November 2025

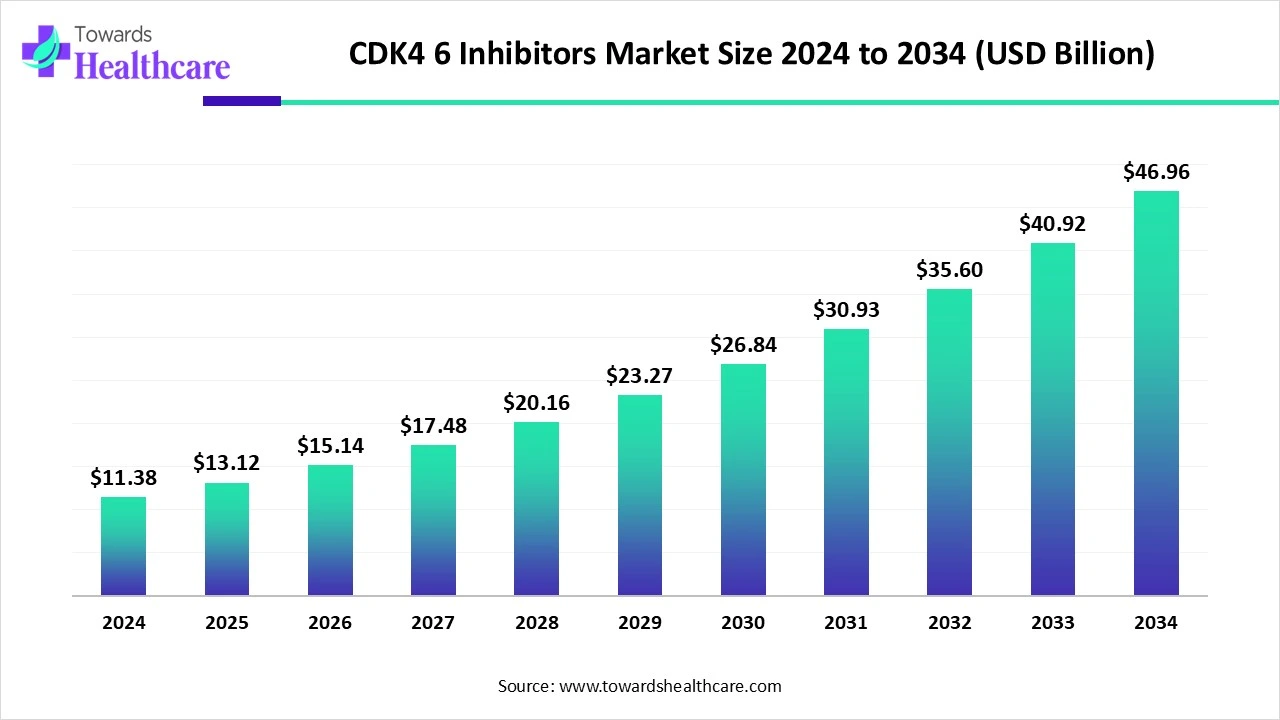

The global CDK4/6 inhibitors market size is calculated at USD 11.38 billion in 2024, grew to USD 13.12 billion in 2025, and is projected to reach around USD 46.96 billion by 2034. The market is expanding at a CAGR of 15.34% between 2025 and 2034.

