February 2026

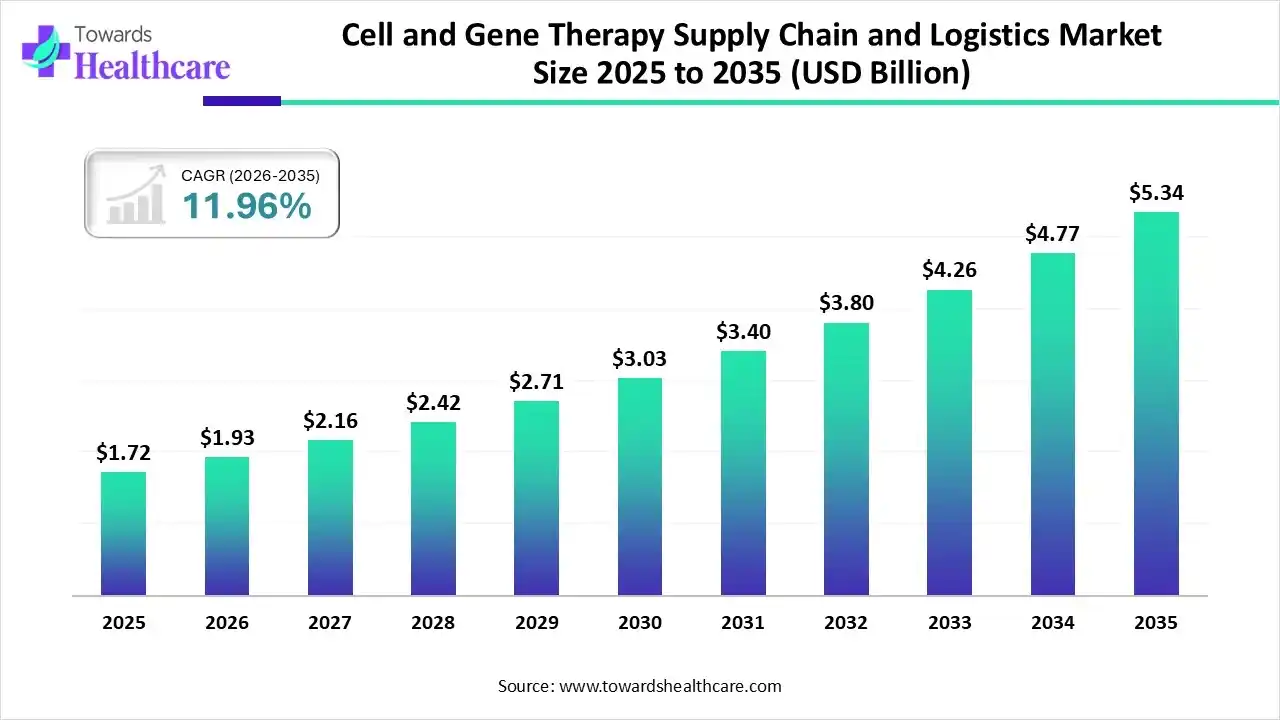

The global cell and gene therapy supply chain and logistics market size was estimated at USD 1.72 billion in 2025 and is predicted to increase from USD 1.93 billion in 2026 to approximately USD 5.34 billion by 2035, expanding at a CAGR of 11.96% from 2026 to 2035.

The cell and gene therapy supply chain and logistics market is growing rapidly, driving its demand for an extremely particular and carefully managed supply chain. From carrying delicate cells and genes safely and effectively at precise temperatures to moving significant patient samples back to the laboratory.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.93 Billion |

| Projected Market Size in 2035 | USD 5.34 Billion |

| CAGR (2026 - 2035) | 11.96% |

| Leading Region | North America |

| Market Segmentation | By Application Area, By type of software, By end user, By Scale of Operation, By Type of Deployment |

| Top Key Players | The Match BioTherapies, MAK-SYSTEM, Cryoport, Brooks Life Sciences, Lykan Bioscience, Clarkston Consulting, Hypertrust Patient Data Care |

The cell and gene therapy supply chain and logistics market includes logistics management, which is a significant element of operationalizing cell and gene therapy (CAGT) trials. There are exclusive logistics necessities for autologous cell therapy modalities and allogeneic cell therapies, also for in vivo and ex vivo gene therapies and gene editing. A holistic strategy to logistics management is also significant to supporting sites, as it enables improved risk management and compliance.

