February 2026

The contract GMP manufacturing market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2026 to 2035. This growth is driven by emerging trends and strong demand across key sectors.

The contract GMP manufacturing market is experiencing robust growth, driven by increasing research and development activities, growing investments by government and private bodies, and technological advancements. Contract manufacturing organizations (CMOs) possess suitable facilities and specialized equipment for conducting pharmaceutical manufacturing. The growing demand for personalized medicines and innovative medical devices also contributes to market growth.

The contract GMP manufacturing market refers to providing manufacturing services to pharmaceutical and biotechnology companies for their proprietary products. Companies must comply with Good Manufacturing Practices (GMP) guidelines to maintain product quality, security, and effectiveness throughout the manufacturing process. Contract development and manufacturing organizations (CDMOs) and CMOs provide GMP manufacturing services for APIs , key intermediates, and other commercial pharmaceutical products to ensure that products fulfill GMP requirements.

By leveraging artificial intelligence (AI) in contract manufacturing, manufacturers can streamline the process and develop high-quality products with high efficiency and reproducibility. AI and machine learning (ML) algorithms can analyze vast amounts of data and perform a wide range of functions, from intelligent process optimization to predictive maintenance. They can allow manufacturers to estimate material requirements, avoid shortages, and reduce risks. They can bolster regulatory compliance and reduce manual errors.

