February 2026

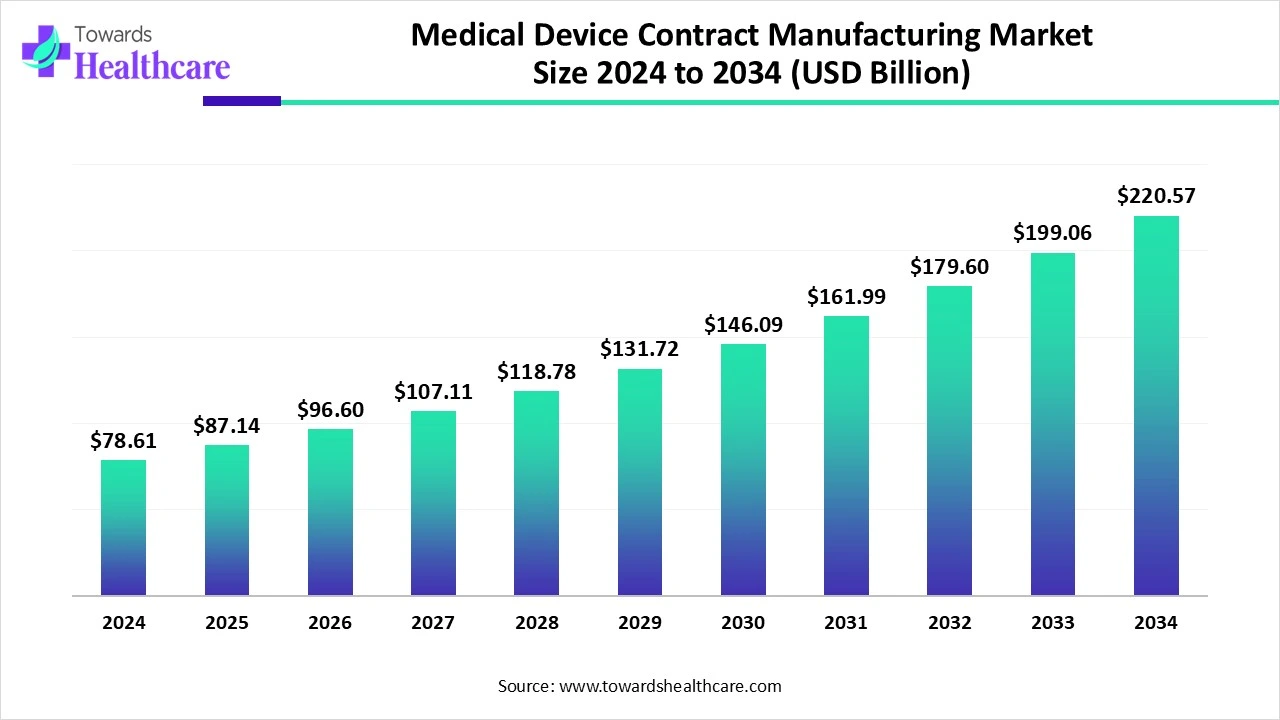

The global medical device contract manufacturing market size is calculated at USD 78.61 billion in 2024, grew to USD 87.14 billion in 2025, and is projected to reach around USD 220.57 billion by 2034. The market is expanding at a CAGR of 10.86% between 2025 and 2034.

The medical device contract manufacturing market is primarily driven by the increasing development of medical devices and stringent regulatory policies. Government organizations support the development of medical devices through funding and policies. Prominent players collaborate to access advanced technologies and expand their services. Integrating artificial intelligence (AI) in medical device contract manufacturing can simplify workflows and enhance efficiency. The future looks promising, with the growth of IVD and single-use microfluidic cartridges and specialist sterile manufacturing capacity.

