February 2026

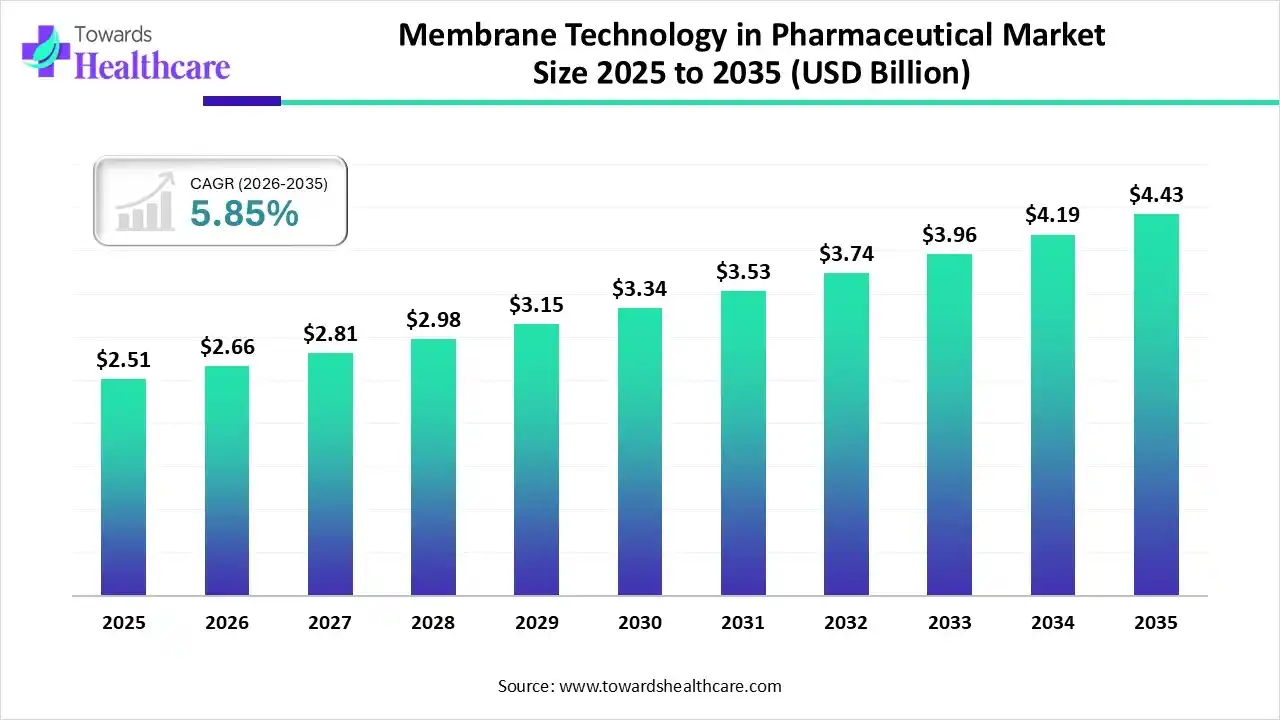

The global membrane technology in the pharmaceutical market size was estimated at USD 2.51 billion in 2025 and is predicted to increase from USD 2.66 billion in 2026 to approximately USD 4.43 billion by 2035, expanding at a CAGR of 5.85% from 2026 to 2035.

The membrane technology in pharmaceutical market is growing as this technology has unique advantages such as high effectiveness, broad applicability, and reduced environmental impact.

The membrane technology in pharmaceutical market is growing as rising applications of membrane technologies in the pharmaceutical/biopharmaceutical sectors, with particular emphasis on new membrane techniques for healthcare applications. Membrane technologies are widely used in downstream processes for bio-pharmaceutical separation and purification operations through microfiltration, ultrafiltration, and defiltration. Membranes in the form of hollow fibers are conveniently used to tools crystallization of pharmaceutical compounds.

Integration of AI-driven technology in membrane technology in pharmaceutical drives the growth of the market, as AI-based technology has been propounded as an efficient tool for predicting membrane separation and filtration processes. AI algorithms are used to predict permeate flux and increasing growth characteristics. Real-time filtration models powered by AI-driven technology improve early fault detection and alarm generation, enhancing safety and reliability. AI-driven technology supports dynamic optimization of backwashing cycles, healthcare chemical cleaning schedules, and energy use, enhancing overall process effectiveness.

Single-use systems (SUS) address these specialized requirements by significantly lowering capital expenses and lowering the time-to-market for major medicines.

Developing antifouling nanofibrous membranes for membrane distillation and continuing modifications on nanofiber membranes for enhanced membrane distillation performance.

