February 2026

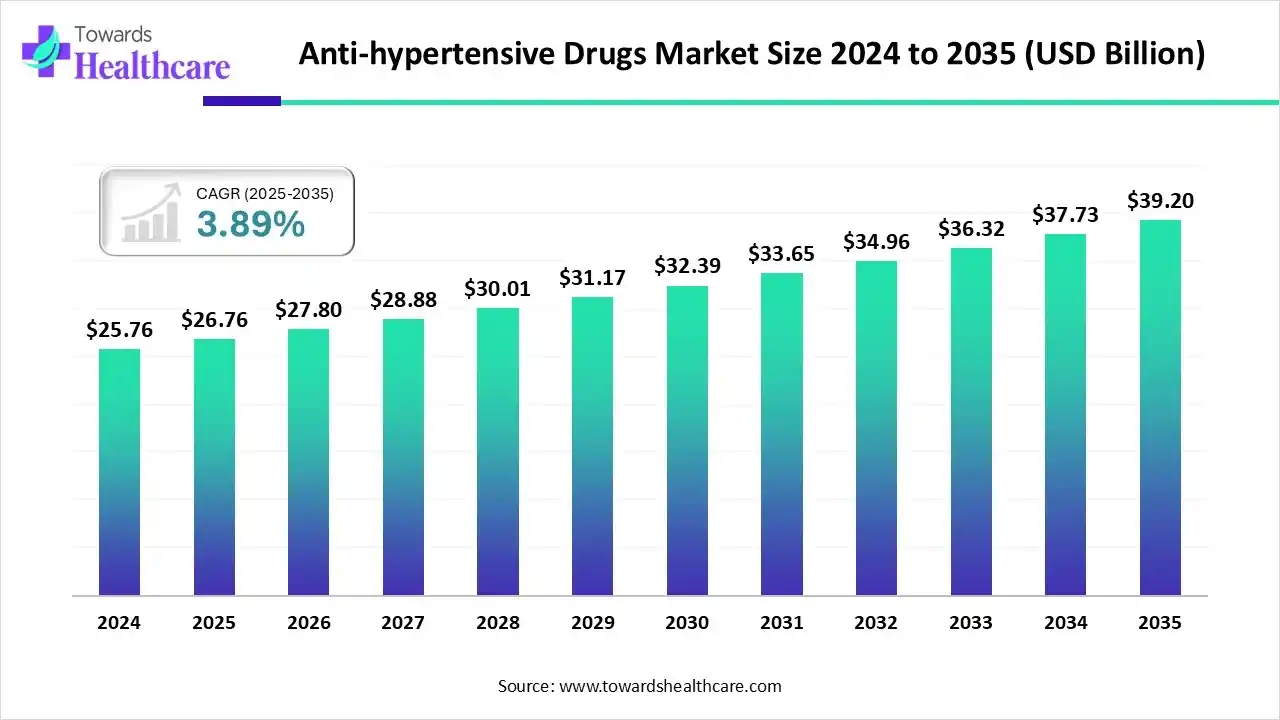

The global anti-hypertensive drugs market size is estimated at US$ 26.76 billion in 2025, grew to US$ 27.8 billion in 2026, and is projected to reach around US$ 39.2 billion by 2035. The market is expanding at a CAGR of 3.89% from 2026 to 2034.

Newly approved drugs and fixed-dose combinations, such as Aprocitentan (Tryvio) and WIDAPLIK™ (telmisartan, amlodipine, and indapamide), are playing a major role in improving patient adherence and achieving better blood pressure control. Emerging trends driving the anti-hypertensive drugs market include the rise of device-based therapies, single-pill combinations, and the integration of digital health tools. According to the European Society of Cardiology (ESC) guidelines, digital tools such as telehealth and mobile applications support patient monitoring, education, and lifestyle management, thereby enhancing overall hypertension care.

