January 2026

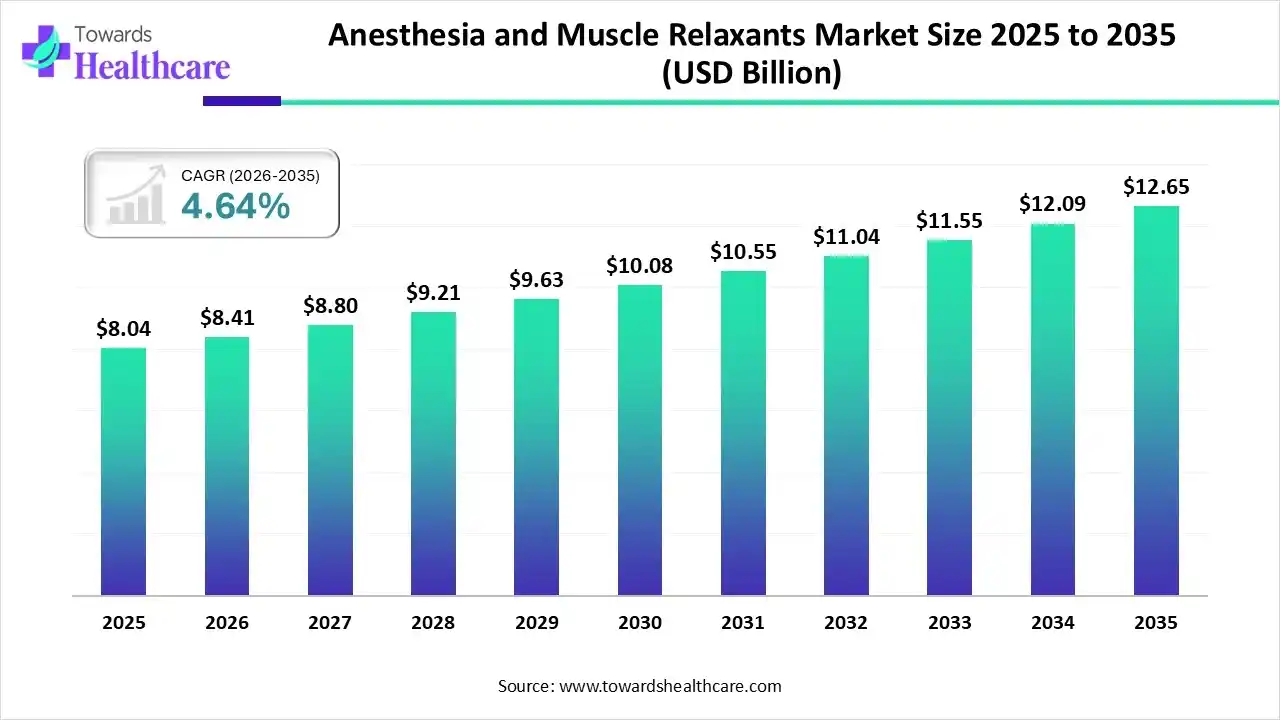

The global anesthesia and muscle relaxants market size was estimated at USD 8.04 billion in 2025 and is predicted to increase from USD 8.41 billion in 2026 to approximately USD 12.65 billion by 2035, expanding at a CAGR of 4.64% from 2026 to 2035.

Day by day, the globe is facing a huge burden of an ageing population, which is highly prone to MSD and other chronic diseases, which fosters the greater demand for efficacious anaesthetics and muscle relaxants during the surgical procedures. Whereas, different regions are encouraging the development of nanotechnology for innovative & robust delivery systems. Also, the globe is leveraging the adoption of outpatient services including ambulatory surgery centers.

