February 2026

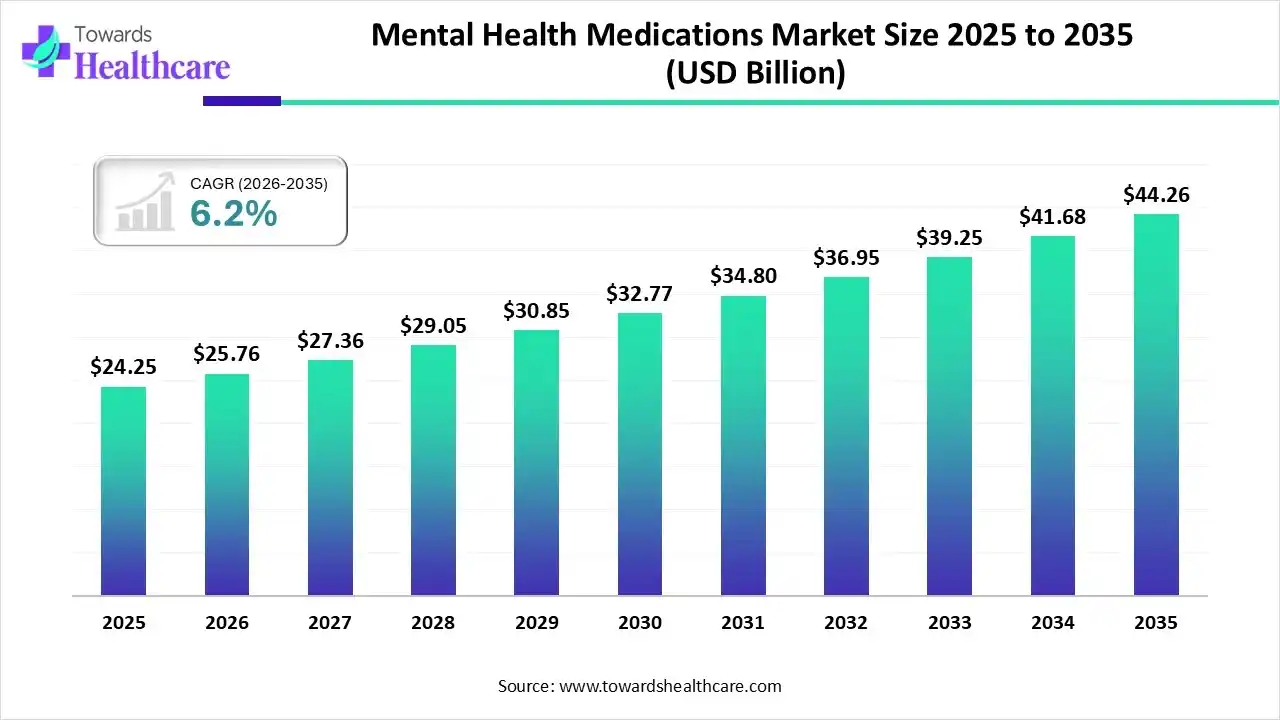

The global mental health medications market size was estimated at USD 24.25 billion in 2025 and is predicted to increase from USD 25.76 billion in 2026 to approximately USD 44.26 billion by 2035, expanding at a CAGR of 6.2% from 2026 to 2035.

Primarily, the worldwide rising changes in lifestyles, work stress, leading to depression and anxiety, as well as a huge ageing population is facing neurological issues like dementia, Alzheimer's, and Parkinson's. These conditions are fostering demand for advanced and more efficacious therapies beyond the traditional mechanisms. Alongside, the widespread adoption of AI solutions is promoting the feasible development of smartphone apps and wearables, which eliminates regional hurdles, especially for rural areas.

| Key Elements | Scope |

| Market Size in 2026 | USD 25.76 Billion |

| Projected Market Size in 2035 | USD 44.26 Billion |

| CAGR (2026 - 2035) | 6.2% |

| Leading Region | North America |

| Market Segmentation | By Drug Class, By Disorder/Indication, By Drug Type, By Patient Demographics, By Region |

| Top Key Players | Pfizer, Johnson & Johnson, Merck, Roche, AstraZeneca, Alkermes plc, Otsuka, Axsome Therapeutics, H. Lundbeck, Sage Therapeutics |

Firstly, the global mental health medications market covers diverse prescription medicines, including antidepressants, antipsychotics, mood stabilizers, and anti-anxiety, which help regulate brain chemicals (neurotransmitters) for better mood, thoughts, and behavior in depression, anxiety, bipolar disorder, and ADHD. Moreover, the worldwide expansion is fueled by the increasing cases of mental disorders, with raised awareness and supportive government initiatives. Current developments include solutions for treatment-resistant issues, with approvals, especially Lumateperone for depression and NRX-101, and psychedelics are in trials.

