February 2026

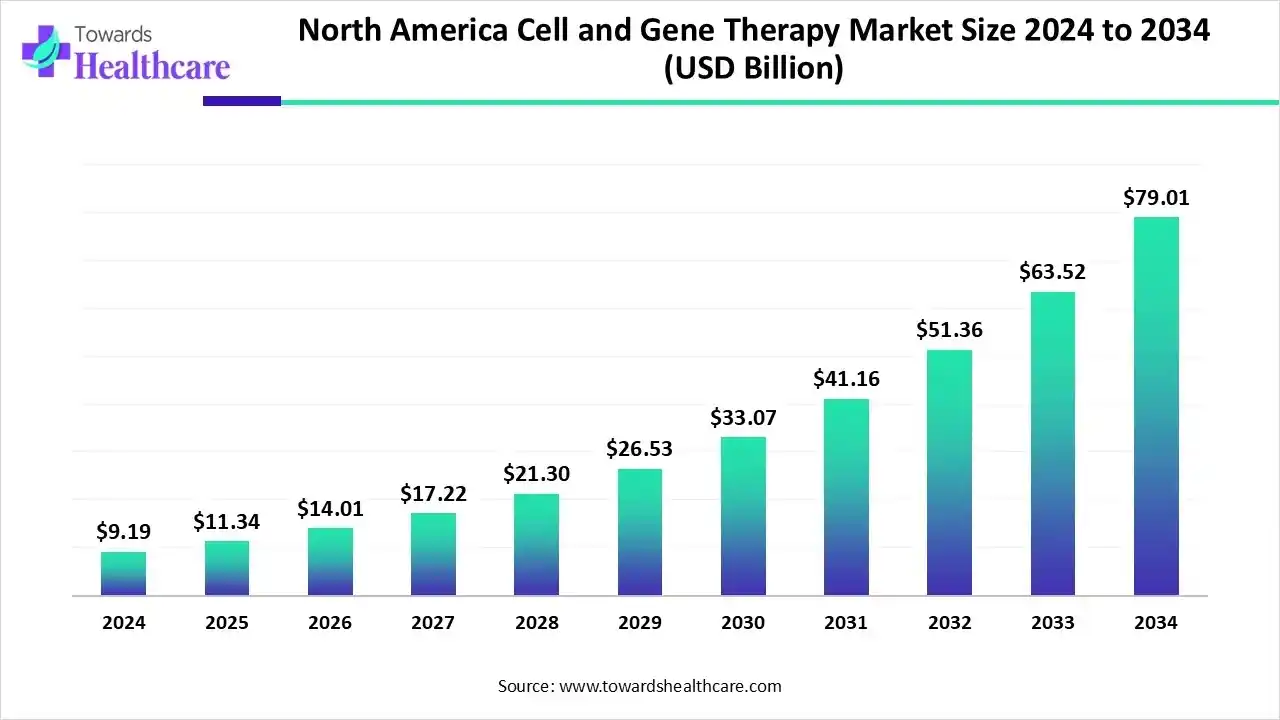

The North America cell and gene therapy market size is calculated at US$ 9.19 billion in 2024, grew to US$ 11.34 billion in 2025, and is projected to reach around US$ 79.01 billion by 2034. The market is expanding at a CAGR of 24.01% between 2025 and 2034.

Due to the potential for curing chronic and rare/orphan diseases for which there were previously few available treatments, the North America cell and gene therapy market is growing quickly. In addition to changing the biopharmaceutical industry, the discovery of advanced medications has played a pivotal role in altering the paradigm for treating a number of rare and life-threatening illnesses. One of the main factors propelling the market is the quick development of the sophisticated therapeutic landscape.

| Table | Scope |

| Market Size in 2025 | USD 11.34 Billion |

| Projected Market Size in 2034 | USD 79.01 Billion |

| CAGR (2025 - 2034) | 24.01% |

| Market Segmentation | By Therapy Type, By Therapeutic Area, By Vector Type, By Cell Source, By Manufacturing Scale, By End User, By Region |

| Top Key Players | Novartis AG, Gilead Sciences (Kite Pharma), Bristol Myers Squibb, Bluebird Bio, Spark Therapeutics (Roche), CRISPR Therapeutics, Editas Medicine, Intellia Therapeutics, Sangamo Therapeutics, Vertex Pharmaceuticals, Moderna Therapeutics, Pfizer Inc., Regeneron Pharmaceuticals, Precision BioSciences, Fate Therapeutics, Allogene Therapeutics, Adaptimmune Therapeutics, Iovance Biotherapeutics, Beam Therapeutics, REGENXBIO Inc. |

The North America cell and gene therapy market is growing due to robust research ecosystems, strong regulatory frameworks, accelerated approvals from the U.S. FDA, and substantial biopharmaceutical investments. Cell and gene therapy encompasses therapeutic innovations that use cellular and genetic materials to prevent, treat, or cure diseases by targeting underlying biological mechanisms. Cell therapies involve the transplantation or modification of live cells, including stem cells, immune cells, and engineered cells, to repair or replace damaged tissues. Gene therapies utilize vectors, often viral or non-viral delivery systems, to introduce, modify, or silence genetic material for long-lasting therapeutic effects. The market is driven by the rising prevalence of chronic and rare diseases, increasing clinical trial activity, and significant funding in regenerative medicine.