| Table | Scope |

| Market Size in 2025 | USD 87.14 Billion |

| Projected Market Size in 2034 | USD 220.57 Billion |

| CAGR (2025 - 2034) | 10.86% |

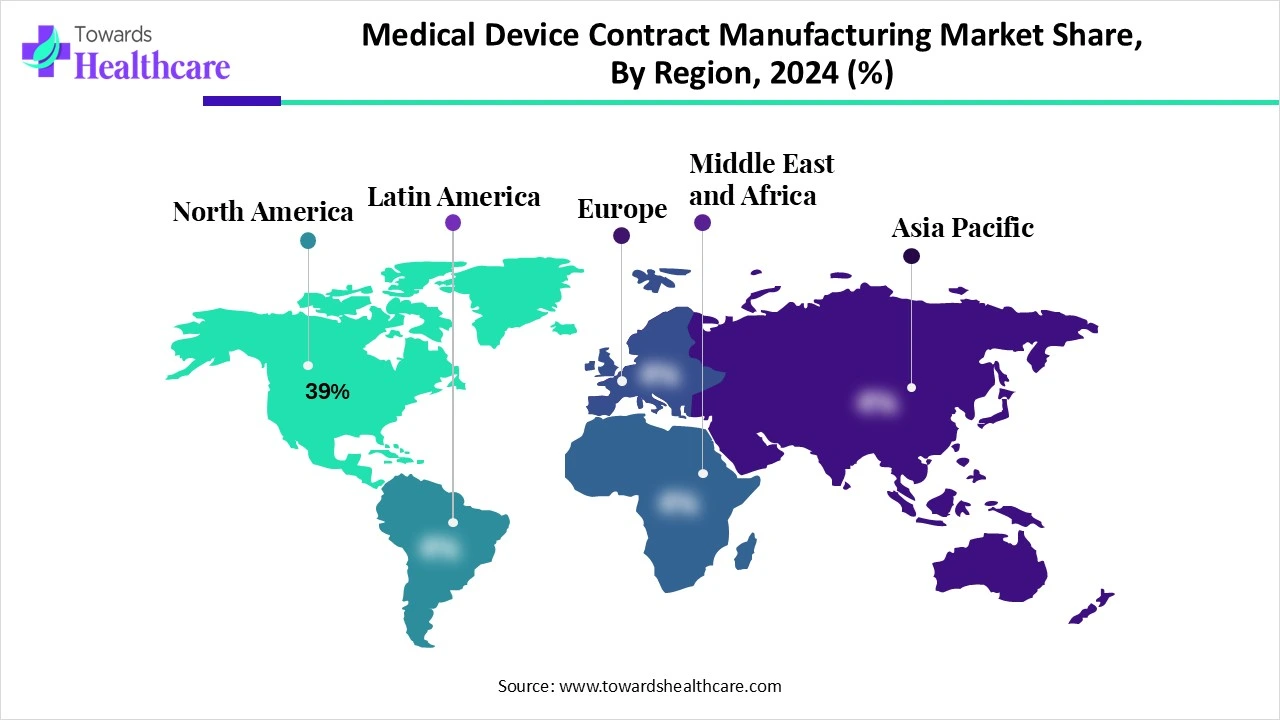

| Leading Region | North America Share 39% |

| Market Segmentation | By Service Type, By Device Type Manufactured, By Manufacturing Capability/Technology, By Engagement Model, By End-User, By Region |

| Top Key Players | Jabil, Flex (Flex Healthcare Solutions), Sanmina Corporation, Plexus Corp., Benchmark Electronics, Celestica, Integer Holdings Corporation, Royal Phillips, Cirtec Medical, Applied Medical, Gerresheimer AG, Sotera Health / Sterigenics / Nelson Labs, WuXi AppTec, ConMed, Aran Biomedical, AptarGroup, Aptuit / Catalent Device Services, B. Braun, MediPharm / Sterling Medical, Kiniksa / Local specialist CMOs & numerous regional precision manufacturers |

The medical device contract manufacturing market covers third-party companies that design, develop, manufacture, assemble, test, package, sterilize, and sometimes supply logistics for medical devices and device components on behalf of OEMs (original equipment manufacturers). Services range from prototyping and precision machining to full turnkey manufacturing (including design for manufacturability, supply-chain management, regulatory support, and sterilization). Contract manufacturing enables medical device OEMs to scale production, reduce capital expenditures, access specialized capabilities (such as micro-machining, polymer molding, electronics, assembly, and sterile high-volume production), and accelerate time-to-market.