AI has a promising role in the progression of numerous and more efficacious digital therapeutics for various mental health disorders. Recently, the FDA approved DaylightRx, a smartphone-based prescription digital therapeutic for generalized anxiety disorder (GAD) in adults. Alongside, the market is exploring AI-assisted non-invasive treatments, like BTL, which launched EXOMIND, a non-invasive transcranial magnetic stimulation (TMS) device that employs patented ExoTMS technology and AI-guided targeting.

Ongoing research activities are shifting beyond traditional monoaminergic neurotransmitter systems (like serotonin) to emphasise novel biological pathways like medicines targeting the glutamate system, particularly NMDA receptor modulators and GABA-A potentiators, which possess faster and sustained antidepressant effects, similar to ketamine and esketamine.

Specifically, mental health care is transforming to a more united approach, blending medication, psychotherapy, and technology, while numerous drugs or solutions are employed to handle complex concerns.

For raising efficiency and patient adherence, researchers are focusing on emerging new delivery methods, such as long-acting implants, which facilitate sustained drug delivery over months or years, by skipping the requirement for daily dosing.

| Investments | Collaboration |

| Governor Gavin Newsom (September 2025) | Awarded a new round of funding of $127 million to local governments for assisting their execution of substance abuse treatment and mental health service efforts, like for Prop 36. |

| Armor Health (September 2025) | Partnered with the Erie County Prison for broadening Medical services to comprise Mental Health services and Drug and Alcohol Treatment Programs. |

| Talkspace (May 2025) | Collaborated with Amazon Pharmacy to simplify psychiatric medication needs and home delivery for its members. |

Which Drug Class Led the Mental Health Medications Market in 2025?

In 2025, the antidepressants segment registered dominance in the market. Rising innovations in Selective Serotonin Reuptake Inhibitors (SSRIs) and Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs) fuel the segmental growth. Currently, the globe is leveraging novelty in glutamatergic, GABAergic, and opioid systems, and also consists of novel formulations and rapid-acting treatments for treatment-resistant depression (TRD) and postpartum depression. Roflumilast is a selective PDE4 inhibitor in Phase 3 trials for the adjunctive treatment of MDD.

Anti-Anxiety Medications (Anxiolytics)

The anti-anxiety medications (anxiolytics) segment will expand rapidly. A prominent driver is a rise in stress from work, personal issues, and global events, like COVID-19. Persistent developments include Fasedienol, an investigational nasal spray for social anxiety disorder (SAD), which has shown promising results in its second Phase 3 trial (PALISADE-2) and is now demonstrating the first positive U.S. Phase 3 study for an SAD therapy in over 15 years. Furthermore, in some cases, Transcranial Magnetic Stimulation (TMS) is being employed to treat anxiety disorders, and researchers are promoting new low-intensity focused ultrasound to modulate deep brain activity.

Why did the Depression Segment Dominate the Market in 2025?

The depression segment held the biggest share of the mental health medications market in 2025. More often, SSRIs, such as Zoloft, Prozac, Lexapro, Celexa, and Paxil, are used with fewer side effects and enhance brain serotonin. Currently, psilocybin (COMP360) and MM-120 (an LSD-based medication) are in Phase 3 clinical trials and have received FDA breakthrough therapy designation for MDD and generalized anxiety disorder (GAD).

Post-Traumatic Stress Disorder (PTSD)

In the future, the post-traumatic stress disorder (PTSD) segment will expand at a notable CAGR. Mainly, SSRIs (sertraline, paroxetine) and SNRIs (venlafaxine) are standard, but only sertraline and paroxetine are FDA-approved for PTSD. According to NIH, there are nearly 13 million people who have PTSD per year in the U.S. Recent approaches include TSND-201 (methylone), a non-hallucinogenic neuroplastogen, which received FDA Breakthrough Therapy designation for PTSD following positive Phase 2 results, with promising faster and sustained symptom reduction.

Which Drug Type Dominated the Mental Health Medications Market in 2025?

In 2025, the prescription medications segment captured a major share of the market. These medications aim to minimise symptoms, boost quality of life and daily functioning, and accelerate the efficiency of other therapies such as psychotherapy. Healthcare professionals usually prescribe various antidepressants for mood, antipsychotics for psychosis/bipolar disorder, anti-anxiety meds, mood stabilizers for bipolar, and stimulants for ADHD.