Membrane technology characteristically provides benefits in energy effectiveness, space requirements, and operational simplicity associated with distillation, evaporation, or chemical treatments.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.66 Billion |

| Projected Market Size in 2035 | USD 4.43 Billion |

| CAGR (2026 - 2035) | 5.85% |

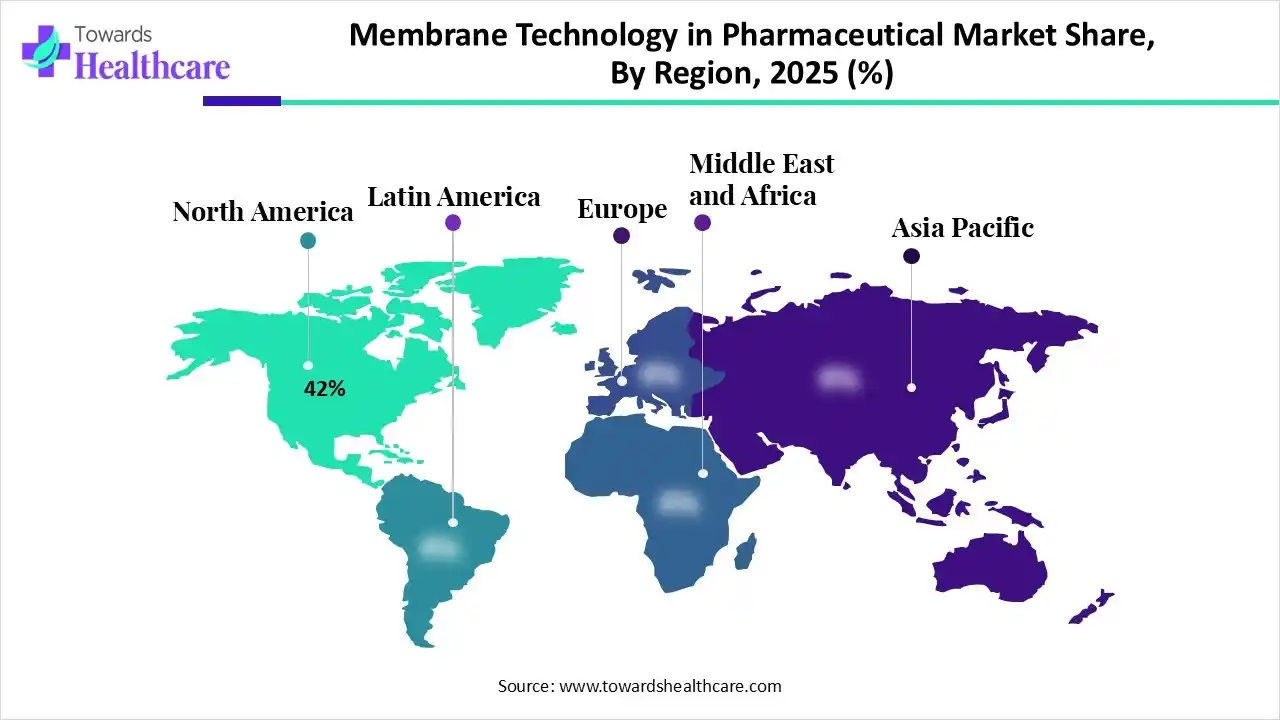

| Leading Region | North America by 42% |

| Market Segmentation | By Technology, By Application, By Product Type, By Material, Regional Outlook |

| Top Key Players | Merck KGaA, Sartorius AG, Danaher Corporation, Thermo Fisher Scientific Inc., 3M Company, Repligen Corporation |

Which Technology Led the Membrane Technology in the pharmaceutical market in 2025?

In 2025, the microfiltration (MF) segment held the dominant market share with approximately 43% share in 2025, as microfiltration membranes eliminate impurities and retain target products, therefore enhancing the purity and activity of the end product. Microfiltration membranes filter out cell debris, nucleic acids, proteins, and other impurities from E. coli lysate, thereby separating the clarified liquid. Because of microfiltration, membranes play a filtering and separating role in the clarification of E. coli lysate.

Nanofiltration (NF)

Whereas the Nanofiltration (NF) segment is the fastest-growing in the market, as the NF membranes show high efficacy in removing a broad spectrum of pharmaceuticals, particularly high-molecular-weight and charged compounds. Nanofiltration technology is energy-saving and environmentally friendly, so it is increasingly used in various separation, purification, and concentration processes in the pharmaceutical industry.

Why did the Final Product Processing Segment Dominate the Market in 2025?

The final product processing segment is dominant and fastest-growing in tissue regenerative therapy, with approximately 35% share in 2025, as scientific and reasonable advantages of membrane separation technology in the pharmaceutical sector enhance production effectiveness, ensure the progressiveness of healthcare processes, reduce pollution, and promote the pharmaceutical sector's development towards a greener, environmentally friendly, and highly effective direction.

