February 2026

The global liquid handling technology market size is anticipated to grow from USD 7.25 billion in 2025 to USD 15.79 billion by 2034, with a compound annual growth rate (CAGR) of 9.03% during the forecast period from 2025 to 2034.

Several types of laboratories require liquid handling procedures, such as those that analyze petroleum samples and highly flammable compounds or those that find infections in human blood or screen products for food-borne viruses. For the safe handling and movement of liquids from one place to another, scientists rely on both automatic and manual equipment. The global laboratory procedures rely heavily on the liquid handling technology market. Significant increases in productivity can be achieved by manipulating liquid samples and reagents with greater precision, speed, and effectiveness.

| Metric | Details |

| Market Size in 2024 | USD 6.65 Billion |

| Projected Market Size in 2034 | USD 15.79 Billion |

| CAGR (2025 - 2034) | 9.03% |

| Leading Region | North America |

| Market Segmentation | By Products, By Type, By Application, By End-use and By Region |

| Top Key Players | Thermo Fisher Scientific, Inc., Eppendorf SE., Gilson, Inc, Tecan Group Ltd., PerkinElmer, Danaher Corporation, SPT Labtech, Agilent Technologies, Inc and Hamilton Company |

Liquid handling equipment in biotechnology has a bright future since a number of changes are predicted to have an impact on the industry. One notable trend is the increasing frequency with which machine learning (ML) and artificial intelligence (AI) are used in liquid handling systems. In order to enable smarter and more effective laboratory operations, AI and ML have the ability to enhance liquid handling practices, anticipate the need for system maintenance, and enhance data analysis.

Automated liquid handling equipment may be found in a wide range of sizes and designs for use in a variety of areas. These devices discharge a predetermined amount of liquid or a sample into a predetermined container using a motorized pipette or syringe that is fastened to a robotic arm. Certain variants have extra lab equipment and can carry out further functions, including heater-cooler plates (link), to satisfy certain needs. With these adjustments, the liquid handling procedure is guaranteed to be as complete, effective, and accurate as possible.

For instance,

Throughout the projected era, the potential for mistakes in automated liquid handling systems might impede the market's expansion. Moreover, during the projection period, a decline in product demand is anticipated due to a shortage of personnel with the necessary skills to operate the system.

Sustainability is increasingly starting to be prioritized for development in the field of liquid handling systems. Manufacturers are coming up with ways to minimize the environmental impact of their goods. For example, they may reduce plastic waste and increase energy efficiency. This aligns with the broader biotechnology trend towards sustainability, which emphasizes eco-friendly methods more and more.

By product, the consumables segment held the largest share of the liquid handling technology market in 2023. Liquid management is a fundamental aspect of laboratory work that includes everything from straightforward liquid transfers to intricate molecular biology investigations. The choice of consumables, including PCR plates, pipette tips, ELISA plates, cell culture plates, and cryogenic vials, greatly affects the precision, effectiveness, and dependability of laboratory procedures. Choosing the appropriate consumables increases workflow productivity, reduces costs, and ensures precise and consistent outcomes.

For instance,

By type, the semi-automated liquid handling segment dominated the liquid handling technology market in 2023. Liquid handlers that automate some sample preparation processes enable labs to adopt semi-automation as a means of gradually increasing productivity and improving repeatability. The only labor-intensive part of semi-automated liquid handlers is for the technician to move a hand probe from vessel to vessel; otherwise, the operator must manually adjust quantities on a pipette or keep track of stages in a process.

By type, the automated liquid handling segment is expected to grow at the fastest CAGR in the liquid handling technology market during the forecast period. Complete automation is especially helpful for high-throughput applications where eliminating human movement altogether is necessary. In these circumstances, liquid handling platforms—which have the capacity to treat hundreds of samples at once—become quite useful. Liquid handling platforms guarantee that samples are treated consistently and without variation by automating extremely complicated techniques. In addition to saving time and money for labs and researchers, this increases the accuracy and repeatability of outcomes. Furthermore, fully automated systems are perfect for large-scale screening and analysis projects that need to handle a huge number of samples due to their high throughput capabilities.

