February 2026

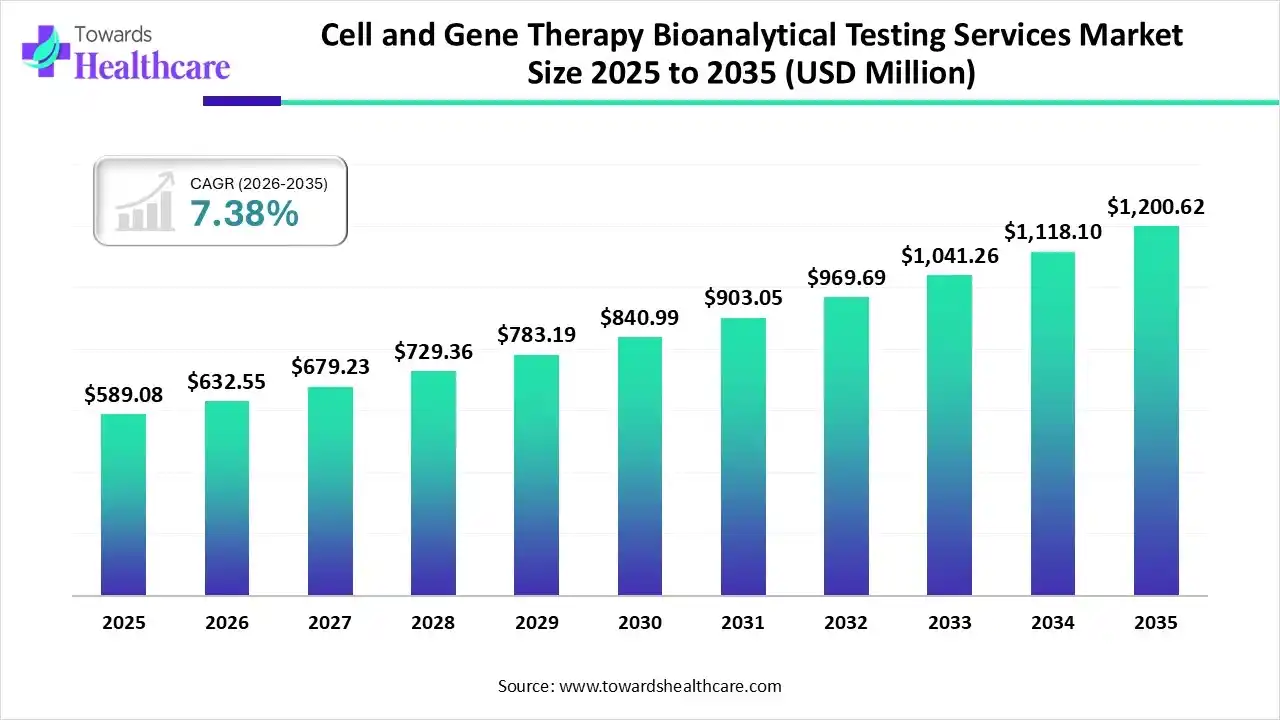

The global cell and gene therapy bioanalytical testing services market size was estimated at USD 589.08 million in 2025 and is predicted to increase from USD 632.55 million in 2026 to approximately USD 1200.62 million by 2035, expanding at a CAGR of 7.38% from 2026 to 2035.

The cell and gene therapy bioanalytical testing services market is rapidly expanding as advanced therapies progress through clinical pipelines, driving demand for precise quality, safety, and regulatory testing. North America dominates due to strong R&D infrastructure, supportive regulations, and high outsourcing to specialized CROs. Growth is fueled by emerging technologies, increased clinical trials, and rising investment, despite high infrastructure costs and complex regulatory landscapes.

| Key Elements | Scope |

| Market Size in 2026 | USD 632.55 Million |

| Projected Market Size in 2035 | USD 1200.62 Million |

| CAGR (2026 - 2035) | 7.38% |

| Leading Region | North America |

| Market Segmentation | By Test Type, By Product Type, By Stage of Development by Product Type, By Indication, By Region |

| Top Key Players | BioAgilytix Labs, KCAS Bioanalytical Services, IQVIA, Inc., Laboratory Corporation of America (Labcorp), Pharmaceutical Product Development (PPD) / Thermo Fisher Scientific, Prolytix, Pharmaron, Charles River Laboratories, Syneos Health, SGS SA |

The cell and gene therapy bioanalytical testing services market is driven by rising clinical trial activity, growing R&D investments, and the need for robust quality, safety, and regulatory compliance assessments. Demand is further boosted by technological advancements and outsourcing to specialized CROs. North America dominates the market with strong infrastructure and favourable regulations. Increasing adoption of precision analytics, single-cell techniques, and personalized therapies supports sustained growth, overcoming challenges like high costs and evolving standards.

