January 2026

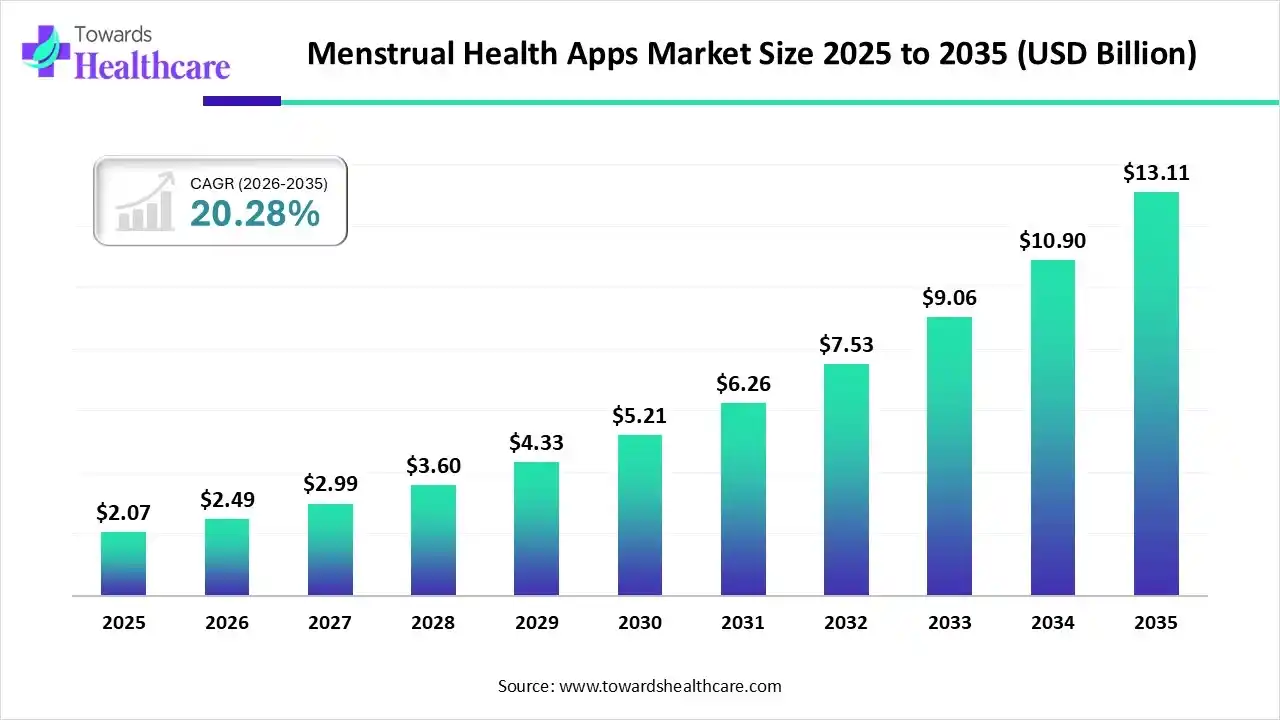

The menstrual health apps market size touched US$ 2.07 billion in 2025, with expectations of climbing to US$ 2.49 billion in 2026 and hitting US$ 13.11 billion by 2035, driven by a CAGR of 20.28% over the forecast period.

The global menstrual health apps market is increasing due to this period tracking apps are a subsection of the Femtech sector, and they offer a simpler way of tracking the menstrual cycle than the traditional pen and paper processes. Cycle tracking also offers insight into the health and wellness when experiencing heavy periods or observing that the period pattern has become unbalanced. This app supports detecting patterns for emotions, food cravings, and symptoms like breast tenderness.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.49 Billion |

