November 2025

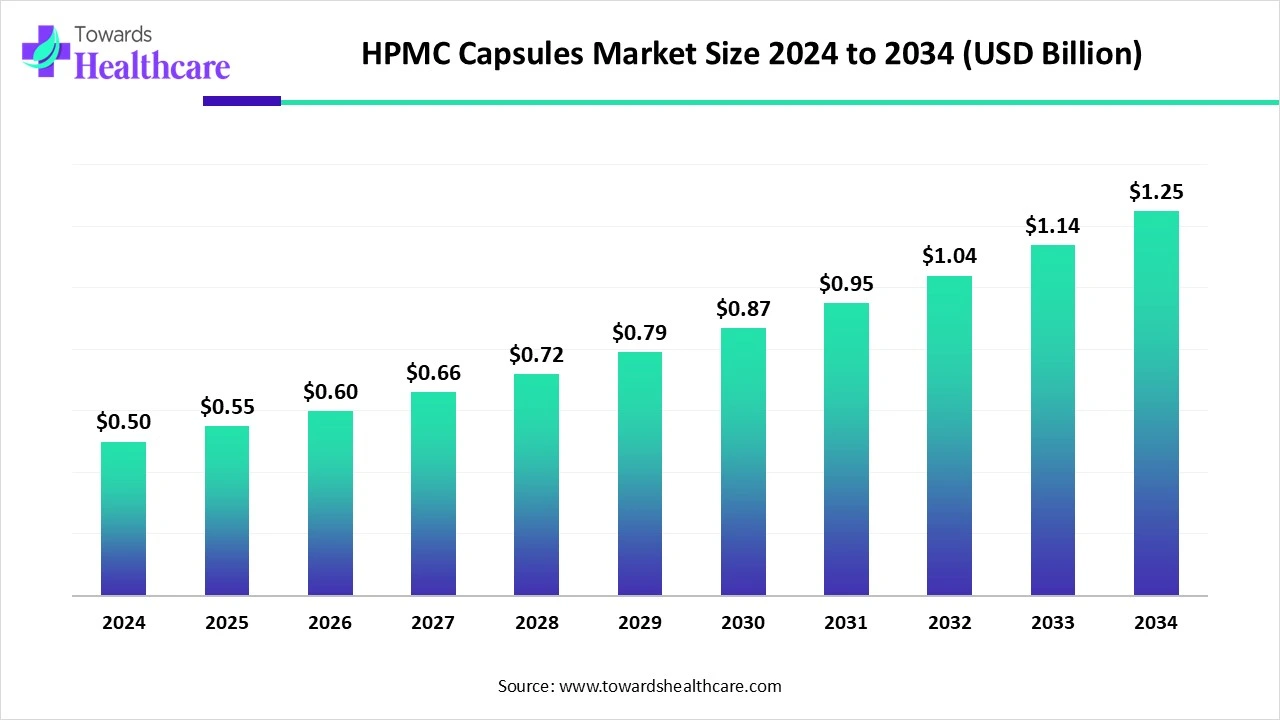

The global HPMC capsules market size is calculated at USD 0.5 billion in 2024, grow to USD 0.55 billion in 2025, and is projected to reach around USD 1.25 billion by 2034. The market is expanding at a CAGR of 9.44% between 2025 and 2034.

The HPMC capsules market is experiencing steady growth due to rising demand for plant-based, allergen-free, and clean-label alternatives to gelatin capsules. These capsules are widely used in the pharmaceutical and nutraceutical industries because of their stability, low moisture content, and suitability for moisture-sensitive drugs. Increased health consciousness, expanding vegan populations, and regulatory support for vegetarian products are further contributing to the market’s expansion across regions.

