January 2026

The global supplemental health market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The supplemental health market is expanding at a rapid rate in the developing and developed regions, such as the Asia Pacific. The Asian Pacific countries, like India, are booming with the expansion of supplemental health insurance. The customizable health insurance plans are attracting more people towards policies. The global population is experiencing improved accessibility to health insurance plans related to mental health, wellness programs, and critical illnesses.

The supplemental health insurance market covers policies that provide additional financial protection beyond primary health insurance. These plans help cover out-of-pocket costs such as deductibles, copayments, coinsurance, and non-medical expenses associated with illness or injury. They include critical illness, accident, hospital indemnity, disability, vision, and dental coverage. The market is expanding due to rising healthcare costs, increasing prevalence of chronic diseases, and consumer demand for financial security against unexpected medical expenses. Employers are also offering supplemental plans to attract and retain talent, while individuals purchase them for added protection.

The government organizations stay committed to advancing global healthcare. For instance, in March 2025, the World Health Organization (WHO) introduced the new health investment platform named the ‘health impact investment platform’ (HIIP) to advance primary healthcare and innovative financing for global health.

The World Bank is dedicated to providing financial and technical assistance to developing countries. For instance, in December 2024, the World Bank announced that the governing board of the Pandemic Fund approved a grant of $500 million for its third round of funding for the establishment of health systems in diagnostics, disease surveillance, laboratory systems, and health workforce to prevent and respond to pandemics, especially in low-and middle-income countries.

Artificial intelligence has revolutionized the medical industry by improving diagnostic accuracy and treatment plans. AI-driven treatment planning in cardiology, oncology, cardiology, and neurology contributes to precision medicine. AI has improved healthcare operations through robotic-assisted surgeries. AI helps in building ethical principles and regulatory frameworks in modern medicine that ensure safer, more efficient, and personalized healthcare solutions.

What are the Major Drifts in the Supplemental Health Market?

Technological integration is at the forefront of innovation. This includes digital health, wearables, telehealth, virtual care, and many other technologies and services. The financial and mental health benefits provide comprehensive mental health support through financial wellness initiatives.

What are the Potential Challenges in the Supplemental Health Market?

The supplemental healthcare experiences regulatory and compliance hurdles, which are related to regulatory changes, health equity, and pricing. The other challenges come up in front of insurers to provide coverage options for vulnerable populations.

What is the Future of the Supplemental Health Market?

The digital health ecosystems are experiencing the integration of telehealth, wellness programs, and digital platforms by insurers to provide holistic care. There is an extensive use of blockchain technology to establish safe and transparent claims management systems. There are improvements in products and services related to wellness benefits, personalized plans, customized healthcare products, alternative therapies, and care options.

The critical illness insurance segment dominated the market in 2024, owing to the priorities for financial stability and income replacement. It helps to fill the coverage gaps and offers non-medical costs for home healthcare and traveling for specialized treatments. It allows people to customize the coverage based on their personalized health risks and health needs.

The dental insurance segment is estimated to grow at the fastest CAGR in the market during the predicted timeframe due to the potential of dental insurance in filling the primary coverage gaps and boosting preventive care. It provides exclusive financial protection and serves various benefits to employees. It supports tele-dentistry, AI-powered claims processing, and a mobile-first experience.

The individual supplemental health plans segment dominated the market in 2024, owing to the exciting options of customization and personalized wellness. These solutions ensure access to advanced healthcare. They enhance specialized coverage related to critical illness insurance, hospital insurance, and Medigap policies.

The group/employer-sponsored plans segment is predicted to be the fastest-growing in the market during the forecast period due to the major responsibilities of these plans to support a diverse workforce and control healthcare costs. They provide flexible voluntary benefits and offer holistic well-being support to a specific population. These services deliver mental health benefits through wellness programs and telehealth services.

The insurance brokers & agents segment dominated the market in 2024, owing to their popularity through increased focus on wellness, rising healthcare costs, and the expanding aging population. They empower employees with correct education by being advisors and educators. These are market experts who contribute to cost optimization and regulatory compliance.

The employer/workplace benefits programs segment is expected to grow at the fastest rate in the market during the studied period due to the rising need for controlling expenses, driving cost-effective care, and boosting wellness programs. These programs aim to enhance the mental health of employees and assist them in fighting health conditions. They utilize telehealth, AI, virtual care, and other digital platforms for better access to services.

The adults segment dominated the market in 2024, owing to the benefits of health coverage and related plans to adults in case of rising healthcare costs, uncovered expenses, and emerging health concerns. The rapid shift to holistic and preventive care raised the importance of advanced healthcare solutions. The favorable regulatory environment in many countries fosters improved healthcare services for adults.

The seniors/retirees segment is anticipated to grow at a notable rate in the market during the upcoming period due to wider access to healthcare and options for cashless treatments. The expansion of various government schemes and lower waiting periods in accessing coverage fuel the efficient healthcare for seniors/retirees. The specialized products, digitalization, and many other benefits drive the growth of the healthcare system.

