February 2026

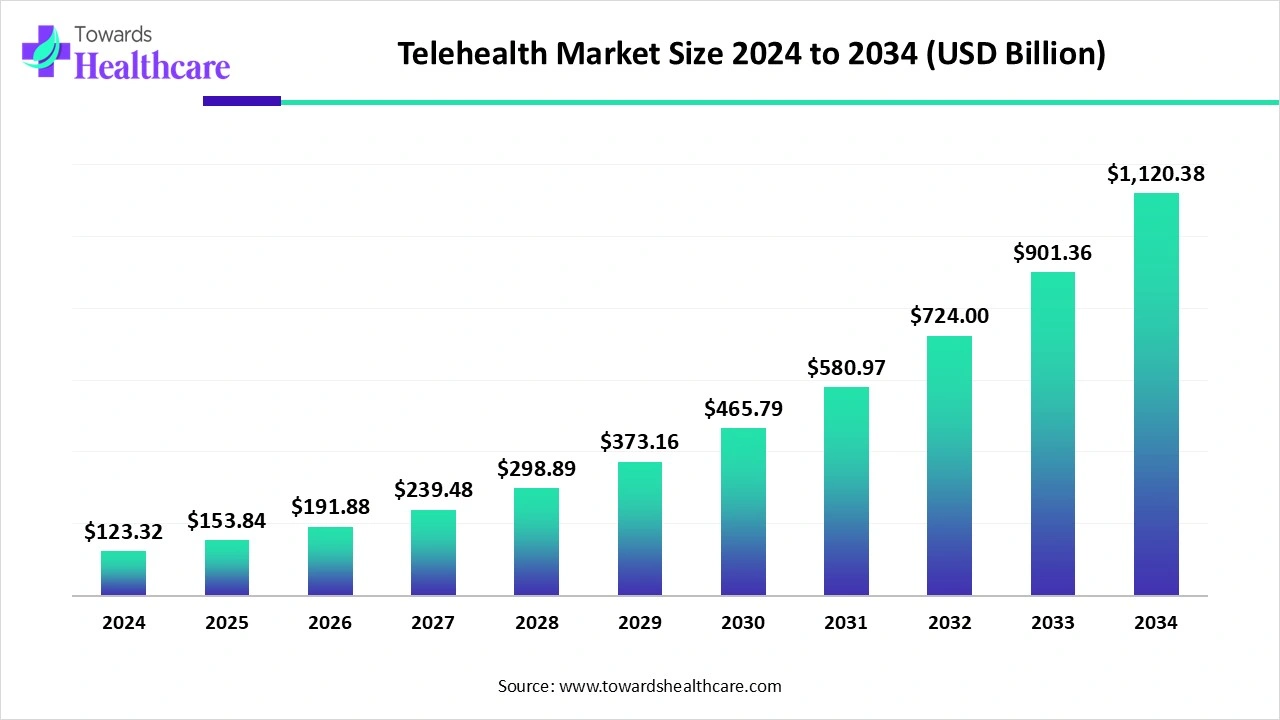

The global telehealth market size is calculated at USD 153.84 billion in 2025, grew to USD 191.88 billion in 2026, and is projected to reach around USD 1402.1 billion by 2035. The market is expanding at a CAGR of 24.73% between 2026 and 2035.

The telehealth market is primarily driven by the rising prevalence of chronic disorders and the growing demand for remote monitoring. Novel mobile apps and software tools are developed to provide telehealth services for patients. Government organizations launch initiatives to support the adoption of digital tools in the healthcare sector. Artificial intelligence (AI) is an indispensable tool that enables real-time monitoring of patients. Mixed reality (MR) systems present future opportunities for healthcare professionals and patients.