| Projected Market Size in 2035 | USD 13.11 Billion |

| CAGR (2026 - 2035) | 20.28% |

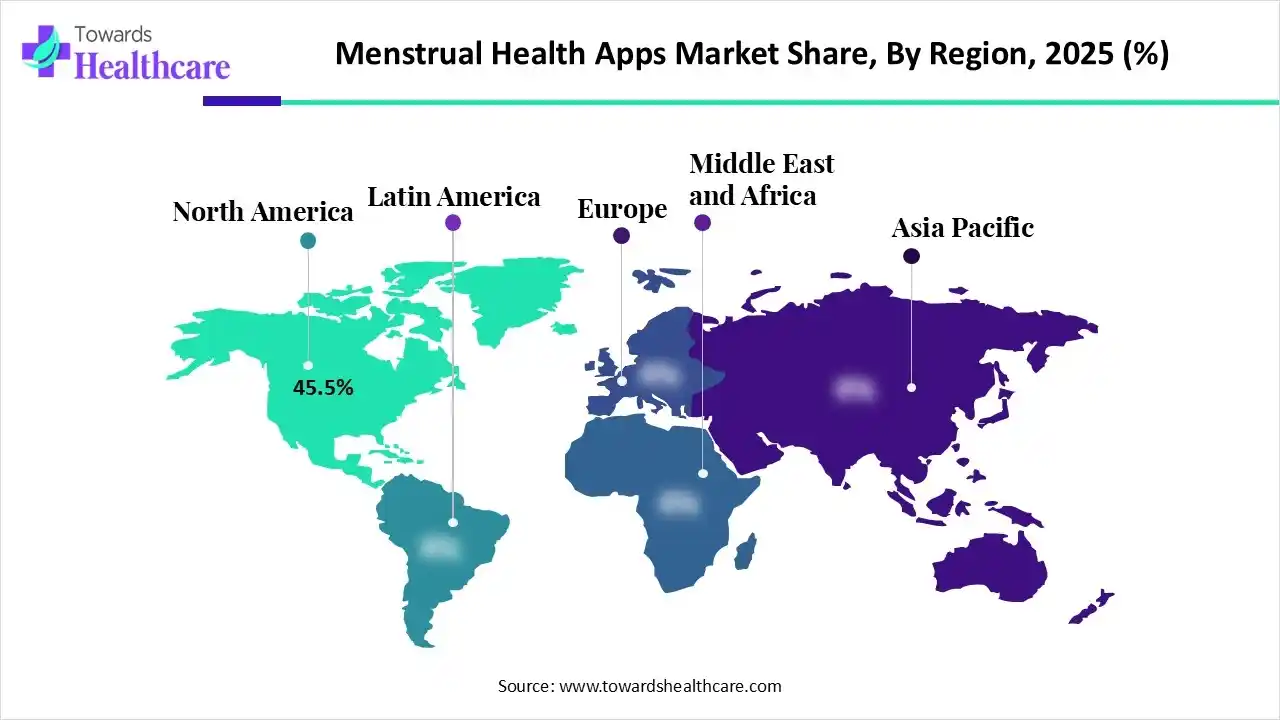

| Leading Region | North America by 45.5% |

| Market Segmentation | By Type, By Platform, By Application, By End User, By Distribution Channel, By Region |

| Top Key Players | Maven Clinic, Laiqa, Clue, Flo Health company, Ovia Health, Natural Cycles |

Integration of AI-driven technology in menstrual health apps drives the growth of the market as it improves menstrual health management by offering targeted and data-driven services that support women’s health. The incorporation of AI-based technology into menstrual health products and apps has led to significant advancements in tracking, managing, and predicting menstrual cycles, which are significant for overall reproductive health. This advanced technology improves the accuracy of menstrual tracking by considering different factors like lifestyle, hormonal changes, and environmental influences. This allows for more precise predictions and tailored health advice. The incorporation of AI in menstrual health management extends beyond tracking to comprise the management of menstrual disorders.

Wearable devices hold promise for forecasting various stages of the menstrual cycle, counting the fertile window, and it used by female persons as part of their reproductive health.

Smartphone apps have the massive potential to overcome barriers to accessing care as they are low-cost and available.

The use of telehealth services to include virtual monitoring, consultation, and patient education increased presentation, improved accessibility of medical care givers to pregnant women, women undergoing gynecological treatment, and women with reproductive health issues.

