January 2026

The behavioral mental health market is rapidly advancing on a global scale, with expectations of accumulating hundreds of millions in revenue between 2025 and 2034. Market forecasts suggest robust development fueled by increased investments, innovation, and rising demand across various industries.

The demand for various diagnostics, treatment approaches, and other services is increasing globally due to growing incidences of behavioural and mental health disorders. Therefore, new initiatives are being proposed by the government along with funding to promote their innovations. AI is also being used to enhance the diagnosis, treatment, and platform developments. Moreover, these advancements are promoting the use of these solutions and services across different regions. The companies are also collaborating and launching various solutions. Thus, this is promoting the market growth.

The Behavioral Mental Health Market refers to the ecosystem of services, solutions, and products focused on diagnosing, treating, and managing behavioral and mental health disorders such as depression, anxiety, bipolar disorder, schizophrenia, and substance use disorders. It encompasses healthcare providers, digital platforms, therapeutic services, rehabilitation programs, and community support systems that address both psychiatric conditions and behavioral patterns affecting overall health. The market also integrates digital health tools, telepsychiatry, mobile applications, and wellness programs designed to improve accessibility and outcomes. Rising prevalence of mental health conditions, government support for integrated care, growing demand for personalized therapy, and technological innovations such as AI-driven diagnostics and telehealth platforms are accelerating the expansion of this market globally.

Growing initiatives: There is a rise in mental health initiatives to reduce and manage behavioral mental health disorders. These initiatives are also driving innovations as well as their clinical trials. Moreover, the government and private sectors are also providing funding and investments to support their development.

