February 2026

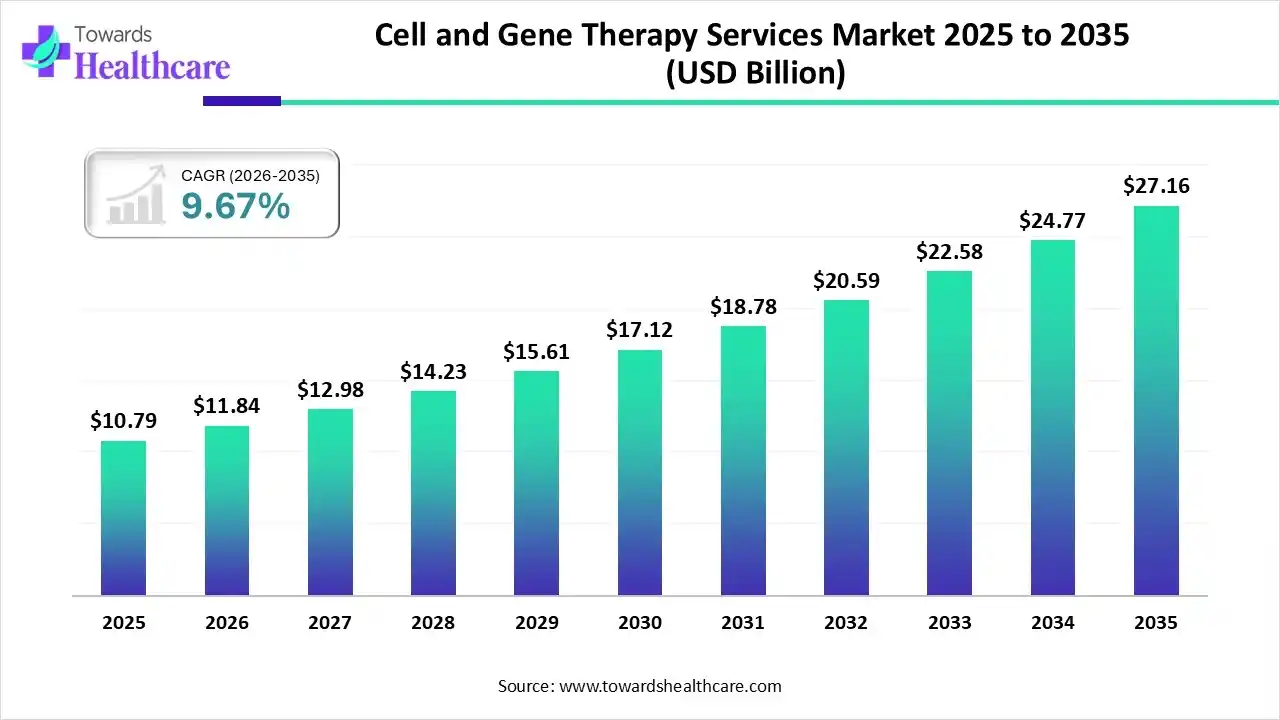

The global cell and gene therapy services market size was estimated at USD 10.79 billion in 2025 and is predicted to increase from USD 11.84 billion in 2026 to approximately USD 27.16 billion by 2035, expanding at a CAGR of 9.67% from 2026 to 2035.

