February 2026

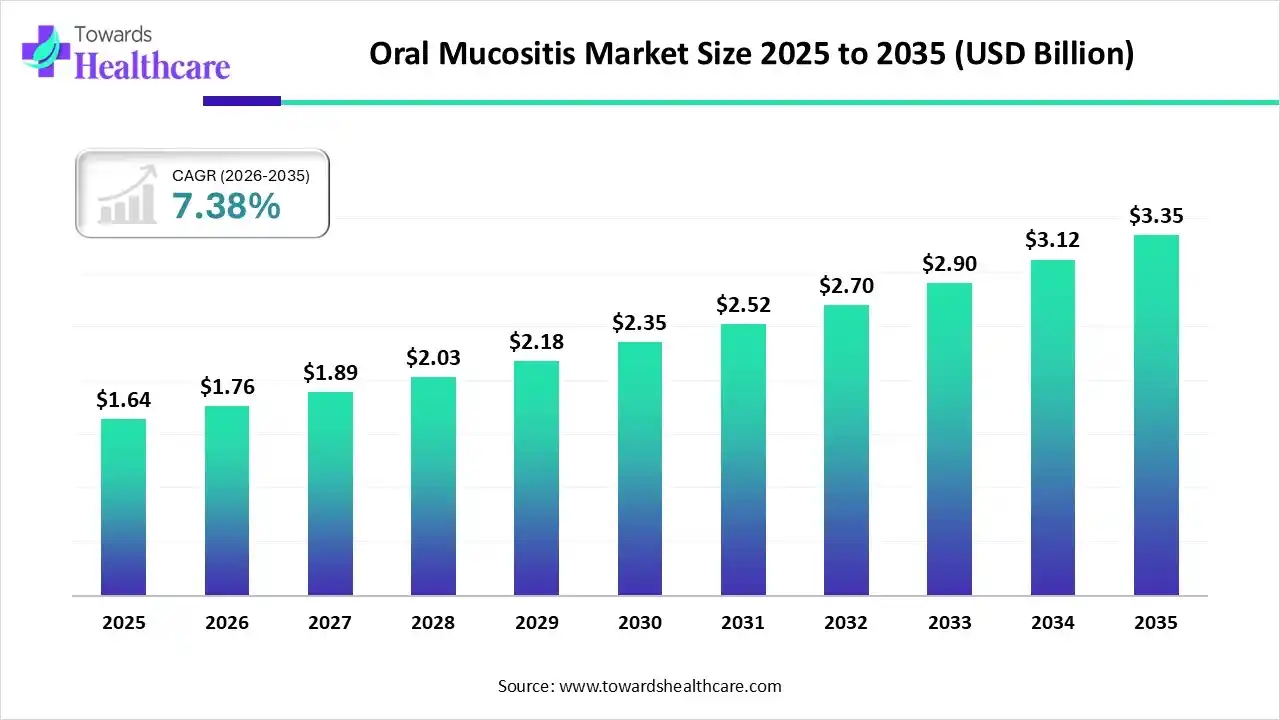

The oral mucositis market size touched US$ 1.64 billion in 2025, with expectations of climbing to US$ 1.76 billion in 2026 and hitting US$ 3.35 billion by 2035, driven by a CAGR of 7.38% over the forecast period from 2026 to 2035.

The oral mucositis market is expected to grow during the forecast period due to the rising incidence of infections, autoimmune diseases, and cancer, as well as advancements in treatment options and increased awareness and diagnosis. Additionally, it is projected that improvements in oral mucositis treatment options for patients undergoing hematopoietic stem cell transplants will accelerate the market's growth during the forecast period.

| Key Elements | Scope |

| Market Size in 2025 | USD 1.64 Billion |

| Projected Market Size in 2035 | USD 3.35 Billion |

| CAGR (2025 - 2035) | 7.38% |

| Leading Region | North America |

| Market Segmentation | By Treatment Type, By Drug Class, By Distribution Channel, By End-Use, By Region |

| Top Key Players | Amgen Inc., Basic Pharma Life Science Pvt Ltd., CANbridge Pharmaceuticals Inc., Enzychem Lifesciences Corporation, EpicentRx, Inc., Galera Therapeutics, Inc., Helsinn Healthcare SA., Innovation Pharmaceuticals Inc., Monopar Therapeutics, Inc., Pfizer Inc., Soleva Pharma, LLC., Swedish Orphan Biovitrum AB |

The main factor driving the oral mucositis market is the rising incidence of cancer. An acute inflammation of the oral mucosa that occurs after systemic cancer therapy, especially chemotherapy and/or radiation, is known as oral mucositis (OM). An estimated 40% of patients are thought to be affected by this issue.

