February 2026

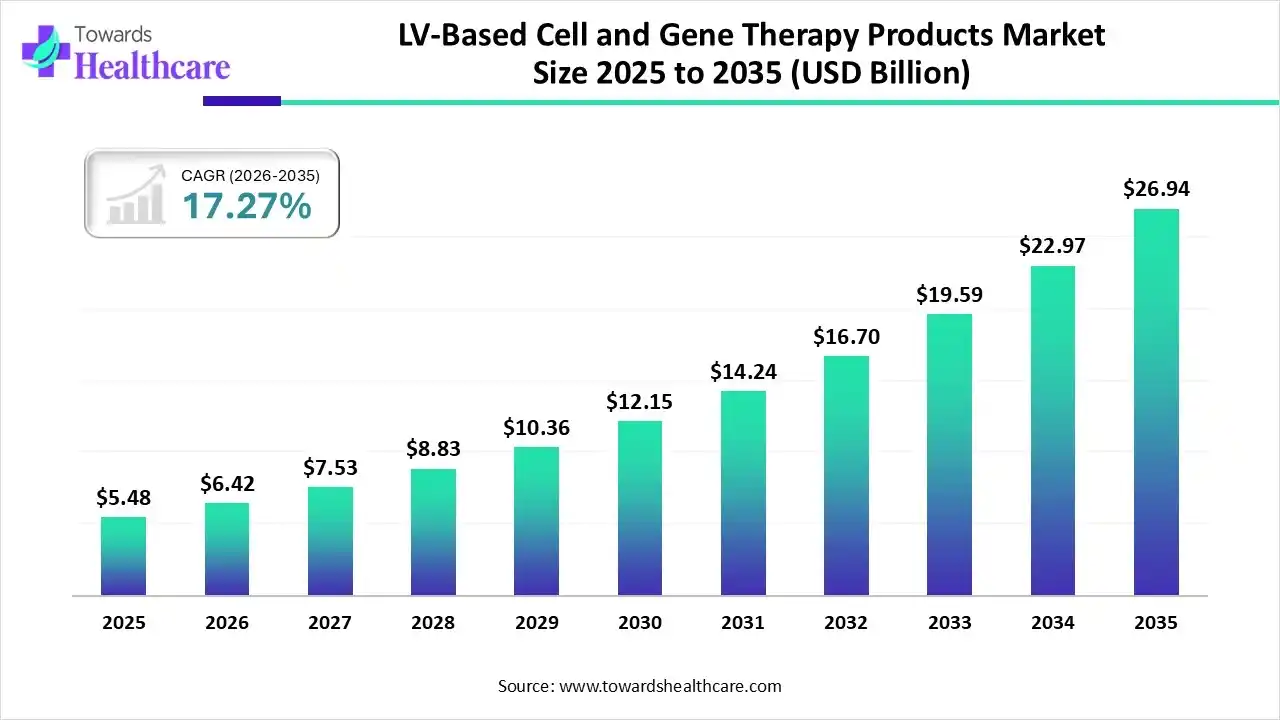

The global LV-based cell and gene therapy products market size was estimated at USD 5.48 billion in 2025 and is predicted to increase from USD 6.42 billion in 2026 to approximately USD 26.94 billion by 2035, expanding at a CAGR of 17.27% from 2026 to 2035.

The growing chronic diseases are increasing the demand for LV-based cell and gene therapies globally, where the use of AI technologies is accelerating their innovations. Additionally, the growing investments are also increasing their R&D activities, where the advanced healthcare, regulatory standards, and expanding industries are also increasing their use across various regions. Furthermore, companies are launching new products, promoting market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 6.42 Billion |