| Table | Scope |

| Market Size in 2025 | USD 26.76 Billion |

| Projected Market Size in 2035 | USD 39.2 Billion |

| CAGR (2026 - 2035) | 3.89% |

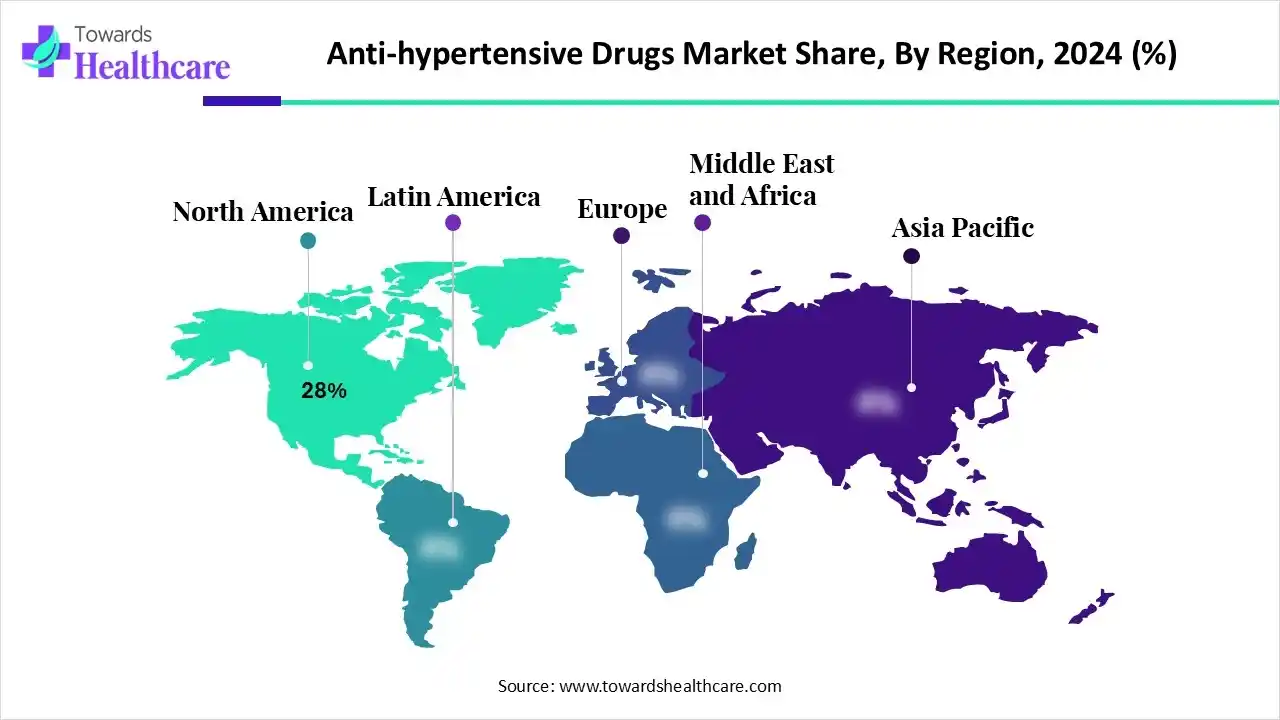

| Leading Region | North America by 28% |

| Market Segmentation | By Product Type, By Therapeutic Class, By Distribution Channel, By End-User Industry/Customer |

| Top Key Players | Novartis AG, Sanofi S.A., Pfizer Inc., AstraZeneca Plc, Johnson & Johnson, Merck & Co., Inc., Boehringer Ingelheim GmbH, Bayer AG, Teva Pharmaceutical Industries Ltd. |

Advancements in drug development and digital health technologies are fueling the adoption of anti-hypertensive medications. The anti-hypertensive drugs market includes pharmaceutical products and therapies used to prevent and treat high blood pressure (hypertension), such as single-agent and combination medications across classes like ACE inhibitors, angiotensin II receptor blockers (ARBs), beta-blockers, calcium channel blockers, diuretics, and renin inhibitors. The market encompasses branded and generic prescription drugs, fixed-dose combinations, various formulations (oral tablets, extended-release, injectables), related diagnostics and monitoring devices, and services related to clinical development, regulatory approval, and distribution. Demand is driven by the global prevalence of cardiovascular disease, aging populations, screening programs, and guideline-based therapy, while pricing pressures, patent expiries, and increasing generic competition influence market dynamics.

