February 2026

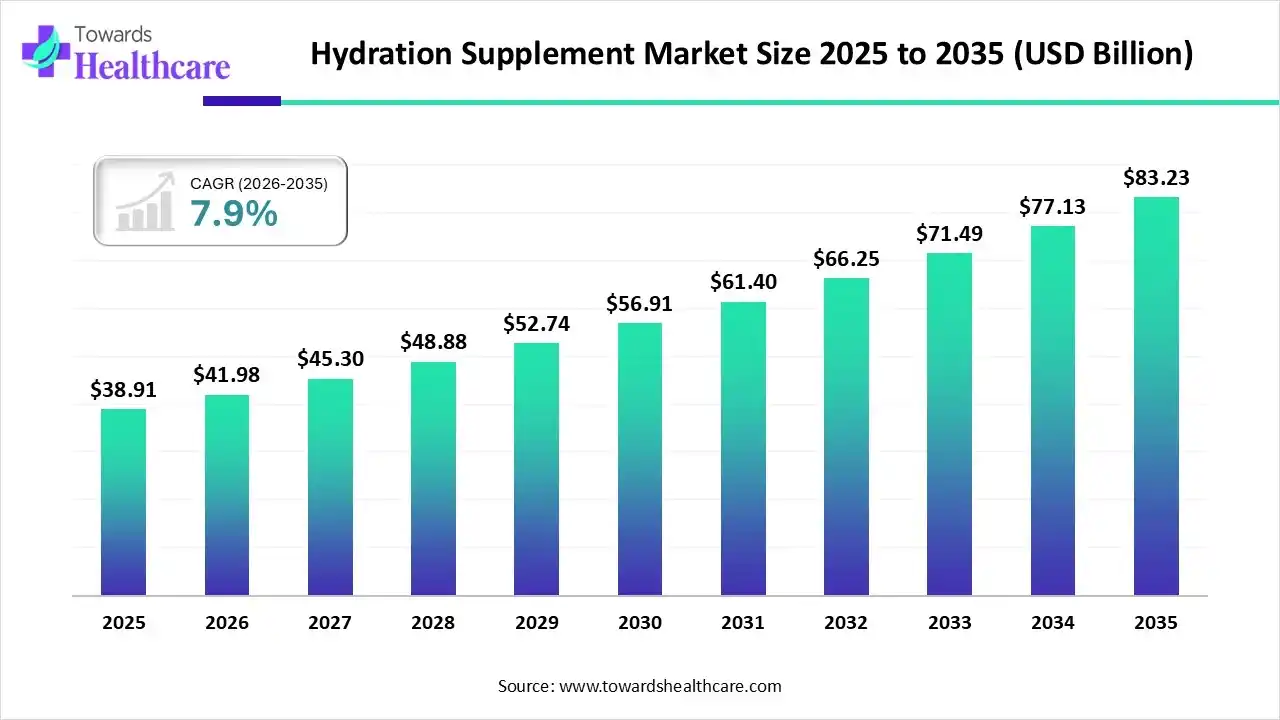

The global hydration supplement market size was estimated at USD 38.91 billion in 2025 and is predicted to increase from USD 41.98 billion in 2026 to approximately USD 83.23 billion by 2035, expanding at a CAGR of 7.9% from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 41.98 Billion |

| Projected Market Size in 2035 | USD 83.23 Billion |

| CAGR (2026 - 2035) | 7.9% |

| Leading Region | North America |

| Market Segmentation | By Form, By Product Type, By Distribution Channel, By Region |

| Top Key Players | Coca-Cola Company, PepsiCo, Inc., Nestlé S.A., Daily electrolytes, Gatorlytes, MyProtein, MuscleBlaze |

Integration of AI-based technology in hydration supplements drives the growth of the market as AI-driven technology analyzes large amounts of patient-centric data to create highly tailored hydration and nutritional plans, thereby enhancing. An exclusive AI-based engine adjusts mineral content like calcium, magnesium, potassium, and sodium, pH (4.5–9.5), and nutritional ingredients in real time. By incorporating nutrition science with machine learning, organizations shift beyond generic vitamins toward systems that provide nutrient dosage, supplement timing, and dietary adoptions based on real-time feedback, which drives the growth of the market.

