January 2026

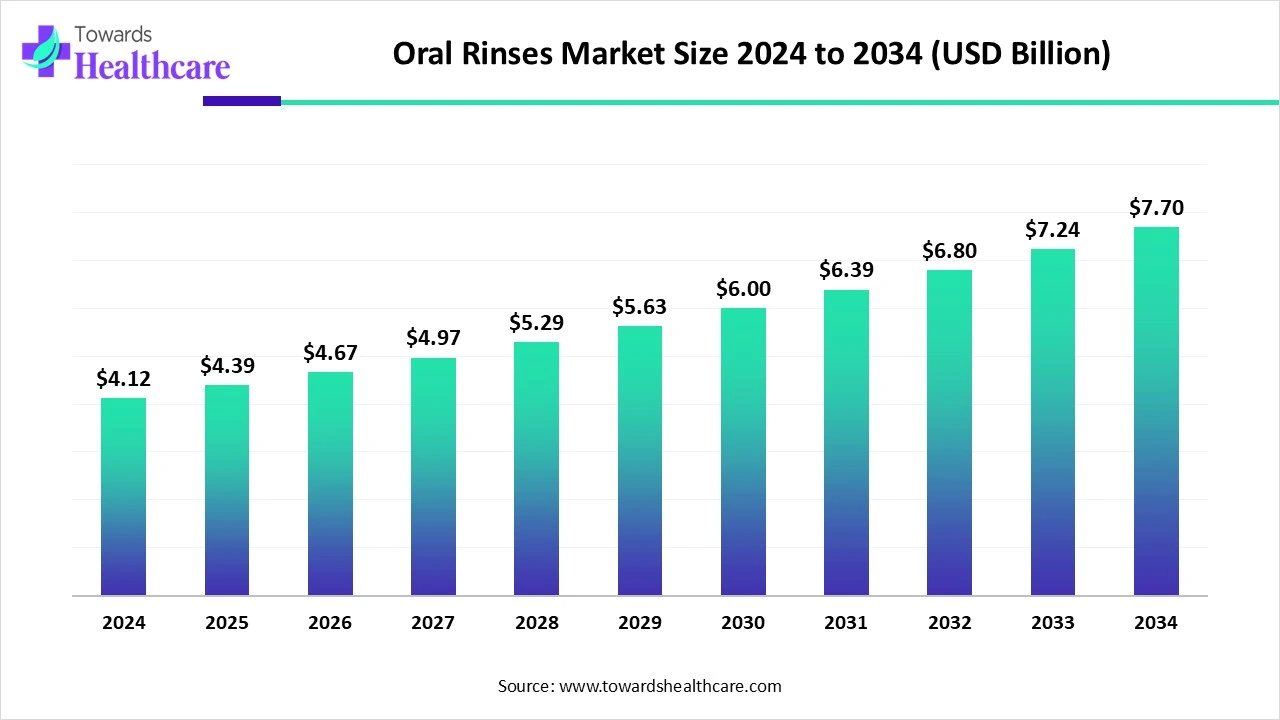

The global oral rinses market size recorded US$ 4.12 billion in 2024, set to grow to US$ 4.39 billion in 2025 and projected to hit nearly US$ 7.7 billion by 2034, with a CAGR of 6.46% throughout the forecast timeline.

The mouthwashes are categorized into different types, such as cosmetic, fluoride, antiseptic, natural, and whitening mouthwashes. They help consumers achieve better oral hygiene. In February 2024, Sensodyne announced the launch of its first innovation in mouthwashes, named ‘Sensodyne Complete Protection + Mouthwash'.