| Table | Scope |

| Market Size in 2025 | USD 153.84 Billion |

| Projected Market Size in 2035 | USD 1402.1 Billion |

| CAGR (2025 - 2034) | 24.73% |

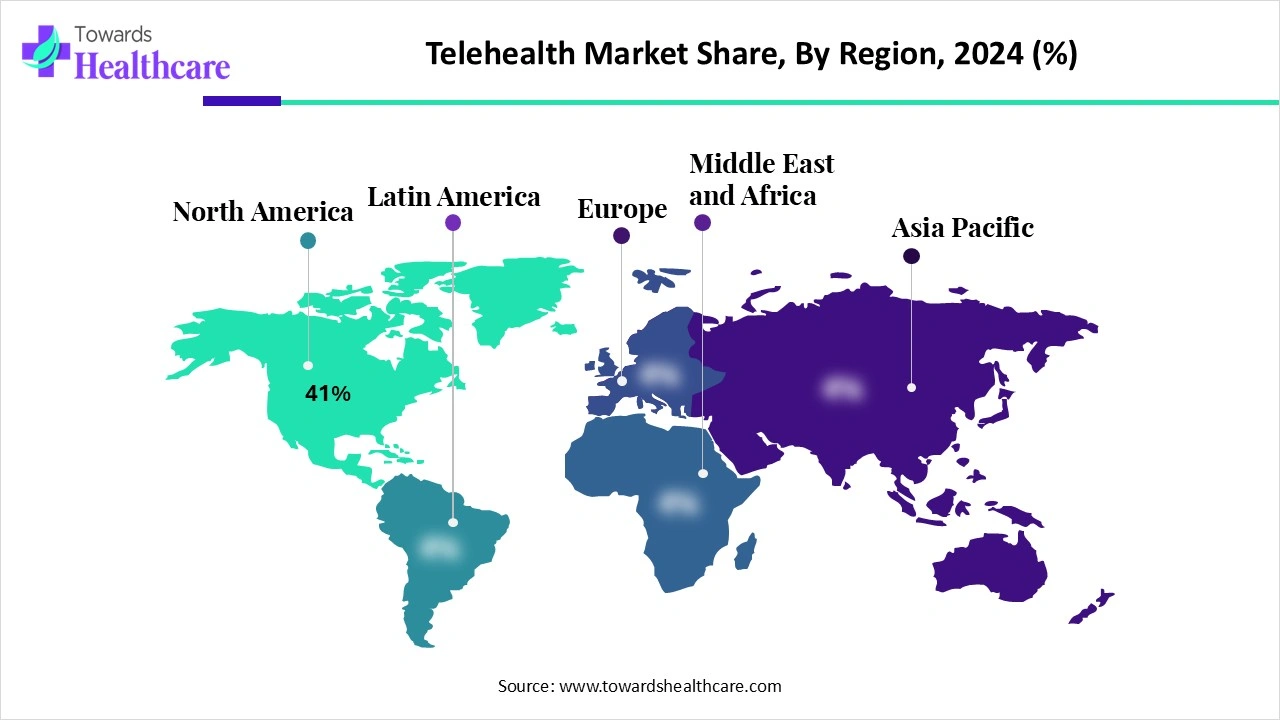

| Leading Region | North America 41% |

| Market Segmentation | By Component, By Application, By Mode of Delivery, By End-User, By Region |

| Top Key Players | Teladoc Health, Inc., Amwell, MDLIVE (Cigna), Doctor on Demand, HealthTap, GlobalMed, Practo, Babylon Health, 98point6, PlushCare, Medtronic, Philips Healthcare, GE HealthCare, Siemens Healthineers, Cisco Systems, Inc., eVisit, Chiron Health, SnapMD, Zipnosis |

The telehealth market encompasses the use of digital communication technologies (video, mobile apps, remote monitoring, and AI-enabled platforms) to provide healthcare services remotely. It includes virtual consultations, chronic disease management, mental health therapy, remote patient monitoring, and specialty care. Telehealth reduces healthcare costs, expands access to underserved populations, and improves patient convenience. Growth is driven by aging populations, chronic disease burden, physician shortages, favorable reimbursement policies, and advancements in AI, IoT, and 5G connectivity.