The development of treatments for oral mucositis is being profoundly altered by automation and artificial intelligence. Early-stage drug discovery is now aided by AI-driven platforms that model mucosal responses and forecast formulation efficacy. To more precisely assess mucositis severity in clinical settings and enable prompt, individualized therapeutic interventions, AI-enabled diagnostic tools are also being investigated.

Which Treatment Type Dominated the Market in 2024?

The pain control medication segment dominated the oral mucositis market in 2024 because OM-related pain is often listed as one of the most prevalent and upsetting side effects that cancer patients encounter during treatment. Patient education, oral rinses, topical and systemic pain management, hydration, nutritional support, and infection prevention techniques are all part of the conventional management of oral mucositis. OM pain management techniques are all-encompassing and address both nociceptive and neuropathic elements.

Mouthwash

The mouthwash segment is expected to grow at the fastest CAGR in the oral mucositis market during the forecast period, as anti-inflammatory mouthwashes are a useful way to prevent or reduce mucositis caused by cancer treatment. These agents have few side effects and high adherence, suggesting their safety and practicality.

Why the Anti-Inflammatory Segment Dominated the Market in 2024?

The anti-inflammatory segment dominated the oral mucositis market in 2024, as anti-inflammatory drugs targeting pro-inflammatory cytokines may help slow the progression of mucositis. Given the existence of an inflammatory mechanism, it makes sense to develop preventive measures to stop early inflammatory cascades. This justifies the study of anti-inflammatory drugs for the prevention or treatment of mucositis.

Antimicrobials

The antimicrobials segment is expected to grow at the fastest CAGR in the oral mucositis market during the forecast period, as numerous antimicrobial agents have been studied for their potential to prevent and treat oral mucositis, as infection may play a significant role in its pathophysiology.

Antifungal

The antifungal segment is expected to grow at a significant rate during the forecast period. Fungemia can be treated with a number of commercially available antifungal medications. Patients with fungemia frequently receive antifungal medications, though prophylactic use is not advised.

Why Hospital Pharmacy Dominated the Market in 2024?

The hospital pharmacy segment dominated the oral mucositis market in 2024. Hospital pharmacy is a specialty area of pharmacy that is integrated into patient care in medical facilities. The profession of hospital pharmacy works to uphold and enhance patient pharmaceutical care and medication management to the highest standards in a hospital environment.

Online Pharmacy

The online pharmacy segment is expected to grow at the fastest CAGR in the oral mucositis market during the forecast period. In the medical field, online pharmacies are becoming increasingly popular. Because they can purchase medications from any location, people favor it. Online pharmacies are accessible from anywhere in the world, whereas traditional pharmacies are typically found only in big cities and towns. Online pharmacies are more common than traditional pharmacies for several reasons.

Which End-User Dominated the Market in 2024?

The hospitals and clinics segment dominated the oral mucositis market in 2024. There are many benefits to treating OM in hospitals and clinics, chief among them being the availability of evidence-based, specialized, multidisciplinary treatments that are difficult to obtain at home. These treatments seek to prevent life-threatening complications, manage pain, lessen the severity of the condition, and prevent it altogether.

Ambulatory Surgical Centers

The ambulatory surgical centers segment is expected to grow at the fastest CAGR in the oral mucositis market during the forecast period. The main benefits of Ambulatory Surgical Centers (ASCs) for the treatment of oral mucositis include facilitating outpatient treatment, shortening hospital stays, lowering costs, and enabling more consistent preventive care. Managing this excruciating side effect of cancer treatment outside of a conventional inpatient hospital setting is the main goal of OM care in an ASC setting.