Artificial intelligence (AI) is transforming the anti-hypertensive drugs market by enhancing efficiency across drug development, clinical management, and patient care. In drug discovery, AI algorithms accelerate the identification of potential therapeutic targets, predict drug efficacy, and optimize molecular design for new anti-hypertensive agents. In clinical trials, AI helps in patient selection, data analysis, and real-time monitoring, improving trial outcomes and reducing costs.

AI technologies improve the diagnosis, monitoring, and treatment of hypertension. AI and digital technologies contribute to cardiovascular care. AI-integrated cardiovascular care is driven by algorithmic data processing, wearable cardiac monitoring, individualized patient management, and automated blood pressure measurement.

How Does the Tablets & Capsules Segment Dominate the Anti-Hypertensive Drugs Market in 2024?

The tablets & capsules segment led the market with a 72% revenue share in 2024, thanks to better patient adherence, improved standards of care, and new product approvals. Tablets and capsules are ideal for oral use because they are convenient, promote high patient compliance, and are easy to self-administer. They are vital solutions for anti-hypertensive treatments and are expanding due to increased adoption of multi-drug single-pill combinations.

The fixed-dose combination (FDC) tablets segment is expected to grow at the fastest CAGR in the market during the forecast period because of their improved efficacy, fewer side effects, and cost savings. They boost long-term patient adherence to treatment plans. The cost-effective tablets decrease the need for additional clinic visits, hospitalizations, and overall healthcare expenses.

The injectables segment is expected to grow at a significant rate in the coming years due to faster and more effective treatment, better clinical outcomes, and reduced side effects. They are cost-efficient and enhance patient adherence and persistence. They are essential for delivering acute and emergency care for chronic conditions or hypertension.

Why Did the ACE Inhibitors Segment Dominate the Anti-Hypertensive Drugs Market in 2024?

The ACE inhibitors segment dominated the market with a 22% revenue share in 2024, due to their extensive use in combination with other antihypertensive classes. They are utilized in therapies because of their proven benefits in decreasing morbidity and mortality beyond blood pressure control. They serve as first-line therapy for hypertension and are often used in combination treatments.

The fixed-dose combination therapies segment is expected to grow the fastest in the upcoming period due to increased efficacy, quicker blood pressure control, and the rising use of triple combinations. These therapies are propelled by digital health integration and focus on particular combinations. They play a vital role in managing hypertension and controlling blood pressure levels.

The angiotensin II receptor blockers (ARBs) segment is projected to grow significantly in the upcoming years due to their key role as alternatives to ACE inhibitors and primary anti-hypertensive treatments. They offer cardiovascular and kidney protection and improve the metabolic profile. They have numerous therapeutic uses, including in neurodegenerative conditions such as Alzheimer's and Parkinson's disease.

Which Distribution Channel Dominates the Anti-Hypertensive Drugs Market in 2024?

The retail pharmacies / drugstores segment led the market with a 60% revenue share in 2024, driven by their significant role in medication management, patient education, and counseling. They improve dispensing, accessibility, monitoring, and patient adherence. They focus on team-based care, digital health, telehealth, and expanding services.

The online pharmacies / e-pharmacy platforms segment is expected to grow at the highest CAGR in the market during the studied period due to greater accessibility, convenience, and medication adherence. They support the integration of digital health interventions and data-driven patient management. They focus on patient engagement and advanced therapies.

The hospital pharmacies / institutional tender segment is expected to grow at a significant rate in the coming years due to supply chain stability, data-driven forecasting, and standardization. Hospital pharmacies are essential in clinical management, patient care, and inventory oversight. Pharmacists play a crucial role in patient education, empowerment, and care.

