February 2026

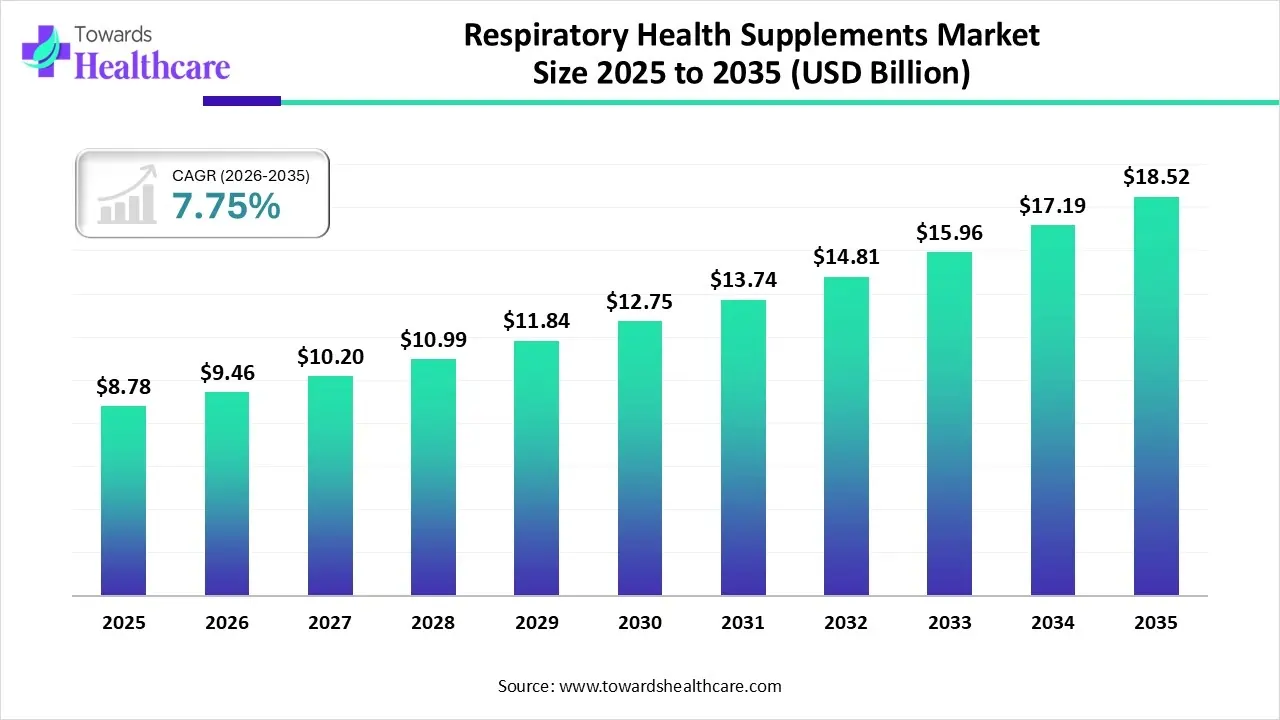

The global respiratory health supplements market size is calculated at US$ 8.78 in 2025, grew to US$ 9.46 billion in 2026, and is projected to reach around US$ 18.52 billion by 2035. The market is expanding at a CAGR of 7.75% between 2026 and 2035.

The respiratory health supplements market is expanding significantly due to rising chronic respiratory disease prevalence, increased awareness of respiratory health, and an increased emphasis on preventive healthcare. In the wake of recent global health crises that have highlighted the significance of respiratory wellness, consumers worldwide are increasingly turning to dietary supplements to boost immunity and lung function.

| Key Elements | Scope |

| Market Size in 2025 | USD 8.78 Billion |

| Projected Market Size in 2035 | USD 18.52 Billion |

| CAGR (2025 - 2035) | 7.75% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Product Type, By Formulation, By Consumer Group, By Distribution Channel, By Region |

| Top Key Players | Amway Corporation, Herbalife Nutrition Ltd., Glanbia PLC, Haleon plc (brands include Otrivin, Theraflu, etc.), Nu Skin Enterprises, Inc., Nature's Sunshine Products, Inc., The Bountiful Company, Vitabiotics Ltd., NOW Foods, Nature's Bounty, Unijules Life Sciences Ltd., Pristine Organics Pvt. Ltd., Zoic Pharmaceuticals, Nutra Healthcare Pvt. Ltd., Lifegenix, Gummies India, BeastLife, MuscleBlaze, GNC India, Optimum Nutrition (ON) |

Products with vitamins, minerals, herbs, and other dietary components that support lung function and general respiratory health are known as respiratory health supplements. They frequently do this by lowering inflammation and enhancing immunity. The respiratory health supplements market is fueled by rising respiratory disease prevalence, consumer awareness of preventive healthcare, and the need for natural, immunity-boosting supplements in a variety of convenient forms.