| Projected Market Size in 2035 | USD 26.94 Billion |

| CAGR (2026 - 2035) | 17.27% |

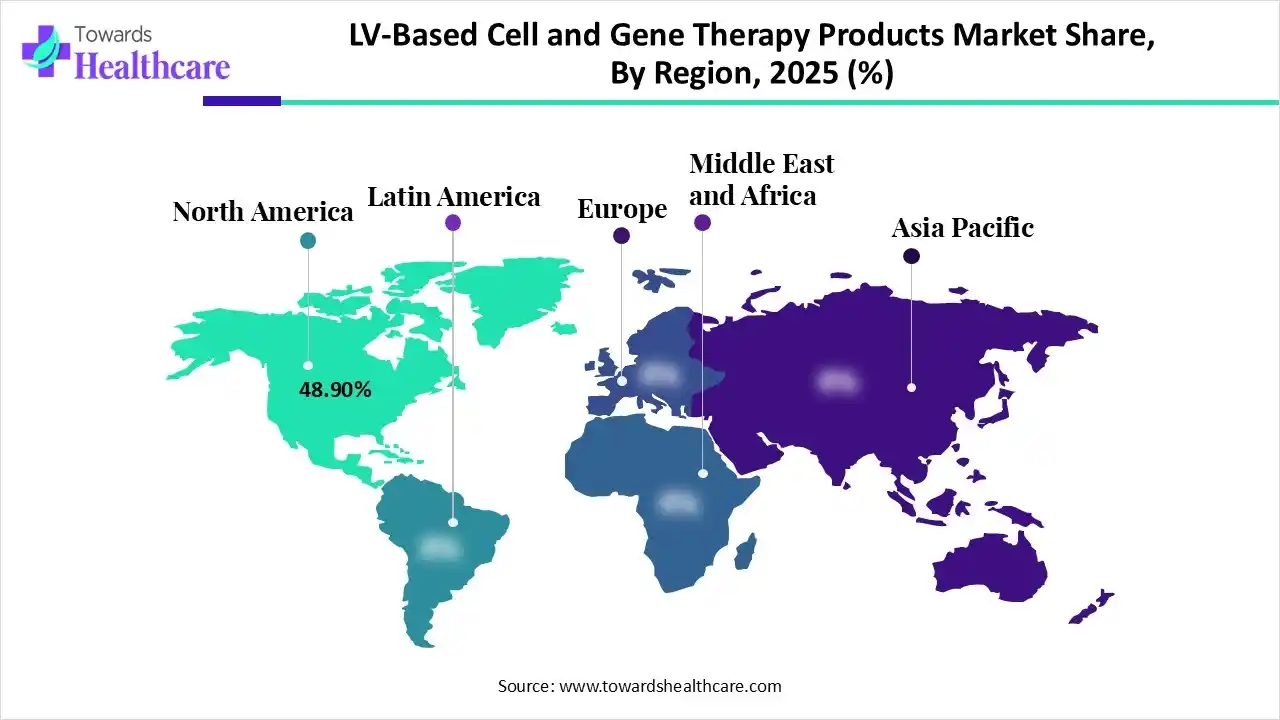

| Leading Region | North America by 48.90% |

| Market Segmentation | By Product Type, By Therapeutic Area, By Indication Type, By End User, By Vector Production Type, By Region |

| Top Key Players | Bristol Myers Squibb, bluebird bio, Novartis, Orchard Therapeutics, Kyverna Therapeutics, Abeona Therapeutics, Rocket Pharmaceuticals, Mustang Bio, Caribou Biosciences, Legend Biotech |

The LV-based cell and gene therapy products market is driven by the clinical success of CAR T cell therapies and new approvals for rare genetic disorders. The LV-based cell and gene therapy products refer to lentiviral therapies used to deliver therapeutic genes into the patient’s cells. They are used for the treatment of cancer, genetic disorders, autoimmune diseases, etc.

The use of AI in the LV-based cell and gene therapy products is increasing for their design and optimization. They are also used for the identification of the targets and biomarkers , and to monitor their manufacturing process. They also detect the off-target effects and reduce the risk associated with them, where they are also used in the design of clinical trials and personalized medication development.

There is a rise in the research and development of the LV-based cell and gene therapies to enhance their application beyond cancer, which is increasing their clinical trials.

The companies are developing self-activating LV vectors along with new lentiviral platforms to enhance their accuracy and efficiency to provide precise gene corrections.

The industries are focusing on offering personalized medications, with the use of individual genetic profiles, which is increasing their acceptance rates, promoting their innovations.

