January 2026

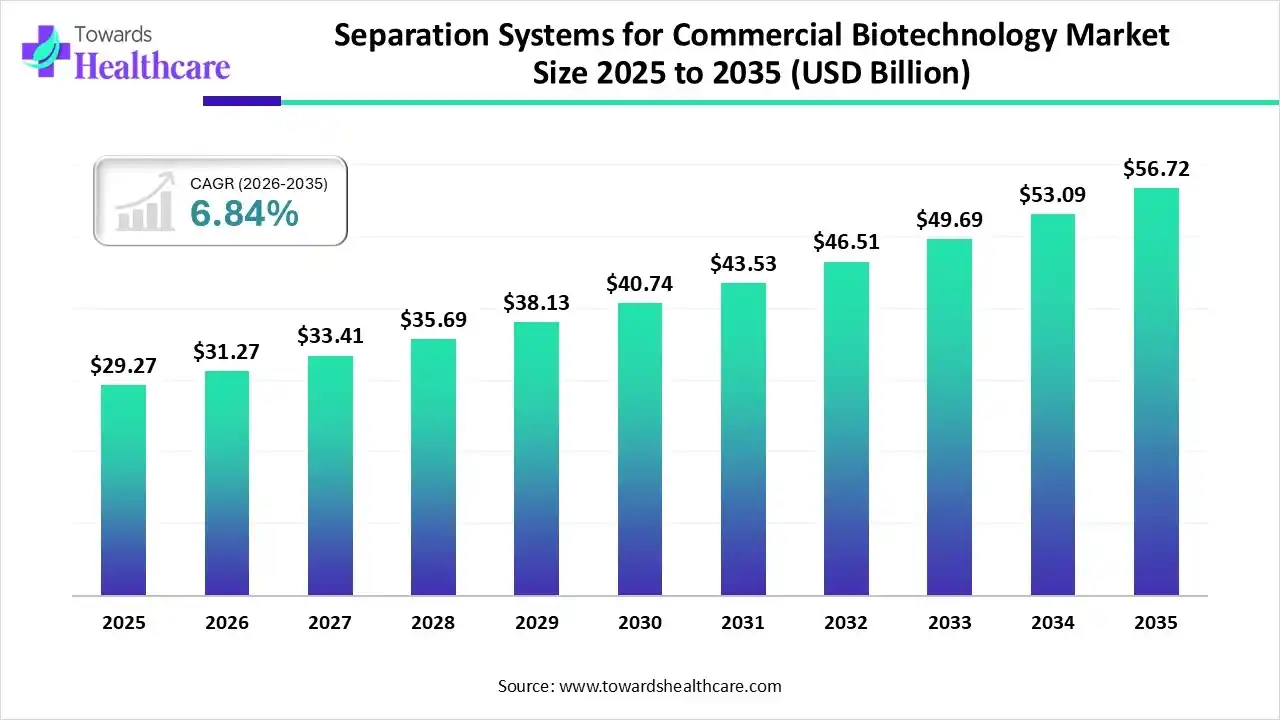

The global separation systems for commercial biotechnology market size was estimated at USD 29.57 billion in 2025 and is predicted to increase from USD 31.27 billion in 2026 to approximately USD 56.72 billion by 2035, expanding at a CAGR of 6.84% from 2026 to 2035.