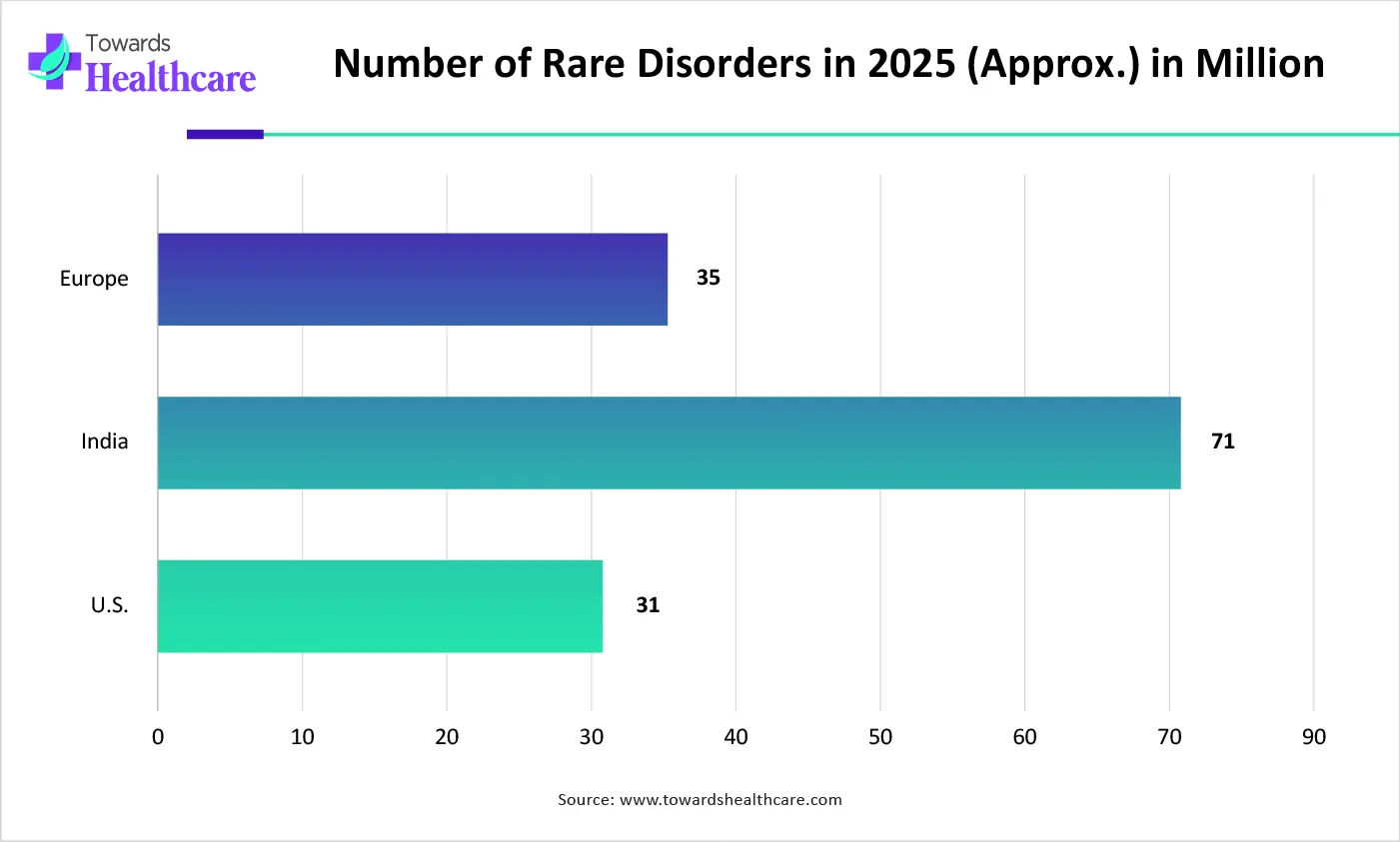

With a huge pool of rare genetic conditions and cancers, the global market has been shifting towards advanced cell and gene therapy or their combinations through the robust clinical trial facilities provided by CDMO or others. Furthermore, leaders are governing AI, automation, and other integrated services, which are increasingly supporting streamlining processes and ensuring patient safety.

