January 2026

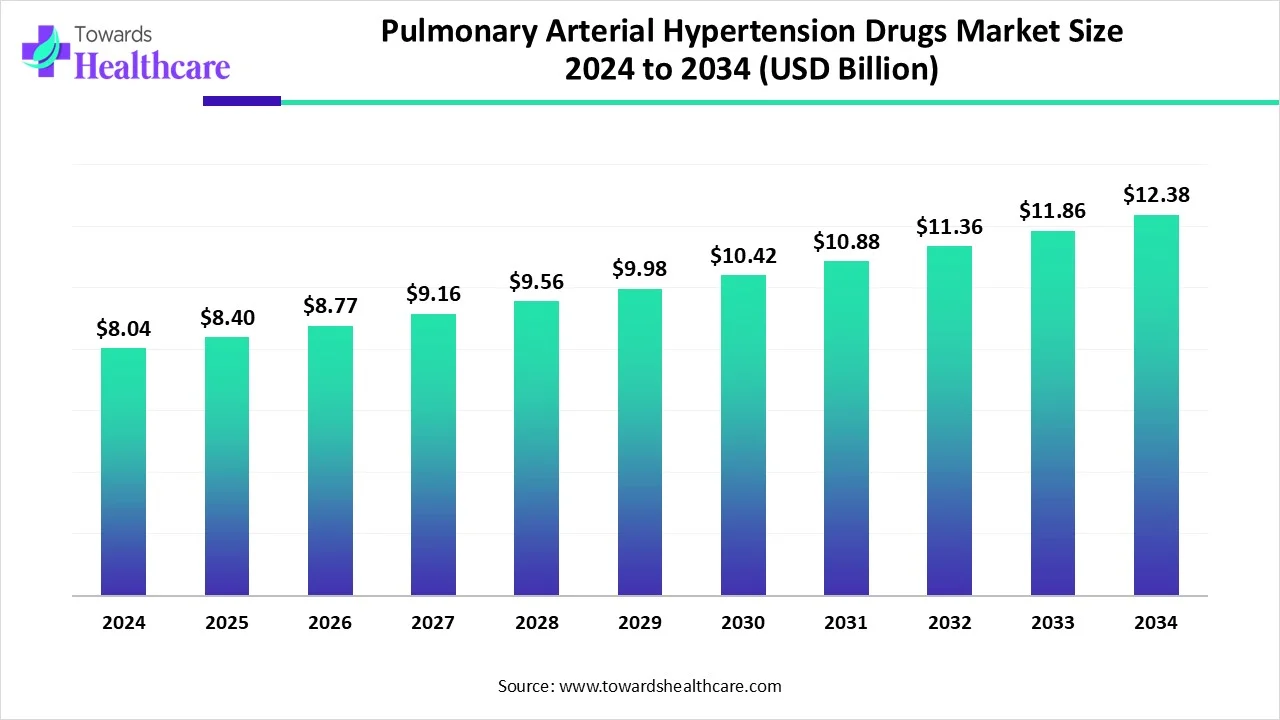

The global pulmonary arterial hypertension drugs market size is calculated at USD 8.04 billion in 2024, grow to USD 8.4 billion in 2025, and is projected to reach around USD 12.38 billion by 2034. The market is expanding at a CAGR of 4.44% between 2025 and 2034.

The pulmonary arterial hypertension drugs market is witnessing steady growth due to increasing cases of PAH globally, driven by factors like sedentary lifestyles, smoking, and associated conditions such as heart and lung diseases. Advances in targeted therapies, including endothelin receptor antagonists, prostacyclin analogs, and soluble guanylate cyclase stimulators, are enhancing treatment outcomes.

Rising awareness, early diagnosis, and supportive healthcare policies further contribute to market expansion. Additionally, ongoing clinical research and the launch of novel drugs are expected to sustain strong growth in the coming years.

| Metric | Details |

| Market Size in 2025 | USD 8.4 Billion |

| Projected Market Size in 2034 | USD 12.38 Billion |

| CAGR (2025 - 2034) | 4.44% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Route of Administration, By End-User, By Region |

| Top Key Players | Arena Pharmaceuticals, Bayer, Gilead Sciences, United Therapeutics Corporation, Actelion Pharmaceuticals, Pfizer, Merck Sharp & Dohme, Novartis AG, Sun Pharmaceutical Industries Ltd |

Pulmonary arterial hypertension drugs are medications used to lower high blood pressure in the lung arteries, improve blood flow, and ease symptoms in PAH patients. They work by relaxing and widening blood vessels to reduce strain on the heart. The pulmonary arterial hypertension drugs market is evolving with a steady growth rate driven by advancements in oral therapies and novel drug targets. There is an increasing focus on developing convenient and effective treatments like macitentan and sildenafil, which improve patient compliance. Additionally, emerging technologies such as artificial intelligence are accelerating drug discovery and enhancing personalized care. These innovations, combined with rising disease awareness and improved diagnostics, are shaping a more effective and accessible PAH treatment landscape.