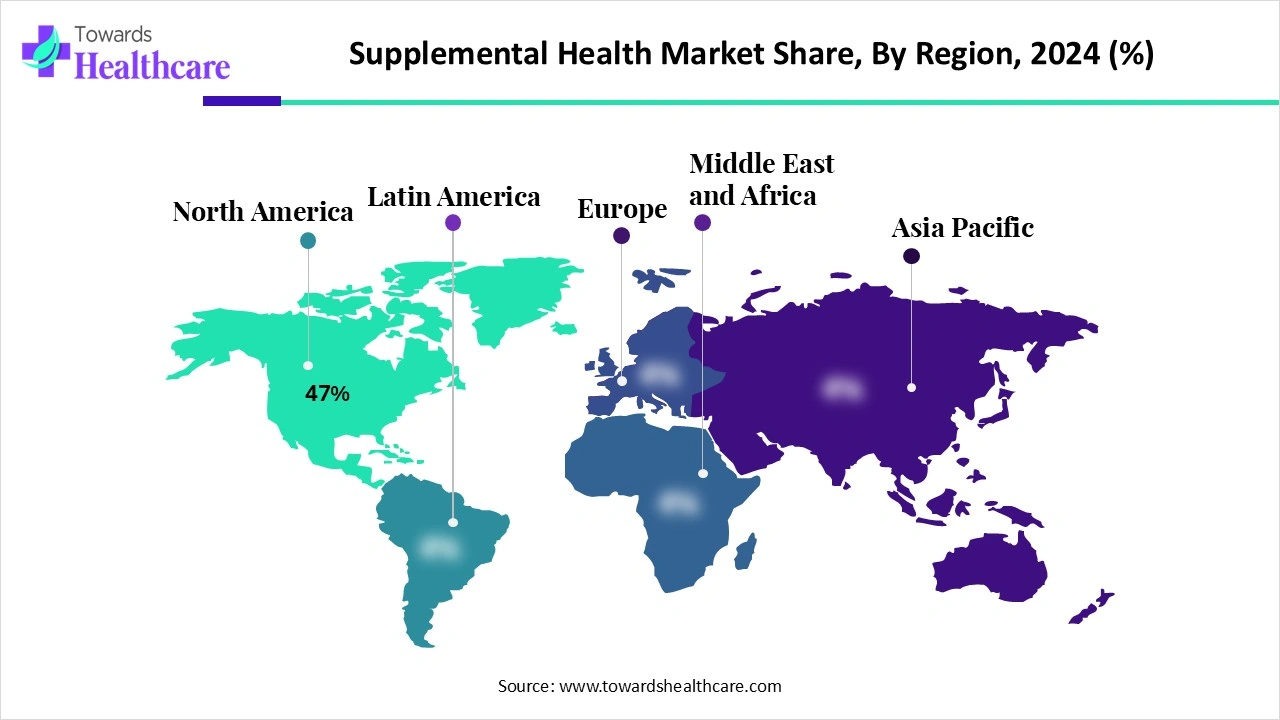

North America dominated the market share 47% in 2024, owing to high healthcare costs and strong private insurance penetration. The Affordable Care Act (ACA) enables more people to access health insurance. People are experiencing more affordable health insurance options through this initiative. The federal and state-level programs in America aim to expand healthcare coverage. The efforts of government organizations focus on achieving healthcare efficiency through accountable ways of research and development. The presence of renowned healthcare organizations like the Centers for Medicare & Medicaid Services (CMS), the National Institutes of Health (NIH), and the World Trade Center (WTC) Health Program contributes to research initiatives and wellness programs.

In January 2025, the U.S. Department of Health and Human Services (HHS) and the Health Resources and Services Administration (HRSA) introduced new funding and policies to advance the maternal health initiative.

The HHS announced $9 million in funding to advance the maternal health initiative. The HHS also announced the health insurance coverage and healthcare access from 2021 to 2024.

