January 2026

The global mental health counseling market size was estimated at USD 12.54 billion in 2025 and is predicted to increase from USD 13.81 billion in 2026 to approximately USD 32.97 billion by 2035, expanding at a CAGR of 10.15% from 2026 to 2035.

Due to growing incidences of mental illnesses, the demand for mental health counselling solutions is increasing. AI is also being used to develop digital platforms offering diverse solutions and increasing access across remote areas. The growing awareness, government initiatives, and robust healthcare are also increasing their use across various regions, driving their investment and launches, promoting market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 13.81 Billion |

| Projected Market Size in 2035 | USD 32.97 Billion |

| CAGR (2026 - 2035) | 10.15% |

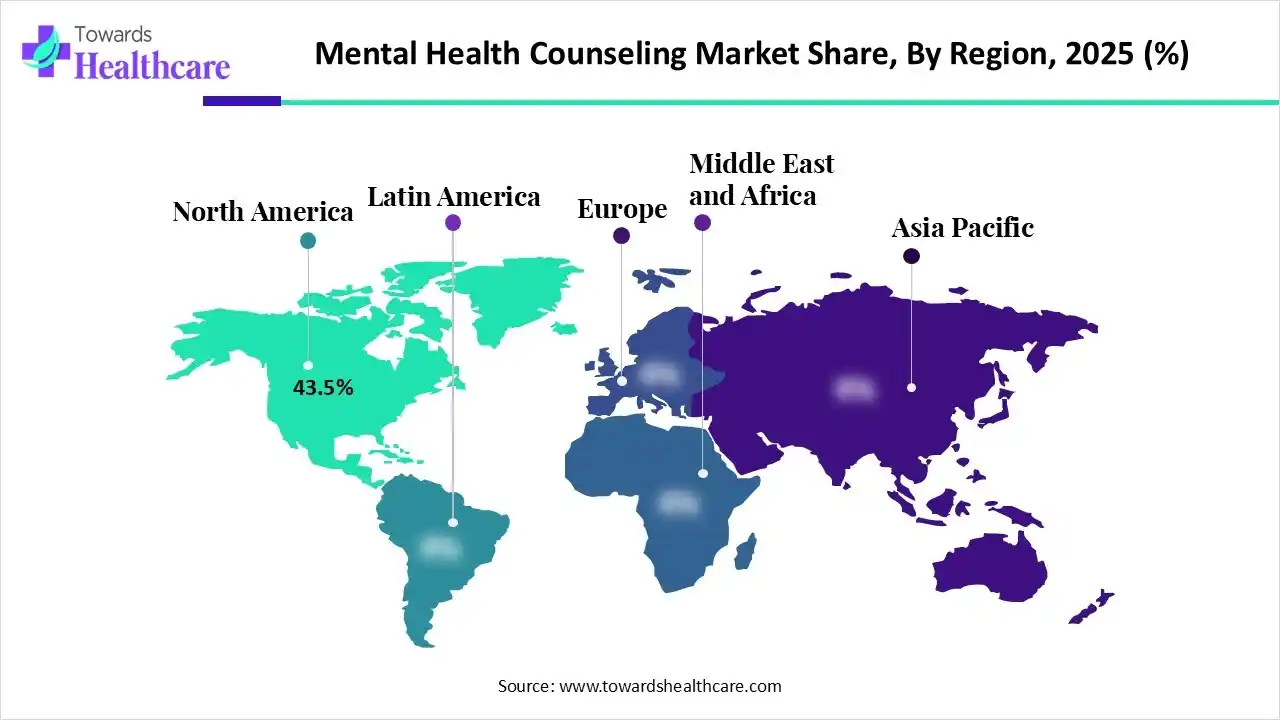

| Leading Region | North America by 43.5% |

| Market Segmentation | By Service Type, By Patient Type, By Application, By End User, By Deployment (Platforms), By Region |

| Top Key Players | Teladoc Health, Ginger (Headspace Health), Talkspace, Lyra Health, Spring Health, Cerebral, Mindstrong, Amwell, Thriveworks |

The mental health counseling market is driven by growing awareness, increasing mental health disorders, and technological advancements. The mental health counseling includes services and digital platforms that provide psychological assessment, therapy, behavioral support, and emotional wellness interventions for individuals with mental health concerns. Services include cognitive behavioral therapy (CBT), psychotherapy, trauma counseling, substance abuse counseling, marriage and family therapy, and online tele-mental health sessions.

