March 2026

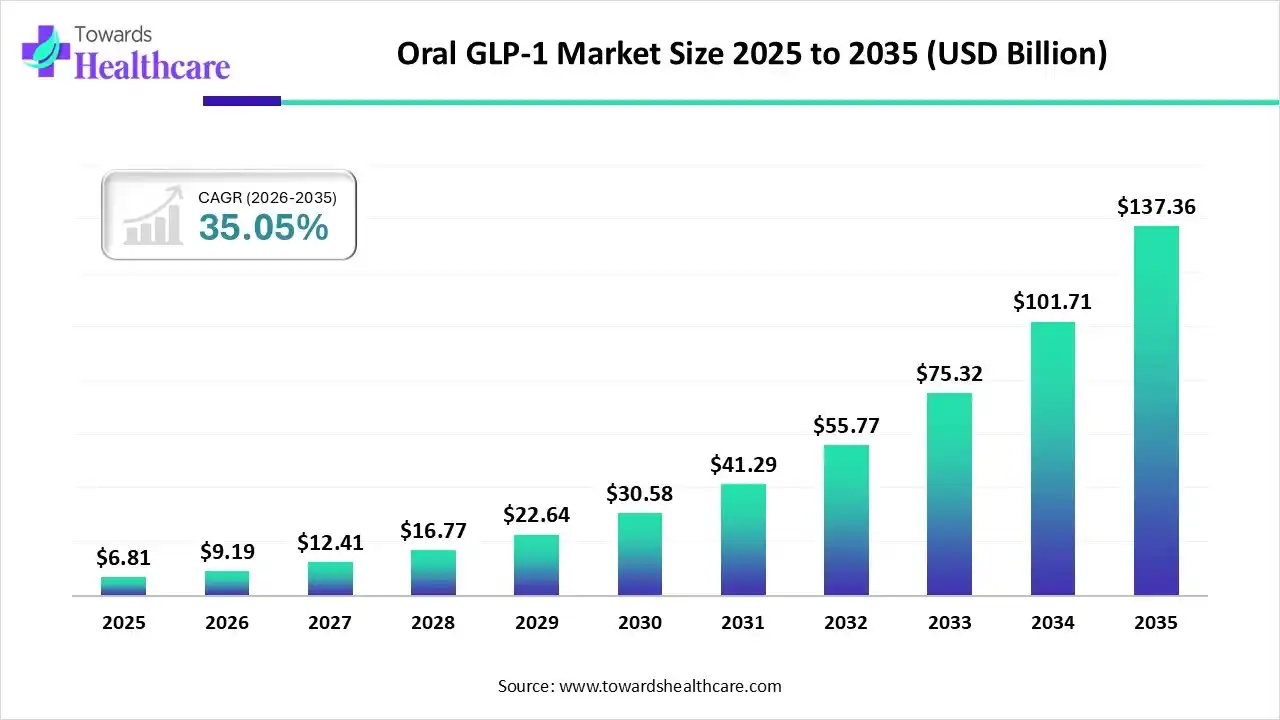

The oral GLP-1 market size in 2025 was US$ 6.81 billion, expected to grow to US$ 9.19 billion in 2026 and further to US$ 137.36 billion by 2035, backed by a robust CAGR of 35.05% between 2026 and 2035.

The oral GLP-1 market is witnessing strong growth, driven by rising prevalence of type 2 diabetes and obesity, increasing patient preference for oral therapies, and continuous pharmaceutical innovations. North America leads the market due to advanced healthcare infrastructure, high patient awareness, supportive reimbursement policies, and the strong presence of key players like Novo Nordisk and Eli Lilly, ensuring rapid adoption of oral GLP-1 therapies.

The oral GLP-1 market is driven by the rising prevalence of type 2 diabetes and obesity, increasing demand for convenient oral treatments, and growing awareness of effective diabetes management options. Patients prefer oral formulations over injectable therapies, boosting adoption and adherence. Oral GLP-1 refers to a class of medications that mimic the action of the naturally occurring hormone GLP-1, which regulates blood sugar levels by stimulating insulin secretion, suppressing glucagon release, and slowing gastric emptying. These therapies improve glycemic control and aid in weight management, offering a less invasive alternative to injectable GLP-1 treatments while enhancing patient convenience and compliance.