| Key Elements | Scope |

| Market Size in 2026 | USD 8.41 Billion |

| Projected Market Size in 2035 | USD 12.65 Billion |

| CAGR (2026 - 2035) | 4.64% |

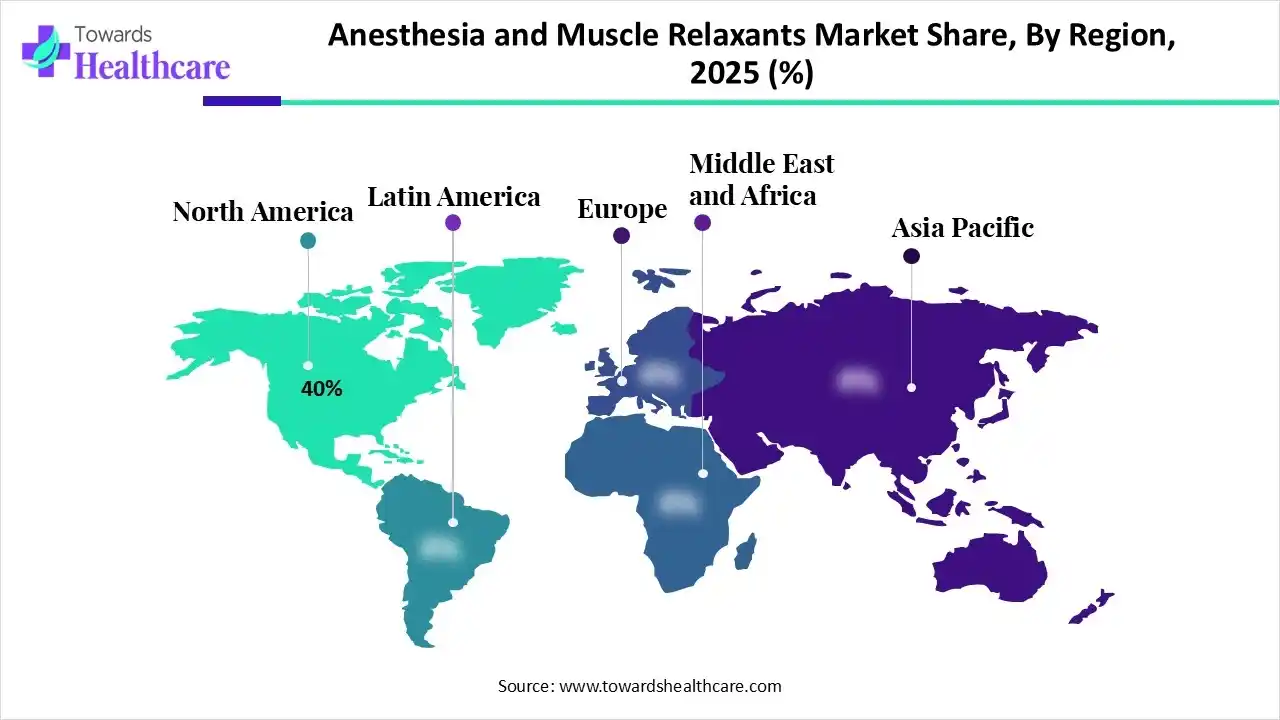

| Leading Region | North America by 40% |

| Market Segmentation | By Drug Type, By Route of Administration, By Application/Indication, By End User, By Distribution Channel, By Region |

| Top Key Players | Baxter International, Pfizer, GlaxoSmithKline (GSK), AbbVie, Mylan/Viatris, Hikma Pharmaceuticals, Sanofi, Teva Pharmaceuticals, Sandoz (Novartis) |

The anesthesia and muscle relaxants market encompasses pharmaceutical agents used during surgical procedures, intensive care, and diagnostic interventions to induce anesthesia (general or local) and provide skeletal muscle relaxation. Increasing surgical volumes, ageing populations, minimally invasive procedures, and ICU demand drive the market globally. It includes general anesthetics (injectable and inhaled), local anesthetics (spinal, epidural, topical), and neuromuscular blocking agents (muscle relaxants) such as depolarizing and non-depolarizing compounds. These drugs enable pain-free procedures, optimize ventilation, prevent movement, and improve surgical conditions.

Specifically, AI is widely adopted for its greater efficiency across sectors, including the anesthesia and muscle relaxants market, through the development of more sophisticated closed-loop systems. Such as McSleepy, a research prototype, which assists in managing all three components of general anesthesia, like hypnosis, analgesia, and neuromuscular blockade, by employing AI to ensure stable levels and offer prompts for the anesthesiologist. In 2025, the PINES project established a model using AI for the prediction of the full course of neuromuscular blocking agents.

The globe is emphasising an evolution of ultra-short-acting agents, such as gantacurium and its analogs (CW002, CW001), with their rapid onset and off-switch, with better reversal agents (like L-cysteine).

Alongside, the market is leveraging Total Intravenous Anesthesia (TIVA), including the use of propofol/remifentanil for better control and quicker recovery, mainly in ambulatory settings.

This technology will have particular applications in injectable nanoparticles, which can attach and neutralize local anesthetics.