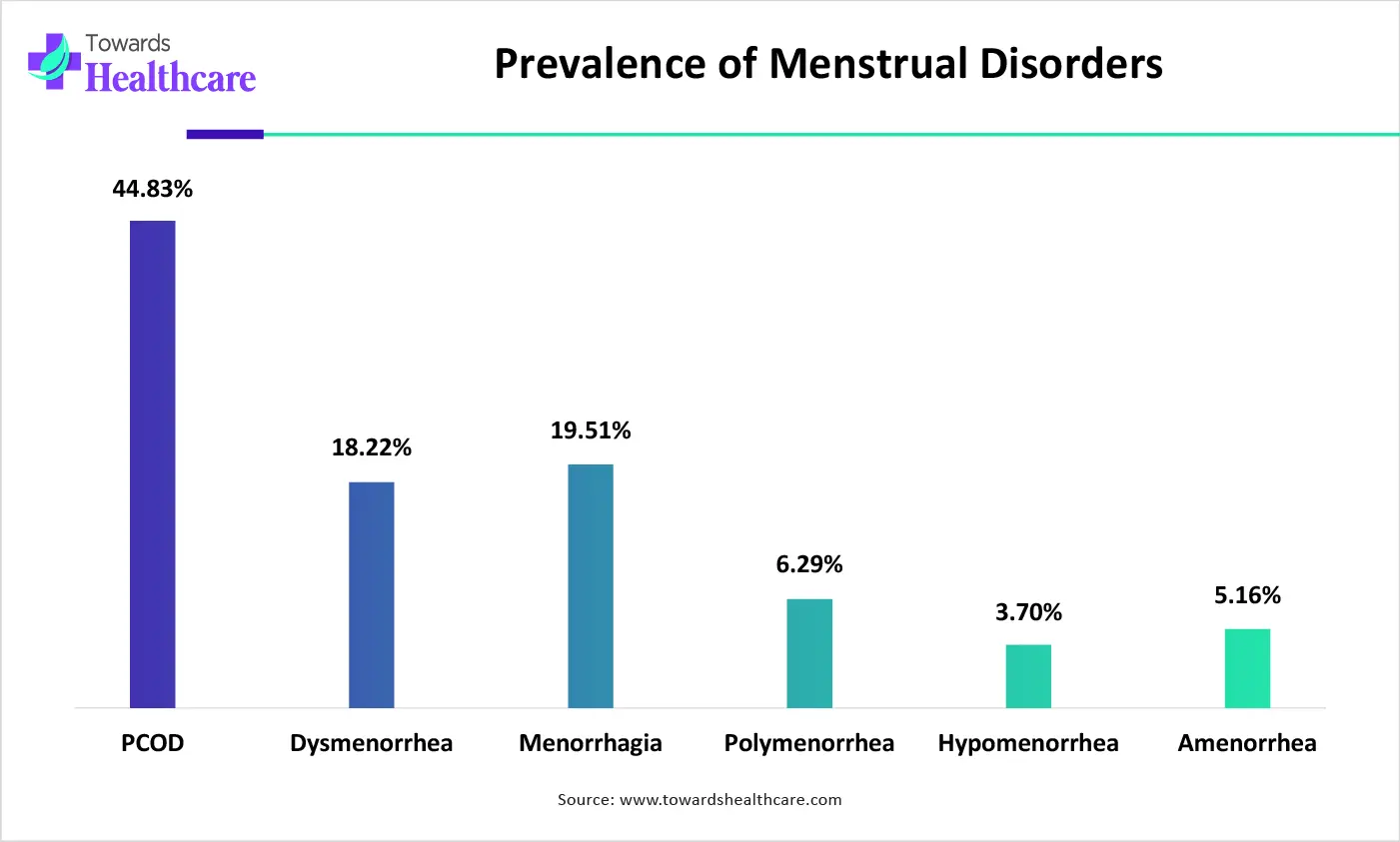

| Disorder | Percentages |

| PCOD | 44.83% |

| Dysmenorrhea | 18.22% |

| Menorrhagia | 19.51% |

| Polymenorrhea | 6.29% |

| Hypomenorrhea | 3.7% |

| Amenorrhea | 5.16% |

Which Period Tracking Apps Led the Menstrual Health Apps Market in 2025?

