Hyperkalemia Drugs Market Size, Key Players with Insights and Trends

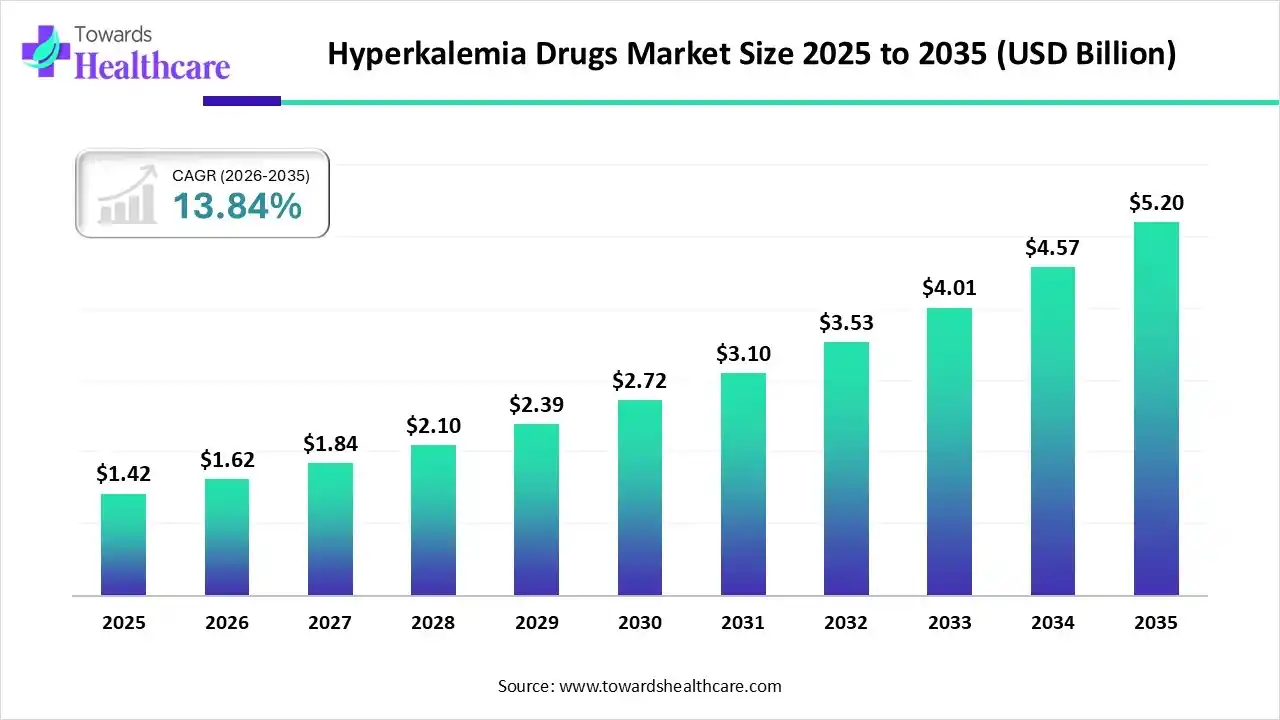

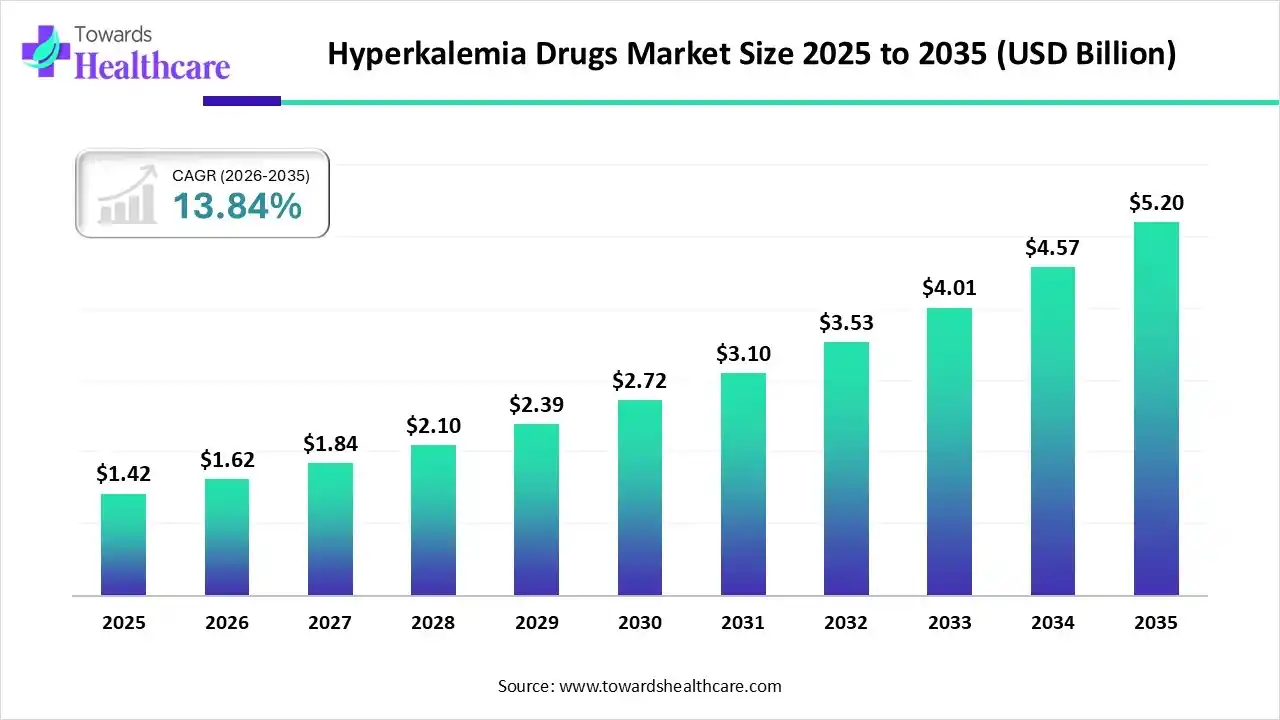

The hyperkalemia drugs market size was reported at US$ 1.42 billion in 2025 and is expected to rise to US$ 1.62 billion in 2026. According to forecasts, it will grow at a CAGR of 13.84% to reach US$ 5.20 billion by 2035.

The hyperkalemia drugs market is growing as cases of chronic kidney disease, heart failure, and the use of RAAS inhibitor therapies continue to rise. Increasing awareness of the dangers of elevated potassium levels and the availability of advanced potassium binders are boosting treatment adoption. Strong R&D efforts and improved diagnostic rates further support market expansion.

Key Takeaways

- The hyperkalemia drugs market will likely exceed USD 1.42 billion by 2025.

- Valuation is projected to hit USD 5.20 billion by 2035.

- Estimated to grow at a CAGR of 13.84% starting from 2026 to 2035.

- North America dominated the hyperkalemia drugs market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast Period.

- By drug class, the novel oral potassium binders segment held the largest market share in 2024.

- By drug class, the traditional cation-exchange resins segment is expected to grow at a significant rate in the market during the forecast Period.

- By distribution channel, the retail pharmacies segment dominated the market with a revenue share of in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR in the market during the forecast Period.

Quick Facts Table

| Key Elements |

Scope |

| Market Size in 2025 |

USD 1.42 Billion |

| Projected Market Size in 2035 |

USD 5.20 Billion |

| CAGR (2026 - 2035) |

13.84% |

| Leading Region |

North America |

| Market Segmentation |

By Drug Class, By Distribution Channel, By Region |

| Top Key Players |

AstraZeneca plc, CSL Vifor (Vifor Pharma AG), Sanofi, Kowa Company, Ltd., KVK-Tech, Inc., Fresenius Kabi AG, Novo Nordisk A/S |

What are Hyperkalemia Drugs?

Hyperkalemia drugs are medications designed to reduce high potassium levels in the blood and prevent related cardiac complications. The hyperkalemia drugs market is growing due to the rising prevalence of chronic kidney disease, heart failure, and diabetes, all of which increase the risk of elevated potassium levels. Greater use of RAAS inhibitors in cardiovascular treatment is also driving demand for effective potassium-lowering therapies. Additionally, improved clinical awareness, advancements in novel potassium binders, and expanding access to outpatient management options are supporting wider adoption and market growth.