In the prospective period, the market will explore different microscopic devices for catering to the functions of red blood cells or white blood cells (microbivores), with more efficacious treatments for poisoning or antibiotic-resistant infections in vital care.

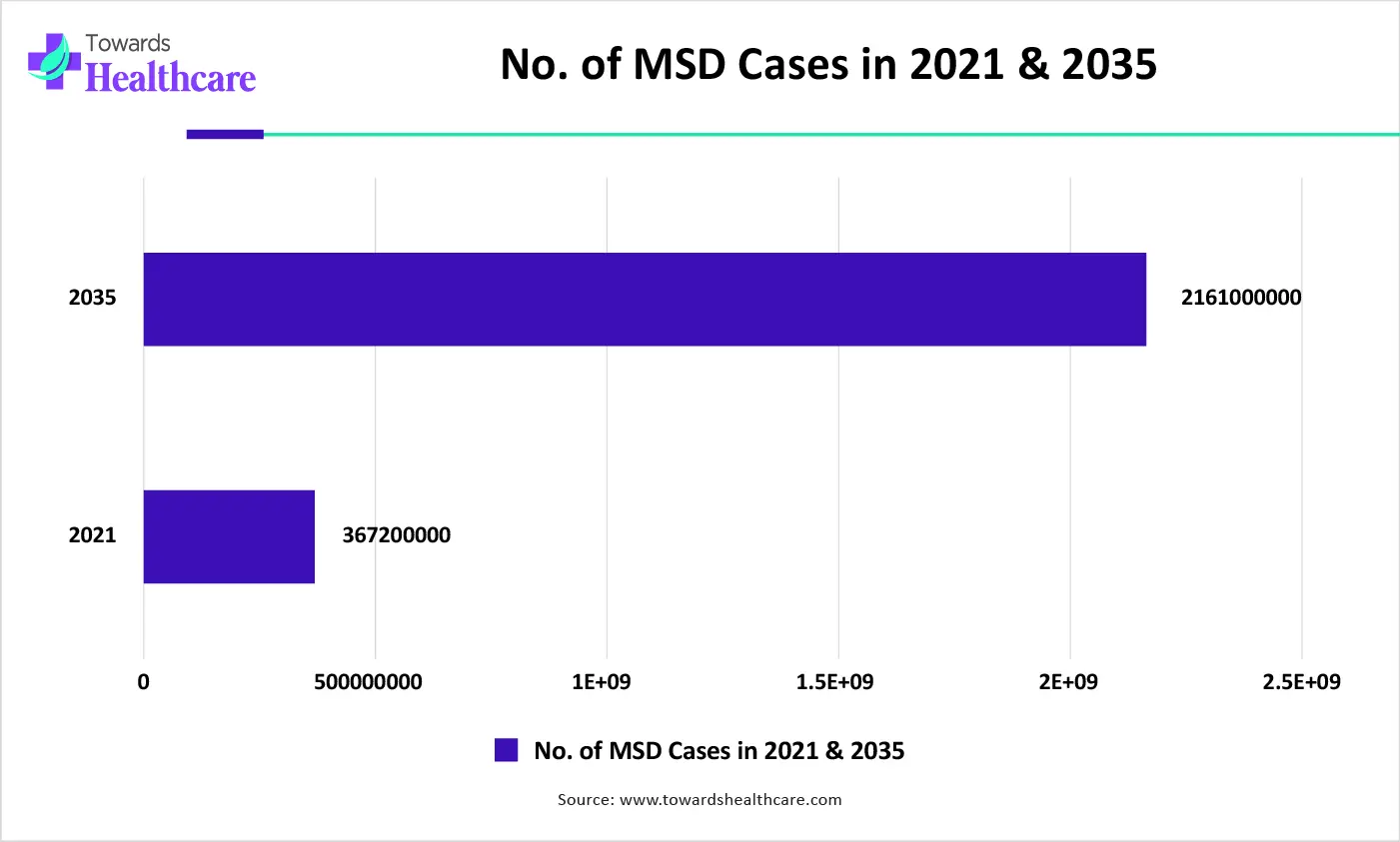

| Number of Musculoskeletal Disorder Cases in 2021 & 2035 | |

| 2021 | 367.2 million |

| 2035 | 2.161 billion |

| Company | Partnerships |

| Philips | In October 2025, it partnered with Getinge in Europe to provide customers with seamless access to a comprehensive anesthesia and monitoring solution. |

| Premier Anesthesia | In October 2025, it collaborated with Riverside Medical Center to boost patient care around Illinois. |

| NorthStar Anesthesia | In June 2025, this expanded partnership with AdventHealth to facilitate premier anesthesia care at AdventHealth Ottawa. |

| NorthStar Anesthesia | In April 2025, a company allied with UChicago Medicine and AdventHealth Bolingbrook to deliver customized, high-quality anesthesia services to health systems across the region. |

Which Drug Type Led the Anesthesia and Muscle Relaxants Market in 2025?