AI makes it possible to create more intelligent formulations, data-driven suggestions, and adaptive supplement protocols that are customized to each person's biology as consumer demand moves toward proactive and personalized healthcare. AI tools are revolutionizing the speed and precision of innovation in the wellness sector, from real-time nutrient deficiency prediction to biomarker and microbiome data analysis.

How Vitamins & Minerals Dominated the Market in 2024?

The vitamins & minerals segment was dominant in the respiratory health supplements market in 2024. The idea that vitamins C, D, and E, carotenoids, and omega-3 fatty acids may prevent the development of chronic respiratory disorders is currently being supported by a growing body of research. Many vitamins, minerals, and antioxidants have drawn a lot of attention lately for their potential to lessen the negative effects of smoking and environmental pollution.

Herbal Supplements

The herbal supplements segment is estimated to grow at the highest rate in the upcoming timeframe. Herbal products and plant extracts have been widely used in Indian Ayurveda and Traditional Chinese Medicine (TCM). These herbal remedies are crucial in the current medical era for boosting immunity and prolonging life. Herbal medicine has a long history of being used to treat respiratory disorders, hemorrhoids, bronchitis, chronic vascular problems, dysentery, and inflammation.

Probiotics

The probiotics segment is expected to grow significantly in the respiratory health supplements market during the forecast period. Probiotics are the good bacteria that support the host's immune system while preserving a balanced microbial population in the gastrointestinal tract. These probiotics have been used to treat a variety of respiratory tract infections (RTIs), such as cough, pharyngitis, laryngitis, pneumonia, and asthma, and their role in controlling immune function has been acknowledged.

Which Formulation Dominated the Market in 2024?

Tablets & Capsules

The tablets & capsules segment was dominant in the respiratory health supplements market in 2024. The most accessible dosage forms across all categories are capsules and tablets, and manufacturers of dietary supplements generally favor capsules. Because they give manufacturers formulation flexibility, capsules and tablets dominate the market. Because capsules come in a variety of sizes, manufacturers have a wide range of dosage options.

Gummies

The gummies segment is estimated to grow at the highest rate in the upcoming timeframe. Gummy candies are a great matrix for adding functional ingredients because they are so popular with people of all ages. Manufacturers can provide consumers with a delicious snack that has additional health benefits by incorporating plant extracts, vitamins, minerals, and other ingredients into their gummy candies.

Liquids

The liquids segment is expected to grow significantly in the respiratory health supplements market during the forecast period. The production of liquid supplements is a painstaking procedure intended to guarantee the uniform dispersion of ingredients in every bottle, thereby maximizing their nutritional potential. Because liquid supplements are easy to consume and absorb quickly, they have many advantages over traditional supplement forms.

How did the Adults Segment Dominate the Market in 2024?

The adults segment was dominant in the respiratory health supplements market in 2024.

Adults dominate the market due to several factors, such as rising disposable income, growing awareness among adults, and an increase in occupational respiratory disorders. Furthermore, as adults tend towards old age, the chances of getting respiratory disorders increase, due to which a lot of adults start consuming supplements as a preventive measure.

Children

The children segment is estimated to grow at the highest rate in the upcoming timeframe. Children with respiratory tract infections (RTIs) have a significant health care burden that includes both the direct medical care costs and the costs associated with parental absences from work. In order to strengthen children's immunity and prevent RTIs, supplements like probiotics and vitamins are strongly advised.

Geriatric

The geriatric segment is growing significantly in the respiratory health supplements market during the forecast period. Due to oxidative stress, age-related immune function decline, and the increased prevalence of chronic lung conditions, older adults may require respiratory supplements. Important supplements can help maintain lung health, lower inflammation, and lessen the risk and severity of infections when combined with a diet high in nutrients.

Which Distribution Channel Dominated the Market in 2024?

Brick-and-mortar

The brick-and-mortar segment was dominant in the respiratory health supplements market in 2024. When navigating the vast array of supplement options available, customers prefer to shop in physical stores where they can ask knowledgeable employees for advice. Because consumers can directly assess product quality through labeling and packaging, in-store experiences offer a sense of trust and dependability that online shopping might not.

E-Commerce

The e-commerce segment is estimated to grow at the highest rate in the upcoming timeframe. The e-commerce market for supplements is changing at an unprecedented rate. In 2025, new regulations, AI-powered shopping, and changing consumer behavior will all have an impact on how brands sell and establish credibility online.

Asia Pacific dominated the respiratory health supplements market in 2024. The integration of traditional medicine and growing concerns about pollution are driving the widespread adoption of respiratory supplements across the Asia Pacific, especially in China and India. Proactive health management strategies that maximize effectiveness and reduce the need for medical intervention are enabled by trends in technology integration, such as direct-to-consumer distribution models, personalized supplements, and synergistic ingredient combinations with improved bioavailability.

Interest in hMPV cases in China has increased recently, with reports of overcrowded hospitals. According to data released by China up to December 29, 2024, there has been a rise in acute respiratory infections in recent weeks, along with increased detection of seasonal influenza, rhinovirus, RSV, and hMPV, especially in northern provinces. Consumer knowledge of respiratory health supplements to strengthen immunity and treat respiratory illnesses has therefore increased.

