February 2026

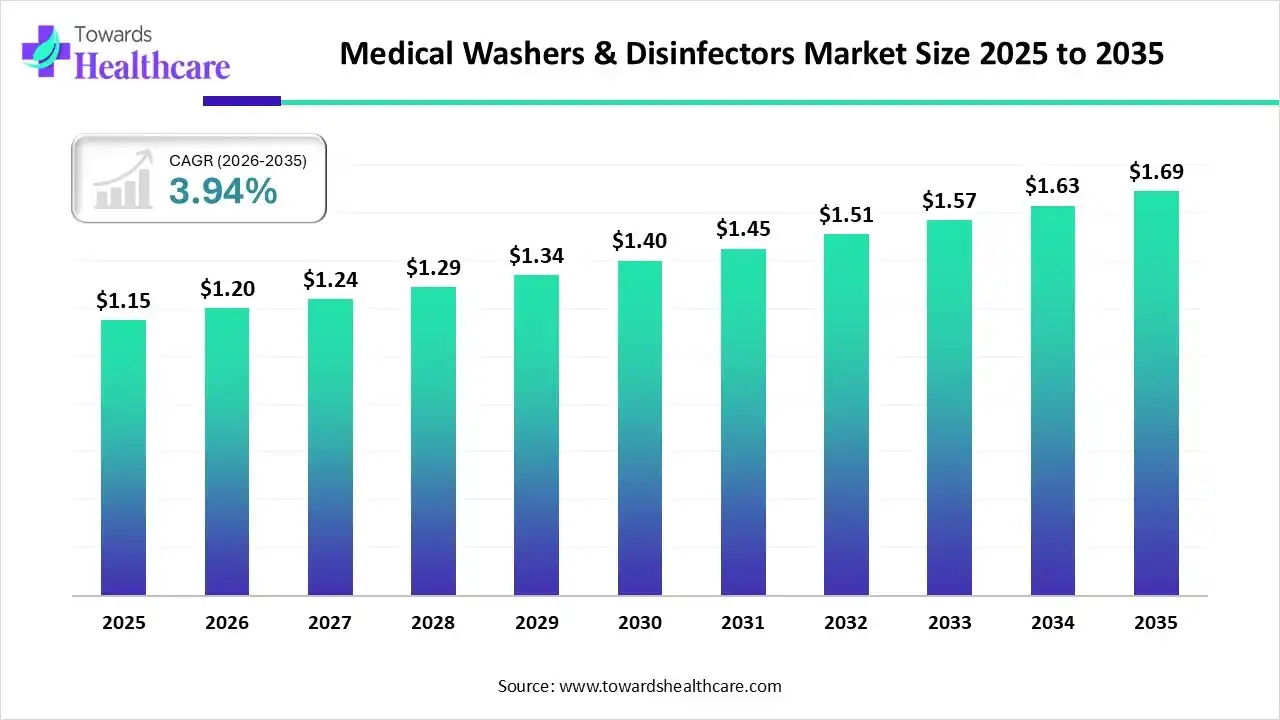

The global medical washers & disinfectors market size was estimated at USD 1.15 billion in 2025 and is predicted to increase from USD 1.20 billion in 2026 to approximately USD 1.69 billion by 2035, expanding at a CAGR of 3.94% from 2026 to 2035.

The globally rising large volume of surgeries, and also growing cases of hospital-acquired infections, are bolstering the development of innovative and more sophisticated medical washers & disinfectors. Moreover, researchers and leading players are putting efforts into progressing integrated solutions by using AI algorithms in cleaning and sterilization. Most of the countries are focusing on infection control, reduced reprocessing times, and boosted results and safety by following strict regulations.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.20 Billion |