Investigators are discovering inclusive equipment and dietary strategies to deliver precise nutritional support and help people live healthier lives.

Development in the functional ingredients of hydration supplements is driven by user demand for health-conscious, active, and natural ingredients.

Plant-based supplements are redefining sports nutrition by their dual capacities to increase exercise performance and speed up recovery. Natural sources such as coconut water, leafy greens, and sea vegetables offer balanced electrolyte ratios that support ideal hydration.

Which Product Led the Hydration Supplement Market in 2024?

In 2025, the powder segment held the dominant market, as application of electrolyte powder supports with enhanced hydration, better athletic performance, improved recovery of tissues and muscles, and healthy cellular and nerve function. Green powders support provides some vitamins and minerals. If consumers need a hydration boost, electrolyte powders will be a supportive tool. Electrolyte powders are also easy for the body to utilize, allowing it to absorb nutrients efficiently and quickly.

Liquid

Whereas the liquid segment is the fastest growing in the market, as liquid vitamins provide many health advantages, including immune support, digestive health, lowering stress, weight management, improved energy levels, enhanced sleep quality, and boosted athletic performance. Liquid vitamins are generally more bioavailable because they don't require actively broken down.

Why did the Organic Segment Dominate the Market in 2024?

The organic segment captured the biggest revenue share of the hydration supplement market in 2025, as organic supplements are dietary supplements that are completely or mostly made from organic elements. They're free of chemicals that aren't natural, meaning there aren't pesticides and other toxic ingredients. It enhanced muscle function, temperature regulation, and metabolic provision, making them ideal for health-conscious patients seeking effective fluid absorption and a purer nutrient profile.

Electrolyte

Whereas the electrolyte segment is the fastest growing in the market, as electrolyte supplements improve hydration by supporting the body to absorb and retain fluids better than water alone, significant during heat, exercise, or illness, preventing cramps, heatstroke, and fatigue. They support the body to regulate chemical reactions and maintain the balance between fluids inside and outside cells.

Why is the Online Segment Dominant in the Market

In 2025, the online segment held the dominating share of the hydration supplement market, as online platforms remove the geographical boundaries, enabling businesses to sell to consumers globally without the requirement for physical stores in every location. E-commerce lowers overhead costs such as commercial rent, utilities, and a large sales staff, resulting in potentially higher profit margins.

