February 2026

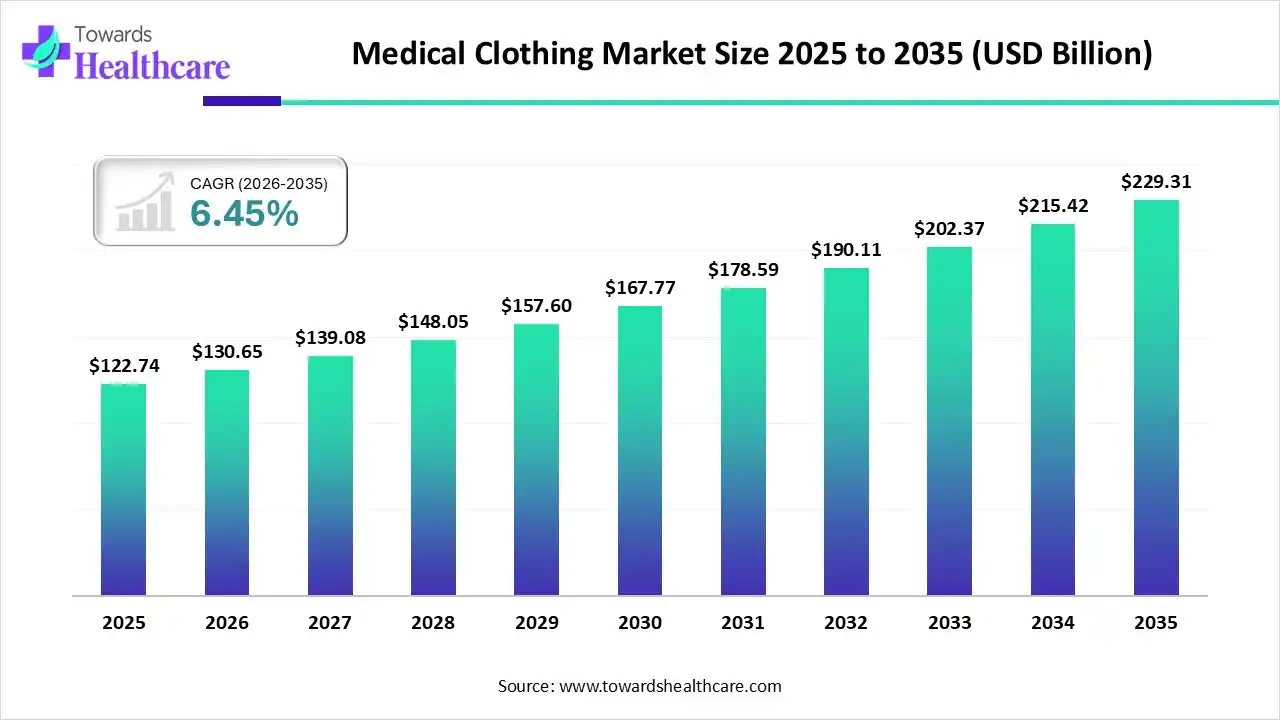

The global medical clothing market size was estimated at USD 122.74 billion in 2025 and is predicted to increase from USD 130.65 billion in 2026 to approximately USD 229.31 billion by 2035, expanding at a CAGR of 6.45% from 2026 to 2035.

The global medical clothing market is experiencing steady growth, supported by increasing demand for infection-control apparel such as surgical gowns, scrubs, and protective wear. Expansion of healthcare facilities and stricter safety regulations are further supporting adoption. North America dominated the market, holding the largest share, supported by well-established healthcare infrastructure, high healthcare expenditure, and strong compliance with quality and safety standards.

| Key Elements | Scope |

| Market Size in 2026 | USD 130.65 Billion |

| Projected Market Size in 2035 | USD 229.31 Billion |

| CAGR (2026 - 2035) | 6.45% |

| Leading Region | North America |

| Market Segmentation | By Product, By Type, By Usage, By End-user, By Sales Channel, By Region |

| Top Key Players | 3M Company, Cardinal Health, Inc., Medline Industries, LP, Mölnlycke Health Care AB, Ansell Limited, Halyard Health (Owens & Minor), Alpha Pro Tech, Ltd., Lohmann & Rauscher |

The medical clothing market refers to the sector focused on the production, distribution, and sale of specialized garments used in healthcare settings, including hospitals, clinics, and outpatient facilities. These garments, such as scrubs, surgical gowns, lab coats, and patient apparel, are designed to ensure hygiene, safety, and comfort for both healthcare professionals and patients. The market is driven by increasing awareness of infection control, rising patient visits, stringent healthcare regulations, and the growing demand for sterile and durable medical apparel. Technological advancements in fabrics, such as antimicrobial, fluid-resistant, and breathable materials, further propel market adoption.

