February 2026

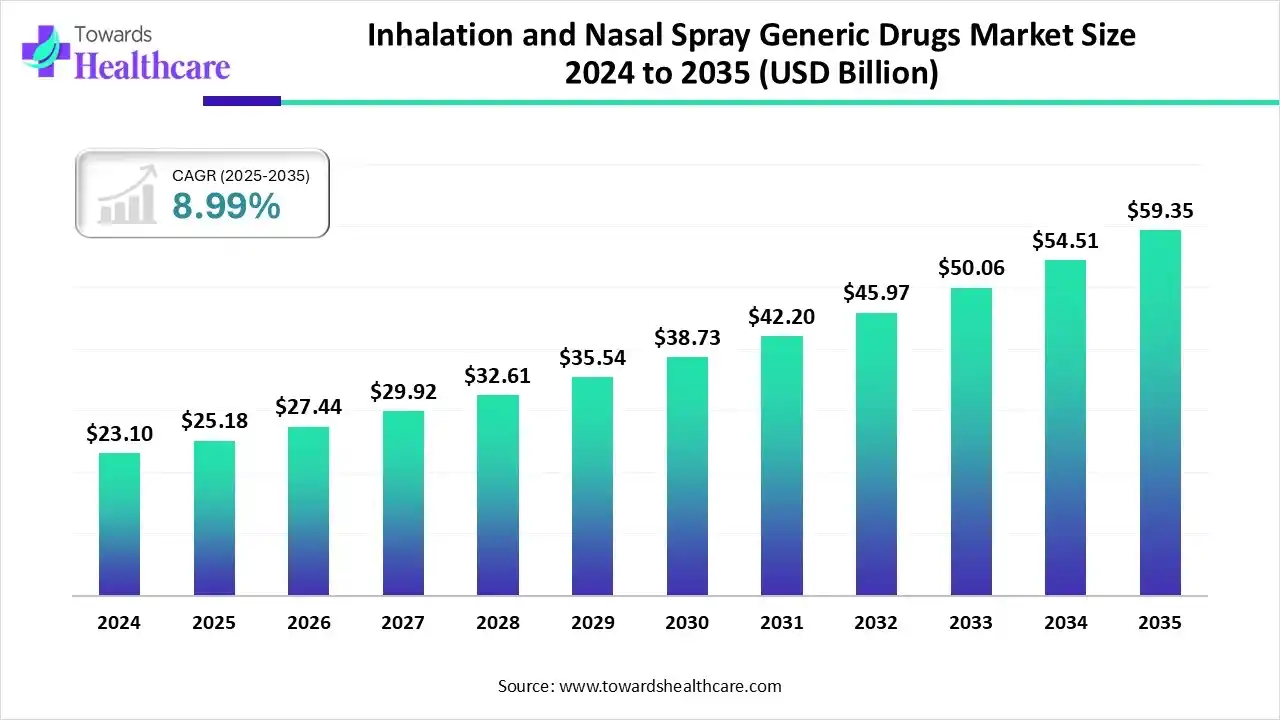

The global inhalation and nasal spray generic drugs market size was US$ 25.18 billion in 2025, grew to US$ 27.44 billion in 2026, and is projected to reach around US$ 59.35 billion by 2035. The market is expected to expand at a CAGR of 8.99% between 2026 and 2035.

The growing prevalence of chronic respiratory diseases is driving increased demand for inhalation and nasal spray generic drugs with AI supporting their manufacturing and innovation. Additionally, the presence of a robust healthcare infrastructure in developed regions, the rise of online pharmacies, and ongoing innovations in drug delivery systems are contributing to market growth. Market players are also expanding their footprints by launching new products, further boosting the growth of the market.

