February 2026

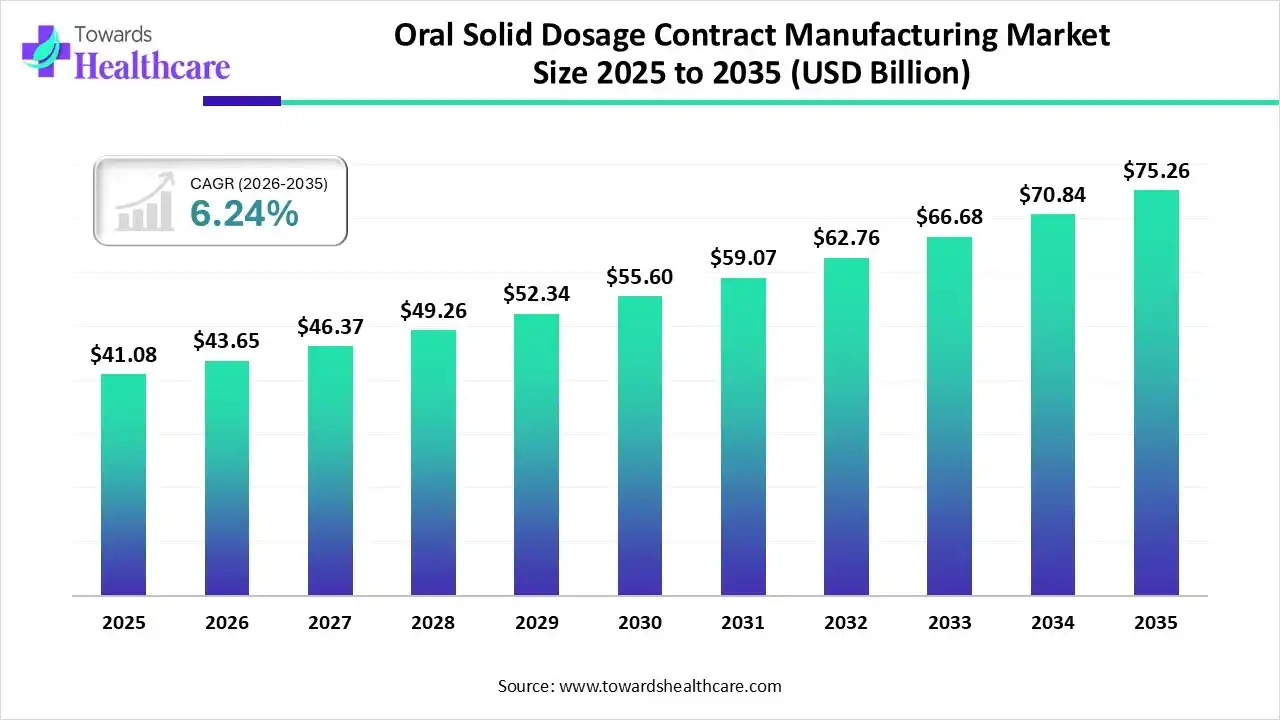

The global oral solid dosage contract manufacturing market size was estimated at USD 41.08 billion in 2025 and is predicted to increase from USD 43.65 billion in 2026 to approximately USD 75.26 billion by 2035, expanding at a CAGR of 6.24% from 2026 to 2035.

Contract manufacturing offers substantial cost-effectiveness, advanced technologies, and specialized professionals to the diverse pharma firms, especially small and medium-sized companies. Moreover, the global researchers are promoting the broader adoption of 3D printing solutions for the immersive development of oral solid dosage forms. Additionally, firms are widely leveraging AI algorithms to expand advanced solutions from R&D to the operational effectiveness of OSDs.

| Key Elements | Scope |

| Market Size in 2026 | USD 43.65 Billion |

| Projected Market Size in 2035 | USD 75.26 Billion |

| CAGR (2026 - 2035) | 6.24% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Product, By Mechanism, By End Use, By Region |

| Top Key Players | Catalent Inc., Lonza, Aenova Group, Boehringer Ingelheim International GmbH, Jubilant Pharmova Limited, Patheon Pharma Services, Recipharm AB., Corden Pharma International, Piramal Pharma Solutions, AbbVie Contract Manufacturing |