| Projected Market Size in 2035 | USD 1.69 Billion |

| CAGR (2026 - 2035) | 3.94% |

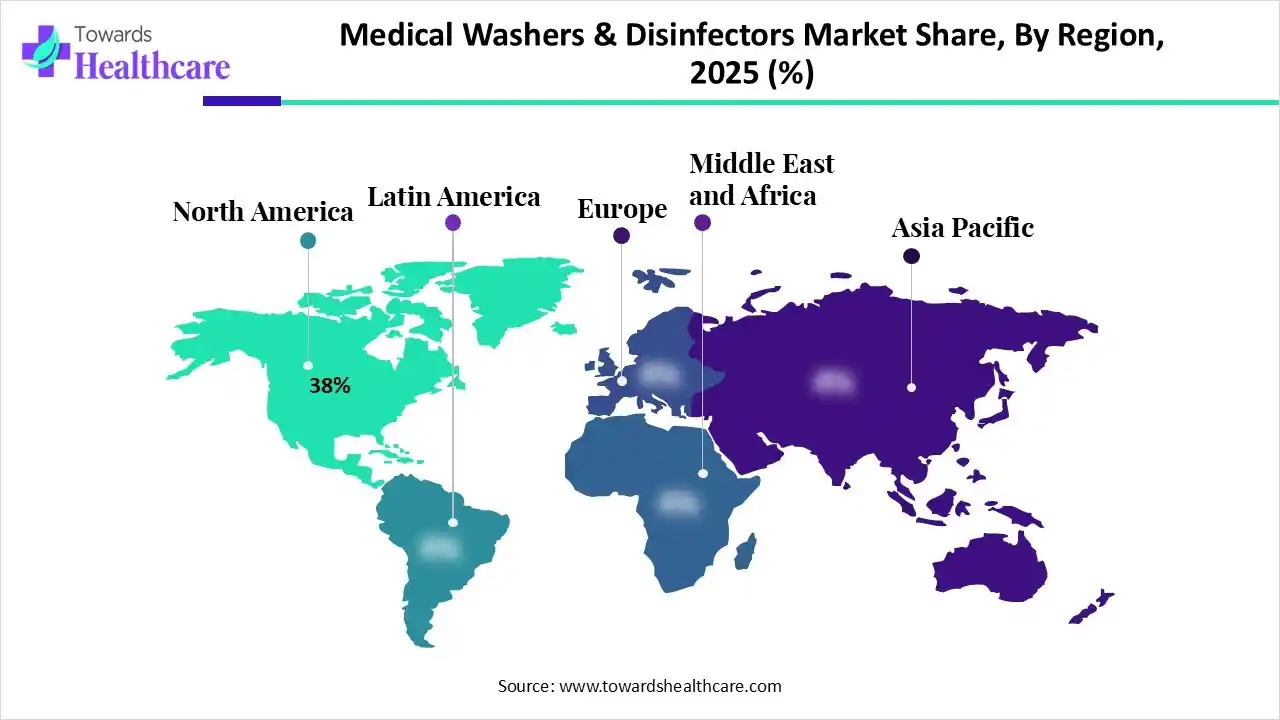

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Technology, By End-Use Setting, By Service & Support, By Distribution Channel, By Region |

| Top Key Players | STERIS, Getinge, Olympus, Miele Professional, Tuttnauer, Shivna Medical, Belimed, Smeg Instruments, Medisafe, Nordson |

The global medical washers & disinfectors market comprises automated cleaning and disinfection equipment used in hospitals, surgical centres, laboratories, and other healthcare facilities to clean, decontaminate, and disinfect medical instruments, surgical trays, endoscopes, and reusable medical devices. These systems ensure infection control, reduce manual handling, provide standardized reprocessing, and support regulatory hygiene standards. The market includes instrument washers, endoscope disinfectors, ultrasonic washers, tunnel wash systems, and integrated washer-disinfector solutions.

Currently, continuous technological breakthroughs in the respective area are fueled by the wider adoption of AI-driven systems in the analysis of operational data to fine-tune and enhance washing and disinfection cycles based on the particular kind of instrument and contamination level. Moreover, the leading players are fostering well-development in the integration of AI with robotics, which is leveraging automated loading and unloading systems. Specifically, manufacturers, like Olympus, have introduced novel AI-enabled washer-disinfectors mainly for complex and delicate instruments, including endoscopes.

This prominently encompasses IoT integration, which provides real-time monitoring of cycles, temperature, chemicals, and digital documentation for compliance.

For water and energy conservation, the market is emphasising closed-loop recycling and minimal consumption technologies, utilising biodegradable detergents and chemical-free ultrasonic/steam options.

Scientists are widely stepping towards the development of sophisticated enzymatic detergents for excellent breaking down of stubborn organic matter and evolving antimicrobial nano-coatings for instruments to prevent bacterial adherence.