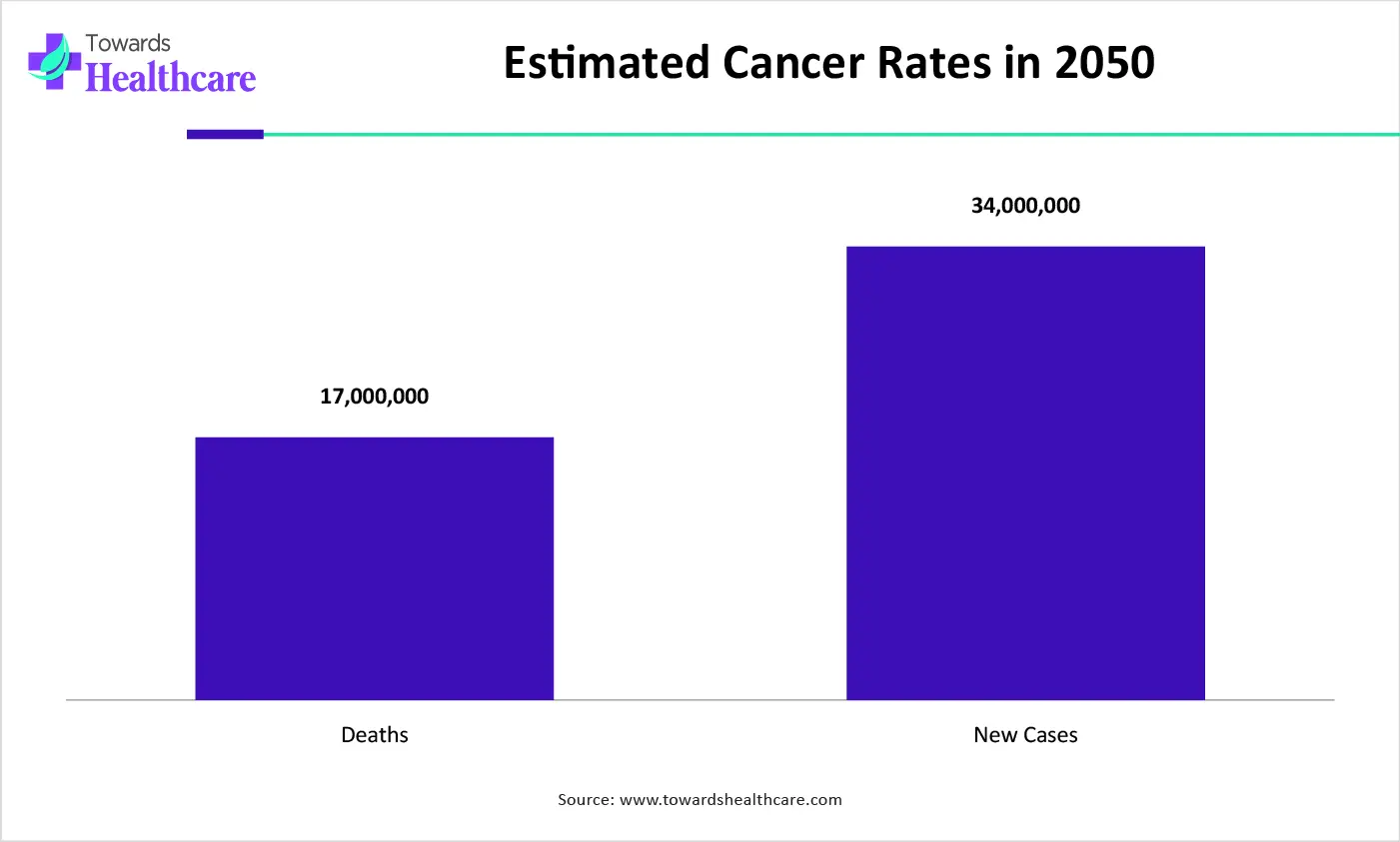

| Global Cancer Rates | 2050 |

| Death | 17 million |

| New cases | 35 million people |

Why Did the Ex vivo LV-modified Cell Therapies Segment Dominate in the Market in 2025?

The ex vivo LV-modified cell therapies segment held the largest share of 38.60% in the LV-based cell and gene therapy products market in 2025, due to their stable and long-lasting therapeutic effect. This increased their use across diving and non-diving cells, where they were also used in the CAR-T cell therapies development, which enhanced their adoption rates.

In vivo LV Gene Therapies

The in vivo LV gene therapies segment is expected to show the fastest growth with a CAGR of 14.90% during the upcoming years, due to their direct delivery. Moreover, their growing applications are also increasing their use in the treatment of a wide range of diseases, promoting new innovations.

How the Oncology Segment Dominated the Market in 2025?