The Oral GLP-1 therapy landscape has seen significant advancements in 2025, focusing on improved bioavailability, enhanced efficacy, and patient convenience. Novel oral formulations now utilize absorption enhancers and protective coatings to optimize gastrointestinal uptake. Extended-release and combination therapies are being developed to provide sustained glucose control and weight management. Key pharmaceutical players, including Novo Nordisk and Eli Lilly, are conducting innovative clinical trials, while strategic collaborations with biotech startups accelerate R&D. These developments collectively enhance therapeutic outcomes, patient adherence, and global accessibility of oral GLP-1 treatments.

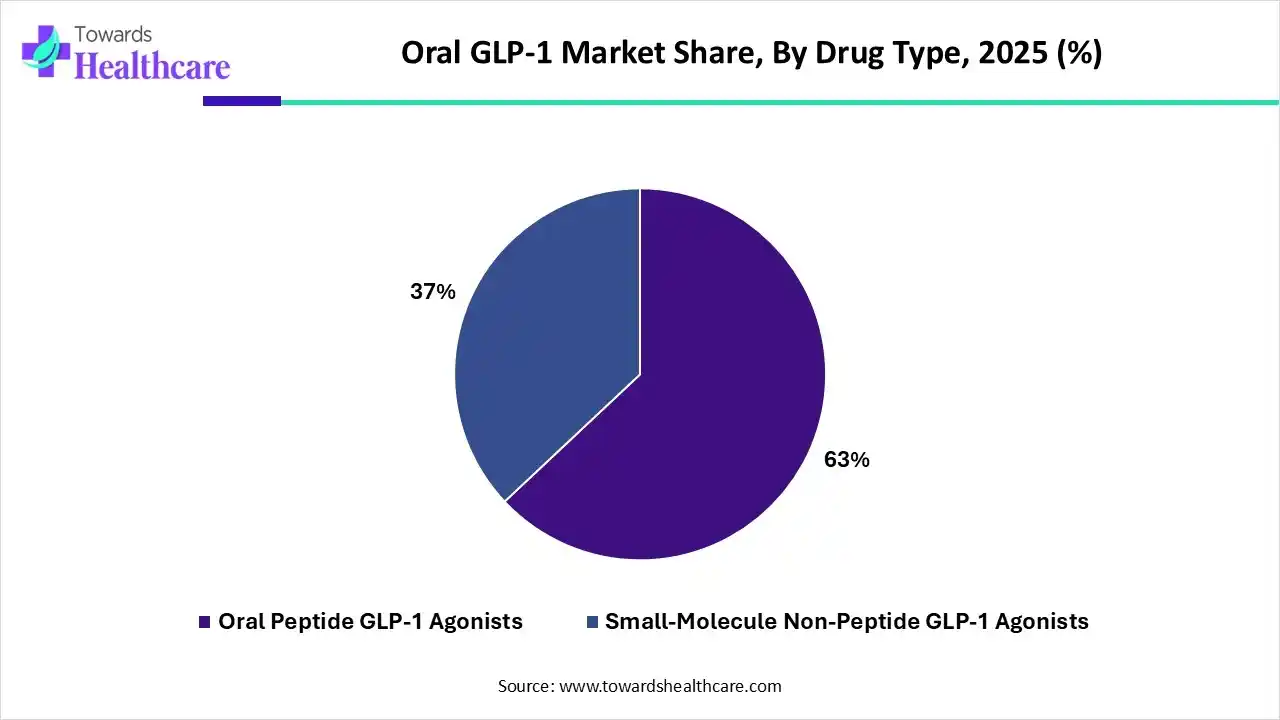

Which Drug Type Segment Dominated the Oral GLP-1 Market?

The oral peptide GLP-1 agonists segment dominates the market with a share of 63% due to its proven efficacy in controlling blood glucose levels and supporting weight management. Patient preference for non-invasive oral administration over injections enhances adherence and convenience. Strong R&D focus, successful clinical trials, and the presence of established pharmaceutical players like Novo Nordisk and Eli Lilly further reinforce its leading position in the market.

The small-molecule non-peptide GLP-1 agonists segment is estimated to be the fastest-growing in the global oral GLP-1 market due to its high oral bioavailability, ease of manufacturing, and potential for cost-effective production. These molecules offer improved patient convenience, reduced injection dependency, and the ability to combine with other therapies. Ongoing clinical trials and strong pharmaceutical investments are accelerating adoption and market expansion.