| Table | Scope |

| Market Size in 2025 | USD 25.18 Billion |

| Projected Market Size in 2035 | USD 59.35 Billion |

| CAGR (2026 - 2035) | 8.99% |

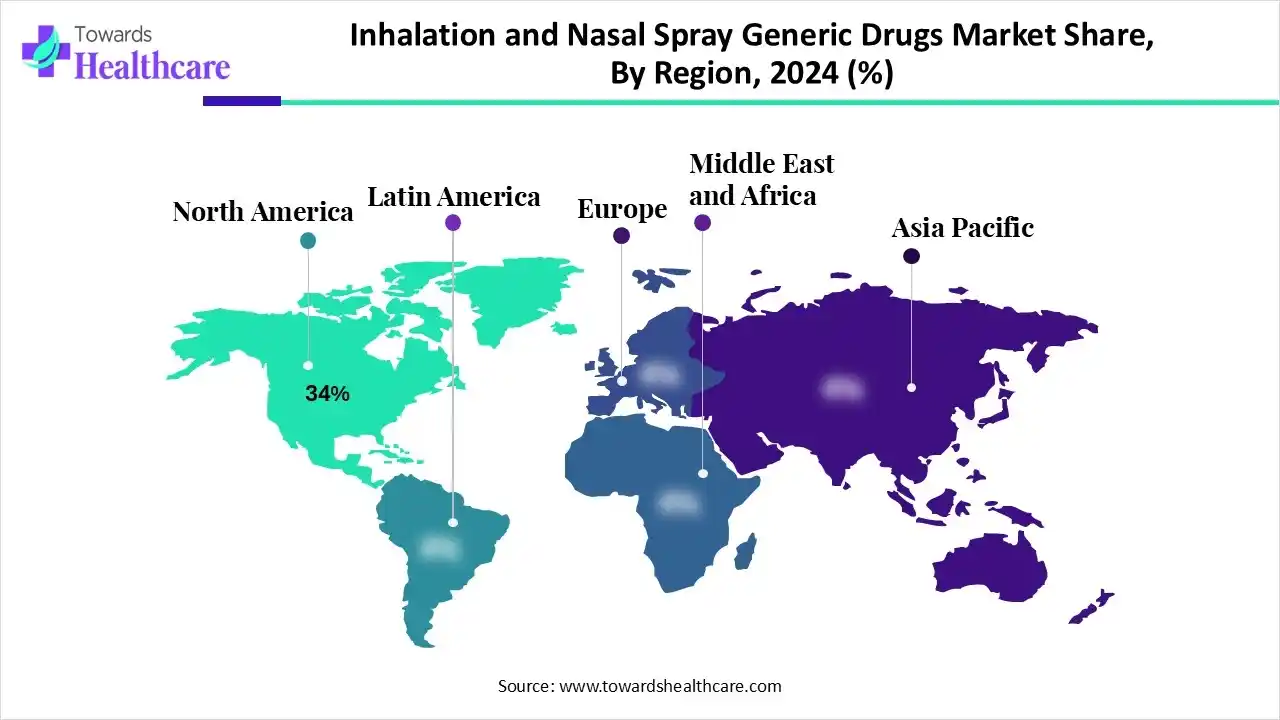

| Leading Region | North America by 34% |

| Market Segmentation | By Product Type, By Drug Class/Molecule Type, By Distribution Channel, By Therapeutic Indication, By Region |

| Top Key Players |

The market is driven by the growing need for affordable treatment options following the expiration of branded drug patents and by the increasing incidence of chronic respiratory diseases. Inhalation generic drugs are medications formulated to be inhaled into the lungs, typically in the form of an aerosol, nebulizer solution, or dry powder. They are commonly used for managing chronic respiratory conditions like asthma, chronic obstructive pulmonary disease (COPD), and pulmonary diseases.

The inhalation and nasal spray generic drugs market comprises generic formulations and device-delivered products (metered-dose inhalers, dry-powder inhalers, nebulized solutions, and nasal sprays) used to treat respiratory and nasal conditions such as asthma, COPD, allergic rhinitis, sinusitis, and emergency indications (e.g., naloxone nasal spray). The market covers development, regulatory approval, manufacturing, and commercialization of off-patent active ingredients and their interchangeable device presentations across retail, hospital, and institutional channels.