Those pharmaceutical companies are involved in outsourcing the development and manufacturing of solid medications, especially tablets, capsules, and powders, to a specialized third-party organization, i.e., a CDMO, which is known as the oral solid dosage contract manufacturing market. The global market is specifically driven by CDMOs' affordability & effectiveness, with increasing demand for generic drugs, and strengthening small & virtual pharma companies. However, these firms are emphasising bioavailability enhancement by leveraging amorphous solid dispersions, hot melt extrusion, nanomilling, and lipid-based formulations.

In the respective market, AI algorithms are increasingly assisting through the unification of AI-driven monitoring and sophisticated data analytics, which bolster quality control, optimize operational efficiency, and allow rapid, data-driven decisions from formulation design to commercial production. Moreover, ML algorithms support the prediction of drug behaviour, stability, and drug-excipient interactions, primarily at the R&D stage. Recently, Thermo Fisher Scientific explored the Quadrant 2 platform, which utilizes AI/ML-based in-silico modeling to estimate optimal solubility enhancement techniques for poorly soluble compounds.

Day by day, the leaders are moving towards continuous production, which facilitates increased effectiveness, consistency, and scalability. Additionally, the adoption of automation and real-time process analytical technology (PAT) is used through their integration to enhance quality control and lower waste.

The era is focusing on raising eco-friendly solutions, such as the adoption of biodegradable excipients, solvent-free manufacturing processes, and energy-efficient operations to minimize environmental impact and meet emerging regulatory and consumer expectations.

Researchers are highly employing 3D printing technology as it allows tailored medicine through personalised dose, accurate control over drug release profiles, and the production of combination (polypill) products.

Which Product Led the Oral Solid Dosage Contract Manufacturing Market in 2025?

In 2025, the tablets segment registered dominance with a major share of the market. Specifically, these products offer cost-effectiveness, ease of use, and patient compliance, while their affordability in terms of manufacturing, packaging, and transportation as compared to other forms is fueling the overall adoption. However, CDMOs are promoting the production of orally disintegrating tablets (ODTs), mini tablets, and tablet-in-capsule solutions. Firms, like Akums, Sun Pharma, Cipla, Dr Reddy’s, etc., are widely developing chewable, coated, modified-release formulations for general, nutraceutical, or Ayurvedic products.

Capsules

In the future, the capsules segment is anticipated to register rapid expansion. Its prominent catalyst is easier to swallow than tablets and efficiently masks the unpleasant taste and odour of the active pharmaceutical ingredients (APIs). Also, it possesses flexibility for various formulations, particularly powders, granules, and even liquids by using liquid-filled capsules, which further supports personalized and combination therapies. Currently, CDMOs are experiencing a huge demand for plant-based capsules, like those made from Hydroxy Propyl Methyl Cellulose (HPMC), to continue to dietary, ethical, and "clean-label" consumer preferences.

How did the Controlled Release Segment Dominate the Market in 2025?

The controlled release segment held the biggest share of the oral solid dosage contract manufacturing market in 2025. This primarily lowers the needed frequency of dosing, often to once daily, which raises patient adherence to medication schedules. Also, results in more consistent and sustained therapeutic effects with minimal adverse side effects, especially for patients with diabetes, hypertension, and pain. CDMOs are using advanced coating approaches, like Wurster coating, and matrix systems for accurate control of the rate and location of drug release.

Immediate Release

The immediate release segment is predicted to expand rapidly. These dosage forms require minimal complex manufacturing process, which fosters quicker development and rapid time-to-market, and is a substantial driver. While 3D printing techniques, such as Binder Jetting (BJT), are evolving highly porous structures, including Spritam (levetiracetam), it is the first FDA-approved 3D-printed drug, which is for patients with swallowing concerns (dysphagia).

Why did the Large Size Companies Segment Lead the Market in 2025?