AI has the ability to completely transform the North America cell and gene therapy market. Although AI is still in its early phases, it has enormous potential for cell and gene-based therapeutics. Comprehensive knowledge of an individual's genetic makeup and risk factors is necessary for personalised therapy. Screening can be aided by algorithms based on machine learning (ML), a branch of artificial intelligence. ML-based models have effectively forecasted gene expression, stem cell differentiation, and cell fate by employing algorithms trained with data previously accessible from various people as well as pre-clinical and clinical research.

Rising clinical trials: One of the major trends in the North America cell and gene therapy market is the rise in cell and gene therapy-based clinical trials. Due to the increasing need for personalized medicine, oncology therapeutics, and the treatment of other serious health issues, large-scale clinical trials are being conducted, particularly in relation to CRISPR gene editing.

For instance,

| Company Name | Headquarters | Date | Major Investments |

| Akadeum Life Sciences | Michigan, U.S. | September 2025 | $20 million+ for supporting scaling-up commercial operations & supporting customers to enter clinical trials. |

| Stylus Medicine | Cambridge, U.S | May 2025 | $85 million funding for developing a new class of in-vivo genetic medicine. |

| AvenCell Therapeutics | Watertown, U.S. | October 2024 | Raised $112 million to support the ongoing clinical validation of CAR-T cell therapy |

| Bristol Myers Squibb | New York, U.S. | April 2024 | In Collaboration with Cellares, announced $380 million for manufacturing CAR-T cell therapies. |

| Arsenal Biosciences, Inc. | San Francisco, U.S. | September 2024 | Raised $325 million for advancing in CAR-T cell therapies. |

By therapy type, the cell therapy segment held the major share of the North America cell and gene therapy market in 2024, accounting for approximately 55% of the revenue. Oncology, immunological-related disorders, and degenerative illnesses have all been successfully treated with cellular therapies, which include stem cell-based regeneration and modified immune cell platforms. In a number of early clinical trials, cell therapy, which alters or uses autologous or allogeneic cells to accomplish precision targeting or tissue regeneration—has demonstrated notable effectiveness.

By therapy type, the gene therapy segment is estimated to be the fastest-growing during 2025-2034. Gene therapy is a novel strategy that has the potential to completely transform the treatment of a wide range of illnesses and medical disorders in an era of fast technological development. Current clinical trial trends indicate that interest and funding for investigating gene therapy as a potential therapeutic option are rising.

By therapeutic area, the oncology segment held the major share of the North America cell and gene therapy market in 2024, accounting for approximately 45% of the revenue. It is estimated that the overall incidence of cancer would rise by almost 45% between 2010 and 2030, from 1.6 million cases in 2010 to 2.3 million cases in 2030. Minorities and older persons who have been diagnosed with cancer are the main causes of this rise. Younger persons are expected to see an 11% rise in cancer incidence, whereas elderly adults are expected to experience a 67% increase.

By therapeutic area, the rare genetic disorders segment is estimated to be the fastest-growing during 2025-2034. To improve the development and licencing processes for rare illness therapies, U.S. regulatory authorities have taken major steps in the last year. The FDA's Rare Disease Endpoint Advancement (RDEA) Pilot Programme in the United States provided active assistance for the creation of new efficacy endpoints for medications used to treat rare diseases.

By vector type, the viral vectors segment held the major share of the North America cell and gene therapy market in 2024, accounting for approximately 70% of the revenue. Recent years have seen an encouraging new beginning for the use of viral vectors in gene therapy. Modern medicine now places viral vector-based therapy at the forefront thanks to notable advancements in vector engineering, delivery, and safety. Hematologic, ophthalmologic, cardiovascular, muscular, metabolic, and infectious disorders, as well as several forms of cancer, have all been treated with viral vectors.

By vector type, the non-viral vectors segment is estimated to be the fastest-growing during 2025-2034. It has been shown that non-viral vectors, especially lipid nanoparticles (LNPs) and cationic polymers, have a strong gene loading capacity, are safe and practical, and are easy to prepare. Non-viral vectors are therefore showing great promise for more clinical research and use.

By cell source, the autologous segment held the major share of the North America cell and gene therapy market in 2024, accounting for approximately 60% of the revenue. Because autologous cells are taken from a patient, they provide several advantages. Because of its immunological benefits, autologous cell therapy products are seen to be worth the effort necessary to create. Additionally, autologously generated cell treatments have a higher potential for long-term effects, lasting months or years in the patient's body.