For instance,

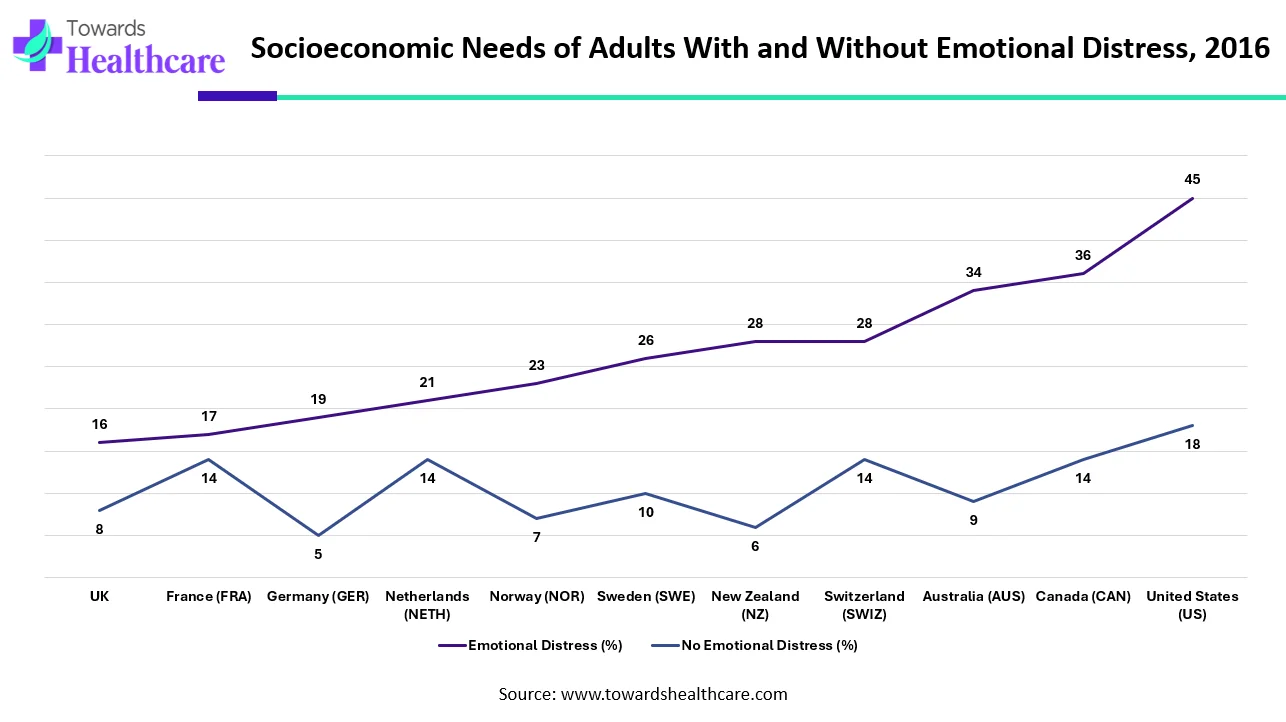

| Country | Emotional Distress (%) | No Emotional Distress (%) |

| UK | 16 | 8 |

| France (FRA) | 17 | 14 |

| Germany (GER) | 19 | 5 |

| Netherlands (NETH) | 21 | 14 |

| Norway (NOR) | 23 | 7 |

| Sweden (SWE) | 26 | 10 |

| New Zealand (NZ) | 28 | 6 |

| Switzerland (SWIZ) | 28 | 14 |

| Australia (AUS) | 34 | 9 |

| Canada (CAN) | 36 | 14 |

| United States (US) | 45 | 18 |

The data shows a strong link between emotional distress and people’s socioeconomic needs across different countries. In every country measured, adults who experience emotional distress report far more unmet needs than those who do not. The United States stands out the most. Nearly half of emotionally distressed adults in the U.S. said they “always” or “usually” faced socioeconomic challenges, which is more than double the rate of adults without distress. Canada and Australia also show large gaps, with distressed adults reporting significantly higher needs.

European countries such as the UK, France, Germany, and Switzerland show smaller but still notable differences. For example, in the UK, 16% of people with emotional distress struggled with socioeconomic needs, compared to only 8% of those without distress. Germany shows one of the lowest rates among people without distress, but the gap between distressed and non-distressed individuals remains clear.

Nordic countries, known for strong social support systems, still display elevated needs among emotionally distressed adults. In Sweden, Norway, and New Zealand, emotionally distressed individuals consistently report needs that are two to four times higher than those without distress. Overall, the data highlights a universal pattern: emotional distress strongly increases the likelihood of facing socioeconomic challenges, regardless of the country. Some countries show bigger gaps than others, but the trend remains the same people who struggle emotionally also tend to struggle more with basic economic and social needs.

The behavioral mental health is being transformed with the integration of AI. It is being used to examine complex patterns and relationships in the behavioural mental health conditions. It can also be used for handling extensive datasets. AI can help in providing solutions as well as insights that cannot be provided by conventional methods. Moreover, tailored therapies, virtual therapeutic platforms, and advanced detection approaches are also provided by AI. Thus, with the use of AI, the treatment outcomes will be enhanced, healthcare availability will be increased, and the stigma will be reduced.

| Mental Illness | Prevalence (%) |

| Anxiety disorders | 19.10% |

| Major depression | 8.30% |

| Post-traumatic stress disorder (PTSD) | 3.60% |

| Bipolar disorder | 2.80% |

| Borderline personality disorder (BPD) | 1.40% |

| Eating disorders | 1.20% |

| Obsessive-compulsive disorder (OCD) | 1.20% |

This chart highlights how common different mental health conditions are in the general population. Anxiety disorders stand out as the most widespread, affecting nearly one in five people. This shows how many individuals struggle daily with overwhelming worry, fear, or panic.

Major depression is the second most common condition, impacting more than 8% of people. It reflects how many individuals experience persistent sadness, loss of interest, or emotional exhaustion that affects their daily life. PTSD affects about 3.6% of people, often developing after traumatic events. Bipolar disorder, which involves extreme mood swings, impacts close to 3%. Though less common, these conditions can deeply shape the lives of those who experience them.

Borderline Personality Disorder affects around 1.4% of the population, while eating disorders and OCD each affect about 1.2%. Even though the percentages seem smaller, these conditions remain serious and require proper care and support. Overall, the data shows that mental health challenges are widespread, and many people quietly face struggles that deserve understanding, empathy, and access to proper treatment.

Growing Awareness

Different types of campaigns and programs are being conducted for normalizing the behavioural mental health disorders, which is increasing their awareness globally. The importance of early detection is also being conveyed through these programs. This is increasing the demand for early diagnostic, counseling, and treatment approaches. This is also increasing the use of self-care as well as preventive services. Additionally, different types of therapies and digital platforms are also being used. Thus, this is driving the behavioral mental health market growth.