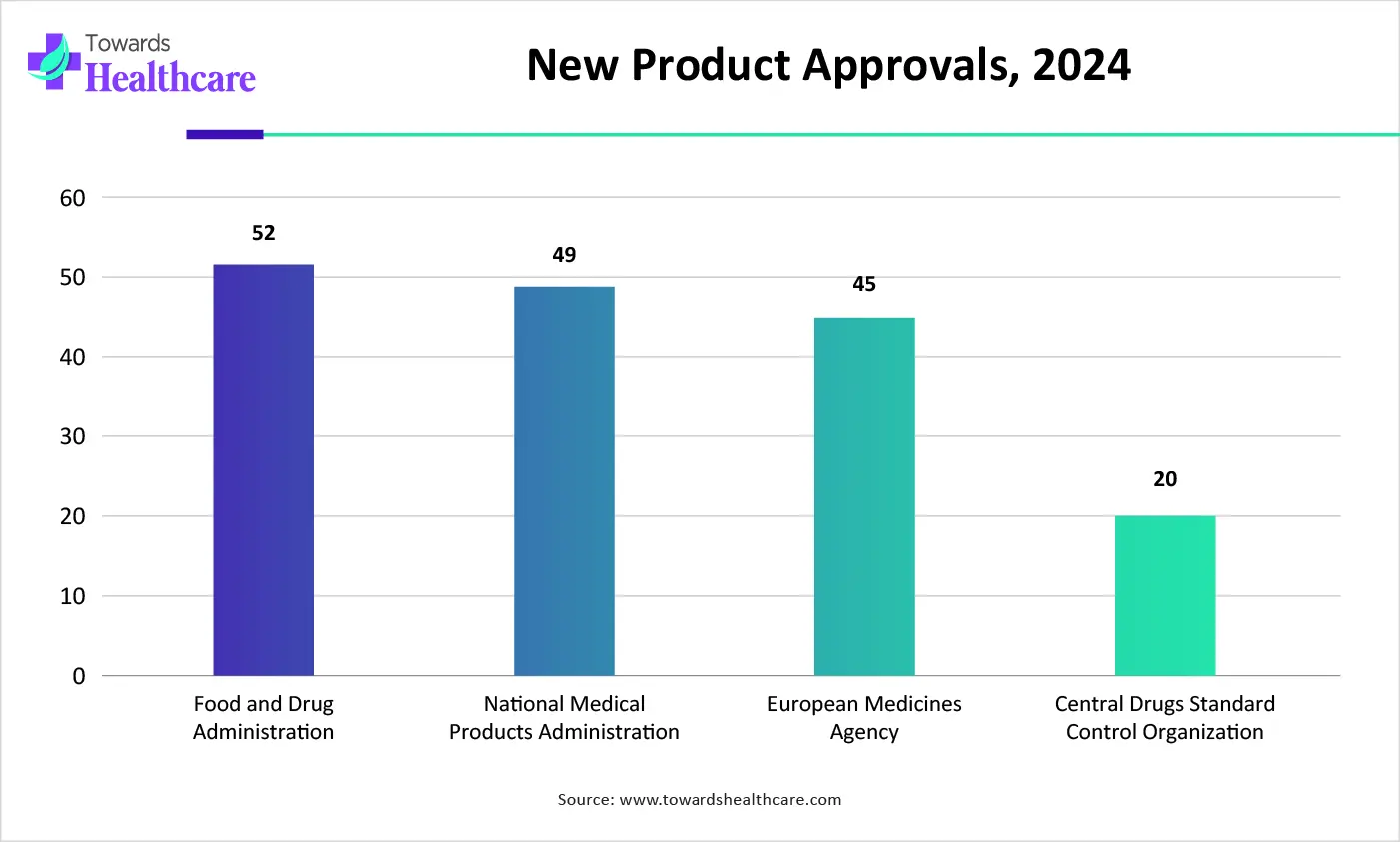

| Regulatory Agencies | New Product Approvals (2024) |

| Food and Drug Administration | 52 |

| National Medical Products Administration | 49 |

| European Medicines Agency | 45 |

| Central Drugs Standard Control Organization | 20 |

Which Therapy/Product Type Segment Dominated the Contract GMP Manufacturing Market?

The small molecules segment held a dominant position in the market in 2025, due to the demand for small molecules as therapeutics. Small molecules are in high demand due to their faster absorption, lower production costs, and easy customization. They have provided medical breakthroughs for human diseases for over a century. They are comparatively cost-effective and eliminate the need for a complex manufacturing facility. The DrugBank database has a record of around 15,480 small molecules.

Biologics

The biologics segment is expected to grow at the fastest CAGR in the market during the forecast period. Biologics offer superior benefits over small molecules, such as targeted therapy and fewer side effects. They require specialized equipment and infrastructure to manufacture complex therapeutics, necessitating biotech companies to collaborate with CDMOs/CMOs. They can target the immune system that is not functioning properly and prevent it from causing inflammation.

How the Pharmaceutical Companies Segment Dominated the Contract GMP Manufacturing Market?

The pharmaceutical companies segment held the largest revenue share of the market in 2025, due to the increasing development of small molecules for a wide range of diseases. Pharmaceutical companies rely on chemical and synthetic processes for producing small molecules. The growing number of pharma startups also boosts the segment’s growth. Pharma startups collaborate with major firms to get products to market faster and gain access to large markets.

Biotechnology Companies

The biotechnology companies segment is expected to grow with the highest CAGR in the market during the studied years. Biotech firms develop medicines or biologics from natural sources. The increasing development of precision medicines potentiates the segment’s growth. Biotech companies can enjoy longer patent protections compared to pharmaceuticals, offering potential marketplace advantages. They collaborate with CDMOs/CMOs to fulfill the unmet medical needs of patients with rare and genetic disorders.

Why Did the cGMP (Pharmaceutical Grade) Segment Dominate the Contract GMP Manufacturing Market?

The cGMP (pharmaceutical grade) segment contributed the biggest revenue share of the market in 2025, due to stringent guidelines for the proper design, monitoring, and control of manufacturing processes and facilities. cGMP guidelines are universal regulations that are complied with by companies across diverse geographical locations. This enables companies to export their products anywhere in the world, without making any significant changes in manufacturing operations.

Specialized Regulatory Certifications

The specialized regulatory certifications segment is expected to expand rapidly in the market in the coming years. Every country releases specific manufacturing guidelines for companies based on the climate of that region. By complying with such regulatory conditions, pharma & biotech companies can distribute their products within that particular region or country. Companies can avoid unnecessary legal issues, foster healthy competition, gain better branding, and reduce risk.

North America dominated the global market in 2025. The presence of key players, the availability of a robust manufacturing infrastructure, and favorable regulatory support are factors that govern market growth in North America. Government organizations provide funding and launch initiatives to support the manufacturing of medicinal products and adopt advanced tools. North American countries have a strong presence of biopharmaceutical companies.