Growth is driven by the increasing need for gene therapies and gene editing technologies such as CRISPR or Cas9 base editors, which feature a similar divergence of logistical difficulty from the chain of identity or chain of care asset tracking of ex vivo gene therapies.

The integration of AI-driven technology into the cell and gene therapy supply chain and logistics market growth by this technology renovates cell and gene therapy (CGT) orchestration by automating physical processes, growing productivity, attractive supply chain visibility, and improving scalability. It optimizes manufacturing technology, lowering time for small batches and forecasting demand. Predictive analytics detects potential challenges before they arise, enabling organizations to proactively tackle risks. AI-driven technology helps mitigate transportation delays by enhancing supply chain logistics and automating communication with suppliers, safeguarding timely updates on inventory levels and shipping timelines.

Cell and gene therapy supply chain and logistics improved traceability intensifies; modern services support organizations to drive patient safety and product integrity.

Cold chain logistics are intended to meet the particular requirements of cell or gene therapy and involve storage temperature requirements, packaging services, and transportation approaches.

Various types of systems, such as PAS-X Savvy, allow smart bioprocess data management for real-time decision-making. Confirm data-driven biomanufacturing decisions with PAS-X Savvy’s well-developed analytics.

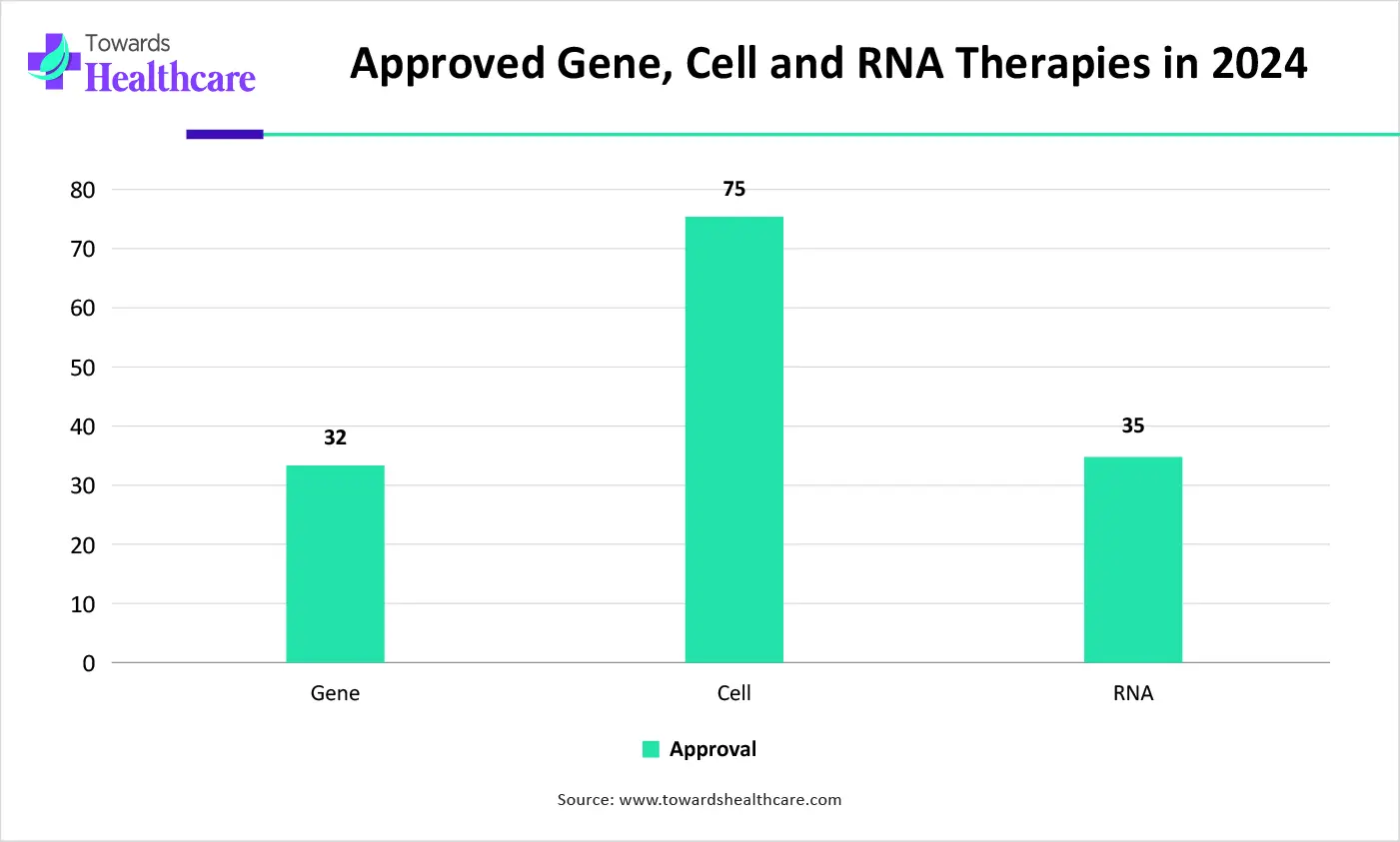

| Type of therapy | Number of therapies |

| Gene therapies | 40 |

| RNA therapies | 35 |

| Non-genetically modified cell therapies | 75 |

Which Application Area Led the Cell and Gene Therapy Supply Chain and Logistics Market in 2025?

In 2025, the donor & patient enrollment segment held the dominant market share, as manufacturing cell and gene therapies (CGTs) involves complex processes that require robust quality management, especially within academic current Good Manufacturing Practice (cGMP) facilities. Providing patients and caregivers with visibility into the status of their therapy's journey (much like tracking a retail shipment) can provide comfort, assurance, and a sense of control during a stressful time.

Sample Collection & Processing

Whereas the sample collection & processing segment is the fastest-growing in the market, it is also reducing costs and turnaround time. Rising efficiency by orchestrating the cell or gene therapy supply chain. Quicken setup and roll out of novel products or therapies. Integration with related business partners, cell labs, treatment centers, CMOs, and logistics solutions providers. It faster time to market for cell and gene therapies