In 2025, the large-sized companies segment captured a dominant share of the oral solid dosage contract manufacturing market. This prominently includes Lonza, Catalent, Thermo Fisher Scientific, and Recipharm, which are immensely facilitating diverse services from drug formulation to commercial production and packaging. Whereas Aenova Group is Europe’s giant OSD firm, which explores different formats of OSD, especially bi-layer and chewable tablets, lozenges, and granules.

Medium & Small Size Companies

The medium & small size companies segment is anticipated to register the fastest growth. The emerging outsourcing of manufacturing services enables these companies to eliminate substantial overhead and capital investment in facilities and equipment, which ultimately improves their operational expenditures. Ongoing and upcoming patent expiration are creating significant opportunities for these companies to explore large-scale and affordable generics. Specifically, Ardena, Alcami, UPM Pharmaceuticals, and Rubicon Research are examples of medium & small size companies for OSDs development.

Asia Pacific captured the biggest revenue share of the oral solid dosage contract manufacturing market in 2025, due to the minimal manufacturing and operation spending, mainly in China & India. Alongside, regional governments are spurring domestic pharmaceutical manufacturing through favourable policies, tax benefits, and infrastructure development, which finally lowers dependency on imports and promotes a competitive environment.

China Market Trends

However, China has been putting efforts into technological breakthroughs, like AI-driven machine learning, automation, and real-time-monitoring. Additionally, they are focusing on developments in sustained-release, targeted-release, and high-potency APIs (HPAPIs), specifically for oncology treatments.

For instance,

In the coming era, North America will expand fastest in the oral solid dosage contract manufacturing market. The region is experiencing wider patent expirations of branded drugs, which impacts the rising demand for affordable generic drugs. For this, contract manufacturers are efficiently supporting large-scale production. Moreover, recently, the FDA unveiled the Commissioner’s National Priority Voucher (CNPV) program, which facilitates a 1–2 month expedited review for CMC submissions to manufacturers with local production, crucially raising the market entry of OSD products produced in North America.

U.S. Market Trends

Whereas the U.S. market will witness rapid expansion, as it is focusing on bolstering domestic production, with rigorous government initiatives and potential tariffs on imports.

For instance,

In the oral solid dosage contract manufacturing market, Europe will experience a notable expansion. Eventually, the regional companies are reinforcing capacity growth and outsourcing to specialized CDMOs with sophisticated technologies, such as nano-milling and particle engineering.

For instance,

Germany Market Trends

Germany is stepping towards high-volume production automation, with a vitalinvestment in high-potency active pharmaceutical ingredients (HPAPI). Recently, Recipharm operationalized its new Pilot Scale Development Centre, which possesses three GMP set for blending, tableting, and hard capsule filling.

| Company | Description |

| Catalent Inc. | It mainly offers a complete set of Oral Solid Dosage (OSD) contract manufacturing services, i.e., from early-phase development to large-scale commercial production. |

| Lonza | This provides commercial production of immediate- and modified-release tablets and encapsulated formulations. |

| Aenova Group | A firm specialises in liquid-filled hard gel capsules. |

| Boehringer Ingelheim International GmbH | It offers both capsules & tablets, such as Jardiance, Ofev, Glyxambi, and also invested in a new, highly automated Solids Launch Factory. |

| Jubilant Pharmova Limited | This explores numerous types of OSDs, like Immediate-release oral solids, modified-release oral solids, MUPS, chewable tablets, etc. |

| Patheon Pharma Services | It facilitates comprehensive contract development and manufacturing (CDMO) services for oral solid dosage (OSD) forms. |

| Recipharm AB. | It is a global contract development and manufacturing organization (CDMO) that offers end-to-end services for OSDs. |

| Corden Pharma International | A company provides clinical to commercial scale facilities, with the expansion of its global facility network. |

| Piramal Pharma Solutions | It offers diverse tablets, capsules, specialty forms, and pediatric formulations. |

| AbbVie Contract Manufacturing | This significantly explores early formulation development to large-scale commercial production and specialized packaging. |

By Product

By Mechanism

By End Use

By Region

February 2026

December 2025

December 2025

November 2025