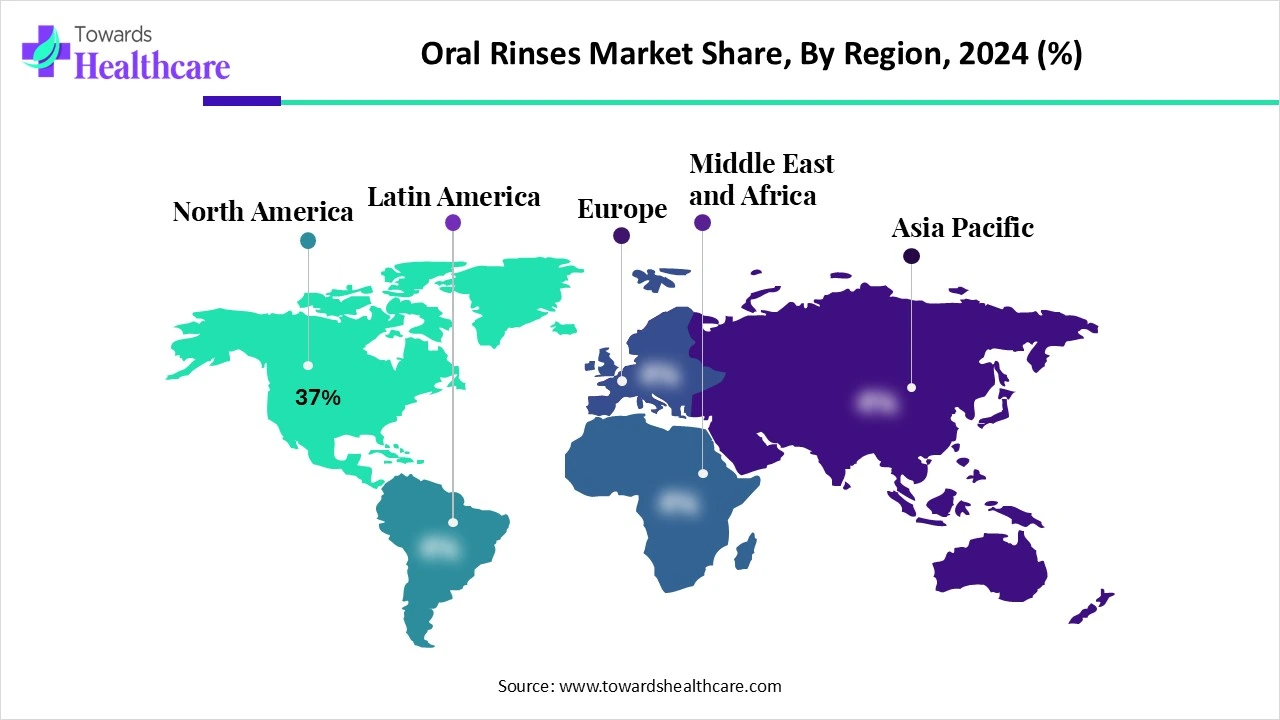

North America led the oral rinse market due to the presence of prominent market players in this region, which include Colgate-Palmolive Company, Procter & Gamble, Church & Dwight, Unilever, Johnson & Johnson, and Haleon. In December 2024, Johnson & Johnson announced the signing of a licensing agreement to develop, manufacture, and commercialize a STAT6 program to address autoimmune and allergic diseases, including atopic dermatitis, with Kaken Pharmaceutical. Johnson & Johnson stepped forward to license novel oral assets to strengthen healthcare.

| Table | Scope |

| Market Size in 2025 | USD 4.39 Billion |

| Projected Market Size in 2034 | USD 7.7 Billion |

| CAGR (2025 - 2034) | 6.46% |

| Leading Region | North America Share 37% |

| Market Segmentation | By Product Type, By Indication, By Distribution Channel, By End User, By Region |

| Top Key Players | Colgate-Palmolive Company, Procter & Gamble, Johnson & Johnson Services, Inc., GlaxoSmithKline plc, Unilever plc, Lion Corporation, Church & Dwight Co., Inc., Sunstar Suisse S.A., Amway Corporation, Himalaya Global Holdings Ltd., Dabur India Ltd., Prestige Consumer Healthcare Inc., 3M Company, Rowpar Pharmaceuticals, BioXtra, SmartMouth Oral Health Laboratories, Dr. Harold Katz LLC, Squigle Inc., Weleda AG, Perrigo Company plc |

The market includes products designed to clean the mouth, reduce oral bacteria, freshen breath, and prevent or treat oral diseases such as gingivitis, plaque buildup, dental caries, and halitosis. Oral rinses are available in therapeutic and cosmetic formulations and are widely used as part of oral hygiene routines, post-dental treatments, or as over-the-counter products. Growth is driven by rising awareness of dental hygiene, periodontal disease prevalence, increasing use of antiseptic and fluoride rinses, and dental professional recommendations.

AI can identify the patient population that is at a high risk of developing oral diseases. AI contributes to routine dental and oral care medical examinations of patients. It plays a major role in various medical technologies, such as medical imaging, electronic health records, analysis of biological specimens, etc. AI tools and AI algorithms can analyze a vast amount of patients’ medical data in less time, which eliminates time-consuming processes and long hours of test results. AI gives accurate, precise, and reliable data based on a patient’s genetic, molecular, behavioral, and dietary patterns. AI empowers dental and oral healthcare practitioners with advanced medical knowledge across various areas of research and innovation.