North America dominated the oral mucositis market in 2024. The North American market is driven by the high incidence of cancer, sophisticated healthcare facilities, and early adoption of novel oral mucositis treatments. The widespread use of treatments such as barrier gels and growth factors is supported by robust research funding, the presence of large pharmaceutical companies, and evidence-based guidelines from organizations such as MASCC/ISOO and NCI. All of these elements support North America's dominance in the global oral mucositis market.

Due to population growth and aging, as well as increased survival due to advancements in early detection and treatment, the number of Americans with a history of cancer keeps increasing. Approximately 18.6 million Americans had a history of cancer as of January 1, 2025, and by 2035, this figure is expected to rise to over 22 million. Prostate (3,552,460), skin melanoma (816,580), and colorectal (729,550) are the three most common cancers in men; breast (4,305,570), uterine corpus (945,540), and thyroid (859,890) are the most common in women.

Asia Pacific is estimated to host the fastest-growing oral mucositis market during the forecast period. The incidence of cancer has suddenly increased in this area, and access to healthcare services is improving. Increased patient awareness, government initiatives to improve cancer treatment infrastructure, and new investments in oncology care are occurring across markets such as China, India, and Japan. Additionally, the region's market is expanding due to rising clinical trials, healthcare spending, and the availability of more reasonably priced treatment options.

According to the most recent "2025 Nature Index-Cancer" supplement, China has surpassed the U.S. as the world's leading contributor to high-quality cancer research for the first time. Hina received a Share of 2,614.5 in research pertaining to cancer. The share for the U.S. was 2,481.7. Compared with the previous year, China's output increased by 19% in 2024, while the U.S. saw a more modest 5% increase.

Europe is expected to grow at a significant CAGR in the oral mucositis market during the forecast period. Key factors include the rising incidence of cancer and the ensuing rise in cases of mucositis. To facilitate faster access to novel treatments, which is essential for market expansion, regulatory organizations such as the European Medicines Agency (EMA) are actively supporting research and development. Leading nations such as the UK, Germany, and France are at the forefront of a competitive landscape that includes major players such as AstraZeneca and Novartis.

One of the biggest social issues facing the UK is cancer. The UK will have to treat 457,000–564,000 new cancer patients a year by 2040 (a 30% increase from today), with an estimated 174,000–234,000 cancer deaths per year and nearly 4 million cancer patients. Better research and improved patient outcomes depend on international cooperation and partnerships. Partnerships with various international organizations and nations, especially the EU and the U.S., have long been a part of UK cancer research and treatment.

South America is expected to grow significantly in the oral mucositis market during the forecast period. South America is witnessing growth in the treatment of oral mucositis as oncology services expand across countries. The region recently reported 1,155,885 new cancer cases, intensifying demand for supportive care to ease treatment-related discomfort and improve patient outcomes.

Brazil is experiencing demand for oral mucositis therapies as cancer care advances nationwide. The country recently recorded 627,193 new cancer cases, prompting clinicians to prioritize supportive interventions that reduce treatment interruptions, improve comfort, and enhance patient outcomes during oncology regimens.

The Middle East and Africa are expected to grow at a lucrative CAGR in the oral mucositis market during the forecast period as oncology capacity expands. The region recently reported 892,408 new cancer cases, driving investment in supportive care that protects patients, reduces discomfort, and improves tolerance to treatment.

The United Arab Emirates is seeing demand for oral mucositis solutions as cancer incidence rises. Recent data show 7,487 new cases, underscoring the need for supportive therapies that sustain treatment continuity, enhance comfort, and strengthen patient resilience across oncology.

Company Overview: Amgen is a leading global biotechnology company dedicated to unlocking the potential of biology for patients suffering from serious illnesses by discovering, developing, manufacturing, and delivering innovative human therapeutics.

Corporate Information

History and Background:

Founded as Applied Molecular Genetics Inc., Amgen pioneered the biotechnology industry. It has a history of developing transformative medicines, including some of the first successful recombinant human proteins, focusing on areas like oncology, inflammation, and nephrology.