| Key Elements | Scope |

| Market Size in 2026 | USD 11.84 Billion |

| Projected Market Size in 2035 | USD 27.16 Billion |

| CAGR (2026 - 2035) | 9.67% |

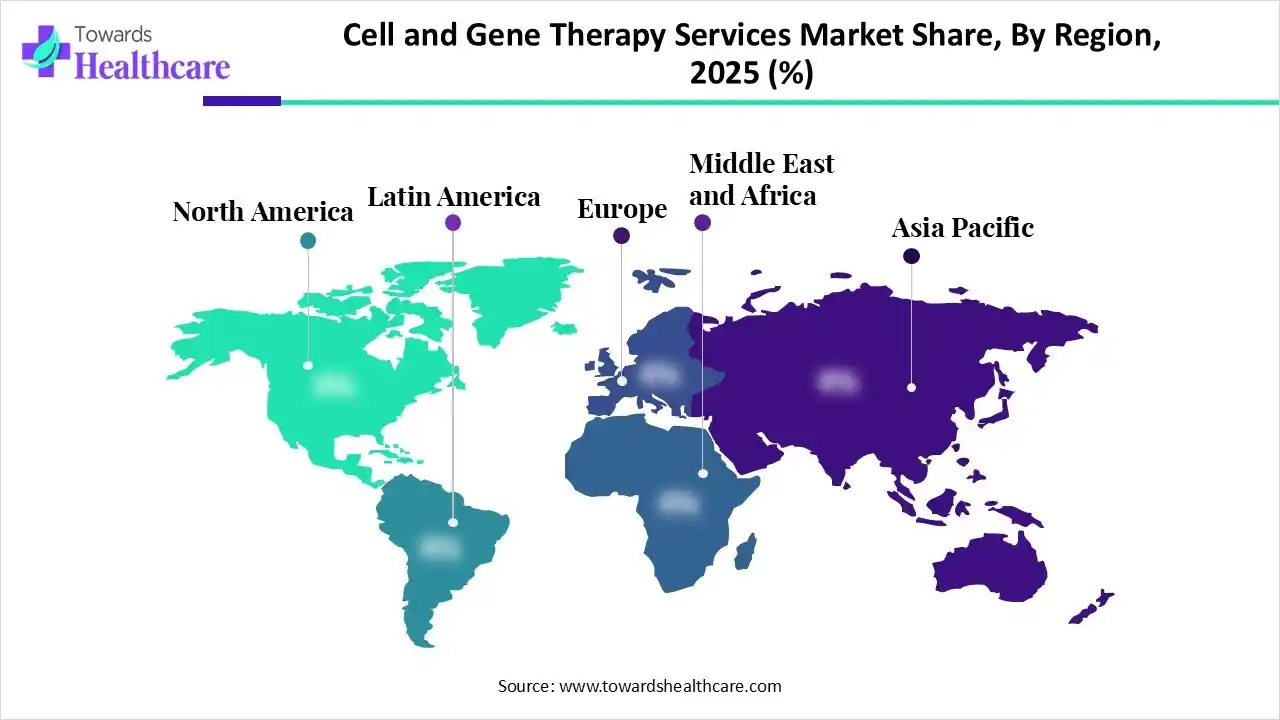

| Leading Region | North America |

| Market Segmentation | By Service Type, By Therapy Type, By Phase of Development, By End User, By Delivery Mode, By Region |

| Top Key Players | Lonza, Thermo Fisher Scientific, Catalent, WuXi App Tec, FUJIFILM Diosynth Biotechnologies, AGC Biologics, Novartis, Charles River Laboratories, Intellia Therapeutics, IQVIA |