The oncology segment led the LV-based cell and gene therapy products market with a 42.30% share in 2025, driven by its proven effectiveness. At the same time, the growth in unmet medical needs also increased their acceptance rates. Moreover, a rise in R&D investments also increased their innovation and adoption rates.

Rare Genetic Disorders

The rare genetic disorders segment is expected to show the highest growth with a CAGR of 13.80% during the upcoming years, due to their growing incidence rates. This, in turn, is increasing the use of LV-based cell and gene therapies for target-specific action, where they are also being used in their early and accurate diagnosis.

Which Indication Type Segment Held the Dominating Share of the Market in 2025?

The monogenic disorders segment held the largest share of 46.70% share in the LV-based cell and gene therapy products market in 2025, due to their single gene defects, which provided ideal targets for LV-based cell and gene therapy products. This, in turn, increased the cure rates and enhanced the successful treatment, which increased the acceptance rates.

Autoimmune Disorders

The autoimmune disorders segment is expected to show the fastest growth rate with a CAGR of 14.20% during the upcoming years, due to their growing incidence rates. Furthermore, the growing awareness is also increasing their early diagnosis, and driving the use of LV-based cell and gene therapies.

What Made Pharmaceutical & Biotechnology Companies the Dominant Segment in the Market in 2025?

The pharmaceutical & biotechnology companies segment led the LV-based cell and gene therapy products market with 44.80% share in 2025, due to the presence of robust R&D infrastructure. This, in turn, increased their innovation and production rate. Additionally, R&D investments also increased their advancements.

Contract Development & Manufacturing Organizations (CDMOs)

The contract development & manufacturing organizations (CDMOs) segment is expected to show the highest growth with a CAGR of 15.10% during the predicted time, due to growing outsourcing trends. At the same time, the presence of expertise and well-developed GMP facilities is also increasing their production rates.

Why GMP-grade Lentiviral Vectors Segment Dominated the Market?

The GMP-grade lentiviral vectors segment held the largest share of 63.40% share in the market in 2025 and is expected to show the fastest growth rate with a CAGR of 13.60% during the predicted time, driven by their high approval rates. Moreover, they also offered enhanced safety and potency, which increased their use and promoted their innovations.

North America dominated the LV-based cell and gene therapy products market with 48.90% in 2025, due to the presence of well-developed industries. This increased the innovation rates of these products, promoting their clinical trials. Additionally, the presence of a robust healthcare system also increased their use to tackle various chronic diseases, which contributed to the market growth.

Due to growing focus on the development of curative treatment options, the development of the LV-based therapies is increasing across the U.S. At the same time, the growth in investments and funding is also increasing their manufacturing and adoption rates. Moreover, growing collaborations also increased their R&D activities.

Asia Pacific is expected to host the fastest-growing LV-based cell and gene therapy products market with a 14.40% CAGR during the forecast period, due to the expanding healthcare sector. This is increasing the adoption and R&D of these products, which are backed by government initiatives. Moreover, the growing diseases are also increasing their demand, which is enhancing the market growth.

The industries in China are experiencing a rapid expansion, which is driving the LV-based cell and gene therapy product innovations. At the same time, the growing government initiatives and disease burden are also increasing their demand. Furthermore, the presence of a well-developed healthcare infrastructure is also increasing its use.

Europe is expected to grow significantly in the LV-based cell and gene therapy products market during the forecast period, due to the robust regulatory framework. This, in turn, is promoting the development of safe and effective LV-based therapies, driving their clinical trials and approvals. New collaborations are also increasing their innovations, promoting market growth.

The presence of robust industries in the UK is increasing the R&D of the LV-based cell and gene therapies. Furthermore, the growing disease burden is also increasing their demand and adoption rates. Similarly, the government initiatives, investments, and regulatory support are also encouraging their innovations.