AI integration can significantly enhance the medical clothing market by improving design precision, manufacturing efficiency, and product performance. AI-driven fabric analytics enable the development of garments with optimized breathability, durability, and fluid resistance. In manufacturing, AI supports predictive maintenance, quality inspection, and demand forecasting, reducing defects and waste. AI-enabled supply chains improve inventory planning and responsiveness during healthcare surges. Additionally, AI helps analyze user feedback and clinical data to refine fit, comfort, and safety compliance. Overall, AI adoption supports faster innovation, cost optimization, and consistent quality across medical clothing products while meeting evolving healthcare standards.

Medical clothing is increasingly made from antimicrobial and antibacterial fabrics that reduce the risk of infections. These fabrics help maintain hygiene in hospitals, clinics, and outpatient facilities, responding to rising awareness of workplace safety and patient protection.

Healthcare professionals prefer scrubs and uniforms designed for comfort, flexibility, and ease of movement. Ergonomic designs reduce fatigue during long shifts, improve productivity, and enhance the overall workplace experience, driving demand for modern, functional medical apparel.

Manufacturers are using recycled, biodegradable, and environmentally friendly materials to produce medical clothing. This trend reflects increasing focus on sustainability and corporate responsibility while meeting consumer demand for green and eco-conscious products.

Medical garments are being embedded with sensors to monitor health parameters or track usage. Smart clothing enhances efficiency, supports patient care, and provides data-driven insights, representing the intersection of healthcare and technology in the apparel sector.

Online platforms, e-commerce, and home delivery services are boosting B2C sales of medical clothing. Individual healthcare professionals and home-care providers increasingly purchase directly, seeking personalized, convenient, and quickly available products.

Hospitals and professionals demand clothing tailored to specific needs, including size, color, or functional features. Customization enhances branding, comfort, and identity, becoming a key differentiator in the competitive medical clothing market.