The U.S. is home to over 5,000 pharmaceutical companies and over 3,000 biotechnology companies. The Food and Drug Administration (FDA) provides stringent regulations and guidelines for manufacturing high-quality pharmaceutical products. There are around 210 CDMOs in the U.S. Numerous private companies, such as Boehringer Ingelheim, Johnson & Johnson, and Novartis, announced investments in the U.S. to boost the local manufacture, spanning manufacturing and R&D.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The increasing number of pharma and biotech startups, the burgeoning biopharma sector, and venture capital investments propel the market. Countries like China, India, Japan, and South Korea have a suitable manufacturing infrastructure and an affordable workforce, motivating foreign companies to set up their facilities in the region. Government bodies launch initiatives like “Made in China” and “Atmanirbhar Bharat” to promote the indigenous manufacturing of healthcare products.

The Chinese government established a new procurement policy to introduce a 20% price evaluation advantage for qualifying domestic products and set clearer standards. China has more than 10,000 pharmaceutical industrial enterprises, and the country’s ability to ensure medical supplies has improved. The pharmaceutical industry’s investment in R&D is booming, with annual average R&D expenditure exceeding 20% over the past three years.

Europe is expected to grow at a considerable CAGR in the upcoming period. Favorable government support, growing research activities, and the rising adoption of advanced technologies propel the market. Manufacturers in the European region need to adhere to stringent EU GMP guidelines to ensure that products are of high quality and are appropriate for their intended use. People are becoming increasingly aware of personalized medicines owing to rapidly changing demographics and the growing geriatric population.

ILS Group, Northway Biotech, and Crystal Pharmatech are some companies that provide CDMO services in the UK. According to a recent study, nearly two-thirds of UK adults believe that access to both standard and personalized medicine is essential, as GP-prescribed medicines fail to meet their health needs. In addition, the UK aims to become a leading life sciences economy in Europe, and the third largest in the world after the U.S. and China.