For Instance,

- In September 2025, AstraZeneca Pharma India gained approval from the Subject Expert Committee under CDSCO to begin a Phase IV trial of Sodium Zirconium Cyclosilicate (Lokelma) in India. The study will further evaluate the drug’s effectiveness and safety for treating hyperkalemia in real-world patients.

Hyperkalemia Drugs Market Outlook

- Sustainability Trends: Sustainability trends in the market include a shift toward eco-efficient manufacturing, reduced waste in production, and increased use of recyclable packaging. Companies are also adopting greener supply chains and investing in energy-efficient facilities to lower environmental impact.

- Global Expansion: Global expansion of the hyperkalemia drugs market is driven by rising CKD and cardiovascular cases worldwide, broader access to advanced potassium binders, and increasing regulatory approvals across emerging regions. Growing investments by pharma companies further strengthen international market presence.

- Startup Ecosystems: The startup ecosystem in the hyperkalemia drugs market is supported by emerging biotech firms developing novel potassium binders, AI-driven diagnostic tools, and patient-monitoring platforms. Collaborations with research institutes and funding from venture capital accelerate innovation and early-stage clinical development.

Why AI Integration is Boosting the Hyperkalemia Drugs Market?

AI integration is boosting the market by improving early detection of elevated potassium levels through advanced predictive analytics and real-time patient monitoring. AI tools help clinicians optimize treatment decisions, reduce hospitalization risks, and personalize therapy. Additionally, AI accelerates drug discovery, enhances clinical trial efficiency, and supports better disease management, strengthening overall market growth.

Segmental Insights

Drug Class Insights

How Does the Novel Oral Potassium Binders Segment Dominate the Market in 2024?

The novel oral potassium binders segment dominated the hyperkalemia drugs market in 2024 because they are more effective, fast-acting, and better tolerated than older agents such as SPS. Their ability to be used safely for long-term management in CKD and heart-failure patients increased clinical preference. They also allow patients to stay on RAAS-inhibitor therapy, which is often limited by high potassium. Strong physician adoption, expanding guidelines, and broad patient eligibility drove their dominant 2024 market share.

Traditional Cation-Exchange Resins

The traditional cation-exchange resins segment is expected to show significant growth because these resins remain widely used, inexpensive, and easily accessible for hyperkalemia management, especially in cost-sensitive healthcare markets. Their long clinical history, broad physician familiarity, and continued use in chronic kidney disease and heart-failure patients support steady demand. Limited healthcare budgets in many regions further encourage reliance on these lower-cost, established therapies, driving strong forecasted growth.

Distribution Channel Insights

What Made the Retail Pharmacies Segment Dominant in the Market in 2024?

The retail pharmacies segment dominated the hyperkalemia drugs market because they offer easy, consistent access for patients managing chronic hyperkalemia, especially those needing long-term oral potassium binders. Their extensive local presence allows convenient prescription refills, medication counselling, and personalized pharmacist support, which boosts adherence. Because hyperkalemia often coexists with conditions like chronic kidney disease or heart failure, patients rely on trusted retail outlets for ongoing treatment.

Online Pharmacies

The online pharmacies segment is expected to grow at the fastest CAGR because it offers convenience, home delivery, and broad product choice, which appeals especially to patients on long-term hyperkalemia therapy. Digital platforms often provide competitive pricing and subscription schemes, while telemedicine integration makes ordering easy. Ongoing improvements in e-commerce infrastructure and regulatory changes further boost patient adoption.

Regional Insights

Why North America Dominated the Hyperkalemia Drugs Market in 2024?

North America dominated the market in 2024 largely due to its advanced infrastructure, favorable reimbursement systems, and strong R&D capacity. The region has a high prevalence of chronic kidney disease and heart failure, which increases demand for potassium-binding therapies. In addition, early adoption of novel oral binders, broad clinician awareness, and early diagnosis further drive the market’s leadership.

Rising Demand Powers U.S. Hyperkalemia Drugs Market Growth

The U.S. market is expanding mainly because chronic kidney disease, heart failure, and diabetes are becoming increasingly common, creating a larger population at risk of elevated potassium levels. The widespread use of RAAS inhibitors also contributes to higher hyperkalemia incidence, strengthening the need for effective treatments. Along with this strong healthcare infrastructure support, faster adoption of advanced oral potassium binders is improving patient access and driving steady market growth.

