December 2025

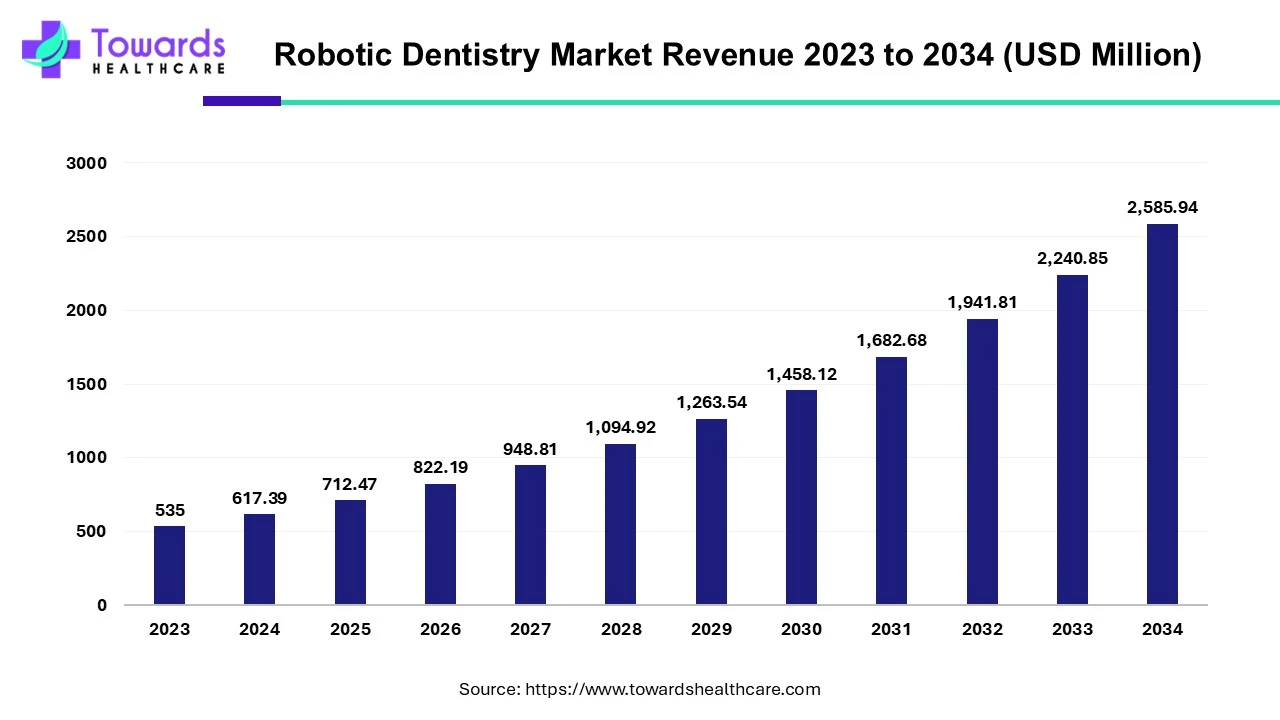

The robotic dentistry market was estimated at US$ 535 million in 2023 and is projected to grow to US$ 2,585.94 million by 2034, rising at a compound annual growth rate (CAGR) of 15.4% from 2024 to 2034. Technological advancements, increasing incidences of dental diseases, and rising dental surgeries drive the market.

Robots have emerged in several medical fields to revolutionize the healthcare ecosystem. Robotic systems in dentistry have immense potential from early diagnosis to effective treatment, as they can perform patient intervention and remote monitoring. Researchers have investigated the role of medical robots in various fields of dentistry, including dental implantology, oral and maxillofacial surgery, prosthetic and restorative dentistry, endodontics, orthodontics, oral radiology, and dental education. Hence, robots implement automation, thereby minimizing errors and enhancing efficiency. They can also deliver superior precision and improve patient outcomes.

The rising incidences of dental diseases and technological innovations increase the demand for using robots in dentistry. The rising incidences of dental diseases are a result of the increasing geriatric population. It has been reported that around 9% of all dental implant cases are performed in patients between 65-74 years old. Additionally, favorable government initiatives and increasing investments augment the market growth.