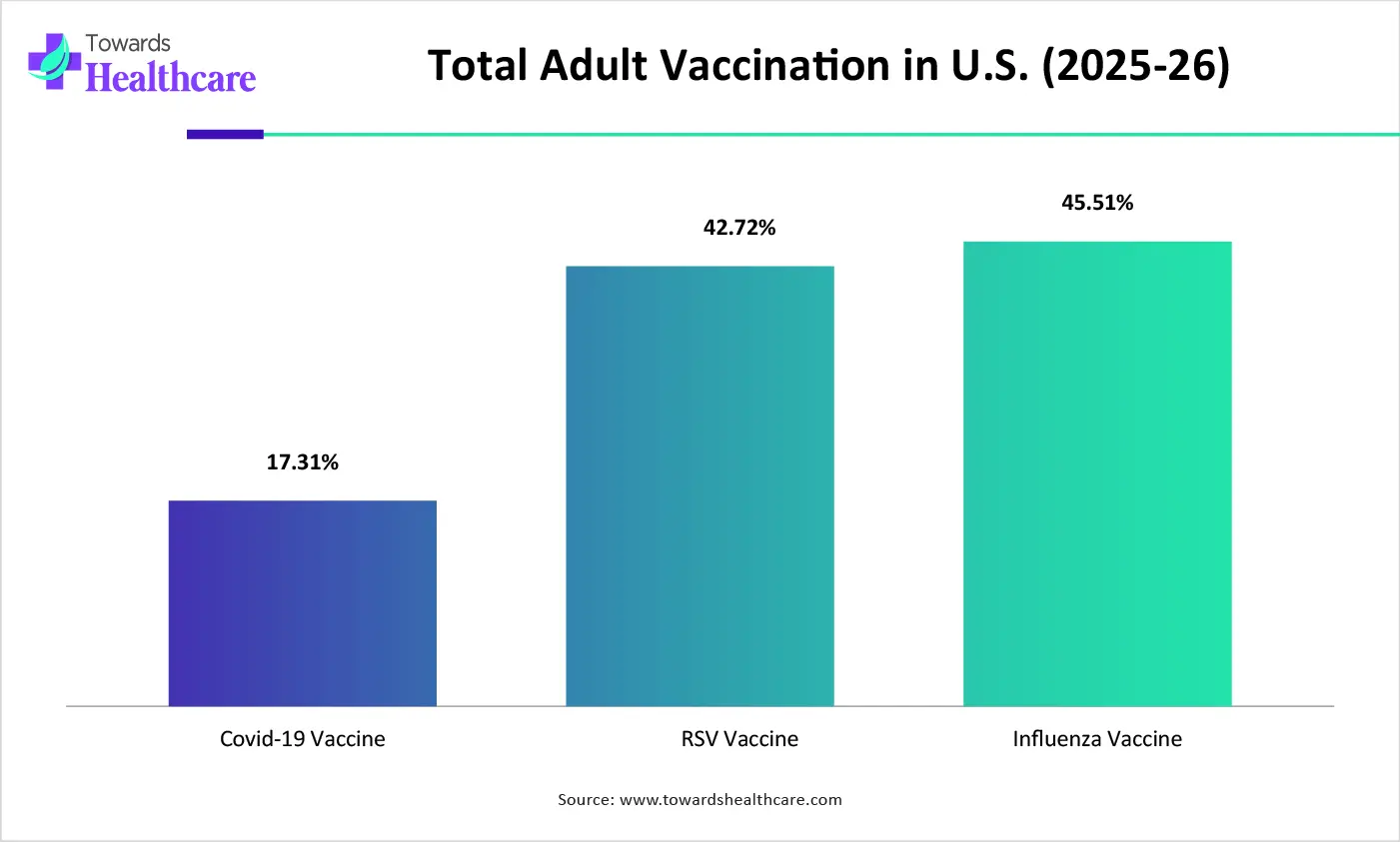

The growing advancements in biologics, therapies, and vaccines are increasing the use of separation systems for commercial biotechnology. AI technologies are also being utilized, where companies are launching new methods, promoting market growth.

The separation systems for commercial biotechnology market is driven by growing demand for personalized cell therapies, vaccines, and monoclonal antibodies. The separation systems for commercial biotechnology refer to systems and technologies used in biotechnological processes such as enzyme production, fermentation, and cell culture for various applications, like purification, isolation, and recovery of specific cells or biomolecules.

The use of AI in the separation systems for commercial biotechnology market is increasing, as they help in the optimization of various process parameters. It also helps in regular maintenance by detecting membrane fouling and equipment failure. AI also helps in enhancing the product purity and yield by its automated controls, where it also reduces the error, enhancing their stability and product consistency.