Emerging Giant: Asia Pacific’s Surge in Hyperkalemia Treatment

Asia Pacific is expected to grow at the fastest CAGR due to the rising burden of chronic kidney disease, diabetes, and heart failure, which increases the need for hyperkalemia management. The region is experiencing rapid improvements in healthcare infrastructure, higher healthcare spending, and greater availability of advanced potassium-binding drugs. Additionally, expanding patient awareness, growing diagnostic rates, and government initiatives to strengthen chronic disease care in countries like China, India, and Japan are accelerating treatment adoption and market growth.

China's Hyperkalemia Drugs Market is Expanding Rapidly

China's hyperkalemia drug market is experiencing rapid expansion, driven by rising chronic kidney disease rates and increasing awareness. The growing geriatric population further fuels demand for effective treatments, indicating significant market potential and growth.

A Growing Need: Europe’s Expanding Hyperkalemia Drug Landscape

Europe’s hyperkalemia drugs market is increasing due to a growing elderly population and a higher prevalence of chronic kidney disease, diabetes, and heart failure, all of which raise hyperkalemia risk. Strong healthcare systems, widespread diagnostic capabilities, and high clinical awareness support early detection and continuous management. In addition, favorable reimbursement policies, adoption of novel oral potassium binders, and ongoing research initiatives across major countries are boosting treatment accessibility and driving consistent market growth across the region.

The UK Hyperkalemia Drug Market: Driven by Demand and Innovation

The UK hyperkalemia drugs market is growing because of rising cases of chronic kidney disease, heart failure, and diabetes, all of which increase the likelihood of elevated potassium levels. The widespread use of RAAS inhibitors in this patient group further boosts treatment demand. Strong NHS support, improving access to newer oral potassium binders, and clear clinical guidelines encourage timely treatment. Increasing awareness among healthcare professionals also promotes early diagnosis and consistent management, driving steady market growth.

South America Embraces Advanced Treatment

South America’s hyperkalemia drug market is expanding due to the increasing prevalence of chronic kidney and heart failure diseases. Adoption of novel oral potassium binders is a recent trend, moving away from traditional resins. This shift is driven by clinical data favoring the sustained efficacy and safety of new treatment protocols.

Brazil’s Chronic Care Focus

Brazil is a significant growth engine, fueled by the large number of patients with chronic kidney disease and hypertension. The market sees strong traction for newer drugs designed for chronic management. Increased patient awareness and improved access to specialized care are accelerating the prescription rates for advanced therapies.

MEA's Strategic Healthcare Investments

The Middle East and Africa region is witnessing robust market development, backed by government investments in healthcare infrastructure. The increasing incidence of noncommunicable diseases, particularly diabetes, is a core driver. New strategic partnerships are crucial to enhancing distribution and market penetration for hyperkalemia drugs.

GCC: High Demand for Premium Drugs

The Gulf Cooperation Council countries show high potential, reflecting their focus on providing premium healthcare services. Favorable reimbursement policies and high disposable incomes support the uptake of costly innovative drugs. This strong institutional demand positions the GCC as a leading emerging market for hyperkalemia treatments.

Hyperkalemia Drugs Market Value Chain Analysis

R&D

- R&D is increasingly focused on next-generation oral potassium binders designed to deliver higher efficacy, quicker potassium reduction, and improved safety compared to traditional resin therapies.

- The rise in CKD, heart failure, and RAASi-treated patients is creating strong demand for safer long-term hyperkalemia solutions, pushing companies to accelerate innovation.

- New formulations aim to reduce gastrointestinal issues, enhance tolerability, and support chronic use, improving patient adherence and overall outcomes.

Key Players: AstraZeneca, CSL Vifor, Ardelyx, ZS Pharma, Cipla

Clinical Trials

- Clinical trials studies are increasingly centered on advanced potassium binders such as patiromer and sodium zirconium cyclosilicate, assessing how well they perform against older options like sodium polystyrene sulfonate.