Artificial intelligence (AI) has emerged as a powerful technology in robotics, introducing automation and simplifying dentists' workflow. It can bolster the efficacy of AI robots in dental diagnosis and treatment plans. It also enables dentists to assess the prognosis of various oral diseases. An AI-controlled robot can perform an entire dental surgery on humans, accelerating the speed of the procedure and minimizing manual errors. Integrating AI in robotic dentistry enhances precision and efficiency, thereby promoting patient care.

The robotic dentistry field is surging due to numerous advantages such as improved efficiency, reduced human error, and higher precision. The increasing demand for improving healthcare efficiency promotes the use of robotics in dentistry. Several recent developments in the field, growing research & development, and an increasing number of patents drive market growth. Several researchers are investigating different potential applications of robotics in various fields of dentistry. The latest technological innovations may relieve human resources for important tasks such as interacting with patients or other functionalities requiring high cognitive skills.

The major challenge faced by dental professionals in implementing robotics is the high upfront cost. A dental clinic requires a huge investment in adapting and installing a robotic system, limiting affordability for small and medium enterprises. Also, the cost of dental surgeries and implants is high. Dental implants in Dallas usually cost around $4,000 to $5,500 per tooth. In addition, the operation of such a complex robotic system requires trained professionals. The lack of skilled professionals, especially in low- and middle-income countries hamper the market growth.

North America dominated the robotic dentistry market in 2023. The rising incidences of dental diseases, technological advancements, and the presence of key players drive the market. The market is also driven by favorable government policies and regulatory approvals. Yomi robots, developed by a Miami-based company, Neocis, is the only US FDA-approved robotic system in dentistry. The Yomi surgical robot has 16 FDA 510(k) clearances. It has performed more than 40,000 implants as of 2023. In 2024, about 3 million Americans have a dental implant. According to the American Association of Endodontists, more than 15 million root canal procedures are performed every year.