AI integration can significantly improve the cell and gene therapy bioanalytical testing services market by enhancing data accuracy, speed, and reproducibility across complex analytical workflows. Machine learning algorithms enable advanced pattern recognition in high-volume biological datasets, supporting faster biomarker identification and potency assessment. AI-driven automation streamlines sample analysis, reduces human error, and optimizes assay development. Additionally, predictive analytics support regulatory compliance, improve quality control, and accelerate clinical development timelines, strengthening overall testing efficiency and reliability.

Emerging tools like single-cell sequencing and high-resolution mass spectrometry enhance sensitivity and precision in testing, enabling deeper characterization of complex therapies and better insight into efficacy and safety profiles.

Biotech firms increasingly partner with contract research organizations to access expertise, scalable infrastructure, and regulatory support, reducing development costs while maintaining high-quality testing standards.

Global regulatory agencies are aligning guidelines for bioanalytical testing, pushing the adoption of standardized protocols and enhancing quality assurance, which supports market growth and smoother global therapy approvals.

North America continues to dominate due to strong investment and innovation hubs, while Asia-Pacific shows rapid growth as infrastructure improves and more clinical trials are conducted internationally.

| Country | Measles Cases (2025) |

| India | 10,544 |

| Indonesia | 1,840 |

| Pakistan | 7,038 |

| Somalia | 467 |

| Yemen | 14,750 |

| Canada | 4,800 |

| Mexico | 9,775 |

| U.S. | 2,013 |

How Bioavailability & Bioequivalence Studies Segment Dominated the Market?

The bioavailability & bioequivalence studies segment dominates the cell and gene therapy bioanalytical testing services market due to strict regulatory requirements for safety, efficacy, and consistency evaluation. The complex nature of advanced therapies demands specialized assays for biodistribution, potency, and immunogenicity. Growing clinical trial activity and widespread outsourcing to expert CROs further strengthen demand for these essential testing services.

Pharmacokinetics

The pharmacokinetics segment is estimated to be fastest growing segment in the market due to increasing demand for detailed assessment of therapy absorption, distribution, metabolism, and elimination. Advanced therapies’ complex biological behavior necessitates precise PK profiling. Rising clinical trial activity, regulatory emphasis on PK data, and adoption of innovative analytical tools further drive growth in pharmacokinetic testing within cell and gene therapy development.

How Did Non-Clinical Become a Dominant Segment in the Cell and Gene Therapy Bioanalytical Testing Services Market?

The non-clinical segment dominates because early safety, toxicity, and mechanism-of-action studies are critical for cell and gene therapies before human trials. Extensive animal testing, regulatory mandates for preclinical evidence, and complex biological assessments drive sustained demand for bioanalytical services in non-clinical development, supported by advanced analytical platforms and expert CRO partnerships.

Clinical

The clinical segment is anticipated to be the fastest-growing in the market due to expanding late-phase trials and increased approvals of cell and gene therapies. Demand for rigorous safety, efficacy, and pharmacokinetic data drives extensive clinical bioanalytical testing. Enhanced regulatory focus, broader patient enrollment, and outsourcing to specialized service providers further accelerate growth in clinical testing services.

Which Product Type Segment Led the Cell and Gene Therapy Bioanalytical Testing Services Market?

The cell therapy segment dominates because of its widespread adoption in treating cancers, autoimmune disorders, and regenerative conditions. High complexity, stringent safety requirements, and the need for comprehensive bioanalytical testing, including potency, identity, and purity assessments, drive demand. Increasing clinical trials and outsourcing to specialized CROs further reinforce its market dominance.

Gene-Modified Cell Therapy

The gene-modified cell therapy segment is estimated to be the fastest-growing segment due to the rising adoption of advanced therapies like CAR-T and CRISPR-based treatments. Its complex genetic modifications require extensive bioanalytical testing for safety, efficacy, and vector characterization. Increasing clinical trials, regulatory focus on precise monitoring, and outsourcing to specialized CROs further accelerate growth in this high-demand segment.