Pharmacies

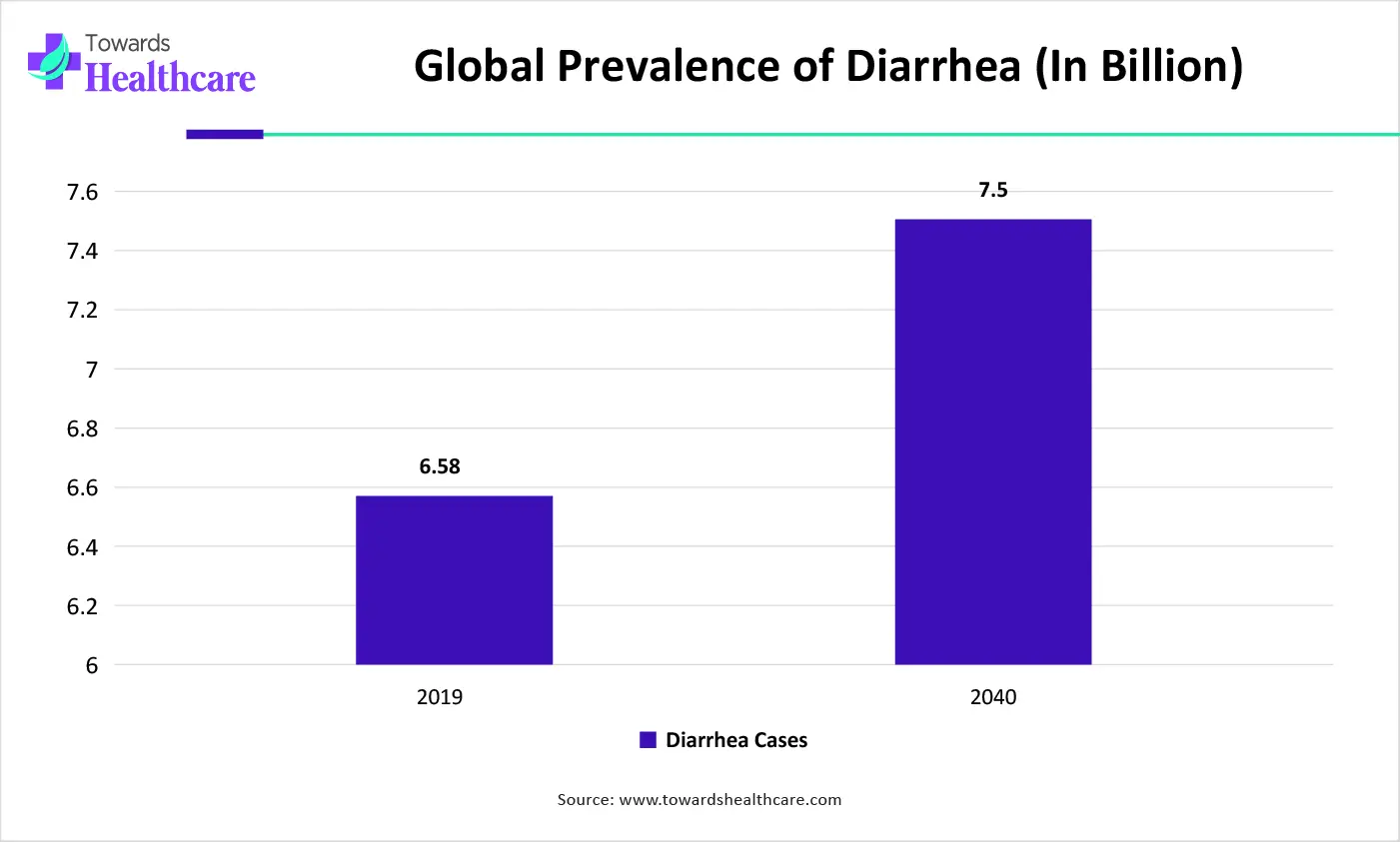

Whereas the pharmacies segment is the fastest growing in the market, as pharmacists counsel patients on the appropriate usage and dosage, helping to prevent potential electrolyte imbalances that occur if supplements are taken without a clear requirement. They can recommend specific oral rehydration solutions for cases of acute diarrhea where electrolyte loss is significant, or for athletes requiring performance and recovery help.

