December 2025

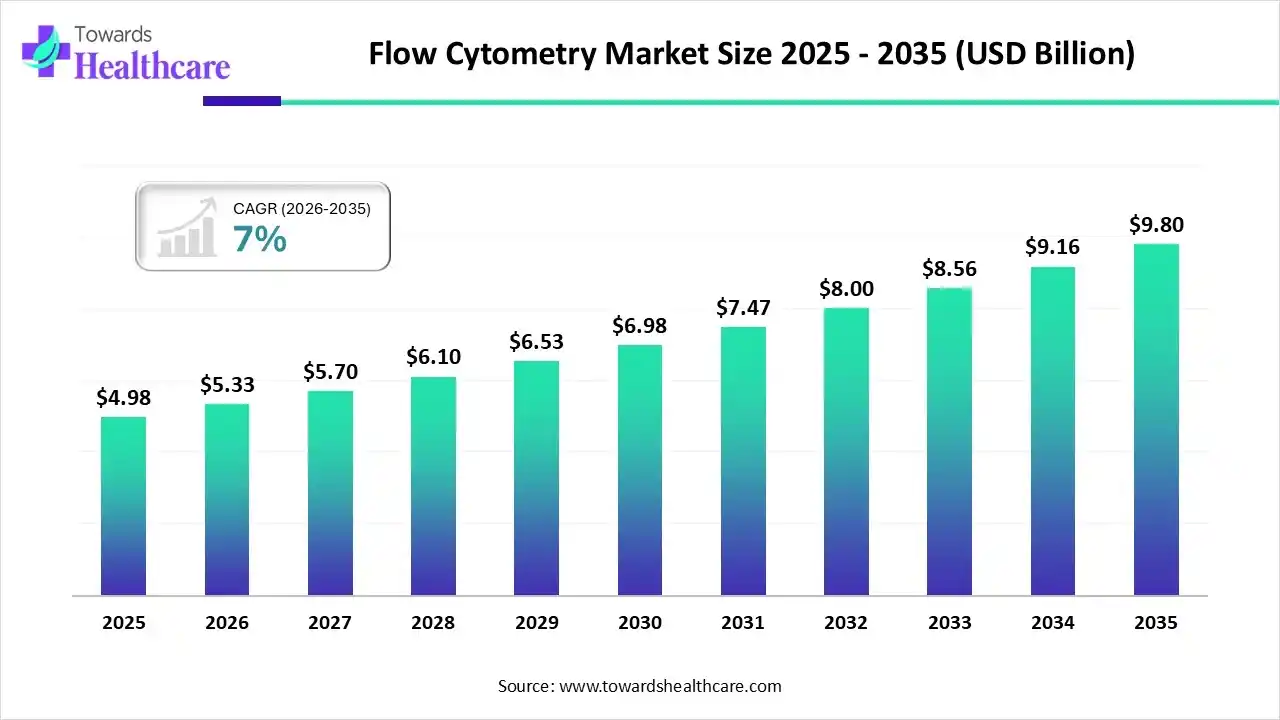

The flow cytometry market size stood at US$ 4.98 billion in 2025, grew to US$ 5.33 billion in 2026, and is forecast to reach US$ 9.80 billion by 2035, expanding at a CAGR of 7% from 2026 to 2035.

| Metric | Details |

| Market Size in 2025 | USD 4.98 Billion |

| Projected Market Size in 2035 | USD 9.80 Billion |

| CAGR (2026 - 2035) | 7% |

| Leading Region | North America |

| Market Segmentation | By Product, By Technology, By Application, By End-Use, By Region |

| Top Key Players | Agilent Technologies, Beckman Coulter Lifesciences, Becton, Dickinson and Company, BioAffinity Technologies, Biotium, Bio-Rad Laboratories, Cytek Biosciences, Danaher Corporation, LabCorp Drug Development, Luminex Corporation, Sony Corporation, Sysmex Corporation, Thermo Fisher Scientific |

Flow cytometry is a laser-based technique for detecting and measuring the physical and chemical properties of a population of cells or particles. It is commonly used to evaluate bone marrow, peripheral blood, and other body fluids. The flow cytometer can perform different functions, including cell counting, cell sorting, determining cell characteristics and functions, detecting microorganisms and biomarkers, etc. Hence, this technique can assess the number and types of immune cells and identify and characterize cancer cells.

Flow cytometry has numerous applications in the medical field, especially in transplantation, hematology, tumor immunology and chemotherapy, prenatal diagnosis, neuroscience, genetics, and sperm sorting. The rising prevalence of hematological disorders, cancers, and immunological disorders. The growing demand for flow cytometry necessitates further research and development, leading to advancements.

Flow cytometry is a versatile tool with widespread applications in various fields, including immunology, cancer research, stem cell research, and drug discovery. Several organizations are working on novel advancements in flow cytometry technology to improve its capabilities and extend its applications. Various innovations are made to enhance the speed, sensitivity, and multiplexing capabilities of flow cytometry. Additionally, flow cytometry is integrated with the mass spectrum and single-cell analysis to provide a deeper understanding of the cell characteristics and functions. Moreover, advancements are also made in the reagents and dyes used in flow cytometry to improve the visibility of cells and tissues.

The major restraint of the market is the high cost of the flow cytometer instrument. The average cost of a flow cytometer ranges from $100,000 to $500,000. This limits the affordability of many organizations in LMICs. Another market restraint is the instrument variability due to different sources. This leads to challenges in standardization and reproducibility of the results.

