January 2026

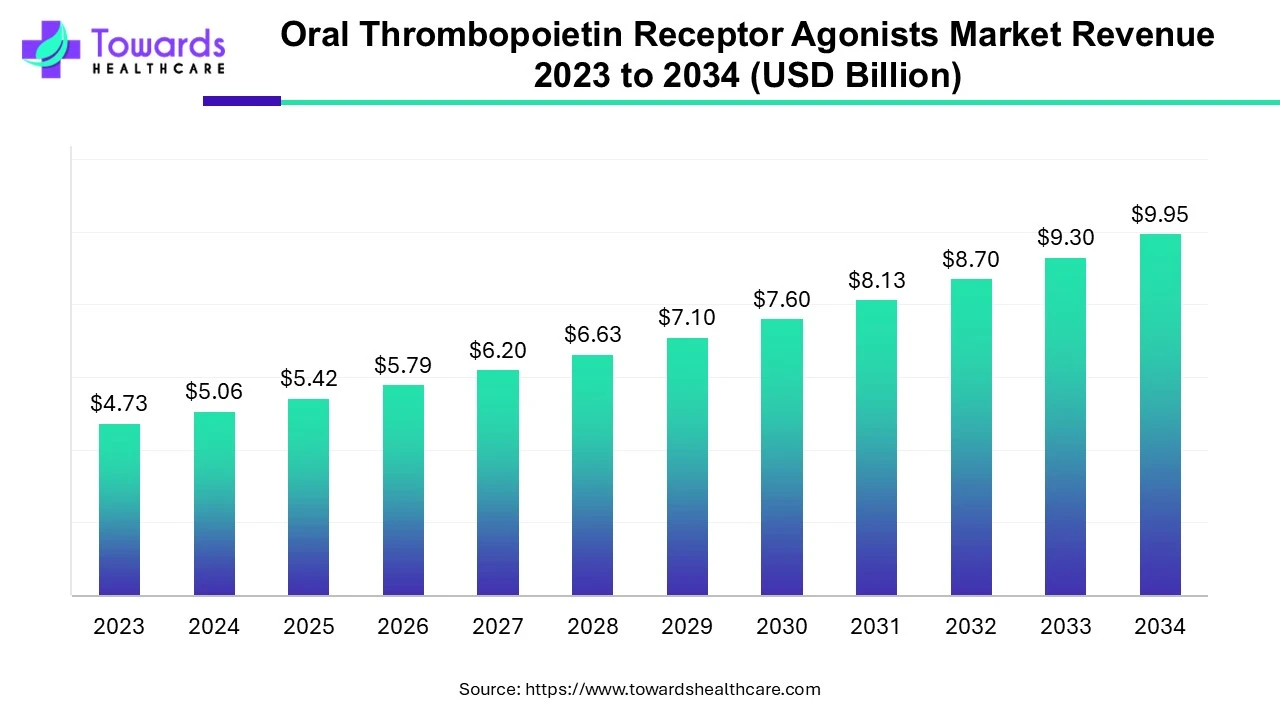

The global oral thrombopoietin receptor agonists market was estimated at US$ 4.73 billion in 2023 and is projected to grow to US$ 9.95 billion by 2034, rising at a compound annual growth rate (CAGR) of 7% from 2024 to 2034. The demand for agonists is increasing due to their support in platelet production, which is needed during various treatments.

Treating immunological thrombocytopenia using thrombopoietin-receptor agonists (TPO-RAs) is currently the state of the art. Reducing bleeding and the requirement for concurrent or rescue treatment is accomplished with TPO-RA. There are presently over 100 nations that use TPO-Ras. A paradigm change in the way ITP is treated was signaled by their arrival. These days, a lot of hematologists are familiar with them, and they are utilized extensively. TPO-RAs' pharmacokinetic, pharmacodynamic, and mechanistic properties provide a variety of therapeutic prospects.

Currently, many TPO-RAs are not approved in many countries and for various conditions due to their safety and efficacy in treating those health issues. However, the oral thrombopoietin receptor agonists market has growth opportunities because the therapeutics are gaining attention due to ongoing research. With the growing research, researchers will be able to enhance drug formulations, better & targeted delivery systems, and improve safety and efficacy, which will increase the adoption of the therapeutics in various countries.