The market is pushing the combination of various approaches, such as ultrasonic cleaning and chemical or UV-C sterilization for ensuring complete cleaning in hard-to-reach areas of surgical tools.

Which Product Type Led the Medical Washers & Disinfectors Market in 2025?

In 2025, the instrument washers segment captured nearly 42% share of the market. A key catalyst is a rise in the number of surgical volumes, particularly endoscopic procedures for chronic diseases, which escalates demand for robust washer-disinfectors. Whereas, recently SHINVA expanded its various "smart" automatic washer-disinfectors, which allow easy programming and tracking of the complete cleaning process, with personalised stages for specific instrument kinds.

Endoscope Washers & High-Level Disinfectors (HLD)

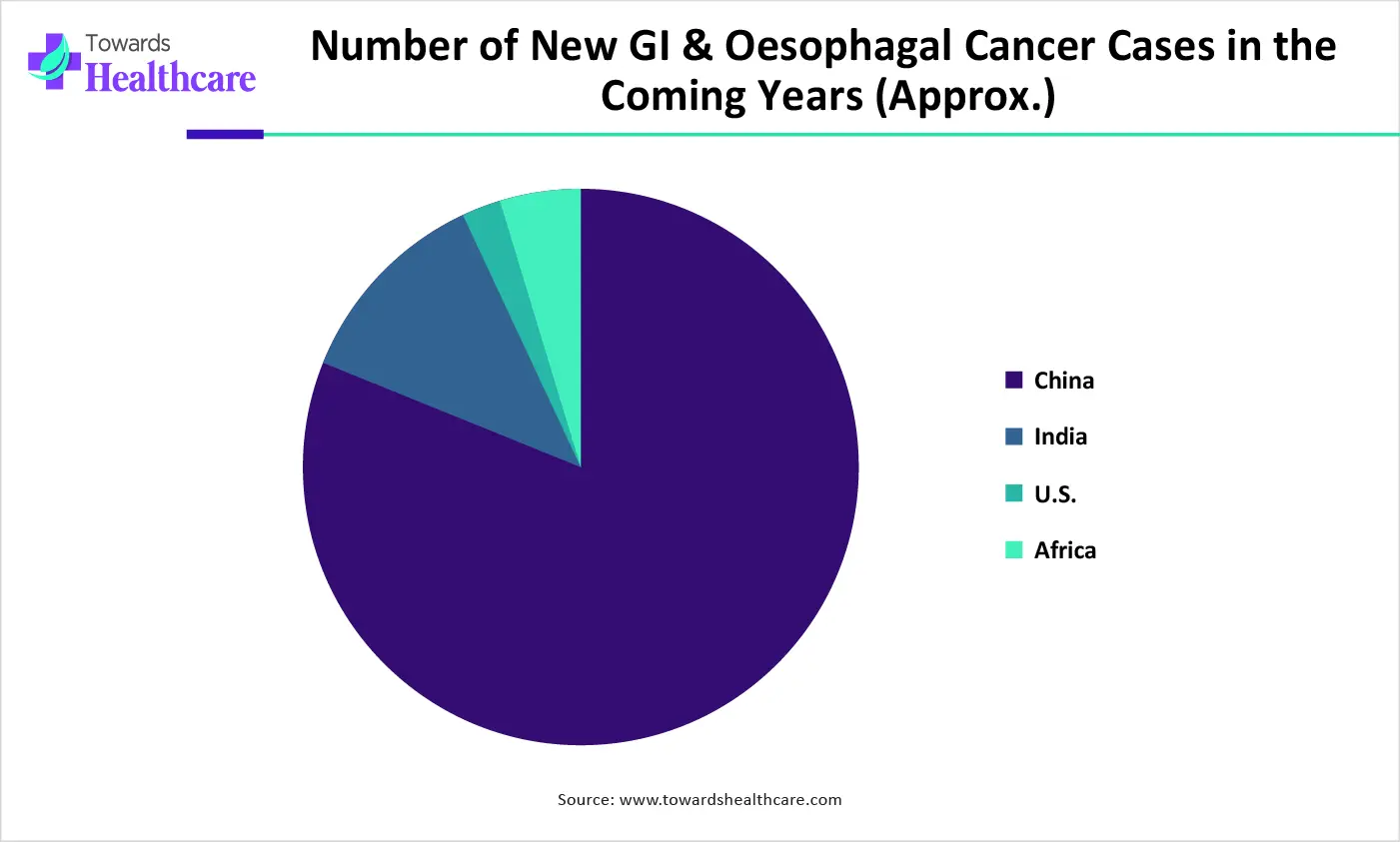

Moreover, the endoscope washers & high-level disinfectors (HLD) segment will expand at approximately 12–14% CAGR. Primarily, increasing cases of gastrointestinal cancers, respiratory concerns, and urological disorders are demanding diagnostic and therapeutic endoscopic procedures, which further encourage rapid, effective, and safe reprocessing of reusable endoscopes to meet daily turnover demands. Recently, Nanosonics CORIS received FDA approval, which is an automated cleaning system and mainly targets the complex channels of flexible endoscopes using micro-bristle technology.

How did the Automated Washer-Disinfectors Segment Dominate the Market in 2025?

By capturing nearly 60% share, the automated washer-disinfectors segment led the medical washers & disinfectors market in 2025. A prominent benefit of automation is that it lowers labor, reduced error, ensures consistent results, and also minimises long-term operational expenditures. However, in the last year, Getinge unveiled the Aquadis Index, a multi-chamber washer-disinfector created for central sterile supply departments (CSSDs) to boost throughput and lower utility consumption.

Integrated Cleaning & Sterilization Solutions

The integrated cleaning & sterilization solutions segment will expand at an approxiamte13–15% CAGR. Nowadays, diverse government bodies and international organisations (like the FDA, CDC, and ISO) are enforcing guidelines for the reprocessing of medical devices, for which these solutions offer automated documentation and cycle tracking, to support healthcare facilities in ensuring compliance and passing audits. Innovations comprise mobile units and integrated HVAC solutions, which facilitate chemical-free disinfection of air and surfaces. Finsen Tech launched its newest UVC disinfection robot, THOR UVC.

Which End-Use Setting Dominated the Medical Washers & Disinfectors Market in 2025?