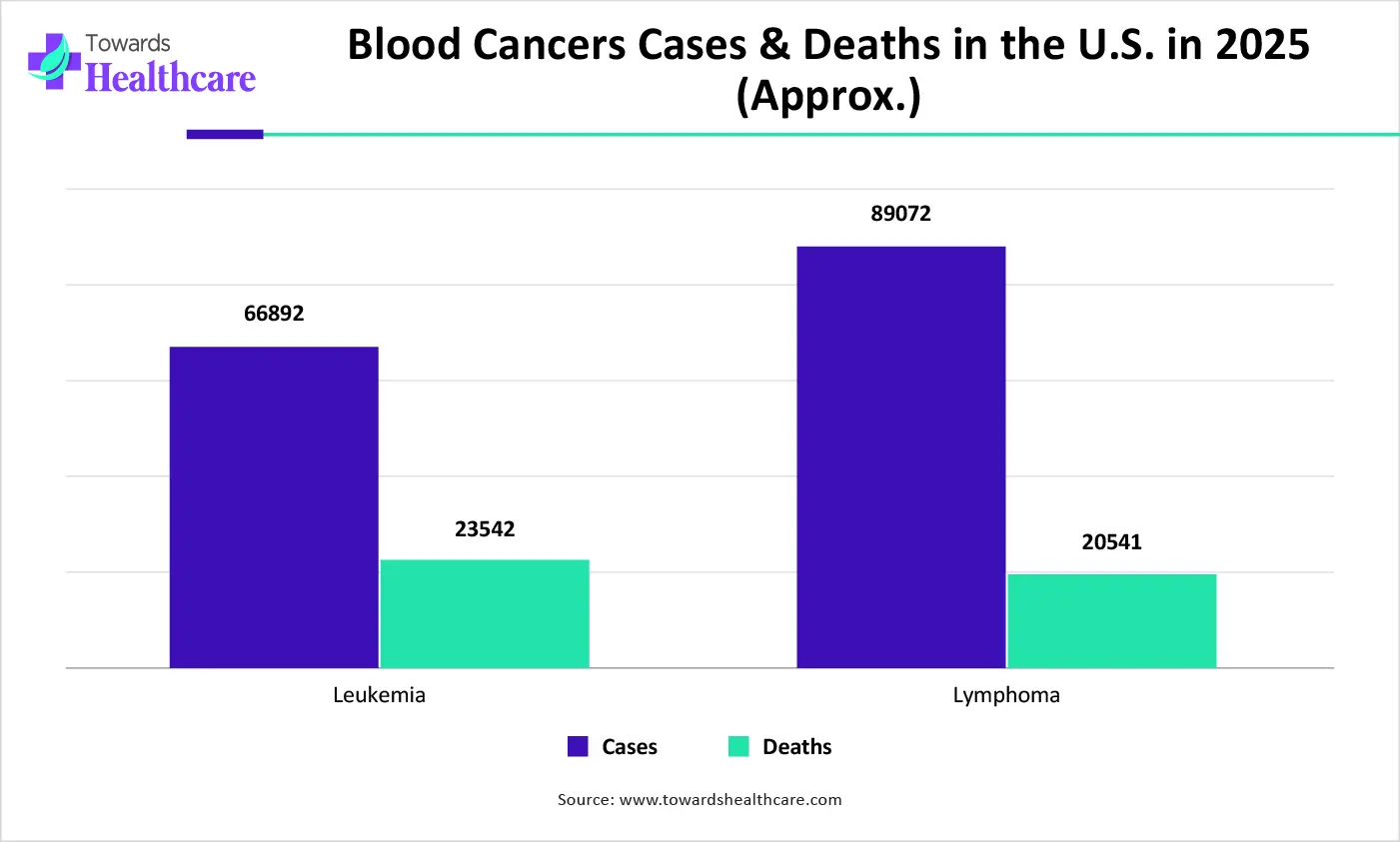

Firstly, the global cell and gene therapy services market encompasses advanced medical treatments, which are immensely involved in the modification of a patient's cells or genes to fight diseases, especially cancer, genetic disorders, and chronic conditions. Moreover, this market is propelled by a rise in patient pool for cancer/genetic disorders, higher investment, favourable government policies, and outsourcing to specialized CDMOs. Major latest developments include Neurotech Pharmaceuticals’ Encelto, which received FDA approval, and is an encapsulated cell therapy implant that secretes a protein to slow vision loss in macular telangiectasia type 2 (MacTel).

The inclusion of substantial AI tools, like large language model-powered CRISPR-GPT established at Stanford Medicine, is acting as "copilots" to support scientists in designing complex gene-editing experiments, forecasting probable concerns, and suggesting guide RNA sequences, which ultimately shorten development timelines and reduce hurdles to entry. Currently, firms, including Ori Biotech, are broadly using automated non-viral manufacturing platforms, which combine real-time AI process control to optimize scalability and maintain consistency between batches.

Beyond rare diseases, the scientists are promoting applications of these therapies into solid tumors (CAR-T), autoimmune disorders (like Type 1 Diabetes), and neurological issues, with numerous trials ongoing.

Nowadays, the leaders are emphasizing the development of allogeneic (off-the-shelf) CAR-T to resolve manufacturing concerns and leveraging CAR-T use in solid tumors.

The globe is focusing on broader execution of automation and closed-system manufacturing processes to raise consistency, lower human error and contamination challenges, and further highlight current production bottlenecks.

Which Service Type Led the Cell and Gene Therapy Services Market in 2025?

In 2025, the vector manufacturing services segment captured 32.80% share of the market. Primarily, many combined solutions omits progression period by simplifying plasmid, vector, and testing steps, further accelerating entry to clinical trials. Nowadays, CDMOs are widely developing large, GMP-compliant facilities for plasmid DNA and viral vectors (AAV, Lentivirus). In 2025, UniQure's AMT-130 (for Huntington's Disease) received FDA Breakthrough Therapy Designation, which utilises an AAV vector to demonstrate a crucial slowing of disease progression, paving the way for accelerated approval.