Raw Material Filtration

Whereas the raw material filtration segment is the fastest-growing in the market, as membrane technology plays a significant role in pharmaceutical processes, providing improved product quality, growing efficiency, and cost savings. Membrane filtration increases recovery, lowers chemical use, and provides high water reuse rates.

Why did the Disposable/Single-Use Membranes Segment Dominate the Market in 2025?

The disposable/single-use membranes segment is dominant and fastest growing in the membrane technology in pharmaceutical market with approximately 55% share in 2025, as single-use systems have transformed bioprocessing by offering contamination control, high cost savings, simplified validation, rapid turnaround times, and sustainability advantages. As the biopharmaceutical manufacturing continues to advance, single-use systems remain a significant enabler of flexible and efficient biopharmaceutical manufacturing. By adopting single-use technologies, organizations benefit from simplified operations, rapid turnaround times, and improved process effectiveness.

Why did the Polymeric Membranes Segment Dominate the Market in 2025?

The polymeric membranes segment is dominant in the membrane technology in the pharmaceutical market, with approximately 80% share in 2025, as polymeric membranes perform well in controlled drug delivery technology. They ensure that patients receive the correct pharmaceutical dosage over extended stages by advancing these membranes to release drugs at a predefined rate. Polymer membranes continue to transform pharmaceutics and medicine by allowing safer, more efficient drug delivery and diagnostic technology.

Ceramic Membranes

Whereas the ceramic membranes segment is the fastest-growing in the market, as ceramic membranes are related to various advantages, including outstanding thermal and chemical stability, mechanical strength, fouling resistance, and durability. These characteristics made ceramic membranes more suitable than polymeric membranes, particularly for water treatment applications.

In 2025, North America dominated the membrane technology in the pharmaceutical market with approximately 42% share, as this region has major well-funded Biotech organizations in novel hubs such as Cambridge, San Francisco, Boston, and New York. York, and San Diego. Increasing manufacturing of significant therapeutic products like monoclonal antibodies , vaccines, and recombinant proteins increases the demand for membrane technology in healthcare.

For Instance,

U.S. Market Trends

In the United States, emerging advanced technologies are being used to enhance and adapt their operations. US firms are incorporating machine learning (ML) and Artificial Intelligence (AI) to improve filtration, enabling predictive analytics that forecast membrane entangling and optimize maintenance, lowering downtime in significant sectors. The presence of leading technology providers like Danaher Corporation, Thermo Fisher Scientific, and 3M.

Asia Pacific is expected to see rapid growth in membrane technology in the pharmaceutical market, driven by the growing geriatric population and increasing prevalence of diabetes have growing demand for dialysis, leading to high consumption of medical membranes in hemodialysis. Stricter environmental regulations and quality standards (such as in India and China) are forcing pharmaceutical companies to adopt advanced membrane systems for water treatment and drug purification.

China Market Trends

China's healthcare sectors are facing multiple challenges, counting insufficient innovation and severe pollution. The regulatory environment is significant in approving membrane filtration technologies, predominantly in water treatment, beverage and food, and the healthcare sector. Many studies demonstrated the inadequacy of conventional water treatment processes in eliminating active pharmaceutical ingredients (APIs).

Europe is significantly growing in the membrane technology in pharmaceutical market, due to high spending in R&D and a focus on progressive bioprocessing, including single-use filtration and incessant processing, which increases innovation. The growing manufacturing of biosimilars , and complex molecules by European Contract Development and Manufacturing Organizations (CDMOs) increases demand for specialized membrane technologies.

| Company | Headquarters | Latest Update |

| Merck KGaA | Germany | Merck presents advanced pharma and electronic materials production to Robert Habeck. |

| Sartorius AG | Germany | Sartorius membranes are available in a wide variety of pore sizes, structures, and surface characteristics to serve nearly unlimited selectivity of separation. |

| Danaher Corporation | United States | In May 2025, Danaher entered a partnership with AstraZeneca to scale precision medicine, including developing the next generation of AI-powered. |

| Thermo Fisher Scientific Inc. | United States | In December 2025, Thermo Fisher Scientific Inc., the world leader in serving science, today announced an expansion of its bioprocessing capabilities across Asia, reinforcing its commitment to supporting the region’s rapidly growing biopharmaceutical industry. |

| 3M Company | United States | 3M's immersion in membrane technology for the healthcare sector is defined by the major divestiture of its separation and purification business |

| Repligen Corporation | United States | Repligen acquired Metenova, an important Swedish innovator in magnetic combination technology for biopharmaceutical production. |

By Technology

By Application

By Product Type

By Material

Regional Outlook

February 2026

February 2026

February 2026

February 2026