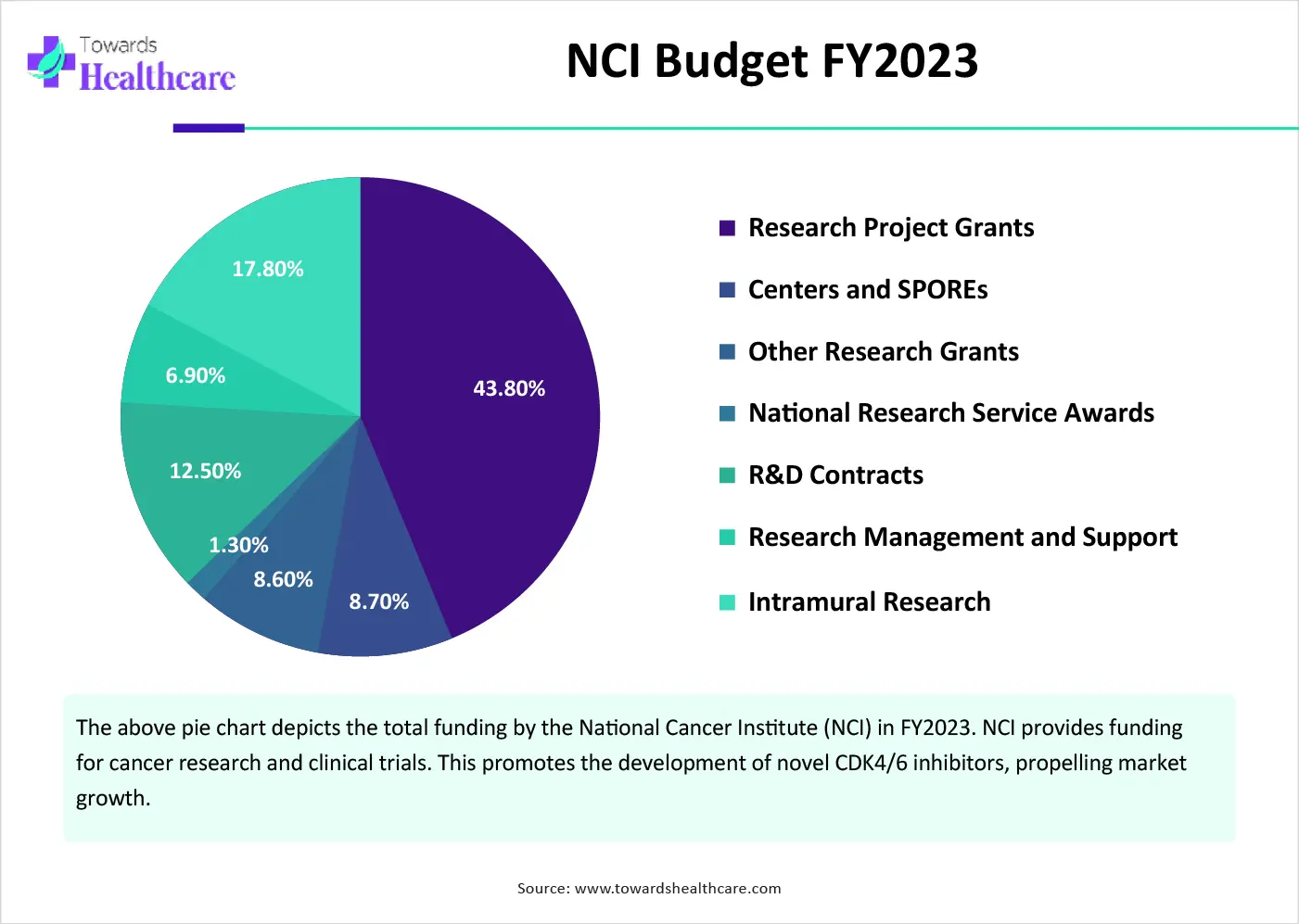

The CDK4/6 inhibitors market is primarily driven by the rising prevalence of cancer and the growing need to develop therapeutics from the same class. Prominent players collaborate to access advanced technologies and develop novel CDK4/6 inhibitors. Government organizations launch initiatives for screening, early diagnosis, and effective treatment of cancer. Integrating artificial intelligence (AI) facilitates the development of more efficacious drugs. The future looks promising, with technological advancements.