The use of AI in mental health counselling is increasing as it helps in analysing and tracking the signs and behavior patterns of the patient's condition. Different types of chatbots and virtual therapists are also being developed, which offer 24/7 services, where the use of predictive analytics helps in detecting the risk of relapses and complications. They also provide online scheduling and reminders, promoting the use of teletherapy.

The industries are developing wearable technologies such as smartwatches and sensors for real-time monitoring of activities like sleep, stress, etc, where their gathered data can be used for early detection of mental health disorders.

Shift Towards Hybrid Care

Depending on the patient's convenience, there is a rise in the use of teletherapy with a traditional session, which offers flexibility, promoting their adherence to the treatment.

Flourishing Digital Therapies

Different types of apps are being introduced which are offering evidence-based therapies, which support remote care as well as drive their acceptance rates.

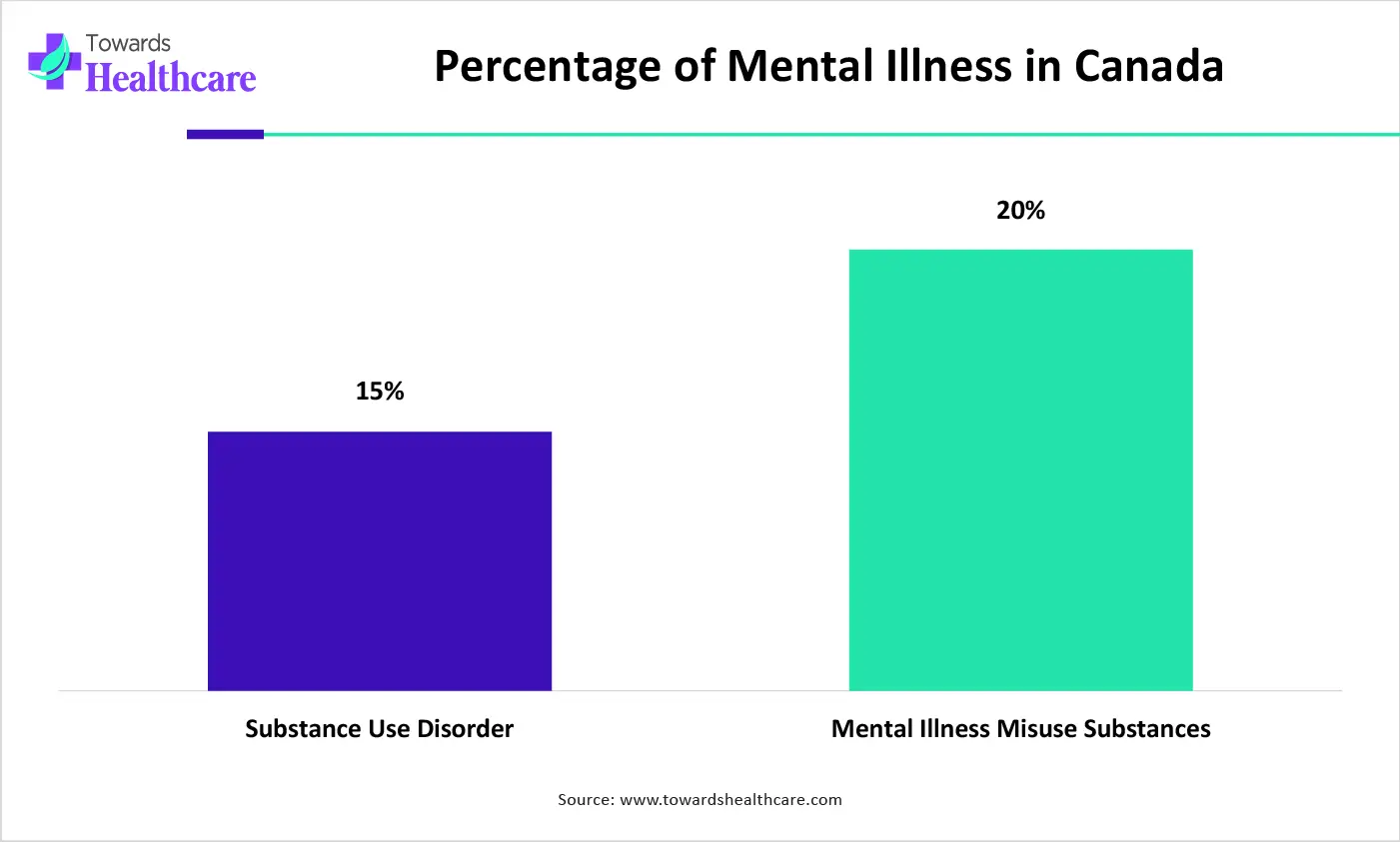

| Mental Health Conditions | Incidence rates (%) |

| Substance Use Disorder | 15 |

| Mental Illness Misuse of Substances | 20 |

Why Did the Psychotherapy Segment Dominate in the Mental Health Counseling Market in 2024?