How is the Oncology Dominant Segment in the Cell and Gene Therapy Bioanalytical Testing Services Market?

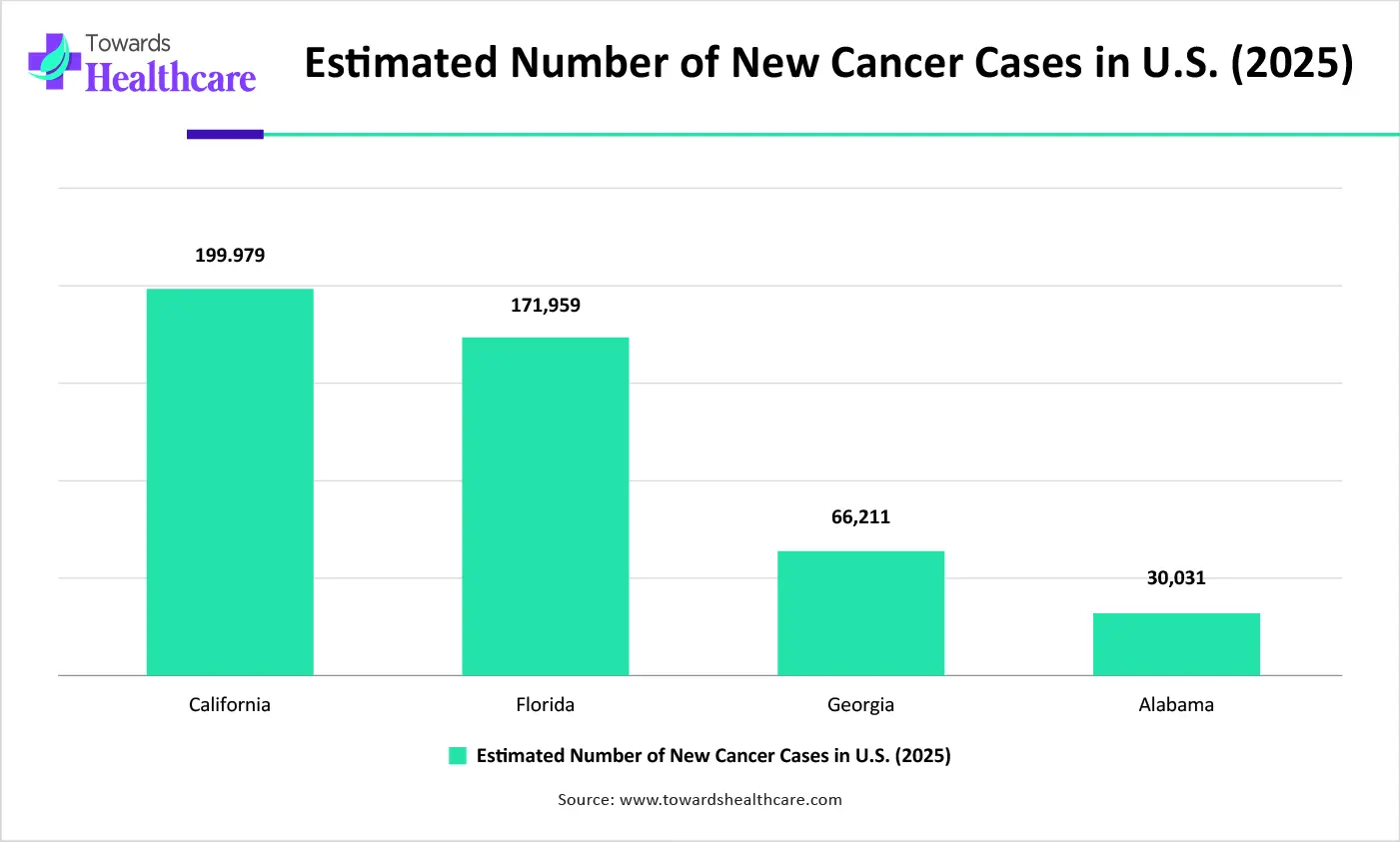

The oncology segment dominates because cell and gene therapies are extensively developed for cancer treatment, including CAR-T and gene-modified therapies. High clinical trial activity, complex therapeutic requirements, and stringent regulatory oversight drive demand for comprehensive bioanalytical testing, ensuring safety, efficacy, and quality in oncology-focused advanced therapies.

