme for Prevention and Control of Non-Communicable Diseases (NP-NCD) aims to prevent and control chronic disorders, such as hypertension, diabetes, cancer, COPD/asthma, etc.

Europe is expected to grow at a notable CAGR in the cytology fixatives market in the foreseeable future. The presence of key players and the growing demand for early diagnosis boost the market. This leads to an increasing number of laboratory tests. The increasing investments and collaborations among key players and academic researchers augment market growth. Favorable trade policies for importing and exporting laboratory reagents drive the market.

Germany was the second-largest exporter of laboratory reagents, followed by the U.S., in 2023, accounting for $59.3 million. The top importers were Argentina, the Philippines, and Lebanon. (Source - OEC) According to the BDL (Berufsverband Deutscher Laborärzte e.V.), approximately 9 million laboratory tests are performed every day in Germany.

The UK became the fourth-largest exporter of laboratory reagents in the world by exporting $19.1 million of laboratory reagents in 2023. (Source - OEC) The Division of Laboratory Medicine at Manchester University NHS Foundation Trust conducts more than 26 million tests annually across four sites. (Source - NHS)

Dr. Gilles Martin, CEO of Eurofins, commented that the addition of Infinity’s laboratories and competencies to Eurofins’ leading BioPharma services network of companies further increases their leadership in providing the most innovative, high-quality, and cost-competitive services and IT systems to their clients. (Source - Businesswire)

By Product

By Application

By End-User

By Region

November 2025

January 2026

October 2025

November 2025