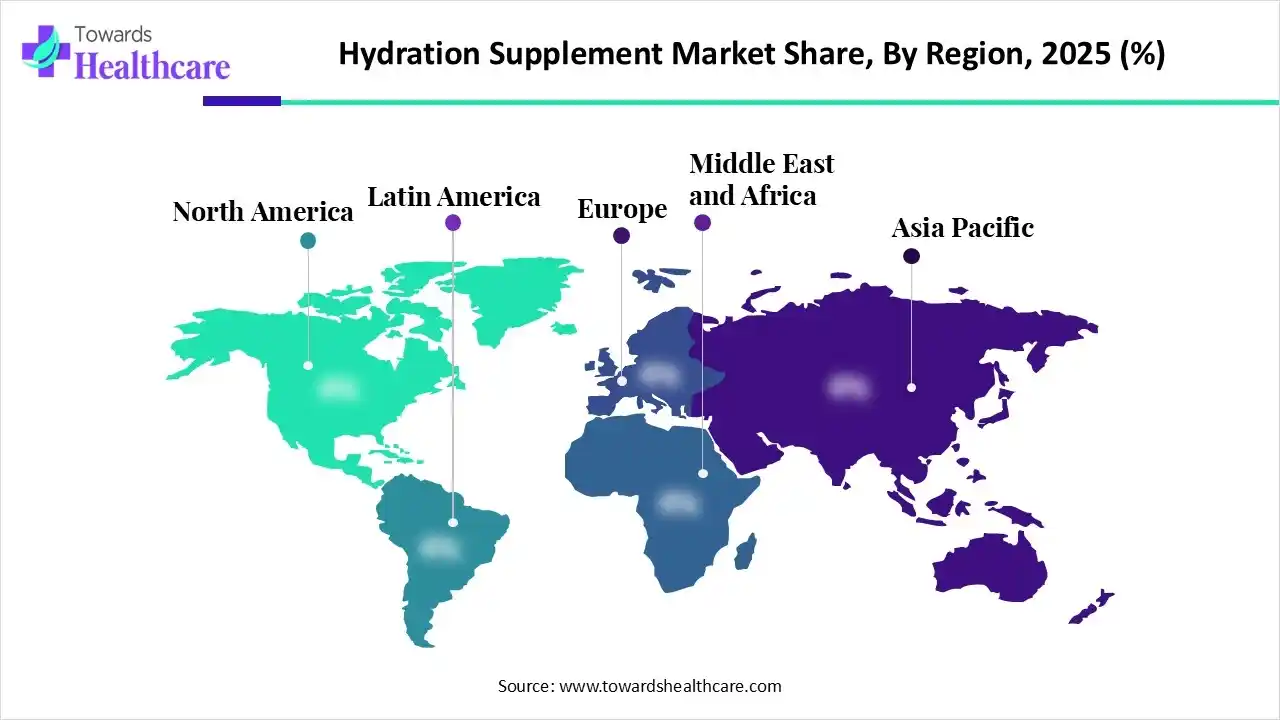

In 2025, North America led the hydration supplement market, driven by a significant portion of this region engaging in exercise, sports, and recreational activities. This active lifestyle, combined with high awareness about the importance of appropriate hydration and electrolyte balance, drives consistent demand for supplements beyond just professional athletes to average fitness enthusiasts.

In the U.S., growing awareness of dehydration challenges is leading to higher investment in health-focused products. A strong presence of major supplement organizations, extensive retail systems, and efficient online and influencer marketing. U.S. regulatory funding for wellness initiatives helps supplement research and increase innovation.

Asia Pacific is growing at the fastest CAGR in the hydration supplement market as consumers in the region, specifically the younger demographic and middle class, are progressively focused on preventive healthcare and adopting healthier, more active lifestyles. There is a significant increase in the number of fitness enthusiasts and participation in sports activities in countries such as Japan, China, and India.

In India, a large, health-sensitive young adult and urban population, influenced by social media and worldwide fitness trends, is increasing demand for performance-enhancing and wellness-focused hydration products. The increasing prevalence of micronutrient lacks and lifestyle-associated disorders has increased the acceptance and demand for supplements as a suitable way to address these challenges, which drives the growth of the market.

Europe is set to experience significant growth in the hydration supplement market, driven by there is a growing awareness among European consumers related to the general health advantages of proper hydration for immunity, energy, and overall wellness. Regularly using supplements as a form of self-care is a prevalent trend. Consumers progressively seek products with natural and organic ingredients and clear, transparent labelling, which contributes to the growth of the market.

The UK has a significant fitness and sports culture, with increasing participation rates in activities like triathlons, marathons, and general gym workouts. This drives a reliable demand for performance-enhancing and recovery-focused products such as hydration supplements. There is an increasing level of customer awareness related to the importance of nutrition and hydration, often driven by health operations.

| Company | Headquarters | Latest Update |

| Coca-Cola Company | Georgia | In March 2025, The Coca-Cola Company emphasizes its franchise leadership and its bottling and distribution operations as key capabilities and strengths. |

| PepsiCo, Inc. | United states | In March 2024, PepsiCo announced that it reached its 2025 global goal of a 25% improvement in operational water-use efficiency in high water-risk areas. |

| Nestlé S.A. | Switzerland | Nestlé is considering the future of some underperforming VMS brands. |

| Daily electrolytes | India | Major player known for its Hydration Multiplier products, Liquid I.V. focuses on rapid hydration technology and offers a wide array of flavors. |

| Gatorlytes | Chicago | In July 2025, Gatorade expanded its powder-based offerings in various markets (like the Philippines) to offer more convenient and budget-friendly hydration solutions. |

| MyProtein | United Kingdom | Myprotein becomes the Exclusive Hydration Partner for International Health, Sports & Fitness Festival 2025. |

| MuscleBlaze | India | MuscleBlaze is India's trusted sports nutrition & bodybuilding supplements Brand. |

By Form

By Product Type

By Distribution Channel

Regional Outlook

February 2026

February 2026

February 2026

February 2026