North America held the largest share of the flow cytometry market in 2023. The presence of key players, technological advancements, and state-of-the-art research and development facilities drive the market. Favorable government policies and initiatives also potentiate the market. The National Institute of Standards and Technology (NIST) regularly conducts the Flow Cytometry Standards Consortium to accelerate the adoption of quantitative flow cytometry in the biomanufacturing of cell and gene therapies. Additionally, the Canadian Government’s Canadian Immunology Quality Assessment Program was developed to ensure reproducible and accurate T-cell subset measurements by flow cytometry.

U.S. Market Trends

Key players, such as Thermo Fisher Scientific, Immunologix Laboratories, and Cytek Biosciences, are the major providers of flow cytometry instruments in the U.S. The increasing stem cell research in the region also favors market growth. The Food and Drug Administration (FDA) regulates the approval of cell and gene therapy products in the U.S. As of August 2025, 46 cell & gene therapies are approved by the U.S. FDA.

Asia-Pacific is anticipated to grow at the fastest rate in the flow cytometry market during the forecast period. The rising prevalence of chronic disorders, increasing investments & collaborations, and growing research and development drive the market. Flow cytometry research is booming in China, accounting for the highest number of publications globally. The rising geriatric population and rapidly changing demographics promote the market, thereby increasing the demand for personalized medicines. The Ayushman Bharat Digital Mission by the Indian Government, Japan Agency for Medical Research and Development, and several Chinese government policies support the development of personalized medicines.

China Market Trends

The burgeoning biotech sector and the increasing number of biotech startups facilitate market growth. China is making constant efforts to become a global hub in the biotech sector, driving investments and innovations in the field. Out of the total 535 clinical trials on flow cytometry, 40 studies are registered in China that use flow cytometry for research purposes.

Europe is estimated to grow at a significant rate during the forecast period. The surge is a result of both the growing number of people with chronic illnesses and the growing need for research to treat them. Additionally, the market in Europe is anticipated to develop as a result of the introduction of flow cytometers and the expansion of CE certifications. Numerous European organizations started a number of initiatives, including standardizing laboratory techniques and antibody panels, as well as standardizing diagnoses to promote clinical viability and reproducibility. It is anticipated that this standardization of laboratory procedures would increase the use of these goods and services in clinical settings and encourage industry participants to launch diagnostic solutions.

Germany Market Trends

Companies like IMMUNOSTEP SL, SYNENTEC, and the European Molecular Biology Laboratory (EMBL) provide tailored flow cytometry analysis services in Germany. The German government launches initiatives and provides funding for advanced biotech research. The biotech growth is also underpinned by strong infrastructure, substantial R&D capabilities, and a skilled workforce.

Which Product Segment Dominated the Flow Cytometry Market?

By product, the instrument segment held a dominant presence in the market. A flow cytometer is an instrument used to accurately and efficiently measure the properties of single cells or particles. The segmental growth is attributed to the latest innovations and technological advancements in flow cytometers.

By product, the software segment is predicted to witness significant growth in the market over the forecast period. The flow cytometer software is used to analyze multicolor and multiparametric data efficiently. The software converts raw data from the instrument to readable data. It offers the advantage of storing and reading data anytime and anywhere through mobile phones or tablets.

Why Did the Cell-based Segment Dominate the Flow Cytometry Market?

By technology, the cell-based segment accounted for a considerable share of the market. Flow cytometry based on cell-based assays involves screening suspension cells. It is used to estimate the percentage of a cell population in different phases of cell cycles. It is also used in cell proliferation assays, cell sorting, immunophenotyping, and apoptosis.

By technology, the bead-based segment is projected to expand rapidly in the market in the coming years. Flow cytometry bead-based assay is a technique that uses beads to analyze cells, bacteria, etc. It is used for semi-quantitative analysis to detect membrane vesicles or extracellular vesicles.

How the Clinical Segment Dominated the Flow Cytometry Market?

By application, the clinical segment led the global market. Flow cytometry is widely used in the diagnosis, treatment plans, and monitoring of residual or relapsed diseases in clinical settings. The increasing prevalence of cancer, infectious diseases, and hematological disorders boosts the segment’s growth. Also, the demand for personalized medicines and targeted therapy augments the market.

By application, the industrial segment is anticipated to grow with the highest CAGR in the market during the studied years. Flow cytometry is widely used in the pharmaceutical, microbiology, and food industries. In the pharmaceutical industry, it is used in the early drug discovery process to support hit identification. In microbiology, it is used in microbial fermentation monitoring and control and bioprocess optimization.

What Made Academic Institutes the Dominant Segment in the Flow Cytometry Market?

By end-use, the academic institutes segment dominated the market. Several academic institutes install flow cytometers for advanced biomedical and immunological research, enabling scientists to analyze cell properties. The growing research and development activities augment the segment’s growth.

By end-use, the clinical testing labs segment is expected to grow fastest in the market during the forecast period. The widespread applications of flow cytometry in clinical settings and favorable infrastructure potentiate the segment’s growth.

Dr. Bill Hanlon, CSO, LabCorp Drug Development, said that flow cytometry has enormous unrealized potential as a companion diagnostic in cancer and other therapeutic fields and is a reliable and effective technique for examining cells to better understand the illness. In order to increase acceptance and eventually bring cutting-edge novel companion diagnostics to market to assist in identifying patients who might benefit most from suitable therapies, he also stated that their strategic partnership with BD, a pioneer and worldwide leader in flow cytometry, is an exciting move.

By Product

By Technology

By Application

By End-Use

By Region

December 2025

November 2025

November 2025

February 2026