Why did the Cell Orchestration Platforms Segment Dominate the Market in 2025?

The cell orchestration platforms (COI/COC) segment is dominant in the cell and gene therapy supply chain and logistics market in 2025, as these platforms play a significant role in cell therapy, particularly for autologous therapies. While the functionality they deliver is undoubtedly required in a profitable setting. This system automates physical processes, enhancing productivity, improving supply chain visibility, and enhancing scalability.

Manufacturing Execution Systems (MES)

Whereas the manufacturing execution systems (MES) segment is the fastest growing in the market, as MES streamlines manufacturing operations by lowering downtime, enhancing machine usage, and reducing waste. By offering precise monitoring and control of manufacturing processes, MES significantly lowers defects and rework. MES integrates with supply chain systems to confirm real-time inventory tracking and demand forecasting future.

Why is the Biobanks & Repository Operators Segment Dominant in the Market?

In 2025, the biobanks & repository operators segment held the dominant cell and gene therapy supply chain and logistics market share, as cell and gene therapy (CGT) logistics demand an extremely specialized and carefully managed supply chain. From carrying delicate cells and genes safely and effectively at specific temperatures to moving significant patient samples back to the lab, each step must be accurately planned and implemented.

Cell Therapy Manufacturing Facilities

Whereas the cell therapy manufacturing facilities segment is the fastest growing in the market, as these facilities are advancing in the advancement of cellular therapies with a focus on cancer immunotherapy, it highlights some of the most challenging operational aspects and points to potential services. These drives are essential in advancing CGT products from phase 1 to phase 3 clinical trials and, ultimately, to commercialization.

Why is the Clinical Scale Segment Dominant in the Market in 2025?

In 2025, the clinical scale segment held the dominant segment in the cell and gene therapy supply chain and logistics market, as it improves relationships with suppliers, enabling better terms and potentially lowering the expenses of healthcare supplies. Well-organized supplier management provides a straightforward path to optimizing medical care logistics and the supply chain.

Commercial Scale

Whereas the commercial scale segment is the fastest growing in the market, as medical companies lower staffing and capital expenditures by outsourcing their shipping, warehousing, and inventory management technology. Healthcare logistics is becoming increasingly effective as organizations strive to optimize their supply chain and increase efficiency.

Why is the Cloud-Based Segment Dominant in the Market?