AI can revolutionize the medical device contract manufacturing market by introducing automation in medical device manufacturing and simplifying the tasks of manufacturers. It enhances the efficiency, precision, and reproducibility of medical device manufacturing. AI-enabled manufacturing improves visibility into key manufacturing processes, uncovering opportunities for improvement. It also significantly reduces operational costs. AI-based predictive analytics detect potential errors in manufacturing, allowing manufacturers to make proactive decisions. Connected manufacturing involves the integration of cloud computing, the Internet of Things (IoT), and real-time communication devices.

Increasing Market Competition

The major growth factor for the medical device contract manufacturing market is the increasing market competition. The rising number of pharma and biotech startups creates competition among market players. This potentiates the demand for developing innovative medical devices. OEMs collaborate with contract manufacturing organizations (CMOs) and contract development manufacturing organizations (CDMOs) to expedite the development of medical devices. This enables them to focus on product sales and marketing, strengthening their market position.

Supply Chain Disruptions

OEMs face supply chain disruptions due to rapidly evolving regulatory policies, geographical barriers, and certain geopolitical issues. All these challenges reduce the global supply of medical devices, thereby significantly impacting the demand-to-supply ratio.

Demand for Innovative Medical Devices

The future of the medical device contract manufacturing market is promising, driven by the growing demand for innovative medical devices. AI/ML-based medical devices are in high demand due to their improved functionality and enhanced precision. The affordability and accessibility of such devices also increase their demand. As of July 2025, the U.S. Food and Drug Administration (FDA) has approved a total of 1,247 AI/ML-based medical devices. (Source: FDA) The rising demand for electronics/connected device manufacturing also presents future opportunities for market players.

By service type, the contract manufacturing–turnkey (end-to-end) segment held a dominant presence in the medical device contract manufacturing market in 2024. This is due to the reduced error rate and increased output through end-to-end manufacturing. Contract manufacturers have complete control over the process, from raw material sourcing to shipping. This saves a lot of time for manufacturers and accelerates the overall manufacturing process. End-to-end manufacturing increases scalability, allowing creators to modify the output as needed.

By service type, the precision components & subassemblies segment is expected to grow at the fastest CAGR in the market during the forecast period. Surgical instruments, such as catheters, stent delivery systems, and sensor delivery systems, require specialized instruments and machines for their manufacturing. Contract manufacturers offer flexibility and speed to produce novel components and subassemblies. This eliminates the need for OEMs to install specialized equipment, saving costs.

By device type manufactured, the disposable single-use devices & consumables segment held the largest revenue share of the medical device contract manufacturing market in 2024. The demand for single-use devices & consumables is increasing due to reduced risk for infection and environmental sustainability. The rising prevalence of hospital-associated infections (HAIs) necessitates healthcare professionals to use disposable devices. The Centers for Disease Control and Prevention (CDC) reported that around 1 in 31 U.S. patients are affected by HAIs.

By device type manufactured, the diagnostic devices & IVD kits segment is expected to grow with the highest CAGR in the medical device contract manufacturing market during the studied years. Government organizations launch initiatives and create awareness about screening and early disease diagnosis. This promotes the demand for diagnostic devices and IVD kits. The advent of point-of-care diagnostics enables patients to quickly diagnose their condition with high precision. PoC diagnostics eliminate the need for patients to visit diagnostic laboratories or other healthcare organizations.

By manufacturing capability/technology, the injection molding & thermoplastic processing segment contributed the biggest revenue share of the medical device contract manufacturing market in 2024. Injection molding & thermoplastic processing are the most conventional manufacturing methods for medical devices. It involves melting thermoplastic materials and transferring them into molds to form the desired shape. This process is very cost-effective and does not require special training to operate the injection molding technique.