The growing application and awareness of cell and gene therapies are increasing their acceptance rates, development, and innovations, which is driving the demand for separation systems.

To reduce the contamination risk, frequent validation and cleaning, as well as companies, are adopting single-use separation systems, such as single-use filtration and chromatography columns.

The companies are focusing on the use of continuous manufacturing processes rather than batch processes to improve productivity, which is increasing the use of separation systems by integrating them with upstream and downstream units.

| Key Elements | Scope |

| Market Size in 2026 | USD 31.27 Billion |

| Projected Market Size in 2035 | USD 56.72 Billion |

| CAGR (2026 - 2035) | 6.84% |

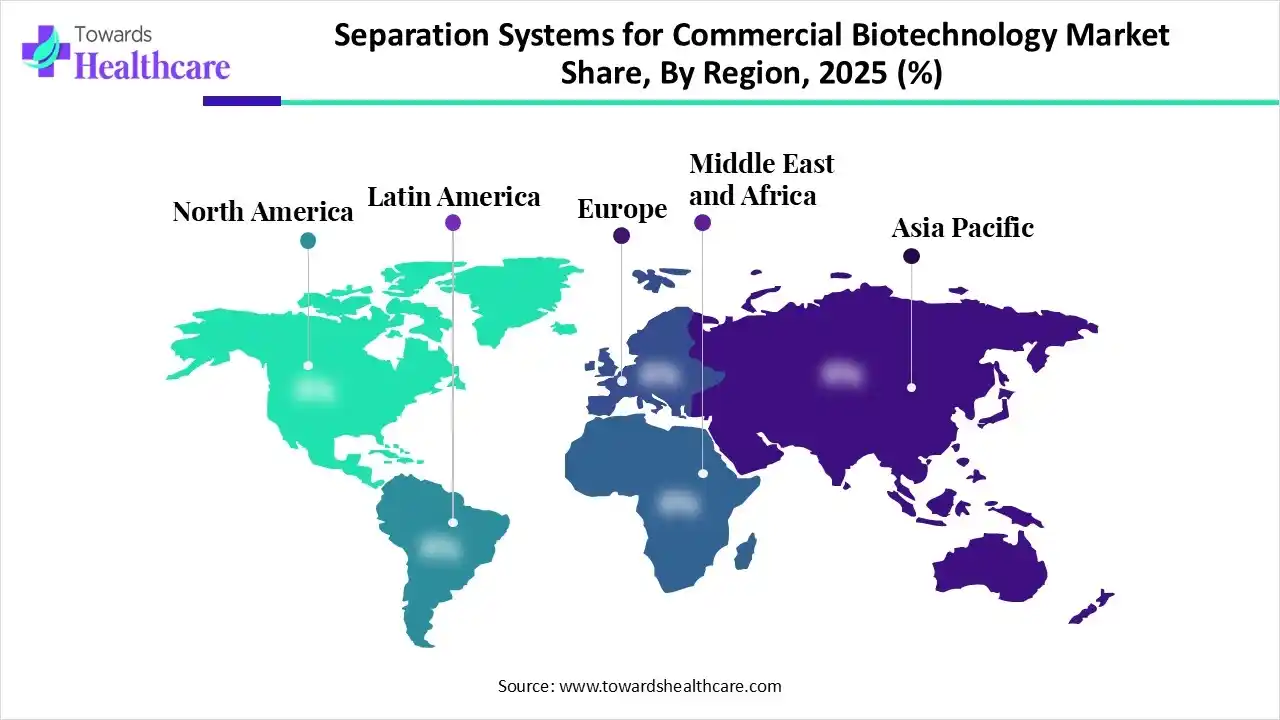

| Leading Region | North America |

| Market Segmentation | By Method, By Application, By Region |

| Top Key Players | Thermo Fisher Scientific Inc., Danaher Corporation, Merck KGaA, Sartorius AG, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Waters Corporation, Repligen Corporation, Shimadzu Corporation, Eppendorf SE |

Which Method Type Segment Held the Dominating Share of the Market in 2025?