Which Innovative Technologies can Detect Gum Disease at an Early Stage?

According to the European Federation of Periodontology, infrared thermography and metabolomic profiling are innovative diagnostic technologies that can detect periodontal diseases. These are the newest methods to traditional periodontal diagnosis that can detect gingivitis and periodontitis with high accuracy. This infrared thermographic imaging can measure temperature variations caused by inflammation, which helps researchers to differentiate between healthy gums, periodontitis, and gingivitis.

What are the Emerging Challenges in Oral Health?

The prevalence of oral diseases or periodontal diseases is seen as one of the major reasons for the consumption of tobacco, which directly affects oral tissues. With the decreasing prevalence of cigarette smoking, there is a rising trend of using e-cigarettes or vaping products for marijuana or tobacco among young people and young adults. There are new threats to oral health that require understanding and research. Oropharyngeal cancer is the most common HPV-associated cancer, which is found 3.5 times more in men than in women.

What are the Takeaways in Oral Care?

According to CareQuest, the total annual spending on dental care is expected to surpass $430 billion across 32 organizations for economic cooperation and development countries in 2030. Key innovations, such as 3D-printed and customizable orthodontic treatments that are coupled with AI-powered scans, are shaping the future of the cosmetic and orthopedic sectors. The availability of robotic assistant surgical systems for oral surgeries and intra-oral imaging for 3D scans for diagnostics expands the oral rinses market globally. Bioactive materials are used for the restoration of dental tissue, which improves its appearance.

The therapeutic mouthwashes segment dominated the market in 2024, owing to the major role of these mouthwashes in helping people fight against gingivitis and gum inflammation. They prevent cavities, strengthen tooth enamel, and provide topical pain relief. They freshen breath and reduce halitosis due to the presence of antimicrobial agents like essential oils such as thymol, menthol, etc., or chlorine dioxide. The presence of anesthetics, such as lidocaine, in certain therapeutic mouthwashes helps patients to get temporary pain relief from ulcers, oral sores, etc. These mouthrinses are designed to supplement regular brushing and flossing. Certain mouthwashes can address dry mouth symptoms, which are commonly caused by some medications or health conditions.

The anti-inflammatory/herbal formulations segment is expected to grow at the fastest CAGR in the oral rinses market during the forecast period due to the effective anti-inflammatory action of herbal remedies like turmeric, ginger, and Boswellia that contain bioactive compounds to reduce inflammation. The medicinal herbs elicit fewer side effects with increased affordability and accessibility to the global population. They are widely used in traditional medicine systems due to the efficacy and safety of herbal formulations. They undergo standardization and quality control to ensure their consistent therapeutic effects.

The dental plaque & gingivitis control segment dominated the market in 2024, owing to the antimicrobial action of oral mouthwashes. The proper use of these solutions allows consumers to clean hard-to-reach areas in their mouths. They are very useful for people with dental restorations and braces, which get good cleaning benefits. They are becoming important in their daily activities of brushing and flossing to remove plaque and debris. The choice of the right type of mouthwash helps to target specific oral health conditions easily. The use of oral rinses allows us to prevent gingivitis and control dental plaque.

The dry mouth (xerostomia) & sensitivity segment is expected to grow at the fastest CAGR in the oral rinses market during the forecast period due to the immediate relief and comfort offered by oral rinses. They reduce the risk of cavities and gum disease by supplementing saliva’s protective functions. The oral rinses desensitize nerves, strengthen enamel, and freshen breath. The mouthwashes address sensitivities and improve the quality of patients’ lives.

The retail pharmacies & drug stores segment dominated the oral rinses market in 2024, owing to the convenience and accessibility to medicines and healthcare advice. The medication expertise of pharmacists and their major role in the assessment of drug interactions drive the popularity of retail pharmacies and drug stores. They provide personalized care and empower patients with medical knowledge. There is flexible pricing for expensive medications that makes them affordable for the communities. Patients do not need to make appointments or wait for long hours like hospitals and clinics. They are involved in conducting medication reviews and adjusting dosages to improve therapeutic outcomes.

The online stores segment is expected to grow at the fastest CAGR in the oral rinses market during the forecast period due to the integration of data analytics for informed business decisions. The online stores offer 24/7 availability and flexibility, which broadens their access and convenience to the customers. They provide increased reach, opportunities to expand markets, cost-effectiveness, and lower overheads. The built-in tools in online businesses provide data to understand customer behavior and improve sales.