Generic Drugs

The generic drugs segment is predicted to witness the fastest growth. A crucial catalyst is their affordability compared to their branded counterparts, often 60-70% minimal two to three years after market entry. Specifically, the "patent cliff," where patents for blockbuster brand-name drugs expire, enables generic substitutes to enter the market. However, in India, there are over 2,000 essential generic medicines, encompassing several for mental health, that are accessible through government initiatives, such as Janaushadhi Kendras, at hugely lowered prices.

How did the Adult Segment Lead the Mental Health Medications Market in 2025?

The adult segment held a dominant share of the market in 2025. In this sector, anxiety and depression are the most prevalent conditions, which are driven by expanding modern life stressors, coupled with increasing awareness and broader access to healthcare resources. As per NHMS, in India, roughly 10.6% to 15% of Indian adults face mental disorders, with increased rates in urban areas (13.5%) than rural areas (6.9%).

Geriatric

During 2026-2035, the geriatric segment will expand significantly. The globe is facing a huge burden of an ageing population, from which numerous instances are related to depression, anxiety, dementia-related psychosis, and Alzheimer's disease, which are fostering demand for advanced mental health medications. According to the WHO, about 20% of those over 60 have a mental disorder or neurological condition. Whereas leading pharma firms are exploring innovative oral jelly formulations or transdermal patches.