By cell source, the allogeneic segment is estimated to be the fastest-growing during 2025-2034. The "off-the-shelf" approach of allogeneic cell treatment is more efficient. The cells used in this process come from healthy donors, are genetically altered, and are kept in big quantities. In just a few days, the best donor cell batch may be matched to the patient's tissue type, which is the main benefit. It is possible that allogeneic cell therapy will increase the accessibility of CAR T therapies by facilitating large-scale preparation and application.

By manufacturing scale, the clinical-scale manufacturing segment held the major share of the North America cell and gene therapy market in 2024, accounting for approximately 65% of the revenue. Cell and gene therapies (CGTs) require clinical-scale manufacturing in order to provide enough reliable, secure, and efficient dosages for use in human clinical trials. This procedure allows for the testing of potentially effective treatments on patients by bridging the gap between laboratory-based research and commercial-scale manufacture.

By manufacturing scale, the commercial-scale manufacturing segment is estimated to be the fastest-growing during 2025-2034. The process is intricate, controlled, and technology-driven, starting with the procurement of raw materials and ending with the delivery of completed goods. The pharmaceutical business must rely on reliable manufacturing processes, skilled facilities, and ongoing innovation in order to meet the demands of an expanding market, rising production volumes, and stricter quality standards. The key to future success is striking a balance between accuracy, conformity, and flexibility.

By end-user, the biopharma & biotechnology companies segment held the major share of the North America cell and gene therapy market in 2024, accounting for approximately 50% of the revenue. Among the top biopharma and biotechnology firms in the field of cell and gene therapy are CRISPR Therapeutics, Bristol Myers Squibb, Gilead Sciences/Kite Pharma, Novartis, and Bluebird Bio. These businesses are creating novel medicines for cancer, rare illnesses, and genetic disorders by using gene-editing and delivery platforms, as well as technologies such as Chimeric Antigen Receptor T-cell (CAR-T) therapies.

By end-user, the hospitals & specialty clinics segment is estimated to be the fastest-growing during 2025-2034. In India, hospitals and speciality clinics that specialise in neurology, regenerative medicine, and cancer provide cell and gene treatments. For a variety of ailments, these institutes provide cutting-edge therapies including gene therapy, stem cell transplants, and CAR T-cell therapy.

due to the contemporary era's excellent healthcare infrastructure and technological advancements. Furthermore, a number of public and commercial organisations are believed to be contributing significantly to the region's current technological achievements in gene and cell treatments. Additionally, the area has a high level of patient awareness and has adopted the newest treatments, giving the market a competitive edge.

The U.S. dominated the North America cell and gene therapy market in 2024 by capturing a revenue of approximately 85%. An increasing number of gene and cell therapies are being approved by the U.S. Food and Drug Administration (FDA) as they progress through clinical studies. The FDA has approved the marketing of seven CAR T-cell products in the U.S., and each of these treatments has been approved for sale in other significant healthcare markets. In the field of cell and gene therapy (CGT), the U.S. is still expanding and holding a dominant position.

Cell and gene treatments have helped many people in Canada and throughout the world by effectively addressing and curing uncommon genetic illnesses as well as chronic ailments. Health Canada's BGTD, which regulates clinical trials and enforces the Food and Drugs Act, must approve gene therapy, which is subject to strict regulations in Canada.

In October 2024, dedicated to CGTs, OmniaBio is Canada's biggest commercial-scale contract development and manufacturing organisation (CDMO), a division of the Centre for Commercialisation of Regenerative Medicine (CCRM) in Toronto. With a total project investment of more than $580 million, OmniaBio has constructed a new biomanufacturing plant in Hamilton, Ontario, with the help of Invest Ontario, generating 250 skilled employment. It is Canada's largest facility of its sort, being opened in October 2024.

Gene and cell therapy R&D starts with payload design and target identification, then moves on to pre-clinical testing, which includes in vivo models and cell characteriszation. Developing and verifying analytical techniques for product quality control, expanding manufacturing in accordance with Good Manufacturing Practices (GMP), and carrying out thorough clinical studies to prove safety and efficacy are all essential tasks. Lastly, reliable production procedures, safe supply chains, and ongoing data-driven monitoring are necessary for commercialisation.

Preclinical laboratory testing is the first step in the process, which is followed by multi-phase human clinical trials, an Investigational New Drug (IND) application to authorities such as the FDA, and a Biologics Licence Application (BLA) for marketing clearance. Following clearance, post-market surveillance continues.

Navigating eligibility and finances, managing treatment logistics, and offering sympathetic, instructive assistance during administration and long-term follow-up are all part of patient support for cell and gene therapy. Case managers oversee travel, lodging, and emotional requirements while coordinating complex care.

By Therapy Type

By Therapeutic Area

By Vector Type (for Gene Therapy)

By Cell Source (for Cell Therapy)

By Manufacturing Scale

By End User

By Region

February 2026

February 2026

February 2026

February 2026