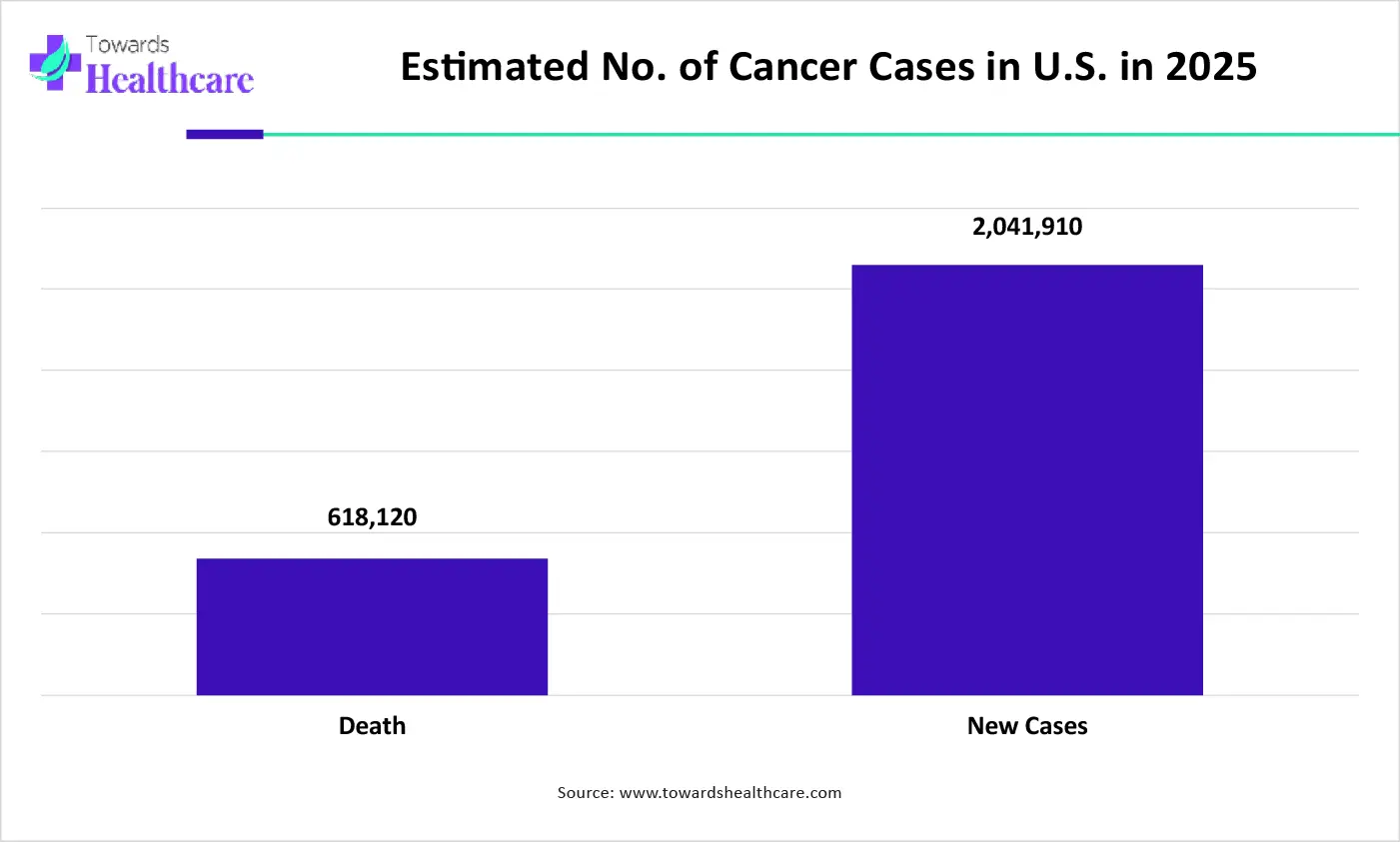

| Cancer Burden in the U.S. | No. of Patients |

| Deaths | 6,18,125 |

| New Cases | 20, 41,916 |

| Companies | Headquarters | Solutions |

| Bristol Myers Squibb | New Jersey, U.S. | Abecma and Breyanzi |

| bluebird bio | Massachusetts, U.S. | Zynteglo, Lyfgenia, and Skysona |

| Novartis | Basel, Switzerland | Kymriah |

| Orchard Therapeutics | London, UK | Lenmeldy |

| Kyverna Therapeutics | California, U.S. | KYV-101 |

| Abeona Therapeutics | Ohio, U.S. | Pz-cel |

| Rocket Pharmaceuticals | New Jersey, U.S. | RP-L102 and RP-L201 |

| Mustang Bio | Massachusetts, U.S. | MB-106 |

| Caribou Biosciences | California, U.S. | CB-010 |

| Legend Biotech | New Jersey, U.S. | Carvykti |

By Product Type

By Therapeutic Area

By Indication Type

By End User

By Vector Production Type

By Region

February 2026

February 2026

February 2026

February 2026