By capturing an approximate 44% share, the general anesthetics segment led the market in 2025. They usually offer a reversible, medically induced state of unconsciousness, enabling patients to safely undergo critical, complex, or otherwise intolerable surgical procedures. Ongoing advances include Methoxyetomidate (ET-26), an investigational intravenous anesthetic agent currently in Phase 3 clinical trials, which crucially lowers suppression of adrenal gland function (a common side effect of traditional etomidate).

Adjuncts/Sedatives & Analgesics

Whereas, the adjuncts/sedatives & analgesics segment will expand rapidly. Mainly, a rise in preference among healthcare providers and patients for non-opioid pain relief alternatives, positioning muscle relaxants and a few adjuncts (such as alpha-2 agonists) as an immersive choice in pain therapy. In 2025, the FDA cleared suzetrigine (Journavx), a first-in-class non-opioid analgesic, and promoted research into the benefits of remimazolam and new delivery approaches for dexmedetomidine.

How did the Intravenous (IV) Segment Dominate the Market in 2025?

In 2025, the intravenous (IV) segment led with nearly 46% share of the anesthesia and muscle relaxants market. Increasing both elective and emergency procedures, such as cardiovascular bypasses, cancer resections, and orthopedic joint replacements, is fostering the need for this ROA with its accelerated action and robust outcomes. Alongside, consistent developments in smart infusion systems and target-controlled infusion (TCI) devices enhance the precision of drug delivery, which is impacting the overall market expansion.

Oral/Other/Fast-Dissolving Forms

However, the oral/other/fast-dissolving forms segment is anticipated to witness rapid growth. These kinds of ROA are increasingly used with their increased bioavailability, rapid onset of action, and a wide range of applications, like the use of low-dose ketamine for depression and mood disorders. In late 2025, a study described the successful formulation of tizanidine (a muscle relaxant) into nanoparticles in a sublingual tablet form. This has shown disintegration in less than 40 seconds and achieved 100% drug release in vitro.

Why did the Surgical Procedures Segment Lead the Market in 2025?

The surgical procedures segment held approximately 48% share of the anesthesia and muscle relaxants market in 2025. Major catalysts are the rising geriatric population, with diverse chronic issues, as well as a growing demand for non-opioid choices. Recently developed liposomal bupivacaine has a prominent role in post-operative pain management, with extended local analgesic effects up to 72 hours, and lowers the need for other pain relief medications.

Procedural Sedation

Moreover, the procedural sedation segment is estimated to expand fastest in the coming era. A rise in the adoption of ambulatory surgical centers (ASCs) and minimally invasive surgeries, with their affordability and convenience, is leveraging the need for fast-acting drugs with expedited recovery profiles. Newer molecules comprise remimazolam and ciprofol for enhanced safety profiles and quicker, more predictable recovery times as compared to traditional agents, especially propofol and midazolam.

Which End User Led the Anesthesia and Muscle Relaxants Market in 2025?

The hospitals & surgical centers segment held nearly 62% share of the market in 2025. They are primarily using these agents to ensure patient safety and comfort, and to enable surgeons to perform complex procedures effectively. At the same time, many muscle relaxants are coupled with the relaxation process, often enabling the anesthesiologist to use minimal doses of other general anesthetic agents, which can result in quicker recovery times and fewer side effects.

Clinics/Outpatient Procedural Facilities

On the other hand, the clinics/outpatient procedural facilities segment is predicted to register the fastest expansion. Specifically, in the ambulatory surgery centers (ASCs), these more efficacious drugs are used in the broader same-day surgeries as needed by the procedure. Additionally, different specialty clinics, like those for ENT (Ear, Nose, and Throat), plastic surgery, or certain dental/oral surgeries, widely use anesthesia and muscle relaxants for their procedures.

What Made the Hospital Pharmacy Procurement Segment Dominant in the Market in 2025?