| Metric | Details |

| Market Size in 2025 | USD 13.12 Billion |

| Projected Market Size in 2034 | USD 46.96 Billion |

| CAGR (2025 - 2034) | 15.34% |

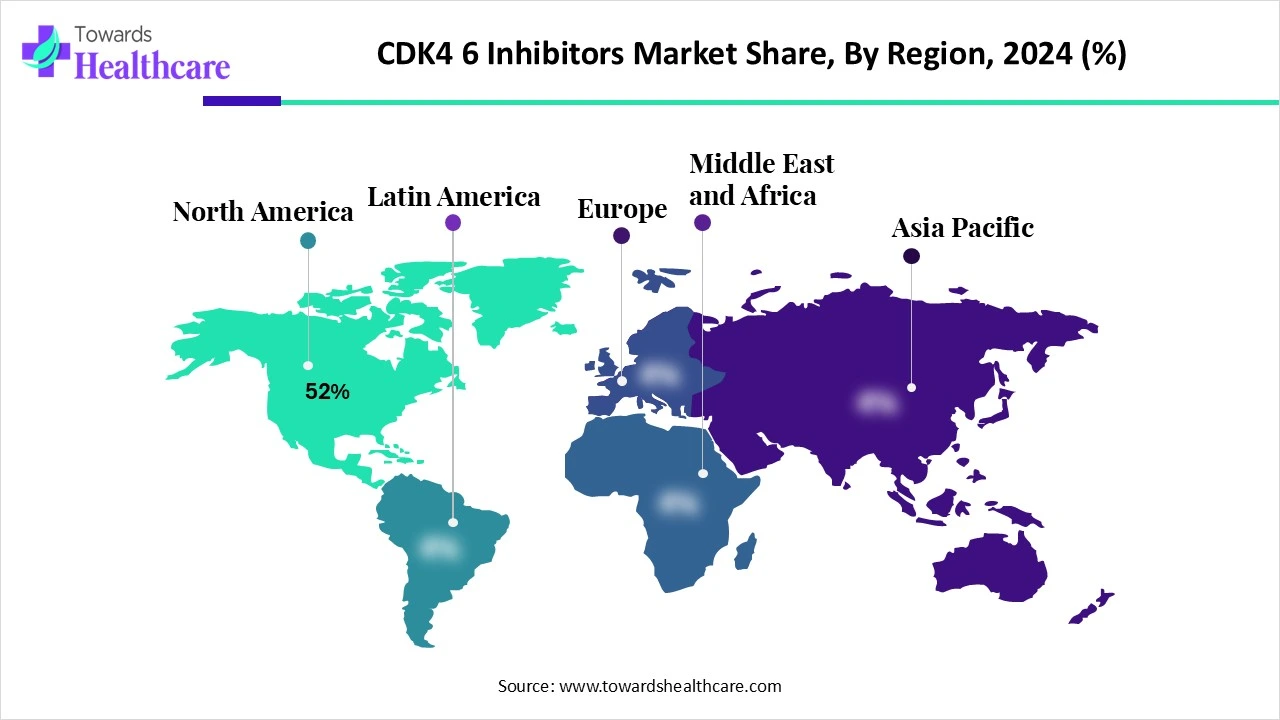

| Leading Region | North America Share 52% |

| Market Segmentation | By Drug, By Therapy Type, By Cancer Type, By Line of Therapy, By Route of Administration, By Distribution Channel, By End-User, By Region |

| Top Key Players | Pfizer Inc., Novartis AG, Eli Lilly and Company, Innovent Biologics Inc., Sanofi S.A., Jiangsu Hengrui Pharmaceuticals Co., Ltd., Fosun Pharma (Shanghai Henlius Biotech), OncoTherapy Science Inc., TG Therapeutics Inc., Prelude Therapeutics, EQRx Inc., Xencor Inc., Biocon Biologics Ltd., AbbVie Inc., Roche Holding AG, Amgen Inc., AstraZeneca Plc, Merck & Co., Inc., Bristol-Myers Squibb, Arvinas Inc. |

The CDK4/6 inhibitors market refers to the global industry involved in the development, production, commercialization, and utilization of cyclin-dependent kinase 4 and 6 (CDK4/6) inhibitors targeted anticancer therapies designed to inhibit the CDK4 and CDK6 proteins selectively, key regulators of cell cycle progression from the G1 to S phase. These inhibitors are primarily used in the treatment of HR-positive, HER2-negative breast cancer, but ongoing research is expanding their potential applications to other solid tumors and hematologic malignancies. CDK4/6 inhibitors work by arresting uncontrolled cellular proliferation, often in combination with endocrine therapies, to improve progression-free survival and overall outcomes.

AI can revolutionize the way CDK4/6 inhibitors are developed. It enables researchers to develop more effective drugs with fewer side effects. Bioinformatics helps to screen large datasets of drug-like candidates to identify molecules that bind effectively to the target. AI and machine learning (ML) algorithms can allow researchers to repurpose existing drugs as CDK4/6 inhibitors. They can also predict potential outcomes in particular patients. Deep learning model of tumor cell architecture elucidates response and resistance to CDK4/6 inhibitors.

Rising Prevalence of Cancer

The major growth factor for the CDK4/6 inhibitors market is the rising prevalence of cancer. Cancer is a major public health threat and is the leading cause of death globally. The World Health Organization (WHO) reported that there were 20 million new cancer cases in 2022 and predicts that 35 million new cancer cases will be reported in 2050, a 77% increase from 2022. (Source: WHO) The growing geriatric population, sedentary lifestyles, and genetic mutations are the primary causes of cancer. People are becoming aware of early diagnosis of cancer types, enabling healthcare professionals to provide effective treatment.

Adverse Effects

CDK4/6 inhibitors have not been found to respond in every patient. However, in responsive patients, these inhibitors have been reported to have significant adverse effects, leading to toxicity and building resistance. This reduces the effectiveness of these drugs, limiting their widespread use.