In 2025, the period tracking apps segment held the dominant market with a 43.3% share, as period tracking apps are a subdivision of the Femtech sector, and they offer a simpler way of tracking the menstrual cycle than outdated pen and paper. Menstrual cycle tracking apps (MCTAs) assist consumers in detecting their menstrual cycle and connected symptoms and signs, also managing their fertility. These apps not only track periods but also help monitor hormonal shifts, moods, and physical indications through the entire cycle.

Menstrual Disorder Management Apps

Whereas the menstrual disorder management apps segment is the fastest growing in the menstrual health apps market, as menstrual health apps have become gradually popular, offering women the equipment to monitor and learn about related menstrual cycles, symptoms, and management. Apps enable users to log a broad range of physical and emotional symptoms. Digital tracking removes the requirement for manual tracking on a paper calendar and provides suitable access to information anytime through a smartphone.

Why did the Android Segment Dominate the Market in 2025?

The Android segment captured the biggest revenue share of the menstrual health apps market in 2025 with a 72.2% share, as smartphone apps have major advantages over outdated paper-based menstrual cycle calendars. The apps count the days from the start of the previous menstrual bleeding, calculate expected days of ovulation, and expected next menstrual bleeding, therefore liberating users from frustrating and time-consuming physical day counting.

iOS

Whereas the iOS segment is the fastest growing in the market, as major iOS apps are noted for their consumer-friendly, clear, and concise interfaces, some even accepting a gender-neutral design that appeals to a wider range of users. It offers educational resources to notify users about menstrual health.

Why is the Menstrual Cycle Tracking Segment Dominant in the Market in 2025?

In 2025, the menstrual cycle tracking segment held the dominating share of the menstrual health apps market with a 32.6% share, as tracking users' cycles supports in detecting patterns for emotions, food cravings, and symptoms like breast tenderness. Knowing these patterns helps plan out work and social calendar. Paying accurate menstrual cycle data through an app greatly enhances research on menstrual cycles.

Health And Wellness Insights

Whereas the health and wellness insights segment is the fastest growing in the market, as these apps provide period symptom monitoring features that enable users to log physical and emotional symptoms daily. This cause to a better understanding of the menstrual cycle’s effect on well-being. The majority of period tracking apps offer detailed self-care tips tailored to the various phases of the menstrual cycle, making them a well-rounded companion for menstrual health.

End User Insights

Why is the Adults Segment Dominant in the Market in 2025?

In 2025, the adults segment held the dominant position in the menstrual health apps market with a 34.7% share, as consistent tracking offers significant data that supports classifying potential health challenges or underlying conditions, such as PCOS or endometriosis, by highlighting changes or irregularities from general patterns.

Women with PCOS/PMDD

Whereas, the women with PCOS/PMDD segment is the fastest growing in the market, as both PCOS and PMDD contribute a broad range of emotional and physical symptoms. Apps enable users to log various metrics, including uneven bleeding, flow intensity, pain levels (cramps, headaches, pelvic pain), anxiety, mood swings, fatigue, acne, weight changes, and cravings.

Why is the App Stores Segment Dominant in the Market in 2025?

In 2025, the app stores segment held the dominant position in the menstrual health apps market with a 63.4% share, as major application providers offer wide logging choices for physical and emotional symptoms, such as cramps, headaches, mood swings, energy levels, and food cravings. Reliable usage encourages an increased awareness of one's own body and its exclusive patterns, driving a sense of control and empowerment over menstrual health.

Healthcare Providers/Integrated Platforms

Whereas the healthcare providers/integrated platforms segment is the fastest growing in the market, as menstrual tracking apps from healthcare providers and combined platforms provide significant benefits over commercial apps, mostly in data privacy and security, clinical accuracy, and the capability to seamlessly integrate health data for a more inclusive care plan.

In 2025, North America dominated the menstrual health apps market by capturing a significant market share with 45.5%, driven by increasing adoption of smartphones, the presence of a robust digital health infrastructure, and rising customer awareness related to reproductive health. Extensive access to smartphones and consistent internet connectivity offer a massive consumer user base for digital health services; all factors contribute to the growth of the market.