Favorable Government Support: Government bodies from different countries collaborate and increase awareness of telehealth for enhanced patient care.

Increasing Merger & Acquisition Activities: The increasing M&A activity expands telehealth services to a large patient population.

AI plays a crucial role in telehealth by providing personalized care to patients from remote locations, enhancing efficiency and accessibility. It enables real-time monitoring of patients and sends alerts and notifications to healthcare professionals directly. This allows them to make proactive clinical decisions. AI and machine learning (ML) algorithms analyze vast amounts of patient data and provide data-driven insights. AI-based natural language processing (NLP) helps in assisting better communication between patients and doctors, irrespective of their native languages.

Remote Monitoring

The major growth factor for the telehealth market is the growing demand for remote monitoring. The increasing geriatric population potentiates the need for remote monitoring. This enables them to access personalized care from the comfort of their homes, saving travel time and costs. People living in rural or underserved areas also benefit from experts practicing in urban areas. Juniper Research reported that around 75 million people used remote patient monitoring solutions in 2023, and projected this number to reach 115.5 million by 2027.

Privacy Concerns

Telehealth carries a risk of privacy infringement due to a lack of control over the collection, use, and sharing of data. It has a high risk of data leakage and a security breach of confidential patient data. The challenge of preserving the privacy of patients’ information during transmission and processing restricts market growth.

What is the Future of the Telehealth Market?

The market future is promising, driven by mixed reality (MR) systems, including virtual reality (VR) and augmented reality (AR). These systems provide an immersive and interactive experience to patients. AR headsets enable healthcare professionals to diagnose patients with greater accuracy, treat patients more efficiently, and deliver an optimal level of care. VR helps patients alleviate the awkwardness of remote telehealth sessions, enabling them to feel closer to the physician. Thus, VR and AR increase accessibility and provide high accuracy and reliability compared with in-person controls.

By component, the services segment held a dominant presence in the market in 2024. This is due to a lack of favorable infrastructure in small- and medium-sized enterprises. Services provide relevant expertise and solutions to complex telehealth problems. They offer tailored teleconsultation, remote monitoring, telepsychiatry, tele-ICU, and telepharmacy services. They eliminate the need for annual subscriptions to software tools for telehealth. They are comparatively cost-effective, enabling routine monitoring, basic consultations, and follow-ups.

By component, the software platforms segment is expected to grow at the fastest CAGR in the market during the forecast period. The development of user-friendly and cost-effective software tools for telehealth boosts the segment’s growth. The increasing adoption of smartphones and advances in connectivity technology potentiate the use of telehealth software. Software tools provide control over patient data and reduce the chance of a security breach. They streamline the administrative tasks of healthcare organizations, such as scheduling and billing.

By application, the teleconsultation segment held the largest revenue share of the market in 2024. This is due to the enhanced benefits of teleconsultation, including high convenience and cost savings. Teleconsultation refers to phone or video appointments between a patient and their healthcare practitioner. It eliminates the need for patients to wait for longer periods in a healthcare setting. Healthcare professionals provide general practice, urgent care, and specialty consultations to patients through teleconsultation.

By application, the mental health & behavioral therapy segment is expected to grow with the highest CAGR in the market during the studied years. The rising prevalence of mental health disorders and the increasing awareness of telehealth services for behavioral therapy augment the segment’s growth. Government organizations promote the use of telemedicine for mental health. Telehealth provides access in a private and safe space, counseling for substance use issues, and the prescription of medications.

By mode of delivery, the web-based/cloud platforms segment contributed the biggest revenue share of the market in 2024. This segment dominated because web-based or cloud-based platforms can store vast amounts of patient data. They are highly scalable and readily adopted by hospitals and providers. Healthcare providers and patients can access patient data from anywhere and at any time. Cloud-based platforms facilitate communication and integrate with various digital health tools, enabling healthcare organizations to manage services effectively.