Which Molecule Segment Led the Oral GLP-1 Market?

The semaglutide segment dominates the market with a share of 71% due to its proven efficacy in controlling blood glucose and promoting weight loss. Strong clinical trial results, widespread physician adoption, and high patient preference for oral administration enhance its market leadership. Additionally, robust marketing, strategic partnerships, and continuous product innovation by key players like Novo Nordisk reinforce semaglutide’s dominant position.

The Orforglipron segment is the fastest-growing in the oral GLP-1 market due to its innovative small-molecule, non-peptide oral formulation, which eliminates the need for injections and enhances patient convenience. High oral bioavailability, strong efficacy in weight reduction and glycemic control, and favorable safety profiles accelerate adoption. Ongoing clinical success, regulatory submissions, and backing by Eli Lilly further drive rapid market growth, making Orforglipron a leading therapy in both obesity management and type 2 diabetes treatment.

| Segment | Share 2025 (%) |

| Hospital & Specialty Clinics | 52% |

| Retail Pharmacies | 30% |

| Online Pharmacies | 18% |

What Made Hospital & Specialty Clinics the Dominant Segment in the Oral GLP-1 Market?

The hospital & specialty clinics segment dominates the market with a share of approximately 52% due to the availability of advanced diagnostic facilities, skilled healthcare professionals, and access to novel diabetes and obesity treatments. These centers are primary points for prescribing and monitoring oral GLP-1 therapies, ensuring patient safety and treatment adherence. Additionally, growing hospital-based clinical research and collaborations with pharmaceutical companies enhance early drug access and drive higher adoption rates.

The online pharmacies segment is anticipated to be the fastest-growing segment in the market due to increasing digital healthcare adoption, convenience in medicine delivery, and rising telemedicine integration. Patients prefer online platforms for accessibility, privacy, and cost-effectiveness. Moreover, partnerships between e-pharmacy platforms and drug manufacturers in 2025 have accelerated the availability of oral GLP-1 therapies across wider geographies.

Which End-User Segment Led the Oral GLP-1 Market?

The diabetic population segment dominates the market with a share of 64% due to the rising prevalence of type 2 diabetes worldwide and increasing awareness of effective glucose control therapies. The growing preference for oral GLP-1 drugs over injectables enhances patient compliance. Additionally, government health programs and clinical advancements in 2025 have strengthened treatment accessibility and adoption among diabetic patients.

The obese/overweight individuals segment is anticipated to be the fastest-growing in the global oral GLP-1 market due to the rising global obesity rates and growing awareness of weight management therapies. In 2025, increased clinical success of oral GLP-1 drugs for weight loss and broader approvals by regulatory bodies have driven demand among individuals seeking non-invasive, effective obesity treatment options.