The use of AI is rapidly increasing, particularly in optimizing and developing formulations. AI helps predict drug-excipient compatibility and bioavailability, enabling the creation of more stable and effective formulations. Additionally, AI is being employed to screen potential drug candidates and monitor the production of nasal sprays, helping to prevent errors and improve the overall development process. AI also contributes to the automation of manufacturing processes, making production faster, more scalable, and cost-efficient. This technological integration is driving innovation and cost-reduction in the market, making inhalation and nasal spray generics more accessible to a broader population while maintaining safety and efficacy standards.

Why Did the Metered-Dose Inhalers (MDI) Segment Dominate the Market in 2024?

The metered-dose inhalers (MDI) segment dominated the inhalation and nasal spray generic drugs market with about 30% share in 2024 due to their ease of use. At the same time, they were portable and provided accurate dosing, thereby increasing self-administration and enhancing patient convenience. Additionally, their rapid drug delivery and affordability increased their use, bolstering segmental dominance.

The dry powder inhalers (DPI) segment is expected to grow at the highest CAGR during the forecast period, driven by their breath-actuated delivery, which is increasing patient compliance. Moreover, their propellant-free approach and growing innovations are also increasing their use. The portability and stability of these formulations are also increasing their adoption rates.

The nebulizers & solutions segment is expected to grow at a notable rate in the upcoming period, as they are used to deliver a wide range of medications. At the same time, the growing diseases and home care trends are increasing their use. Additionally, they are used to treat several cases across a wide range of populations, irrespective of age.

Which Drug Class/Molecule Type Segment Holds the Dominant Share of the Market in 2024?

The bronchodilators segment held the dominant share of 28% in the inhalation and nasal spray generic drugs market in 2024, driven by the growing prevalence of respiratory diseases. These drugs provided rapid relief, which in turn increased their use as a first-line treatment option in asthma and COPD treatment. Furthermore, their proven efficacy and enhanced availability increased their use.

The combination bronchodilator + ICS segment is expected to grow at the fastest rate during the forecast period, as it provides dual action by offering bronchodilation and inflammation control. This, in turn, is increasing their use in the treatment of respiratory diseases. Moreover, they are also being used in emergency conditions, supporting segmental growth.

The inhaled corticosteroids (ICS) segment is expected to grow at a significant rate over the projection period due to their enhanced control of inflammation. This, in turn, is increasing the use in allergic rhinitis, asthma and COPD. Moreover, they are available at affordable prices, which attracts patients and promotes their adherence to treatment.

How Does the Retail Pharmacies (Chain & Independent) Segment Lead the Market in 2024?

The retail pharmacies (chain & independent) segment led the inhalation and nasal spray generic drugs market while holding a 40% share in 2024. This is mainly due to the widespread accessibility of these pharmacies, which enable easier distribution and availability of inhalation and nasal spray products, which are commonly used to treat respiratory conditions. The convenience of retail pharmacies, coupled with the increasing adoption of generic drugs due to their cost-effectiveness, has contributed to a growing demand for these products.

The online/e-pharmacies segment is expected to grow at the highest CAGR during the forecasted years, owing to the convenience and accessibility of purchasing medications online, especially for chronic respiratory conditions, which has driven significant consumer preference. Their 24/7 availability and home deliveries are increasing patient convenience. Additionally, online pharmacies offer competitive pricing on generic drugs, making them an attractive option for cost-conscious consumers.

The hospital pharmacies segment is expected to grow in the upcoming period due to the rising patient volumes in hospitals. This, in turn, is increasing demand for generic inhalation and nasal spray drugs for the treatment of complex cases. Additionally, they are also providing affordable medications for long-term management of respiratory diseases.