For Instance,

AI is transforming the market by accelerating drug discovery, optimizing clinical trial designs, and identifying novel therapeutic targets. It enhances diagnostic accuracy and enables early disease detection through advanced data analysis, improving treatment outcomes. AI also supports personalized medicine by analyzing patient data to tailor therapies. These advancements reduce development time and costs, driving innovation and efficiency in the PAH drug market, ultimately improving patient care and expanding treatment options.

Increased Use of Combination Therapies

The growing use of combination therapies is a key driver in the pulmonary arterial hypertension drugs market, as they offer enhanced clinical outcomes by targeting multiple disease pathways simultaneously. These therapies improve patient survival, reduce symptoms, and slow disease progression more effectively than monotherapy. Additionally, fixed-dose combinations simplify treatment regimens, increasing patient adherence. The growing preference for combination treatments, fueling the demand and innovation in the PAH therapeutic landscape.

For Instance,

High-Cost Treatment

High costs are the major restraint in the pulmonary arterial hypertension drugs market, as many advanced therapies are priced beyond the reach of a large portion of patients, especially in low- and middle-income countries. These high expenses, including lifelong medication and monitoring, place a significant financial burden on both individuals and healthcare systems. As a result, access to timely and effective treatment is limited, hindering optimal disease management and market growth.

Rising Focus on Innovative Therapies

In 2024, the rising focus on innovative therapies offers significant growth potential in the pulmonary arterial hypertension drugs market. With current treatments primarily managing symptoms rather than curing the disease, there’s a growing demand for advanced solutions like gene therapies, novel drug combinations, and targeted biologics. These innovations aim to improve patient outcomes, minimize side effects, and extend life expectancy. Additionally, increased R&D investment, collaborations between biotech firms and pharmaceutical companies, and supportive regulatory frameworks are accelerating the development of breakthrough therapies. This shift towards innovation is expected to transform the treatment landscape and expand market opportunities globally.

For Instance,

The prostacyclin and prostacyclin analogs segment leads the PAH drugs market in revenue because of their strong therapeutic impact in late-stage patients who require aggressive treatment. These Drugs help reduce pulmonary pressure and improve heart function, offering better disease control. Their widespread use in critical care, combined with premium pricing and continuous medical preference for long-term management in severe cases, makes them a major contributor to the overall market.

For Instance,

The Endothelin Receptor Antagonists (ERAs) segment is projected to grow rapidly in the pulmonary arterial hypertension drugs market due to an increasing preference for targeted therapies that effectively manage disease progression. These drugs block the effects of endothelin-1, a key molecule involved in blood vessel constriction, offering better symptom control. Their growing use in early-stage treatment, favorable clinical outcomes, and rising availability of generics and new formulations are boosting market penetration and accelerating their adoption across various patient groups.

The oral segment led the market largely because it supports long-term disease management with minimal disruption to daily life. These medications are easier to store, transport, and administer compared to injectable and inhaled forms. The growing availability of combination oral therapies and improved treatment outcomes have also made them a popular option among physicians. As a result, the convenience and expanding range of effective oral treatments boosted the market dominance.

For instance,

The inhalation segment is witnessing rapid growth in the PAH drug market as it provides a practical alternative for patients requiring targeted pulmonary treatment. Unlike systemic therapies, inhaled drugs act directly on the lungs, enhancing efficiency while reducing unwanted side effects. Increasing R&D investments, the introduction of user-friendly delivery devices, and greater acceptance of non-invasive therapies have made inhaled options more attractive. These factors collectively contribute to the rising demand for inhalation-based treatments, driving the market expansion.

The hospitals segment holds the largest share in the pulmonary arterial hypertension drugs market owing to its capacity to deliver intensive care and manage high-risk patients. These facilities often initiate advanced therapies and handle emergency interventions that can’t be managed in outpatient settings. With access to a wide range of drug formulations and clinical trials, hospitals also become key factors for the early adoption of new treatments. Their infrastructure and especially availability drive higher drug usage compared to other healthcare settings.

The clinics segment is anticipated to grow steadily in the PAH drug market as more patients seek convenient and continuous care outside hospital settings. Clinics are increasingly equipped to handle chronic conditions like PAH through scheduled assessments, tailored treatment, and efficient drug administration. With growing investments in outpatient infrastructure and a focus on personalized care, clinics offer an effective alternative to hospitals, making them a preferred choice for ongoing PAH treatment and contributing to their expanding market.

