February 2026

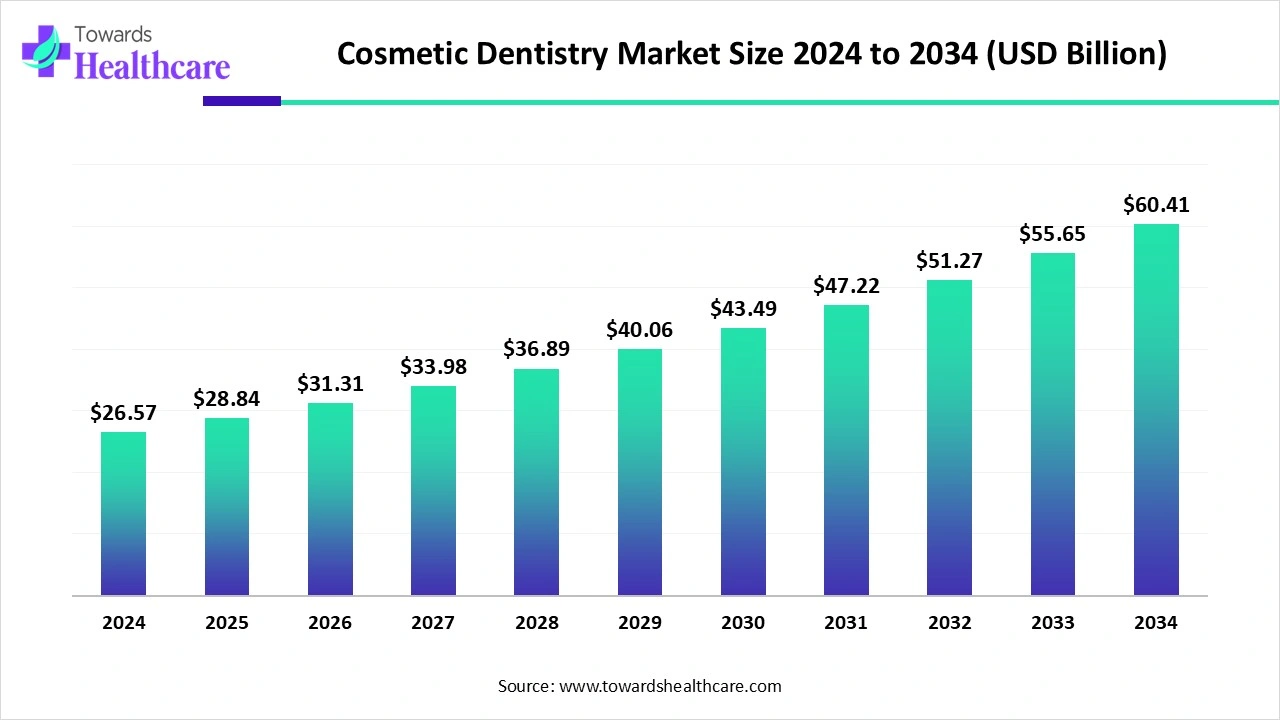

The global cosmetic dentistry market size stood at US$ 26.57 billion in 2024, grew to US$ 28.84 billion in 2025, and is forecast to reach US$ 60.41 billion by 2034, expanding at a CAGR of 8.55% from 2025 to 2034.

The global cosmetic dentistry market is expanding steadily, driven by growing awareness of oral aesthetics, rising disposable income, and increasing demand for smile-enhancing treatments such as teeth whitening, veneers, and orthodontics. Technological advancements in laser dentistry, digital imaging, and minimally invasive procedures are improving efficiency and patient comfort. Additionally, the influence of social media and the rising focus on personal appearance are boosting market adoption. The market is witnessing strong growth across North America, Europe, and emerging regions in the Asia-Pacific.

| Table | Scope |

| Market Size in 2025 | USD 28.84 Billion |

| Projected Market Size in 2034 | USD 60.41 Billion |

| CAGR (2025 - 2034) | 8.55% |

| Leading Region | North America |

| Market Segmentation | By Type, By End-user, By Region |

| Top Key Players | Danaher Corporation, Align Technology Inc., Dentsply International, Inc., 3M Company, Zimmer Biomet Holding, Inc, Institut Straumann AG, Sirona Dental Systems, Inc., Biolase, Inc., Planmeca Oy |

Cosmetic dentistry is dental care focused on improving the appearance of teeth and smiles through treatments like whitening, veneers, bonding, and orthodontics, enhancing both aesthetic and confidence. Innovation is boosting the cosmetic dentistry market by enabling quicker, more personalized treatments and improving aesthetic results. Developments in biomaterials, such as stronger, nature-looking composites and ceramics, enhance durability and visual appeal. Cutting-edge imaging and simulation tools allow patients to preview outcomes before procedures, increasing acceptance.

Additionally, automation in dental labs and robotic-assisted techniques reduce treatment time and error. These advancements are making cosmetic dentistry more efficient, accessible, and appealing, driving market growth globally.

For Instance,

Launch of Digital Imaging and Scanning Tools: Products such as the AlliedStar intraoral scanner enable faster, accurate, and efficient diagnostics and treatment planning, attracting clinics to invest in modern digital dentistry.

Technological Advancements: Innovations such as 3D printing, CAD/CAM systems, laser dentistry, and AI-assisted treatment planning improve precision, reduce treatment time, and enhance patient experience.

AI is influencing the market by enabling faster material selection, optimizing shade matching, and improving customization of restorations like veneers and crowns. It supports digital design of prosthetics with greater precision, reducing the need for manual adjustments. AI-driven analytics also help forecast treatment longevity and patient-specific risks, guiding better clinical decisions. Additionally, integration of AI into inventory and supply chain management ensures the timely availability of dental products, further strengthening efficiency and market growth.

Rising Demand for Aesthetic Dental Procedures

The demand for aesthetic dental procedures is fueling cosmetic dentistry growth as patients increasingly view dental enhancements as part of overall wellness and professional image. Cosmetic treatments are no longer limited to celebrities but are becoming mainstream, supported by expanding dental tourism and easier access to advanced clinics. This growing acceptance of dental aesthetics as a lifestyle choice, along with wider availability of modern procedures, is expanding the market and making cosmetic dentistry a rapidly expanding healthcare segment.

For Instance,

High-Cost Procedures

High treatment costs limit the accessibility of cosmetic dentistry, as many individuals prioritize essential dental care over elective aesthetic procedures. The expenses are further compounded by the need for multiple visits, ongoing maintenance, and advanced equipment use. This financial burden often discourages patients from opting for cosmetic solutions, especially in price-sensitive markets. Consequently, despite growing awareness and interest, affordability barriers slow down wider adoption and restrict the market's expansion potential.

Integration of Digital Dentistry

The growing use of digital technology is opening new opportunities in the cosmetic dentistry market by enhancing patient engagement and decision-making. Digital smile design tools integrated with advanced technologies allow patients to visualize results before treatment, improving confidence and acceptance rates. Digital workflows also support remote consultations and treatment planning, making advanced procedures more accessible. This technological integration not only personalizes care but expands service reach, positioning cosmetic dentistry for significant growth in the coming years.

For Instance,

In 2024, the equipment segment led the market as clinics increasingly focused on improving patient experience and procedural precision. The rise of minimally invasive and digital dentistry procedures boosted demand for advanced tools like intraoral scanners, laser systems, and 3D printing equipment. Additionally, the expansion of dental chains, modernization of practices in emerging regions, and growing emphasis on aesthetic outcomes drove investments in high-tech equipment, securing this segment’s largest market share.

The consumables segment is projected to grow rapidly as consumers increasingly seek long-term solutions for bite correction and improved oral health, alongside aesthetic concerns. Advancements in smart braces, 3D-printed aligners, and faster treatment techniques are enhancing patient comfort and reducing treatment duration. Rising demand among adults who previously avoided braces, coupled with expanding orthodontic clinics and tele-orthodontic services, is driving adoption. These factors position orthodontic braces as the fastest-growing product segment in the market.

By end-user, the solo practices segment held the major share of the cosmetic dentistry market in 2024. Solo practices offer cosmetic dentists a path to increased professional control and financial rewards compared to corporate settings, allowing them to lead their own practice, set their own hours, and determine the quality of patient care they provide, which can lead to more personalized treatments and higher earning potential.

By end-user, the DSO/group practices segment is estimated to witness the highest CAGR during the forecast period. DSOs and group practices are a major, rapidly growing trend in cosmetic dentistry, attracting dentists with non-clinical support like marketing and administration, which frees them to focus on patient treatment. Dental Service Organizations also benefit from economies of scale, leading to lower costs for supplies, increased patient volume, and a more efficient, centralized operation. This model is particularly appealing to newer dentists seeking stability and a better work-life balance, with a significant increase in partnerships driven by strategic acquisitions.

In 2024, North America led the market due to a well-developed dental services network and early adoption of cutting-edge treatments like AI-assisted smile design and 3D-printed restorations. The region’s strong focus on preventive and aesthetic oral care, coupled with high patient spending capacity and supportive regulatory frameworks, encouraged the uptake of advanced procedures. Additionally, the growing influence of lifestyle trends and professional appearance standards fueled demand, securing North America’s position as the largest revenue-generating market.

For Instance,

The U.S. market is growing as more adults and young professionals seek smile-enhancing procedures to improve confidence and social image. Technological advancements in clear aligners, veneers, and teeth-whitening treatments make procedures faster, more comfortable, and widely accessible. Expansion of dental chains, increasing cosmetic dental tourism, and rising patient willingness to invest in elective aesthetic care are also contributing factors, driving strong market adoption and positioning the U.S. as a leading hub for cosmetic dentistry services.

The Canadian market is expanding as more patients seek preventive and aesthetic dental care to enhance confidence and professional appearance. The rising popularity of minimally invasive procedures, coupled with government support for modern dental infrastructure, is increasing access to advanced treatments. Additionally, collaborations between dental technology providers and clinics, along with growing urbanization and lifestyle-driven demand, are fueling adoption. These trends position Canada as a steadily growing market for cosmetic dentistry services.

The Asia-Pacific market is projected to grow rapidly as emerging economies invest in modern dental infrastructure and adopt advanced technologies such as CAD/CAM systems, 3D printing, and AI-assisted treatments. Rising health awareness, changing lifestyles, and increasing acceptance of cosmetic procedures among younger populations are boosting demand. Additionally, the growth of dental chains, affordability of treatments compared to Western countries, and expanding medical tourism are contributing to the region’s fastest CAGR in the global cosmetic dentistry market.

Clinical Trials: Clinical trials in cosmetic dentistry evaluate new dental materials, techniques, and devices to enhance results and patient satisfaction in treatments like veneers, teeth whitening, and bonding. Published in journals such as Clinical, Cosmetic, and Investigational Dentistry, these studies rigorously test the safety, effectiveness, and patient preferences of innovative cosmetic procedures, helping advance the field and guide the adoption of improved dental solutions.

Regulatory Approvals: Regulatory approval in cosmetic dentistry covers both dental procedures and the materials used, with rules varying by country. In the U.S., the FDA regulates cosmetic products under MoCRA and dental materials under the FD&C Act. In India, cosmetic products fall under the Cosmetic Rules, 2020, while the CDSCO and Dental Council of India (DCI) oversee dental materials and professional practices, ensuring safety, compliance, and quality in cosmetic dental treatments.

Patient Support and Services: Patient support in cosmetic dentistry includes treatments such as teeth whitening, veneers, crowns, and bonding, along with follow-up care for maintenance. Services often involve comprehensive smile makeovers that enhance tooth color, shape, and alignment. Clinics also focus on boosting patient confidence and self-esteem by providing personalized treatment plans and ongoing support, ensuring long-term satisfaction with both oral health and aesthetic outcomes.

In April 2025, Silver Spring Cosmetic Dentistry launched its full-service general and cosmetic dental practice in Downtown Silver Spring, Maryland, led by Dr. Raoufinia. The clinic offers a wide range of services, including porcelain veneers, Invisalign, teeth whitening, dental implants, root canal therapy, and general dentistry, using advanced technology and modern techniques. According to the practice, “Through patient education and dialogue, our goal is to build a relationship with you, to help you achieve your best smile. Our guiding philosophy is always to do what is best for the patient, first and foremost.” The clinic emphasizes personalized, compassionate care in a comfortable environment, ensuring every patient receives high-quality, tailored dental treatment.

By Type

By End-user

By Region

February 2026

February 2026

February 2026

February 2026