Key Milestones/Timeline

Business Overview: Focuses on six therapeutic areas: Cardiovascular Disease, Oncology, Bone Health, Neuroscience, Nephrology, and Inflammation. The company is committed to science-based innovation.

Business Segments/Divisions

Geographic Presence: Global presence, with operations across North America (largest market share), Europe, and the Asia-Pacific regions.

Key Offerings (Relevant to OM Market)

Kepivance (palifermin): A recombinant human keratinocyte growth factor (KGF) indicated to decrease the incidence and duration of severe oral mucositis in patients with hematologic malignancies receiving high-dose chemotherapy and/or radiotherapy followed by hematopoietic stem cell transplant (HSCT).

End-Use Industries Served

Key Developments and Strategic Initiatives (Latest Info)

Competitive Positioning

SWOT Analysis

Recent News and Updates (2024/2025)

Company Overview: Bausch Health is a multinational pharmaceutical company that develops, manufactures, and markets a range of pharmaceutical, medical device, and over-the-counter products, primarily in gastroenterology (GI), ophthalmology, and dermatology. Its OM presence is driven by the Salix Pharmaceuticals segment.

Corporate Information (Bausch Health Companies Inc.)

History and Background:

Salix Pharmaceuticals was acquired by Bausch Health (then Valeant Pharmaceuticals) in 2015. Salix is a leading specialty pharmaceutical company focused on GI disorders. It markets Gelclair, an FDA-approved prescription rinse/gel for oral mucositis.

Key Milestones/Timeline (Relevant to OM Market)

Business Overview: Bausch Health operates three segments: Salix (Gastrointestinal), International, and Bausch + Lomb (Eye Health). Salix focuses on developing and commercializing proprietary GI products.

Business Segments/Divisions (BHC)

Key Offerings (Relevant to OM Market)

Gelclair (formerly Salix): An oral rinse/gel that forms a protective barrier over the oral mucosa, providing pain relief and promoting healing of oral lesions caused by chemotherapy and/or radiation therapy. Note: US commercial rights now belong to Jaguar Health as of April 2023/2024.

End-Use Industries Served

Key Developments and Strategic Initiatives (Latest Info)

Competitive Positioning

SWOT Analysis

Recent News and Updates (2024/2025)

| Company | Role / Offering in Oral Mucositis | Key Contribution | Current Status / Highlights | Mechanism / Technology |

| Basic Pharma Life Science Pvt Ltd | API supplier | Manufactures chlorhexidine base, which is used in mouthwashes for oral care/disinfection | Supplies GMP-grade chlorhexidine for global customers | Antiseptic, broad-spectrum disinfectant for mucosal cleaning |

| CANbridge Pharmaceuticals Inc. | Commercialization | Licensed Caphosol® (CAN002) for China to treat oral mucositis | CFDA approval obtained; first commercial OM therapy in China | Supersaturated calcium phosphate oral rinse that lubricates and protects the mucosa |

| Enzychem Lifesciences Corporation | Drug developer | Developing EC-18 (mosedipimod) for chemoradiation-induced oral mucositis | Completed Phase 2, database lock; positive safety/efficacy; Fast Track from FDA for CRIOM | An oral immunomodulator that reduces inflammatory neutrophil recruitment |

| EpicentRx, Inc. | Clinical developer | Developing RRx-001 to prevent/reduce severe oral mucositis | FDA granted Fast Track; IND accepted for phase 2b trial (KEVLARx) in head & neck cancer | NLRP3 inhibitor & Nrf2 activator; anti-inflammatory, antioxidant effects |

| Galera Therapeutics, Inc. | Therapeutic innovator | Developing avasopasem manganese (GC4419) for radiotherapy-induced severe oral mucositis | Submitted NDA; completed Phase 3 ROMAN trial; Fast Track / Breakthrough from FDA | Small-molecule dismutase mimetic (superoxide dismutase mimic) to reduce oxidative damage |

By Treatment Type

By Drug Class

By Distribution Channel

By End-Use

By Region

February 2026

February 2026

February 2026

February 2026