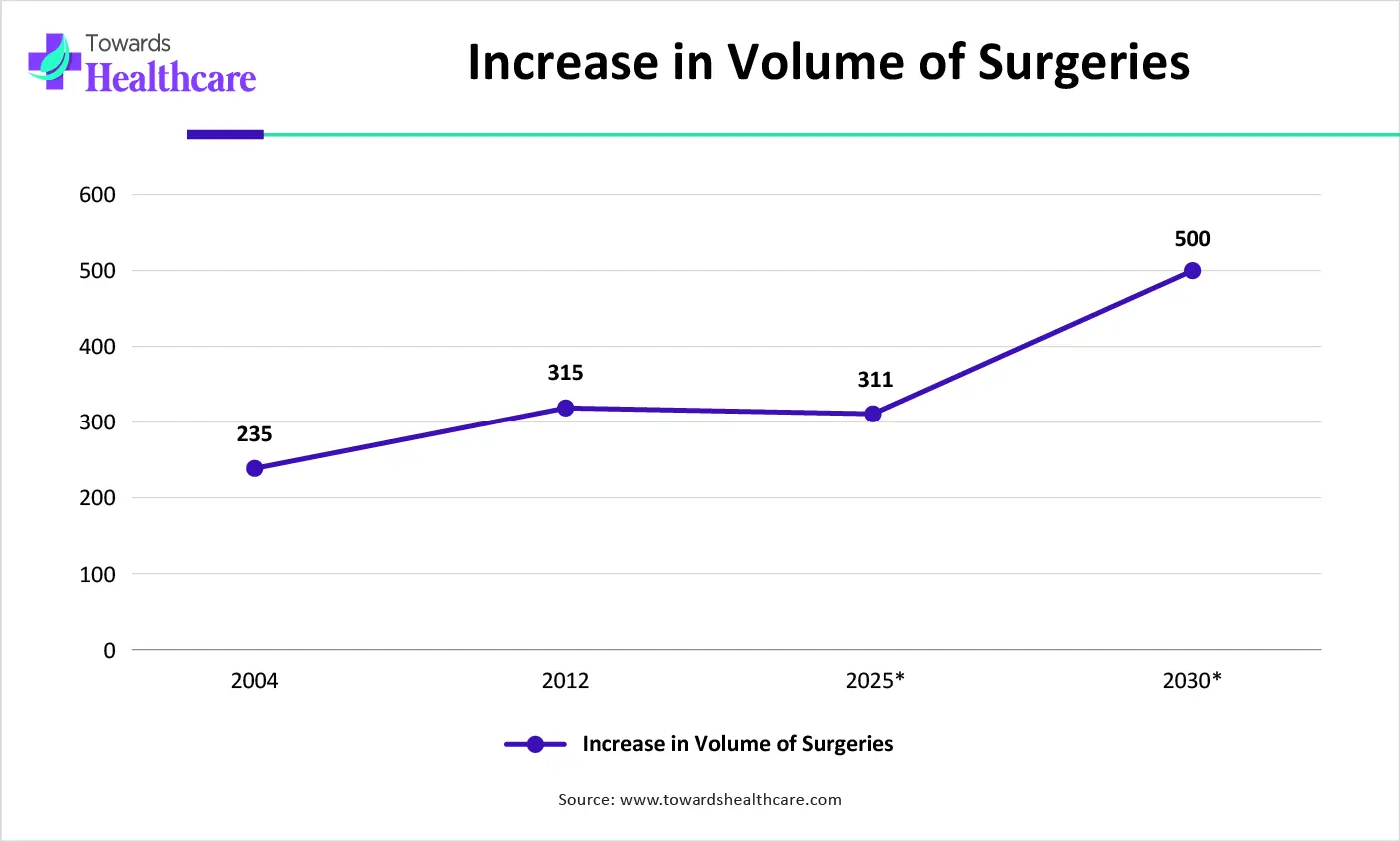

| Year | Estimated Surgeries (million) | Source |

| ~2004 | ~234 | WHO estimate-: https://iris.who.int/bitstream/handle/10665/42891/924156265X.pdf |

| ~2012 | ~313 (estimate) | PubMed analysis-: https://pmc.ncbi.nlm.nih.gov/articles/PMC8460445 |

| 2025 | ~300+ | Recent estimate-: https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(25)00985-7/abstract |

| 2030 (proj) | ~430–550 | WHO delivered projection-: https://pmc.ncbi.nlm.nih.gov/articles/PMC5321301/ https://www.cdc.gov/nchs/fastats/inpatient-surgery.htm |

Which Product Segment Dominated the Medical Clothing Market?

The surgical drapes, scrubs & gowns segment dominates the market due to their routine and mandatory use across hospitals, operating rooms, and outpatient settings. High procedure volumes, strict infection-control protocols, and frequent replacement requirements drive consistent demand. Additionally, standardized guidelines for sterile environments and growing emphasis on healthcare worker and patient safety further reinforce the segment’s leading position.

Facial Protection

The facial protection segment is estimated to be the fastest-growing segment in the market due to increasing awareness of airborne infections and rising demand for masks, face shields, and respirators in hospitals and clinics. Frequent use during surgical procedures, pandemics, and routine healthcare operations, along with stringent safety regulations, drives adoption. Innovations in comfort, breathability, and antiviral materials further accelerate market growth.

Why Did the for Healthcare Professional Segment Dominate the Medical Clothing Market?

The for healthcare professional segment dominates the market due to consistent and high demand from doctors, nurses, and hospital staff. Strict infection-control protocols, mandatory use of protective apparel, and frequent replacement of scrubs, gowns, and lab coats reinforce adoption. Additionally, growing awareness of workplace safety and standardized hospital dress codes further strengthens this segment’s leading position in the market.

For Patient

The for-patient segment is anticipated to be the fastest-growing in the market due to rising hospital admissions, increasing outpatient procedures, and growing awareness of patient hygiene and infection prevention. Demand for comfortable, disposable, and easy-to-wear patient gowns is rising, driven by hospitals’ focus on patient safety, convenience, and compliance with hygiene protocols, fueling rapid adoption of this segment.

Why Did the Above Disposable Dominant Segment in the Medical Clothing Market?

The disposable segment dominates the market due to its convenience, hygiene, and ability to prevent cross-contamination in healthcare settings. High usage in surgeries, clinics, and emergency care, coupled with strict infection-control protocols, drives consistent demand. Additionally, hospitals and medical facilities prefer cost-effective, single-use garments for staff and patients, reinforcing the disposable segment’s leading position.

Reusable

The reusable segment is estimated to be the fastest-growing in the market due to increasing focus on sustainability and environmental concerns. Hospitals and clinics are adopting washable, durable gowns, scrubs, and protective apparel to reduce medical waste. Advances in antimicrobial fabrics and sterilization technologies enhance safety and longevity, while cost-efficiency over repeated use drives rapid adoption in healthcare facilities.

Which End-User Segment Led the Medical Clothing Market?