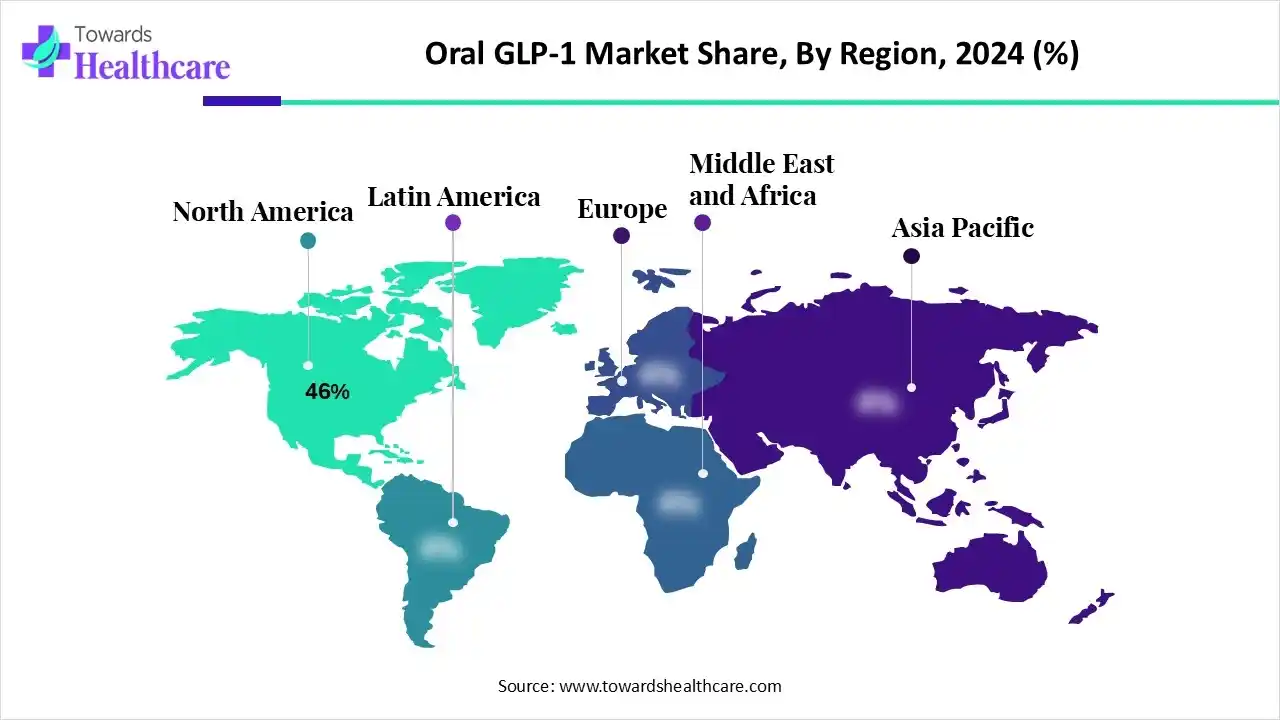

North America dominates the global market with a share of 46% due to the high prevalence of type 2 diabetes and obesity, advanced healthcare infrastructure, and strong presence of major pharmaceutical companies like Novo Nordisk and Eli Lilly. Additionally, the rapid adoption of innovative oral GLP-1 therapies and favorable regulatory support drive market growth across the U.S. and Canada.

The U.S. leads the oral GLP-1 market due to a large diabetic and obese population, strong R&D capabilities, and rapid adoption of innovative therapies like oral semaglutide. Supportive FDA approvals and increasing physician preference for convenient oral alternatives further strengthen the country’s market dominance.

As of 2024, approximately 11.6% of the U.S. population has diabetes, including those undiagnosed. Furthermore, around 30.7% of adults are overweight, and over 42.4% have obesity. A staggering 97.6 million Americans also have prediabetes.

The Asia-Pacific region is the fastest-growing oral GLP-1 market due to the rapidly increasing prevalence of diabetes and obesity, particularly in China, India, and Japan. Rising healthcare expenditure, growing awareness of advanced oral antidiabetic drugs, and improving access to healthcare infrastructure are key contributors. Additionally, the region is witnessing strategic collaborations between global pharmaceutical companies and local firms, along with government initiatives to manage lifestyle diseases, which collectively drive strong demand for oral GLP-1 treatments across Asia-Pacific.

China’s Oral GLP-1 market is expanding rapidly in 2025 due to the country’s rising diabetes and obesity rates, with nearly 148 million diabetic adults and over 60% of the population overweight or obese, creating strong demand for effective glucose-lowering and weight-management therapies. In February 2025, the National Medical Products Administration (NMPA) approved Innogen’s ultra-long-acting GLP-1 injection for type 2 diabetes, signaling growing government and regulatory support for GLP-1 innovation and boosting industry confidence.

In August 2025, Hengrui Medicine advanced its oral small-molecule GLP-1 candidate HRS-7535 into late-stage development, emphasizing local capability in producing affordable oral treatments that improve patient compliance. Additionally, in June 2024, Huadong Medicine’s Sinopharm Huadong received U.S. trial approval for HDM1002, an oral GLP-1 full agonist, demonstrating China’s expanding international research collaborations and technological strength. These developments, combined with active investment in biopharmaceutical R&D, are strongly propelling the growth of China’s oral GLP-1 market.

India has over 77 million adults with diabetes as of 2025. Rising case numbers expand the patient base needing effective, easier treatments like oral GLP-1 therapies. Also, needle phobia and injection inconvenience drive preference for pills. Moreover, recent launches—such as Novo Nordisk’s oral semaglutide in India provide more accessible GLP-1 options. Government policies supporting local manufacturing and incentives for drug makers also help lower costs and widen availability.