For instance,

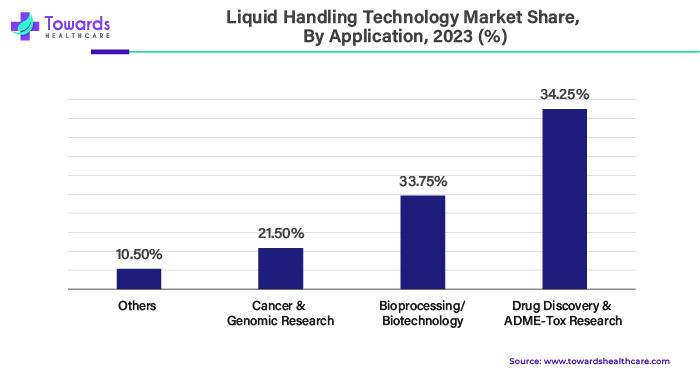

By application, the drug discovery & ADME tox research segment held the largest share of 34.25% in the liquid handling technology market in 2023. In drug development, automated liquid handling has become a vital tool, especially for screening campaigns involving millions of molecules. The rapid advancement of assay downsizing and the intense innovation of these devices have a direct impact on the speed at which medication candidates and chemical probes for probing biological systems are discovered.

By end-use, the academic & research institutes segment dominated the liquid handling technology market in 2023. Through a variety of perspectives that were never recognized or discussed extensively, research enables an understanding of certain difficulties. A researcher gathers evidence for their findings based on logic and facts, not just their own experiences. Many life science investigations need the manipulation of liquids, but proteomics and genomics research, in particular, depend heavily on it. Dispensing samples of protein or DNA solutions into microwells or onto substrates is necessary for this type of study; additional solutions are frequently needed for the synthesis and analysis stages that follow.

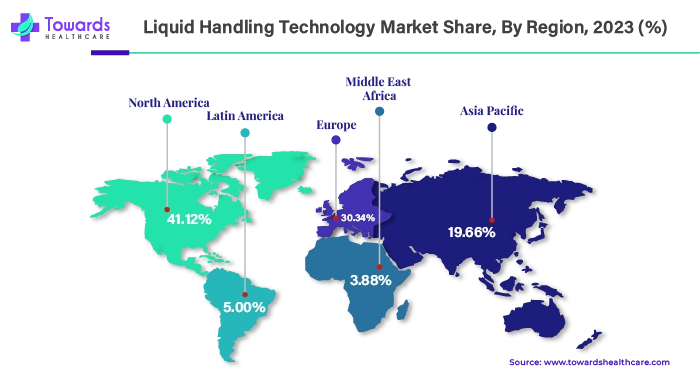

According to region, North America led the liquid handling technology market by 41.12% in 2024 due to the presence of a thriving biotechnology and pharmaceutical sector, which necessitates sophisticated laboratory automation solutions for drug discovery and development processes. The adoption of these technologies is also fueled by the growing importance of precision medicine and personalized healthcare, as well as large investments in research and development.

Canada comes in 8th place globally with a 2.2% market share in pharmaceutical sales. Name-brand medications account for 25.7% of prescriptions by amount and 80.5% of overall sales in Canada in terms of value. When it comes to prescription drugs, generics account for 74.3% of the market share and 19.5% of revenues. Over the period of 2018 to 2022, Canada's pharmacy imports and exports to other countries increased by 38% and 55%, respectively.

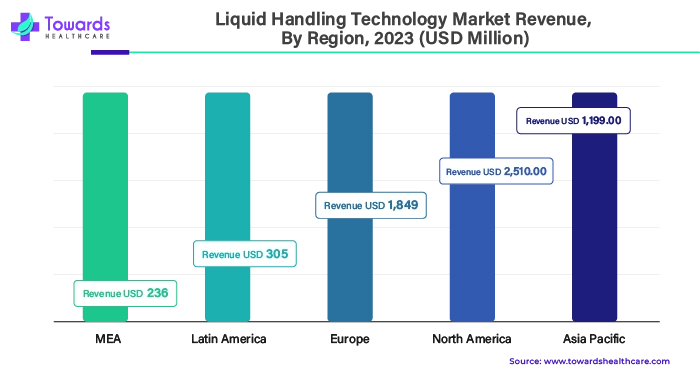

In 2023, North America led the Liquid Handling Technology Market with a notable revenue of $2,510.00 million. This strong performance highlights the region’s advanced technological capabilities and high demand for innovative liquid handling solutions. Driven by its well-established healthcare and pharmaceutical industries, North America continues to be at the forefront of adopting new technologies that improve precision and efficiency in liquid handling processes.