The U.S. has a high adoption of menstrual health apps as they offer a reliable way for consumers to track cycles, manage symptoms, and understand their reproductive health, which empowers users and improves their well-being. U.S. trust in menstrual health apps for cycle identification, symptom management, and complete reproductive health insights.

Asia Pacific is poised for rapid growth in the menstrual health apps market, as growing advanced technology usage in emerging countries, such as India, China, and Japan, is creating a robust environment for these digital health services. Increasing health awareness, helpful government digital health initiatives, urbanization, and a massive young female population looking for discreet, reachable tracking for fertility/wellness are driving innovation and spending in localized services, which drives the growth of the market.

Women in India are progressively using menstrual health apps mainly for convenience, to gain self-knowledge related to their bodies, to manage health situations, and to circumvent societal taboos surrounding menstruation. These apps provide a private and accessible digital space for health education and management.

| Menstrual Health Disorders | % |

| Menstrual Pain (Dysmenorrhea) | 75% |

| PCOS Prevalence | 14% |

| Menstrual Irregularities (General) | 12% |

| Access to Hygienic Products | 78% |

| Reliance on Cloth/Unsafe Methods | 20% |

| Women Seeking Medical Help | 36% |

| Overall Menstrual Disorders | 60% |

Europe is significantly growing in the menstrual health apps market as European governments and health bodies, such as the NHS in the UK, are progressively promoting and incorporating digital health initiatives in their systems, encouraging the use of such apps. There is a high level of awareness related to menstrual and reproductive health among women in Europe, with high smartphone acceptance and digital literacy, making a receptive user base. Several prominent organizations and innovative start-ups are based in Europe, such as Flo Health (UK) and BioWink GmbH, which drives the growth of the market.

The UK has stringent data protection guidelines, like the General Data Protection Regulation (GDPR), which aims to foster customer trust by confirming sensitive health data is handled securely. This environment makes using these apps extra appealing to a privacy-conscious consumer base.

| Company | Headquarters | Latest Update |

| Comma | California | In February 2025, Comma, a female-founded integrated period care company, announces the launch of its secure period tracking app, Sara, alongside a $2 million seed funding round. |

| Maven Clinic | United States | Maven offers four main programs: Fertility & Family Building, Maternity & Newborn Care, Parenting & Pediatrics, and Menopause & Midlife Health. |

| Laiqa | Germany | In February 2025, Gurugram-based start-up Laiqa introduced LAIQA, a health app launching February 10, 2025, targeting women's wellness. Integrating Ayurveda with AI, the app offers personalized insights on hormonal health, addressing PCOS, menstrual wellness, fertility, pregnancy, and menopause. |

| Galgotias University | India | Galgotias University proudly announces the launch of Sakhi – The Menstrual Companion App, now available on the Apple App Store. Developed under the guidance of the iOS Development Center, this pioneering mobile application is a student-driven initiative aimed at empowering menstrual health awareness and support through technology. |

| Clue | Germany | In January 2025, Clue interviewed Rhiannon White, the new CEO of Clue, a globally recognized menstrual health app empowering over 10 million users across 190+ countries. |

| Flo Health company | UK | The Flo smartphone app is a period tracking and reproductive health app. It provides personalized menstruation and ovulation predictions, symptom forecasts based on user input. |

| Ovia Health | United States | Women's and family health solution delivers evidence-based programs, personalized data insights, and Care Team support to empower every woman at every age and stage of life. |

| Natural Cycles | Sweden | Natural Cycles is the first and only app of its kind cleared by the FDA as birth control. |

| Premom | Karnataka | Premom supports women to get pregnant with its free period and ovulation tracking app, virtual consultations with fertility specialists and educators, and high-quality pregnancy and ovulation testing products. |

By Type

By Platform

By Application

By End User

By Distribution Channel

By Region

North America

Europe

Asia Pacific

Latin America

Middle East and Africa (MEA)

January 2026

January 2026

January 2026

January 2026