In 2025, the cloud-based segment held the dominating cell and gene therapy supply chain and logistics market, as cloud-based systems offer enterprises a holistic view of their complete operations, improving supply-chain visibility and efficient partnership. This enables organizations to bypass capital investments and streamline shipping processes to lower any additional operating costs. Cloud services leverage managed automation and data analysis, leading to intelligent systems of resupply processes.

On-Premises

Whereas the on-premises segment is significantly growing in the market, as on-premises services need businesses to manage, install, and maintain software and servers in their own facilities. These systems generally involve high upfront expenses, widespread IT resources, and continuing maintenance. On-premises systems do not trust external vendors for maintenance or service uptime, making them an appropriate choice for industries that prefer an in-house IT strategy.

In 2025, North America led the cell and gene therapy supply chain and logistics market, as this region is a hub for pharmaceutical contract development and manufacturing, home to some of the world's most advanced CDMOs. This region is seeing major capital spending from both biopharma sponsors and private equity, with novel biologics services and advanced modality platforms under construction in states such as North Carolina, Texas, and Ohio.

The U.S. Food and Drug Administration (FDA) needs to mandate stringent drug preservation standards, involving temperature monitoring, safe handling, and appropriate documentation to ensure product safety and effectiveness, which drives the demand for cell and gene therapy logistics systems. IoT-driven temperature sensors allow real-time monitoring of the storage situation, ensuring precise temperature and humidity control. Good Distribution Practices (GDP) in the pharma sector ensure product safety, quality, and traceability to meet government compliance.

Asia Pacific is set to experience rapid growth in the cell and gene therapy supply chain and logistics market, as an increasingly popular spot for leading clinical trials by providing reduced trial costs, access to large patient pools, and a supportive regulatory environment. There is a wealth of extremely trained professionals in different fields associated with clinical research, involving medical professionals, clinical trial coordinators, researchers, and support staff.

For Instance,

In India, scaling healthcare production, which increases the cell and gene therapy supply chain and logistics demand. Supply chain disruptions follow the appropriate trial timelines, and this increases patient outcomes. In India, this sector has emerged as a talented frontier, with research institutions and biotech organizations actively evolving indigenous CGT services while establishing international partnerships to advance these revolutionary strategies to medicine.

Europe is growing significantly in the cell and gene therapy supply chain and logistics market, with growing regulatory support as the European Medicines Agency (EMA) regulates ATMPs by the Committee for Advanced Therapies (CAT), which offers scientific advice and assesses marketing authorization applications for ATMPs based on safety, quality, and effectiveness. UPS Healthcare is investing over €20 million to improve its temperature-controlled fleet, helping the increasing demand for cold chain logistics in Europe.

For instance,

The UK has a combination of world-class academic institutions, well-known infrastructure, and specialised talent. This ecosystem provides a modest edge amid worldwide geopolitical uncertainty, strengthening the case for the UK to serve as an important international hub for advanced therapies production. The UK has an experienced, skilled workforce with developed facilities in strong regional clusters. It is a hub to four of the global top ten universities for life sciences and medicine, and it ranks third for worldwide medical sciences citations.