By region, Asia Pacific is expected to grow at the fastest rate during the forecast period. The sectors with the fastest growth have been biopharma and biotechnology, along with Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) in countries like China, India, and Japan. These industries have made significant advancements in their respective disciplines. Significant investments in the life science fields—omics research, advanced healthcare, microbiology, drug development, and clinical diagnostics—by China, Japan, and India are also expected to drive the growth of the liquid handling technology market.

BIRAC financed 60 bio-incubators, and DBT supported 9 biotech parks. The Department of Biotechnology (DBT) received Rs. 2,251.52 crore (US$ 271 million) in the Interim Budget 2024–25. Thirty MSMEs and over 150 NGOs are among the 101 initiatives that the National Biopharma Mission is funding. The National Biotechnology Development Strategy 2020–25 gives the government a framework for enhancing innovation, resource management, and talent development, which together establish a robust ecosystem for information exchange.

From US$ 10 billion in 2015 to US$ 130 billion in 2024, India's bioeconomy sector has expanded. As of 2021, India's bioeconomy will make up 2.6% of the country's GDP. India is on track to become a $300 billion US bioeconomy by 2030. Biopharma still makes up the overwhelming majority of the Indian bioeconomy. With a projected total economic contribution of US$ 39.4 billion, biopharma accounted for 49% of the bioeconomy. It is estimated that the Indian vaccine market will be valued at Rs. 252 billion (US$ 3.04 billion) by the year 2025. The first-ever locally produced quadrivalent Human Papilloma Virus (qHPV) vaccine against cervical cancer in India was approved for sale by DCGI in July 2022. It was backed by DBT and BIRAC.

Europe is estimated to be a significantly growing region during the forecast period. Because of an aging population, government support is needed for the expansion of the healthcare sector, the availability of state-of-the-art drug research facilities, and the growing use of sophisticated liquid handling technologies. Furthermore, the market for liquid handling systems in the UK grew at the quickest rate in the European area, while the market in Germany had the greatest market share.

With £3.5 billion in investment raised in 2024—a startling 94% increase over the previous year—the UK biotech industry saw tremendous progress. Even in the face of difficult economic conditions, the sector has shown resilient, innovative, and globally appealing, as seen by the largest yearly total since the £4.5 billion generated in 2021. The BioIndustry Association's (BIA) annual UK biotech finance report includes the updated numbers.

| Company Name | Hamilton |

| Headquarters | Nevada, U.S., North America |

| Recent Development | In May 2024, Hamilton is pleased to announce the debut of ZEUS X1, its newest invention. Hamilton is a leading global provider of automated liquid handling workstations, sample management systems, and precision measurement instruments. ZEUS X1 blends cutting-edge air displacement pipetting technology with Hamilton's cutting-edge CO-RE®II technology, all designed for smooth OEM integration. With a variety of active monitoring and correction techniques, our automated pipetting module overcomes the difficulties associated with pipetting and guarantees process security throughout. |

| Company Name | SPT Labtech |

| Headquarters | Cambridgeshire, United Kingdom, Europe |

| Recent Development | In July 2024, with the introduction of mosquito Gen3, SPT Labtech increased the range of liquid handling products for nanoliters. This new model is the most accessible and small in the mosquito line, and it makes next-generation sequencing (NGS) more affordable for labs by increasing laboratory access to cutting-edge downsizing technology. Within a compact benchtop size, Mosquito Gen3 offers accurate multi-channel pipetting from 500 nL to 5 µL with fast plate-to-plate action across three potential deck locations. |

By Products

By Type

By Application

By End-use

By Region

February 2026

January 2026

January 2026

January 2026