| Metric | Details |

| Market Size in 2025 | USD 0.55 Billion |

| Projected Market Size in 2034 | USD 1.25 Billion |

| CAGR (2025 - 2034) | 9.44% |

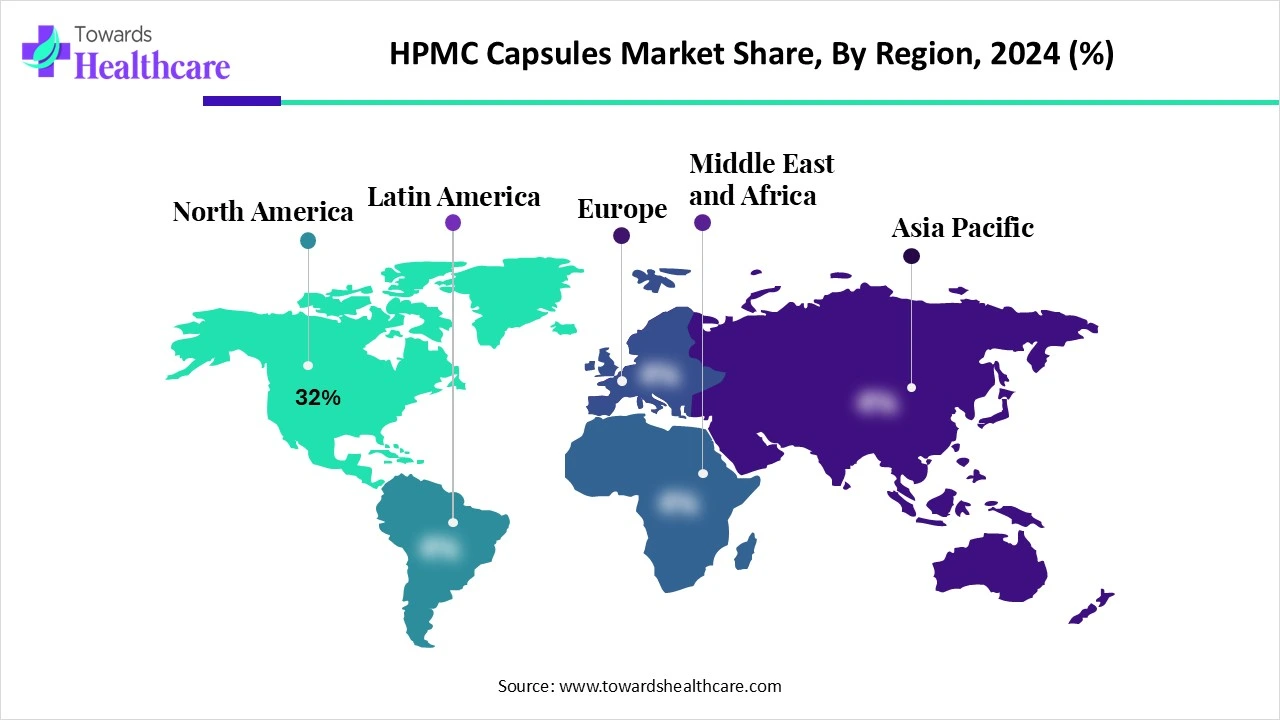

| Leading Region | North America Share by 32% |

| Market Segmentation | By Capsule Type, By Functionality / Release Profile, By Application, By End Use, By Distribution Channel, By Capsule Size, By Sealing Type, By Regions |

| Top Key Players | Capsugel (Lonza Group), Qualicaps, ACG Group, Suheung Co., Ltd., CapsCanada (now part of Lonza), Roxlor LLC, Shanxi Guangsheng Medicinal Capsules Co., Ltd., HealthCaps India Ltd., Sunil Healthcare Limited, Zhejiang Yuexi Capsule Co., Ltd., Natural Capsules Limited, Bright Pharma Caps Inc., Farmacapsulas S.A., Nectar Lifesciences Ltd., Snail Pharma Industry Co., Ltd., Lefan Capsule Co., Ltd., SNAIL Pharmaceutical Co., Ltd., BIOCAPS Enterprise Inc., Erawat Pharma Ltd., Jiangsu Tianjiang Pharmaceutical Co., Ltd. |

The HPMC capsules market refers to the global industry for capsules made from Hydroxypropyl Methylcellulose (HPMC), a plant-derived cellulose polymer used as a vegetarian alternative to gelatin. HPMC capsules are widely used in pharmaceuticals, nutraceuticals, and dietary supplements due to their non-animal origin, stability, low moisture content, and suitability for hygroscopic and heat-sensitive drugs. These capsules are preferred for halal, kosher, and vegetarian formulations, offering clean-label appeal and enhanced consumer acceptance.

The growth of the market is driven by rising consumer preference for plant-based, vegetarian alternatives, along with increasing demand for clean-label and allergen-free products. Their superior stability, low moisture content, and compatibility with sensitive formulations make them ideal for pharmaceutical and nutraceutical applications, further boosting their adoption worldwide.

AI is positively impacting the market by streamlining manufacturing processes, optimizing formulations, and enhancing quality control. It enables real-time monitoring and predictive maintenance in production lines, reducing downtime and improving efficiency. AI also supports research and development by analyzing large datasets to design better capsule materials with improved dissolution, stability, and bioavailability, thereby accelerating innovation and meeting evolving consumer and industry demands more effectively.