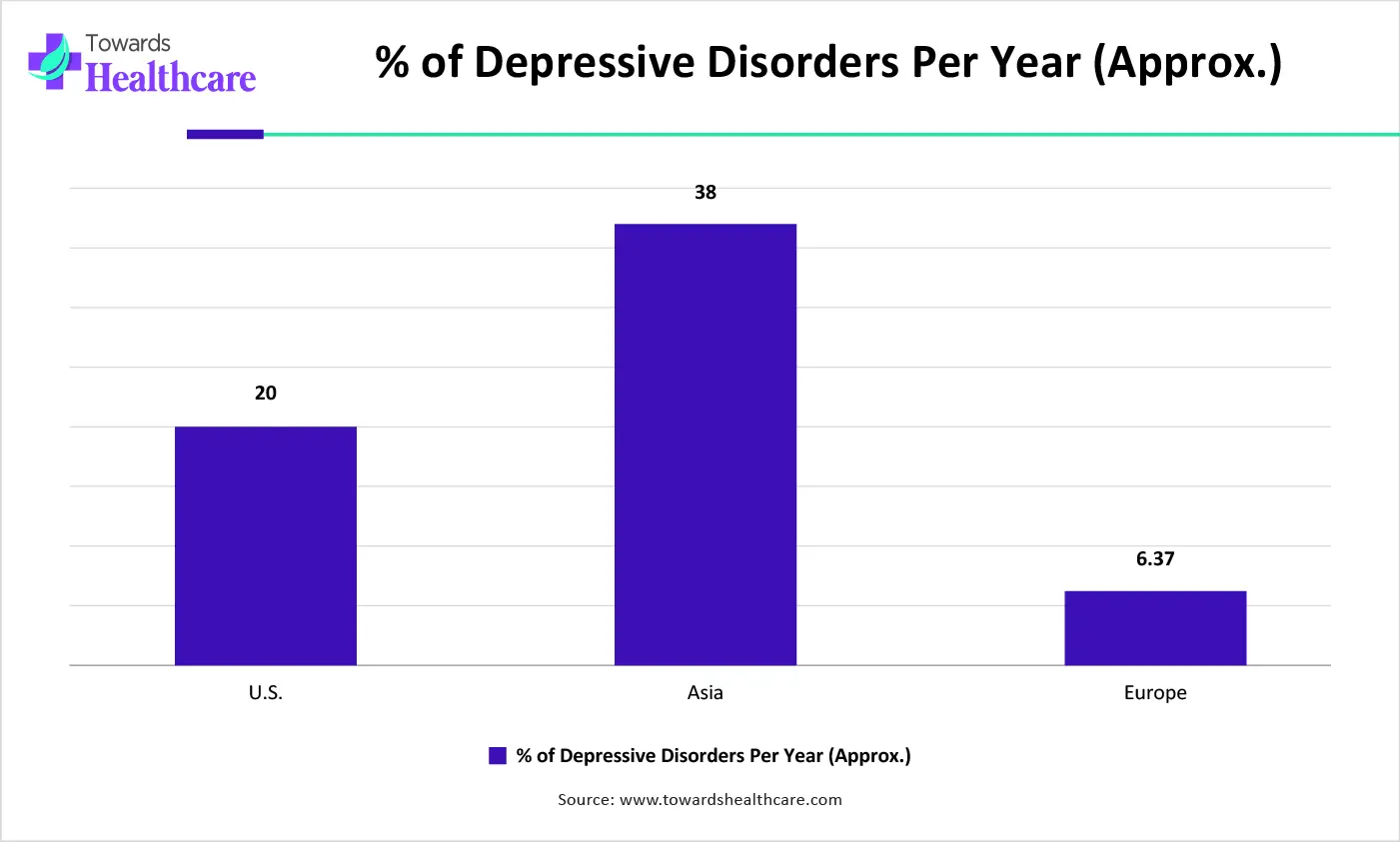

North America led the mental health medications market with a major share in 2025. This dominance is mainly impelled by a growing number of instances of depression, anxiety, and raised programs from agencies, such as SAMHSA (US), which encourages mental health awareness and access. Also, the region is putting efforts into the Innovation in Behavioral Health (IBH) Model, which started its pre-implementation phase in Michigan, New York, and South Carolina, and this focused on the integration of physical and behavioral health care for Medicaid and Medicare beneficiaries.

U.S. Market Trends

However, the U.S. government is fostering growth of medication access (MOUD, telehealth), simplifying regulations (DEA for buprenorphine), highlighting youth mental health concerns, and implementing grants, such as SOR.

For instance,

In the prospective period, the Asia Pacific will expand rapidly in the mental health medications market, as the region is experiencing a significant economic progression, shifting lifestyles, a geriatric population, and favourable government policies. Recently, Zydus Lifesciences received marketing clearance in China for Venlafaxine Extended-Release (ER) Capsules in 75 mg and 150 mg strengths for Major Depressive Disorder and Generalized Anxiety Disorder.

Ongoing psychedelic research covers Japan-based Otsuka Pharmaceutical, which has supported the discovery and development of innovative psychedelic compounds to treat neurological and psychiatric disorders. Recently, Otsuka signed a joint research agreement with Keio University for infrastructure expansion in the social execution of psychedelics in Japan.

With a lucrative growth, Europe is stepping into the expansion of the mental health medications market, through the accelerating improvements in the psychiatric detection systems in substantial countries (UK, Germany, France), which results in early and more efficient treatment initiation. Also, the region has been forwarding trend of long-acting injectable formulations, like Abilify Maintena (aripiprazole) for maintenance treatment of schizophrenia in adults who are already stabilized on aripiprazole.

German Market Trends

The German government is also bolstering innovations in mental health care, such as in the last few days, the Federal Ministry of Education and Research (BMBF) offered as €120 million in funding for progressing the German Centre for Mental Health (DZPG), which unites top research institutions for enhancing the diagnosis, treatment, and prevention of mental concerns and boost the transfer of research into practice.

| Comapny | Description |

| Pfizer | This particularly provides treatments for depression, ADHD, anxiety, and schizophrenia, and support tools, including the Moodivator app |

| Johnson & Johnson | It offers a major portfolio in neuropsychiatry, especially for schizophrenia with long-acting injectables (LAIs), like Invega Sustenna, Trinza, and Hafyera |

| Merck | This has invented the tricyclic antidepressant amitriptyline (brand names Tryptizol, Elavil, Saroten). |

| Roche | A company facilitates some therapies for neurological conditions, like Madopar, Evrysdi, etc. |

| AstraZeneca | It explored antipsychotic drugs, including Seroquel and Seroquel XR (quetiapine). |

| Alkermes plc | This mainly offers treatment of schizophrenia, bipolar I disorder, alcohol dependence, and opioid dependence. |

| Otsuka | Its various portfolio comprises traditional pharmaceuticals for serious mental conditions, novel digital therapeutics, and a unique drug-device combination product. |

| Axsome Therapeutics | A firm leverages Auvelity (dextromethorphan-bupropion) for the treatment of major depressive disorder (MDD) in adults. |

| H. Lundbeck | This unveiled diverse drugs for depression/anxiety, schizophrenia, and alcohol dependence, like Abilify Asimtufii, Cipralex, etc. |

| Sage Therapeutics | It offers one FDA-cleared mental health medication, ZURZUVAE (zuranolone), for the treatment of postpartum depression (PPD) in adults. |

Certain firms may face crucial legal and financial risks from lawsuits regarding serious, and sometimes hidden, adverse side effects, like suicidality, aggression, self-mutilation, and protracted withdrawal symptoms.

By Drug Class

By Disorder/Indication

By Drug Type

By Patient Demographics

By Region

February 2026

February 2026

February 2026

February 2026