Europe is growing notably in the oral GLP-1 market due to a high diabetes burden: about 66 million adults in Europe have diabetes, and nearly 34% remain undiagnosed. Strong national healthcare systems in Germany, the UK, and France support broad access and reimbursement for GLP-1 therapies. Regulatory backing, rising obesity rates, aging populations, and public health programs emphasizing non-injectable treatments are increasing the acceptance of oral GLP-1s. These dynamics, alongside pharmaceutical innovation and awareness campaigns, are accelerating Europe’s market expansion.

As of 2024, there are 4.6 million diagnosed diabetic cases in the UK, plus an estimated 1.3 million undiagnosed. In England, 60 % of adults are overweight or obese, with nearly 30% considered obese. These figures contribute to rising health challenges.

The R&D phase in the oral GLP-1 market begins with target identification and lead discovery, where pharmaceutical and biotech companies such as Novo Nordisk and Eli Lilly focus on developing peptide or small-molecule GLP-1 agonists. This is followed by preclinical studies to assess pharmacology and toxicity, along with formulation development to enhance oral bioavailability through absorption-enhancement systems. Next, companies work on process development and scale-up, supported by Contract Development and Manufacturing Organizations (CDMOs) and academic collaborations. Finally, detailed chemistry, manufacturing, and control (CMC) documentation is prepared to meet regulatory submission requirements.

Organizations involved: pharmaceutical R&D teams (Novo Nordisk, Eli Lilly), biotech startups, academic labs, specialized formulation companies, contract research organizations (CROs) for preclinical work, and CMC/CDMO partners for scale-up.

The clinical development phase begins with Investigational New Drug (IND) submissions and proceeds through Phase I trials for safety and pharmacokinetics, Phase II for dose optimization and early efficacy, and Phase III for large-scale confirmation of therapeutic benefits. Once completed, companies compile data for regulatory submission to agencies such as the U.S. FDA, European Medicines Agency (EMA), Japan’s PMDA, or India’s CDSCO. After review and approval, the drug is launched into the market, followed by post-marketing surveillance to ensure long-term safety and efficacy. Key players in this phase include major pharma sponsors, Contract Research Organizations (CROs), clinical trial networks, and regulatory consultants.

Organizations involved: sponsor pharma/biotech, clinical research organizations (CROs) running trials, clinical sites and investigators, central labs, data monitoring boards, regulatory agencies (FDA, EMA, PMDA, NMPA, CDSCO), and regulatory consultants for dossier preparation

After approval, the focus shifts to market access, pricing, and reimbursement negotiations with healthcare payers. Pharmaceutical companies then launch education programs for healthcare professionals and patient onboarding initiatives to ensure proper prescription and adherence. Patient support services include telehealth assistance, reminder applications, affordability programs, and co-pay support to improve therapy compliance. These activities are carried out by specialty clinics, retail and online pharmacies, pharma patient-support divisions, digital health partners, and patient advocacy groups. Ongoing real-world monitoring and outcomes assessments help optimize treatment benefits and sustain market growth.

Organizations involved: payers/insurers, hospital specialty clinics, retail and online pharmacies, patient advocacy groups, specialty pharmacies, telemedicine providers, pharma patient-support teams, digital health vendors (adherence apps, remote monitoring), and third-party benefits managers.

Offers: Rybelsus (oral semaglutide) for type 2 diabetes, Ozempic (injectable), Wegovy (higher-dose semaglutide for obesity), among its portfolio.

Focus: Improving formulations, patient access, and expanding indications.

Offers: Mounjaro (tirzepatide) for diabetes, Zepbound for obesity, and developing Orforglipron, an oral GLP-1 agonist.

Focus: Dual-agonist therapies, weight loss efficacy, and better adherence via oral options.

Offers / Pipeline: Working on oral GLP-1 analogs; pushing innovations in drug delivery and trials.

Offers / Pipeline: Products like Bydureon (exenatide extended-release) and oral candidates (e.g., AZD5004) in development.

Position: Has historically worked in the GLP-1 space (with drugs like liraglutide, lixisenatide) and is now focusing on metabolic disease innovation and new partnerships.

By Drug Type

By Molecule

By Distribution Channel

By End User

By Region

March 2026

March 2026

March 2026

March 2026