What is the Future of the CDK4/6 Inhibitors Market?

The market future is promising, driven by the increasing number of clinical trials and growing research activities. Ongoing efforts are made to study the treatment potential of CDK4/6 inhibitors in various cancer types, other than breast cancer. Researchers are also aiming to reduce the adverse effects of CDK4/6 inhibitors. This has led to the study of selective CDK4 inhibitors in response. Researchers have found fewer toxicities, such as neutropenia, and higher tolerated drug doses. As of July 2025, 333 clinical trials have been registered on the clinicaltrials.gov website related to CDK4/6 inhibitors.

By drug, the Palbociclib (Ibrance) segment held a dominant presence in the market in 2024. This segment dominated because palbociclib is the first-ever FDA-approved CDK4/6 inhibitor for the treatment of HR-positive and HER2-negative breast cancer. It is used either alone or in combination with other anti-breast cancer agents. It is used in advanced/metastatic breast cancer. It has been found to inhibit cell growth and suppress DNA replication in retinoblastoma tumor suppressor gene (RB) proficient cancer cells.

By drug, the Abemaciclib (Verzenio) segment is expected to grow at the fastest CAGR in the market during the forecast period. Abemaciclib is the latest FDA-approved CDK4/6 inhibitor that is indicated with endocrine therapy as an adjuvant in breast cancer patients. It is prescribed when endocrine therapy fails. Clinical trials have found that abemaciclib can increase PFS and objective response rates. Abemaciclib has reduced the chances of developing neutropenia.

By therapy type, the combination therapy segment held the largest revenue share of the market in 2024. This is due to the enhanced efficacy and therapeutic benefits of combination therapy compared to monotherapy. CDK4/6 inhibitors are combined with aromatase inhibitors, fulvestrant, chemotherapy, etc. Numerous trials have found that CDK4/6 inhibitors in combination with endocrine therapy result in higher PFS compared to CDK inhibitors alone. Combination therapy works by targeting multiple tumor sites simultaneously, potentiating the chance of cell growth inhibition.

The combination therapy with targeted therapy sub-segment is expected to grow rapidly. Targeted therapy, such as PI3K inhibitors and monoclonal antibodies, is given in combination with CDK4/6 inhibitors. The growing need for targeted therapy due to enhanced efficacy and reduced systemic side effects boosts the segment’s growth.

By cancer type, the HR+/HER2- breast cancer segment contributed the biggest revenue share of the market in 2024. This is due to the rising prevalence of breast cancer and the availability of approved drugs for breast cancer. The U.S. FDA has approved a total of 3 CDK4/6 inhibitors, including palbociclib, ribociclib, and abemaciclib, for the treatment of HR+/HER2- breast cancer. Additionally, HR+/HER2- breast cancer is the most common type, accounting for 70% of all cases.

By cancer type, the non-small cell lung cancer (NSCLC) segment is expected to grow with the highest CAGR in the market during the studied years. The rising prevalence of NSCLC and growing research and development activities augment the segment’s growth. The American Cancer Society estimated that about 226,650 new lung cancer cases will be reported in the U.S. in 2025. Ongoing efforts are made to study the therapeutic effects of CDK4/6 inhibitors in NSCLC. Out of all lung cancer cases, 87% are NSCLC.

By line of therapy, the first-line segment held a major revenue share of the market in 2024. CDK4/6 inhibitors and endocrine therapy with an aromatase inhibitor are prescribed as first-line agents for breast cancer treatment. They are prescribed as first-line agents due to overall survival benefits, low disease burden, and long disease-free interval. They have also been found to improve PFS.

By line of therapy, the adjuvant/neoadjuvant segment is expected to witness the fastest growth in the market over the forecast period. CDK4/6 inhibitors have found potential as adjuvant and neoadjuvant therapy in early breast cancer patients. In the adjuvant setting, they are added to endocrine therapy after surgery, while in the neoadjuvant setting, they are given before surgery.

By route of administration, the oral segment accounted for the highest revenue share of the market in 2024. The oral route is highly preferred due to the ease of administration and affordability. Oral drugs can be administered to patients of all age groups. Small-molecule drugs are easily absorbed into the bloodstream and reach cancer cells. The administration of CDK4/6 inhibitors through the oral route does not require any skilled professionals. All these benefits increase the accessibility of CDK4/6 inhibitors in cancer patients.