The adults segment dominated the market in 2024, owing to the importance of oral rinses in the routine oral hygiene regimen of adults. The different types of mouthwashes help adults to prevent tooth decay and achieve overall oral health. Antimicrobial mouthwashes have the potential to reduce dental plaque biofilm and prevent plaque-induced oral diseases. These effective oral care solutions help adults with brushing, clean between teeth, and protecting against cavities. Mouthwashes kill bacteria within the mouth, which prevents oral health-related concerns. They provide a sense of freshness and control of breath odor.

The geriatric segment is expected to grow at the fastest CAGR in the oral rinses market during the forecast period due to the evolution of geriatric dentistry to deliver dental care to older adults. Gerodontics aims to diagnose, prevent, and treat issues associated with normal aging and age-related diseases. The geriatric dentistry field involves the study of common problems associated with the elderly population, which include dry mouth, infection of the lips, burning mouth syndrome, thinning of enamel, etc. They focus on treating dental caries and gum disease to promote overall oral health and well-being.

The mint segment dominated the market in 2024, owing to the natural solution in the form of mint to fight against bad breath and keep healthy teeth and gums. Mint is ideal due to its properties of calmness, which give a soothing feel to painful gums. The presence of menthol in mint helps to refresh breath due to its natural properties. Mint helps fight against germs, reduces swelling, and fights against various systemic disorders and cell damage. Mint is used in many personal care products, such as balms and lotions, which help to soothe discomfort. Mint stimulates saliva flow, supports oral health, and is widely used in products like mouthwashes and toothpaste.

The herbal segment is expected to grow at the fastest CAGR in the oral rinses market during the forecast period due to the antimicrobial and anti-inflammatory properties of herbal-flavored oral rinses. They elicit reduced side effects than chemical mouthwashes while providing fresh breath and a pleasant experience. They are preferred for long-term use by people with specific sensitivities to fluoride, artificial ingredients, and some other agents. There is a wide use of herbs in oral rinses, which include peppermint, clove, tulsi, neem, and tea tree oil, which possess natural antimicrobial properties.

North America dominated the market share by 37% in 2024, owing to the innovations in oral rinse formulas and strong retail and e-commerce infrastructure. The World Health Organization has set up a global strategy and action plan on oral health for 2023-2030. It has set two targets to be achieved by 2030, which include that 80% of the global population must receive essential oral healthcare services by 2030, and there must be a 10% reduction in the global incidence of oral diseases by 2030. In August 2024, the Centers for Disease Control and Prevention reported funding to 20 state health departments of about $370,000 per year to reduce oral health disparities, cavities, and other chronic diseases that are associated with poor oral health.

The Government of Canada led the ‘Oral Health Access Fund’ to support the ‘Canadian Dental Care Plan’. In June 2024, the Government of Canada announced the launch of the second stream of funding to accelerate enhanced access to oral healthcare. In February 2024, the Government of Canada introduced the services that are covered under the Canadian dental care plan. In May 2024, the Government of Canada reported that over 1 million seniors can access services included under the Canadian Dental Care Plan.

Asia Pacific is expected to grow at the fastest CAGR in the oral rinses market during the forecast period due to the growth of e-commerce and accessibility to specialized solutions and product innovations. In November 2024, the World Health Organization conducted its first Global Oral Health Meeting in collaboration with the Government of Thailand in Bangkok, Thailand, to address critical oral health issues of the global population. According to the World Economic Forum, the American Dental Association, Colgate-Palmolive Company, and Henry Schein collaborated to work towards a global commitment to investing in oral health. The WHO has set an action plan for oral health in South-East Asia for the years 2022-2030.

The Government of India introduced the national oral health program to provide integrated and comprehensive oral healthcare services and solutions. In January 2024, Dr. Dento announced the launch of its recent product range for oral health by uniting nature and technology. In August 2024, STIM Oral Care introduced a cutting-edge probiotic toothpaste to redefine the daily dental routine.

In May 2025, Rhiannon Jones, dental therapist and President of the British Society of Dental Hygiene and Therapy, challenged clinicians to reframe their approach to non-engaging patients and look after mouthwash as essential elements of routine care.

By Product Type

By Indication

By Distribution Channel

By End User

By Flavor / Additive Type

Mint

Herbal

Alcohol-Free vs Alcohol-Based

Whitening Agents

pH-balancing or enzyme-based

By Region

January 2026

November 2025

December 2025

October 2025