The conventional methods segment held the dominating share in the separation systems for commercial biotechnology market in 2025, due to their proven reliability. At the same time, they offered improved scalability and enhanced affordability, which also increased their use. Moreover, their compliance with regulatory standards also increased their use.

Modern Methods

The modern methods segment is expected to show the highest growth during the predicted time, due to their improved selectivity and product quality. They also help in maintaining the product purity, which is increasing their use in the development of various complex biologics. Their faster separation process and high yields are also increasing their demand.

What Made Pharmaceutical the Dominant Segment in the Market in 2025?

The pharmaceutical segment held the largest share in the separation systems for commercial biotechnology market in 2025, due to stringent quality and purity standards. The growth in the development of complex biologics, vaccines, and therapies also increased the use of separation systems. Furthermore, the growth in R&D activities also increased their demand for various applications.

Food & Cosmetics

The food & cosmetics segment is expected to show the fastest growth rate during the upcoming years, due to growing consumer awareness. At the same time, the growing demand for natural ingredients and increasing use of nutraceuticals are also increasing the demand for separation systems to maintain the product's purity, quality, and enhance its yield.

North America dominated the separation systems for commercial biotechnology market in 2025, due to the presence of robust biotechnology and pharmaceutical industries. The growth in R&D investments and the presence of advanced healthcare infrastructure also increased the adoption rates of these separation systems. Moreover, the growing technological advancements also contributed to the market growth.

U.S. Market Trends

The U.S. consists of well-developed industries that use separation systems for the development of various biotechnology, pharmaceutical, and cosmetic products. The growing healthcare investments and innovations are also increasing their adoption rates, where the presence of stringent regulations is also increasing their applications.

Asia Pacific is expected to host the fastest-growing separation systems for commercial biotechnology market during the forecast period, due to expanding industries. At the same time, the growing biologics development and increasing use of advanced therapies due to increasing government initiatives are also promoting the use of separation systems. Additionally, growing outsourcing trends are also enhancing the market growth.

China Market Trends

The expanding biotechnology industries in China are increasing the adoption of separation systems. The growing government initiatives and increasing demand for biologics are also increasing their acceptance rates. Additionally, the growing outsourcing trends and technological innovations are also encouraging their use.

Europe is expected to grow significantly in the separation systems for commercial biotechnology market during the forecast period, due to growing R&D investments. Moreover, the presence of robust biotechnology and pharmaceutical industries and stringent regulations is also increasing the use of separation systems. Furthermore, the growing therapies and collaboration are also promoting the market growth.

UK Market Trends

The presence of the advanced biopharmaceutical sector in the UK is driving the development of vaccines, advanced technologies, and biologics, which increases the use of separation systems. The presence of robust institutes is also increasing their use for various experiments, where the R&D investment and funding are also encouraging their use.

| Companies | Headquarters | Separation Systems for Commercial Biotechnology |

| Thermo Fisher Scientific Inc. | Massachusetts, U.S. | HPLC systems, centrifuges, and mass spectrometers |

| Danaher Corporation | Washington, D.C., U.S. | Filtration and AKTA chromatography systems |

| Merck KGaA | Darmstadt, Germany | Pellicon tangential flow filtration and Mobius single-use bioreactors and purification systems |

| Sartorius AG | Gottingen, Germany | Cross filtration systems, single-use separation technologies, and chromatography skids |

| Agilent Technologies, Inc | California, U.S. | Liquid chromatography and gas chromatography |

| Bio-Rad Laboratories, Inc. | California, U.S. | NGC chromatography systems |

| Waters Corporation | Massachusetts, U.S. | Ultraperformance liquid chromatography and mass spectrometry |

| Repligen Corporation | Massachusetts, U.S. | XCell alternating tangential flow systems |

| Shimadzu Corporation | Kyoto, Japan | Prominence and Nexera HPLC and UHPLC systems |

| Eppendorf SE | Hamburg, Germany | High-speed laboratory centrifuges and bioprocess controllers |

By Method

By Application

By Region

January 2026

January 2026

January 2026

January 2026