- Trials are evaluating their speed in reducing high potassium, ability to keep levels stable long-term, and overall safety, particularly in patients with CKD, heart failure, and diabetes.

- Research also compares tolerability, side-effect profiles, and suitability for chronic use to support better treatment decisions.

Key Players: AstraZeneca, CSL Vifor, Ardelyx, ZS Pharma, Cipla, Dr. Reddy’s Laboratories.

Distribution to Hospitals, Pharmacies

- Hospital pharmacies mainly manage urgent hyperkalemia cases, supplying fast-acting treatments needed in emergency and inpatient settings.

- Retail pharmacies support ongoing outpatient care, offering easy access to oral potassium binders for patients requiring routine management.

- Online pharmacies are becoming important for long-term therapy, providing convenient home delivery and refill options for chronic users.

Key Players: AstraZeneca, CSL Vifor, Ardelyx, ZS Pharma, Cipla, Dr. Reddy’s Laboratories.

Company Landscape

AstraZeneca plc (Key Drug: Lokelma)

Company Overview:

- AstraZeneca is a global, science-led biopharmaceutical company focused on the discovery, development, and commercialization of prescription medicines.

- It operates across three key therapy areas: Oncology, BioPharmaceuticals (Cardiovascular, Renal and Metabolism, and Respiratory & Immunology), and Rare Disease (via Alexion, AstraZeneca Rare Disease).

Corporate Information (Headquarters, Year Founded, Ownership Type):

- Headquarters: Cambridge, United Kingdom

- Year Founded: 1999 (formed by the merger of Astra AB of Sweden and Zeneca Group PLC of the UK)

- Ownership Type: Public (LSE: AZN, NASDAQ: AZN)

History and Background:

- Formed in 1999, the company has grown through significant R&D investment and strategic acquisitions.

- Its hyperkalemia drug, Lokelma (sodium zirconium cyclosilicate), was originally developed by ZS Pharma, which AstraZeneca acquired in 2015 for approximately $2.7 billion.

Key Milestones/Timeline:

- 2015: Acquired ZS Pharma for the novel potassium binder, sodium zirconium cyclosilicate (Lokelma).

- 2018: Lokelma approved in the US (FDA) and EU (EMA) for the treatment of hyperkalemia in adults.

- 2024: Announced a new co-marketing agreement in India for Lokelma with Sun Pharmaceutical Industries.

Business Overview:

- Focuses on specialty medicines in Oncology, Rare Diseases, and BioPharmaceuticals (CVRM and R&I).

- Hyperkalemia drug Lokelma is a key product within the Cardiovascular, Renal and Metabolism (CVRM) franchise.

Business Segments/Divisions:

- Oncology

- BioPharmaceuticals (Cardiovascular, Renal and Metabolism [CVRM], Respiratory & Immunology [R&I])

- Rare Disease (Alexion)

Geographic Presence:

- Global operations, with major markets in the US, Europe, China, and Emerging Markets.

- Lokelma is approved and commercialized in over 50 countries globally.

Key Offerings:

- Lokelma (sodium zirconium cyclosilicate): Oral suspension for the treatment of hyperkalemia.

- Major brands include Tagrisso, Imfinzi, Farxiga/Forxiga, and others.

End-Use Industries Served:

- Pharmaceutical/Healthcare

- Specific therapeutic areas: Cardiovascular, Renal, Metabolic, Oncology, Rare Disease, Respiratory, and Immunology.

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

No major M&A specific to hyperkalemia drugs in 2024/2025.

Partnerships & Collaborations:

2024: Entered a "second brand partnership" with Sun Pharmaceutical Industries in India to co-market Lokelma, aiming for broader patient access.

Product Launches/Innovations:

Focus on post-marketing studies to expand Lokelma's clinical data in real-world settings and specific patient populations.

Capacity Expansions/Investments:

Ongoing investment in global manufacturing and supply chain to meet increasing demand for CVRM products.

Regulatory Approvals:

No major new drug approvals for hyperkalemia in 2024/2025; focus is on geographic expansion and label updates for Lokelma.

Distribution channel strategy:

- Uses a mix of specialty pharmacy, hospital distribution, and retail pharmacy, tailored by region.