Why Did the Outpatient / Retail Patients Segment Dominate the Anti-Hypertensive Drugs Market in 2024?

The outpatient / retail patients segment led the market with a 75% revenue share in 2024, driven by the growing need to lower the risk of stroke, heart failure, heart attack, and kidney disease. Personalized treatments aim to decrease the overall cardiovascular risk for patients. Certain drug classes have demonstrated effectiveness and cost-efficiency in preventing cardiovascular events.

The hospitals / inpatient care segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing importance of acute management, chronic therapy, and complication prevention. Multidisciplinary care and combination therapy are highly significant. Inpatient care involves reassessing and adjusting medication regimens.

The ambulatory clinics / primary care centers segment is expected to grow significantly in the coming years due to the increased focus on effective management and treatment of hypertension. They aim to balance pharmacologic and non-pharmacologic interventions and also concentrate on preventing target organ damage.

North America led the anti-hypertensive drugs market, accounting for a 28% revenue share in 2024. This is mainly due to high awareness about hypertension management and ongoing drug innovations. Government initiatives aim to improve drug access, affordability, combination therapies, and new drug approvals. Programs like the Mexico Preventive Health Program, Drug Price Inflation Penalties, Canada Pharmacare Plan, and Mexico Consolidated Drug Purchase support these efforts. These initiatives also encourage the use of single-pill combinations, diagnosis, and treatment. Overall, government healthcare programs seek to enhance health outcomes and increase medication access for older adults.

The U.S. is a major contributor to the market. Ongoing government and organizational programs, such as the Million Hearts initiative of the Centers for Disease Control and Prevention (CDC), provide resources and enable effective management and patient education. They offer rapid treatments and emphasize early interventions to reduce blood pressure. The approval of new drugs and updates to clinical practice guidelines boost the anti-hypertensive drug market.

In June 2025, George Medicines announced FDA approval for WIDAPLIK (telmisartan, amlodipine, and indapamide), a new single-pill combination treatment for hypertension in adults.

Asia Pacific is projected to grow at the fastest CAGR in the market during the forecast period, driven by economic growth, increasing demand for affordable generics, and an aging population. According to the World Health Organization (WHO), over 1.4 billion people were at risk due to uncontrolled high blood pressure in 2024. The WHO also reported that every hour, 1000 lives are lost to heart attacks and strokes caused by high blood pressure, and many of these deaths are preventable. The WHO implements measures that could prevent millions of premature deaths. Countries in Asia Pacific, such as Bangladesh, the Philippines, and the Republic of Korea, are leading the way in integrating hypertension care into universal health coverage (UHC) through community engagement and investments in primary care.

China is the major contributor to the Asia-Pacific anti-hypertensive drugs market, driven by its large patient population, rising prevalence of hypertension, and rapid urbanization leading to lifestyle-related cardiovascular risks. The country’s expanding healthcare infrastructure, growing awareness of hypertension management, and increased access to advanced medications further support market growth. Additionally, strong government initiatives promoting chronic disease control and the presence of both multinational and domestic pharmaceutical companies enhance China’s dominant position in the regional market.

Europe is expected to grow at a notable rate between 2025 and 2034, driven by a strong focus on preventive healthcare, technological innovations, and formulation advancements. The European Society of Cardiology (ESC) guidelines emphasize comprehensive hypertension management, supporting early detection and effective treatment strategies. Furthermore, ongoing research and development efforts by pharmaceutical companies, combined with national-level initiatives across European countries, are accelerating the introduction of novel anti-hypertensive therapies and improving patient outcomes.

In Germany, major developments such as the National Pharmaceutical Strategy, the Medical Research Act, and the 2024 European Society of Cardiology (ESC) Guidelines are shaping the market. The country’s growing aging population and high prevalence of hypertension are key drivers of the market. Additionally, Germany’s increased focus on enhancing healthcare system efficiency and integrating innovative medicines further supports market growth and the adoption of advanced hypertension therapies.