The hospitals segment led with approximately 50% of the market in 2025. Drivers are a growing infection control need (HAIs), rising surgeries, and demand for automated, consistent cleaning. They are mainly used to automate cleaning and disinfection of surgical tools, anesthesia equipment, bedpans, carts, and containers, ensuring infection control standards, by incorporating STERIS, Famed, and systems for specialised items, such as Da Vinci robots, which manage from basic items to complex instruments for safety against hospital-acquired infections.

Ambulatory Surgical Centers (ASCs)

The ambulatory surgical centers (ASCs) segment is predicted to expand at approximately 11–13% CAGR. These facilities are increasingly using AI/IoT integration, sustainable designs, compact/modular units for space-constrained ASCs, high-throughput multi-chamber systems, and touchless operation. Recently developed Olympus ETD is an extensive example of endoscope washer disinfectors established to accelerate usability in facilities, especially in ASCs.

Why did the Installation & Commissioning Segment Lead the Market in 2025?

The installation & commissioning segment captured nearly 45% share of the medical washers & disinfectors market in 2025. Expansion of hospitals, ambulatory surgical centers (ASCs), and central sterile supply departments (CSSDs) around the globe, mainly in developing economies, is demanding innovative equipment installation and commissioning. This specifically follows robust operational qualification (OQ) and performance qualification (PQ) tests for the verification that the system persistently meets specified cleaning and disinfection parameters.

Remote Diagnostics & Service Contracts

The remote diagnostics & service contracts segment will grow at an approximate 16–19% CAGR. Firstly, remote diagnostics are offering automatic cycle tracking and digital reporting, with an immutable audit trail, which is required for regulatory compliance and lowering legal risk. These kinds of services facilitate long-term spending savings by increasing equipment lifecycles, reducing repair expenditures, and minimising hospital readmissions related to infections.

Which Distribution Channel Led the Medical Washers & Disinfectors Market in 2025?

With approximately 50% share, the direct OEM sales segment dominated the market in 2025. They possess increased control over the customer relationship, service quality, and compliance with strict regulations. Also, they can provide integration of automated conveyor systems, electronic health records (EHR), and central sterile supply department (CSSD) software with other hospital infrastructure. Whereas, selling directly offers OEMs quick feedback and data on product performance and customer requirements.