What Made COPD the Dominant Segment in the Market in 2024?

The COPD segment dominated the inhalation and nasal spray generic drugs market with a 36% share in 2024, driven by a combination of high disease prevalence, increased awareness, and the availability of effective treatment options. COPD remains one of the leading causes of morbidity and mortality worldwide, with a significant number of patients requiring long-term management of symptoms, such as shortness of breath and chronic cough. The increasing global incidence of COPD has led to a consistent demand for medications that can manage the disease effectively.

The asthma segment is expected to grow at the fastest rate during the projected period due to rising air pollution, which is increasing incidence, driving demand for inhalers and nasal spray generic drugs. Moreover, growing awareness is also driving earlier diagnosis and the adoption of inhalation therapies.

The allergic rhinitis/nasal congestion segment is expected to experience significant growth in the upcoming period, driven by its increasing prevalence due to environmental pollution or pollen. This, in turn, is increasing the use of inhalation and nasal spray generic drugs. Furthermore, due to its recurrence, the use of affordable generic nasal sprays or inhalers is increasing.

North America led the inhalation and nasal spray generic drugs market, holding a 34% share in 2024. This is mainly due to the presence of a well-established healthcare sector, which has improved access to these drugs. The rising prevalence of respiratory diseases increased the demand for these medications, supported by insurance policies. Additionally, ongoing innovation and increased patient awareness further boosted their use, driving market growth. With rising healthcare costs, consumers in North America are gravitating toward generic options for their affordability and equivalent efficacy to branded products.

The U.S. is a major contributor to the market. The increasing incidence of respiratory diseases like asthma, allergic rhinitis, and COPD is boosting the use of inhalation and nasal spray generic drugs in the U.S. Simultaneously, the expanding generic drug ecosystem is also raising their usage, with these drugs being utilized in developing various new solutions. Additionally, the rise of online pharmacies is improving their accessibility, which in turn enhances patient outcomes.

Asia Pacific is expected to experience the fastest growth during the forecast period due to a combination of rapidly expanding healthcare infrastructure, growing patient populations, and increasing demand for affordable, effective treatments. The large population and growing urbanization are increasing the incidence of respiratory diseases, thereby increasing demand for these drugs. The rising cost of healthcare has driven a preference for generic drugs across Asia Pacific, where a large share of the population seeks cost-effective alternatives to branded inhalers and nasal sprays.

The rising health awareness in India is boosting early diagnosis of respiratory diseases, which increases the demand for inhalation and nasal spray generic drugs. Additionally, the higher incidence of respiratory conditions caused by air pollution and smoking is further driving the popularity of these medications. Moreover, the existence of a manufacturing hub for generic drugs is also encouraging development in this sector.

Europe is expected to experience significant market growth during the forecast period due to the increasing prevalence of respiratory diseases, which is driving the demand for inhalation and nasal spray generic drugs. A strong healthcare system is boosting the acceptance of these drugs, supported by reimbursement policies. Furthermore, ongoing innovations are also encouraging their use, contributing to market expansion.

The robust healthcare system in the UK is driving the adoption of generic drugs, particularly inhalers and nasal sprays, which are readily accessible through the NHS. Their affordability is driving their use in the chronic management of various respiratory conditions. Moreover, domestic companies are developing various product combinations, supporting market growth in the UK.

South America is experiencing an opportunistic rise in the market, driven by expanding healthcare access, rising disease prevalence, and growing demand for affordable treatments. Respiratory conditions such as asthma, COPD, and allergies are becoming more widespread, particularly in countries like Brazil and Argentina, creating a burgeoning market for generic inhalers and nasal sprays. Additionally, government efforts to improve healthcare infrastructure, coupled with the region's growing preference for cost-effective solutions, are driving demand for generic inhalation drugs.