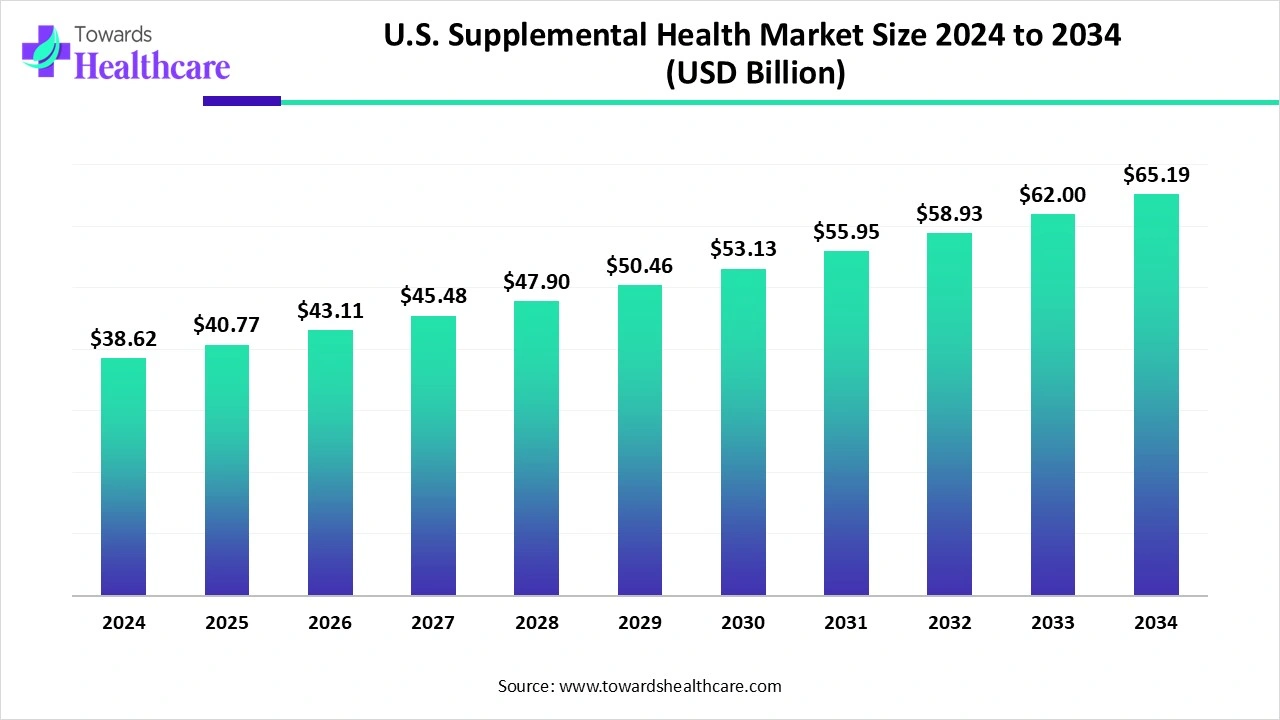

The U.S. supplemental health market was valued at US$ 38.62 billion in 2024 and is expected to reach US$ 40.77 billion in 2025. Looking ahead, the market is projected to grow steadily at a CAGR of 5.64%, reaching nearly US$ 65.19 billion by 2034.

The Government of Canada adopted advanced healthcare plans such as the national dental care program and the national pharmacare program. There is increased access to care for children, infants, women, adults, and seniors in Canada through structural reforms and compliance with regulations. Canadians experience expanded access to medications due to strong funding, investments, and R&D initiatives.

Asia Pacific is anticipated to be the fastest-growing region in the market during the forecast period, driven by the rising middle class and out-of-pocket healthcare burden in China and India. The Asian Pacific governments and regional bodies in this region have launched several programs that support supplemental healthcare. These efforts focused on expanding the universal health coverage and providing improved financial protection. The Asian Development Bank (ADB) serves to develop promising health insurance schemes in the Asian Pacific countries, such as India. Sri Lanka witnessed the association with ADB and the national health policy.

The Government of India is committed to affordable and accessible healthcare for all. India remains ahead with the universal health coverage through Ayushman Bharat, Ayushman Bharat Digital Mission (ABDM), the National Health Mission (NHM), and many other schemes. These schemes made the early diagnosis and screening of various cancer types possible for individuals.

China adopted digital health governance in the form of digital technologies for health. The digital transformation in China enhances health interventions and strengthens health systems. The major factors contributing to the digital health governance in China are investments, standards, interoperability, legislation, policy, compliance, and workforce.

The R&D process for supplemental health includes idea generation, market analysis, product conceptualization and design, prototyping, regulatory compliance, testing, launch, post-launch monitoring, and optimization.

Key Players: Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Danaher Corporation, Stryker Corporation, Thermo Fisher Scientific Inc.

These services include wholesale distributors, group purchasing organizations, pharmacy services administrative organizations (PSAOs), and direct-to-consumer (D2C) models.

Key Players: McKesson Corporation, Cencora, Cardinal Health, Owens & Minor, Medline Industries, PHOENIX Group.

The various types of these services include supplemental insurance plans, employer-led programs, patient advocacy programs, pharma patient support programs, etc.

Key Players: UnitedHealth Group Incorporated, McKesson Corporation, McKesson Corporation, The Cigna Group, Cardinal Health, Inc.

In February 2025, Paul Virtell, vice president and chief product owner at Prudential Financial and Cigna Healthcare, said that the company and its team collaboration drives a culture of care while staying dedicated to improving the lives of customers. He also felt delighted to become a part of this team to embrace new opportunities and deliver a seamless customer experience.

By Product Type

By Coverage Type

By Distribution Channel

By End User

By Region

January 2026

January 2026

January 2026

January 2026