- Focus on driving adoption in chronic care settings for patients with Chronic Kidney Disease (CKD) and Heart Failure (HF).

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Lokelma (sodium zirconium cyclosilicate) is a highly selective inorganic, non-polymer potassium binder.

- Research & Development Infrastructure: Extensive R&D centers globally (e.g., Cambridge, Gaithersburg, Gothenburg).

- Innovation Focus Areas: Cardiorenal space, focusing on managing comorbidities like hyperkalemia to enable optimal use of life-saving RAAS inhibitor therapy.

Competitive Positioning:

- Strengths & Differentiators: Strong global commercial infrastructure; Lokelma's rapid onset of action (median $2.2$ hours); extensive clinical trial data supporting chronic use.

- Market presence & ecosystem role: A dominant leader in the novel oral potassium binder segment; plays a crucial role in enabling guideline-directed medical therapy for CKD and HF patients.

SWOT Analysis:

- Strengths: Patented, best-in-class novel potassium binder (Lokelma); Global commercial footprint; Strong financial backing; Focus on CVRM.

- Weaknesses: High price point compared to older resins; Competition from Veltassa (Patiromer).

- Opportunities: Penetration into developing markets (e.g., India co-marketing); Expanding use in managing RAASi therapy in HF/CKD patients.

- Threats: Patent expiry; Development of next-generation hyperkalemia treatments; Pressure on drug pricing/reimbursement.

Recent News and Updates:

Press Releases:

- November 2025: Announcement of a new co-marketing deal for Lokelma with Sun Pharmaceutical Industries in India.

- Industry Recognitions/Awards:

- Recognized as a global leader in CVRM/Specialty care in various industry reports (general corporate recognition).

CSL Vifor (Key Drug: Veltassa)

Company Overview:

- CSL Vifor is a business unit of CSL Limited, specializing in treatments for kidney disease, iron deficiency, and cardiorenal conditions.

- It was formed following CSL Limited's acquisition of Vifor Pharma in August 2022.

Corporate Information (Headquarters, Year Founded, Ownership Type):

- Headquarters: St. Gallen, Switzerland (CSL Vifor business unit)

- Year Founded: Vifor Pharma was founded in 1999; Acquired by CSL Limited in 2022.

- Ownership Type: Subsidiary of a Public Company (CSL Limited: ASX: CSL)

History and Background:

- Vifor Pharma was historically focused on nephrology and cardio-renal treatments.

- Veltassa (patiromer) was originally developed by Relypsa, which was acquired by Galenica/Vifor Pharma.

- The hyperkalemia business became part of the CSL Vifor division after CSL Limited completed its acquisition of Vifor Pharma in August 2022 for approximately $$11.7$ billion.

Key Milestones/Timeline:

- 2015: Veltassa (patiromer) approved by the US FDA for the treatment of hyperkalemia.

- 2022: CSL Limited completes the acquisition of Vifor Pharma, establishing CSL Vifor and integrating Veltassa into its portfolio.

- 2024: Continued focus on global expansion and leveraging the CSL's larger infrastructure for Veltassa commercialization.

Business Overview:

- CSL Vifor is dedicated to patient blood management, kidney disease, and iron deficiency treatment.

- Veltassa is a flagship product in its cardiorenal portfolio, focusing on the chronic management of hyperkalemia.

Business Segments/Divisions:

- CSL Vifor operates as a key business unit within CSL Limited, alongside CSL Behring and CSL Seqirus.

- Focuses on Nephrology and Cardiorenal Therapy (Veltassa is a key component).

Geographic Presence:

- Major presence in the US and Europe; expanding reach into Asia Pacific and other global markets under the CSL umbrella.

- Veltassa is approved and marketed in numerous countries, including the US, EU, and Australia.

Key Offerings:

- Veltassa (patiromer): Oral suspension powder for the treatment of hyperkalemia.

- Other key products include Ferinject/Injectafer (iron deficiency) and various nephrology products.

End-Use Industries Served:

- Pharmaceutical/Healthcare

- Specific therapeutic areas: Nephrology, Cardiology, and Primary Care settings treating CKD and HF patients.

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

The 2022 acquisition by CSL Limited is the most significant event, integrating Vifor's hyperkalemia expertise into the larger CSL framework.