Brazil has a significant population burdened by respiratory diseases such as asthma, COPD, and allergies, driving strong demand for inhalation and nasal spray treatments. The high prevalence of these conditions makes Brazil a dominant market for generic inhalers and nasal sprays in South America. Moreover, Brazil has been investing heavily in expanding its healthcare infrastructure, including pharmacies and medical services, making generic inhalation drugs more accessible to a wider population.

The Middle East and Africa inhalation and nasal spray generic drugs market is growing due to several key factors. The increasing prevalence of respiratory diseases such as asthma, COPD, and allergies in the region, coupled with rising healthcare awareness, is driving demand for effective treatments. Additionally, the affordability of generic inhalation drugs is a major factor, as many countries in the region seek cost-effective solutions to manage chronic conditions. Government initiatives to improve healthcare access, along with the expansion of pharmaceutical infrastructure and the rise of online pharmacies, are further accelerating the market's growth in MEA.

South Africa has a significant burden of respiratory conditions like asthma and COPD, which are driving the demand for inhalation and nasal spray treatments. These conditions are common across the country, leading to increased usage of generic inhalers and nasal spray products. The country has been making substantial investments in expanding and improving its healthcare system, including increased access to affordable medications.

The R&D focuses on developing complex formulation delivery devices with environmentally friendly propellants that demonstrate bioequivalence with their brand-name counterparts.

Key Players: Teva Pharmaceutical Industries Ltd., Cipla Ltd., Sandoz, Sun Pharmaceutical Industries Ltd.

The clinical trial and regulatory approval of inhalation and nasal spray generic drugs include demonstrating bioequivalence, such as in vitro performance testing, systemic exposure evaluation, pharmacokinetics, and comparative clinical endpoint studies to the branded products.

Key Players: Viatris, Teva Pharmaceutical Industries Ltd., Cipla Ltd., Sandoz, Hikma Pharmaceuticals PLC.

Educational resources on proper device techniques, affordability assistance, and adherence programs are part of patient support and services for inhalation and nasal spray generic drugs.

Key Players: Teva Pharmaceutical Industries Ltd., Viatris, Cipla Ltd., Sandoz, Sun Pharmaceutical Industries Ltd.

Corporate Information: Headquarters: Petah Tikva, Israel | Year Founded: 1901

Business Overview

Teva Pharmaceutical Industries Ltd. is one of the world’s largest generic pharmaceutical companies and a global leader in specialty medicines. It focuses on producing a wide range of generic and specialty drugs across various therapeutic categories, including respiratory, oncology, and central nervous system disorders. Teva also has a strong presence in the over-the-counter (OTC) drug segment. In the inhalation and nasal spray generic drugs market, Teva is a significant player, particularly in the respiratory segment with its portfolio of generic inhalers and nasal sprays.

Business Segments / Divisions

Teva operates in the following business segments:

Geographic Presence

Teva has a vast global footprint, with operations in over 60 countries. Its key markets include:

Key Offerings

Teva’s portfolio in the inhalation and nasal spray generic drugs market includes several respiratory treatments for chronic conditions like asthma and chronic obstructive pulmonary disease (COPD). Notable offerings include:

SWOT Analysis

Recent News

Corporate Information: Headquarters: Canonsburg, Pennsylvania, U.S. | Year Founded: 2020

Business Overview

Viatris is a global healthcare company created to provide access to medicines, sustainable healthcare solutions, and support for both branded and generic pharmaceutical markets. It operates through three primary pillars: access to medicines, sustainable healthcare, and support for patients. In the inhalation and nasal spray generic drugs market, Viatris plays a significant role by offering a range of affordable respiratory medications, including nasal sprays and inhalers, aimed at treating chronic respiratory conditions like asthma and chronic obstructive pulmonary disease (COPD). The company’s robust portfolio and commitment to developing high-quality generics position it well in the competitive generic inhalation sector.