By manufacturing capability/technology, the electronics & PCB assembly segment is expected to expand rapidly in the market in the coming years. The growing demand for advanced medical devices embedded with sensors and electronics augments the segment’s growth. Manufacturing connected devices requires specific equipment and expertise. Hence, OEMs outsource their manufacturing services to contract manufacturers, enabling the development of novel connected devices.

By engagement model, the turnkey/full manufacturing partnerships segment accounted for the highest revenue share of the medical device contract manufacturing market in 2024. The segmental growth is attributed to complete involvement in the entire manufacturing process and faster product development. CDMOs have skilled professionals to provide relevant expertise and solutions to complex manufacturing problems. Turnkey manufacturing enables companies to reduce manufacturing costs by allowing for a single point of contact.

By engagement model, the long-term strategic outsourcing segment is expected to show the fastest growth over the forecast period. Outsourcing specific services and processes benefits both companies and contract manufacturers. This helps OEMs to achieve desired outcomes that align with business goals. Strategic outsourcing also allows companies to focus on core competencies, such as design, marketing, and retail operations.

By end-user, the large medical device OEMs segment led the medical device contract manufacturing market in 2024. Large companies conduct multiple operations and develop numerous medical devices simultaneously. Thus, they prefer outsourcing their medical device manufacturing to focus on core competencies. This enables them to develop more innovative devices and improve their sales and marketing. CDMOs can rapidly expand their capabilities and deliver technically advanced services at scale. This enables large companies to expand and improve their product portfolio.

By end-user, the emerging medtech startups segment is expected to witness the fastest growth in the market over the forecast period. Medtech startups lack suitable manufacturing infrastructure, necessitating the need for CDMOs and CMOs. The increasing number of medtech startups and the rising venture capital investments propel the segment’s growth. According to the Pulse of the MedTech Industry report 2024, the medtech sector achieved at least 4% revenue growth in each of the past 8 years.

North America dominated the medical device contract manufacturing market share by 39% in 2024. The availability of state-of-the-art infrastructure, the presence of key players, and the high demand for precision manufacturing are the major growth factors of the market in North America. The region is home to a large installed base of medtech OEMs and has an advanced regulatory environment. The increasing number of new product launches favors increasing manufacturing activities, promoting market growth.

As of 2024, there were 952 medical device manufacturing companies in the U.S., an increase of 2.3% from 2023. Key players, such as Flex Healthcare Solutions, Plexus Corp., and Cirtec Medical, are the major contributors to the market in the U.S. The FDA regulates the approval of medical devices in the U.S. In 2024, a total of 33 novel medical devices were approved by the FDA.

Canada is home to 692 medical device companies, of which 303 companies have collectively raised $2.89 billion in venture capital and private equity. Canada exported 73% of its medical devices to the U.S., worth CAN$4.08 billion. The other three leading destinations for export were Germany (3%), the UK (2%), and Belgium (2%).

Asia-Pacific is expected to host the fastest-growing medical device contract manufacturing market in the coming years. The increasing number of medtech startups and venture capital investments potentiate market growth. Countries like China, India, Vietnam, and Southeast Asia focus on capacity expansion to develop more medical devices, owing to the increasing demand. Government organizations encourage the indigenous manufacturing of medical devices, fostering market growth.

There are a total of 1,104 medical device startups in China. The 14th Five-Year plan (2021-2025) proposed that mainstream medical equipment should be effectively supplied, as well as product performance and quality must be improved. The federal government has also encouraged incentives for foreign manufacturers.

The Indian medical device sector ranks fourth in Asia. The Indian government launched the “Make in India” and “Atmanirbhar Bharat Abhiyaan” policies to encourage indigenous manufacturing of medical devices. The Production Linked Incentive (PLI) scheme promotes domestic manufacturing of medical devices and has a total budget of INR 3,420 crores. The incentives are offered from FY2020-21 to FY2025-26.