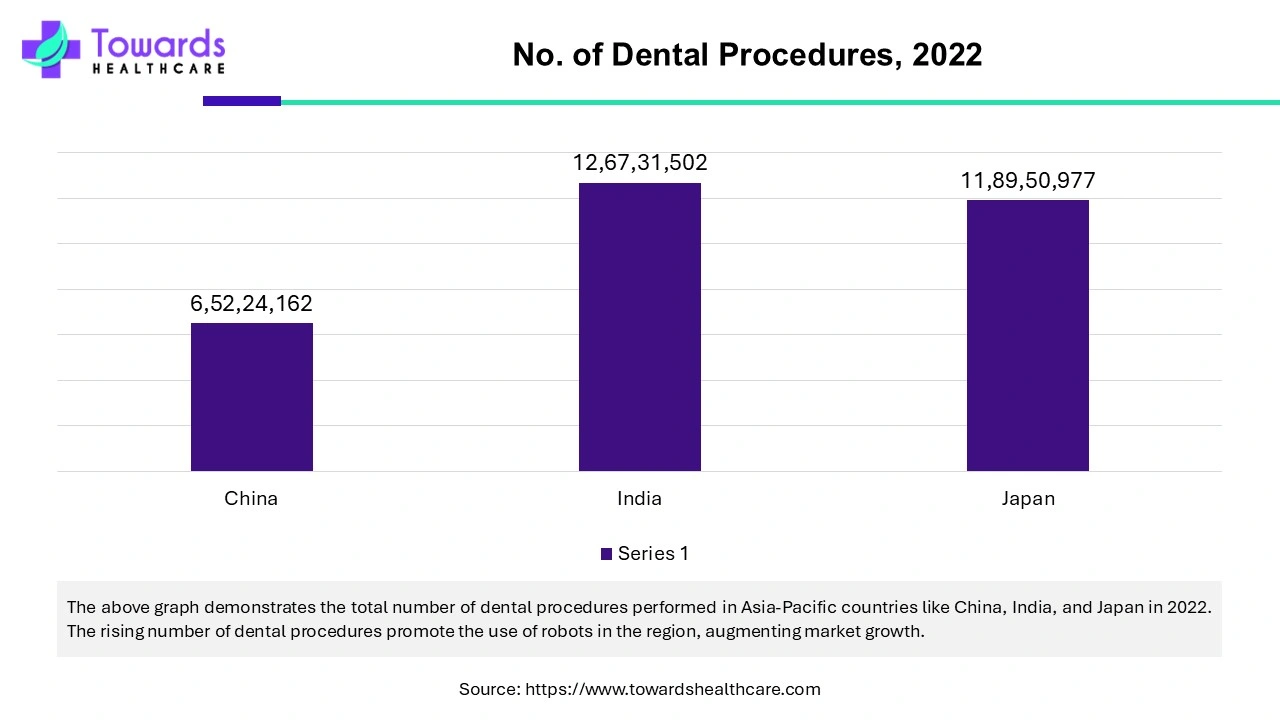

Asia-Pacific is anticipated to grow at the fastest rate in the robotic dentistry market during the forecast period. The rising incidences of dental diseases, rising geriatric population, increasing investments & collaborations, and technological advancements drive the market. The lack of sufficient qualified dentists available for the increasing population in the region demands the installation of robotic systems in dental hospitals and clinics. According to the Dental Council of India, there are only around 356,443 dentists in India. According to the Japan Dental Association, there are only 104,000 dentists in Japan. The market is also driven by favorable government policies. The Indian Dental Association (IDA), in June 2024, encouraged dentists to adopt newer technologies in patient care and also encouraged students to attend sessions related to dental technologies in AI and digital dentistry.

Europe is expected to grow at a considerable CAGR in the robotic dentistry market in the upcoming period. The rising adoption of advanced technologies and the increasing prevalence of dental disorders potentiate market growth. Government organizations launch initiatives to promote oral health and raise awareness about regular dental check-ups. The rising disposable incomes and favorable reimbursement policies also contribute to market growth. The increasing population in the region leads to a shortage of skilled dentists to perform complex surgical procedures and focus on multiple patients simultaneously.

The European government collaborated with the WHO to improve access to safe, effective, and affordable essential oral healthcare as part of universal health coverage. It is estimated that over half of older adults in the WHO European region have a major oral disease. Germany spent the highest amount on dental practices in 2023, accounting for €31.4 billion, followed by France, the UK, Spain, and the Netherlands, which amounted to €11.82 billion, €8.84 billion, €4.48 billion, and €3.41 billion, respectively.

By product & services, the robot-assisted system segment held the largest share of the market. This segment dominated because robot-assisted systems are widely used in dentistry to assist dental professionals in several tasks. The most common example of a robot-assisted system is robot-assisted dental surgery. In this case, the robot is controlled by a surgeon to perform surgeries and implant procedures. The rising incidences of dental implants and demand for high efficiency boost the segment growth.

The standalone robots segment is anticipated to grow with the highest CAGR in the market during the studied years. Standalone robots are devices that operate without the need of a dental professional. Once a command is loaded, the robot can perform the entire task on its own. The latest technological advancements potentiate the segment growth.

By application, the implantology segment registered its dominance over the globa market. The rising incidences of dental implants and the rising geriatric population promote the segment growth. Robotics in implantology can automate the entire process, reducing pain and discomfort and faster recovery. According to a 2023 paper, the majority of the articles, i.e. around 23%, were published studying the role of robots in oral implantology over the last decade.

The endodontics segment is expected to grow at the fastest rate in the market during the forecast period. The increasing root canal procedures drive the segment growth. Robots can assist in studying the anatomy of the root canal system and detecting root fractures and periapical lesions.

By end-use, the dental hospitals & clinics segment led the global market. The dental hospitals & clinics have favorable infrastructure for installing robots and high capital investment, increasing the demand for robotics. The increasing number of patients due to rising incidences of dental diseases in hospitals & clinics potentiate segment growth.

The dental academics segment is projected to expand rapidly in the market in the coming years. Dental students can be trained using robotics, haptic interface technology, and advanced simulation.

Steffen Mueller, Managing Director at Curaden USA, commented that Samba, the world’s first robotic toothbrush, was developed using innovative technology to enable a healthy mouth and a clean smile. The company is empowering millions of individuals to access premium oral care with its first-of-its-kind product, improving their well-being and experiencing excellent cleaning with the push of a button. (Source: Dentistry Today)

By Product & Services

By Application

By End-Use

By Region

December 2025

November 2025

November 2025

October 2025