North America is estimated to host the fastest-growing respiratory health supplements market during the forecast period. High consumer awareness, a robust presence of top supplement manufacturers, and a well-established healthcare infrastructure all contribute to the region's dominance. The area also gains from advantageous regulatory frameworks that promote product innovation and guarantee consumer safety.

In the U.S., air pollution has become a significant contributor to rising medical expenses, respiratory illnesses, and financial hardship. As a result, Americans are concentrating on taking health supplements. In the U.S., there are an estimated 23 million asthmatics and over 16 million COPD sufferers, many of whom are impacted by air pollution. Over $150 billion is spent on illnesses linked to air pollution. The average cost of treating an asthma attack is $1,000. For example, the average hospitalization cost for COPD is $8,000.

Europe is expected to grow at a significant CAGR in the respiratory health supplements market during the forecast period. Growing consumer awareness of health and wellness, along with a shift toward preventive healthcare, are driving the region's expansion. The European Food Safety Authority's (EFSA) strict regulations guarantee product quality and safety, boosting consumer confidence and propelling market expansion.

The UK market for respiratory health supplements is growing, fueled by heightened health awareness and environmental concerns. This expansion, highlighted by rising consumer demand for immune and breathing support products, presents strong growth opportunities for the industry in the coming years.

South America is expected to grow significantly in the respiratory health supplements market during the forecast period. The market is driven by a high regional disease burden. In Brazil, approximately 20 million individuals are affected by asthma, pushing consumers toward preventative supplements. Severe acute respiratory infections in the state of Rio Grande do Sul alone resulted in 2,103 deaths during a recent twelve-month period.

Respiratory diseases are a major health crisis, accounting for over $1 billion in annual healthcare costs for the Brazilian government. An estimated 15.8% of adults over forty have undiagnosed COPD. This high incidence of unmanaged conditions fuels demand for accessible, over-the-counter supplements.

The Middle East and Africa are expected to grow at a lucrative CAGR in the respiratory health supplements market during the forecast period. Market growth is linked to environmental factors and nutrient gaps. Air pollution in urban areas contributes to respiratory ailments. Furthermore, studies indicate an up to 13% increase in acute infections in specific groups with higher than recommended doses of certain vitamins.

The GCC region's healthcare spending as a percentage of GDP varies, with the UAE at approximately 3.5% and Saudi Arabia at 5.7%. The challenge is a healthcare system marked by fragmentation and high costs, which impacts access to specialized care, driving consumer reliance on preventative wellness and supplements.

R&D focuses on finding and verifying active ingredients, such as vitamins, probiotics, or herbal extracts, that can successfully support respiratory health as demonstrated by scientific research and clinical trials.

Key Companies: Johnson & Johnson, Roche, Pfizer, Novartis, Merck & Co., AstraZeneca, and Eli Lilly.

To deliver the active ingredients effectively and ensure optimal bioavailability for targeted action in the respiratory system, this stage involves developing stable, effective dosage forms (such as capsules, syrups, and powders).

Key Companies: Sun Pharmaceutical Industries, Cipla, Dr. Reddy's Laboratories, Lupin, Aurobindo Pharma, Abbott India, and Glenmark Pharmaceuticals.

To increase patient compliance and satisfaction and ensure the supplements are used appropriately and effectively, value is added through educational materials, clear usage instructions, and support programs.

Key Companies: Roche, Pfizer, Novartis, Sanofi, Lupin, Dr. Reddy's Laboratories, and Mylan.

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Technological Capabilities/R&D Focus:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates:

Company Overview:

Corporate Information:

History and Background:

Key Milestones/Timeline:

Business Overview:

Business Segments/Divisions:

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Technological Capabilities/R&D Focus:

Competitive Positioning:

SWOT Analysis:

Recent News and Updates:

| Company | Key Offerings for Respiratory Health | Distribution Channel | Contribution to Market Growth |

| Herbalife Nutrition Ltd. | Immunity VMS (Vit C, Probiotics, Herbal Blends). | Direct Selling (IBOs) | Promotes daily immune support via coaching and network. |

| Glanbia PLC | Supplies B2B ingredients (Vit C, D, Zinc) to finished product makers. | B2B Ingredients | Provides scientifically backed micronutrients essential for immunity products. |

| Nu Skin Enterprises, Inc. | Pharmanex line (CordyMax, ReishiMax) for cellular defense. | Direct Selling | Focuses on premium, clinically studied ingredients for targeted immunity. |

| Nature's Sunshine Products, Inc. | Strong Herbal Supplements (HistaBlock, Echinacea) for comfort. | Direct Selling | Boosts the natural/herbal segment with traditional respiratory solutions. |

| The Bountiful Company | VMS brands (Nature's Bounty, Solgar) with Vit C, D, Zinc, Quercetin, NAC. | Retail/E-commerce | Expands reach through mass-market availability for daily immune boosting. |

By Product Type

By Formulation

By Consumer Group

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026