South America is experiencing an opportunistic rise in the anti-hypertensive drugs market, driven by the growing prevalence of hypertension due to lifestyle changes, urbanization, and an increasing aging population. Governments across the region are strengthening public health initiatives focused on cardiovascular disease prevention and affordable access to essential medicines. Additionally, expanding healthcare infrastructure and collaborations with global pharmaceutical companies are improving the availability of advanced anti-hypertensive therapies. These factors collectively position South America as an emerging and promising market for hypertension management.

Brazil is the major contributor to the South American anti-hypertensive drugs market, primarily due to its large population and high prevalence of hypertension. The country has a growing incidence of lifestyle-related cardiovascular diseases driven by urbanization, obesity, and sedentary habits. Brazil’s well-established healthcare infrastructure, government initiatives promoting early diagnosis and treatment, and strong presence of both multinational and domestic pharmaceutical companies further support the growth of the market.

The growth of the Middle East & Africa (MEA) anti-hypertensive drugs market is supported by several key factors. Rising prevalence of hypertension and other cardiovascular diseases due to changing lifestyles, urbanization, and increasing obesity rates is a primary driver. Expanding healthcare infrastructure, improved access to advanced medications, and government initiatives promoting early diagnosis and treatment of chronic diseases further contribute to market growth. Additionally, increasing awareness about hypertension management, the adoption of digital health tools, and the entry of multinational pharmaceutical companies with innovative therapies are strengthening the MEA anti-hypertensive drugs market.

Saudi Arabia is a major contributor to the market in the Middle East & Africa (MEA) due to its high prevalence of hypertension and other cardiovascular diseases, driven by lifestyle changes, obesity, and an aging population. The country’s well-developed healthcare infrastructure, government initiatives for chronic disease management, and increasing access to advanced medications support market growth. Additionally, rising awareness about hypertension and adoption of digital health solutions for patient monitoring and adherence further strengthen Saudi Arabia’s position as a leading market in the region.

The R&D process for a new anti-hypertensive drug includes discovery and development, preclinical research, clinical trials, regulatory review, and post-market safety monitoring.

Key Players: Merck & Co. Inc., Sanofi S.A., Novartis AG, Pfizer Inc., Johnson & Johnson, etc.

The U.S. FDA approved Aprocitentan, WIDAPLIK, and Javadin. The agency also supports clinical trials and emerging therapies.

Key Players: Merck & Co. Inc., Sanofi S.A., Novartis AG, Pfizer Inc., Johnson & Johnson, etc.

They include digital health integration, multidisciplinary care teams, medication adherence strategies, and improved patient education.

Key Players: Sanofi S.A., Novartis AG, Pfizer Inc., Johnson & Johnson, Merck & Co. Inc.

Corporate Information

Business Overview

Novartis AG is a global pharmaceutical company that researches, develops, manufactures, and markets innovative medicines, generics/biosimilars (primarily through Sandoz), and consumer health products. In the area of cardiovascular and metabolic diseases (including hypertension), Novartis has a strong presence, offering multiple antihypertensive agents and fixed-dose combinations, and highlighting its commitment to cardiovascular, renal, and metabolic therapeutic areas.

Business Segments / Divisions

Geographic Presence

Novartis operates globally, with sales and production facilities spanning the Americas, Europe, AsiaPacific, Latin America, the Middle East & Africa. The company maintains manufacturing and R&D sites in Switzerland, the U.S., Austria, Slovenia, China, France, Italy, and elsewhere.

Key Offerings

SWOT Analysis

Recent News

In August 2025, Novartis initiated a Phase 2b, multicenter, randomized, double-blind, placebo-controlled study to evaluate the efficacy, safety, and pharmacodynamics of QCZ484 in patients with mild to moderate hypertension. The study is expected to test multiple subcutaneous doses of QCZ484 administered every six months over a 12-month period.