Partnerships & Collaborations:

- Leveraging CSL's established global network for greater commercial reach for Veltassa.

- Ongoing collaborations with key opinion leaders and medical societies to reinforce Veltassa's role in chronic hyperkalemia management.

Product Launches/Innovations:

Focus on data generation from real-world evidence and post-marketing studies to support Veltassa's chronic use and RAASi enabling potential.

Capacity Expansions/Investments:

Investment in manufacturing and supply chain optimization under CSL ownership.

Regulatory Approvals:

Gaining new country-specific approvals for Veltassa's use in chronic hyperkalemia.

Distribution channel strategy:

- Strong focus on specialty pharmacies and patient support programs to manage access due to its chronic, take-at-home nature.

- Utilizes a dedicated sales force targeting nephrologists and cardiologists.

Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Veltassa (patiromer) is a non-absorbed, non-polymer, inorganic potassium binder.

- Research & Development Infrastructure: Leveraging the combined R&D resources and clinical expertise of the CSL Group, particularly in cardiorenal space.

- Innovation Focus Areas: Optimization of dosing and administration; generating long-term outcome data in high-risk patient groups like those on RAAS inhibitors for HF.

Competitive Positioning:

- Strengths & Differentiators: Proven efficacy for chronic control; favorable safety profile; benefit of being taken with food (unlike older resins).

- Market presence & ecosystem role: A co-leader in the novel oral potassium binder market; essential provider in the nephrology and cardiorenal treatment ecosystem.

SWOT Analysis:

- Strengths: Global resources and stability from parent company CSL; Established efficacy for chronic hyperkalemia; Strong position in nephrology care.

- Weaknesses: Pricing pressure in some markets; Requires an interval before/after taking other oral medications.

- Opportunities: Integration into CSL's patient blood management and iron deficiency portfolio; Increased adoption in newly diagnosed CKD/HF patients.

- Threats: Aggressive competition from Lokelma; Potential for new, faster-acting therapies; Reimbursement challenges.

Recent News and Updates:

Press Releases:

CSL Limited's financial updates often highlight the strong performance of Veltassa as a growth driver in the CSL Vifor segment (2024/2025 financial reports).

Industry Recognitions/Awards:

None specifically highlighted in 2024/2025 public releases for Veltassa.

Company and Its Offerings

| Company |

Offerings & Contributions in Hyperkalemia |

| Sanofi |

Produces Kayexalate (sodium polystyrene sulfonate), a classic cation-exchange resin for chronic hyperkalemia. |

| Kowa Company, Ltd. |

No specific hyperkalemia potassium binder has been publicly reported; minor or no role in this therapeutic area. |

| KVK-Tech, Inc. |

Manufactures sodium polystyrene sulfonate (marketed as Kalexate/SPS) for oral or rectal use in hyperkalemia. |

| Fresenius Kabi AG |

Partners via VFMCRP to bring Veltassa (patiromer) to China, enabling renal patients to maintain RAASi therapy. |

| Novo Nordisk A/S |

No marketed hyperkalemia binder; previously linked to ocedurenone (KBP-5074), an MR antagonist in CKD, but not a direct potassium binder. |

Top Companies in the Hyperkalemia Drugs Market

- AstraZeneca plc

- CSL Vifor (Vifor Pharma AG)

- Sanofi

- Kowa Company, Ltd.

- KVK-Tech, Inc.

- Fresenius Kabi AG

- Novo Nordisk A/S

Recent Developments in the Hyperkalemia Drugs Market

- In October 2025, AstraZeneca initiated a Phase IV clinical trial in India to assess the long-term safety and efficacy of sodium zirconium cyclosilicate in treating hyperkalemia in patients with chronic kidney disease and heart failure. This study aims to provide real-world data on the drug’s performance in these patient groups.

- In September 2025, AstraZeneca submitted the Phase IV clinical trial protocol for sodium zirconium cyclosilicate to the CDSCO's Subject Expert Committee, which closely evaluated the study’s design, safety plans, and statistical methods before approving the trial to move forward.

Segments Covered in the Report

By Drug Class

- Novel Oral Potassium Binder

- Traditional Cation-Exchange Resins

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA