February 2026

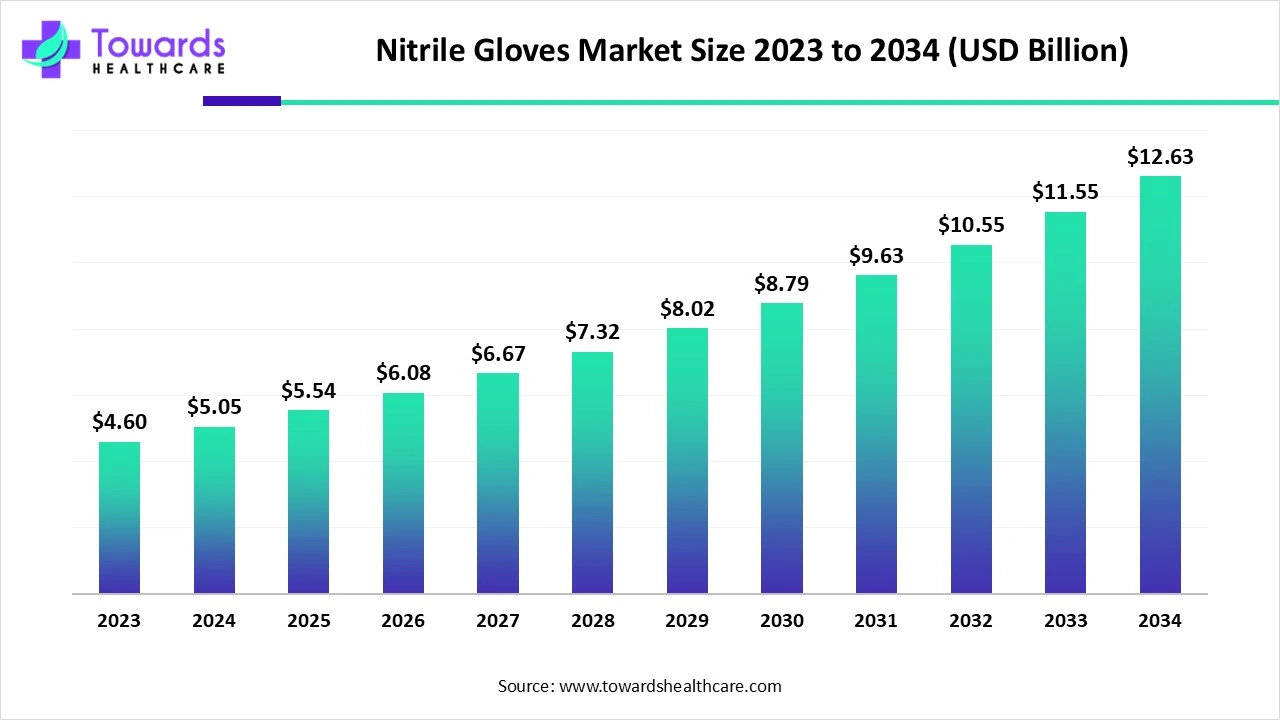

The global nitrile gloves market size is calculated at USD 5.54 billion in 2025, grew to USD 6.07 billion in 2026, and is projected to reach around USD 13.9 billion by 2035. The market is expanding at a CAGR of 9.64% between 2026 and 2035. The increasing incidences of hospital-associated infections and growing research and development drive the market.

| Key Elements | Scope |

| Market Size in 2026 | USD 6.07 Billion |

| Projected Market Size in 2035 | USD 13.9 Billion |

| CAGR (2026 - 2035) | 9.64% |

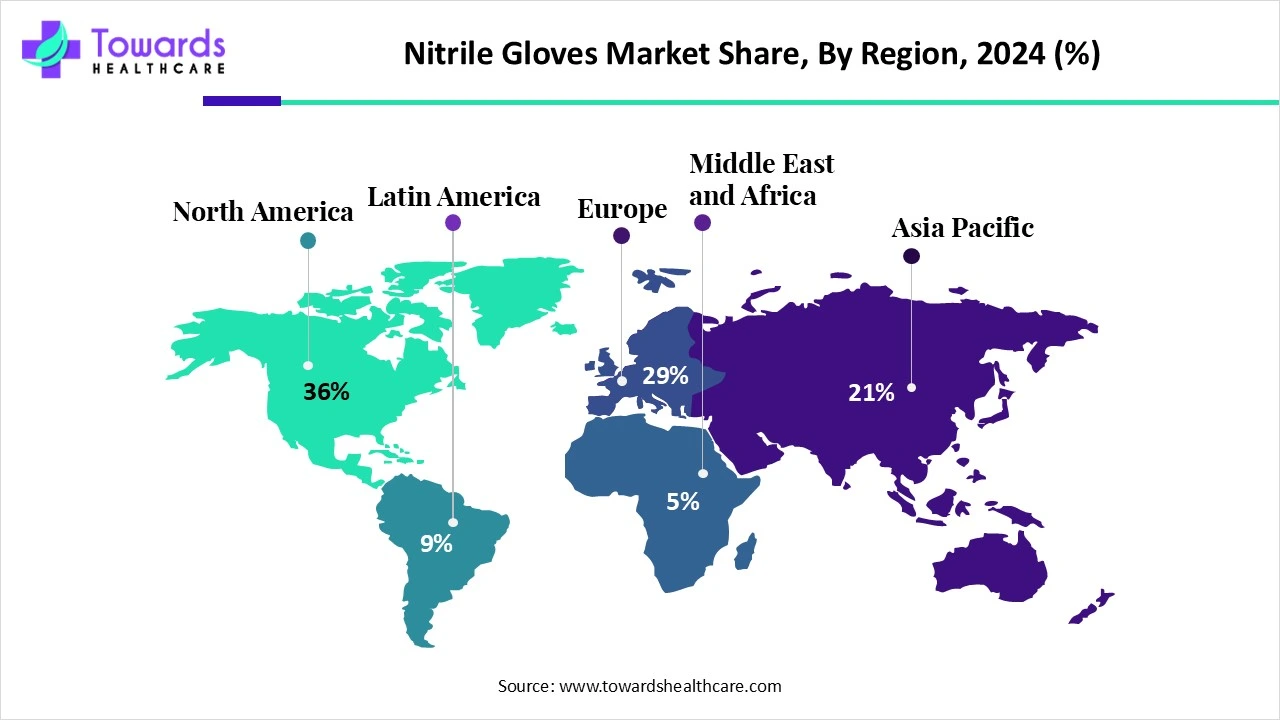

| Leading Region | North America by 36% |

| Market Segmentation | By Type, By Product, By End-Use, By Region |

| Top Key Players | American Nitrile, Ansell, Cardinal Health, Global Gloves S.R.L., Hartalega, Kemei, Kimberly-Clark Professional, Kim Gloves Co. Ltd., Kossan, Mercator Medical Ltd., Sybron, Top Glove, Unigloves Ltd., Wadi Surgicals |

Nitrile gloves are disposable gloves used in various applications, including medical, scientific, industrial, and manufacturing settings. They are made of nitrile rubber, also called Buna-N or NBR, a synthetic rubber copolymer derived from acrylonitrile and butadiene. They are available in sterile and non-sterile forms for protection against chemical exposure in a laboratory or for medical examination and surgery. They are widely preferred as they are more durable and chemical resistant compared to latex or vinyl gloves.

The rising prevalence of chronic disorders increases the number of hospitalizations, potentiating the demand for nitrile gloves. The increasing risk of hospital-associated infections also drives market growth. The growing demand for worker safety and security at workplaces or manufacturing sites augment the market. The COVID-19 pandemic has increased the demand for personal protective equipment (PPE). Additionally, the growing chemistry research and development activities promote the market.

Artificial intelligence (AI) can revolutionize the development of gloves with superior properties. AI algorithms assist in the design, manufacturing, and usage of nitrile gloves, ensuring user safety and comfort. AI can aid researchers in finding novel materials that can be incorporated with nitrile to enhance elasticity, strength, and chemical resistance. AI and machine learning (ML) algorithms can analyze vast amounts of data and understand user requirements. They can also enable manufacturers to design personalized gloves tailored to their intended use. The advent of AI-based sensors can help detect various parameters, including glove integrity, wear and tear, and the presence of harmful substances or pathogens. Integrating sensors into nitrile gloves enables the development of smart gloves, providing real-time monitoring and feedback. However, the use of AI in nitrile gloves is still in its infancy.

Growing Research and Development

The major growth factor of the nitrile gloves market is the growing research and development activities. Ongoing advancements in drug discovery, diagnostics, and therapies involve the use of hazardous chemicals. Increasing investments are favoring the development of novel drugs. According to a Deloitte report, the top 20 pharma companies increased their total R&D spending by 4.5%, reaching $145.5 billion in 2023. Nitrile gloves are the most commonly used gloves for handling chemicals in laboratories. These gloves are used as a physical barrier against brief contact with chemicals and are removed and discarded immediately. They can provide protection when working with oils, greases, acids, caustics, and alcohols. They also prevent the risk of latex allergies and tend to rip visibly when punctured in a chemical lab.

Non-biodegradability

The major challenge of the market is the non-biodegradable nature of nitrile gloves. Since they are non-biodegradable, they pose a significant threat to the environment as they can accumulate in the ecosystem. This can contribute to global warming and disrupt the ecosystem. The growing need for environmental sustainability is limiting the use of nitrile gloves, thereby restricting market growth.

Technological Advancements

The future of the nitrile gloves market is promising, driven by technological advancements that are enabling the development of nitrile gloves. Ongoing efforts are made to enhance the protective abilities and user comfort of nitrile gloves. The burgeoning material science sector and its latest innovations have led to the development of novel and more advanced nitrile gloves. Researchers are also developing gloves with improved tactile sensitivity and better temperature resistance. All these properties increase the demand for nitrile gloves over other materials. Advanced manufacturing techniques are contributing to the development of gloves that are thinner yet stronger, providing superior protection without compromising comfort the result of growing research into the extended applications of nitrile gloves in diverse fields. Thus, advancements in technology create numerous opportunities for nitrile glove manufacturers, enabling them to remain competitive in the market.

Why Did the Powder-Free Segment Dominate in the Nitrile Gloves Market?

By type, the powder-free segment held a dominant presence in the nitrile gloves market in 2024. Powder-free nitrile gloves do not contain powdered cornstarch. The demand for powder-free nitrile gloves is increasing as they offer superior benefits over powdered gloves. They reduce the risk of allergic reactions, which is otherwise common in powdered gloves, thereby decreasing contamination. They are highly preferred in sterile areas as there is no risk of powder contaminants. Additionally, they possess a high level of grip and dexterity, enabling them to handle intricate tasks with ease. They offer superior comfort and dexterity compared to powdered gloves.

Powdered Segment: Significantly Growing

By type, the powdered segment is predicted to witness significant growth in the nitrile gloves market over the forecast period. Powdered gloves contain cornstarch powder that is added as a donning agent. Due to the presence of a donning agent, the powder acts as a lubricant, making it easy to slide gloves on and off. These gloves have improved grip and dexterity, enabling precise handling and control for specific procedures. Moreover, they are more cost-effective and comfortable than powder-free nitrile gloves.

Which Product Type Segment Held the Dominating Share of the Nitrile Gloves Market?

By product, the disposable segment held the largest share of the nitrile gloves market in 2024. Numerous nitrile glove manufacturers are producing disposable gloves for enhanced protection. They eliminate the chances of cross-contamination and the need for sterilization after every use. Technological advancements have led to the development of biodegradable disposable gloves. The growing demand for environmental sustainability and the need to reduce contamination boost the segment’s growth. Disposable gloves provide a strong barrier of protection and are relatively cost-effective.

North America dominated the global nitrile gloves market share by 36% in 2024. Favorable government policies and regulatory frameworks potentiate the market. The increasing investments and collaborations between academia and industry promote the development of nitrile gloves. The emphasis on indigenous manufacturing of nitrile gloves also supports market growth. Advanced healthcare infrastructure, combined with the growth of the pharmaceutical and biotechnology sectors, encourages the development and use of nitrile gloves in North America.

U.S. Market Trends

The increasing investments by government organizations contribute to market growth. The U.S. federal government invested $1.5 billion in 2023 to boost American production of medical masks, gowns, gloves, and the raw materials to produce gloves. The primary objective was to reduce reliance on Asian countries and prevent potentially dangerous shortages. The Food and Drug Administration regulates the approval of medical gloves under the Class I reserved medical devices, requiring a 510(k) premarket approval.

Canada Market Trends

Favorable regulatory frameworks support the development of nitrile gloves. Health Canada regulates nitrile gloves in Canada, classifying them as Class II medical devices that meet specific design, testing, and manufacturing standards. The Canadian government also provides funding to promote the domestic manufacturing of nitrile gloves. The government announced $42 million in financing for Manikheir Canada, Inc. to build a medical-grade nitrile glove manufacturing facility in London, Ontario.

Asia-Pacific is anticipated to grow at the fastest rate in the nitrile gloves market during the forecast period. The availability of suitable manufacturing infrastructure encourages foreign investors and manufacturers to build manufacturing facilities in Asia-Pacific countries. The presence of key players and favorable government support are expected to drive market growth. Key players, including Safina Glove Co. Ltd., Riverstone Resources, and Innovative Gloves Co. Ltd., hold a significant market share in the Asia-Pacific.

China Market Trends

Favorable trade policies support the global export of nitrile gloves and their raw materials. China currently produces approximately 90 billion disposable gloves annually, accounting for over 20% of the global market share. The country’s disposable nitrile glove sector is in a stage of steady development, with production capacity continuing to increase and the utilization rate remaining at a higher level. As of August 8, 2024, the capacity utilization rate of disposable nitrile gloves in China reached 54%.

Malaysia Market Trends

The Malaysian market is in a growth stage, driven by the trade war between the U.S. and China. U.S. regulators increased the tariffs on China-made medical and surgical gloves from 7.5% to 25% in 2026. This is expected to give Malaysia a competitive edge, increasing its chances of exporting nitrile gloves in the U.S. Currently, Malaysia’s rubber glove industry holds 44% of the U.S. market.

Europe is expected to experience significant growth in the nitrile gloves market during the forecast period. The rising disposable income and favorable government support are propelling the market. The growing healthcare and pharmaceutical sectors, as well as research and development activities, also contribute to the market. The European Medicines Agency (EMA) approved a total of 46 new drugs in 2024. New drug approvals facilitate the use of nitrile gloves for handling hazardous chemicals in research.

Germany Market Trends

Germany is the world's largest importer of nitrile gloves. In 2023, Germany imported $327 million worth of rubber surgical gloves. The gloves were mainly imported from Malaysia, China, Thailand, and Indonesia. The country also exported around $103 million of rubber surgical gloves in 2023. Additionally, the increasing adoption of advanced technologies is leading to the development of more advanced nitrile gloves.

South America is expected to grow significantly in the nitrile gloves market during the forecast period, due to the expanding healthcare sector. The growing safety concerns are also increasing their use across various workplaces and for personal hygiene. Additionally, the growing startup ecosystem and expanding industries are also increasing their adoption rates, promoting market growth.

Brazil Nitrile Gloves Market Trends

The growing health and hygiene awareness are increasing the use of nitrile gloves across Brazil. At the same time, the expanding healthcare is also increasing its use for the growing medical procedures. Similarly, the growing R&D activities are also increasing their adoption rates across the industries and institutes.

MEA is expected to grow significantly in the nitrile gloves market during the forecast period, due to growing focus on infection control. The increasing hygiene awareness and expanding healthcare infrastructure across MEA are also increasing the use of nitrile gloves. Moreover, the chemical resistance of the nitrile gloves is also driving their demand for industrial use, which is enhancing the market growth.

Saudi Arabia Nitrile Gloves Market Trends

Due to the post-COVID effect, the demand for nitrile gloves is increasing in Saudi Arabia. The growing hygiene awareness and increasing infection controls are also increasing their use across different workplaces and hospitals, respectively. The growing innovations are also increasing their demand, where growing investments are promoting their production rates.

R&D

Clinical Trials and Regulatory Approvals

Packaging and Serialization

Patient Support and Services

George Mason, Sales and Managing Director of Sybron, commented on the launch of biodegradable latex and nitrile gloves, that the company continuously enhances its product offering for customers. Nitrile and latex gloves end up in general waste. He also stated that the company’s bio-nitrile gloves contribute to environmental sustainability, enabling customers to fulfill their environmental responsibilities.

By Type

By Product

By End-Use

By Region

February 2026

February 2026

February 2026

February 2026