Limited Professionals

To deal with the behavioral mental health disorders the professionals such as psychiatrists are required. The lack of trained personnel prevents unable from providing the right care to the patient. Moreover, the lack of proper training programs as well as facilities is also decreasing their scope. Thus, the lack of professionals can limit the service provided to the patients.

Growing Use of Ketamine Therapies

There is a rise in the cases of anxiety, depression, and PTSD. This is increasing the use of ketamine therapies due to their enhanced effectiveness. At the same time, it offers rapid relief from the conditions. Their use is replacing the traditional antidepressant, as well as are also being used in suicidal crises. This, in turn, is increasing the innovations for developing its personalized treatment options. The studies are also being conducted to enhance its applications. Thus, this is promoting the behavioral mental health market growth.

For instance,

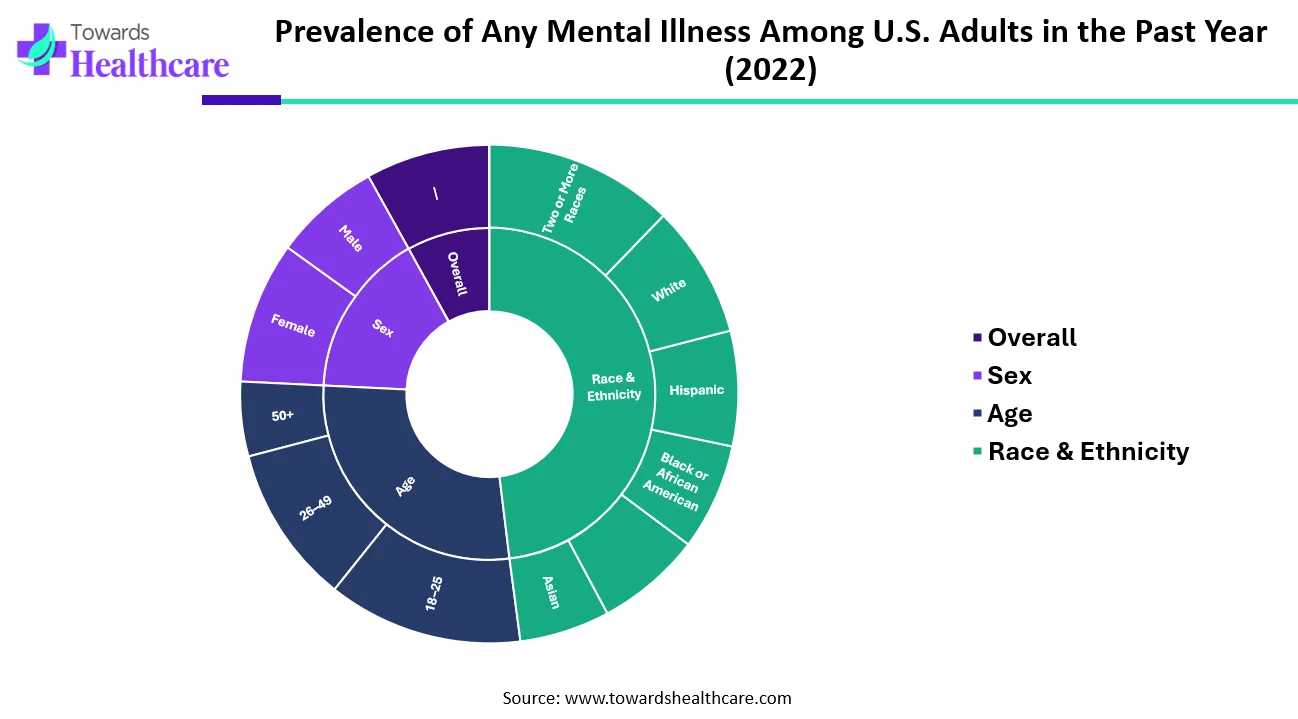

| Category | Sub-Category | Percent (%) |

| Overall | — | 23.1 |

| Sex | Female | 26.4 |

| Male | 19.7 | |

| Age | 18–25 | 36.2 |

| 26–49 | 29.4 | |

| 50+ | 13.9 | |

| Race & Ethnicity | Hispanic | 21.4 |

| White | 24.6 | |

| Black or African American | 19.7 | |

| American Indian / Alaska Native (AI/AN) | 19.6 | |

| Asian | 16.8 | |

| Two or More Races | 35.2 |

The chart highlights how common mental illness was among U.S. adults in 2022, and it reveals some striking differences across gender, age groups, and racial or ethnic backgrounds. Overall, about 23.1% of adults experienced some form of mental illness in the past year. Women reported a noticeably higher rate (26.4%) compared to men (19.7%), showing that mental-health concerns affect women more frequently.

Age plays an even bigger role. Young adults between 18 and 25 years showed the highest prevalence at a significant 36.2%, meaning more than one in three young adults struggled with mental health challenges. The rate drops steadily with age 29.4% among those aged 26–49, and down to 13.9% for adults 50 and older, indicating that younger groups face more emotional and psychological pressures.

When looking at race and ethnicity, individuals who identify as two or more races reported the highest rate at 35.2%, while Asian adults had the lowest at 16.8%. White adults (24.6%) and Hispanic adults (21.4%) also showed notable prevalence, while Black adults and American Indian/Alaska Native adults reported similar levels around 19 - 20%.

Overall, the data paints a clear picture: mental-health challenges affect millions of adults, but younger people, women, and those identifying with more than one race tend to experience these issues at even higher levels.

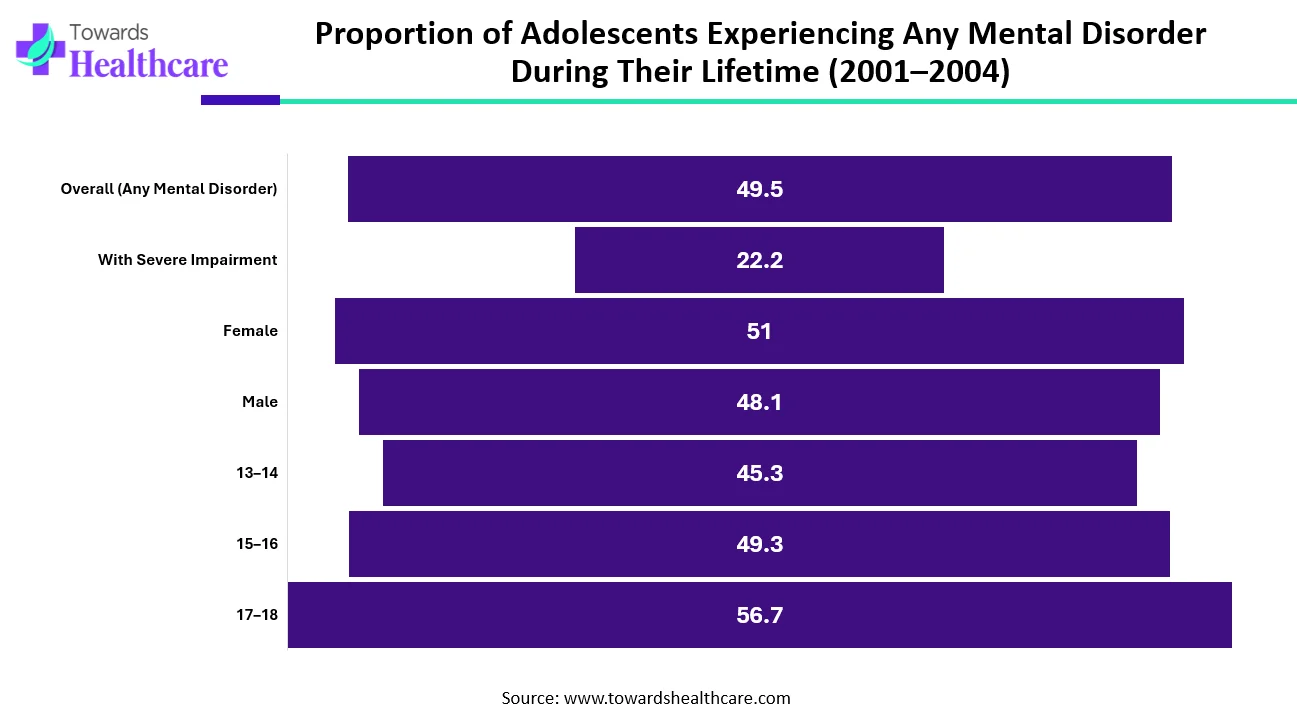

| Category | Sub-Category | Percent (%) |

| Overall Prevalence | Overall (Any Mental Disorder) | 49.5 |

| Severity | With Severe Impairment | 22.2 |

| Sex | Female | 51 |

| Sex | Male | 48.1 |

| Age Group | 13–14 | 45.3 |

| Age Group | 15–16 | 49.3 |

| Age Group | 17–18 | 56.7 |

The data shows that mental health challenges are very common among adolescents. Nearly one out of every two teenagers (49.5%) experiences some form of mental disorder at some point in their life. Even more concerning, about 22.2% face symptoms severe enough to significantly disrupt their daily life. When we look at differences between girls and boys, the numbers are fairly close. Girls report slightly higher rates (51%) compared to boys (48.1%), suggesting that mental health issues affect both groups at almost equal levels.

Age also plays an important role. Younger teens aged 13–14 show a prevalence of 45.3%, but the rate increases with age. Teens aged 15–16 experience a prevalence of 49.3%, and the highest rate appears among older adolescents aged 17–18, where 56.7% report having had a mental disorder at some point. Overall, the data emphasizes that mental health concerns are widespread among adolescents, and the need for early support and intervention grows stronger as teens get older.

By disorder type, the anxiety disorders segment held the largest share of the behavioral mental health market in 2024, due to their growing incidence rates. At the same time, due to their growing awareness and recurrent cases, the demand for their treatment and diagnosis increased. Moreover, it was observed in all age groups.

By disorder type, the substance use disorders segment is expected to show the highest growth during the predicted time. There is a rise in the use of various substances, which is increasing their addiction rates. Additionally, their growing misuse and overdoses are leading to various behavioural mental health problems. This is driving the demand for new treatment options.

By service type, the outpatient counseling services segment led the market with approximately a 35% share in 2024, due to their easy accessibility and scheduling. At the same time, they offer affordable patient care without disturbing the patient’s daily schedules. This increased their acceptance rate.

By service type, the tele-mental health services segment is expected to show the fastest growth rate during the predicted time. These services are enhancing accessibility, which is increasing patient convenience. They are also promoting virtual therapies across the remote areas. This, in turn, is increasing their use for at-home sessions by various patients.

By treatment type, the psychotherapy/counseling segment held the dominating share of the behavioral mental health market in 2024, due to its use as the first-line treatment. It was used in the treatment of a variety of behavioural mental health conditions. Moreover, it also provided long-term benefits, which increased their acceptance rates.

By treatment type, the cognitive behavioral therapy (CBT) segment is expected to show the highest growth during the forthcoming years. It is being used in several behavioural mental health conditions as they are backed by scientific evidence. Moreover, it is also used in different age groups. Additionally, it is being preferred option due to its short-term treatment.

By age group type, the adults segment led the market with approximately 65% share in 2024, driven by the high prevalence rates of behavioral mental health disorders. This, in turn, increased the demand for early diagnostics and treatment options. Thus, there was a rise in the use of various treatment approaches and online platforms to enhance their convenience.

By age group type, the children & adolescents segment is expected to show the fastest growth rate during the upcoming years. The behavioural disorders such as ADHD, anxiety, and depression are increasing in this age group. Additionally, there is a growth in awareness through school-based programs. This is increasing the use of various treatment solutions.

By end user, the hospitals segment held the largest share of approximately 40% in the global market in 2024, because of large patient volumes. They offered the patients a variety of services. Moreover, they also conducted continuous monitoring of the patients. Additionally, the presence of insurance policies increased patient outcomes.

By end user, the community mental health centers segment is expected to show the highest growth during the upcoming years. These centres offer affordable services to the patients. Furthermore, a wide range of treatment options is also being provided. The government is also supporting them by providing funding.

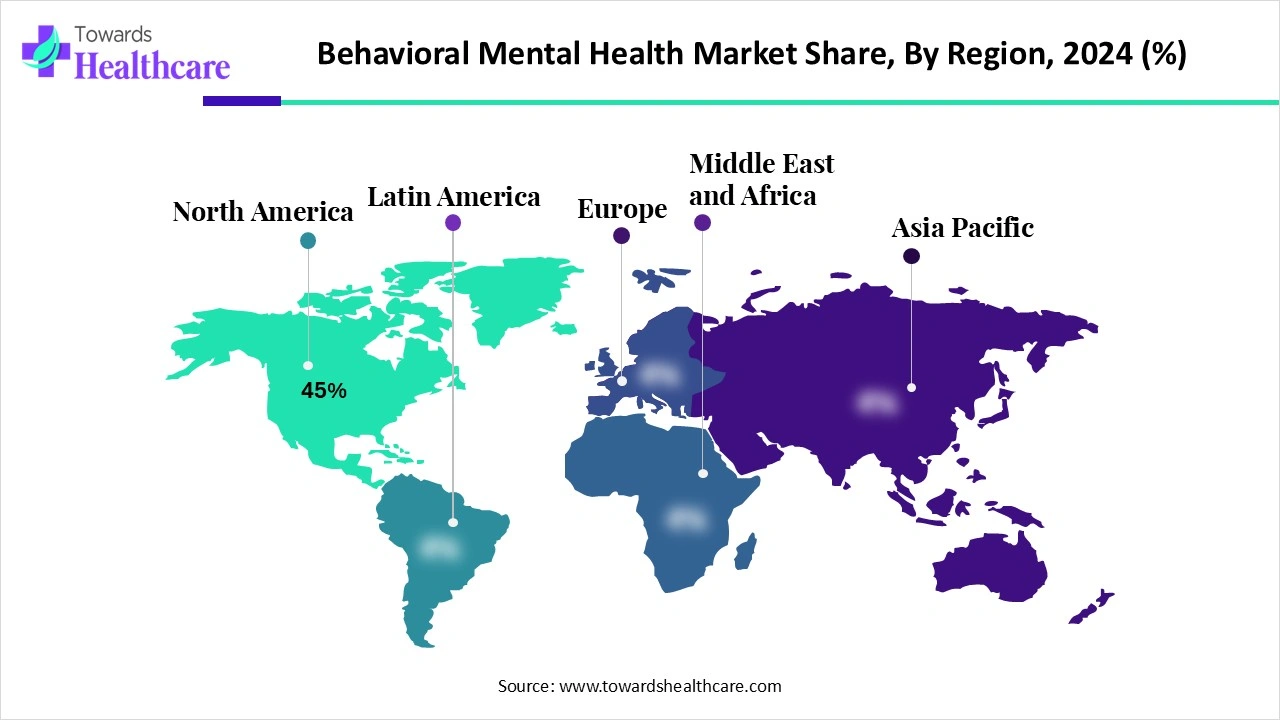

North America dominated the behavioral mental health market share 45% in 2024. The presence of a well-developed healthcare sector in North America increased the development of various behavioral mental health treatment approaches. Additionally, the presence of insurance policies increased the access of the patient to these treatments. This contributed to the market growth.

Due to growing cases of behavioural and mental health disorders in the U.S., the demand for effective treatment options is increasing. The hospitals are providing various treatments and preventive care options to the patients. Additionally, the insurance companies are increasing access to these services. Moreover, various digital platforms are also contributing to the same.

There is a rise in substance use disorders, depression, and anxiety in Canada. Therefore, different types of awareness programs are being conducted for their early diagnosis and appropriate treatment. This is increasing the innovations that are supported by government funding. The government is also promoting the use of digital platforms to tackle these crises.

Asia Pacific is expected to host the fastest-growing behavioral mental health market during the forecast period. Asia Pacific is experiencing a rise in the incidence of various behavioral and mental health disorders. This is increasing their innovation and awareness programs. These developments are supported by the government and private investments. Moreover, digital platforms are also being developed along with the growing traditional practices like yoga and meditation. Thus, this promotes the market growth.

The development of new treatments, methods, and tools for diagnosis, management, and prevention of the conditions that affect the individual's psychological, emotional, and social well-being is included in the R&D of behavioural mental health.

Key Players: Atai Life Sciences, Alto Neurosciences, Vistagen and Relmada Therapeutics, Axsome Therapeutics, Compass Pathways.

The clinical trials and regulatory approvals of behavioural mental health focus on testing new treatments, such as talk therapy approaches, drugs, and digital therapies, to determine their safety and effectiveness.

Key Players: Atai Life Sciences, Alto Neurosciences, Axsome Therapeutics, Compass Pathways, MindMed.

To manage, treat, and prevent the conditions affecting the well-being of individuals with the use of resources such as medications, therapy, peer support programs, crisis intervention, and telehealth, will be provided in the patient support and services of behavioral mental health.

Key Players: Lyra Health, BetterHelp, Talkspace, Headspace Health.

![]()

| Year | US (13.9) | FRA (13.1) | AUS (11.9) | CAN (11.8) | NOR (11.6) | NZ (11.5) | SWIZ (11.2) | SWE (11.1) | NETH (10.5) | GER (10.2) | UK (7.3) |

| 2001 | 11.1 | 17.5 | 12.8 | 11.7 | 12.4 | 13.5 | 18 | 13 | 9.1 | 12.8 | 7 |

| 2002 | 11.3 | 17.6 | 11.9 | 11.5 | 11 | 12.2 | 19 | 12.9 | 9.6 | 12.7 | 6.9 |

| 2003 | 11.1 | 17.8 | 10.9 | 11.7 | 11.1 | 13.3 | 16.6 | 12 | 9.2 | 12.6 | 6.6 |

| 2004 | 11.3 | 17.5 | 10.6 | 11 | 11.8 | 12.4 | 16.6 | 12.4 | 9.1 | 12 | 6.9 |

| 2005 | 11.2 | 17.1 | 11.2 | 11.6 | 12.7 | 16.6 | 13.1 | 9.4 | 11.4 | 6.7 | |

| 2006 | 11.3 | 16.5 | 10.5 | 10.8 | 11.5 | 12.7 | 16.5 | 12.7 | 9.1 | 10.7 | 6.7 |

| 2007 | 11.7 | 15.8 | 10.6 | 10.6 | 10.5 | 11.9 | 16.9 | 11.9 | 8 | 10.2 | 6.3 |

| 2008 | 12 | 16.1 | 10.9 | 10.7 | 10.6 | 12.3 | 16 | 12.2 | 8.4 | 10.3 | 6.9 |

| 2009 | 12.2 | 16.2 | 10.7 | 11.1 | 11.9 | 12 | 13.4 | 12.9 | 8.9 | 10.3 | 6.8 |

| 2010 | 12.5 | 15.9 | 10.9 | 11.1 | 11.2 | 12.4 | 11.9 | 11.7 | 9.2 | 10.8 | 6.7 |

| 2011 | 12.8 | 15.8 | 10.7 | 10.8 | 12.1 | 11.3 | 12.1 | 11.4 | 9.5 | 10.8 | 6.9 |

| 2012 | 13 | 14.6 | 11.4 | 10.8 | 10.2 | 12.5 | 12 | 11.6 | 10 | 10.5 | 6.9 |

| 2013 | 13.1 | 14.3 | 11.3 | 11.1 | 10.8 | 11.8 | 12.2 | 12.3 | 10.5 | 10.8 | 7.5 |

| 2014 | 13.5 | 13.1 | 12.5 | 11.5 | 10.5 | 11.5 | 11.4 | 11.4 | 10.4 | 10.8 | 7.4 |

| 2015 | 13.8 | 13.1 | 12.9 | 11.8 | 11.1 | 11.9 | 11.7 | 10.5 | 10.6 | 7.5 | |

| 2016 | 13.9 | 11.9 | 11.6 | 11.2 | 11.1 | 10.5 | 10.2 | 7.3 |

The table shows suicide rates per 100,000 people for 11 high-income countries over the years, from 1980 to 2016. The U.S. stands out as the country with the highest suicide rate among these nations, reaching 13.9 per 100,000 in 2016. Notably, the U.S. suicide rate has generally increased since 2000, reflecting a concerning upward trend.

Looking at the historical trends:

Overall, this data reveals that while some high-income countries have managed to reduce or stabilize suicide rates over the decades, the U.S. faces a persistent and growing challenge. The trend underscores the urgent need for targeted mental health interventions, awareness programs, and supportive social policies to address rising suicides.

In July 2025, after announcing the launch of Healing Health Alliance, the Co-Founder of HealingMaps, Cory Jones, stated that they are knowledgeable about the industry's pain points as they have been connecting patients with clinics over the past five years. The collective purchasing power required to enhance efficiency, minimize costs, and improve patient care will be provided to the practitioners with the help of Healing Health Alliance. Ensuring the suitability and accessibility of these innovative therapies will be their main goal. Moreover, they also brought it due to its growing adoption across the medical industry.

By Disorder Type

By Service Type

By Treatment Type

By Age Group

By End User

By Region

January 2026

January 2026

January 2026

January 2026