The psychotherapy segment led the market with a 32.4% share in 2024, due to growth in mental health disorders. They also offer therapies like CBT and psychodynamic therapies. Moreover, the reimbursement policies also increased their use, which in turn enhanced their acceptance rates.

Trauma & PTSD Counseling

The trauma & PTSD counseling segment is expected to show the highest growth during the upcoming years, due to growing exposure to trauma. At the same time, growing awareness is increasing their diagnostics, which is driving their use. Additionally, the growing training program is also increasing its use.

How the Adult Segment Dominated the Mental Health Counseling Market in 2024?

The adult segment held the largest share of 57.8% in the market in 2024, due to growth in the incidence of stress and depression. At the same time, growth in the excuse to the pressure environment also increased the demand for mental health counselling. Additionally, the mental initiative also increased their use.

Adolescent

The adolescent segment is expected to show the fastest growth rate during the upcoming years, due to increasing awareness through government initiatives. The growing anxiety, bullying, and depression due to increasing use of social media is also increasing the demand for mental health counselling.

Why Anxiety Segment Dominated the Mental Health Counseling Market?

The anxiety segment led the market with a 37.6% share in 2024, due to growth in its incidence rates in all age groups. The growth in their lifestyle changes and awareness also increased the demand for various mental health counseling services, where the growth in the telehealth platforms also encouraged their use.

PTSD

By application type, the PTSD segment is expected to show the highest growth during the upcoming years, due to growing trauma and violence cases. This, in turn, is increasing the use of mental health counseling services, focused on CBT. Additionally, increasing trauma-informed care centers are providing these services.

What Made Mental Health Clinics the Dominant Segment in the Mental Health Counseling Market in 2024?

The mental health clinics segment led the market with a 34.5% share in 2024, due to increased capacity to accommodate higher patient volume. Moreover, they also offer access to multiple services. Additionally, the presence of reimbursement policies and specialized personnel also increased their dependence.

Homecare/Remote Users

By end user, the homecare/remote users segment is expected to show the fastest growth rate during the predicted time, due to growing telehealth platforms. They offer flexible scheduling, access to remote therapies, and affordable solutions, which in turn is increasing their use, enhancing the patient outcomes.

Which Deployment (Platforms) Type Segment Held the Dominating Share of the Mental Health Counseling Market in 2024?

The web-based platforms segment held the dominating share of 65.5% share in the market in 2024, driven by their easy and faster access to mental health counseling services. They also offer teletherapy, digital records, and online booking with frequent updates, which increases their use by diverse patient populations.

Mobile Apps

By deployment (platforms) type, the mobile apps segment is expected to show the highest growth during the predicted time, due to growing smartphone penetration. This, in turn, offers faster access to various mental health counselling solutions, where their 24/7 availability is also increasing their use.

North America dominated the mental health counseling market with a 43.5% share in 2024, due to the growth in mental health disorders. At the same time, growing awareness and the presence of well-developed healthcare infrastructure have also increased the use of mental health counseling solutions. Additionally, early adoption of digital health solutions also increased their use, which contributed to the market growth.

The presence of an advanced healthcare system is offering various mental health counselling services across the U.S. The growing awareness and government programs are also increasing their demand. Moreover, the reimbursement policies and growing telehealth solutions are also providing various remote patient care services.

Asia Pacific is expected to host the fastest-growing mental health counseling market during the forecast period, due to growing mental health awareness. The growing lifestyle changes and government initiatives are increasing the demand for mental health counseling services. The growing digitalization is also increasing the development of telehealth solutions and their adoption, driving the market growth.

The growing work pressure is increasing the incidence of stress, depression, and anxiety among the adult population in India. The growing government initiatives are increasing awareness across all age groups. The expanding healthcare is increasing the utilization of advanced and digital mental health solutions, where these factors are also increasing the use of mental health counseling.

Europe is expected to grow significantly in the mental health counseling market during the forecast period, due to growth in mental health programs and campaigns. The growth in mental health awareness is also increasing the use of counseling services. The growing mental health disorders, robust healthcare systems, and digital health platforms are also increasing their use, promoting the market growth.

The growing digital mental health solutions in the UK are increasing the use of various mental health counseling services. The growing awareness is also increasing their use. The companies are also developing various digital solutions to provide remote care, which is increasing their acceptance rates.