The hospitals segment dominates the market due to high patient volumes, diverse medical procedures, and strict infection-control protocols. Continuous demand for surgical gowns, scrubs, and protective apparel for healthcare professionals and patients reinforces adoption. Additionally, hospitals’ focus on safety, standardized dress codes, and frequent replacement of medical clothing solidify this segment’s leading position in the market.

Outpatient Facilities

The outpatient facilities segment is anticipated to be the fastest-growing segment in the medical clothing market due to increasing outpatient procedures, rising patient visits, and heightened awareness of hygiene and infection control. Demand for disposable and comfortable gowns, scrubs, and protective apparel is expanding rapidly. Additionally, smaller facilities prioritize cost-effective, easy-to-use medical clothing, fueling growth in this segment.

Why Did B2B (business-to-business) sales channel Dominant Segment in the Medical Clothing Market?

The B2B (business-to-business) channel segment dominates the market due to long-term contracts with hospitals, clinics, and healthcare institutions, ensuring consistent bulk orders. Strong relationships with distributors, suppliers, and institutional buyers facilitate large-scale procurement, while customized product offerings and compliance with healthcare regulations further strengthen B2B adoption. Additionally, centralized purchasing processes in healthcare organizations drive higher demand through this channel.

B2C channel

The B2C (business-to-consumer) channel segment is anticipated to be the fastest-growing segment in the medical clothing market due to increasing consumer awareness about hygiene, comfort, and professional appearance. Online platforms and e-commerce enable direct access to a wide range of products, while personalized options and convenient doorstep delivery attract individual buyers. Rising demand from self-employed healthcare professionals and home-care providers also fuels this growth.

North America dominates the market due to strong emphasis on infection prevention, widespread use of certified protective apparel, and well-established healthcare infrastructure. High awareness of worker safety, strict regulatory compliance, and consistent demand from hospitals, clinics, and ambulatory centers further support adoption. Continuous product innovation and early acceptance of advanced medical textiles also reinforce the region’s leading position.

U.S Market Trends

The U.S. leads the North American market due to its extensive hospital network, high procedural volumes, and strong focus on healthcare worker safety. Stringent regulatory standards, rapid adoption of advanced and disposable medical apparel, and consistent procurement by public and private healthcare institutions further support demand. The presence of major manufacturers and continuous innovation also reinforces the country’s dominant position.

Asia-Pacific is the fastest-growing region in the medical clothing market due to the rapid expansion of healthcare infrastructure, rising hospital admissions, and increasing awareness of infection control. Growth in medical tourism, supportive government initiatives for local manufacturing, and rising investments in healthcare facilities further accelerate demand. Additionally, improving regulatory standards and growing adoption of disposable and protective medical apparel contribute to strong regional growth momentum.

China Market Trends

China dominates the Asia-Pacific market due to its large healthcare system, strong domestic manufacturing base, and cost-efficient production capabilities. Widespread hospital expansion, high demand for protective medical apparel, and government support for medical textile manufacturing strengthen supply. Additionally, China’s ability to scale production rapidly and serve both domestic and export markets reinforces its leading regional position.

Europe is a notably growing region in the market due to increasing focus on healthcare worker safety, stringent infection-control regulations, and rising adoption of certified protective apparel. Expansion of public healthcare systems, aging population-driven hospital demand, and growing preference for sustainable and reusable medical clothing further support regional growth. Continuous regulatory updates and emphasis on quality standards also encourage consistent market expansion.

UK Market Trends

The UK dominates the European medical clothing market due to its well-established public healthcare system and consistent procurement through the NHS. Strong emphasis on infection prevention, strict regulatory compliance, and high usage of standardized medical apparel across hospitals and clinics support demand. Additionally, the presence of experienced suppliers, focus on sustainable healthcare textiles, and continuous upgrades in healthcare infrastructure reinforce the country’s leading position.