The hospital pharmacy procurement segment led with an approximate 55% share of the anesthesia and muscle relaxants market in 2025. A key driver is an expanding emphasis on enhancing perioperative care and reducing postoperative complications, particularly nausea, vomiting, and intraoperative awareness, which are bolstering demand for high-quality drugs and ultimately impact procurement decisions. Also, they are stepping into technological integration (AI, digital twins, automation) to develop resilient supply chains and the launch of new, more targeted drugs.

Direct-To-Clinic/DTC Supply

Although the direct-to-clinic/DTC supply segment will expand rapidly. As this can simplify logistics, potentially optimise cost-effectiveness and ensure a more resilient supply chain, it further fuels its adoption. Considering vital disruptions, such as the Change Healthcare platform concern, industry experts and professional bodies, including the American Society of Anesthesiologists (ASA), are focusing on the need for strong revenue cycle resilience and cybersecurity in billing partners. Alongside, government support and continuous technological advances are supporting the prospective supply chain developments to encourage patient accessibility.

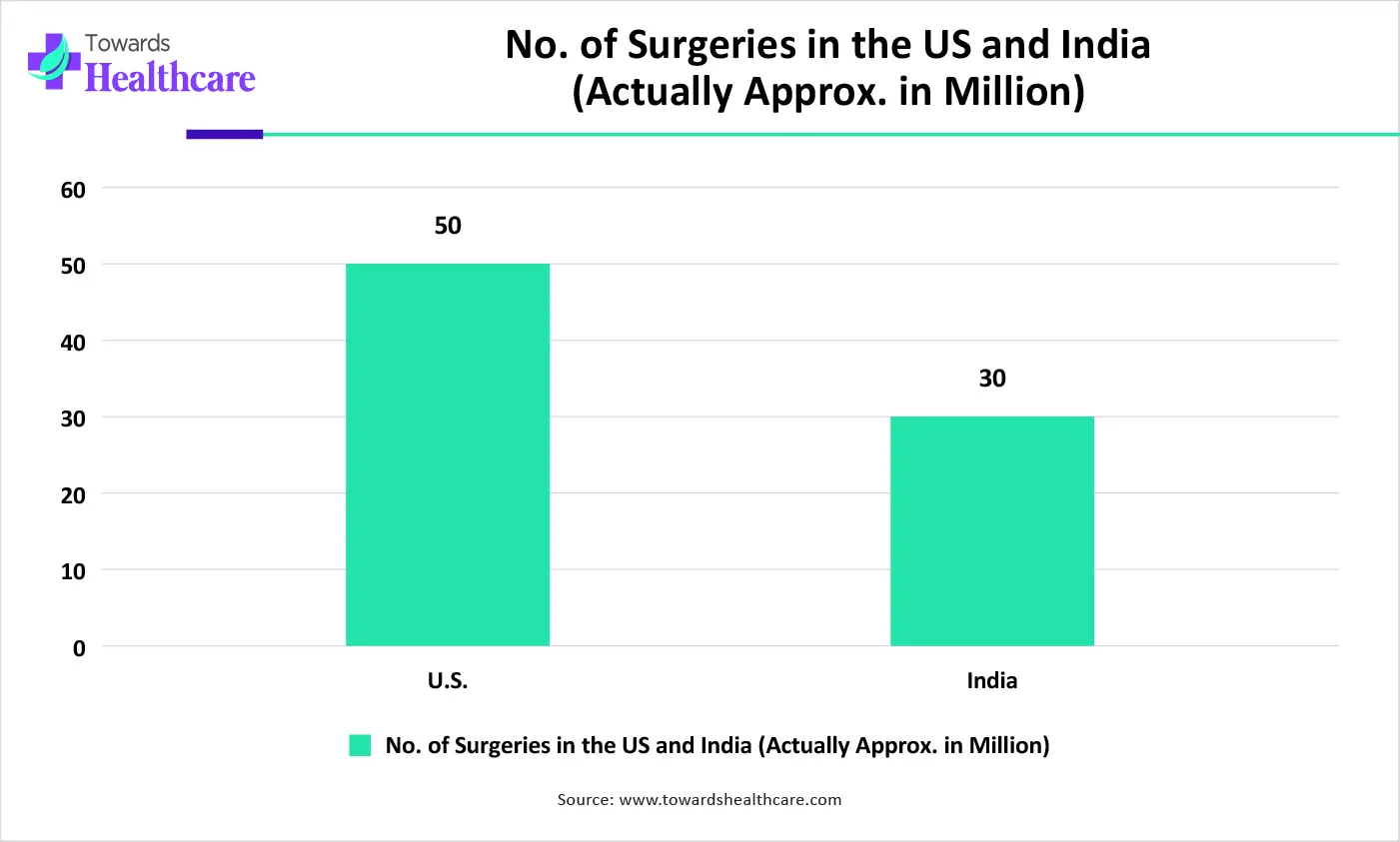

With a nearly 40% share, North America showed dominance in the anesthesia and muscle relaxants market in 2025. Due to the growing surgical volumes, rising musculoskeletal disorders (back pain, spasms), sports injuries, and robust healthcare infrastructure/R&D, are an increasing demand for both general anesthetics and muscle relaxants across this region.

For instance,

In the U.S., ongoing robust research activities demonstrated AI-assisted ultrasound machinery in enhancing nerve localization for regional anesthesia, rising block success rates, especially at the ANESTHESIOLOGY 2025 meeting.

For instance,

The prospective growth of the Asia Pacific in the anesthesia and muscle relaxants market will be propelled by the escalating investments in healthcare facilities, mainly in operating theatres and ICU capacity, to foster medical treatment accessibility across emerging economies. Recently, in 2025, India-based Venus Remedies acquired marketing authorization for its Sugammadex injection in the Philippines to boost its presence around the high-growth ASEAN region.

According to NIH, in 2021, there were over 267 million people aged 60+ (18.9%) entered into a "deeply aging society," and this will reach up to 26.4% or 300 million by 2025 in China. Whereas, in 2024, the Chinese Society of Anesthesiology of the Chinese Medical Association upgraded its "Clinical Practice Guidelines for Total Intravenous Anaesthesia in China" to standardize TIVA application. Also, many leaders are emphasising the launch and increasing use of new sedative-hypnotics, such as ciprofol and remimazolam, under these guidelines.