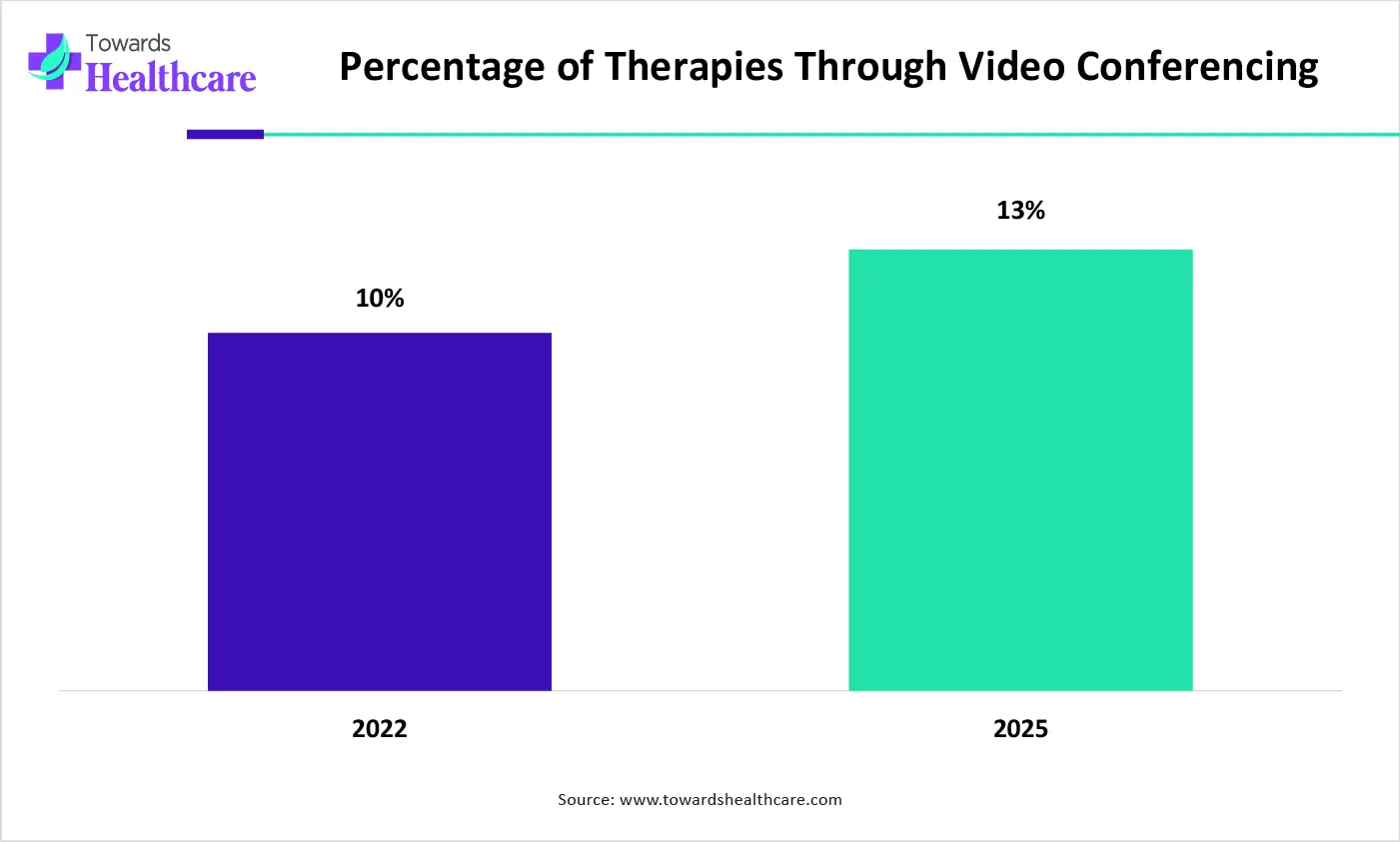

| Year | Use of Therapies Through Video Conferencing Percentage |

| 2022 | 10% |

| 2025 | 13% |

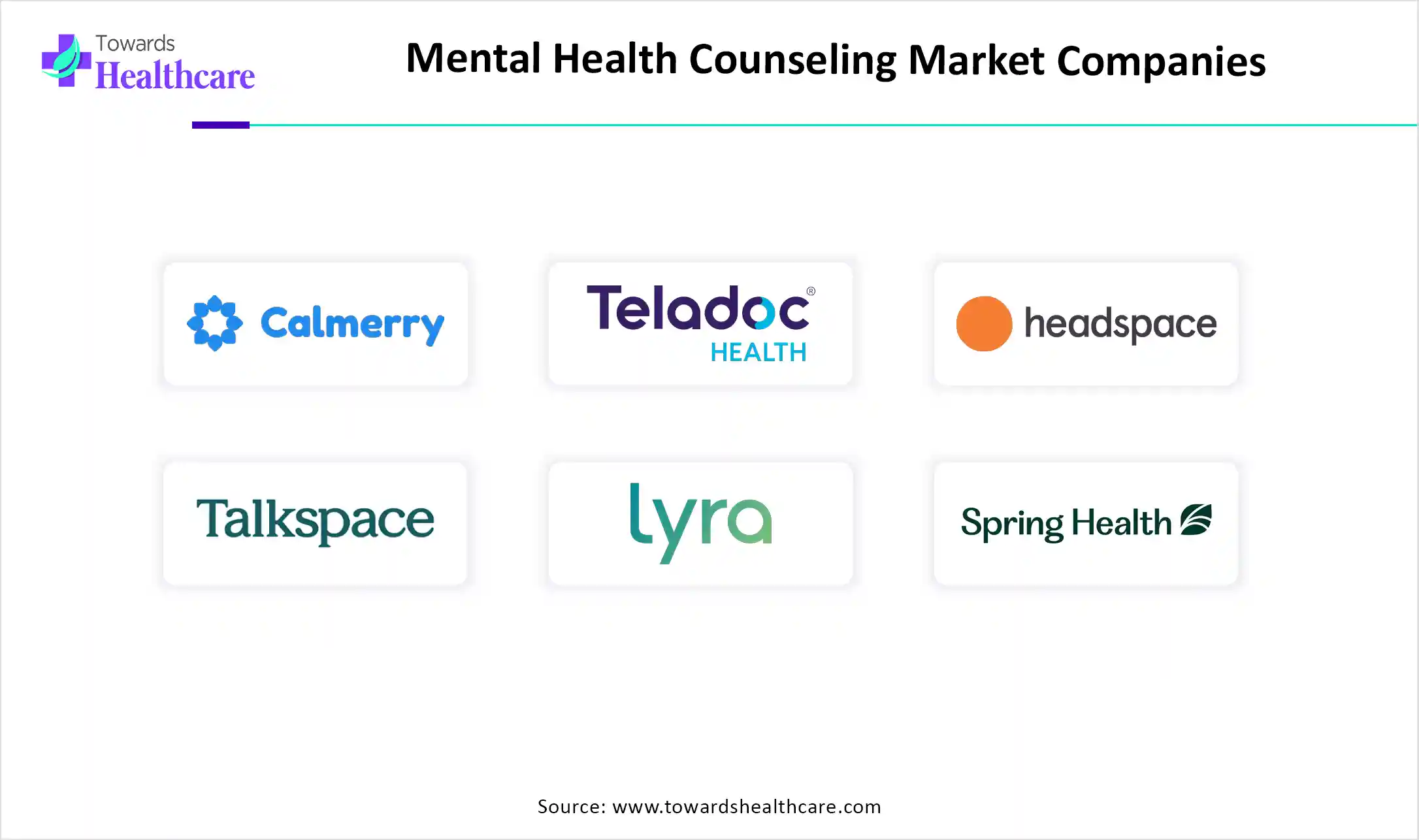

| Companies | Headquarters | Mental Health Counseling Solutions |

| Calmerry | Wyoming, U.S. | Provides budget-friendly online therapies and digital tools |

| Teladoc Health | New York, U.S. | Offers the integrated care segment and BetterHelp Services. |

| Ginger (Headspace Health) | California U.S. | Provides therapy coaching and psychiatry |

| Talkspace | New York, U.S. | Offers online and mobile therapy services |

| Lyra Health | California U.S. | Provides best-fit evidence-based mental health providers and digital self-guided solutions |

| Spring Health | New York, U.S. | Offers personalized mental health care solutions for employees |

| Cerebral | California U.S. | Provides access to licensed providers and services |

| Mindstrong | California U.S. | Offers technologies and care for severe mental illnesses |

| Amwell | Massachusetts, U.S. | Provides a wide range of mental and behavioural health solutions |

| Thriveworks | Virginia, U.S. | Offers various individual and family therapy |

By Service Type

By Patient Type

By Application

By End User

By Deployment (Platforms)

By Region

North America

South America

Europe

Asia Pacific

MEA

January 2026

January 2026

January 2026

January 2026