The use of TPO-RAs to treat ITP has grown throughout the last ten years. In clinical practice, thrombosis is among the growing number of adverse events that have been noted. TPO-RAs may raise the risk of thrombosis by boosting the formation of younger, more hemostatic platelets and raising the platelet count.

The demand for developing novel TPO-RAs is increasing with the rising prevalence of hematological disorders, especially in the geriatric and pediatric populations. Currently, there are only 2 U.S. Food and Drug Administration (FDA)-approved TPO-RAs, including eltrombopag and avatrombopag. These drugs have certain limitations, necessitating researchers to develop novel drugs with minimal side effects and enhanced efficacy. The growing research and development activities lead to an increasing number of clinical trials. As of July 2025, there are 28 clinical studies related to TPO-RAs on the clinicaltrials.gov website. (Source: Clinical Trials Gov)

The region is dominating because of the growing research, collaboration by key market players, government support, and investments in improving healthcare services. All the stakeholders in the region are making continuous efforts to improve the quality of care and current treatment options. The two major countries that contribute to the growth of the market are the U.S. and Canada. Apart from all the advancements, there is a growing prevalence of diseases that require TPO-RAs during treatment.

In the U.S., chronic liver disease (CLD) is quickly evolving. This illness is presently the fourth most common cause of mortality for those between the ages of 45 and 64. Over two million people die from liver disease each year, including cirrhosis, viral hepatitis, and liver cancer. It also accounts for 4% of all fatalities globally or one out of every 25 deaths; females account for one out of every three liver-related deaths. Liver cancer is responsible for 600,000 to 900,000 fatalities, according to this estimate. In adults in the US, Europe, and Asia, there has been a rise in the incidence of hepatitis A infection 69,70 mostly because of the increased frequency of person-to-person transmission among people who struggle with drug abuse and are homeless.

The oral thrombopoietin receptor agonists market is growing strongly in Asia Pacific due to growing investment from other regions and growing collaboration among various stakeholders. The region holds the largest population which gives a boost to the region in terms of manpower. Various market players in the region are also conducting research and development for the betterment of therapeutics in Asia Pacific and to create a dominant position across the world.

China Market Trends

It is estimated that approximately 110,000 people are living with primary immune thrombocytopenia (ITP) in China. Moreover, the prevalence of hepatic diseases is rising. Half of the world’s hepatitis C infections are found only in 6 countries, including China, India, Indonesia, Pakistan, Russia, and the U.S.

India Market Trends

The prevalence of thrombocytopenia is nearly 5.6% among Indian patients. The federal government actively supports the development of novel diagnostics and treatment regimens for hematological disorders in the country. This encourages researchers to work on TPO-RAs.

By type, the eltrombopag segment held a significant share of the market. This segment dominated because thrombocytopenia, or reduced platelets in the blood, is a blood condition known as chronic immune thrombocytopenia (ITP), which is treated with eltrombopag. This medication is used after a splenectomy or surgery to remove the spleen when other medications, such as immunoglobulin or steroids, have not been effective enough.

The lusutrombopag segment is to witness notable growth in the market during the forecast period. The body produces more platelets when one takes LUSUTROMBOPAG. When a procedure is planned for an adult with chronic liver illness, it is utilized to treat low platelets. In the treatment of patients with thrombocytopenia and CLD undergoing invasive operations, lusutrombopag is a safe and efficient way to increase PCs and decrease the need for platelet transfusions.

By application, the hospital and clinic segment held the largest share of the market. Hospitals and clinics dominate because TPO-RAs are used to treat various health conditions such as ITP and CLD. Patients who require these medications visit hospitals for proper treatment and care. Apart from this, proper supervision by professionals ensures that the patients are getting appropriate resources and attention to avoid any emergency situations.

The pharmacy segment is estimated to grow significantly during 2024-2034. Now, when TPO-RA medications are coming in the form of tablets, they will be more often sold in pharmacies, which will increase the growth of the segment in the future. Patients, based on the doctor’s prescription, will be able to buy the medications from offline or online pharmacies.

Dr. Rachael Grace, Director of Hematology Clinical Research at Dana-Farber/Boston Children's Blood and Cancer Disorders Center, commented that the currently available TPO-RAs for children have limitations, including challenging dietary guidelines and potential for liver toxicity, as well as a need for subcutaneous administration. The center’s investigational drug, Avatrombopag, can be administered orally and overcomes other limitations. (Source: Docwirenews)

By Type

By Application

By Region

January 2026

November 2025

December 2025

October 2025