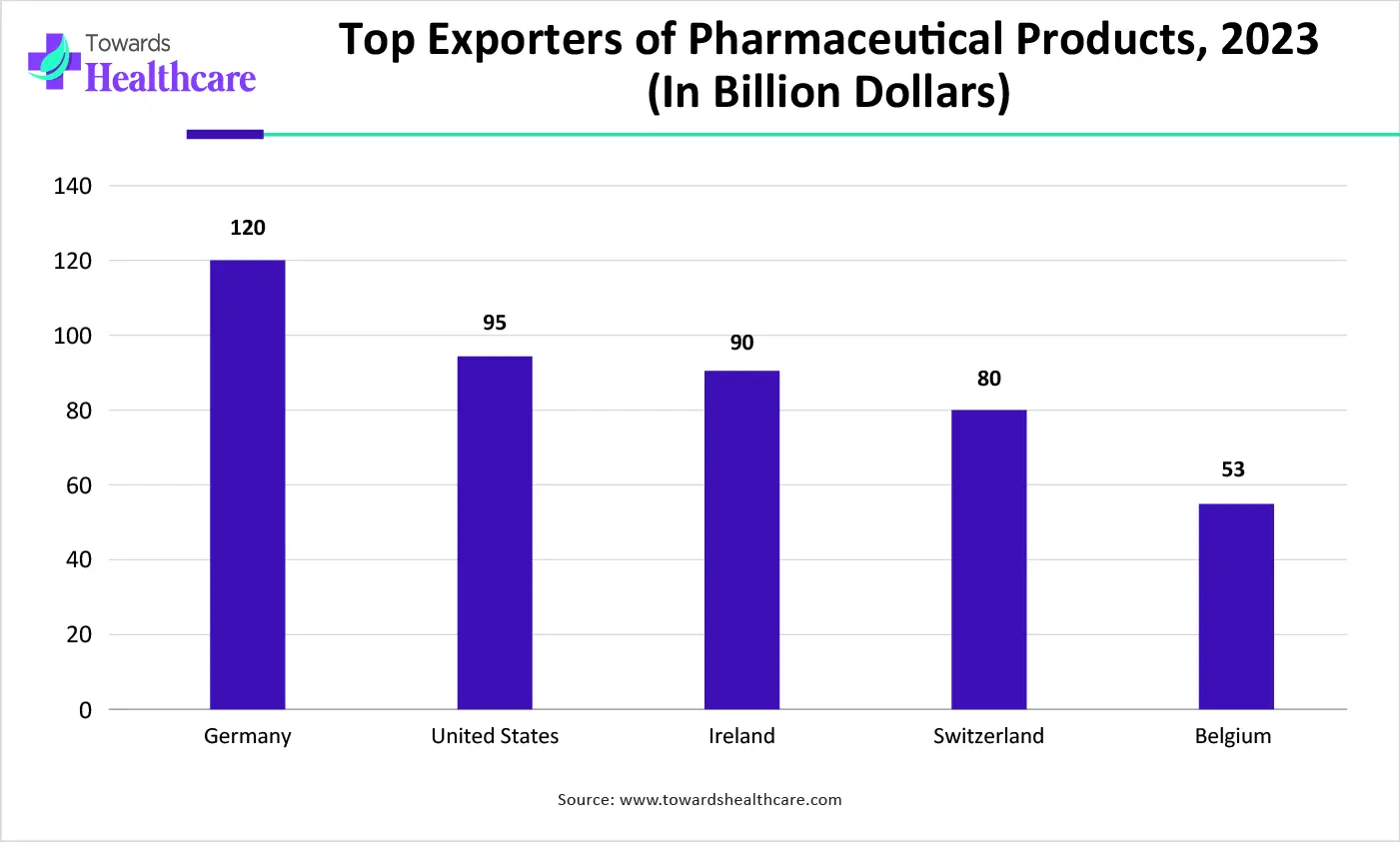

| Countries | Total Exports, 2023 (in billion dollars) |

| Germany | 120 |

| United States | 95 |

| Ireland | 90 |

| Switzerland | 80 |

| Belgium | 53 |

| Companies | Headquarters | Offerings | Revenue (2024) |

| Eli Lilly and Company | Indiana, United States | It specializes in developing medicines for various disorders, such as diabetes, neurodegenerative diseases, cardiometabolic diseases, and obesity. | $45.04 billion |

| Novartis AG | Basel, Switzerland | Its cGMP manufacturing sites are located across Europe, the U.S., and Asia to create high-end solutions efficiently and at scale. | $50.32 billion |

| Curia | New York, United States | It is a global CDMO with over 30 years of experience, producing small molecules, generic APIs, and sterile drug products & biologics. | - |

| AbbVie, Inc. | Illinois, United States | AbbVie leverages decades of scientific expertise, operational excellence, and best-in-class facilities for clinical and commercial manufacturing of small & large molecules. | $15.102 billion |

| AGC Biologics | Washington, United States | The company provides development and manufacturing services for protein-based biologics and advanced therapies. | JPY 20.67 trillion |

| Samsung Biologics | Incheon, South Korea | The global CDMO company provides end-to-end biologics development, cGMP manufacturing, and aseptic fill/finish services for biopharmaceuticals. | KRW 4.55 trillion |

| Lianhe Aigen Pharma Co., Ltd. | Shanghai, China | The company provides tailored pharmaceutical manufacturing services to global companies. | - |

| WuXi Biologics | Jiangsu, China | It offers a global dual source manufacturing network that employs multiple large-scale drug substance GMP manufacturing facilities. | RMB 18.67 billion |

| Porton Pharma Solutions | Chongqing, China | It offers manufacturing services for numerous products, including small molecules, tides, biologics & conjugates, and advanced therapy medicinal products. | - |

| Hillgene Biopharma | Suzhou, China | It provides full-service CDMO solutions for CAR-T, CAR-NK, and TCR-T therapies, from research to GMP manufacturing. | - |

By Therapy/Product Type

By End-Use

By Regulatory Compliance

By Region

February 2026

January 2026

February 2026

December 2025