Fill & Finish Services

The fill & finish services segment will expand at 17.60% CAGR. This mainly comprises sterile filling of the final drug product (cells or vectors) into vials, a major complex, sensitive process, which needs strict aseptic conditions. The latest breakthrough covers Symbiosis finished the qualification of its innovative automated fill/finish line for commercial production in Scotland, which operates within a Grade A Restricted Access Barrier System (RABS) for aseptic liquid filling of up to 15,000 vials per batch.

Why did the Gene Therapy Segment Dominate the Market in 2025?

The gene therapy segment held a 41.30% share of the cell and gene therapy services market in 2025. A prominent driver is the rising need for curative treatments for genetic diseases, rare disorders, and cancers. The widespread use of ultra-rapid whole-genome sequencing (WGS) for newborn screening is fostering speed in initiatives, such as the UK and NYC's GUARDIAN study, which allows earlier diagnosis of actionable conditions and develops lifelong genomic baselines.

Cell & Gene Combination Therapy

In the future, the cell & gene combination therapy segment will expand rapidly at 18.90% CAGR. Ongoing advances in CRISPR-Cas9 and novel delivery approaches are allowing accurate gene editing and cellular changes, which unveil newer therapeutic avenues. Current development includes a Phase I/II clinical trial (BNT211) that unites a Claudin 6 (CLDN6) targeting CAR-T cell product with a CAR-T cell-Amplifying RNA Vaccine (CARVac).

How did the Clinical (Phase I, II, III) Segment Lead the Market in 2025?

With a 46.50% share, the clinical (Phase I, II, III) segment registered dominance in the cell and gene therapy services market in 2025. Phase I is mainly fueled by new early-stage biotech/academic research, gene editing tools, and synthetic biology platforms. Currently, numerous Phase I/II trials have been started or are continued for allogeneic CAR-T cell therapies targeting conditions, particularly Lupus Nephritis (LN), Systemic Lupus Erythematosus (SLE), and others. Whereas Adicet Bio's ADI-100 and Century Therapeutics' therapies dosed first patients in their Phase I/II trials, respectively, used from cancer to autoimmune conditions.

Commercial Manufacturing

The commercial manufacturing segment is predicted to expand at 19.40% CAGR. The increasing number of R&D activities in various biopharma firms is highly dependent on specialized Contract Development & Manufacturing Organizations (CDMOs) to manage complex production. Day by day, players are exploring decentralized or "point-of-care" manufacturing models for enhancing patient access & lowering logistic risks, like cold-chain management.

Which End User Dominated the Cell and Gene Therapy Services Market in 2025?

The pharmaceutical & biotechnology companies segment captured 57.60% share of the market in 2025. Significant players, like Novartis, Gilead Sciences (Kite Pharma), Bristol Myers Squibb (BMS), Amgen, Johnson & Johnson, Biogen, and Merck KGaA, are increasingly stepping into the evolution of CAR-T, TILs, gene editing, and viral gene therapy. However, Cytiva, Lonza, and Merck KGaA are widely implementing their bioreactor portfolios and manufacturing capabilities (CDMO services) to assist commercial-scale production.

Hospitals & Specialty Clinics

In the coming era, the hospitals & specialty clinics segment is estimated to grow at 16.80% CAGR. Substantial catalysts are the complexity of treatments, the need for skilled staff, and the role in clinical trials, which are highly fueling CGT services' demands. An immersive example is Boston Children's Hospital Gene Therapy Program, which emphasizes diverse inherited disorders, such as beta-thalassemia, hemophilia, and sickle cell disease. Although other facilities are focusing on stem cell research and clinical applications for blood disorders, cardiac, and neurological issues.

Why did the Outsourced Services Segment Lead the Cell and Gene Therapy Services Market in 2025?

In 2025, the outsourced services segment captured 68.90% share & will expand at 16.20% CAGR in the coming years. Specifically, CDMOs are widely offering significant expertise in cell culturing, viral vector production, and regulatory navigation. Alongside extensive testing, like potency assays, vector quantification, and immunogenicity testing, is often outsourced to expert contract research organizations (CROs) and CDMOs. Recently, Elly's Team (a rare disease foundation) signed a CDMO agreement with Charles River Laboratories to produce starting materials for a Phase I clinical trial.