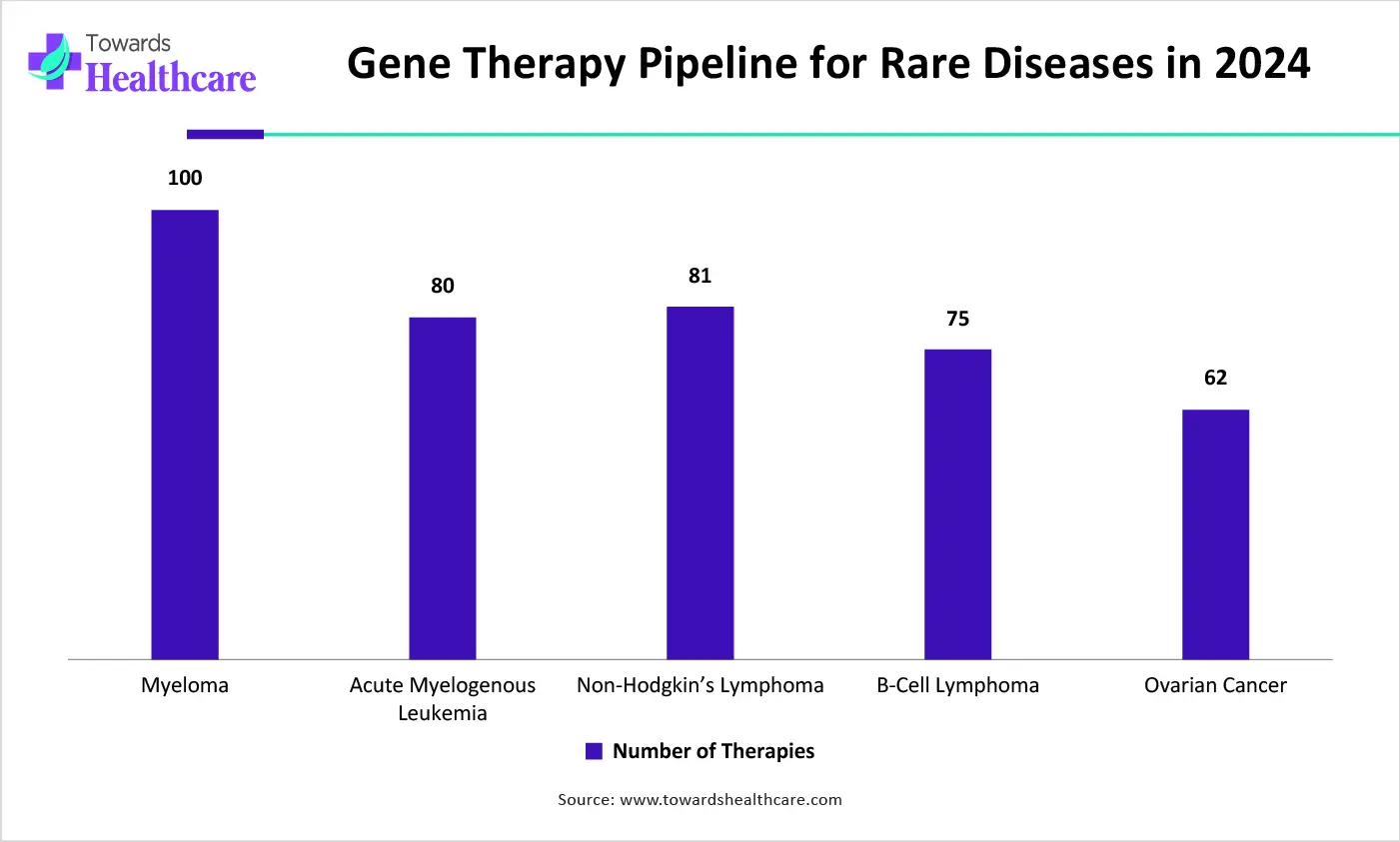

| Diseases | Number of therapies |

| Myeloma | 99 |

| Acute myelogenous leukemia | 80 |

| Non-Hodgkin’s lymphoma | 80 |

| B-cell lymphoma | 75 |

| Ovarian cancer | 63 |

| Company | Headquarters | Latest Update |

| The Match BioTherapies | Minneapolis | Recent activity shows continuing integration efforts and increasing capabilities in decentralized productions. |

| MAK-SYSTEM | London | MAK System's COSMAS / TCS cell therapy software manages aspects of stem cell management, from procurement to transplantation. |

| Cryoport | Tennessee | Cryoport Systems is advancing the cell therapy landscape by incorporating cryopreservation services into our industry-leading supply chain platform. |

| Brooks Life Sciences | United States | Brooks Life Sciences is now known as Azenta Life Sciences. |

| Lykan Bioscience | United States | In December 2025, RoslinCT is performing technology transfer and supporting the commercial manufacture of Omisirge for an additional indication following successful clinical trials. |

| Clarkston Consulting | North Carolina | Clarkston Consulting services for cell and gene therapy support organizations bridge the gap between scientific discovery and commercial reality. |

| Hypertrust Patient Data Care | Belgium | Hypertrust Patient Data Care (HPDC) focuses on orchestrating complex Cell and Gene Therapy (CGT) supply chains with its X-Chain platform, providing end-to-end visibility. |

wasted time in cell and gene therapies certainly becomes wasted therapies and possibly patient lives on the line, and any number of supply chain complications lead to those unacceptable results.

By Application Area

By type of software

By end user

By Scale of Operation

By Type of Deployment

Regional Outlook

February 2026

February 2026

February 2026

February 2026