By mode of delivery, the mobile-based applications segment is expected to expand rapidly in the market in the coming years. Mobile-based applications help to maintain privacy and provide personalized services. They allow on-demand audio and video calls with providers without scheduling an appointment. They send notifications about medication refills and scheduled appointments to patients. Through mobile-based applications, users can leverage a conversational AI interface for self-service capabilities and extend 24/7 care.

By end-user, the healthcare providers segment led the market in 2024. The segmental growth is attributed to the need to provide tailored care and the shortage of healthcare professionals. The World Health Organization (WHO) estimated a shortfall of 11 million health workers by 2030, especially in low- and middle-income countries. Telehealth allows providers to track patients’ conditions and medication intake. Providers use telehealth to provide personalized care to a larger patient population. They can also collaborate with experienced professionals.

By end-user, the payers & employers segment is expected to witness the fastest growth in the market over the forecast period. Payers can get members’ transparency into patients’ conditions and care plans, promoting medication compliance and health literacy. This helps them provide reimbursement to patients. Employers also adopt telehealth platforms to help reduce employee absenteeism and improve workplace productivity. An employee can access advanced care without taking a day off from the schedule.

North America dominated the global market in 2024. The availability of a robust healthcare infrastructure, the rising adoption of advanced technologies, and favorable reimbursement policies are a few growth factors that govern market growth in North America. The increasing use of electronic health records (EHRs) and the growing demand for personalized care augment the market. Government organizations make constant efforts to transform the healthcare sector into an advanced digital health infrastructure.