With a notable CAGR, the Europe anesthesia and muscle relaxants market is expanding its progression of targeted disease treatment, such as in December 2025, was the European Commission approved IMAAVY (nipocalimab) by Johnson & Johnson. This is an FcRn-blocking monoclonal antibody used in generalized myasthenia gravis (gMG), a chronic autoimmune disease causing severe muscle weakness, in adults and adolescents.

Furthermore, German expert panels are highly recommending the utilization of quantitative neuromuscular monitoring, like acceleromyography or mechanomyography at the adductor pollicis muscle to achieve full recovery from muscle relaxants, instead of depending on subjective clinical tests.

| Key Players | Offerings |

| Baxter International | This leader mainly provides a portfolio of inhaled general anesthetics and diverse injectable medications used as adjuvants in anesthesia. |

| Fresenius Kabi | A company specialises in a different portfolio of products for anesthesia, muscle relaxation, and their connected reversal agents. |

| Pfizer | Its portfolio encompasses general and local anesthetics, with various neuromuscular blocking agents, like Amidate, Alfentanil Injection and Fentanyl Citrate, etc. |

| GlaxoSmithKline (GSK) | A vital leader introduced Ultiva (remifentanil), Nimbex (cisatracurium besylate), Tracrium (atracurium besylate), Mivacron (mivacurium chloride), and Anectine (succinylcholine chloride). |

| AbbVie | It prominently explores a specific anesthetic product called Sevorane/Sevorane AF (sevoflurane). |

| Mylan/Viatris | This company offers general anesthetic adjunct Dexmedetomidine and the muscle relaxant Rocuronium Bromide. |

| Hikma Pharmaceuticals | Its portfolio includes Ropivacaine HCl Injection, USP, Dexmedetomidine Hydrochloride Injection, etc. |

| Sanofi | Specifically, it leveraged its muscle relaxant brand Myoril (generic name: Thiocolchicoside) to Corona Remedies. |

| Teva Pharmaceuticals | It mainly offers generic muscle relaxants and a specific injectable neuromuscular blocking agent, such as Cyclobenzaprine Hydrochloride, Vecuronium Bromide for Injection, etc. |

| Sandoz (Novartis) | A company provides a generic version of rivastigmine (brand name: Rivastigmine Sandoz) used to treat Alzheimer's and Parkinson's-related dementia. |

By Drug Type

By Route of Administration

By Application/Indication

By End User

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026