With a major share, North America led the cell and gene therapy services market in 2025, due to the escalating technological breakthroughs and R&D expenditures. Also, they have well-developed biotech facilities and an advanced manufacturing hub, which bolsters the overall cell and gene therapy developments.

For instance,

On the other hand, the U.S. is greatly impelling automation and robotics for simplifying processes and reducing errors. Cencora was selected to facilitate integrated distribution and commercialization services for the launch of Neurotech's novel cell therapy.

At the highest CAGR, in the cell and gene therapy services market, the Asia Pacific will widely explore different regulatory and industrial events in CGT. Recently, the Singapore Cell and Gene Therapy Pan Asia Summit (SCGT 2025) was conducted to bring together industry leaders for discussing regulatory harmonization and transforming research into clinical and commercial applications.

Specifically, China is fostering cell therapy trials, mainly in oncology, with over 400 therapies in diverse clinical stages. Also, Contract Research Organizations (CROs) are primarily managing and strengthening these trials, which bolsters a more favourable regulatory landscape and pre-IND engagement with the Center for Drug Evaluation (CDE).

Europe will expand notably, due to the rising focus on expanding its manufacturing to meet the increasing demand, through investments or collaborations. Recently, Miltenyi Biotec has leveraged its automated CliniMACS Prodigy Platform, a highly used solution for combining CGT production steps into a single closed workflow.

Besides this, the UK is increasingly putting efforts into expansion of the cell and gene therapy services market, such as NHS England announced that the personalised therapy, obecabtagene autoleucel (brand name Aucatzyl) will be accessible via specialist centres for adults with relapsed or refractory B-cell acute lymphoblastic leukaemia.

In October 2025, Mytos, a biotechnology company automating cell manufacturing, launched its automated contract development and manufacturing organization (CDMO) offering to resolve one of regenerative medicine’s substantial risks.

| Comapny | Description |

| Lonza | They facilitate comprehensive Cell & Gene Therapy services (CDMO) from research to commercialization, like viral/non-viral vector manufacturing (AAV, Lentivirus), autologous/allogeneic cell therapy support (iPSCs, TILs, NK cells), etc. |

| Thermo Fisher Scientific | It mainly explores end-to-end services and products for cell and gene therapy (CGT), broadening from early research through commercial manufacturing and global distribution. |

| Catalent | This acts as a leading CDMO for advanced therapies, comprising development, manufacturing (clinical & commercial), and supply chain for cell types. |

| WuXi App Tec | A company covers discovery, development, testing, manufacturing, and commercialization, like viral vector services (like OXGENE's tech) and advanced analytical testing for CAR-T and others. |

| FUJIFILM Diosynth Biotechnologies | Specifically, it offered various facilities in the US (CA, TX) and UK (Darlington) for clinical & commercial supply. |

| AGC Biologics | It provides services from pre-clinical to commercial scale, specializing in viral vectors (AAV, Lentivirus), plasmid DNA, and engineered cell manufacturing. |

| Novartis | A firm innovating CAR-T cancer treatments (like Kymriah) and developing gene therapies for rare genetic diseases (like SMA with Zolgensma). |

| Charles River Laboratories | They leverage an end-to-end "concept-to-cure" portfolio for cell & gene therapy (CGT) progression. |

| Intellia Therapeutics | A clinical-stage biotech company emphasizing curative cell and gene therapies using its proprietary CRISPR/Cas9 genome editing platform. |

| IQVIA | It supports addressing complex logistics, regulatory barriers, and manufacturing requirements through integrated lab, clinical, regulatory, and real-world evidence services. |

Sometimes, certain therapies may targets wrong cells or integrate into unintended parts of the genome (insertional mutagenesis), which have chances to result in new diseases or cancer.

In a few cases, greater investments lead to high failure rates in clinical trials and restrictions in commercialisation. Further, returning investment can be uncertain and delay to materialize, which makes investors more cautious and selective with funding, particularly impacting smaller biotech companies.

By Service Type

By Therapy Type

By Phase of Development

By End User

By Delivery Mode

By Region

February 2026

February 2026

February 2026

February 2026