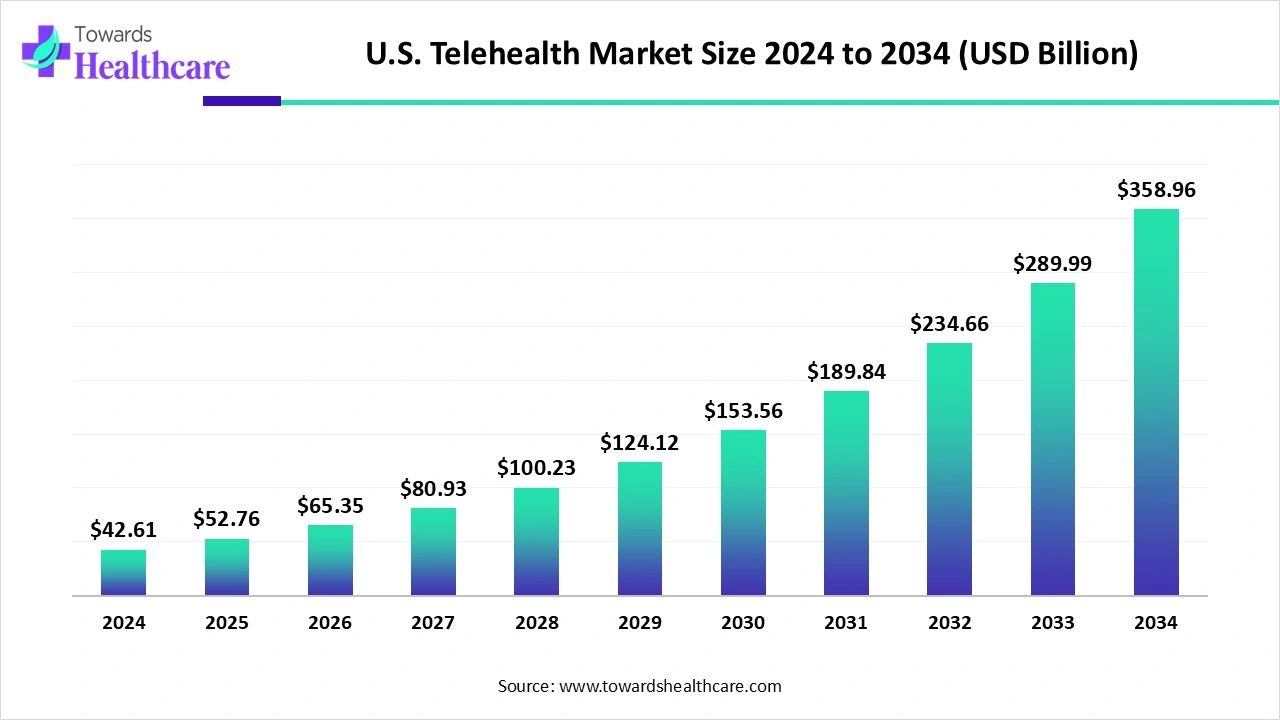

As of early 2024, 54% of Americans have used telehealth, and around 80% physicians indicated plans to continue using telehealth. The Centers for Medicare & Medicaid Services (CMS) provides reimbursement for telehealth services in the U.S. More than 96% of all hospitals in the U.S. have adopted EHRs. It is also estimated that about 78.6% of hospitals have installed a telemedicine solution.

The U.S. telehealth market was valued at $42.61 billion in 2024 and is expected to rise to $52.76 billion in 2025. Looking ahead, the market is projected to reach about $358.96 billion by 2034, growing at a strong CAGR of 23.84%.

During the COVID-19 pandemic, more than half (50.5%) of Canadians consulted their family doctor on the telephone, and almost one-third (31.3%) saw a specialist on the telephone. There are about 489 telemedicine startups in Canada. Companies like WELL Health Technologies, Teladoc Health, and Siemens Healthineers offer advanced telehealth solutions in Canada.

Asia-Pacific is expected to grow at the fastest CAGR in the telehealth market in the upcoming years. The increasing use of smartphones and large rural populations promotes the use of telehealth. Government bodies from India, China, and the Southeast Asia region launch initiatives to support digitization in healthcare. The increasing number of medtech startups and venture capital investments contributes to market growth. The growing need for remote monitoring and the demand for saving healthcare expenses encourage patients to use telehealth.

More than 180 million elderly people suffer from chronic diseases in China. China has an expanding network infrastructure to encourage telecom expansion and lower network fees. As of Q3 2024, China had installed over 4.04 million 5G base stations, accounting for 66% of global deployments and achieving 100% coverage in all areas. The country is also set to install 6G technology.

Chronic diseases are very common among Indian adults, accounting for 21% of the total population suffering from at least one chronic condition. The Indian government is at the forefront of providing telehealth services to a larger population base through its platform, e-Sanjeevani, and initiatives like Tele-MANAS. As of March 2025, e-Sanjeevani has served more than 36 crore patients through teleconsultations since 2020.

Europe is expected to grow at a considerable CAGR in the telehealth market in the upcoming period. Government organizations support the development and deployment of digital tools in the healthcare sector. The growing geriatric population and the rising prevalence of chronic disorders facilitate the demand for telehealth. The rising use of wearable medical devices and the increasing awareness of a healthy lifestyle propel the market. The increasing investments and collaborations among key players to develop novel telehealth platforms foster market growth.

The International Trade Administration (ITA) reported that the penetration rates for digital treatment were 18.1% in 2024, and that for online consultations were 2.29% in Germany. The German government’s “Digital Healthcare Act” and “Digital Health Applications Ordinance” support the adoption of digitization in the healthcare sector and provide reimbursement by public health insurance schemes.

The UK government announced an investment of £30 million in innovative medical technology (medtech) to help cut waiting lists, expedite the diagnosis process, and deliver new and improved ways to treat patients. More than 9,800 virtual ward beds were developed from its target of 10,000 beds.

Dr. Kashif Saeed, CEO of DocNow, commented that virtual care is an essential part of delivering timely, effective post-acute care. DocNow Telehealth platform is a workflow solution that was built to meet the specific needs of its customers and is fast, secure, and integrated.

By Component

By Application

By Mode of Delivery

By End-User

By Region

February 2026

February 2026

February 2026

February 2026