Corporate Information

Business Overview

Sanofi is a global pharmaceutical and healthcare company engaged in research, development, manufacturing, and marketing of prescription medicines, vaccines, and consumer health products. In the context of the anti-hypertensive drugs market, Sanofi holds a legacy role via established cardiovascular / hypertension therapies (for example, its ARB irbesartan under brand names such as Aprovel) and single-pill combinations.

Business Segments / Divisions

Sanofi organizes its business into several major segments including:

Rare Diseases / Specialty Care

Within Pharmaceuticals, therapeutic areas include cardiovascular (which covers hypertension), diabetes, immunology, oncology, rare diseases & more.

Geographic Presence

Sanofi operates in over 100 countries across all major regions (Americas, Europe, Asia-Pacific, Latin America, Middle East & Africa) and has manufacturing and R&D facilities worldwide. Its Western Europe market remains significant, and it is expanding in emerging markets.

Key Offerings

SWOT Analysis

Read further to see how top players are shaping the future of anti-hypertensive drugs market at: https://www.towardshealthcare.com/companies/anti-hypertensive-drugs-companies

| Vendor | Headquarters | Key Offerings / Highlights |

| Pfizer Inc. | U.S. | Leading anti-hypertensive drugs and combination therapies; active in R&D for new hypertension treatments. |

| AstraZeneca Plc | UK | Develops ACE inhibitors, ARBs, and combination drugs for hypertension and cardiovascular diseases. |

| Johnson & Johnson | U.S. | Offers anti-hypertensive therapies and cardiovascular care products; invests in patient adherence technologies. |

| Merck & Co., Inc. | U.S. | ACE inhibitors and ARBs in its cardiovascular portfolio; focuses on global hypertension management. |

| Boehringer Ingelheim GmbH | Germany | Provides angiotensin receptor blockers (ARBs) and fixed-dose combination therapies for hypertension. |

| Takeda Pharmaceutical Company Limited | Japan | Anti-hypertensive drug development, including ARBs and combination therapies; expanding market access. |

| Bayer AG | Germany | ACE inhibitors, ARBs, and novel formulations for hypertension; emphasizes patient-centric therapy solutions. |

| Daiichi Sankyo Company, Limited | Japan | Focuses on ARBs and multi-drug combinations for effective blood pressure control. |

| Teva Pharmaceutical Industries Ltd. | Israel | Generic anti-hypertensive drugs portfolio; helps improve affordability and accessibility worldwide. |

From the vantage point of an industry leader in the antihypertensive domain, the market for anti-hypertensive drugs presents a highopportunity corridor that demands strategic prioritisation. With persistent global epidemiologic tailwinds, aging populations, escalating prevalence of hypertension in emerging markets, and shifting lifestyle risk factors, the addressable base continues to expand.

Yet the traditional treatment classes are increasingly commoditised and marginconstrained, necessitating an inflection toward innovation. Distinct value can be captured by pioneering differentiated assets: novel mechanisms of action for treatmentresistant hypertension, fixeddose combinations (FDCs) that improve adherence, and delivery systems or digital–therapy hybrids that address patient behavioural gaps.

Concurrently, from a geographic and access standpoint, growth levers are strongest in underpenetrated geographies, specifically AsiaPacific and certain highburden middleincome markets, where market penetration, reimbursement maturity and treatment adherence remain suboptimal. Here the dual strategy of portfolio localisation (including costeffective generics/FDCs) and premium innovation (for the uncontrolledhypertension segment) aligns with lifecycleextension imperatives.

Given these dynamics, we believe the antihypertensive category presents a compelling “growthfrommaturity” paradigm: not explosive, but strategically rich, where being firstorbest in segmentspecific niches (e.g., resistant hypertension) will yield outsized returns compared to competing in commoditised massmarket segments.

By Product Type

By Therapeutic Class

By Distribution Channel

By End-User Industry/Customer

February 2026

February 2026

February 2026

February 2026