By route of administration, the intravenous segment is expected to show the fastest growth over the forecast period. The intravenous (i.v.) route offers numerous benefits, such as faster onset of action and high bioavailability. It can be administered even in unconscious patients. Drugs are administered through the IV. The Route bypasses the first-pass metabolism and does not cause gastrointestinal side effects.

By distribution channel, the hospital pharmacies segment led the market in 2024. The segmental growth is attributed to the favorable infrastructure and suitable capital investments. Hospital pharmacies can store a wide range of CDK4/6 inhibitors and deliver to patients when prescribed by oncologists. They have skilled professionals to advise patients about the medication. The increasing number of people visiting hospitals for cancer treatment prefer purchasing drugs from hospital pharmacies.

By distribution channel, the online pharmacies segment is expected to account for the highest growth in the upcoming years. The burgeoning e-commerce sector and the rising adoption of smartphones propel the segment’s growth. Working professionals and the geriatric population prefer buying drugs in the comfort of their homes through online pharmacies. Online pharmacies offer numerous benefits, such as free home delivery and special discounts.

By end-user, the hospitals segment registered its dominance over the global market in 2024. Hospitals have professionals from multiple departments, providing multidisciplinary expertise to patients. People prefer hospitals due to favorable reimbursement policies. Hospitals have sufficient investment to adopt advanced technology.

By end-user, the cancer treatment clinics segment is expected to expand rapidly in the market in the coming years. The increasing number of cancer treatment clinics, owing to the rising prevalence of cancer, fosters the segment’s growth. In the U.S., there are 73 NCI-designated cancer centers as of March 2025. Cancer treatment clinics have specialized equipment and trained professionals to provide personalized treatment.

North America dominated the market share by 52% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable government support are the major growth factors of the market in North America. Government and private organizations provide funding for conducting research activities related to cancer. Favorable reimbursement policies encourage patients to receive advanced treatment.

Key players, such as Pfizer, Inc., Eli Lilly and Company, and AbbVie, Inc., are the major contributors to the CDK4/6 inhibitors market in the U.S. Cancer-related costs in the U.S. are estimated to be $21.1 billion, including $16.2 billion in total out-of-pocket costs and $4.9 billion in patient time costs (travel and receiving care). The Centers for Medicare and Medicaid Services provide reimbursement for cancer expenses.

The Government of Canada launched the 2025-26 Departmental Plan to build a stronger healthcare system in Canada. As part of this plan, the government supports the “Canadian Partnership Against Cancer” to advance cancer control the prevention & early diagnosis, and expand a national network of cancer centers to advance precision medicines.

Asia-Pacific is expected to grow at the fastest CAGR in the CDK4/6 inhibitors market during the forecast period. The rising prevalence of cancer and the growing geriatric population are the primary growth factors of the market. People are becoming increasingly aware of the screening and early diagnosis of cancer. The increasing collaborations among key players and the burgeoning pharmaceutical sector contribute to market growth.

In 2024, China reported about 3.25 million new cancer cases and 1.69 million cancer deaths.China conducts the second-highest number of clinical trials related to CDK4/6 inhibitors. As of July 2025, 103 clinical trials are reported in China, of which 13 are active and 45 are recruiting.

The Indian Council of Medical Research (ICMR) estimated that there will be around 1.57 million new cancer cases in 2025 in India. There are around 62 cancer centers in India. As of July 2025, India is conducting seven clinical trials related to CDK4/6 inhibitors.

Europe is expected to grow at a notable CAGR in the CDK4/6 inhibitors market in the foreseeable future. The growing research and development activities and the rising adoption of advanced technologies bolster market growth. Government organizations launch initiatives and provide funding for effective cancer treatment. Favorable regulatory support leads to the approval of novel CDK4/6 inhibitors.

The UK government launched the “National Cancer Plan” to support the prevention, access, early diagnosis, treatment, and research & development activities of cancer. The government aims to reduce lives lost to cancer through the 10-year Health Plan. As of November 2024, more than 3.1 million people were investigated for suspected cancer. About 355,935 people received their first cancer treatment from November 2023 and November 2024.

Arielle Heeke, MD, Atrium Health, commented that CDK4/6 inhibitors can be prescribed to patients with stage II or higher breast cancer, and the Phase 3 NATALEE data are strong for both abemaciclib and ribociclib. Selecting between these agents can be based on patients' and/or providers' preferences. She also said that over time, we will probably lean into using ribociclib in the non-metastatic setting.

By Drug

By Therapy Type

By Cancer Type

By Line of Therapy

By Route of Administration

By Distribution Channel

By End-User

By Region

November 2025

November 2025

November 2025

November 2025