Europe is considered to be a significantly growing area in the medical device contract manufacturing market in the foreseeable future. The burgeoning medtech sector and favorable government support bolster market growth. Favorable trade policies encourage local manufacturers to manufacture medical devices. The increasing investment and collaborations among key players also contribute to market growth. The rising prevalence of chronic disorders and the growing geriatric population potentiate the demand for medical devices.

Germany was the second-largest exporter of medical devices globally after the U.S. It exported $18.4 billion of medical instruments in 2023, primarily to the U.S., China, the Netherlands, France, and Italy. Germany was also the third-largest importer of medical instruments in the world after the U.S. and the Netherlands.

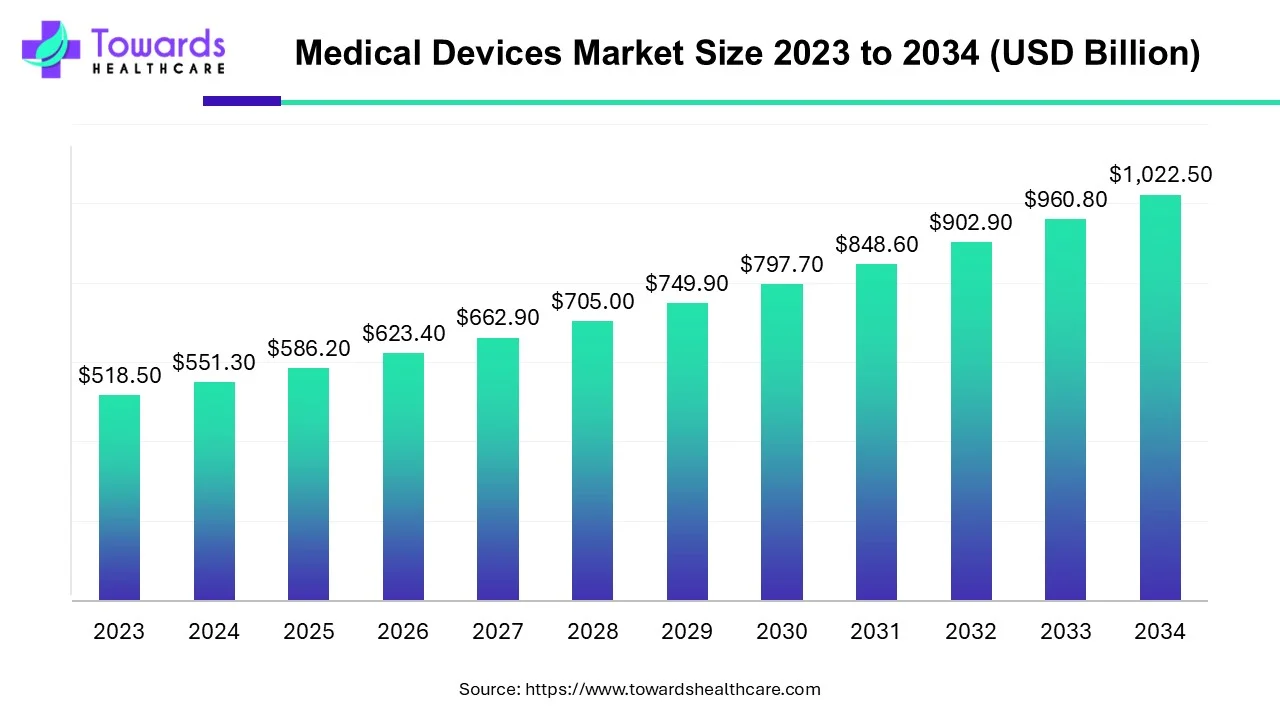

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

Alex Wallstein, CEO of Quasar Medical, commented on the acquisition of Nordson’s design and development contract manufacturing businesses that the company is now positioned to deliver fully integrated interventional solutions from concept to scale-up finished device, adding significant capacity in Ireland and Mexico to its well-established Asian footprint, thereby diversifying Quasar into a global CDMO partner.

By Service Type

By Device Type Manufactured

By Manufacturing Capability/Technology

By Engagement Model

By End-User

By Region

February 2026

February 2026

February 2026

February 2026