North America led the market in 2024 due to its well-developed healthcare infrastructure and high healthcare spending, which ensures better access to advanced treatments. The presence of major pharmaceutical companies driving innovation and clinical trials in the region also supports market growth. Additionally, increased awareness, early diagnosis, and effective management programs contribute to higher treatment rates. These combined factors have solidified North America’s dominant position in the global PAH drug market.

For Instance,

The U.S. market is growing due to an increasing number of diagnosed cases and greater awareness among healthcare providers and patients. Advances in treatment options, including new targeted therapies like endothelin receptor antagonists and prostacyclin analogs, have improved patient outcomes and expanded the market. Additionally, better diagnostic methods allow for earlier detection and management of PAH, driving demand for effective medications and fueling market growth in the region.

The Canadian market is experiencing growth due to the aging population, with a significant number over 60 years old, who are more susceptible to PAH, leading to increased demand for treatments. Advancements in drug development, including the introduction of novel therapies targeting multiple pathways involved in PAH, are improving patient outcomes and expanding treatment options. Additionally, heightened awareness and early diagnosis contribute to timely interventions, further driving market expansion.

The Asia-Pacific market is led by prostacyclin and prostacyclin analogs, which accounted for nearly half of the revenue. Oral medications dominated due to their convenience, while intravenous and inhalation routes are also growing. Branded drugs hold a larger market share, though generics are increasing. Hospitals and clinics remain the primary end-users, driving demand through diagnosis and treatment services, and boosting overall market growth in the region.

China’s market is growing due to the rising number of patients with heart and lung-related diseases, along with an aging population. Improved healthcare infrastructure and greater government support are making advanced treatments more accessible. Additionally, increased awareness and better diagnosis rates are driving demand for innovative PAH therapies in the country, fueling market expansion.

For Instance,

India's market is expanding due to increased awareness, improved diagnostic capabilities, and greater access to advanced therapies. Government initiatives and expanding healthcare infrastructure are facilitating the availability of innovative treatments. Additionally, the introduction of biosimilar drugs and the expansion of local pharmaceutical production capacity have made treatments more affordable, further driving market growth.

Europe is accelerating the market through several strategic initiatives. The European Medicines Agency (EMA) has approved innovative therapies like sotatercept, enhancing treatment options for patients. Countries such as Germany and the UK are leading in market share, driven by robust healthcare infrastructure and specialized centers for PAH. Additionally, increasing awareness campaigns and government support for rare disease research are contributing to early diagnosis and improved patient outcomes, thereby fostering market growth.

The UK market is growing steadily due to several factors. In late 2024, Merck’s etanercept (Winrevair) received approval from the UK’s regulatory authority, providing an effective new treatment for PAH patients. Additionally, increased awareness and early diagnosis initiatives by healthcare providers, along with better access to advanced therapies through the National Health Service (NHS), are supporting market expansion. These combined efforts contribute to improving patient outcomes and fueling growth in the UK PAH drug market.

The market in Germany is growing due to the approval of innovative treatments like Merck’s etanercept (Winrevair) has expanded therapy options for PAH patients. Germany’s strong healthcare system, with comprehensive insurance coverage, ensures wide access to these medications. Additionally, rising cases of risk factors such as obesity, diabetes, and an aging population contribute to the increased demand for PAH drugs in the country. These elements collectively support the steady growth of the PAH drug market in Germany.

In March 2024, Merck announced FDA approval of WINREVAIR™ (etanercept-cork) injections for treating adults with pulmonary arterial hypertension (PAH). This new therapy improves exercise capacity and functional class and reduces clinical worsening. WINREVAIR is the first activin signaling inhibitor approved for PAH, targeting vascular cell proliferation. Dr. Marc Humbert, a leading researcher, highlighted that PAH is a rare, progressive disease causing lung vessel narrowing and heart strain, emphasizing the significance of this breakthrough treatment. (Source - Merck)

Researchers focus on developing novel PAH drugs using computational methods to accelerate their development and save costs. They also work on repurposing licensed medications for the treatment of PAH.

Key Players: Johnson & Johnson, Arena Pharmaceuticals, and PhaseBio Pharmaceuticals.

Clinical trials are conducted to assess the safety and efficacy of PAH drugs. Regulatory agencies subsequently approve these medications for market use based on their clinical trial data.

Key Players: VASTHERA Co., Ltd., Aerovate Therapeutics, and Insmed, Inc.

Patient support & services refer to providing financial assistance and guiding patients about drug delivery and dosage. Healthcare professionals suggest resources for navigating diagnosis and treatment.

By Drug Class

By Route of Administration

By End-User

By Region

January 2026

January 2026

January 2026

January 2026