Rare Diseases

The rare diseases segment is anticipated to be the fastest-growing in the market due to increasing development of personalized cell and gene therapies targeting genetic disorders. Rising patient demand, supportive regulatory incentives, and complex bioanalytical requirements for safety, efficacy, and vector characterization drive the need for specialized testing services, accelerating growth in this niche segment.

North America dominated the cell and gene therapy bioanalytical testing services market in 2025. North America dominates the market due to a well-established biotechnology infrastructure, strong R&D investments, and supportive regulatory frameworks. The region hosts numerous advanced CROs, extensive clinical trial activity, and early adoption of innovative technologies, ensuring robust bioanalytical testing capabilities and maintaining leadership in the global cell and gene therapy ecosystem.

U.S. Market Trends

The U.S. leads the North American cell and gene therapy bioanalytical testing services market due to its advanced biotechnology ecosystem, high R&D investment, and presence of numerous specialized CROs. Strong regulatory support, extensive clinical trial activity, and early adoption of innovative testing technologies further reinforce the country’s dominance in bioanalytical services for advanced therapies.

Asia Pacific is estimated to host the fastest-growing cell and gene therapy bioanalytical testing services market during the forecast period. The Asia-Pacific region is the fastest-growing market for cell and gene therapy bioanalytical testing services due to increasing investment in biotechnology infrastructure, rising clinical trial activity, and government initiatives supporting advanced therapies. Growing outsourcing to specialized CROs, expanding healthcare access, and adoption of innovative analytical technologies further drive rapid growth, positioning the region as a key emerging hub for bioanalytical testing.

China Market Trends

China dominates the Asia-Pacific market due to substantial government support, rapid expansion of biotechnology infrastructure, and growing R&D investment. The country hosts numerous clinical trials, advanced CROs, and manufacturing facilities, while regulatory reforms and the adoption of innovative analytical technologies enhance testing capabilities, positioning China as the region’s leader in advanced therapy bioanalytical services.

Europe is expected to grow at a significant CAGR in the cell and gene therapy bioanalytical testing services market during the forecast period. Europe is witnessing notable growth in the market due to increasing investment in advanced therapies, supportive regulatory frameworks, and the expansion of specialized CROs. Strong clinical trial activity, collaborations between biotech companies and research institutes, and adoption of innovative analytical technologies enhance testing capabilities, driving the region’s steady growth in bioanalytical services.

UK Market Trends

The UK dominates Europe’s cell and gene therapy bioanalytical testing services market due to its strong biotechnology ecosystem, robust R&D investment, and presence of leading CROs. Supportive regulatory frameworks, extensive clinical trial activity, and early adoption of advanced analytical technologies further strengthen the country’s position as a key hub for bioanalytical testing in advanced therapies.

| Company | Core Offerings in Cell & Gene Therapy Bioanalytical Testing | Notes / Services Focus |

| BioAgilytix Labs | Specialized bioanalytical testing for biologics, immunogenicity, PK/PD, and advanced assays | Focus on complex CGT analytics and large-molecule testing. |

| KCAS Bioanalytical Services | Regulatory-compliant bioanalytical testing, assay development & validation | Strong regulatory focus tailored to therapeutic trials. |

| IQVIA, Inc. | Integrated bioanalytical services, including LC-MS/MS, cell-based assays | Supports full drug development lifecycle. |

| Laboratory Corporation of America (Labcorp) | Comprehensive bioanalytical testing, molecular diagnostics, and quality control | Broad laboratory network supporting CGT programs. |

| Pharmaceutical Product Development (PPD) / Thermo Fisher Scientific | Bioanalytical testing, PK/PD, biomarker assays | Expanded capabilities for CGT sample testing |

| Prolytix | Customized advanced analytical solutions using state-of-the-art technologies | Emphasis on tailored and innovative bioanalysis. |

| Pharmaron | Broad CGT bioanalytical services (PK/TK, biodistribution, immunogenicity, cell-based assays) | Supports IND/BLA submissions; viral vector and cell assay suite |

| Charles River Laboratories | High-precision analytics, including vector characterization, immunoassays | Expanded viral vector and bioanalytical platforms. |

| Syneos Health | Early-phase bioanalytical testing networks and biomarker analysis | Integrated clinical/bioanalytical solutions supporting CGT trials |

| SGS SA | ELISA, LC/MS, biomarker testing, advanced analytical services | Global testing solutions with specialized PK/PD capabilities |

By Test Type

By Product Type

By Stage of Development by Product Type

By Indication

By Region

February 2026

February 2026

February 2026

February 2026