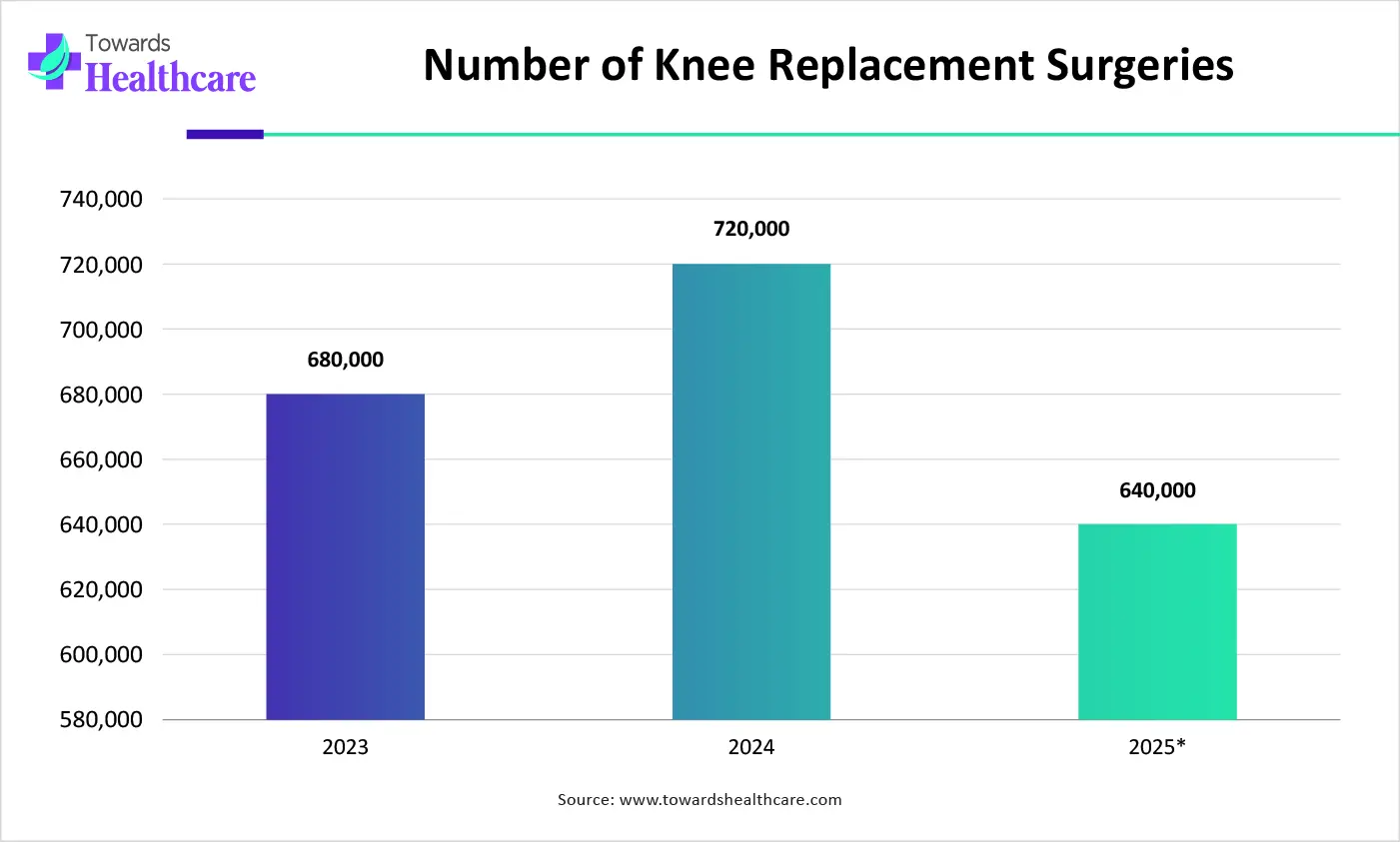

| Years | Number of Knee Replacement Surgeries |

| 2023 | 690,000 |

| 2024 | 718,000 |

| 2025* | 637,059 |

| Company Name | Key Medical Clothing Offerings | Headquarters Region |

| 3M Company | Surgical gowns, protective coveralls, isolation apparel, medical PPE | North America (U.S.) |

| Cardinal Health, Inc. | Surgical gowns, scrubs, isolation gowns, disposable medical apparel | North America (U.S.) |

| Medline Industries, LP | Scrubs, surgical gowns, lab coats, patient apparel | North America (U.S.) |

| Mölnlycke Health Care AB | Surgical gowns, drapes, infection-control clothing | Europe (Sweden) |

| Ansell Limited | Protective medical clothing, gloves, and surgical apparel | Asia-Pacific (Australia) |

| Halyard Health (Owens & Minor) | Surgical gowns, sterile and non-sterile medical clothing | North America (U.S.) |

| Kimberly-Clark Corporation | Disposable medical gowns, protective apparel, and healthcare wear | North America (U.S.) |

| Hartmann Group | Surgical and protective medical clothing, reusable textiles | Europe (Germany) |

| Alpha Pro Tech, Ltd. | Isolation gowns, protective apparel, disposable medical wear | North America (Canada) |

| Lohmann & Rauscher | Surgical gowns, protective garments, and medical textiles | Europe (Germany) |

By Product

By Type

By Usage

By End-user

By Sales Channel

By Region

February 2026

February 2026

February 2026

February 2026