Business Segments / Divisions

Viatris operates through the following major business segments:

Geographic Presence

Viatris has an extensive global reach, operating in over 165 countries and territories worldwide. The company’s geographic presence includes:

Key Offerings

Viatris offers a variety of generic inhalation therapies aimed at managing respiratory conditions like asthma and COPD. Notable products include:

SWOT Analysis

Recent News

In July 2023, Viatris and Kindeva Drug Delivery launched Breyna™ (budesonide and formoterol fumarate dihydrate) Inhalation Aerosol, the first generic version of AstraZeneca’s Symbicort®, approved by the FDA. Breyna is indicated for asthma and COPD patients and is available in 80 mcg/4.5 mcg and 160 mcg/4.5 mcg doses.

| Company | Headquarters | Key Strength | Products |

| Sandoz | Basel, Switzerland | Leader in generics and biosimilars | AirFluSal Forspiro, AirFluSal MDI, Generic Naloxone HCl Nasal Spray |

| Cipla Ltd. | Mumbai, India | Leader in respiratory generics with a focus on affordable inhaler therapies | Asthalin, Duolin, Tiova, Seroflo, Furamist Az |

| Hikma Pharmaceuticals PLC | London, UK | Strong manufacturing capabilities focusing on complex generics | Generic Fluticasone Propionate Nasal Spray, Ryaltris, Kloxxado |

| Mylan (now part of Viatris) | Pennsylvania, U.S. | Expertise in complex generics and respiratory treatments | Generic Ventolin, Generic Albuterol, Nasal sprays like Triamcinolone |

| Novartis | Basel, Switzerland | Leading global healthcare company with a strong focus on respiratory therapies | Xolair, Sandoz generic nasal sprays |

| AstraZeneca | Cambridge, UK | Leading in respiratory disease and inhalation therapies | Symbicort, Pulmicort (note: AstraZeneca also produces inhalers, but more focus on branded products) |

| Hovione | Lisbon, Portugal | Specializes in high-quality API development and generics | Generic nasal spray formulations in collaboration with various partners |

| Lupin Pharmaceuticals | Mumbai, India | Expertise in respiratory formulations and nasal sprays | Generic Fluticasone, Nasal Sprays for allergy relief and asthma |

The global inhalation and nasal spray generic drugs market stands at a pivotal juncture, characterized by an expanding market size underpinned by several dynamic factors. Inhalation and nasal spray formulations, historically dominated by branded therapies, have witnessed significant penetration from generics, driven by a combination of rising healthcare costs, patent expirations, and regulatory push for affordable alternatives. The transition toward generic formulations has created an attractive opportunity, particularly in respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD), where the treatment landscape is expanding alongside the growing incidence of these conditions globally.

From a market expansion perspective, North America and Europe remain dominant regions, while Asia-Pacific is emerging rapidly due to expanding healthcare infrastructure and the adoption of advanced drug-delivery technologies. Key players in this space, such as Teva Pharmaceuticals and Viatris, are capitalizing on robust R&D pipelines and scalable manufacturing to meet increasing demand. Moreover, the growing prevalence of chronic respiratory disorders and innovations in drug-device combination products contribute to expanding the therapeutic applications of inhalation and nasal spray generics.

The integration of artificial intelligence (AI) into formulation optimization, coupled with advancements in soft mist and dry powder inhalers, is enhancing the reliability and efficacy of these products, making them increasingly attractive to patients. The market also benefits from an influx of venture capital and strategic mergers and acquisitions, as companies pursue global expansion to capitalize on the untapped potential in emerging markets like Latin America and the Middle East.

In conclusion, the inhalation and nasal spray generic drugs market is poised for substantial growth, with substantial opportunities arising from technological advancements, favorable regulatory frameworks, and increased demand for cost-effective respiratory therapies. The convergence of industry giants with innovative startups and the continuous expansion of online pharmacies further ensure sustained momentum for this market in the coming years.

By Product Type

By Drug Class/Molecule Type

By Distribution Channel

By Therapeutic Indication

By Region

February 2026

January 2026

January 2026

January 2026