Rising Consumer Shift Towards Plant-Based and Vegetarian Alternatives

The increasing demand for plant-based vegetarian options is propelling the growth of the HPMC capsules market as consumers seek cleaner, ethical, and more inclusive health products. Unlike gelatin capsules, HPMC capsules cater to dietary preferences and religious restrictions without compromising quality or performance. This shift in consumer behavior is encouraging pharmaceutical and nutraceutical companies to adopt HPMC capsules to meet broader market expectations and maintain a competitive advantage.

For Instance,

Higher Production Cost Compared to Gelatin Capsules

HPMC capsules face challenges due to their relatively complex production process and the use of plant-derived materials, which makes them more expensive than traditional gelatin capsules. This cost difference can discourage some pharmaceutical and nutraceutical companies from switching, particularly in markets where budget constraints are critical. As a result, despite their benefits, the higher cost can slow down the broader adoption of HPMC capsules in various regions.

Rising Demand for Clean-Label and Allergen-Free Products

The increasing consumer inclination towards safer, transparent, and naturally sourced healthcare solutions is creating future opportunities for the HPMC capsules market. As awareness about food sensitivities, ethical consumption, and sustainability rises, pharmaceutical companies are shifting to capsule formulations that avoid animal products and synthetic additives. HPMC capsules meet these needs with their plant-based composition and clean profiles, positioning them as an ideal solution in the evolving demand for healthier and more responsible pharmaceutical products.

For Instance,

In 2024, the demand for clear capsules surged as they offer excellent visibility of the filled content, enhancing both consumers' confidence and product appeal. Their ability to showcase purity and eliminate the need for artificial coloring aligns well with the growing clean-label trend. Additionally, these support faster product approval by regulators due to easier inspection during quality checks. Their adoption is particularly high in the nutraceutical and plant-based supplement sectors.

In 2024, the immediate release format gained prominence in the HPMC capsules market due to its ability to quickly liberate the active ingredient, ensuring rapid onset of therapeutic effects. This quick-dissolving capability makes it ideal for medications that require prompt action, such as pain relievers and fast-acting remedies. Additionally, its straightforward production process and versatile use in both pharmaceuticals and nutraceuticals have driven its widespread adoption, solidifying its market leadership through efficient and reliable drug delivery.

The pharmaceuticals segment led the market due to the increasing adoption of plant-based capsules in prescription and over-the-counter drugs. These capsules offer better stability for complex formulations, avoid cross-linking issues common with gelatin, and meet growing regulatory and consumer preferences for vegetarian and allergen-free options, making them the preferred choice for modern pharmaceutical products.

In 2024, the prescription drugs subsegment dominated the HPMC market as these capsules offer better stability, are plant-based, and meet regulatory standards. Their compatibility with sensitive drug formulations and preference for ethical pharmaceuticals made them ideal for precise dosage in prescription medicines, boosting their adoption across pharmaceutical companies.

The pharmaceutical companies segment has increasingly adopted HPMC capsules due to their plant-based origin, stability with hygroscopic drugs, and suitability for clear-label formulations. These capsules supported innovation in drug delivery while meeting evolving consumer and regulatory expectations. Their compatibility with automated filling equipment and extended shelf life further encourages widespread use, making them a preferred choice for manufacturers aiming to meet both performance and ethical standards in modern pharmaceutical production.

The direct sales segment gained prominence in the market due to its ability to provide greater control over product quality, pricing, and supply chain efficiency. This approach allows capsule manufacturers to build stronger client relationships, ensure timely delivery, and offer customized solutions. Such advantages make direct sales a preferred channel, especially for pharmaceutical companies requiring consistent and high-quality capsule supplies.

The dominance of the Size 0 capsule segment in the HPMC capsule market in 2-24 can be attributed to its ideal combination of capacity, ease of swallowing, and flexibility for different dosage strengths and formulations. Size 0 offers a balance between volume and patient comfort, making it suitable for a wide range of drug types, including high-potency or multi-ingredient formulations. Its versatility and widespread acceptance among consumers and manufacturers helped drive its leading position in the market.

By sealing type, the pre-locked capsules segment led the market in 2024. The widespread use of pre-locked HPMC capsules in 2024 can be attributed to their ability to streamline production processes and enhance operational efficiency. These capsules come pre-fitted, reducing manual intervention and contamination risks during filling. Their compatibility with high-speed machinery and consistent sealing quality made them a preferred choice among pharmaceutical companies aiming for precision, hygiene, and faster turnaround times.

North America led the market share by 32% in 2024 due to its highly developed pharmaceutical and nutraceutical industries, growing consumer preference for vegetarian and clean-label products, and strong regulatory support. Pharmaceutical firms in the U.S. and Canada adopted HPMC capsules widely for stability, low moisture content, and suitability for moisture-sensitive formulations. Well-established players like Qualicaps and CapsCanada, plus high R&D investment, solidified North America’s dominance in the HPMC capsule space.

The U.S.market is gaining momentum in 2024, driven by strong consumer demand for vegetarian, non-GMO, and allergen-free dosage formats. These plant-based capsules are increasingly used by nutraceutical brands about 65% now relying on HPMC for supplements due to their clean-label appeal and stability. Pharmaceutical adoption is also rising, with companies choosing HPMC to enhance drug shelf-life and compliance with dietary preferences. Additional momentum comes from widespread regulatory acceptance and mature supply chains supporting product quality and availability.

The market in Canada is expanding steadily due to a rising shift toward plant-based and vegetarian pharmaceutical solutions. Consumers are increasingly choosing clean-label and allergen-free options, aligning with broader wellness trends. Local manufacturers are responding with innovative capsule formulations, while supportive regulations and growing demand in the nutraceutical and pharmaceutical sectors continue to push the market forward.

Asia-Pacific is expected to experience the fastest growth in the market due to rapidly expanding pharmaceutical and nutraceutical industries in China, India, Japan, and South Korea. A rising population, increasing disposable incomes, and greater health awareness are boosting demand for clean-label, plant-based capsules. Government support, growing manufacturing infrastructure, and local innovation are accelerating the region's adoption of advanced HPMC formulations, positioning Asia-Pacific as a major growth hub.

China’s market is expanding due to rising demand for plant-based, vegetarian-friendly products across pharmaceuticals and nutraceuticals. The country's strong manufacturing base, growing health awareness, and preference for clean-label formulations further boost adoption. Additionally, the expansion of China’s generic drug sector and innovations in drug delivery systems are encouraging pharmaceutical companies to shift toward HPMC capsules for better compatibility and consumer appeal.

For Instance,

India’s market is growing steadily for several reasons. Pharmaceutical and nutraceutical companies are increasingly favoring plant-based delivery systems, aligning with rising consumer demand for vegetarian and clean-label products. The country’s robust pharmaceutical industry, widely known as the “pharmacy of the world,” is expanding rapidly with strong local manufacturing capacity and innovation in formulations. Together, these trends support the broader adoption of HPMC capsules across India.

In 2024, Europe continued to advance in the market due to a growing demand for plant-based, clean-label pharmaceutical and nutraceutical products. Countries like Germany, France, and the UK are witnessing increased usage of HPMC capsules as consumers prefer vegetarian alternatives. Supportive regulatory standards and an expanding focus on health-conscious formulations are also encouraging manufacturers to innovate and invest more in sustainable capsule production across the region.

The U.K. market is growing in 2024 due to increasing demand for vegetarian and clean-label medicinal and supplement options. The country’s strong pharmaceutical R&D ecosystem and strict regulations on non-animal excipients enhance trust in HPMC use. With rising consumer health awareness and more brands offering vegan-friendly formulations, manufacturers are rapidly expanding production and customizing capsules to meet local market preferences.

Germany’s market is growing steadily in 2024, thanks to rising consumer preference for plant-based and vegetarian supplements. With increasing demand for clean-label and allergen-free pharmaceutical products, manufacturers in Germany are increasingly choosing HPMC over gelatin. Supportive regulatory standards and thriving local pharmaceutical production further enhance the acceptance and availability of HPMC capsules within the German market.

In February 2025, ACG introduced vegan printed capsules made from plant-derived polymers like Hydroxypropyl Methylcellulose (HPMC), certified by Vegan Action and The Vegetarian Society. These capsules, including both shell and print, meet strict vegan criteria and cater to the rising demand for sustainable and cruelty-free products. Dr. Subhashis Chakraborty, ACG’s Head of Global Product Management, stated that the innovation reflects their commitment to ethical, transparent, and eco-friendly healthcare, setting a new industry standard.

By Capsule Type

By Functionality / Release Profile

By Application

By End Use

By Distribution Channel

By Capsule Size

By Sealing Type

By Region

November 2025

December 2025

November 2025

November 2025