E-Procurement/Online Channels

The e-procurement/online channels segment is estimated to grow at a nearly 14–17% CAGR. Specifically, government and public-sector healthcare organizations, including AIIMS in India, are mandating the application of centralized online portals for tendering and bidding processes to ensure transparency and competitive pricing. Recently, the UK's NHS Supply Chain eDirect route has adopted an inherent, e-commerce-style user experience, which enables clinicians and administrators to easily order supplies from a centralized digital catalogue.

In 2025, with a nearly 38% share, North America dominated the market due to the stricter infection control requirements, complex surgeries, accelerating Hospital Acquired Infections (HAIs), and stringent regulatory standards, especially JCAHO/Accreditation Canada. The regional market is focusing on progressing specialised cleaning, such as CS Medical's Ethos automated ultrasound probe cleaner/disinfector, which meets unique needs.

In the U.S., the medical washers & disinfectors market is driven by attractive efforts, such as the Society for Healthcare Epidemiology of America (SHEA), which collaborated with eight partner organisations and launched novel comprehensive guidance. This further supports health care facilities in preventing the transmission of infections through optimised practices in sterilisation and high-level disinfection (HLD) of reusable medical devices.

In the medical washers & disinfectors market, the Asia Pacific will expand rapidly at approximately 14–17% CAGR, with a rise in awareness and stricter regulations, which fosters hospitals to adopt automated cleaning for patient safety. Alongside, in the last few days, the Korea Institute of Machinery and Materials (KIMM) allied with the local company VITALS Co., and created an on-site, high-temperature and high-pressure steam medical waste sterilization system.

However, in 2025, China’s NMPA described a revised version of the Good Manufacturing Practice (GMP) for medical devices, which will take effect in November 2026. This encompasses combined Chinese standards with international quality management system (QMS) principles and focuses on lifecycle-based risk management and digital innovation, compelling hospitals to advance their equipment.

With a lucrative growth, Europe will bolster in the medical washers & disinfectors market, with rising volume of surgeries, like general, robotic, endoscopic, and increasing shift towards automation, AI, specialized cycles, and instrument-specific racks for complex, delicate tools used in modern surgery. Along with this, hospitals in the NHS (UK), France, and Germany are preferring smart, automated systems for reducing HAIs.

Germany is experiencing a huge need for seamless, multi-chamber machines for managing various instruments (endoscopes, implants) effectively, with lowered reprocessing times. For this, many leading German-focused or global firms are involved, such as Miele, Getinge, Steelco, and MMM Group, to promote innovation, compliance, and smart solutions.

| Comapny | Description |

| STERIS | This mainly facilitates a variety of single & multi-chamber washer/disinfector, large ultrasonic cleaners, cart washers, and decontamination sinks. |

| Getinge | It unveiled various models, such as Getinge 86-series, Getinge 46-series, Getinge 9100-series, etc. |

| Olympus | A company usually leverages a comprehensive portfolio of medical automated endoscope reprocessors (AERs). |

| Miele Professional | This provides different medical washer-disinfectors for several clinical settings, like hospitals, clinics, dental practices, and laboratories. |

| Tuttnauer | It explores the TIVA series of medical washer-disinfectors, offering rapid, flexible, and automated solutions for cleaning, disinfecting, and drying instruments. |

| Shivna Medical | A company specialises in automatic flexible endoscope washer-disinfectors. |

| Belimed | It introduced high-capacity WD 290 IQ, space-saving WD 200, large-scale WD 750, and specialised Endoscope AERs. |

| Smeg Instruments | This specifically facilitates advanced, made in Italy medical washer-disinfectors for hospitals and CSSDs, processing surgical tools, etc. |

| Medisafe | It is a part of STERIS, which explores different medical washer-disinfectors and sonic irrigators. |

| Nordson | This emphasises precision manufacturing equipment and components that are suitable for common sterilization and cleaning processes used in the industry. |

Involvement of high heat, moisture, or chemicals can damage sensitive materials, particularly aluminium, a few plastics, or electronics.

A need for greater initial investment, continuous maintenance, validation, and training spending connected with advanced disinfection systems can create a financial hurdle, specifically for smaller facilities.

By Product Type

By Technology

By End-Use Setting

By Service & Support

By Distribution Channel

By Region

February 2026

January 2026

January 2026

January 2026